On Advanced Business Simulations

Converging Operational and Strategic Levels

Marc Drobek

1,2

, Wasif Gilani

1

, David Redlich

1

, Thomas Molka

1

and Danielle Soban

2

1

SAP UK Ltd., Belfast, U.K.

2

Department of Mechanical and Aerospace Engineering, Queens University Belfast, U.K.

{marc.drobek, wasif.gilani, david.redlich, thomas.molka}@sap.com, d.soban@qub.ac.uk

Keywords:

KPI predictions, Business Dynamics, Business Process Simulation, Process Performance Parameters,

Business Simulations, Semantic Knowledge, Ontologies.

Abstract:

Business Dynamics (BD) enables strategic Key Performance Indicator (KPI) predictions to monitor the health

status of companies and support the decision making process. Nevertheless, a very important factor, which

is generally overlooked, is that the top level strategic KPIs are highly influenced by the operational level

business processes. These two domains are, however, mostly segregated and examined as silos with different

solutions. In this paper, we are proposing a framework for advanced business simulations, which converges

the two domains by utilising Ontologies and process execution data. Establishing this connection enables

drilling down from a high level KPI perspective into the underlying operational level details to discover hidden

bottlenecks and pre-emptively apply corrective actions.

1 INTRODUCTION

Managing global companies is an extremely challeng-

ing task, which needs a lot of expertise and experi-

ence. These companies are highly complex ecosys-

tems, with millions of customers and thousands of

employees organised in various departments in dif-

ferent geographical locations. Like every other com-

plex ecosystem, these need to be managed carefully

and with huge responsibility to keep them flourish

and stimulate growth. KPI monitoring and predic-

tion solutions, based on multiple concepts (for exam-

ple, database reporting tools, time series analyses or

Business Dynamics (BD) (Sterman, 2000)), are gen-

erally employed to keep a check on the company’s

performance, foresee future development and make

critical decisions. Examples of conventional strate-

gic KPIs, which are generally monitored, are revenue,

profit, number of orders, employee turnover rate, cus-

tomer satisfaction, etc. These KPIs mainly relate to

business objects, (e.g. Sales Order, Customer, Em-

ployee, etc.) and in most cases are computed based

on the actual data contained in the business objects

(e.g. sales orders in case of sales revenue). A very

important factor, which is generally overlooked, is

that these strategic KPIs are highly influenced by the

operational level business processes, which are the

foundation pillars of any company, and are orches-

trated to offer the services or products that the com-

pany deals with. An efficient execution of these pro-

cesses is therefore vital for company’s success. Huge

amount of event data (process logs), is generated dur-

ing process execution, which has only recently re-

ceived attention by the business world and research

community. The performance indicators computed

from execution data, called Process Performance In-

dicators (PPIs), are used to evaluate the performance

of business processes (Ann et al., 2011; Del-Rio-

Ortega et al., 2010). Such PPIs are, for instance,

process queue length, throughput, resource utilisa-

tion, instance occurrence, etc. This process execu-

tion data, therefore, holds the key to uncover prob-

lems and bottlenecks at the business process execu-

tion level. Significant research work has been carried

out in the area of PPI extractions, for instance, in the

context of Process Performance Mining and Business

Process Performance Management (Redlich and Gi-

lani, 2011; Fritzsche et al., 2009; Heilig and M

¨

oller,

2014).

However, so far KPIs and PPIs have mostly been

dealt with and consumed in isolation at different lev-

els (strategic and operational). For example, if one

looks into the widely adopted commercial solutions

in the Business Intelligence domain, such as Business

Objects, Aris WebMethods, Oracle BAM, SAP Pro-

cess Observer, they all deal exclusively either with

166

Drobek M., Gilani W., Redlich D., Molka T. and Soban D.

On Advanced Business SimulationsConverging Operational and Strategic Levels.

DOI: 10.5220/0005425601660171

In Proceedings of the Fourth International Symposium on Business Modeling and Software Design (BMSD 2014), pages 166-171

ISBN: 978-989-758-032-1

Copyright

c

2014 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

PPIs or KPIs (Howson and Newbould, 2012; Heck-

ing and Schroder, 2013). The authors have not come

across any work that connects the PPIs and KPIs, ex-

cept a commercial solution by Software AG that of-

fers a manual mapping approach to connect these two

levels (SoftwareAG, 2014). But clearly, there is a con-

nection between the two levels, as inefficient execu-

tion of BPs eventually leads to KPI deviations, which

might cause financial collapse of the company. Sim-

ple examples highlighting this deep connection be-

tween PPIs and KPIs are:

• An inefficient execution of Sales Opportunity

Management process in a sales office leads to de-

creased revenue.

• A delayed Consignment Fill-up process leads to

lost sales.

• An imperfect execution of the Idea to Market

(I2M) process leads to companies failing to in-

troduce novel competitive solutions, thus loosing

market share (e.g. Kodak and Blackberry).

In this paper, we propose a systematic framework

for BD simulations which utilises semantic knowl-

edge sources, simulations and PPI analyses, to ex-

plore and enhance KPI predictions. This paper is

therefore split into the following sections: Section 2

describes the available operational data and the two

approaches that are generally used for PPI predic-

tions. Section 3 gives an explanation of KPI pre-

dictions with BD simulations and highlights the need

of semantic knowledge to generate such predictions.

Section 4 introduces our advanced business simula-

tion framework and design decisions that have been

made, to incorporate PPI predictions in BD models

with the goal of enhanced KPI predictions. We fur-

ther outline the need for additional semantic knowl-

edge sources, necessary to describe the dependencies

between KPI-KPI and KPI-PPI to create KPI predic-

tions. Finally, in Section 5, we conclude the paper

and list further research challenges, which need to be

tackled in future work.

2 BUSINESS PROCESS

ANALYSES

Software systems supporting the execution and man-

agement of operational BPs are called Business Pro-

cess Management Systems or Business Process Man-

agement Suites (BPMSs) (Ko et al., 2009). Exam-

ples of BPMSs are SAP Netweaver BPM (Woods

and Word, 2004) or Intalio BPMS Designer (Intalio,

2013). When BPs are executed they produce events

each representing a transition in the system’s state.

Enterprise

System

BPMS 1

Event Processing

Performance

Discovery

BPMS 3

BPMS 2

Events

PPIs

Historical

Predicted

BP

Simulation

BP

Scenario

BP State

Extraction

BP

State

PPI Prediction

Analytical

Prediction

Events

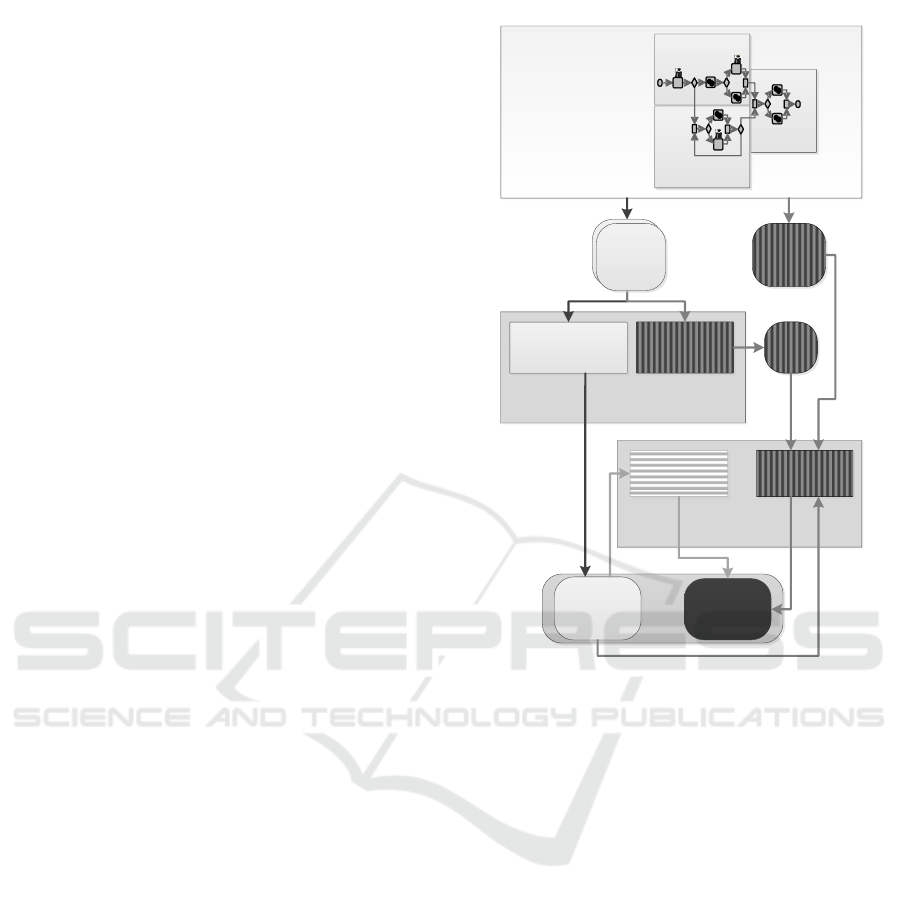

Figure 1: Information flow for PPI Extraction and Pre-

diction: (1) Analytical Prediction (horizontally striped);

(2) Prediction via Simulation (vertically striped).

These events are usually of a simple nature and often

only comprise raw information, like process instance

id, timestamp, and type of the state transition but not

the state of the whole system (Van Der Aalst, 2011).

One example of such an event is:

2013-05-26 T 13:45 CET: Activity "Check

availability" completed, pi-id: 253

The performance of the BPs is measured with PPIs,

e.g. activity net working time - the elapsed time of an

execution of a single activity, or activity throughput

- number of executions of a single activity per time

period, or process instance occurrence - how often

the process has been initiated. The historical PPIs are

computed by capturing, selecting, aggregating, and

eventually abstracting raw events from process logs

to generate high-level performance information about

the system (Performance Discovery).

The prediction of PPIs is generally carried out

with two different approaches: The first approach is

to utilise existing data-centric Business Intelligence

tools to predict each PPI individually based on its

history, i.e. Analytical Prediction. These numeri-

On Advanced Business Simulations - Converging Operational and Strategic Levels

167

cal and/or statistical methods do, however, not take

the workflow information that is readily available

in many BPMSs into account (Redlich and Gilani,

2011). The second approach, which includes work-

flow information to create more meaningful predic-

tion results, is Prediction via Simulation. In this

second approach, in addition to the extracted his-

torical performance data, BP Scenario information

about control workflow, involved roles and resources

are utilised in a discrete event simulation (Robinson,

1964). The beneficial effect of using simulation over

analytical methods for predicting PPIs is discussed

in (Redlich and Gilani, 2011) and (Porzucek et al.,

2010). Figure 1 shows the general concept for ex-

tracting Historical (and current) PPI data plus the two

approaches of how to compute the Predicted PPI data

via Analytical Prediction (horizontally striped) and

Prediction via Simulation (vertically striped).

3 BUSINESS DYNAMICS

Predicting KPIs in enterprises is a commonly used

method to support the decision making process to line

up the future business strategy. These predictions are

usually carried out with time series analyses of his-

torical KPI data (Brockwell and Davis, 2006). How-

ever, in large businesses, KPIs appear to be high-

dimensional, non-linear, are part of feedback loops

and not isolated. Especially the fact, that KPIs are

no silos, thus are being influenced by a variety of

other KPIs and variables, raises the level of mathe-

matical expertise needed to perform time series ana-

lyses. In such cases, when the system under study is

highly non-linear and contains feedback, Forrester’s

System Dynamics concept is in general well suited

(Forrester, 1961). Sterman already showed the appli-

cability of Business Dynamics (BD) in the business

domain (Sterman, 2000). Since BD is essentially a

specialised SD concept, it adopts the same traditional

SD steps to support the modeller in understanding the

business and creating predictions. SD itself is, how-

ever, already a well established concept and various

steps involved in SD have been debated for decades

(Burns, 1977; Ford, 1999; Binder et al., 2004). We

have summarised these traditional steps in the life-

cycle figure 2, using Burns and other sources.

The process usually starts with eliciting knowl-

edge from the business domain experts (company em-

ployees, BP owners, managers, directors and so on)

and formalise it into Causal Loop Diagrams. CLDs

capture the most important business variables (rev-

enue, sales, orders, customer satisfaction) and their

inter-connections (Burns, 1977). The next phase is

Figure 2: The traditional BD life cycle.

the transformation of CLDs into State/Flow Diagrams

(SFDs), which capture the resources/material flow-

ing through the business (Forrester, 1961). In the

next step, the SFDs are annotated with parameters

and equations, which embodies a variety of different

limitations (Drobek et al., 2013), and then fed into

the simulation engine (e.g. Vensim, Stella (Richmond

and isee systems (Firm), 2008)) to finally carry out

simulations. Once first simulation results have been

produced, the modeller has to evaluate, whether the

output matches the real-world behaviour. Further it-

erations are executed to improve simulation results.

The BD modelling process is, however, not triv-

ial, since it is mostly based on the modellers under-

standing and knowledge of the target business. For

instance, the modeller is expected to:

• semantically link together the KPIs and their in-

fluencing variables in the CLD (e.g., profit is in-

fluenced by monthly expenses)

• detect and model feedback loops

• determine the resources/material flowing through

the system to create SFDs (e.g., money, cus-

tomers, satisfaction)

To find these connections, the modeller usually relies

on the business domain experts (Forrester, 1991).

Mostly, this knowledge is a mental model and needs

to be manually extracted by the modeller, which

gives room for misinterpretation and failure (Ford

and Sterman, 1998). Additionally, the modeller

has access to the historical business data (KPIs,

documentation, reports), which she uses to extract

the dependencies and relations of the target KPI. But

even with this knowledge, modelling CLDs and SFDs

is still a very challenging task, since the identification

of the important variables, which influence the target

KPI and main feedback loops, requires a lot of

experience, expertise and imagination.

Fourth International Symposium on Business Modeling and Software Design

168

Enterprise

System

Event

Processing

Performance

Discovery

Events

PPIs

Historical

Predicted

BP

Scenario

BP State

Extraction

BP State

Events

BD Lifecycle

Semantic

Knowledge

Model

KPIs

Predicted

CLD

creation

SFD

creation

Enhanced

CLD

SFD

Business

Process

Level

Strategic

Level

Business

Data

Historical

BP Simulation

BD Simulation (SFD)

Simulation Engine

External

Variable

BPMS 1

BPMS 3

BPMS 2

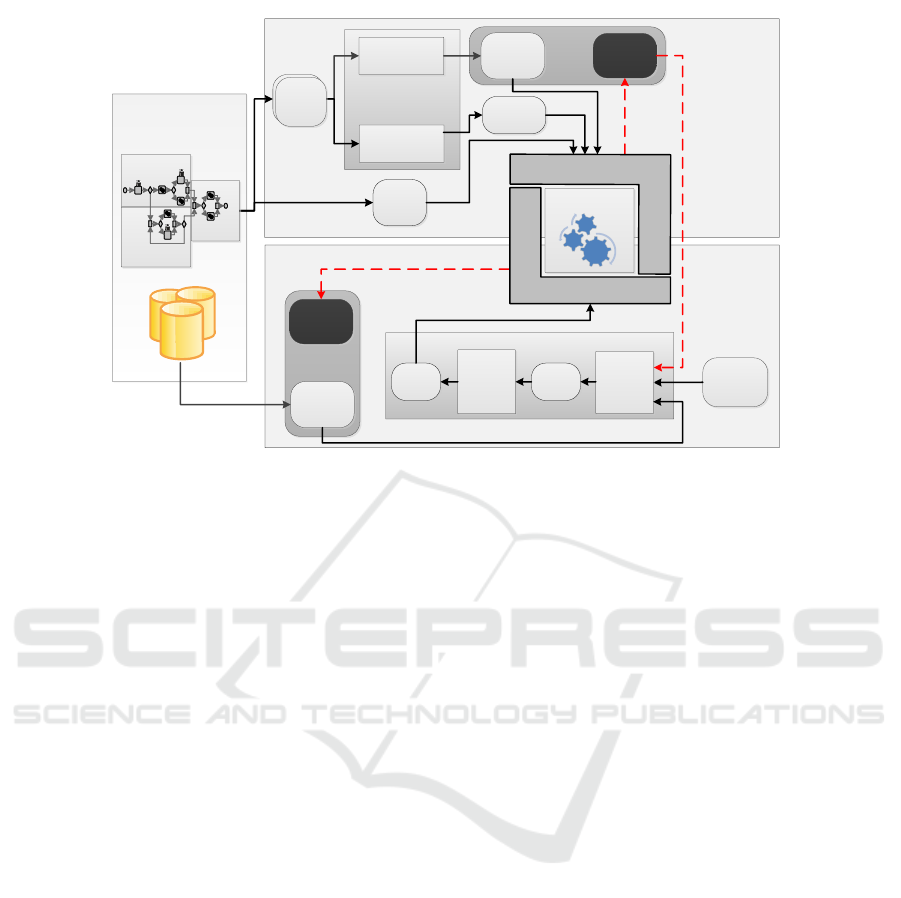

Figure 3: Framework for linking strategic KPIs with operational PPIs.

4 AN ADVANCED BUSINESS

SIMULATION FRAMEWORK

As stated earlier in the introductory section, and high-

lighted with examples, the strategic KPIs are highly

influenced by the execution of BPs at the operational

level. However, the strategic level decision makers

(head of sales, board members, etc.) lack the process

level visibility to make informed decisions. Establish-

ing a link between the PPIs and KPIs will enable this

process visibility. Our proposed framework solution,

in addition to the strategic KPIs, also incorporates the

predicted PPIs in the BD life cycle, thus establish-

ing a link between the operational and strategic level.

With these links, our framework enables identifying

and addressing issues and bottlenecks pro-actively at

the operational level before they start impacting the

strategic KPIs. Figure 3 shows a schematic descrip-

tion of our advanced business simulation framework.

The two main approaches to compute PPI predictions

are described in Section 2. Our framework employs

the second approach, Prediction via Simulation, be-

cause it preserves the control flow information of the

targeted BPs and thereby helps to exploit the bene-

fits of behavioural simulations (Porzucek et al., 2010).

Additionally, the KPI prediction process via BD sim-

ulation is orchestrated following the BD life cycle

provided in Section 3 (shown in figure 2). The con-

nection between the operational and strategic level is

established by including the PPIs in the CLD creation

process. This is done by applying causal indicators,

such as correlations and Granger causality (Granger,

1969), among the KPIs and PPIs and further extract-

ing their semantic dependencies from available en-

terprise ontologies, as described later. The precom-

puted PPIs are an additional input data source, when

designing these enhanced CLDs in our framework.

Once an enhanced CLD is transformed into an SFD,

it is simulated and finally KPI predictions are gener-

ated. In a standard BD simulation run, each element

apart from static parameters or converters is simu-

lated. Since the PPIs are more accurately calculated

via event processing and BP simulations (as shown in

figure 1), they are not recomputed again in the BD

simulation. The reason behind this accuracy is the

availability of highly formalised and well structured

behavioural models and event data that enables an au-

tomated prediction process. The PPIs are therefore,

by definition, considered to be parameters or convert-

ers in a BD simulation run, even though, they also

change over time. Our solution introduces a new BD

element type called ”external variable”, which maps

to a precomputed PPI. Such an external variable is not

influenced by any of the other BD elements, but is still

continuously updated with each simulation run at the

operational level.

The creation of CLDs has always been a non-

trivial task, as discussed in Section 3. By introduc-

ing an additional operational PPI input, this prob-

lem becomes even more challenging. This raises the

need for a definition of some sort of a ”dependency

model” to provide a guideline on how to link to-

gether operational data to the KPIs. Such a model

needs to describe the relations and dependencies be-

On Advanced Business Simulations - Converging Operational and Strategic Levels

169

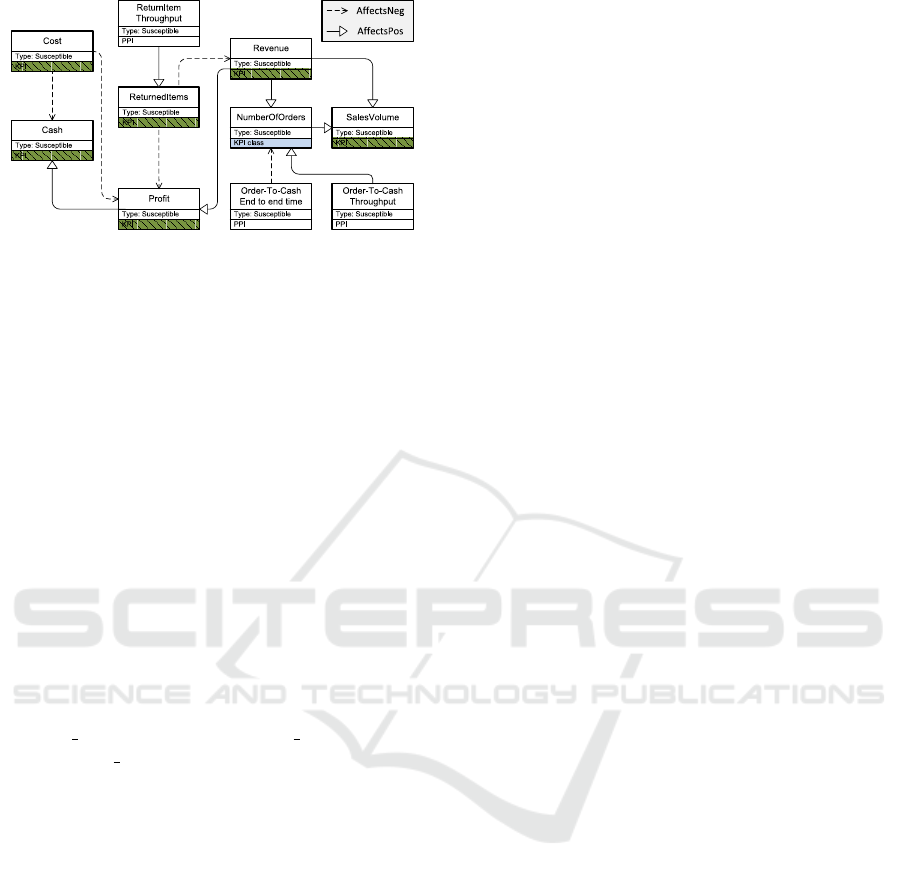

Figure 4: Visual representation of a business ontology to

describe the relation between KPIs and PPIs.

tween KPI-KPI and KPI-PPI, thus reflecting the se-

mantic knowledge that usually resides in the mental

models of the domain experts. Ontologies and knowl-

edge graphs are two examples for formal ”semantic

knowledge models” (SKM) (Zhang, 2002). Compa-

nies, such as Google, are using knowledge graphs to

”... understand real-world entities and their relation-

ships to one another”, which are either automatically

harvested from the web or are once manually created

by the domain experts and then reused (Steiner et al.,

2012). We find Ontologies to be well suited to de-

scribe this kind of semantic information and have in-

cluded such ”semantic knowledge models” into the

framework, as shown in figure 3. A snapshot of an ex-

ample retailer business ontology is shown in figure 4.

This picture visualises the connection between some

high-level KPIs, for instance, Revenue, NumberOf-

Orders, ReturnedItems, and three PPIs, namely Re-

turnItem Throughput, OrderProcess Throughput and

OrderProcess EndToEndTime. These three PPIs are

reflecting the throughput of the ReturnItem and

Order-To-Cash BP, as well as the average execution

time for one Order-To-Cash BP instance. Addition-

ally, the KPIs and PPIs are connected via two re-

lations: affectsPos and affectsNeg. Whilst the af-

fectsPos relation suggests a positive influence from

source to target element (e.g. directly proportional),

the affectsNeg relation negates this dependence (e.g.

inversely proportional). In this given case, we know

that the Order-To-Cash BP drives the high-level KPI

NumberOfOrders, which then impacts the sales vol-

ume and finally the overall revenue of the company.

If a modeller was to predict the company’s revenue,

she should consider the impact of the Order-To-Cash

PPIs and incorporate those into the simulation.

A valid question at this point is the expected num-

ber of KPIs and PPIs, which have to be considered to

create such ontologies. Mostly, BPs are standardized,

but are still sometimes customised to cater specific

requirements of particular companies, for instance,

introduction of additional activities in the standard

Order-To-Cash BP. The fundamental PPIs, such as

end-to-end execution time or instance occurrence,

still remain valid. The same holds for universal KPIs

(revenue, sales volume, cost), which are employed in

all companies to check the health status of the busi-

ness. On the other hand, there are also KPIs, which

are unique for each different company, e.g., ”number

of orders for product X” or ”current stock of product

Y”. Because companies are selling so many different

products and services, one can not simply map each

single product into one universal ontology. In our

framework, we have introduced the notion of KPI/PPI

classes. These classes are used as templates in the on-

tology. A good example for such a class in our on-

tology is NumberOfOrders, which acts as parent for

each single ”number of orders for specific product”

KPI. With this available ontology, all that is left for

the modeller to create CLDs, is: Classify the current

KPI/PPI and query the relationships of its parent class

to other KPIs/PPIs from the ontology.

The introduction of a link between the operational

and strategical level within our framework offers one

huge benefit: It enables the modeller to drill-down

from a high-level strategic view to the low-level op-

erational view. Since an enhanced CLD now contains

both, the KPIs and PPIs, possible strategic KPI bottle-

necks can be tracked all way down to the operational

level, thus showing the root cause of deviations. This

KPI-PPI connection is established with the help of on-

tologies within our framework. Additional benefits

of having such an ontology is, that these are highly

extensible and reusable for the targeted domains, for

instance, any newly observed domain specific depen-

dencies can be included into the ontology. On top

of that, ontologies are well suited for automated pro-

cessing and can easily be queried with SPARQL to re-

trieve the KPI/PPI relationships (The W3C SPARQL

Working Group, 2013).

5 CONCLUSION AND FUTURE

WORK

In this paper, we have proposed an advanced busi-

ness simulation framework that addresses the missing

connection between the strategic and operational level

in businesses, thereby converging the two domains.

Within our framework, the operational level PPIs are

included as a part of BD simulation for KPI predic-

tions and enabling operational level visibility. This

means any KPI violation at the strategic level can be

tracked down to the operational level to carry out cor-

rective actions. Furthermore, in order to address the

increased complexity resulting from the introduction

Fourth International Symposium on Business Modeling and Software Design

170

of PPIs into BD simulations, we have designed and

implemented additional SKMs. These SKMs (ontolo-

gies) provide knowledge about relations and depen-

dencies of KPIs and PPIs, and can be used as busi-

ness dictionaries to look up relationships of KPIs and

PPIs either manually or automatically. An automated

consumption of SKMs can further be used to auto-

mate the BD simulation process for continuous KPI

predictions in real-time. So far this approach is uni-

directional, because we have only incorporated PPIs

as main influencing factor towards KPIs. For future

work, it would be interesting to analyse the KPI influ-

ence towards PPIs as well. We believe, that the pre-

diction of PPIs could also be beneficially impacted

by incorporating the simulated KPIs. The next step

would be, to evaluate the framework in the context of

an industrial use-case, to demonstrate improved KPI

predictions.

REFERENCES

Ann, R., Chase, G., Omar, R., Taylor, J., and von Rosing,

M. (2011). Applying Real-World BPM in an SAP En-

vironment. Galileo Press, Bonn.

Binder, T., Vox, A., Belyazid, S., Haraldsson, H. V., and

Svensson, M. (2004). Developing System Dynamics

models from Causal Loop Diagrams. Technical re-

port, University of Luebeck, Germany; Lund Univer-

sity, Sweden.

Brockwell, P. J. and Davis, R. A. (2006). Time Series: The-

ory and Methods. Springer, second edition.

Burns, J. R. (1977). Converting signed digraphs to For-

rester schematics and converting Forrester schematics

to Differential equations. IEEE Transactions on sys-

tems, man, and cybernetics, 10:695–707.

Del-Rio-Ortega, A., Resinas, M., and Ruiz-Cortes, A.

(2010). Defining Process Performance Indicators : An

Ontological Approach. On the Move to Meaningful

Internet Systems: OTM 2010, 6426:555–572.

Drobek, M., Gilani, W., and Soban, D. (2013). Parameter

estimation and equation formulation in Business Dy-

namics. In Third International Symposium on Busi-

ness Modeling and Software Design, Noordwijker-

hout. ScitePress.

Ford, A. (1999). Modeling the environment: An Intro-

duction to System Dynamics Models of Environmental

Systems. Island Press, Washington, D.C.

Ford, D. N. and Sterman, J. D. (1998). Expert knowledge

elicitation to improve formal and mental models. Sys-

tem Dynamics Review, 14(4):309–340.

Forrester, J. W. (1961). Industrial Dynamics. MIT Press;

currently available from Pegasus Communications;

Waltham, MA, Cambridge, MA.

Forrester, J. W. (1991). System Dynamics and the Lessons

of 35 Years. pages 1–35.

Fritzsche, M., Picht, M., Gilani, W., Spence, I., Brown,

J., and Kilpatrick, P. (2009). Extending BPM Envi-

ronments of Your Choice with Performance Related

Decision Support. In Business Process Management,

pages 97–112. Springer.

Granger, C. W. J. (1969). Investigating Causal Relations

by Econometric Models and Cross-spectral Methods.

Econometrica, 37(3):424–438.

Hecking, M. and Schroder, C. (2013). Current Implementa-

tion Level of Business Process Management in Corpo-

rate Practice: A Quantitative Analysis. GRIN Verlag.

Heilig, B. and M

¨

oller, M. (2014). Business Process Man-

agement mit SAP NetWeaver BPM. Galileo Press

Gmbh, 1st edition.

Howson, C. and Newbould, E. (2012). SAP BusinessOb-

jects BI 4.0 The Complete Reference 3/E. McGraw-

Hill Osborne, 3rd edition.

Intalio (2013). BPMS designer; http://www.intalio.com/

products/bpms/overview/.

Ko, R. K. L., Lee, S. S. G., and Lee, E. W. (2009). Busi-

ness process management (BPM) standards: a survey.

Business Process Management Journal.

Porzucek, T., Kluth, S., Fritzsche, M., and Redlich, D.

(2010). Combination of a Discrete Event Simula-

tion and an Analytical Performance Analysis through

Model-Transformations. In IEEE ECBS, pages 183–

192.

Redlich, D. and Gilani, W. (2011). Event-Driven Process-

Centric Performance Prediction via Simulation. In

BPM Workshops.

Richmond, B. and isee systems (Firm) (2008). An Introduc-

tion to Systems Thinking: STELLA Software.

Robinson, S. (1964). Simulation - The Practice of Model

Development and Use. John Wiley & Sons.

SoftwareAG (2014). Software AG: webMethods, last

accessed: April 2014; http://www.softwareag.com/

corporate/products/wm/bpm/overview/default.asp.

Steiner, T., Verborgh, R., Troncy, R., Gabarro, J., and Walle,

R. V. D. (2012). Adding Realtime Coverage to the

Google Knowledge Graph. In Proceedings of the

ISWC 2012.

Sterman, J. D. (2000). Business Dynamics: Systems think-

ing and modeling for a complex world. McGraw-Hill,

New York, NY.

The W3C SPARQL Working Group (2013). SPARQL

Query Language for RDF; http://www.w3.org/TR/

rdf-sparql-query/.

Van Der Aalst, W. (2011). Process Mining - Discov-

ery, Conformance and Enhancement of Business Pro-

cesses. Springer.

Woods, D. and Word, J. (2004). SAP Netweaver for Dum-

mies. Wiley Hoboken.

Zhang, L. (2002). Knowledge Graph Theory and Structural

Parsing. Ph.d. thesis, University of Twente.

On Advanced Business Simulations - Converging Operational and Strategic Levels

171