The Method of Automated Monitoring of Product Prices and Market

Position Determination in Relation to Competition Quotes

Monitoring of Product Prices and Marketability Development with Continuous

Assessment of Market Position in on-Line Sales

Radoslav Fasuga, Pavel Stoklasa and Martin Němec

Department of Computer Science, VŠB Technical University of Ostrava, 17.listpadu 15, Ostrava-Poruba, Czech Republic

Keywords: e-Commerce, Price Trends, Competitor Monitoring, Product Aggregator, Auction Systems, Availability of

Products, XML, Product Availability, Online Sales, e-Shop.

Abstract: This article deals with the issue of automated determination of product sales price in the on-line

environment. It also describes the method of calculation and the importance of global market position based

on the prices and services offered. The article describes the sources where you can obtain information on the

prices and marketability of the products. It describes the procedure to find the relevant products on the

competitor's websites, in product aggregators and auction systems. The article describes the monitoring of

price trends, product availability, promotional offers, sales and other means of sales promotion and on-line

marketing. In its final part the article describes the method that based on the information obtained

recommends the setting of the particular product price level, monitors the market developments and

recommends the seller price changes in relation to the current state of the market. Finally, it presents an on-

line application solution in which the previously described procedures are implemented.

1 INTRODUCTION

This article deals with the issue of monitoring price

trends of products in the on-line environment. It

describes the methods of obtaining information on

price trends, competitive offers, product availability

and their further processing for the purposes of

gaining strategic competitive advantage in terms of

sale.

One of the determining sales factors is the

product price. There is a large group of customers

for whom the price is the determining factor in on-

line shopping. The customers prefer the lowest

product price, regardless of the possible risks. They

accept a price increase only provided that there is an

offer of additional services: transport, service,

bonuses, etc. (Zhang, Shi, Lu, 2014).

The price of products is dynamically developing

in the on-line environment. There are general rules

of price trends for the selected product groups. New

products usually have the highest price and during

the sales cycle the price is decreasing until the

product is replaced by a new model resulting in a

clearance sale at the lowest prices. However there

may be situations where this model ceases to apply.

For example, the lack of a product on the market

may increase its price or, conversely, an excess of

the product can result in its price decrease. There are

even products whose price is increasing with its

decreasing availability on the market.

The product price may be influenced even by

external factors, such as the exchange rate trends in

the imported products, the commodity prices trends,

the economic situation in the particular region, etc.

In the context of competitive struggle, use is very

often made of the principles of special action offers,

discounts, loyalty programmes and the like.

Alternatively, a new seller may emerge trying to

gain market share through low breakthrough prices.

With the advancement of on-line shopping and

the growing amount of competitive bids, it is today

virtually impossible to be manually monitoring in

real-time the price developments of several products

and the behaviour of the competition.

This article deals with the method of automated

process monitoring of the competition prices trends

not only in the area of acquiring the necessary

information, but also their subsequent processing

5

Fasuga R., Stoklasa P. and N

ˇ

emec M..

The Method of Automated Monitoring of Product Prices and Market Position Determination in Relation to Competition Quotes - Monitoring of Product

Prices and Marketability Development with Continuous Assessment of Market Position in on-Line Sales.

DOI: 10.5220/0005014400050013

In Proceedings of the 11th International Conference on e-Business (ICE-B-2014), pages 5-13

ISBN: 978-989-758-043-7

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

and presentation in the form of strategic

recommendations: how to handle the price of a

specific product, whether to increase it, decrease it

or retain at the same level (Yang, Liu, Cau, 2013).

An important part of the article is formed by the

description of the method of calculating the global

market position in relation to the selected relevant

products. The comparison of the results with the

competitors makes it possible to optimise efficiently

one's own price levels and additional services.

The article describes the sources of information

on the product prices. The development of prices in

the course of time. Product availability and other

factors affecting the sale itself.

The article also describes marginally the unfair

practices used in the context of product offerings.

It describes an efficient procedure by which it is

automatically identified whether the products are

sold at the offered prices by the competitors.

In conclusion, the implementation of an on-line

tool is described by which the set of problems

outlined above is automatically resolved.

2 SOURCES OF INFORMATION

ABOUT PRODUCT PRICING

This chapter provides the resources for obtaining

competitive prices of the products offered. The

article is generally focused on the issues of the

product prices trends. The procedures described can

be generalised and used also to monitor the

development of the prices of services.

The sources of price information are arranged in

the usual order as preferred by the customer when

searching for prices and competitive offers.

2.1 Product aggregators

The first choice when searching for product prices

are usually the product aggregators. On a global

scale, this is the Google Products service, while

regionally these are the local portals. The major

market players in the Czech Republic (CR) are the

Heureka.cz and Zboží.cz portals. In the Czech

Republic, the advertising of products in these

aggregators is subject to the payment of an official

service fee. A seller who intentionally or by

omission ceases to pay for these services loses the

possibility of being found out for an ordinary

customer. Even though he may have the best offer

on the market, the customer does not know about it.

The customer searches in the aggregators based

on the key words describing the product concerned,

its model or variants.

In the aggregators, the products are divided into

two groups of matched and unmatched products.

2.1.1 Matched Products

Matched products are those that can be clearly

identified and classified by the aggregator. It is

usually done based on the EAN code or the typical

(unique) product name or its variant. Moreover, the

matched products are also included in a specific

product category and are listed in a preferential

position in the search results.

Here the heaviest competition struggle for

customers is taking place, which is primarily

influenced by the price of the product (the main

sorting criterion when listing the quotations). All the

sellers are presenting the same product and except

for the price, they can influence the customer only

by supplementary services (value added, transport

options) and by their references.

It is very important to ensure that in the offers

classified in this way, the price of the product would

be set at least below the average sales price.

Higher prices can be afforded only by the sellers,

who have a strong commercial position, which is

usually obtained after a long time of using intensive

marketing campaigns.

2.1.2 Unmatched Products

There is a relatively large set of unmatched products

in the aggregators. These are usually products

without EAN or products with ambiguous (unequal)

denomination (Zhao, Sundersan, Shen, Yu, 2013).

These products are subsequently searched for on

a full-text basis and their listing in the aggregator

results is only under the matched products.

Here, the seller must be very careful as regards

the choice of the right keywords and phrases that

will be used by the customers when searching for the

particular product. These keywords and phrases

must be listed in the product name and description,

which is imported into the aggregator usually in the

form of a XML Feed.

2.1.3 Unfair Practices in Product

Aggregators

The results in the aggregators can be presented even

in an unfair and incorrect manner. This conduct is

sometimes caused by the malfunction of the e-shop

but sometimes it is done deliberately by the sellers.

ICE-B2014-InternationalConferenceone-Business

6

The most common misconducts include presenting

false information and manipulating the keywords.

False information often means incorrect

indication of the product price. In such a case, the

seller usually indicates a lower price in the

aggregator than that at which the product is

subsequently available on the seller's website.

The second misconduct is the unavailability of

the goods. The seller presents in the aggregator

information about the product's being available in

stock, but in fact, it is not available in the e-shop.

The third malpractice is unfair manipulation of

keywords. The seller does not have exactly the

featured product, but has a product that is somehow

related to it. When referring to it and describing it,

the seller uses the key words of a different product,

and thus the product is listed in the search results of

other irrelevant products (Zhang, Zhong, 2013).

It is very difficult without an automated solution

to identify whether the seller uses the unfair

practices deliberately or whether they are just an

error in the seller's system. It can clearly be

identified only after examining more items from the

seller's offers whether these procedures occur

recurrently or not. In the final stage, however, these

unfair practices do harm to the person by whom they

have been used because the customer expects the

declared availability of the goods for the indicated

sales price. Otherwise, the customer loses

confidence in the particular seller.

2.2 e-Shop Websites

If the item of the goods is not found in the product

aggregators, the customer starts to search directly in

e-shops or by using website search engines (Google,

Bing, Seznam). This procedure, however, is rather

time-consuming. By contrast, there is a relatively big

advantage that when the customers find the

particular result they do not compare competitive

offers.

However, it is important to know what offers,

with what availability and competition prices are

presented on the websites.

2.2.1 Template e-Shops

E-shops created based on customary templates or

using open-source designs (Magento, Prestashop,

etc.) or commercial prototype solutions are relatively

easy to analyse.

Despite the different visual appearance, the

internal structure of the e-shop (HTML) is usually

identical or very similar. It is possible to create a

tool to browse the e-shop sites and obtain

information from them about the product pricing and

availability.

2.2.2 Tailored e-Shops and Individual

Implementation

A problematic group of e-shops are those using their

own tailored implementation solutions or those

having very specific requirements for price listings,

availability of goods (services) and the like.

For these types of design, it is necessary to create

an individual solution that within the available

website source code retrieves the areas with the

required information.

In the worst cases, the text extraction methods

are used within which the required information is

obtained based on the identification of the

appropriate text string on the webpage (for example,

the page contains such words as available, in stock,

etc.).

The biggest problems are with the e-shops,

which offer only bulk listings of products. This

means that one webpage is indicating several dozens

or even hundreds of products without the possibility

of displaying details about any particular product.

Such lists or products can be extracted as

spreadsheet tables and based on the key words or

product numbers they can be subsequently matched

together.

2.3 Auction Systems

A good source of the trends of product prices, as

well as the marketability itself are the auction

systems. Of course, here there are offers of used or

unwanted goods, but still more and more sellers are

apprehending the auction systems as an alternative

to the sale and advertising channels. The auction

systems have the disadvantage of increased costs of

selling, because it is necessary to pay fees to the

system operator for the bid publishing and the

subsequent auctioning. These costs are negligible for

products with high margins whereas the products

with margins in the order of just a few percent are

unsalable in this way as a matter of fact.

In terms of the analysis of the product prices

trends, however, the auction systems are a very

valuable source of information. We can monitor

whether a product is offered at auctions or not. If a

product is offered in this way, we can see the price

level and whether it was successfully auctioned off

(sold), what was the final sales price, how often and

by how many people the bid was changed or

TheMethodofAutomatedMonitoringofProductPricesandMarketPositionDeterminationinRelationtoCompetition

Quotes-MonitoringofProductPricesandMarketabilityDevelopmentwithContinuousAssessmentofMarketPositionin

on-LineSales

7

increased (what is the interest in the product). This

information is very useful for setting the e-shop

prices and represents the relevant realistic

information about the marketability of the particular

product (Etzion, Moore, 2013).

3 METHODS OF OBTAINING

INFORMATION ABOUT THE

PRODUCT PRICES

As it is clear from the previous chapter, manual

monitoring of the development of product prices is

possible today only for a very small set of products

and competitors. For commonly sold goods, we may

want to follow hundreds of products with dozens of

possible competitors. It is therefore evident that this

task cannot be resolved without automation of these

processes (Felfernig, Jeran, Ninaus, Renfrank,

Reiterer, 2013).

In the next chapter, we will focus on the

description of the automation of these processes, the

preparatory phase of gathering the product

information and the subsequent application of such

information for the purposes of retrieving and

correct matching of the results obtained.

3.1 The Preparatory Phase of the

Product Prices Collection

Before we start searching and automatic matching

the given product, it is necessary to obtain the basic

information about it to narrow the search results.

It is important to have the following information

ready for reference:

The original name of the product

The commonly used names and abbreviations

of the product

Keywords and exclusive keywords that the

customers will use when retrieving the desired

product:

In aggregators

In search engines

In auction systems

The price range for the product

URL addresses to:

aggregators of the goods, where the

product is matched

the particular website where the product

is offered

competitive websites, where the product

is offered

The gathering of the above information is a

relatively time-consuming process. On the other

hand, the strategic advantage in the subsequent

automated processing is invaluable.

It is clear that the product names and keywords,

under which the products will be searched, can be

used for automated data mining from the price

aggregators, search engines and auction systems. It

is also advisable to opt for the so-called exclusive

keywords that may not appear with the product

being retrieved. In this way, we are eliminating the

possibility of confusing products of different types

with similar names. Determining the product's

minimum and maximum prices eliminates the

possible confusion with other products or product

packages or, as the case may be, products with

additional accessories. It is important to modify the

price interval either manually or automatically based

on the continuously monitored prices.

The information about our own website provides

reference information about whether and at what

price the product is offered by us.

The competitive websites or, more specifically,

the URL addresses leading to a specific product on

these sites provide actual information about the

prices at which the product is offered by the

competitor, and whether the product is actually

available (or, as the case may be, in what quantities).

The competitive websites also need to be updated,

supplemented by new competitors and the non-

functional links of the existing competitors need to

be updated.

3.2 Automated Data Acquisition from

Aggregators and Auction Systems

Automatic machine acquisition of the above

described data is dealt with in several ways. Some

auction systems and product aggregators offer an

application communication programming interface

(API) through which it is possible to receive replies

to formulated queries (in the search process). These

services can be limited to a certain number of

queries and possibly subject to the payment of a fee.

Many services, however, do not provide an open

communication interface and it is therefore

necessary to ask queries directly via the web forms

of the respective aggregators. Subsequently, it is

necessary to capture the generated result and to

obtain the required data from it using certain

programming techniques. Despite the fact that this

ICE-B2014-InternationalConferenceone-Business

8

method is complicated and the aggregator operators

are trying to prevent it (by limiting the number of

queries of the respective clients), this method is very

effective and brings the desired results.

If we are downloading information about the

retrieved matched product, we require only one

specific webpage. For the full-text results, it is

necessary to eliminate the undesirable results based

on more specific keywords, exclusive keywords and

the price range.

3.3 Direct Product Search on e-Shop

Websites

The basic question is how to get information about

a specific URL address on which the reference

product is presented by the competitor.

3.3.1 Getting URL Links from the

Aggregators

The first source is the product aggregators, because

the search results not only provide information on

the availability and prices, but also a direct link to

the product in the particular e-shop. This source of

machine obtained direct URL links constitutes an

essential basis for subsequent direct analyses (Wang,

Zhang, Chen, 2012).

3.3.2 Manually Added URL Links

It is also necessary, however, to add URL links to

offers of e-shops that are not registered in the

aggregators. We can get to these sources by

monitoring the advertising channels, social network

bulletin boards, using the information obtained from

customers and the like.

Then we can browse the particular website

address and retrieve the relevant product in the

offerings. If this website is indexed in search engines

(e.g. Google), then it is possible to accelerate the

process of finding the relevant website by

formulating a query:

site:concurency.com product_keyword

The site means the page of the competitive

website and the

product_keyword means the

relevant keywords for the given product. The result

provides the most likely sites for the given product.

3.3.3 Extracting the Relevant Information

from the Websites

If we already have a list of URL addresses of the

product for the particular competitors, it is necessary

to ensure the automated extraction of the relevant

information (Mikians, Gyarmeti, Erramilli, 2012).

The most important for us is the information

about the sales price, whether the product is

available and/or in what quantities. It is necessary to

collect the information on a long-term basis and

record the ongoing changes.

By monitoring the long-term changes on the

competitive e-shop websites we can identify the

typical conduct of the competitors. How they react

to market fluctuations, which advertising and

promotional techniques are used by them, whether

they use incentives in the form of special rates and

discounts, and/or how quickly they replenish the

inventory stock, etc. (Hajli 2013).

4 DESCRIPTION OF THE DATA

COLLECTED

We have to record the individual monitored products

and for them their own sales prices. Then we register

the competition price of the same product, i.e. the

source e-shop, the valuation date, the actual price

and availability. For prices, we also indicate the

source from which the data were obtained

(aggregator, auction, direct URL link). In regular

iterations, we are going through our own e-shop,

aggregators, auction systems and competitive e-

shops and are monitoring the changes over time

(Figure 1).

Product

Obtained

information:

Date,Price,

Availability

Competitor

Datasource:

Aggregator,

Searchengine,

DirectUR L link

Figure 1: The obtained monitored data.

Based on the data collected in this way we can

monitor the price developments of the individual

products. We can keep track of the maximum,

minimum, average, median and other various prices.

We can set up a tracking mechanism that will alert

us:

TheMethodofAutomatedMonitoringofProductPricesandMarketPositionDeterminationinRelationtoCompetition

Quotes-MonitoringofProductPricesandMarketabilityDevelopmentwithContinuousAssessmentofMarketPositionin

on-LineSales

9

if our price is the highest (and thus the

goods are unsaleable)

or if our price is the lowest (we can

increase the price of the goods and can

still remain the cheapest)

whether we are in the optimum price

range

whether the goods are available from

the competition and in what quantities

whether a special price, discount or

clearance sale price is applied to the

goods by the competitors

All this information can be obtained

automatically on a machine basis, without the

necessity of manually browsing through a collection

of links and the search results.

5 GLOBAL ANALYSES OF

COMPETITION PRICES

Just as we can track the individual products and the

development of their prices, we can monitor the

entire collections of products.

We define therefore the products that are

relevant to us. We define the significance percentage

for each product, i.e. how important to us the

product is within our sales portfolio. Different e-

shops may have different priority products.

5.1 Calculation of the Product Price

Evaluation Indicator

The next step is the setting of the rating price level,

for example using again the assessment level of 0-

100. The lowest price represents the best value, i.e.

100. The second step is to set up the so-called zero

level, i.e. how significant is the fact that the product

is not offered (is not available) by the e-shop as

compared with the product's highest price. For

example, if the product is not offered by the e-shop,

it gets 0 points and if the product is offered by the e-

shop at the highest price, it gets 50 points. E-shops

that offer the product with different prices, receive a

proportional number of points in the interval

between 50-100 points according to their prices

(where 50 represents the highest and 100 the lowest

price).

Other factors that may influence the evaluation

of the product can be defined as penalty points,

which will reduce the product rating for the

particular e-shop. Typical examples for penalizing

are as follows:

the goods are not in stock - only on

request

the goods cannot be taken away by

person

the goods cannot be sent on the cash-

on-delivery basis

the goods cannot be paid by cash, by

bank transfer, by credit card

the goods are available only based on

inconvenient modes of transport

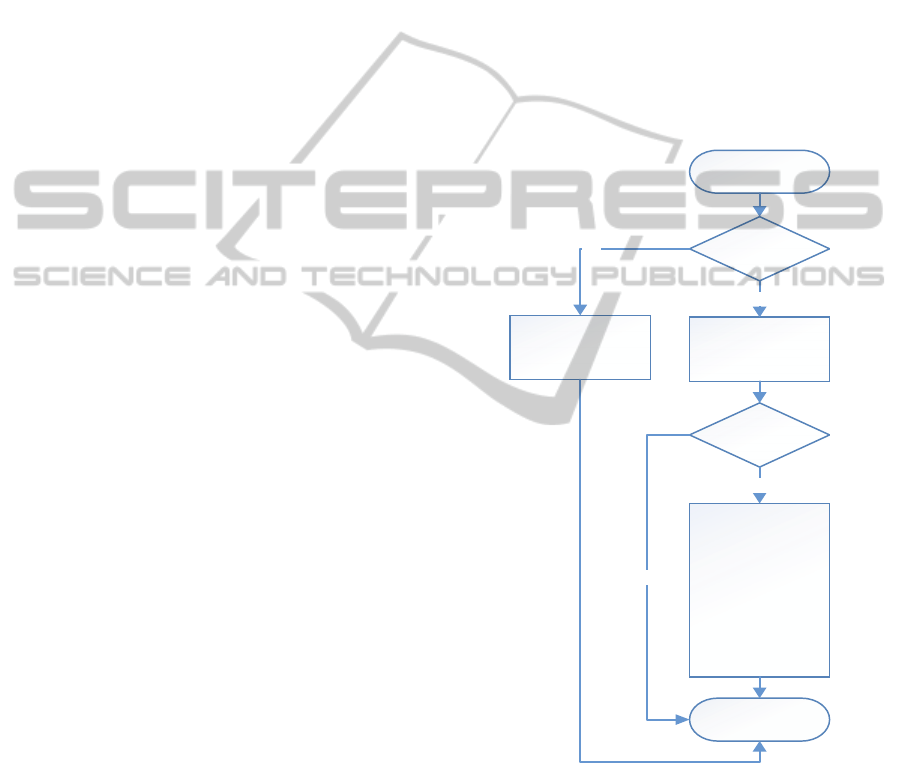

The entire pricing process can be seen in the

following flowchart (Figure 2).

Start

Finish

Calculatebasic

valueof rating

basedonpri ce

Score:100–50

Productissold

bye‐shop?

Yes

Setratingto:0

No

Existssome

penalty?

Penaltyscorefor:

Toorderproduct,

Personal

consumption,

Cashondelivery,

Wire transfer,

Creditcard,

Transport,

Additionalservices

Minus:0–30

No

Yes

Figure 2: Product rating flowchart.

5.2 Market Position and Its Analyses

If we multiply the above result by the significance

percentage and sum up these results for all the

relevant products defined by us, we get the

assessment of our offer and the offers of the

competition, where the higher score represents a

better result. By sorting out the list of competitors in

ICE-B2014-InternationalConferenceone-Business

10

accordance with the calculated criterion, we get the

current market position (Elakehal, Padget, 2012).

Using the comparative analysis, we can compare

our position with the best competitors. In this way

we can find out in which attributes and values we

are lagging behind. Subsequently we can work on

these indicators and correct them.

We can also use the so-called differential

analysis, where we try to identify the areas in which

a few or no competitors are active. If these areas are

relevant to our customers, we can offer them new

options and services.

5.3 Frequency of the Market Position

Analysis

Just as it is important to update regularly the

development of the product prices and availability, it

is necessary to upgrade the market position rating.

It often appears that the competition is doing

nothing and that their changes at the level of partial

products are negligible, but still they can be of great

importance on a global scale.

Our monitoring has shown that small but regular

changes and sensitive price adjustments (not only

price reductions, but also price increases) of the

products are much more efficient in the long term

than dramatic actions, discounts and clearance sales.

The sellers who sell at discount prices are losing

their own profits and often have to sell much more

to achieve the same profits as those who sell without

discounts, not to mention the increased costs of

distribution, complaints and similar services.

In the on-line solution implemented by us, the

users can define the relevant products, product

groups and all the criteria described above.

This is subsequently followed by the process of

gathering the necessary data and generating detailed

reporting assemblies, both to determine the global

market position and to identify the position of the

individual products.

In addition, the system offers the possibility of

defining the control and decision-making rules,

where it is possible to define the conduct of an

expert, who based on the selected sales and

marketing strategy may recommend the appropriate

corrections to the prices and services provided.

6 THE METHOD OF

MARKETABILITY RATING

The most common user question is: Whether and at

what price the product is sold? The answer to this

question can be found in the process of monitoring

the product sales prices and their availability. The

evaluation principle is relatively simple.

If in the previous iteration, the e-shop did not

have and offer the product in stock and now it has it

in stock, it cannot be predicted whether the given

product was sold in the meantime and at what price.

If in the previous iteration the e-shop offered the

product in stock and now the product is out of stock,

it can be assumed that in the meantime the product

had been sold for the formerly ?withdrawn?

(adjusted) price. The same applies if the e-shop

indicates on its website a certain number of available

products and this number changes again (decreases)

downwards.

A problem may occur in the case when the

number of products to be sold changed (decreased),

but the price in the given period has also changed

(increased or decreased). Then we cannot say with

certainty whether the product was sold for the

original price or for the current price (Figure 3).

Start

Selectconcrete

e‐shop

Getprevious:

Productstock

count,

Product pr ic e

Previous

productstock

countis0?

Unpredictable

Sale

Yes

Getcurrent:

Productstock

count,

Product pr ic e

No

Count

previous=

current?

Yes

Count

previous>

current?

No

No

Price

previous=

current?

Yes

Productwassold

for:

Givenprice

Yes

Finish

Predictablesale,but

unpredictablepr i ce

No

Figure 3: Marketability flowchart.

TheMethodofAutomatedMonitoringofProductPricesandMarketPositionDeterminationinRelationtoCompetition

Quotes-MonitoringofProductPricesandMarketabilityDevelopmentwithContinuousAssessmentofMarketPositionin

on-LineSales

11

In the chapters above, we have also indicated

how to obtain information about sales within the

auction systems.

7 DESCRIPTION OF THE

IMPLEMENTATION

The procedures and methods described above have

been experimentally implemented within the specific

research of the Mining University (VŠB), Technical

University of Ostrava.

The implementation section is divided into the

so-called crawler layer that continuously retrieves

data from product aggregators and auction systems

and accesses the e-shops as such. This layer is

implemented as a multi-threaded Java application.

MySQL was chosen as the primary database for the

storage of downloaded data as well as the calculated

intermediate results.

7.1 Extraction of Relevant Data

After the data have been downloaded, they are

extracted, both of the websites obtained from the

aggregators, where the sets of records are extracted,

as well as from the specific e-shops.

There are import templates defined for each e-

shop that describe the structural content of the

website and are able to extract effectively the

desired information. The tool allows to analyze new

websites, load new structure and in a visually

acceptable form (without knowledge of the

implementation of website presentations) to define

the places where the relevant information (prices,

availability, etc.) is located. The system is also able

to manage identification of multiple variants and

product prices within a single webpage.

7.2 Presentation Layer

The presentation layer is implemented over the PHP

technology with the Nette framework (with respect

to the choice of the open source software). The

HighCharts component is used for the presentation

of graphs. The initially intended visual

representation using the responsive CSS Framework

Metro UI (Figure 4s) was replaced with the ACE

template comprehensive solution based on Twitter

Bootstrap.

The presentation layer also includes the ability to

export the results in the CSV, XLS, XML formats

for additional processing.

Figure 4: Marketability flowchart.

7.3 Optimization, Deduplication and

Security

In the context of the analyses conducted, there are

works carried out even for relatively small projects

with large amounts of data in terms of their

transmission, processing, subsequent storage and

reasonable reporting.

Here, an important role is also played by the

continuity and smoothness of the process of

obtaining information because failures in the

downloading process cannot be replaced by

anything, because pricing is a constantly changing

dynamic process.

For the projects, it is also necessary to deal with

the query deduplication over the product

aggregators, auction systems and the sales websites.

It is very likely that the system will be also used for

analyses by competing projects, which would want

to evaluate each other. It is necessary to eliminate

duplicate requirements and especially to prevent the

possible abuse of the resulting analyses.

Each user brings into the system part of their

personal knowledge and experience with a given

market segment. They propose their own

assessments and metrics for comparing the projects.

It is therefore necessary to ensure thorough security

ICE-B2014-InternationalConferenceone-Business

12

and backup of user accounts to prevent the stealing

of such critical information.

7.4 Objectives of the Implementation

and the Related Modules

At present, the application is fully localised in the

Czech language and is oriented on the Czech on-line

sales environment. The extension of the scope of

operation is being prepared for the future within the

European Union.

The entire solution should be integrated into a

comprehensive solution, which - besides solving the

pricing policy and the price developments - will also

deal with the other aspects of on-line commerce,

such as monitoring the positions in search engines,

SEO optimisations, finding similarities within the

same or competing websites, analysis of backward

references and operation on social networks. The

system is implemented on a modular basis so that

partial results of the different modules can be

mutually combined and assessed.

The system can also integrate external data

sources, such as foreign exchange lists, commodity

prices developments, demographic data and

sociological or statistical results.

8 CONCLUSIONS

The principles and procedures described herein are

reflecting the current state of the development of the

tool for the analysis of competitive quotations and

the determining of global market positions. All the

results published herein have been verified in

practice under real projects. Currently, a pilot launch

of the project is under preparation for the public.

The project is oriented with its focus on small and

medium-sized entrepreneurs who do not have

enough time and human and financial resources to

analyse such large collections of data. The

implemented system should automate and streamline

this entire process and make it available for any

common user.

We will welcome any comments, suggestions for

improvements or opportunities for cooperation and

joint research in this practice-oriented field of e-

commerce. The aim is to give the ordinary users

comprehensible facts, which will help them

streamline and further develop their business.

ACKNOWLEDGEMENT

This work was partially supported by the SGS in

VSB Technical University of Ostrava, Czech

Republic, under the grant No. SP2014/217, and

grant No. SP2014/211.

This work was partially supported by the

Development of human resources in research and

development of latest soft computing methods and

their application in practice project, reg. no.

CZ.1.07/2.3.00/20.0072 funded by Operational

Programme Education for Competitiveness, co-

financed by ESF and state budget of the Czech

Republic.

REFERENCES

ZHANG, L.Y., SHI, Y.J. and LU, Q., 2014. Consumer's

decision-making behavior in online shopping: An

integrated analysis. Applied Mechanics and Materials.

YANG, Y., LIU, H. and CAI, Y., 2013. Discovery of

online shopping patterns across websites. INFORMS

Journal on Computing, 25(1), pp. 161-176.

ZHAO, Y., SUNDARESAN, N., SHEN, Z. and YU, P.S.,

2013. Anatomy of a web-scale resale market: A data

mining approach, WWW 2013 - Proceedings of the

22nd International Conference on World Wide Web

2013, pp. 1533-1543.

ZHANG, H.-. and ZHONG, H.-., 2013. The optimal

pricing of E-commerce market with network

externalities, International Conference on

Management Science and Engineering - Annual

Conference Proceedings 2013, pp. 126-132.

FELFERNIG, A., JERAN, M., NINAUS, G.,

REINFRANK, F. and REITERER, S., 2013. Toward

the next generation of recommender systems:

Applications and research challenges. Smart

Innovation, Systems and Technologies.

HAJLI, M., 2013. A research framework for social

commerce adoption. Information Management and

Computer Security, 21(3), pp. 144-154.

ETZION, H. and MOORE, S., 2013. Managing online

sales with posted price and open-bid auctions.

Decision Support Systems, 54(3), pp. 1327-1339.

WANG, J., ZHANG, Y. and CHEN, T., 2012. Unified

recommendation and search in e-commerce. 8th Asia

Information Retrieval Societies Conference 2012.

MIKIANS, J., GYARMATI, L., ERRAMILLI, V. and

LAOUTARIS, N., 2012. Detecting price and search

discrimination on the Internet, Proceedings of the 11th

ACM Workshop on Hot Topics in Networks, HotNets-

11 2012, pp. 79-84.

ELAKEHAL, E.E. and PADGET, J., 2012. Market

intelligence and price adaptation, ACM International

Conference Proceeding Series 2012, pp. 9-16.

TheMethodofAutomatedMonitoringofProductPricesandMarketPositionDeterminationinRelationtoCompetition

Quotes-MonitoringofProductPricesandMarketabilityDevelopmentwithContinuousAssessmentofMarketPositionin

on-LineSales

13