Auditing Data Reliability in International Logistics

An Application of Bayesian Networks

Lingzhe Liu

1

, Hennie Daniels

1,2

and Ron Triepels

2

1

Rotterdam School of Management, Erasmus University, Burg.Oudlaan 50, Rotterdam, The Netherlands

2

CentER, Tilburg University, Warandelaan 2, Tilburg, The Netherlands

Keywords: Data Reliablity, Data-level Auditing, Business Intelligence.

Abstract: Data reliability closely relates to the risk management in international logistics. Unreliable data negatively

affect the business in various ways. Due to the competence specialization and cooperation among the

business partners in a logistics chain, the business in a focal company is inevitably dependent on external

data sources from its partner, which is impractical to control. In this paper, we present a research-in-

progress on an analysis method with Bayesian networks. The goal is to support auditor’s assessment on the

reliability of the external data. A case study is provided to illustrate the merits of Bayesian networks when

dealing with the data reliability problem.

1 INTRODUCTION

Reliable data are important for the business partners

operating in international trade and logistics, with

inter-organizational transactions dominating the

daily business in those companies. Inaccurate data

lead to inefficient business administration and of

course inefficient operations. Problems may include,

among others, bad planning, operations disruption,

and financial lost as well as reputation damage.

Simply put, when the data stored and processed in

the information system are not reliably representing

the cargo flows in reality, the companies are exposed

to the risks of losing control. Moreover, inaccuracy

in the data exchanged among partners adds to supply

chain uncertainty, blurring visibility (Klievink et al.,

2012) and eventually compromising the confidence

throughout the chain and the performance of the

whole chain (Christopher and Lee, 2004).

For a focal company in the chain, these are all

commercial risks which negatively affect the market

competitiveness of the company. On the other hand,

failure to manage data reliability can also bring in

compliance risk: in that, fraudulent cases may go

unnoticed, and its supply chain could be exploitable

to international criminals and terrorism.

Auditing the reliability of data serves both

purposes of preventing unintentional errors and

deterring intentional frauds (Cendrowski, Petro,

Martin & Wadecki 2007). Data coming from

internal or external sources should all be audited.

Internally, the audit focus more on the system level

than on the data level, since deploying proper

segregation of duties could better assure that

business operation generates data which will

undeniably correspond to reality (Hulstijn and

Overbeek, 2012). This would be difficult for

external data, because it is not always possible to

directly observe external operations in international

logistics, but only to get data from a third party. For

example, a carrier normally does not observe if

dangerous goods are packed in a container by the

shipper. It has to rely on the face-values of the

container contents stated on a packing list. The

packing list itself is usually provided by a third-party

logistics agent instead of the shipper. In such a case,

data reliability analysis using business intelligence

(BI) would be a useful instrument for detecting

inaccuracies in the external source, regarding the

latter as business exceptions in contrast to the

“normal” reliable data (Liu et al., 2013). The

analysis cannot replace the indispensable controls in

the external operations, such as the direct observer,

yet it serves as an internal control measure that

mitigates the related risks that affect the focal

company.

Due to the uncertainty nature of errors and data

frauds, managing them is a part of organizational

learning. The company learns to recognize the

symptoms indicating that data could be inaccurate

707

Liu L., Daniels H. and Triepels R..

Auditing Data Reliability in International Logistics - An Application of Bayesian Networks.

DOI: 10.5220/0004987507070712

In Proceedings of the 16th International Conference on Enterprise Information Systems (ISS-2014), pages 707-712

ISBN: 978-989-758-028-4

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

and the causes of inaccuracy. BI as a knowledge

distiller helps to capture those indications by

analyzing the patterns hidden in historical data. The

pattern found may have a “side” benefit that they

can be used for other purpose, e.g. mitigating other

type of risks or managerial problems.

In this article, we examine the requirement of

data reliability analysis in the business setting of

international logistics in Section 2, and propose to

use Bayesian networks as the analysis approach.

After comparing the approach with other machine

learning methods in Section 3, we will explore the

applicability of Bayesian networks with a case study

in Section 4 on a data set collected from a freight

forwarding company, for the purpose of auditing the

correctness of their declarations, with discussions

and conclusions in Section 5.

2 DATA RELIABILITY ANALYSIS

WITH BAYESIAN NETWORKS

Reliability is a feature of an object or a system

which indicates how predictable the object or system

behaves. The research on the reliability of data

address the requirement that business decisions have

to be based on “high-quality data”, i.e. data which

are correct, accurate, and always reflecting the

reality (Wang and Strong, 1996). The goal of data

reliability analysis is to detect inaccurate data as a

business exception. The basic approach is to

integrate evidences to prove or disprove the

occurrence of the exception.

Statistical methods can be applied to find

exceptional data, based on how unlikely a piece of

data can occur given that the business behaves

normally. Although statistically “proving” that an

piece of data is exceptional is not always convincing

(Korb and Nicholson, 2003), one could at least infer

about the reality with statistical confidence, given

the evidence.

Two working assumptions are behind the

application of analytics in managing data reliability.

First, the majority of the data are reliable, meaning

that inaccuracy is a rare event; otherwise the

business would not be sustainable. Second, logistics

operations and business behaviors follows a

relatively stable and tractable pattern. For example,

the optimal choice of route for transporting certain

type of goods exists, as the buyer, seller and logistics

service provider makes rational decision basing on

similar economic consideration, such as price,

flexibility and service level (see e.g. Choi and

Hartley 1996; Tongzon, 2009). These assumptions

correspond to two types of uncertainties in the data:

1) the uncertainty of data reliability, which is to

some extend similar to the “measurement error” in

statistics, and 2) the uncertainty of business behavior,

which can be regarded as “structural error”. Note

that, in general these two types of uncertainties are

not distinguishable merely by statistical analysis, yet

the exceptions flagged by the analysis draw attention

for further investigations.

The analysis of exceptions takes the canonical

format of (Feelders and Daniels, 2001):

〈

, ,

〉

because

, despite

(1)

To determine whether the instance under question

is exceptional, its feature is compared with the

same feature of other instances of a reference. If

the difference is large, will be regarded

exceptional, and vice versa. To determine the

threshold for the difference, domain knowledge is

usually incorporated. One can further investigate the

contributing causes

and counteracting causes

to the difference. These causes are by definition the

exceptions on a lower level of details with finer data

granularity. Caron & Daniels (2013) demonstrated

an implementation of this type of analysis on multi-

dimensional data stored in OLAP cubes.

This format of analysis is arguably more suitable

to detect exceptions in managerial settings than

classification approaches, for several reasons. The

detection of business exception is usually an

explorative and unsupervised process, in which it is

difficult to explicitly and a priori define the feature

of an exception. Besides, the exceptional instances

are saliently recognizable only when compared to

proper reference, while the choice of the reference

depends to a large extent on the context of the

business problem. For instance, a piece of inaccurate

data may not be detectable on a case-by-case

comparison with other presumably accurate data of

the same type, but it would be more easily revealed

by comparing to the business behavior which is

summarized out of a set of accurate data. Therefore,

an interactive learning performed by the analyst with

BI support is more preferable in this setting, so that

the analyst can zoom in or out to proper level of

details to find a proper reference.

A Bayesian network is defined as a directed

acyclic graphical model containing a set of random

variables

,

,⋯

and a set of arcs

connecting two random variables

→

,

representing their dependency as a conditional

probability (Jensen and Nielsen, 2007).

We propose to use Bayesian networks to model

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

708

the feature for data reliability analysis (the

investigation for further causes

and

is not

within the scope of this paper). Given the

assumption that the feature of accurate data reflects

business behavior, this feature is unobservable at the

least and can be described with a probability at the

most. This is because the business behavior is

dictated by the economic rationale behind, which is

not captured by the data. Using conditional

probabilities to represent the dependencies of

variables allows a Bayesian network to update our

belief about the business behavior given the data as

evidence. Our proposed approach is to detect the

difference between the behaviors reflected by

accurate and inaccurate data, with the working

hypothesis that the behavior reflected by inaccurate

data will contradict intuitive economic rationale.

A procedure is followed when using Bayesian

networks for the analysis:

1. Identify the managerial problem;

2. Build the conceptual model of the economic

behavior by identifying relevant variables in the

data, as well as their inter-dependency;

3. Estimate and update the probability using

referential data (e.g. historical data);

4. Assess the reliability of target data.

3 RELATED WORKS

Available research dedicated to the use of machine

learning to analyze the declaration data of shipped

goods approach the learning problem from a risk

management perspective and use different

approaches to detect fraudulent declarations. Early

research proposes clustering to divide shipments into

similar clusters, since it appears that shipments

containing large quantities of goods share a lot of

common characteristics (Yan-hai and Lin-yan,

2005). Clustering approaches allow freight

forwarders to improve their risk management by

defining specific risk measures for each cluster of

shipments. More recent research is focused on the

classification task of high risk variables, like the

type of commodity or the paid customs duty. Several

machine learning approaches are proposed to

facilitate this learning task including: decision trees

(Kumar and Nagadevara, 2006), hierarchical

Bayesian modeling (Jambeiro Filho and Wainer,

2007), and association rules (Yaqin and Yuming,

2010). Freight forwarders can use predictions of

high risk variables to take specific risk measures

when they significantly deviate from the provided

declaration data.

4 CASE STUDY

This case study addresses a practical data reliability

problem facing a freight forwarding company ABC.

Freight forwarding companies nowadays strive

to increase the added value in their services, since

their role as an information intermediary is fading as

a result of the trend of globalization and e-Business.

ABC decides to strengthen their competence with

data analytics and knowledge management, while

continuing to excel in traditional services like

customs brokerage.

Being the party who files the declaration, ABC is

exposed to the risks of inaccurate data because it is

dependent on the accuracy of external provided

shipment data, while it will be held responsible for

any fraudulent declarations. Attempts to deal with

this risk from a classic risk management perspective

usually fail. This is because of the lack of control on

the external data source, and most IT controls lack

sufficient intelligence. ABC currently hires internal

auditor to do manual, ex-post verification on the data

accuracy of the filed declaration. In this research, we

aim to explore the innovative approach of using

Bayesian network to deal with the uncertainty during

the declaration process. This approach can support

both the ex-post assessment by the auditor and the

ex-ante assessment by the declarer on the data

accuracy.

4.1 Data

The data used for this case study are obtained from

ABC and constitute an extensive dataset of

international maritime freight transport including

compiled declarations. We collected 13.367

declarations between July 2012 and June 2013. The

declarations were made for 24 type of goods shipped

from 67 different states in the world to the harbors

of Port_P and Port_Q (location is anonymized to

protect confidentiality for ABC’s clients).

For the transportation variables, we used the

country of origin (COO) and the port of destination

(POD) to capture the route that goods took to travel

from the consignor to the importing country. As

ABC also arranges the physical transportation for

the client, data for the two variables can be regard as

coming from internal source and 100% accurate. For

the declaration variables, we identified the

commodity code (HSC), preferential documents

(PRD) and customs weight ratio (CWR) as the most

important variables to compile a declaration. Data

for these three variables come from external sources

and their accuracy need to be analyzed. Constructing

AuditingDataReliabilityinInternationalLogistics-AnApplicationofBayesianNetworks

709

a Bayesian network upon these variables allows

freight forwarders to analyze the patterns of

international trade, i.e. the relationships between the

type of goods and the transportation routes. This

information can be compared with a piece or a set of

the external provided shipment data, and this gives

certain indication on the accuracy of the data during

ABC’s declaration process. Table 1 shows an

example of the records. CWR takes numerical value,

while the rest of the variables are categorical.

Table 1 Example freight data of computers and plastic

articles.

HSC COO POD PRD CWR

8471 Country_S Port_P 100 12

8471 Country_X Port_P 100 10

3926 Country_D Port_P 200 – 035 7

8471 Country_F Port_P 100 11

3926 Country_M Port_Q 100 24

3926 Country_C Port_Q 100 23

4.2 The Bayesian Network

By using a Bayesian network with conditional

probabilities to represent the dependencies between

variables, we can update our belief about a variable

given the fact that other variables received evidence.

Our proposed network exploits this property to gain

more confidence about the accuracy of the external

provided shipment data when compiling a

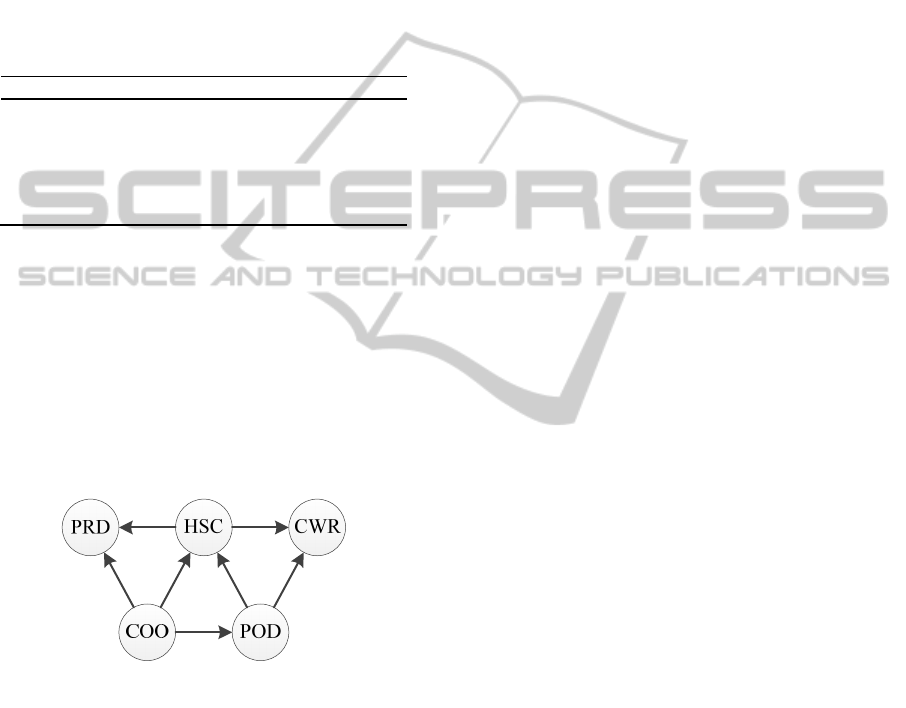

declaration (see Figure 1).

Figure 1: The Bayesian network of declaration variables.

We assume that the shipping routes from the country

of origin to the port of discharge allow us to explain

the declaration variables which at the time of

clearance are uncertain. The network is designed to

answer three main questions:

(I). Do the products stated in the commercial

invoice correspond to reality?

(II). Is the importer allowed to use a preferential

document to import the goods or gain a discount

on the customs duty?

(III). Does the ratio between the weights and the

commercial values of the goods correspond to

reality?

To answer these questions, we first identify the

logical dependencies among the declaration

variables, and then design the network accordingly.

The rationale behind question (I) is the following.

The type of goods is dependent on the origin of the

goods since many countries specialize in the

production and exportation of certain types of goods

according to their available resources and

knowledge. The opposite is also valid: countries that

lack specific goods need to import them from

favored country that is willing to sell. Modeling

these relationships in a Bayesian network requires

the converging relationship between HSC given

COO and POD. This converging relationship would

make COO and POD marginally independent to one

another. This is essentially invalid given the fact that

countries engage in long-term trade relationships

and buy specific goods from preferred countries.

Therefore, an additional arc is added between COO

and POD to include this dependency. Based on this

rationale, a design decision is made to model the

declaration variable (HSC) as conditionally

dependent on the transportation variables (COO and

POD). The arrows between HSC and COO, POD

cannot be reversed; otherwise the model would be

answering a different business question, i.e.

“whether the transportation route is normally /

correctly chosen for certain type for product”.

Reminding the format of exceptions analysis, we

use the dependency relations among HSC, COO and

POD to model the feature of accurate data. Having

this probability allow ABC to determine how likely

a product type (HSC) stated on the commercial

invoice is corresponding to reality and whether the

invoice may contain potential fraudulent information,

given the trading route COO and POD.

We can do similar reasoning for questions (II)

and (III) to incorporate declaration variables PRD

and CWR into the network. We leave this out from

the paper, and the following analysis will focus on

question (I) only.

4.3 Estimating the Parameters

The structure of the network must be parameterized

by determining the conditional probabilities for each

node. Identifying these probabilities based on expert

elicitation is problematic given the high cardinality

of some of the variables. Instead, we estimated each

conditional probability from our dataset given the

structure of our proposed network. The data does not

contain missing values but requires special attention

to deal with inaccurate submitted values. Maximum

Likelihood is used to deal with these inaccuracies.

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

710

4.4 Bayesian Inference

The posterior probability distribution of the target

variable HSC can be calculated when we receive

evidence on the transportation routes for various

types of goods. There has been a body of literature

on inference algorithms for Bayesian networks.

Logic sampling (Korb and Nicholson, 2003) is

applied in this case study to perform reasoning on

our network. Logic sampling computes the posterior

probability for each node in the network, traversing

from the root nodes down to the leaves.

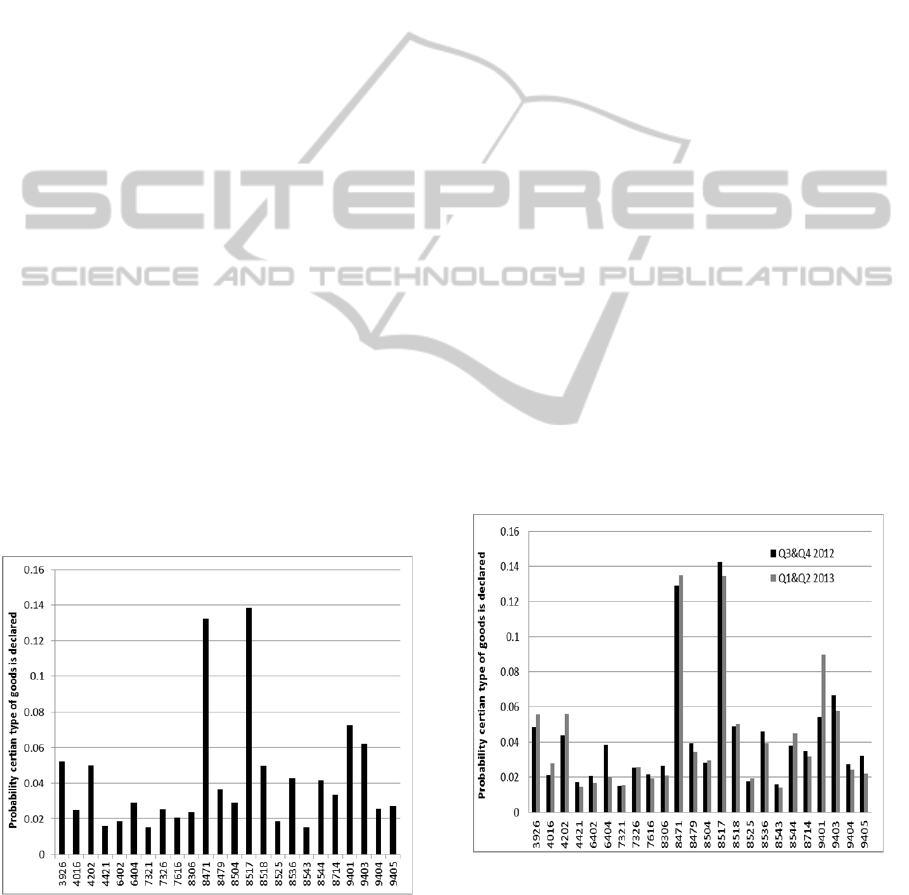

To illustrate the intuition of the model, let’s look

at a fictional scenario in which a new declaration is

to be made for goods transported from the country of

origin Country_C to the port of discharge

Port_P. We use the distribution of as

prior which represents the probability that certain

type of goods are shipped globally during July 2012

to June 2013 (see Figure 2).

The posterior conditional probability

| Country_C, Port_P can be

calculated from the Bayesian network and used as a

decision variable. If the probability is below 0.2 (the

threshold is devised by experience of the experts),

there is doubt on the correctness of the value of HSC.

For instance, posterior conditional probabilities for

plastic articles ( 8471 ) and computers

( 3926) are:

3926| Country_C,

Port_P0.733

(2)

8471| Country_C,

Port_P0.133

(3)

Figure 2: Global shipping behavior.

So the correctness for declarations for plastic articles

transported on this route should be further verified,

e.g. by checking the weight ratio CWR.

In this analysis, the other products than plastic

articles transported on this route are used as the

reference.

Following this line of reasoning, we can then

analyze the change of shipping behavior in certain

period of time. We split the data set into two parts

and calculate the conditional probabilities

respectively:

In the second half of 2012:

3926| Country_C,

Port_P 0.800

(4)

8471| Country_C,

Port_P 0.100

(5)

And in the first half of 2013:

3926| Country_C,

Port_P 0.600

(6)

8471| Country_C,

Port_P 0.200

(7)

An interesting change of shipping behavior is

observed in this transportation route, with the

conditional probability for computers reduced while

that for plastic articles increased. The probability for

plastic articles becomes even higher than or equal to

the threshold 0.2. One should note that the

shipments of both types of goods are increasing

slightly during the same period (see Figure 3). The

change of probability distribution conditional on this

route contradicts the global seasonal effect. This

calls for more attention and further investigation by

the internal auditors in ABC.

Figure 3: Change of global shipping behavior in second

half of 2012 (black) compared with first half of 2013

(grey).

AuditingDataReliabilityinInternationalLogistics-AnApplicationofBayesianNetworks

711

5 DISCUSSION AND

CONCLUSIONS

As an initial attempt, the analysis presented here is

rather basic and for the purpose of demonstrating the

use of Bayesian network. However, it sufficiently

shows the merits of Bayesian inference for the audits

on the correctness of the declarations.

Compared to the OLAP-based analysis, Bayesian

networks provide a lot more flexibilities in modeling

the relations between variables. Bayesian networks

allow us to update our beliefs about the conditional

probabilities of the declaration variables when new

evidence is received. This is especially useful for a

logistics company that is continuously operating and

accumulating data, as trends and changes in shipping

behavior can be monitored. Another merit of

Bayesian networks is their resemblance to the

transportation network in international trade, as the

behavior of transportation and trading routes can be

easily incorporated in the analysis.

When applying this analysis, one should note

that the inference cannot indicate whether a

declaration is incorrect, or vice versa. The analysis

result only gives an indication on the data reliability.

This can still be helpful for the auditor to direct his /

her attention to verify the most suspicious cases.

The quality of the analysis result is of course

sensitive to the choice of the threshold. Expert

knowledge and experience can be brought in for this

choice. Analytically, supervised method like

classification can be combined to complete the

“learning cycle” for this choice.

ACKNOWLEDGEMENTS

This work was supported by the EC FP7 project

CASSANDRA (Grant agreement no: 261795). We

are thankful to the reviewers’ constructive feedbacks.

REFERENCES

Caron, E. & Daniels, H. 2013, “Explanatory Business

Analytics in OLAP.” International Journal of

Business Intelligence Research (IJBIR), vol. 4, no. 3,

pp. 67–82.

Cendrowski, H, Petro, L, Martin, J & Wadecki, A 2007,

The handbook of fraud deterrence,

Choi, T. Y. & Hartley, J. L. 1996, “An exploration of

supplier selection practices across the supply chain.”

Journal of Operations Management, vol. 14, no. 4, pp.

333–343.

Christopher, M. & Lee, H. L. 2004, “Mitigating Supply

Chain Risk through Improved Confidence.”

International Journal of Physical Distribution &

Logistics Management, vol. 34, no. 5, pp. 388–396.

Feelders, A. & Daniels, HAM 2001, “A general model for

automated business diagnosis.” European Journal of

Operational Research, vol. 130, no. 3, pp. 623–637.

Hulstijn, J. & Overbeek, S. 2012, “Integrity of supply

chain visibility: Linking information to the physical

world.” Lecture Notes in Business Information

Processing, vol. 112, pp. 351–365.

Jambeiro Filho, J & Wainer, J 2007, “Using a Hierarchical

Bayesian Model to Handle High Cardinality Attributes

with Relevant Interactions in a Classification

Problem.,” in IJCAI,pp. 2504–2509.

Jensen, F. V. & Nielsen, TD 2007, Bayesian networks and

decision graphs, Springer Science+Business Media,

LLC, New York.

Klievink, B, van Stijn, E, Hesketh, D, Aldewereld, H, et al.

2012, “Enhancing Visibility in International Supply

Chains.” International Journal of Electronic

Government Research, vol. 8, no. 4, pp. 14–33.

Korb, K. B. & Nicholson, A. E. 2003, Bayesian artificial

intelligence, cRc Press.

Kumar, A. & Nagadevara, V. 2006, “Development of

hybrid classification methodology for mining skewed

data sets-a case study of indian customs data,” in

Computer Systems and Applications, 2006. IEEE

International Conference on.,pp. 584–591.

Liu, L., Daniels, H. & Hofman, W. 2013, “Detecting and

Explaining Business Exceptions for Risk Assessment.”

ICEIS 2013.

Tongzon, J. L. 2009, “Port choice and freight forwarders.”

Transportation Research Part E: Logistics and

Transportation Review, vol. 45, no. 1, pp. 186–195.

Wang, R. Y. & Strong, DM 1996, “Beyond accuracy:

What data quality means to data consumers.” J. of

Management Information Systems, vol. 12, no. 4, pp.

5–33.

Yan-hai, L. & Lin-yan, S 2005, “Study and applications of

data mining to the structure risk analysis of customs

declaration cargo,” in e-Business Engineering, 2005.

ICEBE 2005. IEEE International Conference on,pp.

761–764.

Yaqin, W. & Yuming, S. 2010, “Classification Model

Based on Association Rules in Customs Risk

Management Application,” in Intelligent System

Design and Engineering Application (ISDEA), 2010

International Conference on,pp. 436–439.

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

712