Influence of Resource Allocation in the Photovoltaic R&D of Japan

based on Technology Stock Modeling

Eiichi Endo

National Institute of Advanced Industrial Science and Technology, 1-2-1, Namiki, Tsukuba, Ibaraki, 305-8564 Japan

Keywords: Solar Cell, R&D, Resource Allocation, Technological Progress Model, Technology Stock, Module Price,

Market Share.

Abstract: In Japan, crystalline silicon solar cells have a large market share in production, however they have not been

a priority in R&D. This paper analyzes the influence of resource allocation in the photovoltaic (PV) R&D in

Japan on the price of solar cells and the market share in world solar cell production. Firstly, it finds that the

price of solar cells in Japan, with respect to the resource allocation in R&D of crystalline silicon solar cells,

did not reduce significantly but maintained a constant level. For the projection, it does not use an experience

curve, but models technological progress and price reduction of solar cells in Japan, excluding mass

production effects, based on technological knowledge stock modeling. Secondly, solar cell prices in other

countries are estimated based on their market share of the world's solar cell production. The estimated solar

cell price in Japan is reduced by up to 40% from the actual price, and is competitive to the estimated solar

cell prices in China and Taiwan. In this case, Japan could maintain its high share in the world solar cell

production for a few years longer. This analysis will contribute to cost-effective R&D resource allocation by

a simulation approach.

1 INTRODUCTION

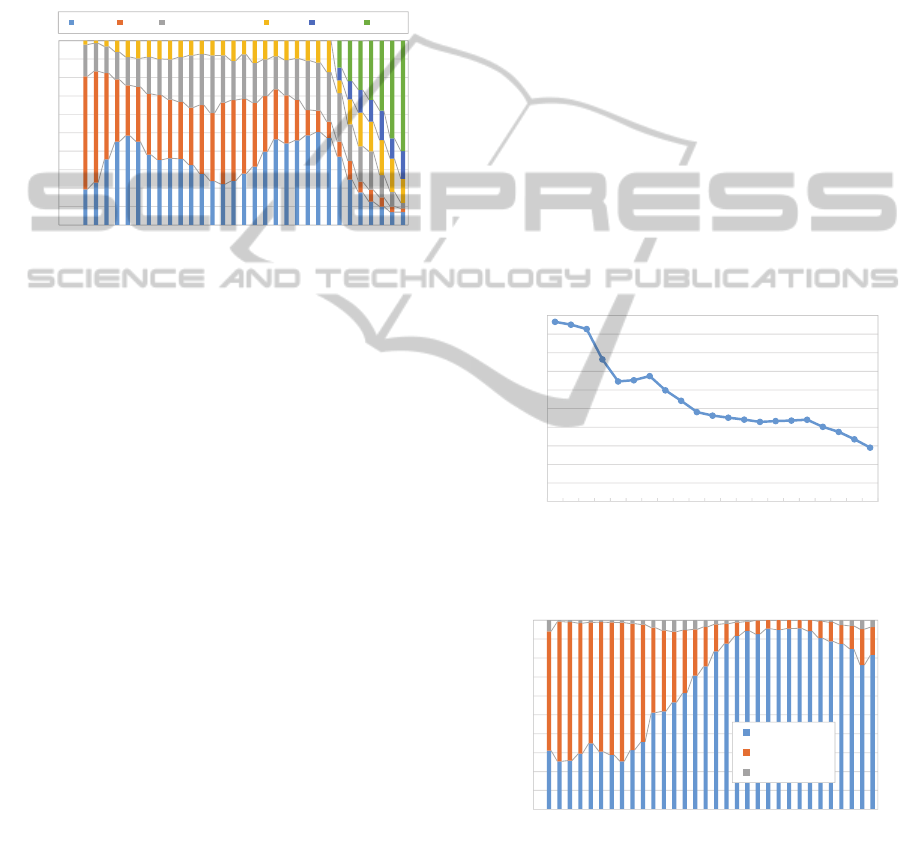

Figure 1 shows the market share of the world solar

cell production by country (IEA-PVPS, 1998, 2013,

Maycock, 1982,…,2006). The market share of Japan

had increased by up to 50% from 1995 to 2004.

However, after that, Japan has lost its market share,

declining rapidly to 7%. Instead of Japan, China and

Taiwan have rapidly expanded their market share. A

few of the reasons why Japan has lost its market

share, according to New Energy and Industrial

Technology Development Organization (NEDO),

one of the governmental funding agencies of Japan,

are that Japanese solar cell manufacturers could not

import enough materials made of silicon and they

could not keep up with the large investments made

by China and Taiwan. However, prior studies point

out other problems in the photovoltaic (PV)

technology development and industrial policies of

the government (Endo, 2003, Oshika, 2013).

Most analyses regarding solar cell technologies, for

example, price projection, are based mainly on the

experience curve (IEA, 2000). However, it cannot

distinguish between the effects of mass production

and technological progress. Other than the

experience curve, other approaches, such as the

analysis of cost factors (Nemet, 2006), life cycle

assessment (LCA) (Yamada, 2012), and analysis of

technology development (Watanabe, 2000), were

used for analyzing solar cell technologies and

projecting their costs, but there are no studies

focusing on the resource allocation in PV R&D.

Based on the background mentioned above, this

paper focuses on R&D of crystalline silicon solar

cells (single and multi-crystalline silicon solar cells)

in Japan, from a resource allocation point of view,

and analyzes its effects on price reduction of solar

cells and change in market share of the world's

production of solar cells. This analysis is not based

on the experience curve, but models price reduction

as a result of R&D, excluding the effects of mass

production, and adopts the technology knowledge

stock approach. On the other hand, price ratios of

solar cells between Japan and other countries are

estimated based on their market share of the world

solar cell production. The analysis shows the

influence of resource allocation in PV R&D of Japan

709

Endo E..

Influence of Resource Allocation in the Photovoltaic R&D of Japan based on Technology Stock Modeling.

DOI: 10.5220/0005038007090716

In Proceedings of the 4th International Conference on Simulation and Modeling Methodologies, Technologies and Applications (SIMULTECH-2014),

pages 709-716

ISBN: 978-989-758-038-3

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

on the price of indigenous solar cells and market

share of the world's solar cell production.

A combination of the technological progress model

of solar cells, the world solar cell market model, and

the dissemination model for residential PV systems

(Endo, 2014) suggests the possibility of utilizing a

simulation approach to achieve cost-effective

resource allocation in PV technology development.

0

10

20

30

40

50

60

70

80

90

100

1980 1984 1988 1992 1996 2000 2004 2008 2012

Solar cell production (%)

(Year)

Japan USA Europe/Germany ROW Taiwan China

Figure 1: Market share of the world solar cell production

by country.

2 MODELING OF

TECHNOLOGICAL PROGRESS

OF SOLAR CELLS

2.1 Solar Cell Price

Figure 2 shows the module price of solar cells in

Japan (IEA-PVPS, 2013), which has been reducing

steadily since 1992. However, it was affected by

increases in silicon price and almost stabilized in the

middle of the 2000s. After 2008, the price of solar

cells dropped rapidly due to oversupply in the world

solar cell market. The price can be regarded as the

module price of crystalline silicon solar cells, as

crystalline silicon has had a large market share in the

solar cell production of Japan, except in the early

years, when solar cells were used mainly in

calculators, as shown in Figure 3.

The module price declined from 966 JPY/W in 1992

to 290 JPY/W in 2012. This price reduction to 0.300

(=290/966) of the 1992 level was because of

technological progress and the effects of mass

production, such as economies of scale and learning-

by-doing. For modeling technological progress, that

is, price reduction due to R&D, the effects of mass

production are removed in the following manner.

Regarding the effects of mass production, economies

of scale is estimated using LCA. Yamada, 2012

showed that the module cost was 350 JPY/W ten

years ago, at a production scale of 10 MW/year. It is

now 144 JPY/W at the production scale of 1

GW/year. In this case, the effects of economies of

scale are computed to be 40 JPY/W. This means that

the price, reduced by 10 times of the scale up, is

0.941 = ((310/350)^0.5). For this analysis, instead of

the total annual production of crystalline silicon

solar cells in a production line or a company, the

indigenous production of Japan is used as the annual

production. For the figures on cumulative

production, total cumulative production of

crystalline silicon solar cells in Japan is used. The

annual and cumulative solar cell production

increases are 401 times and 334 times, respectively,

during the last 20 years. If the price, reduced by 10

times of the scale up, is rounded and assumed as

0.94, the price reduction due to economies of scale

during the last 20 years is 0.851 = (0.94^

log

10

(401)).

0

100

200

300

400

500

600

700

800

900

1000

199219962000200420082012

Module price (JPY/W)

(Year)

Figure 2: Solar cell price in Japan.

0

10

20

30

40

50

60

70

80

90

100

1980 1984 1988 1992 1996 2000 2004 2008 2012

Solar cell production (%)

(Year)

crystalline Si

thin film Si

others

Figure 3: Solar cell production in Japan by cell

technology.

The progress ratio (PR) (IEA, 2000) includes

technological progress and the effects of mass

production, and is 0.866 = 0.300^(1/log

2

(334)) =

SIMULTECH2014-4thInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

710

(2^-E), with (E=0.207). However, PR for only

learning-by-doing is assumed to be 0.991 (price

reduction of 0.97 for 10 times of the cumulative

production). In other words, price reduction during

the last 20 years is assumed to be 0.926 with

learning-by-doing (=0.991^log

2

(334) or

0.97^log

10

(334)) and 0.381 (=0.300/(0.851*0.926))

with technological progress due to R&D.

2.2 R&D Expenditures for PV

Figure 4 shows the governmental budget for PV

R&D in Japan. In the figure, budgets are categorized

into three types of solar cells, crystalline silicon, thin

film silicon, and others, PV systems including

balance of system (BOS), and other PV related ones.

From 1974 to 2000, PV R&D was promoted under

the Sunshine Program (from 1993, the New-

Sunshine Program) of the Ministry of International

Trade and Industry (MITI). From 2001, PV R&D

was conducted as a part of NEDO’s technology

development program (from 2008, the advanced

solar cell technology development program was

initiated). NEDO does not disclose R&D

expenditures by themes. For the analysis, therefore,

R&D expenditures from 2001 were estimated based

on the budget for individual projects and the number

of themes or sub-themes in the project.

Regarding R&D expenditures on crystalline silicon

solar cells, it was reduced drastically in 1997. It

came back to previous levels soon, but it has been

kept at a low level after that.

0

1000

2000

3000

4000

5000

6000

7000

8000

9000

10000

11000

1980 1984 1988 1992 1996 2000 2004 2008 2012

R&D expenditures (million JPY)

(Year)

crystalline Si thin film Si other cells system other PV

Figure 4: R&D expenditures for photovoltaics by the

Japanese government by technologies.

2.3 Technology Knowledge Stock

Based on Watanabe, 2000, let us define technology

knowledge stock by equation (1).

TS

t

= TS

t

-1

* (1 - ro) + RE

t

-

m

/ rd

t

-

m

(1)

where

TS

t

: technology knowledge stock of R&D in year t

(million JPY)

m: lead-time from R&D to commercialization

(year), m=5 is used based on NEDO’s PV

technology development (Ogawa, 2001)

ro: rate of obsolescence (%), ro=20% (Watanabe,

2000) and 10% (MRI, 1991) are used for PV R&D

RE

t

: R&D expenditures in year t (million JPY)

rd

t

: R&D deflator in year t (MEXT, 2013)

R&D expenditures become obsolete and contribute

lesser to technological progress over time.

Technology knowledge stock is the cumulative

R&D expenditure, after considering the

obsolescence of technologies. Obsolescence is

defined not by period, but by the rate of

obsolescence. ro=20%, 10% mean technologies

become obsolete in 5 and 10 years, respectively. If

the rate of obsolescence can be omitted (ro=0), then

technology knowledge stock is the same as

cumulative R&D expenditure.

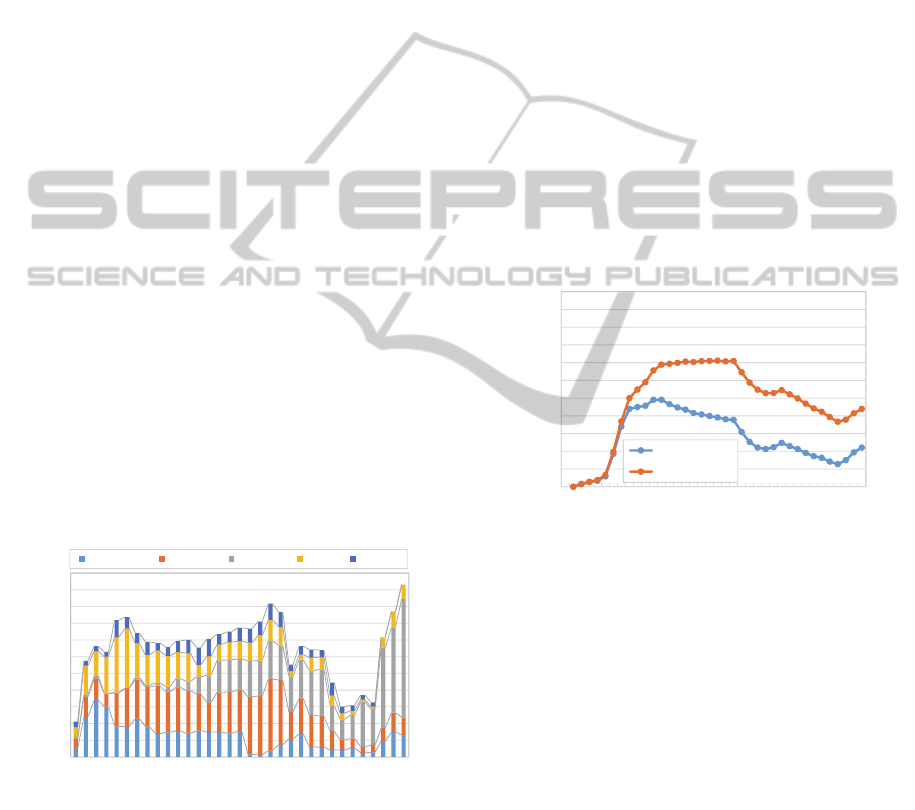

0

2000

4000

6000

8000

10000

12000

14000

16000

18000

20000

22000

1980 1984 1988 1992 1996 2000 2004 2008 2012 2016

Tecknology knowledge stock

(million JPY)

(Year)

m=5y,ro=20%

m=5y,ro=10%

Figure 5: Technology knowledge stocks for crystalline

silicon solar cells, through PV R&D by the Japanese

government.

Figure 5 shows the technology knowledge stocks for

crystalline silicon solar cells, through PV R&D, of

the Japanese government in m=5 years, ro=20% and

10%, based on equation (1). R&D expenditures for

crystalline silicon solar cells from 1988-1996

maintain technology knowledge stock until 2001 in

the case ro=10%. However, the allocated R&D

expenditure is not enough to keep technology

knowledge stock constant in the case of ro=20%.

After the drastic budget reduction in 1997,

technology knowledge stock could not be

maintained in both the cases.

InfluenceofResourceAllocationinthePhotovoltaicR&DofJapanbasedonTechnologyStockModeling

711

2.4 Technological Progress Model of

Solar Cells

If R&D expenditure is constant, technology

knowledge stock will saturate at RE/ro, as shown in

Figure 6. However, even if R&D expenditure is

constant, technological progress is induced by the

expenditure. This means that there is no correlation

between technology knowledge stock of PV R&D

and the price of the solar cells, but there exists a

correlation between technology knowledge stock of

PV R&D and solar cell price reduction. In this study,

correlation between cumulative technology

knowledge stock and solar cell price is modeled for

stable parameter estimation (a and b in equation (2)).

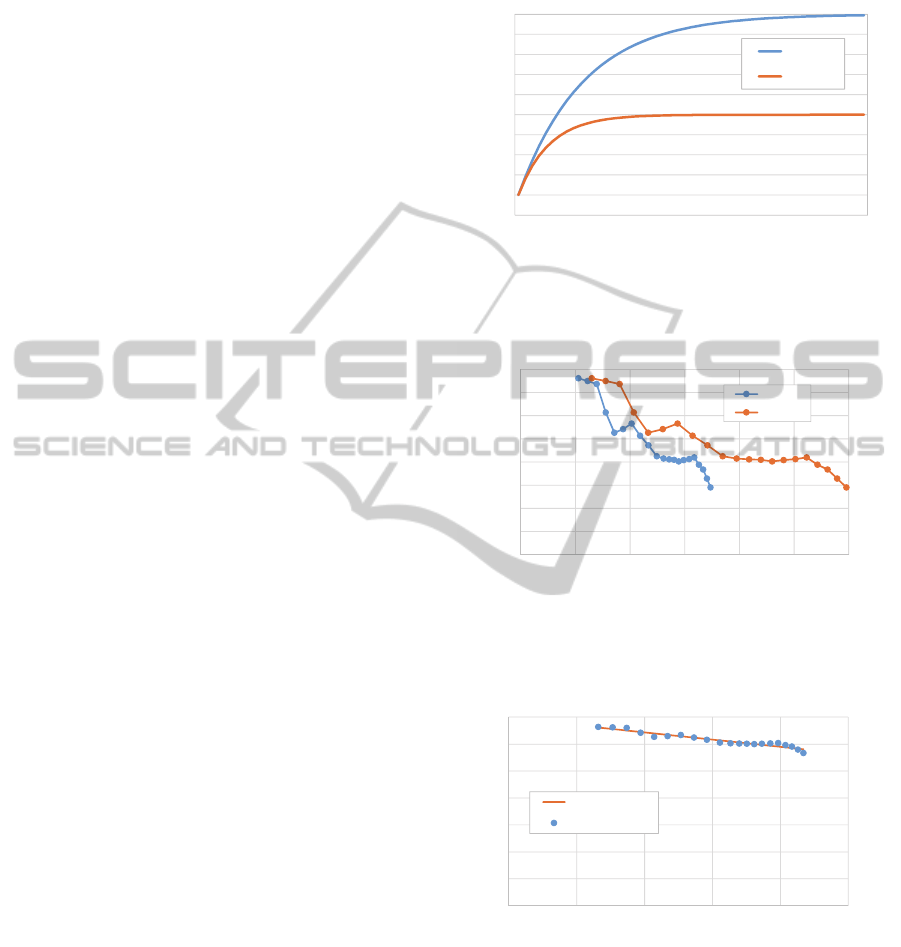

Figure 7 shows the correlation between cumulative

technology knowledge stock for crystalline silicon

solar cells (given in Figure 5) and module price,

excluding the effects of mass production in Japan

(annual and cumulative production for 2012 is

assumed during the entire period).

Prior models indicate that the module price of solar

cells converge with the material price. However, the

silicon necessary for solar cells (g/W) and the silicon

price (JPY/g) are both changing. In this paper, for

convenience, the exponential curve in equation (2) is

used for modeling technological progress of solar

cell price.

y = exp (a * x + b) (2)

where

x: cumulative technology knowledge stock (million

JPY)

y: solar cell price (JPY/W)

a, b: parameters, a<0

Using equation (2) means continuity and additivity

are assumed for R&D. By applying the regression

analysis in equation (3),

log

e

(y) = a * x + b (3)

a and b are estimated as -6.61 E-6 and 7.02,

respectively, with the coefficient of determination

(R

2

) being 0.922 when ro=20%, and -3.30 E-6 and

6.82 with coefficient of determination at 0.910 when

ro=10%.

The estimated regression line and technological

progress model, when ro=20%, are shown in Figures

8 and 9, respectively. The projected module price of

50 JPY/W is the present target of PV R&D for

crystalline silicon solar cells in Japan.

0

1

2

3

4

5

6

7

8

9

10

1 6 11 16 21 26 31 36 41 46 51

Technology knowledge stock

(Year)

ro=10%

ro=20%

Figure 6: Relationship between constant R&D expenditure

(=1) and technology knowledge stock.

0

100

200

300

400

500

600

700

800

0 50000 100000 150000 200000 250000 300000

Module price (JPY/W)

Technology knowledge stock (million JPY)

ro=20%

ro=10%

Figure 7: Correlation between cumulative technology

knowledge stock for crystalline silicon solar cells and

solar cell price, excluding mass production effects.

0

1

2

3

4

5

6

7

0 40000 80000 120000 160000 200000

ln(module price (JPY/W))

Cumulative technology knowledge stock (million JPY)

regression line

data

Figure 8: Correlation between cumulative technology

knowledge stock for crystalline silicon solar cells and

solar cell price excluding mass production effects, in

logarithm, and its regression line, with ro=20%.

SIMULTECH2014-4thInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

712

0

100

200

300

400

500

600

700

800

0 100000 200000 300000 400000 500000

Module price (JPY/W)

Cumulative technology knowledge stock (million JPY)

regression line

data

Figure 9: Correlation between cumulative technology

knowledge stock for crystalline silicon solar cells and

solar cell price, excluding mass production effects and the

technological progress model, with ro=20%.

3 ESTIMATION OF SOLAR CELL

PRICE RATIO

In some countries, reliable average module prices of

solar cells over a long period are not available. In

this paper, solar cell price is estimated based on the

market share of the world’s solar cell production,

which is more reliable, as shown in Figure 1. For the

estimation, market share of the world's solar cell

production is assumed to be proportional to the

inverse square of the solar cell price ratio, as shown

in equation (4). This relationship is also used for

estimating market share based on price ratios of

solar cells in Japan and other countries. Equation (4)

means that the same market share estimates the

same solar cell price (price ratio=1). Larger market

share estimates lower price, while smaller market

share estimates raise the price. However, small

differences in prices are enlarged in the estimation

of market share. If solar cell price data are available,

estimated prices are compared and discussed with

respect to the data.

n

MS

i

= (1 / PR

i

)

2

/ Σ (1 / PR

i

)

2

i=1

(4)

where

MS

i

: market share of i, i=1,…,n

PR

i

: price ratio of i.

Figure 10 shows the estimated solar cell price ratios,

as compared to Japan, by country, based on equation

(4).

0

0.5

1

1.5

2

2.5

2000 2002 2004 2006 2008 2010 2012

Price ratio (Japan=1)

(Year)

Japan USA

Europe/Germany ROW

Taiwan China

Figure 10: Estimated solar cell price ratios by country,

with Japan=1.

4 INFLUENCE OF RESOURCE

ALLOCATION OF PV R&D

4.1 Influence on Solar Cell Price

Comparing Figures 3 and 4, shares of solar cells by

technology type are completely different in

production and R&D, even when considering a 5-

year lead-time. It seems market projection after the

lead-time is not reflected in R&D resource

allocation. In this study, a case where crystalline

silicon solar cells are allocated, adequate R&D

expenditures are assumed. 50%, 40%, 30%, and

20% of R&D expenditure for solar cells is allocated

to crystalline silicon solar cells during the Sunshine

Program (1974-1992), New-Sunshine Program

(1993-2000), and NEDO’s technology development

program (2001-2007, and 2008-2012), respectively.

These figures are assumed considering gradual

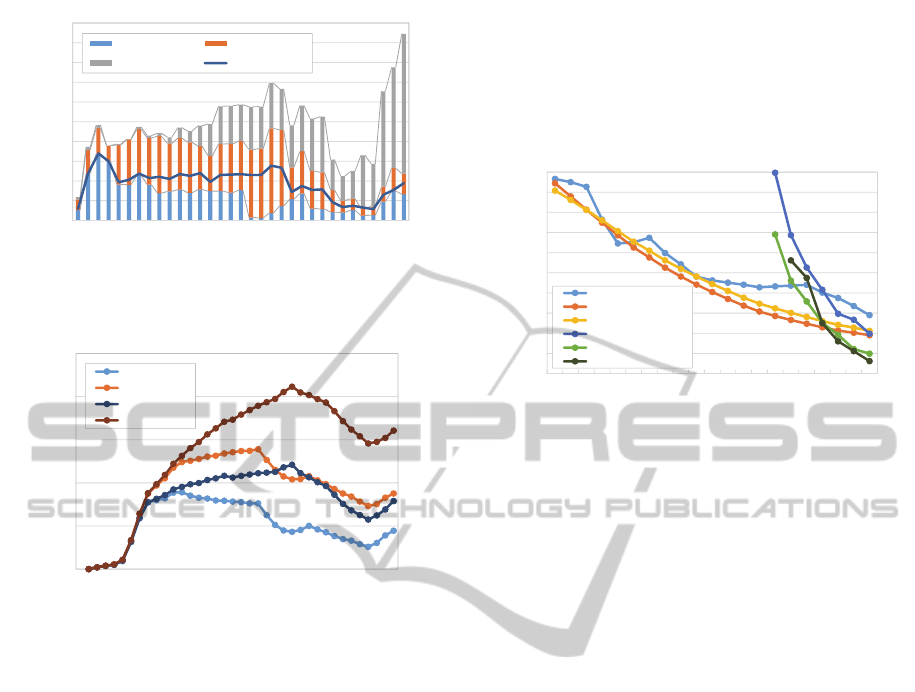

increase in priority of new solar cell technologies.

R&D expenditures for crystalline silicon solar cells

and technology knowledge stock under the

assumption are shown in Figures 11 and 12,

respectively. Actual and assumed R&D expenditures

for crystalline silicon solar cells are different,

especially in 1997-2000, when major budget cuts

were made. In this assumption, technology

knowledge stock is maintained and increases until

2005 at ro=20% and 10%, respectively. However, it

decreases after 2005 in both the cases. Cumulative

technology knowledge stock in 2012 goes from 183

billion JPY to 268 billion JPY when ro=20% and

316 billion JPY to 445 billion JPY when ro=10%.

InfluenceofResourceAllocationinthePhotovoltaicR&DofJapanbasedonTechnologyStockModeling

713

0

1000

2000

3000

4000

5000

6000

7000

8000

9000

10000

1980 1984 1988 1992 1996 2000 2004 2008 2012

R&D expenditures (million JPY)

(Year)

crystalline Si thin film Si

other cells cSi, assumption

Figure 11: R&D expenditures for solar cells with

assumptions about crystalline silicon solar cells.

0

5000

10000

15000

20000

25000

1980 1984 1988 1992 1996 2000 2004 2008 2012 2016

Tecknology knowledge stock

(million JPY)

(Year)

data,ro=20%

data,ro=10%

est.,ro=20%

est.,ro=10%

Figure 12: Technology knowledge stocks for the assumed

R&D resource allocations.

Increase of cumulative technology knowledge stock

accelerates solar cell price reduction. It gives 191

JPY/W and 212 JPY/W in 2012 when ro=20% and

10%, respectively, as shown in Figure 13. This price

is not reflected in the secondary effects of price

reduction through R&D.

The estimated solar cell price shows that the

assumed resource allocation in R&D for crystalline

silicon solar cells gives around a 30% price

reduction in solar cells in 2012. However, the

difference between the actual and estimated module

prices peaks at around 40% in 2008-2010. This is

because actual module price dropped after that due

to the price reduction of silicon and solar cells

because of oversupply. This is, however, not

reflected in the estimated solar cell prices.

Figure 13 compares solar cell prices in Japan, China,

and Taiwan, based on the estimated price ratios in

Figure 10. Estimated solar cell prices of China and

Taiwan come close to that of Japan in 2007 and

2009, respectively. However, under the assumed

R&D resource allocation, the catching-up by China

and Taiwan is delayed by 2 and 3 years,

respectively.

Regarding China, estimated solar cell price based on

its market share is different when compared to the

data (Lv, 2013) in 2007 and 2008, but it shows a

relatively good fit after that, as shown in Figure 13.

0

100

200

300

400

500

600

700

800

900

1000

1992 1996 2000 2004 2008 2012

Module price (JPY/W)

(Year)

Japan, data

Japan,est.,ro=20%

Japan,est.,ro=10%

Taiwan, est.

China, est.

China, data

Figure 13: Solar cell price in Japan, estimated under the

assumed R&D resource allocation, in comparison to China

and Taiwan.

4.2 Influence on Solar Cell Market

Share

Based on the estimated solar cell prices in Japan and

other countries, market share in the world solar cell

production can be estimated by assuming a market

share that is proportional to the inverse square of the

price ratio shown in equation (4). Figure 14 shows

the estimated market share of the world solar cell

production by country, under the assumed R&D

resource allocation, when ro=20%.

In actuality, the market share of Japan is the same as

that of China in 2007 and Taiwan in 2009. Japan

could not maintain its top share and fell behind

China and Taiwan in 2008 and 2010, respectively.

However, under the assumed R&D resource

allocation, the catch up delays to 2009 for China and

2012 for Taiwan. This means that the assumed R&D

resource allocation could not keep Japan’s top share,

but allows Japan to maintain a price advantage and

keep the top share in the market 2 or 3 years longer.

It shows that Japan could have had the highest

market share of 63.5% and 58.2% in 2004 with

ro=20% and 10%, respectively. This is around 10

points larger than the actual market share. Japan

could have maintained a 14.8% and a 12.3% market

share in 2012 with ro=20% and 10%, respectively.

This is around 2 times larger than the actual market

share.

SIMULTECH2014-4thInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

714

0

10

20

30

40

50

60

70

80

90

100

1980 1984 1988 1992 1996 2000 2004 2008 2012

Solar cell production (%)

(Year)

Japan USA Europe/Germany ROW Taiwan China

Figure 14: Estimated market share in world solar cell

production by country, under the assumed R&D resource

allocation, with ro=20%.

4.3 Secondary Effects of Mass

Production

Annual and cumulative production of crystalline

silicon solar cells in Japan can be calculated using

the world solar cell production, estimated market

share of Japan in the world solar cell production, and

the share of crystalline silicon in the solar cell

production of Japan. The estimated peak of solar cell

production in Japan is 6.10 GW/year in 2010 with

ro=20%. This is 2.24 times higher than the actual

maximum annual production of 2.73 GW/year in

2011, as shown in Figure 15. Similarly, the

cumulative production increases to 1.9 times in

2011. The increase of both annual and cumulative

production causes a price reduction due to increased

production. Solar cell prices reflect secondary

effects and become 188 JPY/W and 211 JPY/W in

2012 with ro=20% and 10%, respectively.

0

1000

2000

3000

4000

5000

6000

7000

1980 1984 1988 1992 1996 2000 2004 2008 2012

Solar cell production (MW/year)

(Year)

data

estimation

Figure 15: Estimated annual solar cell production in Japan,

under the assumed R&D resource allocation, with

ro=20%.

5 DISCUSSION

In this section, among the assumptions and

parameters used in this study, R&D expenditures of

the private sector are discussed.

Figure 16 shows R&D expenditures on solar energy

in Japan during 1977-1997 (Statistic Bureau of

Japan, 1979,…,1999). This figure can be categorized

into R&D expenditures for solar energy in Japan by

government and non-government owned funds, as

shown in Figure 17. The R&D expenditures include

not only those on solar cells, but also on PV systems

including BOS and solar thermal power generation

and utilization. As the survey has since been

terminated, there is no recent data. Both government

and non-government funds have a correlation of

0.762 during the entire period of 1977-1997 and

have a very strong correlation of 0.950 during 1989-

1997. This means that the non-government sector

promotes R&D in solar energy at the same pace as

the government. If both sectors have the same lead-

time, the non-government sector could be omitted in

the modeling of this study.

0

5000

10000

15000

20000

25000

30000

35000

1977 1981 1985 1989 1993 1997

R&D expenditures (million JPY)

(Year)

company

institute

university

Figure 16: R&D expenditures for solar energy in Japan by

companies, institutes, and universities.

0

5000

10000

15000

20000

25000

30000

35000

1977 1981 1985 1989 1993 1997

R&D expenditures (million JPY)

(Year)

government non-government

Figure 17: R&D expenditures for solar energy in Japan by

government and non-government owned funds.

InfluenceofResourceAllocationinthePhotovoltaicR&DofJapanbasedonTechnologyStockModeling

715

6 CONCLUSIONS

In this paper, the price reduction of solar cells in

Japan is modeled, excluding mass production

effects, based on the technology knowledge stock

approach. By using the technological progress model

of solar cells and the relationship between price ratio

and market share, possible influence of resource

allocation in the PV R&D of Japan is analyzed.

Conclusions of this study are as follows.

(1) The estimated influence of resource allocation in

the PV R&D of Japan on module prices of solar

cells and market share in world solar cell production

is not small and should not be ignored.

(2) Japan could achieve a module price of solar cells

of around 200 JPY/W, which is 30% cheaper than

presently available. The price is comparable to solar

cell prices in China and Taiwan,

and (3) though Japan could not keep its top share, it

could have maintained a large share in world solar

cell production for several more years by reducing

solar cell prices, if the assumed R&D resources had

been allocated to crystalline silicon solar cells,

which are very affordable.

The analysis depends on assumptions such as

continuity and additivity in R&D and the relation

between price and market share, which needs more

discussion. Sensitivity analysis for assumed data and

parameters, such as R&D expenditures after 2000

and mass production effects of learning-by-doing,

are necessary.

For further study, we could look at combining the

technological progress model of solar cells, the

world solar cell market model, both shown in this

study, and the dissemination model for residential

PV systems model (Endo, 2014). The study of cost-

effective resource allocation will be simulated for

PV technology development in Japan, in terms of

not only R&D expenditure, but also subsidies by the

government.

REFERENCES

Watanabe, C., Wakabayashi, K., Miyazawa, T., 2000.

Industrial dynamism and the creation of a “virtuous

cycle” between R&D, market growth and price

reduction, the case of photovoltaic power generation

(PV) development in Japan, Technovation 20, 299-

312.

Ogawa, K., 2001. Status and Prospect of PV R&D

Projects by NEDO, Technical Digest of the 12th

International Photovolatic Science and Engineering

Conference, 59-61.

Endo, E., Tamura, Y., 2003. Cost-effectiveness analysis of

R&D on solar cells in Japan, Solar Energy Materials

and Solar Cells, 75, 751-759.

Nemet, G. F., 2006. Beyond the learning curve: factors

influencing cost reductions in photovoltaics, Energy

Policy 34, 3218-3232.

Yamada, K., Komiyama, H., 2012. LCS social scenario,

Chapter 2.3, 24-29.

http://www.jst.go.jp/lcs/en/documents/publishes/

Endo, E., 2014. Analysis of Dissemination of Residential

PV Systems in Japan, Electrical Engineering in Japan,

188, 4, 20-30.

IEA, 2000. Experience curves for energy technology

policy, OECD/IEA.

Oshika, Y., 2013. Japan’s inattention to PV, policy change

was delayed (in Japanese). The Asahi Shimbun.

Maycock, P. D., 1982,…,2006. World PV cell/ module

shipments, PV News, PV Energy Systems.

Yamada, H., Ikki, O., 2013. National Survey Report of PV

Power Applications in Japan -2012.

Lv, F., Xu, H., Wang, S., 2013. National Survey Report of

PV Power Applications in China -2012.

IEA-PVPS, 2013. Trends 2013 in photovoltaic

applications, 1998. Trends in PV applications in

selected IEA countries between 1992 and 1997, Report

IEA-PVPS Task 1.

Statistics Bureau of Japan, 1979,…,1999. Report on the

Survey of Research and Development, Statistics

Bureau of Japan.

Mitsubishi Research Institute (MRI), Inc., 1991. Survey

research on quantitative comparison of Japan and US

(in Japanese). Japan Society for the Promotion of

Machine Industry.

Science and Technology Policy Bureau, Ministry of

Education, Culture, Sports Science and Technology

(MEXT), Japan. 2013. Indicators of Science and

technology.

Japan Photovolatic Energy Association, Shipment

statistics of PV cells and modules.

http://www.jpea.gr.jp/en/statistic/

SIMULTECH2014-4thInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

716