Combining Piecewise Linear Regression and a Granular Computing

Framework for Financial Time Series Classification

Valerio Modugno

1

, Francesca Possemato

2

and Antonello Rizzi

2

1

Dipartimento di Ingegneria Informatica, Automatica e Gestionale (DIAG)

SAPIENZA University of Rome, Via Ariosto 25, 00185, Rome, Italy

2

Dipartimento di Ingegneria dell’Informazione, Elettronica e Telecomunicazioni (DIET)

SAPIENZA University of Rome, Via Eudossiana 18, 00184, Rome, Italy

Keywords:

Time Series Classification, Evolutionary Optimization, Granular Computing, Linear Piecewise Regression,

Sequential Pattern Mining, Algorithmic Trading.

Abstract:

Finance is a very broad field where the uncertainty plays a central role and every financial operator have to

deal with it. In this paper we propose a new method for a trend prediction on financial time series combining a

Linear Piecewise Regression with a granular computing framework. A set of parameters control the behavior

of the whole system, thus making their fine tuning a critical optimization task. To this aim in this paper we

employ an evolutionary optimization algorithm to tackle this crucial phase. We tested our system on both

synthetic benchmarking data and on real financial time series. Our tests show very good classification results

on benchmarking data. Results on real data, although not completely satisfactory, are encouraging, suggesting

further developments.

1 INTRODUCTION

Prediction of price movements of a security is a very

hard task. A well known economic theory, the Effi-

cient Market Hypothesis (EMH) (Malkiel and Fama,

1970) states that, in an informationally efficient mar-

ket, price changes are unforeseeable if they fully in-

corporate the information and expectations of all mar-

ket participants. The more efficient is a market, the

more random is the sequence of price changes gener-

ated by such a market. So, in principle, the EMH does

not allow to make predictions about future behaviors

of a financial time series and the evolution of a stock

or a bond are modeled as a random walk.

Over the years this hypothesis gaverise to a strong

debate about its credibility and a lot of researchers

have disputed the efficient market hypothesis both

empirically and theoretically. Among the EMH skep-

tics it is possible to cite two works (Haugen, 1999),

(Los, 2000) in which the authors show the deficiency

of the theory by analysing the behaviour of six Asian

markets. In their work the authors do not find any

empirical confirmations of EMH. These results give

a chance to some market operators to realize a gain

exploiting information on past behavior. One of the

most common approaches used by brokers is called

Technical Analysis (TA). TA consists in a large tool

set that is used to predict market movements. One

of the most common tools of TA is the Chart Pattern

Analysis: technicians try to discover patterns from the

market price graph and use this information to buy or

sell assets. This approach appears to be very ineffi-

cient because of the subjectivity that guides the se-

lection of patterns inside data. Today the mainstream

research on the financial field employs a lot of soft

computing techniques to face the challenging prob-

lem of market behaviour prediction. Considering the

classification proposed in (Vanstone and Tan, 2003) it

is possible to gather each method in one of the subse-

quent categories:

• Time Series Prediction: forecasting time series

points using historical data. Research in this area

generally attempts to predict the future values of

time series. Possible approaches comprise raw

time series data, such as Close Prices, or time

series extracted from base data, like the indica-

tors employed in TA. Some examples are: (Chang

et al., 2009), (Radeerom et al., 2012).

• Pattern Recognition and Classification: extraction

of significant known patterns inside data and us-

age of such patterns to attempt a classification

problem. Some examples are: (Nanni, 2006), (Sai

281

Modugno V., Possemato F. and Rizzi A..

Combining Piecewise Linear Regression and a Granular Computing Framework for Financial Time Series Classification.

DOI: 10.5220/0005127402810288

In Proceedings of the International Conference on Evolutionary Computation Theory and Applications (ECTA-2014), pages 281-288

ISBN: 978-989-758-052-9

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

et al., 2007), (Cheng et al., 2010).

• Optimization: solving problems where patterns in

the data are not known a priori. Research in this

area goes from the optimal selection of the param-

eters of soft computing systems, to the extraction

of the optimal point at which to enter transactions.

One example is (Kendall and Su, 2005).

• Hybrid: this category is used to identify research

which attempts to combine more than one of the

previous categories. One example is (Bagheri

et al., 2014).

In this paper we introduce a newHybrid Classification

Algorithm based on a Piecewise Linear Regression

(PLR) preprocessing of raw data within a Granular

Computing (GrC) framework (Bargiela and Pedrycz,

2003). From a structural point of view our work has

something in commonwith (Sai et al., 2007), in which

the authors apply a feature selection on several TA in-

dicators and use the extracted features subset to train

a Support Vector Machine for classification purposes.

However, in this paper we do not use any technical in-

dicator as input,trying to identify some recurrent pat-

terns in the raw data prices sequence through PLR and

a GrC algorithm. This approach shares some features

with (Chang et al., 2009). In particular the main fea-

tures of the proposed work are:

1. our approach analyses the financial data at differ-

ent time scales since we can control the granular-

ity of the PLR preprocessing stage;

2. we employ a Dynamic Time Warping dissimilar-

ity measure that manages very well the presence

of noise in data set;

3. our method handles the phenomenon of errors in

the labeling procedure, which is very common in

a financial application, due to the fact that certain

types of heuristics are generally used to describe

a financial time series;

4. our approach is conservative in the sense that it re-

duces the risk of economic loss by rejecting, dur-

ing the pattern discovery phase, all the sequences

that do not have informative contents.

The rest of the article consists of four parts. In the

first part we provide a description of the problem def-

inition, as well as, the hypothesis settings; in the sec-

ond part we present the system GRASC-F (GRanular

computing Approach for Sequences Classification-

Financial application), focusing on the preprocessing

stage and the rejection policy in the embedding pro-

cedure; in the third part we show the results obtained

by applying the algorithm to synthetic data with dif-

ferent kinds of noise and show some test results on

real stocks. Finally some comments are reported in

the conclusion section.

2 PROBLEM DEFINITION

In this paper we propose a method that is conceived to

bring a reliable approach to market trend predictions

in financial time series. We refer to market trends

as tendencies of a market to move in a particular di-

rection. So through our method we want to identify

ordered behaviors of the market that technicians in-

dicate with the terms bull market, when they speak

about an upward trend, and bear market, when they

refer to a downward trend. This algorithm can work

alone or as a trading assistant to support the buy and

sell asset operations of a financial operator. Due to

the overall complexity that arises when we face this

kind of problems, it is necessary to make some sim-

plifying assumptions. First of all we deny the EMH

that refuses the existence of solid trends inside finan-

cial markets considering them only as random fluctu-

ations. Instead, we take on two simple principles that

are the bases of all the TA:

• prices move in trends up and down;

• history tends to repeat itself, and the collective

mood of the investor works always in the same

manner, impressing specific patterns on price

graphs that act as fingerprints. We can use this

information to make trend prediction.

In this work we represent a financial time series as

a sequence of trends: raw financial data are prepro-

cessed to extract trend objects that become the ba-

sic information units for the GrC-based data mining

procedure. Therefore, the preprocessing stage plays

a central role and is significant for the overall per-

formance of the classification system. After the pre-

processing phase we have to deal with a sequence of

structured objects and two different kinds of problems

arise:

• the selection of significant patterns inside the se-

quence of structured data;

• the labeling of unlabeled sequences of trends.

For the first problem we use a featureless GrC frame-

work to describe structured data: dissimilarities be-

tween subsequences of variable lengths and a cluster-

ing procedure are used to select the best representa-

tives for all the sequences according to some given

criteria. Therefore, chosen the correct dissimilarity

measure, we can identify a set of prototypes (called

”Alphabet”) and project all the sequences data in this

prototypes space, where it is easier to accomplish a

ECTA2014-InternationalConferenceonEvolutionaryComputationTheoryandApplications

282

classification task. The labeling problem is faced con-

sidering the overall trend of a fixed time window of

the raw data. In this paper we will not take care about

the cost of transaction, taxes and other losses which

take place during the common market operations, be-

cause we only want to prove the reliability of the clas-

sification algorithms and taking into consideration all

the economic aspects in future works.

3 THE GRASC-F SYSTEM

In this Section we describe in detail the structure of

the whole classification system GRASC-F, focusing

our attention on all the aspects that concern the fi-

nancial prediction task. The system GRASC-F is

an evolution of GRAPSEC (Rizzi et al., 2013), a

sequences classification system based on GrC algo-

rithms GRADIS (Livi et al., 2012) and RL-GRADIS

(Rizzi et al., 2012). These are data mining procedures

able to discover consistent patterns of variable-length

that occur frequently in a data set. The computation of

the prototypes through a clustering technique is cen-

tral in GRASC-F system: a further refining stage is

performed in order to remove prototypes with low re-

currence; all the prototypes that are retained become

part of the so-called symbols alphabet A. We base

the new representation of the input data on the alpha-

bet A. The alphabet is extracted with an unsupervised

technique.

Since the alphabet building phase depends on the

choice of a dissimilarity measure, in this paper we de-

cide to use the DTW (Berndt and Clifford, 1994) dis-

tance, because the preprocessed sequences data are

made by complex objects belonging to R

n

. More-

over, DTW similarity measure is resilient to noise.

GRASC-F depends upon a lot of different parame-

ters and in order to obtain a good performance of the

whole classification process, a fine tuning of them be-

comes a critical task. We get rid of this problem in-

cluding an optimization phase inside the classification

system, which aims to automatize the setting of the

(relevant) parameters.

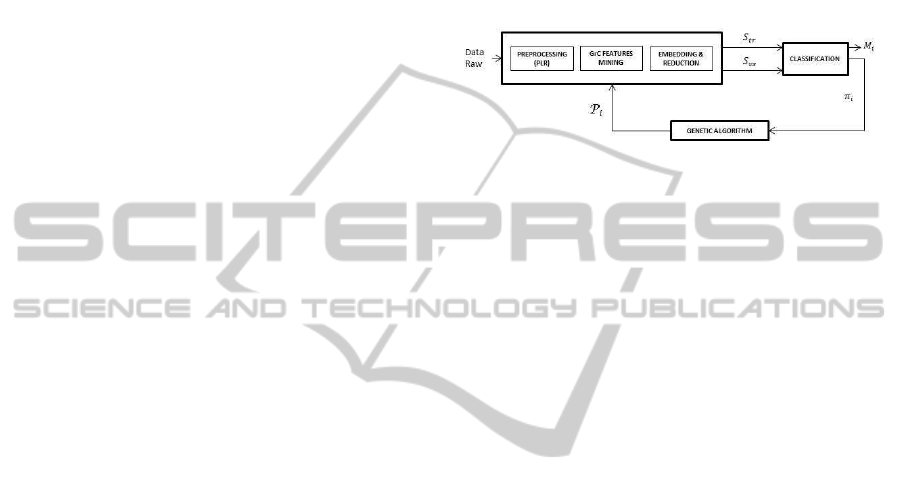

From a general point of view, the GRASC-F sys-

tem can be described as a pipeline of four main

blocks: financial time series pre-processing, alphabet

building, sequence data projection, and classification.

During the preprocessing stage the input row data is

transformed into sequences of trends. Then we la-

bel every sequence by means of an empirical heuris-

tic. The alphabet building step is performed through

RL-GRADIS algorithm. The developed alphabet A

is successively used to represent the input sequences,

building the so-called symbolic histograms represen-

tation. Finally, a suited feature-based classifier, in our

case a simple K-NN , is adopted to work directly on

this new representation. All these steps are repeated

inside an optimization cycle until the process hits one

of the stop conditions. In this paper we use a genetic

algorithm as optimization procedure. Figure 1 shows

the overall structure of the GRASC-F classification

system.

Figure 1: GRASC-F Classification System.

3.1 Preprocessor

Data preprocessing occupies the first step of the

whole classification system. This phase aims to rep-

resent raw data about the prices of a stock as a labeled

sequences database of trends. The main preprocess-

ing steps are:

• Linear Piecewise Regression

• Labeling of sequences

In the following Sections we will describe briefly the

preprocessing phases.

3.1.1 Linear Piecewise Regression

First we collect raw data about the prices of a stock,

in a fixed time interval, from a specific data file. Dur-

ing the acquisition of the data, we consider a con-

stant sampling rate and for each sample we choose the

close price. Then, the obtained time series is normal-

ized between zero and a fixed maximum value. At this

point we perform a trend extraction on the time series,

using the technique described in (Muggeo, 2003).

This method, that is freely available as an R package,

takes as input a time series and returns a sequence of

trends using a procedure of breakpoints detection. A

breakpoint describes a sample time at which a trend

stops and a new one starts. Since in our application

we do not know a priori the number of breakpoints on

the input time series, we decided to use the algorithm

described in (Muggeo, 2003) because it performs well

in this kind of situations. Practically, we set an ini-

tial number of breakpoints candidates that we call bp

on the stock price function, then, after some itera-

tions of the algorithm, we obtain a segmented linear

regression with the most reliable breakpoints, while

the other are dropped off. The number of breakpoints

CombiningPiecewiseLinearRegressionandaGranularComputingFrameworkforFinancialTimeSeriesClassification

283

candidates determines the scale of the linear segmen-

tation. The more are the points, the more accurate is

the segmentation of the time series. The output of the

Figure 2: Sequences extraction from preprocessed time se-

ries using a fixed time window W.

LPR is a sequence of trends. Each trend is described

by two real values: the slope of the current trend and

its duration expressed in number of ticks. Therefore

the sequence is constituted by objects that belongs to

the R

2

space. Before the learning phase, we normal-

ize each element of the sequence in the [0, 1] range.

Then, the entire preprocessed data set is divided into

different sequences of R

2

objects, considering a non

overlapping time window W

i

made by a fixed number

of time samples on the input time series. For exam-

ple if we take a window of 1000 ticks (see Figure 2),

then all the trends that are extracted from that win-

dow become a sequence. Therefore, the preprocessed

data set is made by sequences of different number of

objects, depending on how many trends are detected

by the preprocessor in that window. In Figure 3 it is

Figure 3: Example of the LPR applied to a real raw data of

closing prices of a stock.

possible to observe an example of the LPR applied to

a single window of a real raw data.

3.1.2 Labeling of Sequences

In the second step of the preprocessing, we label the

sequences previously extracted. Consider a sequence

s

i

computed from the time window W

i

of n

t

ticks and

a time window W

i+1

that follows W

i

with the same

number of ticks. In order to establish the label of s

i

,

we read the open value p

w

i+1

1

and the close value p

w

i+1

n

t

of the original time series that belongs to W

i+1

. Then

the label l

i

of s

i

is computed as:

l

i

=

0 if p

w

i+1

n

t

− p

w

i+1

1

≤ 0 (1)

1 otherwise

Thus if the label l

i

is equal to 0 it means that

the sequence s

i

anticipates a downward trend in the

next time window, otherwise it anticipates an upward

trend. From the practical trading point of view, a clas-

sification model able to predict such labels with a suf-

ficient accuracy could be used to raise sell and buy

signals. We repeat this procedure for each sequence

of the database extracted in the previous phase except

for the last one because we cannot label it. Finally,

we divide the sequences database into three sets: the

training set S

tr

, the validation set S

vs

and the test set

S

ts

.

3.2 Symbols Alphabet

We define our training set S

tr

= {s

1

, s

2

, ..., s

n

} as a

list of sequences, choosing the DTW distance as the

dissimilarity measure d : S × S → [0, 1] for the GrC-

based features mining procedure. Through a cluster-

ing algorithm and using d(·, ·) we identify a finite set

of symbols A = {a

1

, a

2

, ..., a

n

}; the clustering proce-

dure that we employ, is the well-known Basic Sequen-

tial Algorithmic Scheme (BSAS) algorithm. From

each sequence we build a set of variable-length subse-

quences that is obtained by slicing the sequence con-

sidering its contiguous elements only. We repeat the

slicing operation, extracting all the subsequences with

a length value between two user defined parameter

namely l and L, which define respectively the min-

imum and the maximum number of contiguous el-

ements that compose each subsequence. After the

expansion phase, in which we generate all the sub-

sequences (from now on we refer to this new set as

N ), a clustering procedure is executed on N multi-

ple times. In BSAS we have to set a scale param-

eter θ, taking values in the [0, 1] interval and con-

trolling the maximum radius allowed for all the clus-

ters in the final partition. For information compres-

sion purpose we decide to use the Minimum Sum

of Distances (MinSOD) technique to represent com-

pactly every cluster C

j

with only one element η

j

ECTA2014-InternationalConferenceonEvolutionaryComputationTheoryandApplications

284

selected in the cluster. In GRASC-F we decide to

use RL-GRADIS as mining algorithm because it im-

proves the overall computational performance dur-

ing the clustering-based symbols alphabet extraction

phase. The main idea is to track the evolution of

the cluster construction when the input stream N is

analyzed. RL-GRADIS maintains a dynamic list of

receptors, constituted by the MinSOD cluster repre-

sentatives and characterized by an additional parame-

ter called firing strength denoted as f ∈ [0, 1], which

is dynamically updated by means of two additional

parameters: α, β ∈ [0, 1]. The α parameter is used

as a reinforcement weight factor each time a recep-

tor/cluster ¯r is updated, i.e., each time a new input

subsequence is added to the receptor/cluster. The β

parameter, instead, is used to model the speed of for-

getfulness of receptors. In this way, the clusters that

are not frequently updated during the alphabet con-

struction phase are discarded and we only retain the

clusters that show a good firing strength.

3.3 Embedding Procedure

After the computation of the symbols alphabet A we

proceed with the embedding phase that consists to

map the input sequences in S to a new R

d

space,

where d is the number of symbols that belongs to A

and we refer to it as feature space. In this new space

each input sequence s

i

is represented as a real-valued

vector called symbolic histogram h

(i)

∈ R

d

. The j-

th component of h

(i)

represents the number of occur-

rences of the symbol a

j

∈ A into s

i

. To recognize

if an instance of a symbol a

j

appears within an in-

put sequence s

i

we use an inexact matching proce-

dure based on d(·, ·). For more information about the

matching procedure we suggest to read (Rizzi et al.,

2013). Specifically, in GRASC-F, after the embed-

ding procedure, a second analysis stage is performed

on the symbolic histograms, that we refer to as reduc-

tion phase. In this step, we search for all the subse-

quences s

i

which are mapped to symbolic histogram

with all zero entries. Every time we found such a se-

quence, we remove it from the data set only for the

current individual fitness evaluation. In fact, we made

the assumption that if there are no symbols in a se-

quence, it means that it is not significant and, from a

financial trading point of view, it corresponds to a sit-

uation where the price of a certain security stalls and

there are no emerging behaviors inside data that can

be useful for prediction purposes. So, to be conser-

vative, we prefer to clear off the data set from every

sequence that does not bring any predictive informa-

tion based on the current alphabet A.

3.4 Optimization

The GRASC-F classification system depends on some

parameters that control the behavior of the whole sys-

tem. In order to choose the best setting for these

parameters, we decide to introduce an optimization

step that maximizes the classification performance on

a validation set. These parameters affect the function-

ality of every single stage that composes the system.

In the following we list all the parameters to be tuned

in order to improve the final performance:

• bp: the number of presumed breakpoints that con-

trol the scale of granulation of LPR;

• Q: the maximum number of receptors;

• α: the reinforcement factor when the cluster is up-

dated;

• β: the speed of forgetfulness of receptors;

• ε: the threshold to remove not-frequently updated

receptors;

• θ: the threshold to decide whether a subsequence

is added to an existing receptor/cluster or to a new

one;

• σ: the default strength value for new receptors.

To this aim we introduce an automatic optimiza-

tion procedure using a suited genetic algorithm. We

use a cross-validation strategy to evaluate the fitness

function guiding the optimization, by computing the

recognition rate achieved on the validation set S

vs

. In

this paper, we incorporate the preprocessing stage in-

side the optimization routine to optimize also the pre-

processor parameter bp. We pay in terms of com-

putational effort, that impacts on the training time

but on the other hand we are able to find the opti-

mal time scale for sequences representation. In this

way, we obtain a sort of multi-resolution approach al-

lowing the automatic identification of the time scale

which minimizes the classification error on the S

vs

.

In other words we choose the observation scale cor-

responding to the best informative process represen-

tation. Then, after the preprocessing step, the initial

data set is split into a validation set S

vs

and a training

set S

tr

. At this point we extract a symbols alphabet A

l

from S

tr

. By using the computed A

l

, the input training

and validation sequences are embedded by means of

the symbolic histograms representation. During the

embedding phase we strip away all the sequences in-

side S

vs

and S

tr

that has all zeros inside the symbolic

histogram and, after that, we obtain a reduced embed-

ded training set and a reduced embedded validation

set. Finally, we compute the per-class recognition rate

CombiningPiecewiseLinearRegressionandaGranularComputingFrameworkforFinancialTimeSeriesClassification

285

using a K-NN classifier on the reduced embedded val-

idation set. The fitness value f is thus given by

f = 1−

1

n

n

∑

i=1

#err

i

#patt

i

, (2)

in which #err

i

is the number of misclassified patterns

of class i and #patt

i

is the total number of patterns of

class i, i = 1, ..., n. The optimization stage stops if

the fitness value reaches a predefined value or after a

maximum number of generations of the optimization

algorithm.

4 TESTS AND RESULTS

In this section we present some experiments that we

performedin order to test the behaviour of the classifi-

cation system in different operational situations. First

we analyse classification results using synthetic data

set, then we evaluate the performance of the system

using four real financial time series.

4.1 Synthetic Data Set Generation

The aim of this section is to test the effectiveness and

performance of the GRASC-F system in a synthetic

and controlled environment. In order to analyze the

behavior of the algorithm, we use a synthetic data

generator. The output of the generation process is a

time series over a predefined time interval, represent-

ing the prices valuesof a fictitious stock at a fixedtime

sampling. As described in Section 3.1.2, we consider

two possible classes for the sequences: upward and

downward trends. The domain D of the sequences is

defied as D =

[x, y]

T

∈ R

2

| − 60 ≤ x ≤ +60, 5 ≤

y ≤ 30

, where x models the slope and y the duration

of a trend.

The data are generated through three main steps per-

formed for each class:

• Frequent sequential pattern generation. For each

of the two possible classes, a set of n

pat

sequences

of objects in D (the symbols, i.e. frequent pat-

terns) are generated. The size of each pattern is

randomly determined using a normal distribution

with user defined mean l

pat

and standard deviation

σ

p

. These patterns should be considered as sell or

buy signals for the trading system.

• Sequential database generation. A database of

n

seq

sequences of trend and duration is built us-

ing the previously determined frequent patterns.

The size of each sequence size

seq

represents the

number of frequent patterns in each sequence.

• Labelling of sequences. A labelling sequence of

duration equal to size

seq

·t

pat

is generated for each

sequence in the database in order to assign a la-

bel to it. If the sequence represents a downward

trend, the domain D

down

of the corresponding la-

belling sequence is defined as D

down

=

[x, y]

T

∈

R

2

| −60 ≤ x ≤ +30, 5≤ y ≤ 30

; if the class of

the patterned sequence indicates an upward trend,

the domain D

up

of the corresponding labelling se-

quence is D

up

=

[x, y]

T

∈ R

2

| − 30 ≤ x ≤

+60, 5 ≤ y ≤ 30

. This choice guarantees that

the relation (1) is satisfied.

• Interpolation and data raw generation. The se-

quences of trends are interpolated to obtain a

unique sequence of fictitious prices values of a

stock.

In order to test the robustness of the classification sys-

tem we add some noise to the original sequences be-

fore the interpolation step. In particular we consider

two different types of noise:

• Intra Pattern. The noise is added in a frequent pat-

tern according to a probability µ. Three types of

intra pattern alterations are possible, deletion, in-

sertion or substitution of N

MAX

objects in each in-

stance of a pattern.

• Inter Pattern. This noise is used to insert noisy

objects between patterns in a sequence, randomly

generated in D. The parameter η defines the ratio

between the total duration of all the symbols in the

sequence and the total time of the sequence after

the insertion of noise. In formula

η =

size

seq

·t

pat

t

tot

in which t

tot

= size

seq

·t

pat

+ t

noise

.

4.2 Real Data Set Description

For experiments on real data we decide to try our

method on a inter-day trading task. Since for our pur-

pose we need to employ a financial time-series with

a high frequency sampling time we choose data sets

with a five minute tick. We decide to employ our

method on single stocks and on stock market index.

To this aim, we consider Lukoil, Gazprom, MICEX

and CAC-40, all in the time window from 1/1/2009 to

14/4/2014.

4.3 Classification Results

In order to test the performance of the classification

system we present three different types of synthetic

experiments: (1) clean sequence database (2) fixed

ECTA2014-InternationalConferenceonEvolutionaryComputationTheoryandApplications

286

intra pattern noise with different degrees of inter pat-

tern noise, (3) fixed inter pattern noise with different

degrees of intra pattern noise. We generate N

pat

= 5

sequential patterns of mean length l

sec

= 8. The Train-

ing Set S

tr

is balanced (Possemato and Rizzi, 2013)

and contains 100 patterned sequences (50 sequences

per class) and 100 labeling sequences, while the Vali-

dation and Test Sets (S

vs

and S

ts

) contain 50 patterned

sequences (25 sequences per class) and 50 label-

ing sequences. The feature-based classifier adopted

on the embedding space is based on the k-NN rule

equipped with the Euclidean metric. The symbols

alphabet are extracted considering subsequences of

length between l

min

= 4 and l

max

= 11. The overall

GRASC-F performance measure is the generalization

capability achieved on S

ts

defined as follows:

Accuracy = 1−

#errS

ts

|S

ts

|

(3)

in which #errS

ts

is the number of classification er-

rors on the sequences of S

ts

. As shown in our pre-

vious work (Rizzi et al., 2013) the optimized sys-

tem parameters allow a better performance with re-

spect to default parameters. RL-GRADIS parame-

ters are defined in the following search intervals: Q ∈

{1, ··· , 300}, α ∈ [0, 0.1], β ∈ [0, 0.01], ε ∈ [0, 0.1],

and θ ∈ [0, 0.1]. The number of breakpoints for the

preprocessing procedure can vary in the interval bp ∈

[10, 100]. The number of iterations performed for

each optimization by GA is set to 10. We have empiri-

cally verified that the GA convergeto a stable solution

in less than 10 iterations. We show the results for k of

the k-NN rule fixed to 3. The genetic algorithm has

been initialized by proper random seeds.

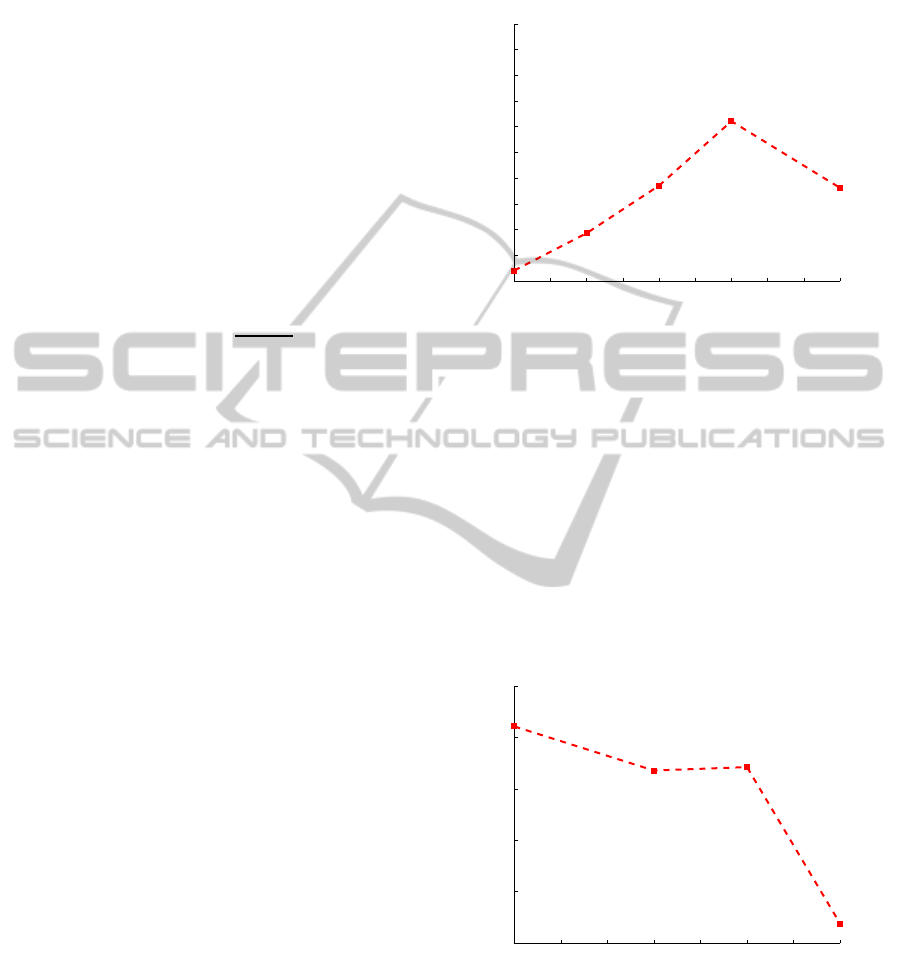

4.3.1 Inter-Pattern Noise

The first experiments are performed setting µ = 0, i.e.

no intra-pattern noise, and increasing levels of inter

pattern noise η. This means that the patterns are left

unaltered, but increasing amounts of random objects

are added between symbols in every sequence. Note

that the smaller is the η parameter, the higher is the

inter-pattern noise and the longer is the duration of

the each sequence (both patterned and labelling). Re-

sults obtained are shown in Figure 4. The curve of

the classification accuracy shows a counterintuitive

trend. Higher amounts of inter-pattern noise (that

means lower values for the η parameter) indicate that

the frequent symbols are more likely to be separated

by random objects. This prevents the clustering algo-

rithm to find false patterns generated by portions of

real contiguous patterns. This behavior occurs until

the η parameter is higher than 0.3. After this value

the number of noisy objects becomes very high and it

is more difficult to identify frequent symbols signifi-

cant for the classification problem at hand.

0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1

55

60

65

70

75

80

85

90

95

100

105

Classification Accuracy on Test Set (µ = 0)

Accuracy

η

Figure 4: Classification Accuracy on Test Set considering

a fixed intra-pattern noise µ = 0 with respect to the level of

inter-pattern noise η.

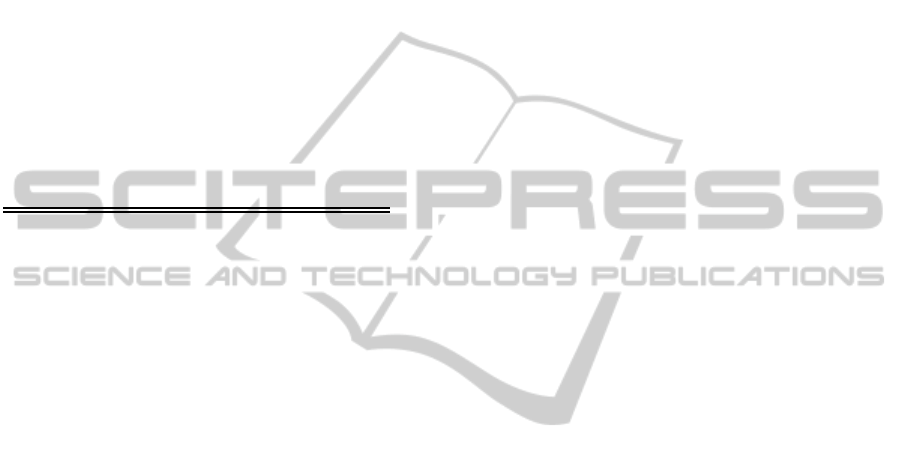

4.3.2 Intra-Pattern Noise

Considering the results of previous experiments, in

these tests we set η = 0.7 and we progressively in-

crease the value of the intra-pattern noise µ. The clas-

sification accuracy is shown in Figure 5. The higher

is the intra-pattern noise, the lower is the classifica-

tion accuracy on the test set. As we could expect, the

generalization capability of the classification system

decreases with the increase of noisy patterns.

0 0.1 0.2 0.3 0.4 0.5 0.6 0.7

65

70

75

80

85

90

Classification Accuracy on Test Set (η = 0.7)

Accuracy

µ

Figure 5: Classification Accuracy on Test Set considering a

fixed inter-pattern noise η = 0.7 with respect to the level of

intra-pattern noise µ.

4.3.3 Real Data Results

We perform tests on real data sets described in Sec-

tion 4.2. Table 1 shows the results in terms of clas-

sification error on the test set and of the number of

CombiningPiecewiseLinearRegressionandaGranularComputingFrameworkforFinancialTimeSeriesClassification

287

sequences of S

ts

before and after the reduction phase

described in Section 3.3. We can note that the over-

all number of selected sequences after the reduction

phase is higher for single stocks than for the stock

market indexes. Considering that the error rate be-

tween the stock market indexes and the single stocks

(apart from CAC-40) is very similar, we can say that

this is a very encouraging result because in principle,

if we perform this method on a big set of different

stocks, we could obtain a gain on average. From this

point of view, we consider very promising the per-

formances obtained on real stocks prices in this first

work.

Table 1: Results on Real Data Sets: Lukoil (L), Gazprom

(G), MICEX (M), CAC-40 (C). Classification Error on Test

Set, number of sequences in the Test Set and number of

selected sequences after the reduction procedure.

Err. S

ts

(%) # seq. S

ts

# sel. seq. S

ts

L 52.8571 202 63

G 54.2334 202 126

M 55.5556 202 13

C 100 208 1

5 CONCLUSION AND FUTURE

WORK

In this paper we introduce a new classification system

aiming to perform trend prediction on financial time

series. We prove, through synthetic benchmarking

data sets, that if there are some regularities inside data

our method is able to detect them, showing good clas-

sification performances also in the presence of noise

and with errors in the labeling procedure. The results

on real data show us the path to follow for the future

extension of the proposed method. We consider as en-

couraging the result obtained on real data, suggesting

further developments. To this aim, among other pos-

sible improvements, we are currently working on an

agent based mining algorithm, as the core procedure

for the alphabet synthesis.

REFERENCES

Bagheri, A., Mohammadi Peyhani, H., and Akbari, M.

(2014). Financial forecasting using anfis networks

with quantum-behaved particle swarm optimization.

41:6235–6250.

Bargiela, A. and Pedrycz, W. (2003). Granular computing:

an introduction. Springer.

Berndt, D. J. and Clifford, J. (1994). Using dynamic time

warping to find patterns in time series. In KDD work-

shop, volume 10, pages 359–370. Seattle, WA.

Chang, P.-C., Fan, C.-Y., and Liu, C.-H. (2009). Integrating

a piecewise linear representation method and a neu-

ral network model for stock trading points prediction.

Systems, Man, and Cybernetics, Part C: Applications

and Reviews, IEEE Transactions on, 39(1):80–92.

Cheng, C.-H., Su, C.-H., Chen, T.-L., and Chiang, H.-H.

(2010). Forecasting stock market based on price trend

and variation pattern. 5990:455–464.

Haugen, R. A. (1999). The new finance: the case against ef-

ficient markets, volume 2. Prentice Hall Upper Saddle

River.

Kendall, G. and Su, Y. (2005). A particle swarm optimi-

sation approach in the construction of optimal risky

portfolios. In Artificial Intelligence and Applications,

pages 140–145. Citeseer.

Livi, L., Del Vescovo, G., and Rizzi, A. (2012). Graph

recognition by seriation and frequent substructures

mining. In ICPRAM, pages 186–191.

Los, C. A. (2000). Nonparametric efficiency testing of asian

stock markets using weekly data. Advances in Econo-

metrics, 14:329–363.

Malkiel, B. G. and Fama, E. F. (1970). Efficient capital

markets: A review of theory and empirical work. The

journal of Finance, 25(2):383–417.

Muggeo, V. M. (2003). Estimating regression models

with unknown break-points. Statistics in medicine,

22(19):3055–3071.

Nanni, L. (2006). Multi-resolution subspace for financial

trading. Pattern recognition letters, 27(2):109–115.

Possemato, F. and Rizzi, A. (2013). Automatic text cate-

gorization by a granular computing approach: Facing

unbalanced data sets. In Neural Networks (IJCNN),

The 2013 International Joint Conference on, pages 1–

8. IEEE.

Radeerom, M., Wongsuwarn, H., and Kasemsan, M. L. K.

(2012). Intelligence decision trading systems for stock

index. 7198:366–375.

Rizzi, A., Del Vescovo, G., Livi, L., and Mascioli, F. M. F.

(2012). A new granular computing approach for se-

quences representation and classification. In Neural

Networks (IJCNN), The 2012 International Joint Con-

ference on, pages 1–8. IEEE.

Rizzi, A., Possemato, F., Livi, L., Sebastiani, A., Giuliani,

A., and Mascioli, F. M. F. (2013). A dissimilarity-

based classifier for generalized sequences by a gran-

ular computing approach. In Neural Networks

(IJCNN), The 2013 International Joint Conference on,

pages 1–8. IEEE.

Sai, Y., Yuan, Z., and Gao, K. (2007). Mining stock mar-

ket tendency by rs-based support vector machines. In

Granular Computing, 2007. GRC 2007. IEEE Inter-

national Conference on, pages 659–659. IEEE.

Vanstone, B. and Tan, C. (2003). A survey of the application

of soft computing to investment and financial trading.

Information Technology papers, page 13.

ECTA2014-InternationalConferenceonEvolutionaryComputationTheoryandApplications

288