Pricing and Competition in Mobile App Markets

Ning-Yao Pai and Yung-Ming Li

Institute of Information Management, National Chiao Tung University, Hsinchu, Taiwan

Keywords: Two-Sided Market, Game Theoretical Analysis, Mobile App Market, Pricing Strategy.

Abstract: With the fast growth in smart phones, tablets and apps markets, the competition is increasing between

market platform such as Android and iOS. And the growth numbers of apps available and downloaded, the

competition between app market platforms are also very intensive. The economic behaviours of participants

are determined by market factors, such as the effects of the number of apps available in the market and the

number of users purchasing mobile platform devices and download apps. In this research, we analyse the

pricing issues (subscription fee and revenue sharing ratio) in apps market under the scenarios of

monopolistic and duopolistic apps markets.

1 INTRODUCTION

With the fast growth in smart phones, tablets and

apps markets, the competition is increasing between

Android and iOS. According to comScore Reports

(source: comScore), the top smart phone operating

system in the United States was Android with 52.2%

of all smart phone owners, while Apple’s iOS was

the second most common smart phone operating

system with 40.6% of the market. BlackBerry OS

ranked third with 3.6 percent share, followed by

Microsoft with 3.2% share and Symbian with 0.2

percent of the market. IDC reports that, in 2013,

1,004.2 million smart phones were sold worldwide

and a sale of smart phone in Q4 2013 is 284.4

million (source: IDC). The growth number of apps

and the number of downloads of apps are also very

impressive. App Store is the official Apple online

app distribution system for iPad, iPhone, and iPod

touch, and Google Play (Android Market) is a digital

application distribution platform for Android

operated by Google. Both Google Play and App

Store launched in 2008. In July 2013, there were

more than 1,000,000 apps available for Android, and

the estimated number of apps downloaded from

Google Play was 50 billion (source:

www.androidanalyse.com). In December 2013,

Apple's App Store contained more than 1,006,557

apps, which have collectively been downloaded

more than 60 billion times (source:

www.macrumors.com). The amount of apps and

support are important indicators to rational

customers who have the will to purchase smart

phone. And mobile device OS determines the costs

and difficulty of apps development. With the

increasing number of smart phone users each day,

meanwhile, there is an equal increase in the number

of app developers. Although the developers have a

lot of mobile platforms to choose from, they are

likely to choose the most popular one or two

platforms, iOS and Android.

App market is a two sided market, it provides

platform to bring two types of participants (Bakos

and Katsamakas, 2008), such as apps users and apps

developers. A two-sided market is two sets of

participants interact through a platform and the

decisions of each set of participants affects the

outcomes of the other set of participants (Rysman,

2009). The apps market economy is different from

the past economy. There are three elements

combined in the economy: mobile device, operating

system provider, and apps channel. Such as Apple

Inc., its best-known mobile device products are the

iPhone and iPad. It is also the iOS operating system

provider and the apps platform App Store which is

the official Apple online application distribution

system. Different apps markets have different

management or usage rules. Google Play, for

example, inherited from the Android system which

is free and open, Google also takes an open

management strategy on app publishing. It does not

set strict management and process for developers

261

Pai N. and Li Y..

Pricing and Competition in Mobile App Markets.

DOI: 10.5220/0005056802610266

In Proceedings of the 11th International Conference on e-Business (ICE-B-2014), pages 261-266

ISBN: 978-989-758-043-7

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

when publishing an app on Google Play. App Store

is another type of apps platform. In order to maintain

a consistent quality assurance, before app

publishing, an app must be examined through the

review process to ensure that the iOS system device

users can get the best experiences. Apps become a

highly competitive market, because it not only can

create enormous revenue, but also drive hardware

sales, advertising and technology innovation. The

massive software business opportunity becomes the

new Blue Ocean of business competition, and an

important driving force of industrial transformation.

With the rapid growth of hardware sales, the rapid

growth of apps accompanies.

In this paper, from the mobile platform

infrastructure aspect, we aim to contribute to the

effort of proposing the model to analyse apps

market’s competing strategy between platforms.

Therefore, a natural issue faces us is the analysing

business (revenue) model for mobile apps markets.

We consider the models of two types of apps

markets: one is the monopolistic apps market, and

the other is the duopolistic apps market. In the apps

market setting, we need to consider two types of

participants: apps providers and apps users. Each

participant has its profit function and utility function

respectively. The economic behavior of participants

are determined by market factors, such as the effects

of the number of apps available in the market and

the number of users purchasing mobile platform

devices and downloading apps in the apps market.

The apps market platforms are assumed to maximize

their profits, and need to consider the factors that

critically influence profits such as the apps quality,

varieties, provision fee, and download fee etc.

Specifically, the profit function of the apps market

platform is composed of apps market subscription

fee and apps revenue sharing from apps providers.

For instance, Google Play has a one-time

subscription fee of $25; iOS developer program on

App Store is $99 a year. The two app market

platforms get 30% of app sales revenue and share

70% of app sales revenue to app developers. In a

duopolistic apps market, the market shares of apps

providers and users are different in the two

platforms. Therefore, we will study the effect of

competition on the apps market revenue model

development.

On the apps platform, there are many factors

influencing the obtainable profit, such as mobile

device price, the apps subscription fee, the number

of apps available in the market, the number of app

developers, the quality of apps, and the apps

publishing rules. We want to develop the optimal

pricing strategy (subscription fee) of the apps market

platform. How does a platform company set the apps

market subscription fee? How does competition

affect the pricing scheme? The game theoretical

models, which are mainly used to extend the

decision context to the competitive environment,

will be developed in the whole research structure. It

is important to do a deep analysis and modelling for

all different kinds of participant behavior in various

market structures which reflect the real world

situations.

The remainder of the paper is organized as

follows. In section 2, we review the related

literatures. Section 3 we describe the models of two

types of apps market and discuss the implications of

our analytical results. Finally, Section 4 provides

concluding remarks and discusses future research

directions.

2 RELATED LITERATURE

A two-sided market is two sets of participants

interact through a platform in which the decisions of

each set of participants affect the outcomes of the

other set of participants (Economides and

Katsamakas, 2006). There are many Internet

intermediaries providing two-sided marketplace;

they operate platforms to bring together two types of

participants, such as buyers and sellers (Bakos and

Katsamakas, 2008). Two-sided market can be found

in many Internet intermediaries, such as operating

systems composed of users and developers;

recruitment sites composed of job seekers and

recruiters; search engines composed of advertisers

and consumers. The well-known companies that

operating platform including Match.com, eBay,

Google, Facebook and others. There exist same-side

and cross-side network effects in two-sided markets,

and each network effect can be either positive or

negative. In this paper, we use the two-sided market

structural characteristics to analyse apps market.

Shy (2001) proposed software are the supporting

service for the hardware, and the variety of software

that supports a hardware influences the value of this

hardware device. Users can get more utilities when

joining a platform that provides higher variety

compatible products. Through the indirect network

effect, user’s purchase behaviour will be altered

(Mantena et al., 2010) in the information goods

(software application / video games). With the

ICE-B2014-InternationalConferenceone-Business

262

network effects, the two types of participants attract

to each other and the platform’s value is dependent

on the number of both sides of the groups

(Eisenmann et al., 2006). Platforms attend to do

more efforts to their business model, and they give

overall considerations to attract two-sided users

while making money (Rochet and Tirole, 2003). The

competition occurs between platforms that have to

attract two-sided participants to transact on them.

The platform can charge the fees

(commission/access fees) to the buyers or to the

sellers, in terms of overall market conditions, the

consumers on the one side of the platform are

permitted free entry (S. Li et al., 2010). Rysman

(2009) show that openness means two strategic

points on two-sided markets; one is the amount of

sides to pursue, the other is how to compete with

rival platforms. In this research, we will model and

examine the pricing strategies for the mobile app

markets, which are an emerging popular type of

two-sided market.

3 THE MODEL

We consider the apps market platform with two

types of participants: apps providers and apps users.

A typical apps user has heterogeneous value creation

rate on the apps market platform, where value

creation rate is uniformly distributed within an

interval. The higher personal value creation rate or

the higher total number of apps download, the

higher apps user’s utility. Besides, because of

Google Play and App Store have different apps

publishing policy, the expected quality of apps also

influence the user’s utility. The user utility function

of using mobile devices that is determined by

individual value creation rate, the total number of

apps download, the expected quality of apps, and the

mobile platform device price. The apps users will

purchase the mobile device and apps when they have

non-negative utility.

Assume there are totally potential

0

apps

providers and potential

0

apps users in the apps

markets. A typical apps user i has heterogeneous

value creation rate

i

v

on the apps market platform,

where

i

v

is uniformly distributed within an interval

[0, 1]. We represent the created value creation for

apps user as

i

vq

, where

q

is the expected quality

of apps and

is the total number of apps available

in the market. The apps market platform earns

revenues from users when they purchased apps.

Apps users will evaluate the quality and the number

of apps to download to decide whether to download

free apps or do nothing. Notice that apps users may

download some paid apps and get some free apps.

The value creation rate

i

v

can be interpreted as a net

value which has deducted the charge of purchasing

apps. In order to be able to use apps, the apps users

must pay a price

p to purchase a mobile device.

The utility of each apps user with

i

v

is defined as

follows:

, Purchase the mobile device and apps

0 , Purchase none

i

i

vq p

U

(1)

According to the apps user utility function, we

observe that the apps users will purchase the mobile

device and apps in non-negative utility,

0

i

U

.

Hence, we have the set of purchased users

{| }

i

p

Div

q

and the demand of users is

0

||1

p

D

q

.

A typical apps provider j has heterogeneous

revenue creation rate

j

r on the apps market platform,

where

j

r

is uniformly distributed within an interval

[0, 1]. Not every apps user will buy the apps; some

users pay for apps and some users download free

apps.

j

r

is a random variable, it means the average

revenue and benefits gained from per apps user. App

providers which provide a free app can still have

revenues, such as through advertising, in-app

purchase, provided a paid subscription advanced

version, ad-free version with an additional fee. Some

free app providers want to increase goodwill, or

provide extra service to customers. For instance,

some restaurants provide a free app that allows their

customers to book in the app prior to going to the

restaurant. Moreover, some stores provide a free app

to get services or obtain goods in the stores that

realize the business model of online to offline. We

represent the generated revenue for apps provider as

j

r

, where

is the total number of apps users

purchasing the mobile device and apps. The

expected benefits from providing apps is

jj

ru

.

Assume

(

01

) proportion of the app

providers provide a paid app. They can gain revenue

sharing from apps market platform. The expected

revenue sharing ratio of apps is denoted as

j

u

,

where

01

. Furthermore,

1

proportion of

PricingandCompetitioninMobileAppMarkets

263

the app providers provide a free app and they will

retain all the benefit (

1

j

u

). Assume parameter f

represents the apps market subscription fee for an

app provider. The profit function of apps provider

j

is defined as follows:

, Subscribes to the apps market and develops apps

0 , Subscribes none and develops none

jj

j

ru f

(2)

According to the apps provider profit function,

we observe that the apps providers will subscribe to

the apps market and develop apps in non-negative

profit,

0

j

. Hence, we have the set of subscribed

apps supplier

{| }

j

j

f

Sjr

u

. The total number of

apps available in the market is

||

f

S

,

which includes the number of paid apps

0

1

f

and the number of free apps

0

11

f

f

.

The notations used in the model are summarized in

Table 1.

3.1 Monopolistic Apps Market

While monopolistic apps market does not currently

exist in the real world, we treat the scenario as a

model for an early stage of the market and use this

baseline model as a benchmark for comparison.

When there is only one apps market platform in the

market, we represent the profit function of the apps

market platform as:

1|

mj

fErjS

(3)

The first part of the profit function is the revenue

from apps market subscription fee; the second part is

the revenue from selling apps to users that deducted

some revenue shared to apps providers. For

expression simplification, we denote

/pq

.

Since the platform will choose the best pricing

strategies (apps market subscription fee) to

maximize its profit, we can derive the optimal

subscription fee for the apps market platform as:

Table 1: Notations used in the model.

Notation Description

0

Potential apps users in the apps markets

0

Potential apps providers in the apps markets

i

v

A typical apps user i has heterogeneous value

creation rate on the apps market platform

The total number of apps available in the

market

q

The expected quality of apps

p

The mobile platform device price

i

U

The utility function of the apps user

j

r

A typical apps provider j has heterogeneous

revenue creation rate

j

r on the apps market

platform

j

u

The expected benefits from providing apps

The total number of apps users purchasing the

mobile device and apps

The expected revenue sharing ratio of apps

f

The apps market subscription fee

j

The profit function of the apps provider

m

The profit function of the apps market platform

Examining (4) , we have the following results.

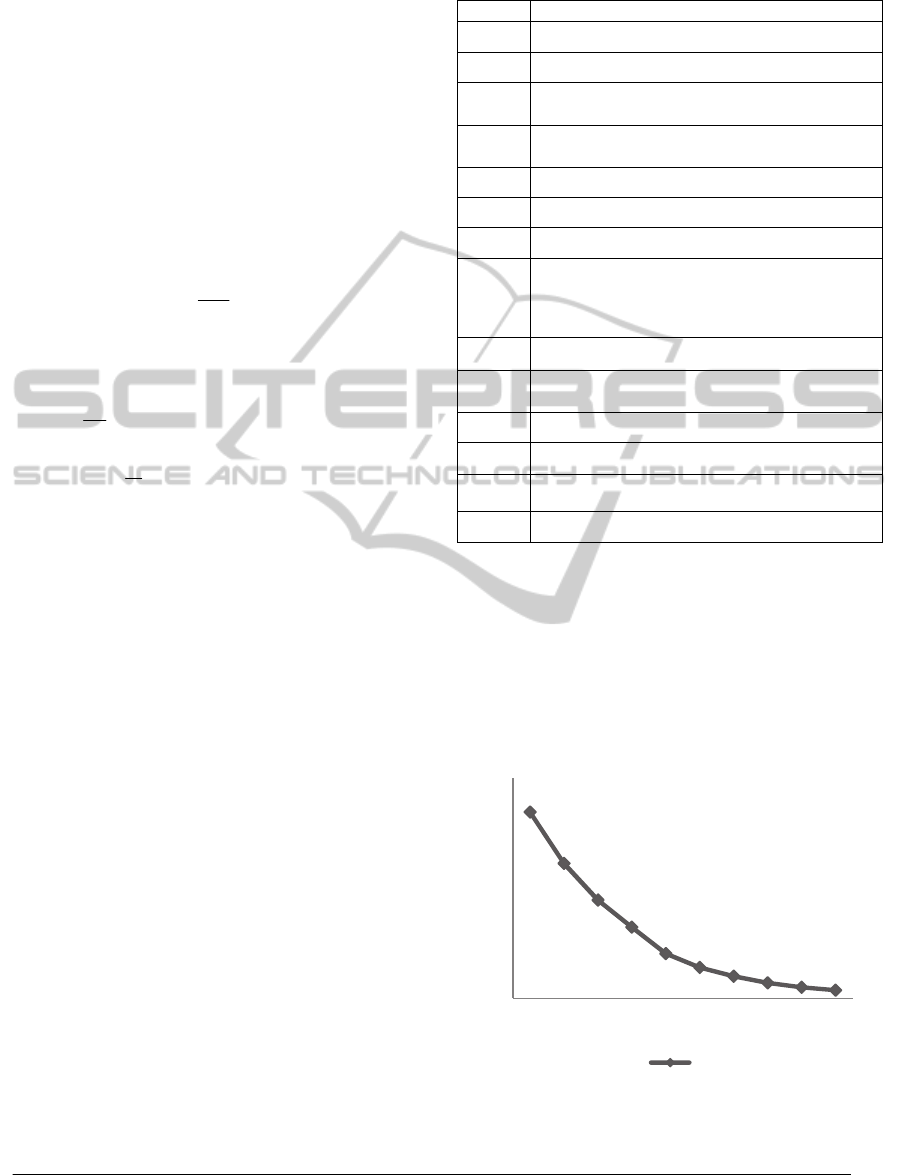

PROPOSITION 1. The apps market platform

subscriptionb fee decrease with the number of apps

providers.

When the number of apps providers is increasing;

the platform would like to earn profit from sales

apps, and therefore the subscription fee is decreasing.

Figure 1: The impact of the number of apps providers on

subscription fee level.

22 222 22 222

0000 00000 00000

22 222

0000000

222 2 22 2

2222 2

f

(4)

0

50

100

150

200

250

300

100 200 300 400 500 600 700 800 900 1000

f

ρ

0

f

ICE-B2014-InternationalConferenceone-Business

264

If there are more free apps in the market, the

platform would not make profit from sales apps. In

order to keep the profit level, the apps market

platform subscriptionb fee increases with the

number of free apps.

3.2 Duopolistic Apps Market

In this subsection, we consider a market with two

apps market platforms in the market. Assume there

are two competing apps market platform A and B.

portion of apps users having higher preference to

market platform brand A (

A

iD

) and

1

portion

apps users having higher preference to apps market

platform brand B (

B

iD

), the disutility for a user to

use a less preferred mobile platform is denoted as

.and

portion of apps providers having higher

development skill in apps market platform brand A

(

A

j

S

) and 1

portion apps users having higher

development skill in apps market platform brand B

(

B

j

S

).

is the extra cost for an app provider to

develop apps in a less preferred market platform.

The utility of each apps user with

i

v

is defined as

follows:

, Buy mobile device and apps, for

, Buy mobile device and apps, for

0 , Buy none

ik k k k

iikkk k

vq p i D

Uvq p iD

, where

{,}kAB

(5)

The profit function of apps provider

j is defined as

follows:

, Subscribes to the apps market and develops apps, for

, Subscribes to the apps market and develops apps, for

0 , Subscribes none and develops

j

jk k k

j

jjk k k

ru f j S

ru f j S

none

, where

{,}kAB

(6)

When there are two apps market platforms in the market, we represent the profit function of each apps market

platform as

1, ,

kkk k kjkk

f

Er k AB

,

(7)

Denote

*

A

f

and

*

B

f

are undercut-proof equilibrium subscription fees (Shy, 2001; Li and Lin, 2009). In this

conditions that both competing apps market platforms have no incentive to undercut its subscription fee are

*

11

D

AA A Aj A B A AjAA

fErf Er

and

*

11 11 1

D

B

BBBjBABBjBB

fEr fEr

, (8)

where

1

AS

,

1

B

S

, and

0

1

S

p

q

. The expected revenue value of

A

paid apps providers develop apps (subscribed apps supplier) in platform A is denoted

Aj

Er

, and

B

j

Er

is the

expected value of

1

B

paid apps providers develop apps (subscribed apps supplier) in platform B.

D

Aj

Er

is the expected value of

A

subscribed apps supplier in platform A and

D

B

j

E

r

is the expected value of

B

subscribed apps supplier in platform B. Assume the expected revenue sharing ratio of apps in two apps

market platforms are the same,

AB

and d is equal to

1

.

The symmetric subscription fees can be obtained:

222222222

*

22 22 2

211 2 42 2

44 1

BBA BBA

A

dd d d d

f

dd

, (9)

222222222

*

22 22 2

21 2 42 1

44 1

BA BA

B

dd d d d

f

dd

(10)

f

PricingandCompetitioninMobileAppMarkets

265

Examining (9) and (10), we have the following

results.

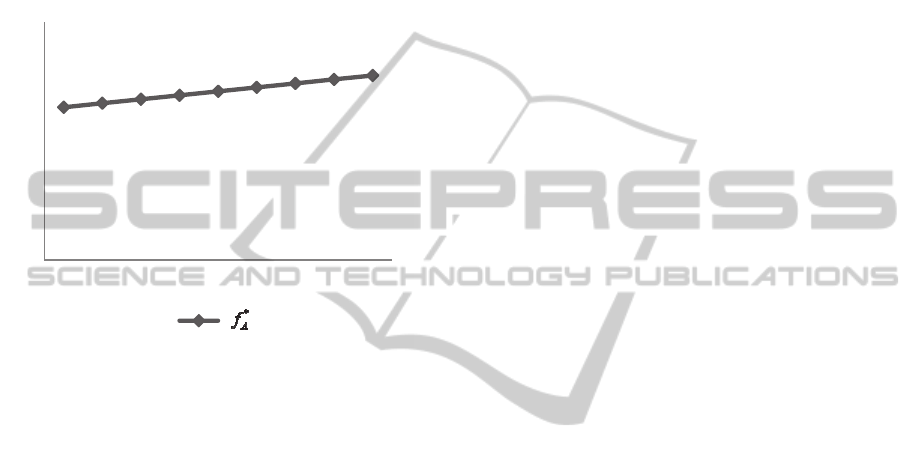

PROPOSITION 2. Under competition, the apps

market platform subscription fee increases with the

market share of apps users.

Figure 2 shows the subscription fee increases

with the market share of apps users.

Figure 2: The impact of θ

on subscription fee.

4 CONCLUSION AND FUTURE

WORKS

In this paper, utilizing the methodologies of game

theoretic and economic modelling, we analyze the

platform subscription fee under the structures of the

monopolistic and duopolistic apps market platforms.

In monopolistic apps market, we find that the apps

market platform subscription fee decrease with the

number of apps providers. In duopolistic apps

market, the apps market platform subscription fee

increases with the market share of apps users.

There are several issues which can be further

studied. First, we assume that the expected quality of

apps is the same. It would be interesting to develop a

model that apps have different quality which would

affect apps user’s utility. Second, the role of

difficulty of developing apps can be incorporated

into the model. The difficulty of developing apps

will affect the incentive of the apps providers to

choose which apps market platform to subscribe and

develop apps. Third, the role of apps review policy

and quality assurance can be incorporated into the

model. The decision of review policy can be further

analyzed in our model.

REFERENCES

AndroidAnalyse, 2013. Google Play passes one million

apps, fifty billion downloads. Retrieved February,

2014, from http://www.androidanalyse.com/google-

play-passes-one-million-apps-fifty-billion-downloads/

Bakos, Y., Katsamakas, E., 2008. Design and ownership

of two-sided networks: Implications for Internet

platforms. Journal of Management Information

Systems, 25(2), 171-202.

comScore, 2013. comScore Reports October 2013 U.S.

Smartphone Subscriber Market Share. Retrieved

February 10, 2014, from

http://www.comscore.com/Insights/Press_Releases/20

13/12/comScore_Reports_October_2013_US_Smartp

hone_Subscriber_Market_Share

Economides, N., Katsamakas, E., 2006. Two-sided

competition of proprietary vs. open source technology

platforms and the implications for the software

industry. Management Science, 52(7), 1057-1071.

Eisenmann, T., Parker, G., Alstyne, M. W. V., 2006.

Strategies for two-sided markets. Harvard Business

Review, 84(10), 92-101.

IDC, 2014. Worldwide Smartphone Shipments Top One

Billion Units for the First Time. Retrieved February

10, 2014, from

http://www.idc.com/getdoc.jsp?containerId=prUS246

45514

Li, S., Liu, Y., Bandyopadhyay, S., 2010. Network effects

in online two-sided market platforms: A research note.

Decision Support Systems, 49(2), 245-249.

Li, Y.-M., Lin, C.-H., 2009. Pricing schemes for digital

content with DRM mechanisms. Decision Support

Systems, 47(4), 528-539.

MacRumors, 2013. Apple's App Store Hits One Million

Apps in the United States. Retrieved Feburary 11,

2014, from

http://www.macrumors.com/2013/12/07/app-store-

hits-one-million-apps-in-u-s-app-store/

Mantena, R., Sankaranarayanan, R., Viswanathan, S.,

2010. Platform-based information goods: The

economics of exclusivity. Decision Support Systems,

50(1), 79-92.

Rochet, J. C., Tirole, J., 2003. Platform competition in

twosided markets. Journal of the European

Economic Association, 1(4), 990-1029.

Rysman, M., 2009. The economics of two-sided markets.

The Journal of Economic Perspectives, 23(3), 125-143.

Shy, Oz., 2001. The economics of network industries:

Cambridge University Press.

θ

0

10

20

30

40

50

60

0,1 0,2 0,3 0,4 0,5 0,6 0,7 0,8 0,9

f

f

ICE-B2014-InternationalConferenceone-Business

266