A Data Rich Money Market Model

Agent-based Modelling for Financial Stability

Paul Devine and Rahul Savani

Dept. of Computer Science, University of Liverpool, Liverpool, L69 3BX, UK

Keywords:

Agent-based Model, Financial Stability, Money Markets, Liquidity, Contagion, Regulation, Risk.

Abstract:

Our position is that agent-based modelling is a potentially powerful complementary tool in the study of finan-

cial systems, especially where institutional behavioural factors and empirical data are incorporated. The work

reported here concerns an agent-based model of a banking system focused on liquidity provision, principally

the flows of cash between banks and other system actors. This model has been developed in conjunction with

senior staff drawn from a major UK bank and consultancy and is highly data-rich in comparison with previous

theoretical work in the field. Agents and relationships reflect practitioners’ views of the system and it incor-

porates institutional balance sheet representations, financial instruments together with real-world data collated

from a range of sources. The bank agents in the model possess heterogeneous behaviours and data content

drawn from real bank data. We report preliminary studies of the dynamical behaviour of this system in the

context of the types of systemic shocks and perturbations observed in the real world. We review results which

model the impact on a bank of a perceived lowering of its creditworthiness. These dynamics are not the result

of endogenous assessments of the bank’s position, but the interplay of other banks’ and actor’s responses with

its own behaviour.

1 INTRODUCTION

Our contention is that data-rich agent-based models

can become a valuable component of the toolkit avail-

able for analysis of financial systems. The finan-

cial system is comprised of a large number of ac-

tors, financial instruments and relationships and is a

considerable challenge to both model and regulate.

This challenge has become more urgent since the sub-

prime crisis of 2008 which precipitated substantial

state intervention to shore up the system. A feature of

that crisis was the evaporation of the interbank money

market, the system by which liquidity (cash) is ac-

cessed by banks to meet their immediate needs. Tradi-

tionally, theoretical system models are high level and

use macro-economic techniques, while at the institu-

tional, real-world level a large amount of financial and

balance sheet data may be analysed.

To this end, we have taken an intermediate ap-

proach, developing an agent-based model to simulate

the system actors and their interactions with a par-

ticular emphasis on the provision of liquidity. This

facilitates individual behaviour to be explicitly mod-

elled and the individual corporate actors in the system

differentiated by this behaviour and their state data.

It has been argued that the crisis exposed the limi-

tations of traditional approaches, and that agent-based

models may be essential to building effective mod-

els of the economy to address these shortcomings

(Farmer and Foley, 2009). The promise of apply-

ing agent-based models to the economy had already

been noted in the context of the shortcomings of ap-

proaches that assume homogeneity or weak hetero-

geneity (Gallegati et al., 2003). Subsequently, agent-

based models have been applied to areas of the sys-

tem including housing (Geanakoplos et al., 2012) and

its contribution to systemic risk. We concur with this

and believe that no single paradigm is adequate for

a sufficient understanding of the system. Macro ap-

proaches such as Dynamic General Stochastic Equi-

librium (DGSE) models describe the system in a rela-

tively stable state, not the unstable systemic dynamics

that often occur under stress or at the periphery of this

region. Traditional models of financial systems and

stability used by banks, central banks and regulatory

bodies are typically highly data intensive, concentrat-

ing on the systematic evaluation of balance sheets and

known exposures. For example, the Bank of England

employs the RAMSI stress testing framework (Bur-

rows et al., 2012) which entails the collection and

231

Devine P. and Savani R..

A Data Rich Money Market Model - Agent-based Modelling for Financial Stability.

DOI: 10.5220/0005096602310236

In Proceedings of the 4th International Conference on Simulation and Modeling Methodologies, Technologies and Applications (SIMULTECH-2014),

pages 231-236

ISBN: 978-989-758-038-3

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

processing of a wide range of publicly available data

together with regulatory data submitted in confidence

by the banks. The goal of RAMSI is to identify po-

tential deficiencies or weaknesses in a specific part of

the system. In stark contrast are theoretical models of

contagion, e.g. the seminal work by Allen and Gale

(Allen and Gale, 2000) where liquidity is modelled as

an equilibrium process with counterparty risk acting

to spread contagion. These examine mechanisms and

structures in a manner that could not be further re-

moved from bankers’ balance sheets, financial instru-

ments and day-to-day activities. The underlying tech-

nical infrastructure of centrally cleared interbank cash

flows, Real Time Gross Settlement Systems (RTGS),

has also been investigated from an agent-based per-

spective, in modelling (Biancotti et al., 2009), design

and operational (Galbiati and Soramki, 2011) con-

texts. Our agent-based approach is intended to cap-

ture some elements of all.

2 THE TARGET DOMAIN

Money Markets are central to the effective opera-

tion of the financial system and were first analysed

in the 19th century (Bagehot, 1873) when the Lon-

don market was pre-eminent. In fact, banking crises

and financial bubbles long predated this, having been

a problem in ancient Rome (Thornton and Thornton,

1990), as was the formulation of effective regulation.

The market consists of a highly heterogeneous set of

actors, complex interactions and a lack of clarity in

overall exposures, largely due to the opacity of coun-

terparty risk. In terms of investigating liquidity risk as

a systemic threat, endogenous cycle and macro stress

testing models tend to have little behavioural con-

tent, though post-crisis analysis has highlighted the

behavioural factor in events (van den End and Tabbae,

2012). It has been hypothesised that the overnight

market freeze of August 2007 was due to the adop-

tion of precautionary behaviours (Acharya and Mer-

rouche, 2012). Crucially, the potential for crisis does

not appear to have receded, the Chinese interbank

market froze in 2013 with interbank rates peaking at

25% (Economist, 2013).

Interbank liquidity is essential for the smooth op-

eration of banking, banks rely on the availability of

cash and highly liquid assets to meet their obligations

to clients and to engage in financial transactions. Re-

quirements may vary greatly during any given time

period, with extremely large volumes of cash typi-

cally flowing both into and out of banks on a daily

basis. This is driven by trading activities in equities,

bonds and foreign exchange markets, together with

the needs of customers to make commercial and per-

sonal payments. The potential for contagion through

these linkages has long been recognised and has been

the subject of theoretical investigation and close prac-

tical scrutiny. A significant illustration of the cen-

trality of interbank liquidity occurred during the 2008

sub-prime crisis where institutions (e.g. Bear Stearns)

failed not as a result of insolvency, where total liabili-

ties exceed assets, but of illiquidity due to inability to

meet immediate liquidity requirements despite appar-

ently sound underlying balance sheets.

3 THE MODEL AND AGENTS

The core assumptions on which the liquidity model

is based were identified in collaboration with banking

professionals. The principal actors are: banks; cus-

tomers; the central bank; cash rich entities( CREs).

Cash and liquidity flows across the system between

individual banks and CREs with the central bank as

the final resort for liquidity. Customers represent the

real economy, withdrawing and depositing liquidity to

and from the system. The following five agent classes

were developed to represent principal actors, comple-

mented by a financial instrument type (contract) to

encapsulate the exposures and relationships between

market members.

Banks are the principal actors with the system.

Each bank contains a unique balance sheet, described

in Table 1, together with sample data used in the ini-

tial evaluation of the simulation.

Table 1: Bank Balance Sheet.

Assets £m

Cash and Reserves 68,487

Loans to Banks 97,140

Loans to Customers 489,399

Highly Liquid Assets (Bonds) 71,392

Illiquid Assets 706,363

Liabilities £m

Deposits from Banks 109,097

Deposits from Customers 472,388

Other liabilities 851,296

Equity 61,964

The balance sheet structure reflects its centrality to

practitioners’ perspectives on the market and incorpo-

rates features considered most salient for the proposed

work. Additional to this, a bank agent also contains

state information for risk appetite (ra) and creditwor-

thiness (cds) together with a full expression of the

bank’s assets and liabilities with respect to each of the

other banks and its known position at future points. At

SIMULTECH2014-4thInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

232

any simulated day, d, a bank contains data that details:

total cash owed; total cash owing; cash owed (by in-

stitution); debts due at d + n; credits due at d + n. In

tandem with the balance sheet data this information is

available to be used in defining complex, differentiat-

ing behaviors across banking agents. The information

can also be used to evaluate the banks’ states in rela-

tion to proposed regulatory measures like the Liquid-

ity Coverage Ratio (LCR) (BIS, 2013) and Net Stable

Funding Ratio (NSFR) (BIS, 2014), proposed under

the Basel III regulatory regime designed in response

to the events of 2008.

Cash Rich Entities represent non-bank sources of

liquidity, for example corporations or money market

funds. Since the market for interbank liquidity be-

came moribund in the aftermath of the sub-prime cri-

sis, UK Banks have become more reliant on what they

refer to as Cash Rich Entities (CREs) for the provi-

sion of liquidity. The rise of the non-Bank Financial

Institutions (NBFIs) and Other Financial Institutions

(OFIs) has resulted in them being of great systemic

importance, a European Commissions study indicated

that their assets in the EU27 totalled e32.6tn in 2011,

exceeding those held by MFIs by c.50 % (EC, 2012).

Though used solely as potential sources of liquidity in

the preliminary work reported here, CREs have been

included not only due to their size, but also because

some are becoming increasingly important in Shadow

Banking.

The Central Bank (in the UK, the Bank of Eng-

land) is the lender of last resort and setter of inter-

est rates, it both participates in and, to some extent,

makes the market. The lender of last resort role,

where a the Central Bank acts as a source of liquid-

ity, can operate to smooth out inefficiencies in the

market (Matsuoka, 2012). However, in the after-

math of Lehmann Brothers’ collapse in 2008 Cen-

tral Banks intervened in what were considered non-

standard ways (Giannone et al., 2012), with banks be-

ing propped up due to systemic importance, ”To Big

to Fail” (TBTF) . Concerns with respect to the poten-

tial market distortions and moral hazard engendered

by TBTF are not new, Herbert Spencer, a nineteenth

century contemporary of Bagehot, argued ”the ulti-

mate result of shielding man from the effects of folly

is to people the world with fools”, a remark specif-

ically aimed at this activity (Kindleberger, 1996), a

sentiment that has been revisited with vigour post-

2008. Nevertheless, central banks on both national

and supranational levels are essential components of

the financial system. Their policies are vital in-

struments of market and regulatory control and they

can be conduits of state intervention. Cross-country

econometric analysis has indicated that the fiscal cost

of state and central bank support in crisis situations

may exceed 50 % of GDP (Honohan and Klingebiel,

2003). Like a real central bank, the central bank agent

sets the central bank interest rates and acts as a source

of liquidity.

Customers, retail and commercial, help drive

banks’ day-to-day liquidity activities which are heav-

ily informed by movements in deposits and with-

drawals. Though largely known in advance, there

are significant, unpredictable fluctuations which may

stress the institution’s liquidity position and a trend

towards heavy withdrawals may cause catastrophic

stress, ultimately leading to failure in the absence of

external intervention to shore up liquidity. This hap-

pened with Northern Rock in the UK. Customers have

been incorporated in the form of customer agents that

provides aggregated withdrawal and deposit activity

for corresponding bank agents.

Financial Instruments are incorporated into the

model as Contracts, illustrated in 1.

C = (p, r, d, m, t, l, b, y) (1)

The terms represent: p, principal, the amount

loaned; r, the rate of interest; d, the date of incep-

tion; m, the time of maturity; t, the term of the loan

(duration); l, the identity of the lender; b, the identity

of the borrower; y, the yield (expected profit) of the

contract. Contracts are used to build up interbank po-

sitions over four term lengths: overnight; one month;

three months; six months.

4 AGENT RELATIONSHIPS

Each bank has transaction relationships with a spe-

cific customer agent, a set of CREs, the central bank

and all other banks, or a subset. A subset in this con-

text represents preferential relationships, these may

exist in the market and evidence suggests that they

persisted through the 2008 crisis, facilitating the sup-

port of badly affected banks (Affinito, 2012) thus mit-

igating contagion. Transactions with customer agents

are straightforward withdrawals and deposits, those

with all other agents involve negotiation and the cre-

ation of a Contract, Contracts are then settled when

their terms are reached. The relationship networks

provide the routes via which stress and contagion may

propagate through the system.

5 IMPLEMENTATION

The model has been developed on the Repast Sim-

phony platform after investigating other options

ADataRichMoneyMarketModel-Agent-basedModellingforFinancialStability

233

(Railsback et al., 2006) and Java selected for the im-

plementation. Reasons for this selection include the

relative maturity of the platform, well developed li-

braries and data handling facilities.

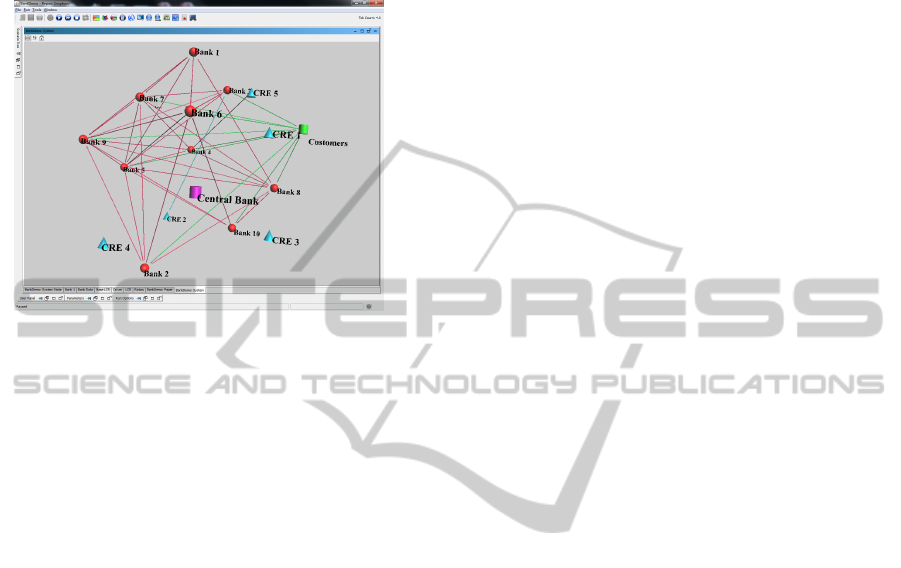

Figure 1: Screen shot of the simulation.

The simulation is illustrated in figure 1 where the

evolution of the transaction network may be observed

and individual agents interrogated for their state vari-

ables. Scenarios and outputs may also be specified

and data collected for post simulation analysis. For

display purposes the customer agents have been ag-

gregated into a single visual representation.

5.1 Data Population

Data availability and consolidation is a challenging

issue, there exist both famine and feast in terms of

the the publicly available data. Banks’ annual and

quarterly reports contain a wealth of data, typically

running into hundreds of pages, this is far in excess

of requirements at this formative stage of the project.

However, quarterly and annual report balance sheets

only contain snapshots of a bank’s state, detail be-

tween the reporting periods is lost and the most in-

teresting features may not be widely known outside

the banks. Similarly, details of interbank exposures

are not publicly available.

Banks’ Balance Sheets were initialised from a

variety of sources, principally the institutions own

published consolidated balance sheets for the period

covering 2011 onwards. This was supplemented by

data obtained from Bureau Van Dijk’s BankScope

product, this makes balance sheet data available for

all a banks in Fitch’s uniform format.

Two further sources of data were utilised for set-

ting up banks’ initial states, and potentially drive be-

haviour during runs of the simulation. Credit Default

Swap (CDS) pricing, a proxy measure of an institu-

tion’s creditworthiness was gathered in the form of

daily prices for each bank corresponding the to bal-

ance data. During each run the CDS value within in

each bank may be adjusted in accordance with his-

torical data, or recalculated as required by simulation

scenarios or outcomes. The second data requirement

was for a means of initialising rates in the financial in-

struments, a realistic baseline being required. For this

the now somewhat discredited LIBOR data set was

used. LIBOR was a daily statement of interbank rates

over a range of terms and currencies collated from the

banks’ own submissions to the British Banking Au-

thority. It has been demonstrated that there were at-

tempts by some participating banks to manipulate the

published rates, this renders the data commercially

unreliable. However, extremely accurate data was not

required for our purposes and the magnitude of the

attempted manipulation was well within our require-

ments.

Customer Transaction data were not readily

available. In the absence of real day-to-day trans-

action data from the banks we approximated de-

posit/withdrawal behaviour from publicly available

data. Sources used included: Bank of England; BBA;

UK Cards Association. The data was used to prime

the activities of the customer agents, scaled in accor-

dance with their relative balance sheet sizes and then

subjected to a random positive or negative offset to

replicate the unpredictable component of daily trans-

actions. The customer agents may be further manipu-

lated to replicate customer withdrawal stress or excess

liquidity.

5.2 Model Operation

In its general form the model contains n banks, m

CREs, 1 central bank and x customer agents. It has a

flexible, discrete time-step form with the highest real

data resolution at the day level. For simplicity, in the

work presented here a time step is the equivalent to a

day. However, a facility to run multiple steps per day

was included to allow simulation of intra-day interac-

tions if necessary. In the reported form the simulation

is bank-centric. All banks are processed each step but

randomly chosen to avoid introducing ordering arte-

facts in the output data. For bank B

n

the behaviour

suite, i.e. activities it may initiate each step t, are as

follows:

• B

n

receives withdrawal or deposit from customer

agent C

n

and updates balance sheet

• If B

n

is solvent the bank is frozen

• Calculate liquidity required to cover obligations

and satisfy LCR

SIMULTECH2014-4thInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

234

• Settle financial instruments due this step, updating

accordingly

• Buy highly liquid assets (bonds) if cash supply al-

lows

• Approach CREs for liquidity

• Poll other banks to borrow liquidity (may be

routed through broker agent) for outstanding liq-

uidity requirement

• Approach Central Bank if liquidity requirements

not met

• If liquidity requirements are not met, sell liquid

assets at balance sheet value

• If liquidity requirements are not met, sell illiquid

assets at discount (fire sale)

Each time step bank m may assess requests for

loans submitted by other other banks, these requests

are made in the form of a contract c. The lending de-

cision behaviour is governed by the function in 2.

f (LP

m

, CDS

n

, r

c

, y

c

, t

c

) (2)

Where LP is the liquidity position of bank m;

CDS

n

the creditworthiness of bank n; r the rate of c;

y the yield of c and t the term of c. Bank m may ac-

cept, reject or modify the terms of c, in the event of

modification a revised contract c

0

is returned to bank n

for acceptance or rejection, no further negotiation be-

ing entered into between n and m. In the preliminary

investigation, subject to LP

m

, contracts were assessed

on the basis of CDS

n

, r

c

and y

c

, weighted in that order.

More complex behaviours will be the subject of future

work and should be developed in conjunction with in-

dustry expertise. Stress may be applied system-wide,

to a single bank or a subset of banks. Potential sources

of stress are: Customers, nett withdrawals; CDS val-

ues, the creditworthiness of the bank; Devaluation of

illiquid assets; General system confidence.

5.3 Model Behaviour, a Credit Example

In common with many models of complex systems

this one can be highly sensitive to initial conditions

and initial work has concentrate on qualitative be-

hvoiurs. The example is illustrative of the type of re-

alistic qualitative behaviour the model exhibits. Two

scenarios are compared in Figure 2, the plots are for

a single bank within the system, not an aggregated

view, and cover a period of 800 working days.

Blue represents business as usual, for red all data

is the same except for stress applied to CDS spread of

one bank in the ten, effectively lowering its creditwor-

thiness for a period. For blue, the Banks’ CDS spread

are set from corresponding real data and the balance

Credit Default Swap Rate ($)

Illiquid Assets (£)

Holdings of Bonds (£)

Interbank Liabilities (£)

2e+02

3e+02

4e+02

1.5e+04

2.0e+04

2.5e+04

3.0e+04

2e+04

3e+04

4e+04

5e+04

2e+04

4e+04

6e+04

8e+04

250 500 750

Tick (day)

Shocked

Not shocked

Figure 2: Normal vs. depressed bank creditworthiness.

sheets initialised from real banks’ consolidated bal-

ance sheets. Customer agent deposits decline over

this period, providing a mild reduction in day to day

liquidity. The graphs show the bank’s activity on

the interbank market to meet liquidity requirements,

together with a gradual sale of highly liquid assets

(Bonds) where required. The bank’s illiquid assets

remain untouched. In the red plot the bank’s CDS

value is inflated to simulate a perception of relatively

poor creditworthiness in the market. The first conse-

quence is the difficulty in securing liquidity on the in-

terbank market, illustrated by the depressed interbank

liabilities graph. To compensate, bonds are sold in or-

der to stave off illiquidity, a clear difference between

the stressed and unstressed scenarios. Eventually the

bank is forced to sell its illiquid assets at a heavily

discounted price, an asset firesale. For this scenario,

the customer agent acted merely as a source of with-

drawals and deposits. Were more complex customer

behaviours to be incorporated we would expect to see

heavy withdrawals as confidence in the bank erodes.

6 NEXT STEPS

We believe the current work to be promising with

qualitatively realistic dynamic behaviour observed in

the model. The immediate focus should now be on

drawing these closer to reality with a greater degree

of quantitative rigour. The wealth of data in the sim-

ulation has yet to be full exploited, and it should be

noted that this level of complexity is a source of both

potential weakness and strength, especially in respect

of sensitivity to initial conditions. Next steps will en-

ADataRichMoneyMarketModel-Agent-basedModellingforFinancialStability

235

tail restricting data and behavoiurs to provide a more

tractable simulation with a more managable parame-

ter space, it is envisaged that scenarios simulating a

range of bank behaviours under idealised regulatory

regimes (e.g. Basel III) would be a logical next step,

hence the inclusion of LCR.

7 CONCLUSIONS

Ideally, an agent-based model may encapsulates ex-

pert knowledge, actor behaviours and system struc-

ture in a manner that eludes other techniques. The

model described here does not share the clean and

often elegant characteristics of a classical, analytical

model, but then the real world does not share these

features either. Neither does it posses the rich de-

tail of institutions’ financial positions, covering hun-

dreds of pages of their annual reports, one of the ex-

perts commented that there is no simple represen-

tation of a £1.4tn balance sheet. Our model does

capture behaviours, structure and expert knowledge

and includes some of the data richness of the real

world. The most important outcome of the initial sim-

ulations, like the creditworthiness example described

here, is that they demonstrate that the model is an in-

teracting set of institutions rather than merely single

entities or an aggregation of many. For example, the

effect of diminished creditworthiness on a bank was a

combination of the behavioural responses of the other

agents and its own response to those actions, all oc-

curring within the context of a realistic structure with

real data. These features are particularly suitable for

analysing crisis scenarios or testing the impact of reg-

ulation where behavioural responses can dictate out-

comes.

ACKNOWLEDGEMENTS

We wish to acknowledge the invaluable input and sup-

port we received from Peter Lightfoot of the Royal

Bank of Scotland and Simon Bailey of the CGI

Group.

REFERENCES

Acharya, V. V. and Merrouche, O. (2012). Precautionary

hoarding of liquidity and interbank markets: Evidence

from the subprime crisis. Review of Finance.

Affinito, M. (2012). Do interbank customer relation-

ships exist? and how did they function in the crisis?

learning from italy. Journal of Banking & Finance,

36(12):3163 – 3184. Systemic risk, Basel III, global

financial stability and regulation.

Allen, F. and Gale, D. (2000). Financial contagion. The

Journal of Political Economy, 108(1):1–33.

Bagehot, W. (1873). Lombard Street: A Description of the

Money Market. London:HS King, London.

Biancotti, C., D’Aurizio, L., Ilardi, G., and Terna, P. (2009).

Modelling an rtgs system with slapp. Technical report.

BIS (2013). Basel iiii the liquidity coverage ratio and liq-

uidity risk monitoring tools. Technical report, Bank

of International Settlements.

BIS (2014). Basel iii: The net stable funding ratio. Techni-

cal report, Bank of International Settlements.

Burrows, O., Learmouth, D., McKeown, J., and Williams,

R. (2012). Ramsi: a top-down stress-testing model

developed at the banks of england’s. Technical report,

Bank of England.

EC (2012). Non-bank financial institutions: Assessment of

their impact on the stability of the financial system.

Technical report, European Commission Directorate-

General for Economic and Financial Affairs.

Economist (2013). Bear in the china shop. Economist, 408.

Farmer, J. D. and Foley, D. (2009). The economy needs

agent-based modelling. Nature, 460:685–686.

Galbiati, M. and Soramki, K. (2011). An agent-based model

of payment systems. Journal of Economic Dynamics

and Control, 35(6):859–875.

Gallegati, M., Giulioni, G., and Kichiji, N. (2003). Com-

plex dynamics and financial fragility in an agent-

based model. Advances in Complex Systems (ACS),

6(03):267–282.

Geanakoplos, J., Axtell, R., Farmer, D., Howitt, P., Conlee,

B., Goldstein, J., Hendrey, M., and Palmer, Nathan

amd Yang, C.-Y. (2012). Getting at systemic risk via

an agent-based model of the housing market. Techni-

cal report, Cowles Foundation.

Giannone, D., Lanza, M., Pill, H., and Reichlin, L. (2012).

The ecb and the interbank market. Technical report,

European Central Bank.

Honohan, P. and Klingebiel, D. (2003). The fiscal cost im-

plications of an accommodating approach to banking

crises. Journal of Banking & Finance, 27:1539–1560.

Kindleberger, C. (1996). Maniacs, Panics and Crashes.

Macmillan.

Matsuoka, T. (2012). Imperfect interbank markets and the

lender of last resort. Journal of Economic Dynamics

and Control, 36(11):1673 – 1687.

Railsback, S. F., Lytinen, S. L., and Jackson, S. K. (2006).

Agent-based simulation platform: Review and devel-

opment recommendations. In (Railsback et al., 2006),

pages 609–623.

Thornton, M. K. and Thornton, R. L. (1990). The financial

crisis of a.d. 33: A keynsian depression? The Journal

of Economic History, 50:655–662.

van den End, J. W. and Tabbae, M. (2012). When liq-

uidity risk becomes a systemic issue: Empirical evi-

dence of bank behaviour. Journal of Financial Stabil-

ity, 8(2):107 – 120.

SIMULTECH2014-4thInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

236