Artificial Intelligence Neural Networks Applications in Forecasting

Financial Markets and Stock Prices

Veselin L. Shahpazov, Lyubka A. Doukovska and Dimitar N. Karastoyanov

Institute of Information and Communication Technologies, Bulgarian Academy of Sciences,

Acad. G. Bonchev str., bl. 2, 1113 Sofia, Bulgaria

veselin_georgiev@abv.bg, doukovska@iit.bas.bg, dkarast@iinf.bas.bg

Keywords: Artificial Neural Network, Business, Predicting Stock Prices, Review, Historic Development.

Abstract: The interest in using artificial neural networks (ANN’s) for forecasting has led to a tremendous surge in

research activities over time. Artificial Neural Networks are flexible computing frameworks and universal

approximators that can be applied to a wide range of time series forecasting problems with a high degree of

accuracy. Forecasting problems arise in so many different disciplines and the literature on forecasting using

ANN’s is scattered in so many diverse fields that it is hard for a researcher to be aware of all the work done

to date in the area. There is an extensive literature in financial applications of ANN’s. Naturally forecasting

stock price or financial markets has attracted considerable interest and it has been one of the biggest

challenges. This paper reviews the history of the application of artificial neural networks for forecasting

future stock prices. From the introduction of the back-propagation algorithm in 1980’s for training an MLP

neural network by Werbos, who used this technique to train a neural network and claimed that neural

networks are better than regression methods and Box-Jenkins model in prediction problems through the

application of such technics to financial markets forecasting by pioneers in the field like White, Kimoto and

Kamijo to the more recent studies of stocks prices in not only the biggest capital markets but also in some

emerging and illiquid markets, we will look at the progress made in the past more than twenty five years of

research.

1 INTRODUCTION

It is nowadays a common notion that vast amounts

of capital are traded through the stock markets all

around the world. National economies are strongly

linked and heavily influenced from the performance

of their stock markets. Moreover, recently the

markets have become a more accessible investment

tool, not only for strategic investors but for common

people as well. Consequently they are not only

related to macroeconomic parameters, but they

influence everyday life in a more direct way.

Therefore, they constitute a mechanism which has

important and direct social impacts.

The characteristic that all stock markets have in

common is the uncertainty, which is related with

their short and long-term future state. This feature is

undesirable for the investor but it is also unavoidable

whenever the Stock Market is selected as the

investment tool. The best that one can do is to try to

reduce this uncertainty. The Stock Market prediction

task divides researchers and academics into two

groups those who believe that we can devise

mechanisms to predict the market and those who

believe that the market is efficient and whenever

new information comes up the market absorbs it by

correcting itself, thus there is no space for prediction

(EMH). Furthermore they believe that the Stock

Market follows a Random Walk, which implies that

the best prediction you can have about tomorrow’s

value is today’s value.

In literature a number of different methods have

been applied in order to predict Stock Market

returns. These methods can be grouped in four major

categories: 1) Technical Analysis Methods,

2) Fundamental Analysis Methods, 3) Traditional

Time Series Forecasting and 4) Machine Learning

Methods. Technical analysts, known as chartists,

attempt to predict the market by tracing patterns that

come from the study of charts which describe

historic data of the market. Fundamental analysts

study the intrinsic value of an stock and they invest

on it if they estimate that its current value is lower

that it’s intrinsic value. In Traditional Time Series

282

L. Shahpazov V., Doukovska L. and Karastoyanov D.

Artificial Intelligence Neural Networks Applications in Forecasting Financial Markets and Stock Prices.

DOI: 10.5220/0005427202820288

In Proceedings of the Fourth International Symposium on Business Modeling and Software Design (BMSD 2014), pages 282-288

ISBN: 978-989-758-032-1

Copyright

c

2014 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

forecasting an attempt to create linear prediction

models to trace patterns in historic data takes place.

These linear models are divided in two categories:

the univariate and the multivariate regression

models, depending on whether they use one of more

variables to approximate the Stock Market time

series. Finally a number of methods have been

developed under the common label Machine

Learning these methods use a set of samples and try

to trace patterns in it (linear or non-linear) in order

to approximate the underlying function that

generated the data. The aim is to draw conclusions

from these samples in such way that when unseen

data are presented to a model it is possible to infer

the to-be explained variable from these data. These

methods have been applied to market prediction;

particularly for Neural Networks there is a rich

literature related to the forecast of the market on

daily basis.

2 AN OVERVIEW

OF ARTIFICIAL NEURAL

NETWORKS

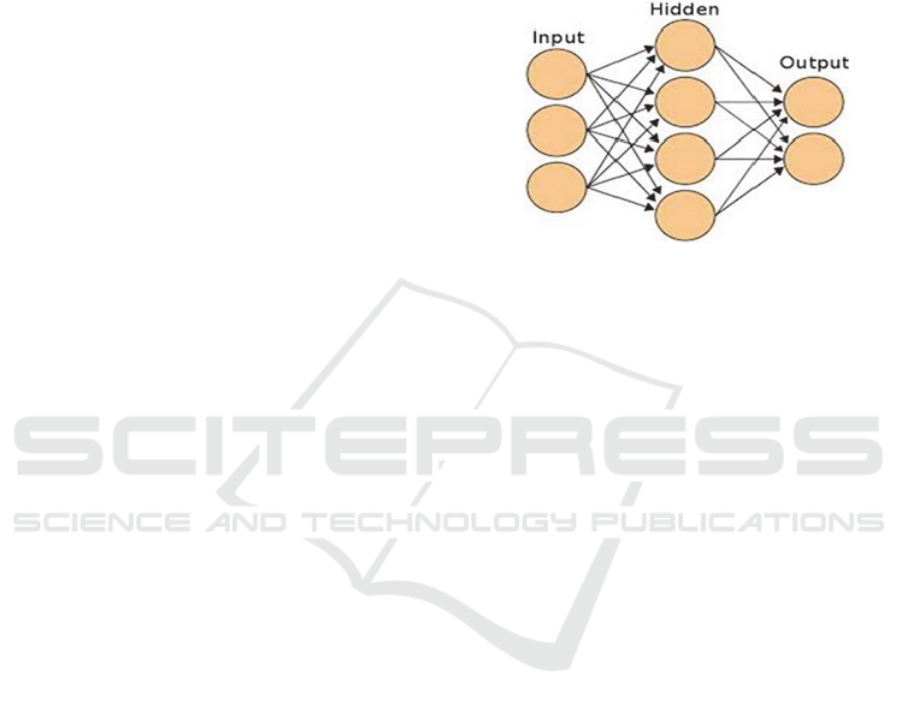

The most commonly used forecasting network

structure of ANN’s is the multi-layer feed forward

network brain particularly, are composed of a num-

ber of interconnected simple processing elements

called neurons or nodes. Each node receives an input

signal which is the total “information” from other

nodes or external stimuli, processes it locally

through an activation or transfer function and

produces a transformed output signal to other nodes

or external outputs. Although each individual neuron

implements its function rather slowly and im-

perfectly, collectively a network can perform a

surprising number of tasks quite efficiently. This

information processing characteristic makes ANNs a

powerful computational device and able to learn

from examples and then to generalize to examples

never before seen.

A number of different ANN models have been

proposed. Perhaps the most influential models are

the multi-layer perceptrons (MLP), Hopfield

networks, and Kohonen’s self-organizing networks.

Other popular network structures are radial-basis

functions networks, ridge polynomial networks, and

wavelet networks.

An MLP is typically composed of several layers

of nodes. The first or the lowest layer is an input

layer where external information is received. The

last or the highest layer is an output layer where the

problem solution is obtained. The input layer and

output layer are separated by one or more

intermediate layers called the hidden layers. The

nodes in adjacent layers are usually fully connected

by acyclic arcs from a lower layer to a higher layer.

Figure 1 gives an example of a fully connected MLP

with one hidden layer.

Figure 1: Example of a fully connected MLP.

For an explanatory or causal forecasting problem,

the inputs to an ANN are usually the independent or

predictor variables. The functional relationship,

estimated by the ANN, can be written as:

y = f(x

1

, x

2

, …, x

p

) (1)

where x

1

, x

2

, …, x

p

are p independent variables and y

is a dependent variable. In this sense, the neural

network is functionally equivalent to a nonlinear

regression model. On the other hand, for an extra-

polative or time series forecasting problem, the

inputs are typically the past observations of the data

series and the output is the future value. The ANN

performs the following function mapping:

y

t+1

= f(y

t

, y

t –1

,…, y

t –

p

) (2)

where y

t

is the observation at time t. Thus, the ANN

is equivalent to the nonlinear autoregressive model

for time series forecasting problems. It is also easy

to incorporate both predictor variables and time-

lagged observations into one ANN model, which

amounts to the general transfer function model.

Before an ANN can be used to perform any

desired task, it must be trained to do so. Basically

training is the process of determining the arc weights

which are the key elements of an ANN. The

knowledge learned by a network is stored in the arcs

and nodes in the form of arc weights and node

biases. It is through the linking arcs that an ANN can

carry out complex nonlinear mappings from its input

nodes to its output nodes.

Artificial Intelligence Neural Networks Applications in Forecasting Financial Markets and Stock Prices

283

3 ANN APPLICATIONS

AS FORECASTING TOOLS

Forecasting problems arise in so many different

disciplines and the literature on forecasting using

ANNs is scattered in so many diverse fields that it is

hard for a researcher to be aware of all the work

done to date in the area. One of the first successful

applications of ANNs in forecasting is reported by

Lapedes and Farber. Using two deterministic chaotic

time series generated by the logistic map and the

Glass Mackey equation, they designed the feed-

forward neural networks that can accurately mimic

and predict such dynamic nonlinear systems. Their

results show that ANNs can be used for modelling

and forecasting nonlinear time series with very high

accuracy. After that a number of papers were

devoted to using ANNs to analyse and predict

deterministic chaotic time series with and/or without

noise. Chaotic time series occur mostly in engine-

ering and physical science since most physical

phenomena are generated by nonlinear chaotic

systems. As a result, many authors in the chaotic

time series modelling and forecasting are from the

field of physics.

There is an extensive literature in financial

applications of ANNs. ANNs have been used for

forecasting bankruptcy and business failure, foreign

exchange rate, stock prices off course. Another

major application of neural network forecasting is in

electric load consumption study.

Many other forecasting problems have been

solved by ANNs. A short list includes airborne

pollen commodity prices, environmental tempera-

ture; helicopter component loads international airline

passenger traffic macroeconomic indices, ozone

level, personnel inventory, rainfall, river flow, stu-

dent grade point averages, tool life, total industrial

production, transportation, and wind pressure and

wind pressure and many more.

4 ANN AND STOCK MARKET

FORECASTING

The idea of using neural networks for predicting

problems was first expressed in (Hu, 1964) which

was used for weather forecasting. The absence of

any learning method for multi-layer networks made

it impossible to apply these networks to complex

prediction problems. But in 1980’s the back-

propagation algorithm was introduced for training an

MLP neural network. Werbos used this technique to

train a neural network (Werbos, 1988) and claimed

that neural networks are better than regression

methods and Box-Jenkins model in prediction

problems.

In recent years so many researches have been

done on neural networks to predict the financial

markets and the stock market changes in particular.

Probably the first paper in the vast field, at least

from today’s perspective of stock market prediction

with ANN’s is (White, 1988), in which the main

focus is to try to prove wrong the Efficient Market

Hypothesis. In its simplest form, this hypothesis

asserts that asset prices follow a random walk that is,

the movement of an asset's price is completely

unpredictable from publicly available information

such as the price and volume history for the asset

itself or that of any other asset.

One of the first efforts was by Kimoto and his

colleagues in which they used neural networks to

predict the index of Tokyo stock market (Kimoto

et al., 1990). They used several neural networks

trained to learn the relationships between past values

of various technical and economic indices for

obtaining the expected returns of the TOPIX. The

TOPIX is a weighted average of all stocks listed on

the Tokyo Stock Exchange. The used technical and

economic indices are: the vector curve (an indicator

of market momentum), turnover, interest rate,

foreign exchange rate and the value of the DJIA

(Dow Jones Industrial Average). The desired output

of the networks is a weighted sum, few weeks, of the

logarithm of the ratio of the TOPIX at the end of

week t to the TOPIX value at the end of week (t – 1)

and the desired output is a weighted sum of r

t

for

some weeks. The future extraction is not explained

in this paper, except for the fact that some irregul-

arity is removed and logarithm function is used

before normalization.

In (Kamijo, Tanigawa, 1990) is proposed the use

of “Elman recurrent net” (recurrent neural network

is class of neural network, where connections

between units form a directed cycle. This creates an

internal state of the network which allows it to

exhibit dynamic temporal behaviour) for predicting

the future stock prices using extracted features from

past daily high, low and closing stock prices. Unlike

feed-forward neural networks, RNNs can use their

internal memory to process arbitrary sequences of

inputs. The method used tries to extract triangle

patterns in stock prices which are seen on the daily

high, low and closing graph. A triangle is usually

seen as a beginning of a sudden stock price rise after

that the high and low prices appear and the price

oscillates for a period of time before the lines

Fourth International Symposium on Business Modeling and Software Design

284

converge. The ANN is trained to recognize this

pattern in the stock prices.

Matsuba uses a feed-forward NN with the last n

stock index values as inputs and the next N – n

values as the outputs (Matsuba, 1991). This is an

N – n step ahead prediction. Thus, if the index for

the n

-th

day is denoted by X

n

then, the inputs are X

1

,

X

2

, …, X

n

and the outputs are X

n+1

, X

n+2

, …, X

N

.

If such a network is trained, any correlation between

the index values for n + 1 through N

-th

day will be

neglected. To ensure that this does not happen, the

network is trained with errors between the desired

and actual outputs in addition to the n inputs.

These errors will then be X

n – 1

– Y

n+1

, …, where Y is

the output of the network. As the training proceeds

this error will tend to zero and these additional

inputs are not required in the testing phase.

In his work Freisleben used a simple feed-

forward NN trained using past and present data to

predict the value of the FAZ Index (Freisleben,

1992). Input data includes the moving average of

past 5 and 10 weeks of the FAZ Index a first order

difference of the FAZ Index and its moving average,

the present bond market index and its first order

difference and the Dollar-Mark exchange rate along

with its first order difference. The value of the FAZ

Index is predicted for the next week based on this

data. The neural network is trained for the past

M weeks and is then tested based on data for the

next L weeks, where M is called the training window

and L is called the testing window. For every

successive prediction, the windows are shifted ahead

and the network is retrained.

In (Azoff, 1994) is outlined that networks are

computer program that can recognize patterns in

data, learn from this and make forecasts of future

patterns. At the time, there were just over 20

commercially available neural network programs

designed for use on financial markets and there have

been some notable reports of their successful

application. However, like any other computer

program, neural networks are only as good as the

data they are given and the questions that are asked

of them. Proper use of a neural network involves

spending time understanding and cleaning the data:

removing errors, pre-processing and post-pro-

cessing. His book provides the knowledge that is

required for the proper design and use of ANN’s in

financial markets forecasting – with an emphasis on

futures trading.

In (Kaastra, Boyd, 1995) is provided a practical,

non-technical introduction to designing a neural

network forecasting model using economic time

series data (16). The procedure of designing a model

is divided into eight steps: 1) variable selection; 2)

data collection; 3) data pre-processing; 4) training,

testing and validation sets; 5) neural network

paradigms; 6) evaluation criteria; 7) neural network

training; and 8) implementation. Three major

conclusions are made, the first being that researchers

must have the time resources and patience to

experiment mainly because of the nature financial

markets. The second is that NN software must allow

automated routines such as walk-forward testing,

optimization of hidden neurons and testing of input

variable combinations, either through direct

programming or the use of batch or script files. And

third the researcher must maintain a good set of

records that list all parameters for each network

tested since any parameter may turn out to cause a

significant change in neural network performance.

In (Leung, Daouk, Chen, 2000) is conducted a

research which focuses on estimating the level of

return on stock market index. Given the notion that a

prediction with little forecast error does not

necessarily translate into capital gain, they evaluate

the efficacy of several multivariate classification

techniques relative to a group of level estimation

approaches. Among the level estimation counter-

parts, which forecast the level, are exponential

smoothing are the multilayered feed-forward neural

network and a probabilistic neural network.

With the introduction of electronic communic-

ation networks (ECN) as electronic trading systems

facilitating trading of stocks and other financial

products in the world’s leading stock exchanges at

first and later on other non-mainstream stock

markets, and the constantly growing interest by both

retail and institutional investors all around the world

in stock’s investing, the research in this field

exploded. The advancement in computational and

communicational power allowed researchers to

develop models using artificial neural networks that

are fed with real time data and capable to produce

real time buy and sell signals.

In (Pan, Tilakaratne, Yearwood, 2005) is

presented a computational approach for predicting

the Australian stock market index – AORD using

multi-layer feed-forward neural networks from the

time series data of AORD and various interrelated

markets. This effort aims to discover an effective

neural network or a set of adaptive neural networks

for this prediction purpose, which can exploit or

model various dynamical swings and inter-market

influences discovered from professional technical

analysis and quantitative analysis.

Kalyvas attempts to predict the daily excess

returns of FTSE 500 and S&P 500 indices over the

Artificial Intelligence Neural Networks Applications in Forecasting Financial Markets and Stock Prices

285

respective Treasury Bill rate returns (Kalyvas,

2001). Then the author applies two different types of

prediction models: Autoregressive (AR) and feed-

forward Neural Networks (NN) to predict the excess

returns time series using lagged values. For the NN

models a Genetic Algorithm is constructed in order

to choose the optimum topology. Data consists of

3275 daily observations of FTSE-100 index, UK

T-Bill Rates and 3277 observations of S&P-500

index and US T-Bill Rates from 4 Jan 1988 until 12

Dec 2000. Finally he evaluates the prediction

models on four different metrics and concludes that

they do not manage to outperform significantly the

prediction abilities of naive predictors.

In their study (Chen, Leung, Daouk, 2003) the

authors attempt to model and predict the direction of

market index of the Taiwan Stock Exchange, one of

the fastest growing financial exchanges in the

developing Asian countries (considered an emerging

market). The probabilistic neural network (PNN) is

used to forecast the direction of index return after it

is trained by historical data. Statistical performance

of the PNN forecasts are measured and compared

with that of the generalized methods of moments

(GMM) with Kalman filter. Moreover, the forecasts

are applied to various index trading strategies, of

which the performances are compared with those

generated by the buy-and-hold strategy as well as

the investment strategies guided by forecasts

estimated by the random walk model and the

parametric GMM models. They conclude that

empirical results show that the PNN-based

investment strategies obtain higher returns than

other investment strategies examined in this study.

In (Kim, Lee, 2004) is compared a feature

transformation method using genetic algorithm with

two conventional methods for artificial neural

networks. The genetic algorithm is incorporated to

improve the learning and generalization abilities of

ANN’s for stock market prediction. Daily

predictions are conducted and their accuracy is

measured. The authors use the proposed model to

predict South Korea composite stock price index

(KOSPI). The comparison of the results achieved by

a feature transformation method using a genetic

algorithm to other feature transformation methods

shows that the proposed model performs better.

Experimental results show that the proposed model

reduces the dimensionality of the feature space and

decreases irrelevant factors for stock market

predictions.

In (Kim, 2006) is proposed a genetic algorithm

approach to instance selection in artificial neural

networks for financial data mining. He notes that

artificial neural networks have preeminent learning

ability, but often exhibit inconsistent and unpredict-

able performance for noisy data. In addition, it may

not be possible to train ANN’s or the training task

cannot be effectively carried out without data

reduction when the amount of data is so large. The

proposed model uses a genetic algorithm to optimize

simultaneously the connection weights between

layers and a selection task for relevant instances.

The globally evolved weights mitigate the well-

known limitations of gradient descent algorithm. In

addition, genetically selected instances shorten the

learning time and enhance prediction performance.

In (Madden, O’Connor, 2006) is evaluated the

effectiveness of using external indicators, such as

commodity prices and currency exchange rates, in

predicting movements in the Dow Jones Industrial

Average index. The performance of each technique

is evaluated using different domain-specific metrics.

A comprehensive evaluation procedure is described,

involving the use of trading simulations to assess the

practical value of predictive models, and comparison

with simple benchmarks that respond to underlying

market growth. In the experiments presented, basing

trading decisions on a neural network trained on a

range of external indicators resulted in a return on

investment of 23.5% per annum, during a period

when the DJIA index grew by 13.03% per annum.

In (Gosh, 2012) is presented a hybrid neural-

evolutionary methodology to forecast time-series

and prediction of the NASDAQ stock price in

particular. The methodology is hybrid because an

evolutionary computation-based optimization process

is used to produce a complete design of a neural

network. The produced neural network, as a model,

is then used to forecast the time-series. The model

identification process involves data manipulation

and a highly experienced statistician to do the work.

Compared to previous work, this paper approach is

purely evolutionary, while others use mixed, mainly

combined with back-propagation, which is known to

get stuck in local optima. On the direction of model

production, the evolutionary process automates the

identification of input variables, allowing the user to

avoid data pre-treatment and statistical analysis.

The study proves the nimbleness of ANN as a

predictive tool for Financial Time series Prediction.

Furthermore, Conjugate Gradient Descent is proved

to be an efficient Back-propagation algorithm that

can be adopted to predict the average stock price of

NASDAQ.

In (Chen, Du, 2013) are studied the interactions

between social media and financial markets. The

authors use a popular online Chinese stock forum

Fourth International Symposium on Business Modeling and Software Design

286

Guba.com.cn as well as traditional sentimental

analysis methods, for each stock, they build a Social

Behaviour Graph based on human’s online

behaviour, calculate key characteristics of the graph,

and find out the correlations between trading

volume/price and those characteristics. They make

use of a back-propagation neural network to predict

the trading volume and price of stocks from the

Shanghai/Shenzhen Stock Exchange in China. Their

method has achieved better outcome compared to

the traditional trading volume/price based time

series models. A trading strategy based on this

method achieved 56.28% benefits for a period of

three month, during which the stock index increased

by only 1.17%.

5 CONCLUSION

This paper surveyed the application of neural

networks to financial systems. It demonstrated how

neural networks have been used to test the Efficient

Market Hypothesis and how they outperform

statistical and regression techniques in forecasting

share prices. Although neural networks are not

perfect in their prediction, they outperform all other

methods and provide hope that one day we can more

fully understand dynamic, chaotic systems such as

the stock market.

Nowadays the technical advancement in comput-

ational power has served researchers to implement

ANN’s and obtain results faster and easier.

The Efficient Market Hypothesis is being heavily

criticized and rejected mainly because of the fact

that not all market participants possess the same

amount of information and speed of access to the

market and so on. This fact is encourages even more

researchers to look for ways to predict the stock

markets using the machine learning methods and

artificial neural networks in particular.

Great deal of work has been done in the field

since the late 1980’s and progress has been

substantial, putting ANN’s in the centre of

sophisticated models for predicting stock markets all

around the world, from mainstream market indexes

like the Daw Jones IA and S&P 500 through the

Emerging markets of the BRIC to the less liquid

financial markets in Eastern Europe, Latin and South

America and the Middle and Far East.

ACKNOWLEDGEMENTS

The research work presented in this paper is partially

supported by the FP7 grant AComIn №316087,

funded by the European Commission in Capacity

Programme in 2012-2016 and by the European

Social Fund and Republic of Bulgaria, Operational

Programme “Development of Human Resources”

2007-2013, Grant № BG051PO001-3.3.06-0048

from 04.10.2012.

REFERENCES

Azoff E. M., 1994. Neural Network Time Series

Forecasting of Financial Markets. John Wiley&Sons.

Chen A. S., M. T. Leung, H. Daouk, 2003. Application of

neural networks to an emerging financial market:

Forecasting and trading the Taiwan Stock Index.

Computers & Operations Research, Vol. 30, Issue 6,

pp. 901–923.

Chen Z., X. Du, 2013. Study of Stock Prediction Based on

Social Network, In: Proceedings of 2013 International

Conference on Social Computing, September 8–14

Alexandria, VA, USA, pp. 913–916.

Freisleben B., 1992. Stock market prediction with back-

propagation networks. In: Proceedings of 5

th

Intl.

Conf. on the industrial and engineering application of

artificial intelligence and expert systems, Germany,

June 1992, pp. 451–460.

Gosh A., 2012. Comparative study of Financial Time

Series Prediction by Artificial Neural Network with

Gradient Descent Learning. Brain, Vol. 3 Issue 1, pp.

41–49.

Kaastra I., M. Boyd, 1995. Forecasting futures trading

volume using neural networks Journal of Futures

Markets, Vol. 15, Issue 8, pp. 953–970.

Kalyvas E., 2001. Using Neural Networks And Genetic

Algorithms to Predict Stock Market Returns.

Department of Computer Science, The University of

Manchester, UK.

Kamijo K., T. Tanigawa, 1990. Stock market pattern

recognition – A recurrent neural network approach

Proc. IJCNN, San Diego, Vol. 1, pp. 215–221.

Kim K., 2006. Artificial neural networks with evolution-

ary instance selection for financial forecasting. Expert

Systems with Applications, Vol. 30, Issue 3, pp. 519–

526.

Kim W., B. Lee, 2004. Stock Market Prediction using

artificial neural networks with optimal feature

transformation. Neural Comput & Applic, Vol. 13, pp.

255–260.

Kimoto T., K. Asakawa, M. Yoda, M. Takeoka, 1990.

Stock market prediction system with modular neural

network. Proceedings of the International Joint

Conference on Neural Networks, pp. 1–6.

Leung M. T., H. Daouk, A.-S. Chen, 2000. Forecasting

stock indices: A comparison of classification and level

estimation models. Int. J of Forecasting, Vol. 16, pp.

173–190.

Madden M. G., N. O'Connor, 2006. Neural Network

Approach to Predicting Stock Exchange Movements

Artificial Intelligence Neural Networks Applications in Forecasting Financial Markets and Stock Prices

287

using External Factors. In: Applications and

Innovations in Intelligent Systems XIII, pp. 64–77.

Matsuba I., 1991. Neural sequential associator and its

application to stock price prediction Proc. IECON 91,

Japan, Vol. 2, pp. 1476–1479.

Pan H., I. Tilakaratne, J. Yearwood, 2005. Predicting

Australian Stock Market Index Using Neural Net-

works Exploiting Dynamical Swings and Intermarket

Influences, Journal of Research and Practice in

Information Technology, Vol. 37, No. 1, pp. 43–55.

Werbos P. J., 1988. Generalization of back-propagation

with application to a recurrent gas market model,

Neural Networks, Vol. 1, pp. 339–356.

White H., 1988. Economic prediction using Neural

Networks: The case of IBM daily stock returns. In:

Proc. of the IEEE International Conference on Neural

Networks, pp. 451–458.

Fourth International Symposium on Business Modeling and Software Design

288