Intercriteria Decision Making Approach to EU Member States

Competitiveness Analysis

Vassia K. Atanassova

1

, Lyubka A. Doukovska

1

, Krassimir T. Atanassov

2,3

and Deyan G. Mavrov

3

1

Institute of Information and Communication Technologies, Bulgarian Academy of Sciences,

Acad. G. Bonchev str., bl. 2, 1113 Sofia, Bulgaria

2

Institute of Biophysics and Biomedical Engineering, Bulgarian Academy of Sciences,

Acad. G. Bonchev str., bl. 105, 1113 Sofia, Bulgaria

3

Prof. Dr. Asen Zlatarov University, 1 Prof. Yakimov Blvd., 8010 Burgas, Bulgaria

vassia.atanassova@gmail.com, doukovska@iit.bas.bg, krat@bas.bg, dg@mavrov.eu

Keywords: Global Competitiveness Index, Index Matrix, Intercriteria Decision Making, Intuitionistic Fuzzy Sets,

Multicriteria Decision Making.

Abstract: In this paper, we present some interesting results derived from the application of our recently developed

decision making approach to data from the World Economic Forum’s Global Competitiveness Reports for

the years 2008–2009 to 2013–2014. The discussed approach, called ‘Intercriteria Decision Making’,

employs the apparatus of index matrices and intuitionistic fuzzy sets to produce from an existing multiobject

multicriteria evaluation table a new table that contains estimations of the pairwise correlations among the set

of evaluating criteria, called ‘pillars of competitiveness’. Using the described approach over the data about

WEF evaluations of the state of competitiveness of the 28 present EU Member States, certain dependences

are discovered to connect the 12 ‘pillars’, termed a ‘positive’ and a ‘negative consonance’. The whole

research and the conclusions derived are in line with WEF’s address to state policy makers to identify and

strengthen the transformative forces that will drive future economic growth.

1 INTRODUCTION

The present work contains a novel analysis of the

most recent Global Competitiveness Reports (GCRs)

of the World Economic Forum (WEF), produced

from 2008–2009 to 2013–2014, aiming at the

discovery of some hidden patterns and trends in the

present Member States of the European Union. We

use a recently developed method, based on

intuitionistic fuzzy sets and index matrices, two

mathematical formalisms proposed and significantly

researched by Atanassov in a series of publications

from 1980s to present day.

The developed method for multicriteria decision

making (Atanassov et al., 2013) is specifically

applicable to situations where some of the criteria

come at a higher cost than others, for instance are

harder, more expensive and/or more time consuming

to measure or evaluate. Such criteria are generally

considered unfavourable, hence if the method

identifies certain level of correlation between such

unfavourable criteria and others that are easier,

cheaper or quicker to measure or evaluate these

might be disregarded in the further decision making

process. In particular, the approach has been so far

applied to petrochemical industry, where the aim has

been to reduce some of the most costly and time

consuming checks of the probes of raw mineral oil,

which have proven to correlate with other cheaper

and quicker tests, thus reducing production costs and

time needed for business decision making.

The present work is the first application of the

developed approach in the field of economics. We

have considered it appropriate to analyse our

selection of data, in order to discover which of the

twelve pillars (criteria) in the formation of the

Global Competitiveness Index (GCI) tend to

correlate. In comparison with related applications of

the method, here, we do not conclude that any of the

correlating criteria might be skipped, as in the

petrochemical case study. We are interested however

to discover dependences between the pillars, which

could help policy makers, especially in the low

performing EU Member States, to focus their efforts

in fewer directions and reasonably expect on the

basis of this analysis that improved country’s

289

Atanassova V., Doukovska L., T. Atanassov K. and Mavrov D.

Intercriteria Decision Making Approach to EU Member States Competitiveness Analysis.

DOI: 10.5220/0005427302890294

In Proceedings of the Fourth International Symposium on Business Modeling and Software Design (BMSD 2014), pages 289-294

ISBN: 978-989-758-032-1

Copyright

c

2014 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

performance against those pillars would positively

affect the performance in the respective correlating

pillars. Such correlation can be deemed reasonable

to expect, as the twelve pillars are based on a

multitude of indicators, some of which enter the GCI

in two difference pillars each, as explained in the

GCR’s Appendix “Computation and structure of the

Global Competitiveness Index” (and to avoid double

counting, half-weight is being assigned to each

instance).

This attempt to identify the correlations between

the different pillars of competitiveness reflects WEF

addressing the countries’ policy makers with the

advice to ‘identify and strengthen the transformative

forces that will drive future economic growth’, as

formulated in the Preface of the latest Global

Competitiveness Report 2013–2014.

This paper is organized as follows. In Section 2

are briefly presented the two basic mathematical

concepts that we use, namely, intuitionistic fuzzy

sets and index matrices. On this basis, the proposed

method is outlined. Section 3 contains our results

from applying the method to analysis of a selection

of data about the performance of the currently 28

Member States of the EU during the last six years

against the twelve pillars of competitiveness. We

report of the findings, produced by the algorithm and

formulate our conclusions in the last Section 4.

2 BASIC CONCEPTS

AND METHOD

The presented multicriteria decision making method

is based on two fundamental concepts: intuitionistic

fuzzy sets and index matrices. It bears the specific

name ‘intercriteria decision making’.

Intuitionistic fuzzy sets defined by Atanassov

(Atanassov, 1983; Atanassov, 1986; Atanassov,

1999; Atanassov, 2012) represent an extension of

the concept of fuzzy sets, as defined by Zadeh

(Zadeh, 1965), exhibiting function µ

A

(x) defining the

membership of an element x to the set A, evaluated

in the [0; 1]-interval. The difference between fuzzy

sets and intuitionistic fuzzy sets (IFSs) is in the

presence of a second function ν

A

(x) defining the non-

membership of the element x to the set A, where:

0 ≤ µ

A

(x) ≤ 1,

0 ≤ ν

A

(x) ≤ 1,

0 ≤ µ

A

(x) + ν

A

(x) ≤ 1.

The IFS itself is formally denoted by:

A = {x, µ

A

(x), ν

A

(x) | x E}.

Comparison between elements of any two IFSs, say

A and B, involves pairwise comparisons between

their respective elements’ degrees of membership

and non-membership to both sets.

The second concept on which the proposed

method relies is the concept of index matrix, a mat-

rix which features two index sets. The theory behind

the index matrices is described in (Atanassov, 1991).

Here we will start with the index matrix M with

index sets with m rows {C

1

, …, C

m

} and n columns

{O

1

, …, O

n

}:

11 1 1 1

1

1

1

1

1, , , ,

,, ,,

,, ,,

,, ,,

,

kln

iikilin

jjkjljn

mmjmlmn

kln

CO CO CO CO

iCOCO COCO

jCOCO COCO

mCO CO CO CO

OO OO

M

Ca a a a

Ca a a a

Ca a a a

Ca a a a

where for every p, q (1 ≤ p ≤ m, 1 ≤ q ≤ n), C

p

is a

criterion (in our case, one of the twelve pillars), O

q

in an evaluated object (in our case, one of the 28 EU

Member states), a

C

p

O

q

is the evaluation of the q-th

object against the p-th criterion, and it is defined as a

real number or another object that is comparable

according to relation R with all the rest elements of

the index matrix M, so that for each i, j, k it holds the

relation R(a

C

k

O

i

, a

C

k

O

j

). The relation R has dual re-

lation

R

, which is true in the cases when relation R

is false, and vice versa.

For the needs of our decision making method,

pairwise comparisons between every two different

criteria are made along all evaluated objects. During

the comparison, it is maintained one counter of the

number of times when the relation R holds, and

another counter for the dual relation.

Let

,kl

S

be the number of cases in which the rel-

ations R(a

C

k

O

i

, a

C

k

O

j

) and R(a

C

l

O

i

, a

C

l

O

j

) are simul-

taneously satisfied. Let also

,kl

S

be the number of

cases in which the relations R(a

C

k

O

i

, a

C

k

O

j

) and its

dual

R

(a

C

l

O

i

, a

C

l

O

j

) are simultaneously satisfied. As

the total number of pairwise comparisons between

the object is n(n – 1)/2, it is seen that there hold the

inequalities:

,,

(1)

0

2

kl kl

nn

SS

.

Fourth International Symposium on Business Modeling and Software Design

290

For every k, l, such that 1 ≤ k ≤ l ≤ m, and for

n ≥ 2 two numbers are defined:

,,

,,

2, 2

(1) (1)

kl kl

kl kl

CC CC

SS

nn nn

.

The pair constructed from these two numbers plays

the role of the intuitionistic fuzzy evaluation of the

relations that can be established between any two

criteria C

k

and C

l

. In this way the index matrix M

that relates evaluated objects with evaluating criteria

can be transformed to another index matrix M* that

gives the relations among the criteria:

11 11 1 1

11

1

1,C,C ,C,C

,C ,C ,C ,C

*

.

,,

,,

mm

m m mm mm

m

CC C C

mCC C C

CC

M

C

C

The final step of the algorithm is to determine the

degrees of correlation between the criteria,

depending on the user’s choice of µ and ν. We call

these correlations between the criteria: ‘positive

consonance’, ‘negative consonance’ or ‘dissonance’.

Let α, β [0; 1] be given, so that α + β ≤ 1. We

call that criteria C

k

and C

l

are in:

(α, β)-positive consonance, if µ

C

k

,C

l

> α and ν

C

k

,C

l

< β

;

(α, β)-negative consonance, if µ

C

k

,C

l

< β

and ν

C

k

,C

l

> α

;

(α, β)-dissonance, otherwise.

Obviously, the larger α and/or the smaller β, the

less number of criteria may be simultaneously

connected with the relation of (α, β)-positive con-

sonance. For practical purposes, it carries the most

information when either the positive or the negative

consonance is as large as possible, while the cases of

dissonance are less informative and can be skipped.

3 MAIN RESULTS

We ran the described algorithm over collected data

from six WEF GCRs for the 28 (current) EU

Member States. Here, we present only the results

from the two extreme periods: years 2008–2009 and

year 2013–2014, comparing them for µ

C

i

C

j

and ν

C

i

C

j

in Tables 1–2. Despite having the results with

precision of 9 digits after the decimal point, we will

use precision of 3 digits after the decimal point.

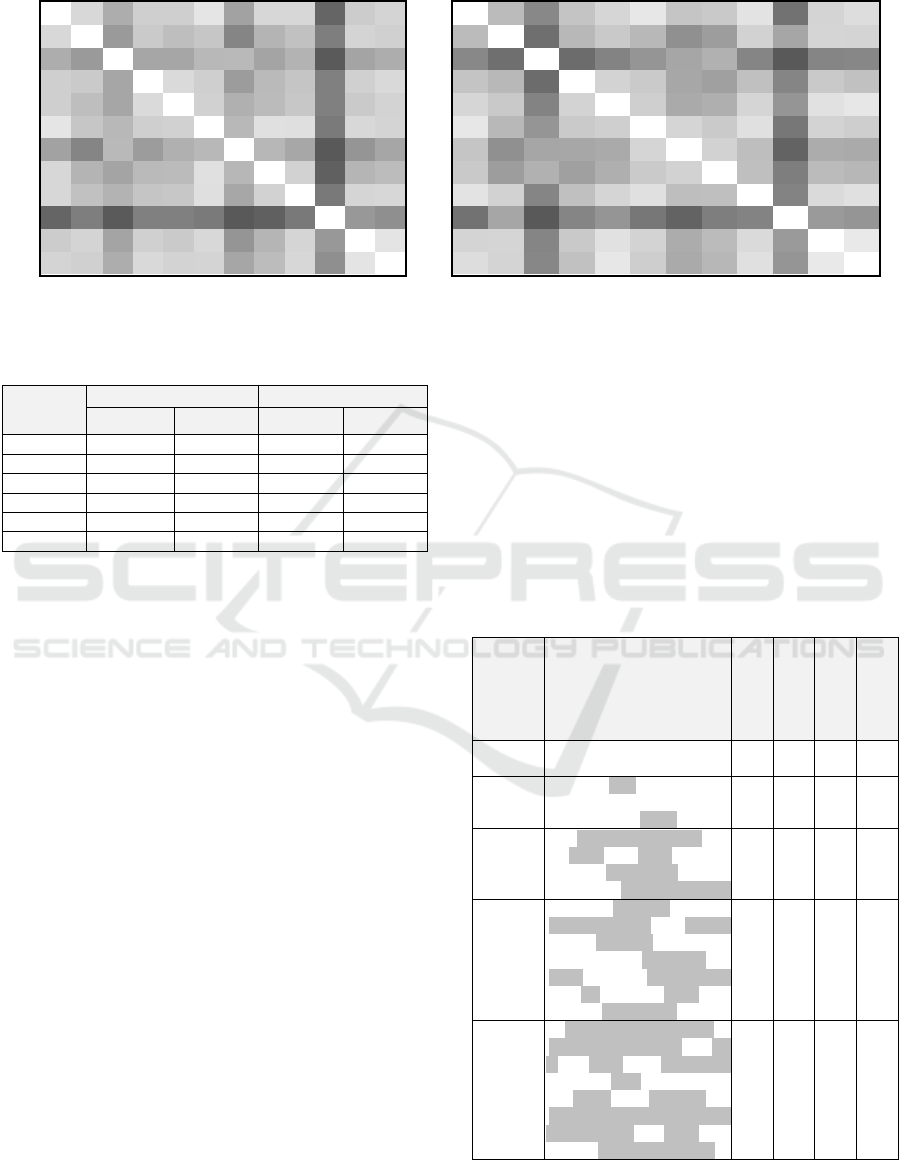

In Tables 1 and 2, all cells are coloured in the

greyscale, with the highest values coloured in the

darkest shade of grey, while the lowest ones are

coloured in white. Of course, every criteria perfectly

correlates with itself, so for any i the value

µ

C

i

C

i

is

always 1, and

ν

C

i

C

i

= π

C

i

C

i

= 0. Also, the matrices are

obviously symmetrical according to the main dia-

gonal. The twelve pillars are: 1. Institutions; 2. Infra-

structure; 3. Macroeconomic stability; 4. Health and

primary education; 5. Higher education and training;

6. Goods market efficiency; 7. Labour market effic-

iency; 8. Financial market sophistication; 9. Techno-

logical readiness; 10. Market size; 11. Business

sophistication; 12. Innovation.

In the beginning, let us present in Table 3 some

findings from the analysis of the six periods.

Table 1: Comparison of the calculated values of µ

C

i

C

j

for years 2008–2009 and 2013–2014.

µ

1 2 3 4 5 6

7 8 9 10

11

12

1 1.000 0.844 0.685 0.757 0.788 0.833 0.603 0.828 0.823 0.497

0.794

0.802

2 0.844 1.000 0.627 0.751 0.749 0.743 0.529 0.741 0.775 0.582

0.831

0.807

3 0.685 0.627 1.000 0.616 0.638 0.664 0.653 0.648 0.693 0.434

0.651

0.667

4 0.757 0.751 0.616 1.000 0.780 0.720 0.550 0.704 0.725 0.524

0.765

0.772

5 0.788 0.749 0.638 0.780 1.000 0.746 0.622 0.728 0.757 0.558

0.767

0.796

6 0.833 0.743 0.664 0.720 0.746 1.000 0.627 0.817 0.802 0.505

0.786

0.765

7 0.603 0.529 0.653 0.550 0.622 0.627 1.000 0.664 0.611 0.389

0.563

0.590

8 0.828 0.741 0.648 0.704 0.728 0.817 0.664 1.000 0.820 0.476

0.733

0.751

9 0.823 0.775 0.693 0.725 0.757 0.802 0.611 0.820 1.000 0.548

0.817

0.815

10 0.497 0.582 0.434 0.524 0.558 0.505 0.389 0.476 0.548 1.000

0.648

0.601

11 0.794 0.831 0.651 0.765 0.767 0.786 0.563 0.733 0.817 0.648

1.000

0.860

12 0.802 0.807 0.667 0.772 0.796 0.765 0.590 0.751 0.815 0.601

0.860

1.000

µ

1

2

3

4

5

6

7 8 9 10 11

12

1 1.000

0.735 0.577

0.720 0.807 0.836

0.733 0.749 0.854 0.503 0.804 0.844

2 0.735

1.000 0.479

0.661 0.749 0.677

0.537 0.590 0.786 0.661 0.804 0.799

3 0.577

0.479 1.000

0.421 0.519 0.558

0.627 0.675 0.550 0.413 0.548 0.556

4 0.720

0.661 0.421

1.000 0.730 0.683

0.590 0.563 0.677 0.497 0.712 0.690

5 0.807

0.749 0.519

0.730 1.000 0.735

0.622 0.632 0.775 0.579 0.815 0.847

6 0.836

0.677 0.558

0.683 0.735 1.000

0.749 0.712 0.788 0.466 0.759 0.751

7 0.733

0.537 0.627

0.590 0.622 0.749

1.000 0.741 0.685 0.399 0.624 0.624

8 0.749

0.590 0.675

0.563 0.632 0.712

0.741 1.000 0.712 0.497 0.688 0.680

9 0.854

0.786 0.550

0.677 0.775 0.788

0.685 0.712 1.000 0.526 0.810 0.831

10

0.503

0.661 0.413

0.497 0.579 0.466

0.399 0.497 0.526 1.000 0.611 0.598

11

0.804

0.804 0.548

0.712 0.815 0.759

0.624 0.688 0.810 0.611 1.000 0.873

12

0.844

0.799 0.556

0.690 0.847 0.751

0.624 0.680 0.831 0.598 0.873 1.000

Intercriteria Decision Making Approach to EU Member States Competitiveness Analysis

291

Table 2: Comparison of the calculated values of ν

C

i

C

j

for years 2008–2009 and 2013–2014.

ν

1 2 3 4 5 6

7 8 9 10 11

12

1 0.000 0.114 0.241 0.140 0.140 0.077

0.275 0.116 0.116 0.458 0.148

0.127

2 0.114 0.000 0.304 0.156 0.190 0.167

0.365 0.220 0.180 0.384 0.127

0.138

3 0.241 0.304 0.000 0.265 0.265 0.209

0.204 0.270 0.225 0.495 0.270

0.241

4 0.140 0.156 0.265 0.000 0.108 0.140

0.294 0.201 0.169 0.381 0.138

0.111

5 0.140 0.190 0.265 0.108 0.000 0.135

0.233 0.198 0.164 0.378 0.156

0.130

6 0.077 0.167 0.209 0.140 0.135 0.000

0.209 0.090 0.095 0.397 0.114

0.127

7 0.275 0.365 0.204 0.294 0.233 0.209

0.000 0.212 0.259 0.497 0.315

0.265

8 0.116 0.220 0.270 0.201 0.198 0.090

0.212 0.000 0.132 0.476 0.217

0.196

9 0.116 0.180 0.225 0.169 0.164 0.095

0.259 0.132 0.000 0.399 0.122

0.116

10 0.458 0.384 0.495 0.381 0.378 0.397

0.497 0.476 0.399 0.000 0.307

0.336

11 0.148 0.127 0.270 0.138 0.156 0.114

0.315 0.217 0.122 0.307 0.000

0.079

12 0.127 0.138 0.241 0.111 0.130 0.127

0.265 0.196 0.116 0.336 0.079

0.000

ν

1

2

3

4

5

6

7

8 9 10 11 12

1 0.000 0.220 0.386 0.188 0.132 0.077 0.185 0.172 0.090 0.452 0.138 0.111

2 0.220 0.000 0.466 0.228 0.172 0.228 0.362 0.317 0.146 0.286 0.135 0.138

3 0.386 0.466 0.000 0.476 0.405 0.344 0.286 0.251 0.394 0.537 0.394 0.389

4 0.188 0.228 0.476 0.000 0.143 0.169 0.283 0.307 0.201 0.397 0.175 0.198

5 0.132 0.172 0.405 0.143 0.000 0.153 0.272 0.259 0.135 0.341 0.098 0.079

6 0.077 0.228 0.344 0.169 0.153 0.000 0.135 0.169 0.101 0.439 0.143 0.159

7 0.185 0.362 0.286 0.283 0.272 0.135 0.000 0.146 0.209 0.505 0.267 0.275

8 0.172 0.317 0.251 0.307 0.259 0.169 0.146 0.000 0.206 0.415 0.217 0.233

9 0.090 0.146 0.394 0.201 0.135 0.101 0.209 0.206 0.000 0.405 0.119 0.101

10

0.452 0.286 0.537 0.397 0.341 0.439 0.505 0.415 0.405 0.000 0.328 0.344

11

0.138 0.135 0.394 0.175 0.098 0.143 0.267 0.217 0.119 0.328 0.000 0.071

12

0.111 0.138 0.389 0.198 0.079 0.159 0.275 0.233 0.101 0.344 0.071 0.000

Table 3: Maximal and minimal values of positive and

negative consonance between the twelve pillars of com-

petitiveness for years 2008–2009 to 2013–2014.

Year

µ ν

max(

µ

C

i

C

j

) min(

µ

C

i

C

j

) max(

ν

C

i

C

j

) min(

ν

C

i

C

j

)

2008–2009 0.860 0.389 0.497 0.077

2009–2010 0.865 0.410 0.505 0.071

2010–2011 0.852 0.447 0.468 0.087

2011–2012 0.870 0.405 0.534 0.074

2012–2013 0.870 0.421 0.519 0.071

2013–2014 0.873 0.399 0.537 0.071

From Table 3, we can make certain conclusions

about the range of values of the parameters α and β,

which are used to measure the consonance between

the criteria. Obviously, depending on how the values

of α and β have been chosen, different sets of

correlating criteria will form; and this can be done

over the data for each year. For the purposes of

illustration, let us only take the data for the latest

period (2013–2014), and check how the relations

between the criteria change by selecting different

values of α and β. Obviously, in this case putting

α > 0.873 or β < 0.071 would yield no results.

In general, the question how to select the values

of α and β, with respect to our various needs and

purposes, is important and challenging, but is

beyond the scope of the present research. Hence, we

will conduct our analysis by taking the following

exemplary pairs of (α; β): (0.85; 0.15), (0.80; 0.20),

(0.75; 0.25), (0.70; 0.30), (0.65; 0.35), and will see

which pillars are in positive consonance (Table 4,

those in negative consonance follow by analogy).

Obviously, values α = 0.85; β = 0.15 are rather

discriminative, since only two consonance pairs are

discovered to hold between four different criteria:

‘Institutions – Technological readiness’ and

‘Business sophistication – Innovation’, the second

one being quite natural, since these two pillars take

part in the formation of the ‘Innovation and

sophistication factors’ defining the difference

between the efficiency driven countries (2

nd

stage of

development) and innovation driven countries (3

rd

stage of development). The rest two criteria are of

more heterogeneous nature, where ‘Institutions’

belongs to the set of ‘Basic requirements’ and

‘Technological readiness’ belongs to the set of

‘Efficiency enhancers’.

Table 4: List of pillars in positive consonance for the year

2013–2014, per different α, β. Highlighted in grey on each

row are those consonances, which have been reported on

previous (upper) rows, the white ones appearing for first.

(α, β)

List of positive consonances

C

i

–C

j

No. of µ-pairs

No. of ν-pairs

No. of

consonances

No. of involved

criteria

(0.85;

0.15)

1–9; 11–12 2 19 2 4

(0.80; 0.2

0)

1–5; 1–6; 1–9; 1–11; 1–12; 2–

11; 5–11; 5–12; 9–11;

9–12; 11–12

11 29 11 7

(0.75; 0.2

5)

1–5; 1–6; 1–9; 1–11;

1–12; 2–9; 2–11; 2–12;

5–9; 5–11; 5–12; 6–9

6–11; 6–12; 9–11; 9–12; 11–1

2

17 37 17 7

(0.70;

0.30)

1–2; 1–4; 1–5; 1–6; 1–7; 1–8;

1–9; 1–11; 1–12; 2–5; 2–9; 2–

11; 2–12; 4–5;

4–11; 5–6; 5–9; 5–11;

5–12; 6–7; 6–8; 6–9; 6–11; 6–

12; 7–8; 8–9; 9–11;

9–12; 11–12

29 45 29 10

(0.65;

0.35)

1–2; 1–4; 1–5; 1–6; 1–7;

1–8; 1–9; 1–11; 1–12; 2–4; 2–

5; 2–6; 2–9; 2–10; 2–11; 2–12

;

3–8; 4–5; 4–6; 4–9;

4–11; 4–12; 5–6; 5–9;

5–11; 5–12; 6–7; 6–8; 6–9; 6–

11; 6–12; 7–8; 7–9; 8–9; 8–11

;

8–12; 9–11; 9–12; 11–12

39 51 39 12

Fourth International Symposium on Business Modeling and Software Design

292

The rest investigated values of α and β are

looser, thus yielding greater number of consonance

pairs between larger sets of criteria. We make the

detailed analysis only for the second pair, (0.8; 0.2).

Putting α > 0.8, we obtain 11 pairs of criteria

which have their µ > 0.8; and putting β < 0.2, we

obtain 29 pairs of criteria which have their ν < 0.2.

The first set of 11 pairs is completely a subset of the

second set of 29 pairs, meaning that we will discuss

only these 11 pairs, which are in positive conso-

nance; they connect 7 out of 12 pillars, as shown in

Table 5.

Table 5: List of pillars in positive consonance for the year

2013–2014, when α > 0.8, β < 0.2.

C

i

–C

j

Full titles of criteria C

i

–C

j

µ

C

i

C

j

ν

C

i

C

j

1–5

Institutions –

Higher education and training

0.807 0.132

1–6

Institutions –

Goods market efficiency

0.836 0.077

1–9

Institutions –

Technological readiness

0.854 0.090

1–11

Institutions –

Business sophistication

0.804 0.138

1–12

Institutions –

Innovation

0.844 0.111

2–11

Infrastructure –

Business sophistication

0.804 0.135

5–11

Higher education and training –

Business sophistication

0.815 0.098

5–12

Higher education and training –

Innovation

0.847 0.079

9–11

Technological readiness –

Business sophistication

0.810 0.119

9–12

Technological readiness –

Innovation

0.831 0.101

11–12

Business sophistication –

Innovation

0.873 0.071

Putting α = 0.75; β = 0.25, we obtain 17 pairs

w.r.t. α and 37 pairs w.r.t. β, giving a total of 17

pairs of consonance w.r.t. both parameters at a time.

In these 17 pairs take part again the same 7 criteria,

as in the previous case (0.80; 0.20), but 6 more

correlations between them are now discovered,

namely, ‘Infrastructure – Technological readiness’,

‘Infrastructure – Innovation’, ‘Higher education and

training – Technological readiness’, ‘Goods market

efficiency – Technological readiness’, ‘Goods mar-

ket efficiency – Business sophistication’ and ‘Goods

market efficiency – Innovation’.

The pairs (0.70; 0.30) and (0.65; 0.35) are rather

inclusive and non-discriminative values, since they

involve, respectively, 10 and 12 out of 12 pillars of

competitiveness and yield, respectively, 29 and 39

correlations between them.

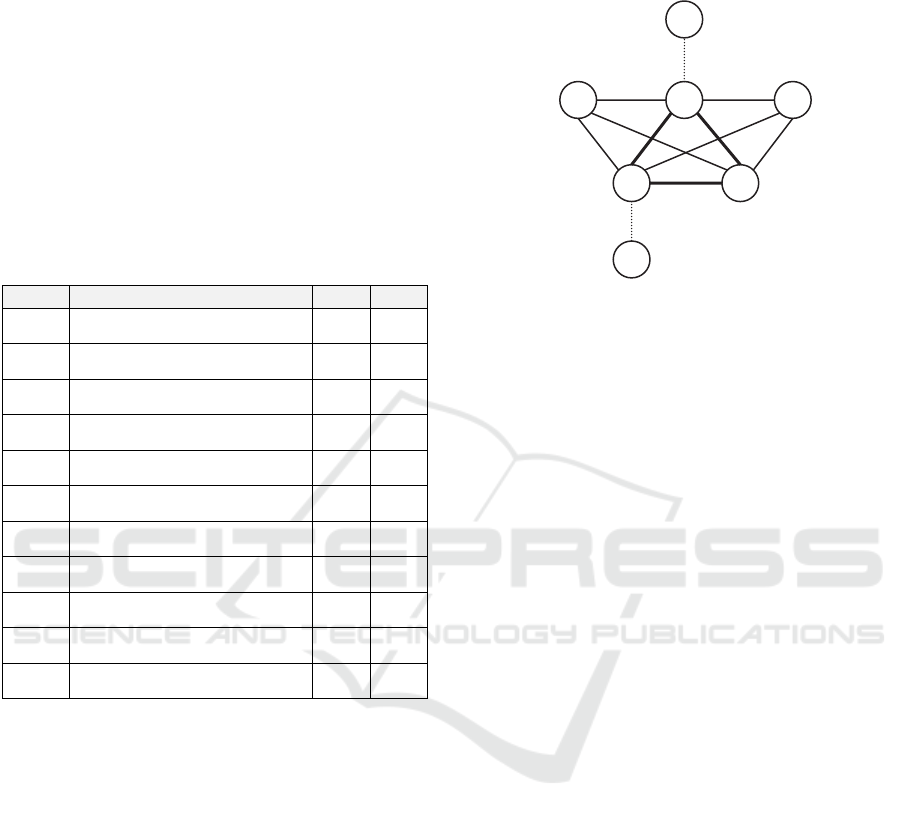

We can visually illustrate the findings in Table 4

by constructing graphs for each run of α and β,

depicting the outlined dependences. We will do it

here only for the described case when α > 0.8,

β < 0.2, see Figure 1.

9

11

1

12

5

6

2

Figure 1: Graph structure of the pillars forming positive

consonance for the year 2013–2014 when α > 0.8, β < 0.2.

Now it becomes rather visual that when α > 0.8,

β < 0.2 three out of seven pillars completely correlate

with each other (‘1. Institutions’, ‘11. Business

sophistication’, ‘12. Innovation’), two other (‘5.

Higher education and training’ and ‘9. Technological

readiness’) completely correlate with the triple 1–11–

12, but not among each other, while vertices ‘2.

Infrastructure’ and ‘6. Good market efficiency’ are

connected by only one arc to the rest of the structure.

Obviously, for each run of α and β a series of

graphs will be formed, where every consequent

graph will act as a supergraph for the previous one,

becoming gradually more complex and intercom-

nected. It is interesting to compare for each run of α

and β whether and how these graph structures

change over the different time periods before 2013–

2014.

These graph structures are a matter of further

economic analysis, and it is particularly interesting

to study which of the pillars of competitiveness are

fully connected, like 1–5–11–12 and 1–9–11–12 in

Figure 1.

Also, it is noteworthy that in the WEF’s meth-

odology for forming the countries’ competitiveness

index, there are four sub-indicators take part in two

pillars each, namely: ‘Intellectual property pro-

tection’ takes part of the formation of the 1

st

and 12

th

pillar, ‘Mobile telephone subscriptions’ and ‘Fixed

telephone lines’ in 2

nd

and 9

th

pillar, and ‘Reliance

on professional management’ in 7

th

and 11

th

pillar.

We can hence make the conclusion, that our

findings generally support the proximity between the

mentioned pillars, as suggested by the presence of

shared sub-indicators, yet our conclusions are much

stronger and sophisticated as a result of the research.

It is also very important to make the comparison

Intercriteria Decision Making Approach to EU Member States Competitiveness Analysis

293

of the calculated values in Tables 1 and 2 between

years 2008–2009 and 2013–2014. We can focus the

reader’s attention to several particularly well

outlined observations. Over the period 2008–2014,

the pillars ‘5. Higher education and training’ and ‘7.

Labour market efficiency’ have become gradually

more correlated to all the rest pillars, while pillar ‘3.

Macroeconomic stability’ has become gradually less

correlated. However, in general, these comparisons

are a matter of detailed analysis by economists.

4 CONCLUSION

The present research aimed at discovery of some

hidden patterns in the data about EU Member States’

competitiveness in the period from 2008 to 2014.

We conduct the analysis of the World Economic

Forum’s Global Competitiveness Reports, using a

recently developed multicriteria decision making

method, based on index matrices and intuitionistic

fuzzy sets.

Using index matrices with data about how the

EU Member States have performed according to the

outlined twelve ‘pillars of competitiveness’, we

construct new matrices, giving us new knowledge

about how these pillars correlate and interact with

each other. Moreover, the application of the method

has been traced over a six-year period of time and

has revealed certain changes and trends in these

correlations that may yield fruitful further analyses

by interested economists. The results are illustrated

with data tables and graphs of the strongest cor-

relations between the criteria.

These conclusions may also be useful for the

national policy and decision makers, to better

identify and strengthen the transformative forces that

will drive their future economic growth. The same

approach can be equally applied to other selections

of countries and time periods, and comparisons with

the hitherto presented results will be challenging.

Besides the comparison of the twelve pillars of

competitiveness, our research plans include also

exploring the correlations between the most prob-

lematic factors for doing business, as outlined in the

WEF’s GCRs. Further investigation how the pillars

of competitiveness correlate with these most

problematic factors may also prove interesting and

useful.

ACKNOWLEDGEMENTS

The research work reported in the paper is partly

supported by the project AComIn “Advanced

Computing for Innovation”, grant 316087, funded

by the FP7 Capacity Programme (Research Potential

of Convergence Regions).

REFERENCES

Atanassov K. (1983) Intuitionistic fuzzy sets, VII ITKR's

Session, Sofia, June 1983 (in Bulgarian).

Atanassov K. (1986) Intuitionistic fuzzy sets. Fuzzy Sets

and Systems. Vol. 20 (1), pp. 87–96.

Atanassov K. (1991) Generalized Nets. World Scientific,

Singapore.

Atanassov K. (1999) Intuitionistic Fuzzy Sets: Theory and

Applications. Physica-Verlag, Heidelberg.

Atanassov K. (2012) On Intuitionistic Fuzzy Sets Theory.

Springer, Berlin.

Atanassov K., D. Mavrov, V. Atanassova (2013). Inter-

criteria decision making. A new approach for multi-

criteria decision making, based on index matrices and

intuitionistic fuzzy sets. Proc. of 12

th

International

Workshop on Intuitionistic Fuzzy Sets and General-

ized Nets, 11 Oct. 2013, Warsaw, Poland (in press).

World Economic Forum (2008, 2013). The Global

Competitiveness Reports. http://www.weforum.org/

issues/global-competitiveness.

Zadeh L. A. (1965). Fuzzy Sets. Information and Control

Vol. 8, pp. 333–353.

Fourth International Symposium on Business Modeling and Software Design

294