A Cooperative Game Approach to a Production Planning Problem

D. G. Ramírez-Ríos

1

, D. C. Landinez

2

, P. A. Consuegra

1

, J. L. García

1

and L. Quintana

1

1

Department of Industrial Engineering, Universidad de la Costa, Calle 58 # 55 - 66, Barranquilla, Colombia

2

Research Department, Fundación Centro de Investigación en Modelación Empresarial del Caribe,

Carrera 60 # 64 -122, Barranquilla, Colombia

Keywords: Cooperative Game Theory, Production Planning, Mixed Integer Linear Programming, Optimization,

Shapley Value.

Abstract: This paper deals with a production planning problem formulated as a Mixed Integer Linear Programming

(MILP) model that has a competition component, given that the manufacturers are willing to produce as

much products as they can in order to fulfil the market’s needs. This corresponds to a typical game theoretic

problem applied to the productive sector, where a global optimization problem involves production planning

in order to maximize the utilities for the different firms that manufacture the same type of products and

compete in the market. This problem has been approached as a cooperative game, which involves a possible

cooperation scheme among the manufacturers. The general problem was approached by Owen (1995) as the

“production game” and the core was considered. This paper identifies the cooperative game theoretic model

for the production planning MILP optimization problem and Shapley Value was chosen as the solution

approach. The results obtained indicate the importance of cooperating among competitors. Moreover, this

leads to economic strategies for small manufacturing companies that wish to survive in a competitive

environment.

1 INTRODUCTION

The high competition in the market has led many

companies to adopt supply chain management in

order to obtain better results and competitive

advantages to achieve a good positioning in them.

For this reason, businesses today search for an

optimal performance of their overall operations in

important areas like Production and Logistics

(Gimenez and Ventura, 2005). In order to do this,

many authors have provided contributions in this

field: Optimizing Inventory Operations (Hartman

and Dror, 2003); Optimal operations planning (Li et

al., 2003); Optimal price and return policy

(Mukhopadhyay and Setaputro, 2004); Optimal

operations of transportation fleet (Kang et al., 2008);

Optimal multi-stage logistic and inventory policies

(Hsiao, Lin & Huang, 2010); Optimal production

planning (Shi et al., 2011); Optimal deteriorating

items production inventory models (Widyadana and

Wee, 2011); Optimal production management

(Cadenillas et al., 2013); Optimal production

planning (Gong and Zhou, 2013); Optimal

transportation and business cycles (Das et al., 2014);

and Optimal dynamic policies for integrated

production (Chen, 2014).

Optimal production is directly related to

increased capacity and thus, a business is able to

offer more to their clients. Yet, the overall

performance of a business is not guaranteed by this,

given that there are many other factors (financial,

marketing, commercial) that affect the business’

performance and could be even more important than

production itself. Production planning optimization

problems have been approached to obtain the best

solution that maximizes or minimizes an objective

aimed by the business or group of businesses. This

solution, in many cases, seems an unrealistic

solution given that the businesses are observing a

static market. Getting a view of the competitors’

movements, on the other hand, makes the decision

even a more competitive one. Not only this, but if

integrating the competitor’s decisions in the market

to the production planning problem, could result in a

more plausible solution. When tackling this type of

problems, with a competition component involved, a

game theoretic solution approach should be

considered.

148

G. Ramírez-Ríos D., C. Landinez D., A. Consuegra P., L. García J. and Quintana L..

A Cooperative Game Approach to a Production Planning Problem.

DOI: 10.5220/0005220201480155

In Proceedings of the International Conference on Operations Research and Enterprise Systems (ICORES-2015), pages 148-155

ISBN: 978-989-758-075-8

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

Production planning has been widely studied in

many of its components and applications in the

industry (Khaledi and Reisi-Nafchi, 2013), where

mathematical models have been the most

representative of this type of problems, on both

static and dynamic models (Missbauer and Uzsoy,

2011). Moreover, the competitive component of the

production planning has been approached by a few

authors and most of them have offered game

theoretic solutions to these problems. In (Zhou, Xiao

and Huang, 2010), the authors proposed a game

theoretic mathematical solution to generate the

optimal process plan for multiple jobs; (Manupati et

al., 2012) presented a scheme for generating optimal

process plans for multiple jobs in a networked based

manufacturing system by applying non-cooperative

games; (Aydinliyim and Vairaktarakis, 2013)

considered a competitive scheduling setting using a

cooperative game theoretic approach to achieve the

maximum savings possible.

Generally, production planning problems are

formulated using mixed integer linear programming

(MILP) models, issue that has had a great

development in the literature. Lütke Entrup et al.,

(2005) developed a MILP model that integrates

shelf-life issues into production planning and

scheduling. In (Ertugrul and Isik, 2009), the authors

presented a MILP model to wine production

planning. In (Doulabi et al., 2012), the formulation

of an open shop scheduling problem was developed

as two different MILP models. Jolayemi (2012)

developed a MILP model for scheduling projects

under penalty and reward arrangements, while in

(L'Heureux et al., 2013), the authors presented a

MILP model to solve a short term planning problem.

In (Mattik et al., 2014), an MILP optimization model

based on the block planning principle was developed

to obtain optimal production scheduling.

On the other hand, the application of game

theory to solve the production planning problem has

shown great impact during the last years. In (Li et

al., 2012), the authors developed an application of

game theory in planning and scheduling integration,

using Nash equilibrium to deal with multiple

objectives; In (Zamarripa et al., 2012), a multi-

objective MILP model was developed, to optimize

the planning of supply chain with a game theoretic

approach; In (Yin et al., 2013) a game theoretic

model to coordinate single manufacturer and

multiple suppliers with asymmetric quality

information was proposed.

Others have used cooperative game theory for

the formation of alliances in other contexts other

than production. For example, in (Okada, 2010) the

author proposed a cooperative game that describes

an economic situation in which n individuals can

communicate and form coalitions with each other

under the concept that such a strategic alliance

would increase individual income per participant.

The purpose of this paper is to illustrate an

approach to solving problems of production

planning with a competitive component through the

application of Game Theory.

2 PROBLEM FORMULATION

2.1 Mathematical Model for the

Production Planning Problem

We consider a production planning problem as a

MILP model in order to obtain the maximum

income for each of the manufacturers involved in

a specific market, which considers the production of

different products. The following model is

represented for each manufacturer.

Notation:

1,..., Product (good) type

1,…, Production facilities

1,…, Manufacturing firms

1,…, Type of raw materials

1,…, Client types

Parameters:

= Production capacities of product type at

production facility of the manufacturing firm.

= Raw material type available at

production facility of manufacturing firm.

= Quantity demanded of product type at

client.

= Price of product type offered to client by

manufacturing firml.

= Cost of manufacturing product type at

production facility by manufacturing firm.

= Quantity of raw material w required producing

product type

Variables:

Quantity of product type produced at

production facility by manufacturing firm sold to

client.

1,

0,

Objective Function:

ACooperativeGameApproachtoaProductionPlanningProblem

149

Maximize

(1)

Subject to

∀,

,

(2)

,

∀,

,

(3)

,

∀,

(4)

∈

∀,

,,

(5)

Equation (1) establishes the objective function of the

production problem, which aims to maximize the

total utilities of the manufacturers. Equation (2), (3)

and (4) establish capacity and demand restrictions.

For a single manufacturing firm this model is

simple (the decision variable

should not be

included) and an optimal solution is guaranteed,

which makes the capacity restriction the main

concern to obtaining greater income for each

manufacturer.

Given that there are multiple manufacturers

integrated in the same optimization problem, when

competing in the same market, the solution is not

that simple. Moreover, if some of the manufacturing

companies are small and, as an overall, the industry

is affected by external competitors that are

threatening to take away a part of their own market,

a strategy besides working at optimal conditions, has

to be implemented by the manufacturers.

2.2 Cooperative Game Model

The "Production Game” (Owen, 1995) is defined as

a set of players

1,2,…,

, each player has a

batch of kinds of raw material. Player 1 has

units of raw material 1,

units of raw material 2,

and

,

units of raw material ; Player 2 has

units

raw material 1,

units of raw material 2

and

,

units of raw material ; player 3 has

units of raw material 1,

units of raw material 2,

and

,

units of raw material ,…, player has

units of raw material 1,

units of raw

material 2,…,

,

units of raw material . The

products do not have value for themselves, except

that they are used to produce goods

,

,…,

which can be sold at prices set in the market. A

linear production process is assumed, in which one

unit of the product 1 requires

raw material 1,

units of the raw material 2 and

,

units of the

raw material ; a unit of the product 2 requires

units of raw material 1,

units of raw material

units 2 and

,

units of the raw material , one

unit of the product requires

units of raw

material 1,

units raw material 2 and

,

units

of the raw material . Products

,

,…,

can be

sold at

,

,…,

dollars respectively.

When a coalition is formed, members will

contribute to each of their products in order to

maximize profits from the sale of products on the

market. Therefore, the characteristic function is

given by the following linear equation:

v

S

(6)

Subject to:

,∀

(7)

Where:

∈

(8)

3 SOLUTION APPROACH

3.1 Application of the MILP to the

Cooperative Game Model

The model described in section 2.1 is integrated to

the Cooperative Game Model described in section

2.2. For the implementation of the game, the

following cooperation strategies were considered:

When cooperating, each player is allowed to

share its capacity with the others that form the

coalition.

Utilities are transferable among players that form

the same coalition.

3.1.1 Definition of the Cooperative Game

Consider the manufacturers, players of the game.

Each player has a manufacturing facility with

available raw materials for production and clients

requiring each type of product. Each one yields for

the maximum payoff, according to the MILP

formulated in section 2.1. When cooperating, the

production is set on two strategies: (i) more capacity

ICORES2015-InternationalConferenceonOperationsResearchandEnterpriseSystems

150

is available and (ii) prices are stabilized according to

the market’s needs.

3.1.2 Characteristic Function

Given the optimal income function presented

previously and for the general problem, the

resulting characteristic function evaluated is:

v

S

∗

∈

(9)

where,

∗

is the average price of product type

offered to client for all players belonging to the

coalition , That is, every player belonging to the

coalition , offers to each client , a product type

with a

∗

price. On the other hand, the cost involved

corresponds to the facility that is actually managing

the production of the type of product sold. The

facilities chosen to manufacture a product are

subject to the capacity restriction that was previously

stated in the MILP formulation, and adapted to the

cooperative model as follows in eq. 10.

∀,

,

(10)

3.2 Shapley Value

Shapley Value is a solution approach to cooperative

games and is given by the following equation:

φ

1

!

1

!

!

⊂

(11)

Where is any finite company, with

|

|

.

This formulation expresses the Shapley value for

each player in a game as a weighted sum of

terms of the form

, which is the

contribution of player to coalition (Roth, 1988).

In this way, the contribution of each player can

be calculated by using an algorithm that evaluates

the Shapley Value, which is explained in the

following sections.

3.2.1 Solution Algorithm

Calculating the Shapley Value has been a research

topic of interest. Its computational complexity is

combinatorial given that it requires knowing all

possible combinations among the different

players, that is, 2

1. The model proposed in this

paper presents an efficient algorithm that can be

applied to many players, given that it integrates the

probabilistic aspect of the Shapley Value formula

and the possible margin of contribution that any

player is able to make in a coalition. Similar to the

expected value a decision making model under

uncertainty restrictions, the Shapley Value is the

expected value of each player under the different

coalition scenarios. The table 1 explains the

calculations executed in this algorithm with an

example of four players.

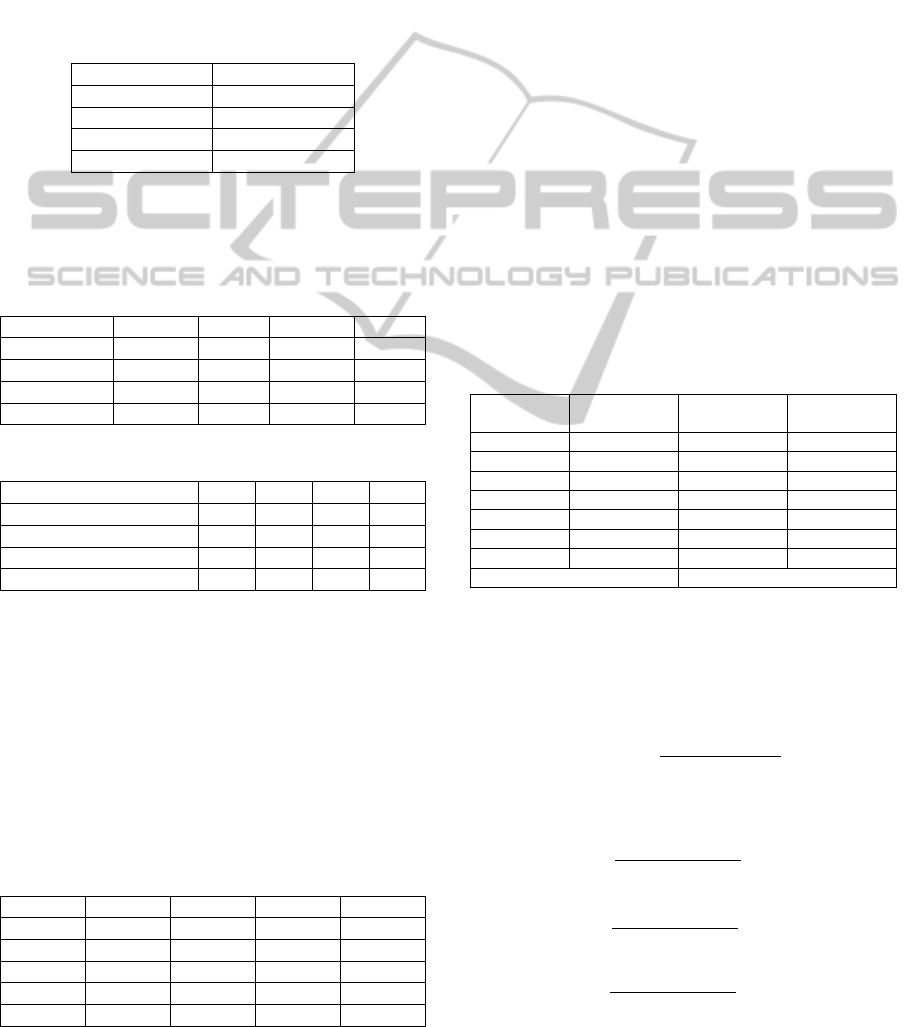

Table 1: Shapley Value calculation for 4 players.

th pl.

1 2 3 4

1 v(1)

v(1,2) – v

(2) + v (1,3)

– v(3) + v

(1,4) - v (4)

v(1,2,3) -

v (2.3) +

v(1,2,4) -

v(2.4) +

v(1,3,4) -

v(3,4)

v

(1,2,3,4)

-

v(2,3,4)

2 v(2)

v (1,2) - v

(1) + v (2,3)

- v (3) + v

(2,4) - v (4)

v (1,2,3) -

v (1,3) + v

(1,2,4) - v

(1,4) + v

(2,3,4) - v

(3,4)

v

(1,2,3,4)

-v

(1,3,4)

3 v(3)

v (1,3) - v

(1) + v (2,3)

- v (2) + v

(3,4) - v (4)

v (1,2,3),

v (1,2) + v

(2,3,4), v

(2,4) + v

(1,3,4), v

(1,4)

v

(1,2,3,4)

-v

(1,2,4)

4 v(4)

v (1,4) -

v (1) + v

(2,4) - v (2)

+ v (3,4), v

(3)

v (1,2,4),

v (1,2) + v

(1,3,4), v

(1,3) + v

(2,3,4), v

(2,3)

v

(1,2,3,4)

-v

(1,2,3)

3.2.2 Pseudo Code

The resulting program code for the solution

algorithm generated is showed in the Appendix

section.

This solution approach was first applied to other

applications related to supply chain, resulting in

interesting results. In the electric energy industry,

where a two-level game was proposed, in which the

first one looks for a Stackelberg Equilibrium

solution where the leader is a generator, in

particular, then the second-level obtains the

coordination among a group of marketers following

a cooperative game, where Shapley Value is

calculated for each player as a result of their

coordination (Guzmán et al., 2008). Also, in the

furniture industry, with respect to the competitive

value of both supplier and manufacturing companies

(Puello-Pereira and Ramírez-Ríos, 2014).

ACooperativeGameApproachtoaProductionPlanningProblem

151

4 RESULTS

4.1 Numerical Example

For the numerical example, a 4-player game is

considered, where each player represents a

manufacturing company that competes for a single

client with four different products. The information

below includes the market price and consumption of

raw material per type of product.

Table 2: Market price:

Product type

Price

1 40

2 50

3 45

4 35

It is assumed that the fabrication of product

requires four different materials in the proportions

showed in Table 4.

Table 3: Amount of raw material.

Raw material Player 1 Player 2 Player 3 Player 4

1 200 150 130 180

2 100 210 190 140

3 50 155 230 160

4 300 135 180 90

Table 4: Raw material requirement.

Row material

1 5 6 6 5

2 6 2 1 5

3 1 2 5 1

4 3 5 1 6

4.1.1 Optimal Solution for the Competitive

Model

This problem was solved initially as global

optimization model that didn’t consider possible

cooperation among the agents.

By using an optimization engine (GAMS), an

optimal solution was generated, with a total utility of

$5.155, where the optimal value, corresponding to

each player, is presented in table 5.

Table 5: Solution generated.

P. type Player 1 Player 2 Player 3 Player 4

Prod 1 10 0 2 0

Prod 2 20 25 20 15

Prod 3 0 0 0 15

Prod 4 0 0 0 0

Utilities 1400 1250 1080 1425

4.1.2 Cooperative Game Solution to the

Problem

For this numerical example, the possible coalitions

are the following:

1, 2, 3, 4, 1,2,

1,3, 1,4, 2,3, 2,4, 3,4, 1,2,3,

1,2,4, 1,3,4, 2,3,4 y, 1,2,3,4.

According to the solution approach implemented,

after weighing the coalitions, an optimization engine

is integrated to generate the optimal value for each

scenario, resulting in each contribution to the

coalition, as was presented in table 1.

For each scenario generated, the FO value for

each player is considered as the contribution of each

one to the coalition. In the first case, when

considering individual coalitions, that is, {1}, {2},

{3} and {4}, the optimal solution would be the ones

considered in the optimization model previously

solved if solved individually. Thus for Player 1, it

turns to be optimal to manufacture 10 units of

product 1 and 20 units for product 2. Nevertheless,

when it comes to sharing demanded quantity, the

solutions change for the other players.

After solving for all scenarios, optimal values for

each coalition are given in the following table.

Table 6: Optimal value.

Coalition

Optimal

value

Coalition

Optimal

value

v (1) 1400 v (2,3) 2333.3

v (2) 1250 v (2,4) 2687.5

v (3) 1083.33 v (3,4) 2583.3

v (4) 1425 v (1,2,3) 4000

v (1,2) 2916.66 v (1,2,4) 4416.66

v (1,3) 2750 v (1,3,4) 4250

v (1,4) 3166.66 v (2,3,4) 3833.33

v (1,2,3,4) 5500

4.1.3 Shapley Solution

In the previous subsection coalitions were formed

and also optimal values for each coalition were

calculated, the next step is find optimal coalitions

s1

!

ns

!

n!

:

(12)

We replace for each player:

11!41!

4!

0,25

:

(13)

21!42!

4!

0,083

:

(14)

31!4 3!

4!

0,083

:

(15)

ICORES2015-InternationalConferenceonOperationsResearchandEnterpriseSystems

152

41!44!

4!

0,25

:

(16)

The resulting solution that gives the Shapley Value

is given in table 7, as shown in the last column,

which is considered as the payoff that should be

assigned to each player in the coalition

1,2,3,4

, also known as the grand coalition.

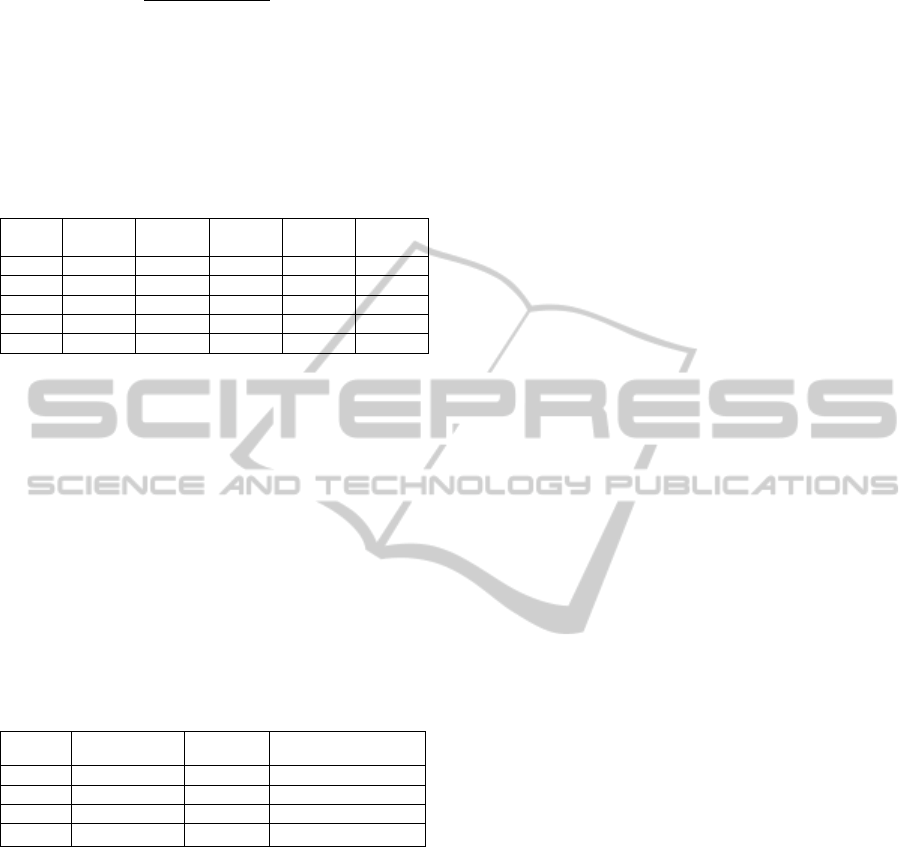

Table 7: Shapley values.

th

player

1 2 3 4 ᶲ

1 1400 5075 5062.5 1667 1611.5

2 1250 4029 3750 1250 1273

3 1083 3592 3312.5 1083 1117

4 1425 4500 4500 1500 1498

0.25 0.0833 0.0833 0.25 5500

According to the Shapley value, the distribution

of the profits associated with each player in the

grand coalition are as follows:

For player one USD $ 1,611.45.

For player two USD $ 1,273.26.

For the player three USD $ 1,273.26.

For the player four USD $ 1,273.26.

Value of grand coalition USD $ 5,500.00.

The results, as compared to the individual payoffs

observed in table 5, show the feasibility of the

solution and the economic incentive for cooperating.

Table 8 show the comparison of the results obtained.

Table 8: Results compared.

Player Individual SV % Improvement

1 1400 1611,5 15%

2 1250 1273 2%

3 1083 1117 3%

4 1425 1498 5%

4.2 Analysis Results Generated

After solving the numerical example shown above, it

can be observed that cooperation is possible among

competitors, which assume the share of demanded

quantities for each one of the products offered. The

grand coalition sets an overall of $5.500, much

greater than what the global model considered

initially, $5.155. In the resulting cooperative model,

player 1 is most strategically benefited as shown by

the Shapley values generated. Yet, overall, all

players are benefitted, obtaining greater benefits

than operating individually.

5 CONCLUSIONS

The increase of market competitiveness generates a

growing interest in companies to improve their

processes and operations in order to obtain

satisfactory results and become well positioned. This

has encouraged many of them to integrate with their

competitors where the implementation of strategies

focused on collaboration between several companies

with a common goal. Nevertheless, this is not

always true due to the lack of incentives that

businesses have to cooperate. For this reason, many

companies decide to continue working

independently. In this particular case, cooperative

game theory offers solutions such as the Shapley

Value that allows an efficient distribution of

incentives among each player, thus, resulting in a

contribution received by each player, according to

its objective function.

In this paper, we considered a problem of

production planning in manufacturing companies,

with a cooperative game model that integrated with

MILP models that made possible the determination

of optimal coalitions and the amount of each type of

product to be manufactured by each player. The

results generated, indicate that involving

competition to obtain optimal benefits is not as

simple as solving for a MILP model. Involving

competition requires generating previous decisions,

which are considered in several scenarios that must

be evaluated. Moreover, if cooperation is

considered, the implications make it a more dynamic

and complex model.

The Shapley value calculation determine an

efficient way of distributing their income and a

solution algorithm was implemented in order to

calculate the value among many companies.

This solution approach demonstrated that

cooperation is not only recommended at a strategic

level, but also is considered an important strategy for

companies that are struggling in a competitive

market and are striving to succeed.

Future research directions are considered

reducing the complexity of coalition formation when

addressing Shapley Value. Also, there are multiple

applications where cooperation is needed and more

and more companies are searching for a way to

cooperate without losing money.

ACKNOWLEDGEMENTS

This research is supported by Universidad de la

Costa (CUC) and Fundación Centro de Investigación

ACooperativeGameApproachtoaProductionPlanningProblem

153

en Modelación Empresarial del Caribe (FCIMEC).

This paper responds to the project “Cooperative

Game Theory and Shapley Value” that integrates the

research groups SimOpt and Producom.

REFERENCES

Aydinliyim, T., Vairaktarakis, G. L., 2013. A cooperative

savings game approach to a time sensitive capacity

allocation and scheduling problem. Decision Sciences,

44(2), 357-376.

Cadenillas, A., Lakner, P., Pinedo, M., 2013. Optimal

production management when demand depends on the

business cycle. Operations Research, 61(4), 1046-

1062.

Chen, L. T., 2014. Optimal dynamic policies for integrated

production and marketing planning in business-to-

business marketplaces. International Journal of

Production Economics, 153, 46-53.

Das, B. C., Das, B., Mondal, S. K., 2014. Optimal

transportation and business cycles in an integrated

production-inventory model with a discrete credit

period. Transportation Research Part E: Logistics and

Transportation Review, 68, 1-13.

Doulabi, S. H. H., Avazbeigi, M., Arab, S., Davoudpour,

H., 2012. An effective hybrid simulated annealing and

two mixed integer linear formulations for just-in-time

open shop scheduling problem. The International

Journal of Advanced Manufacturing Technology,

59(9-12), 1143-1155.

Ertugrul, I., Isik, A. T., 2009. Production Planning for a

Winery With Mixed Integer Programming Model. Ege

Academic Review, 9(2), 375-387.

Gimenez, C., Ventura, E., 2005. Logistics-production,

logistics-marketing and external integration: their

impact on performance. International journal of

operations & Production Management, 25(1), 20-38.

Gong, X., Zhou, S. X., 2013. Optimal production planning

with emissions trading. Operations Research, 61(4),

908-924.

Guzman, L., Ramírez Ríos, D. G., Yie, R., Ucros, M.,

Acero, K., Paternina, C. D., 2008. Modelos de

planificación cooperativa de recursos energéticos.

Ediciones Uninorte, Barranquilla, 178p.

Hartman, B. C., Dror, M., 2003. Optimizing centralized

inventory operations in a cooperative game theory

setting. IIE Transactions, 35(3), 243-257.

Hsiao, Y. C., Lin, Y., Huang, Y. K., 2010. Optimal multi-

stage logistic and inventory policies with production

bottleneck in a serial supply chain. International

Journal of Production Economics, 124(2), 408-413.

Jolayemi, J. K., 2012. Scheduling of projects under

penalty and reward arrangements: a mixed integer

programming model and its variants. Academy of

Information & Management Sciences Journal, 15(2).

Kang, S., Medina, J. C., Ouyang, Y., 2008. Optimal

operations of transportation fleet for unloading

activities at container ports. Transportation Research

Part B: Methodological, 42(10), 970-984.

Khaledi, H., Reisi-Nafchi, M., 2013. Dynamic production

planning model: a dynamic programming approach.

The International Journal of Advanced Manufacturing

Technology, 67(5-8), 1675-1681.

L'Heureux, G., Gamache, M., Soumis, F., 2013. Mixed

integer programming model for short term planning in

open-pit mines.

Mining Technology, 122(2), 101-109.

Li, P., Wendt, M., Wozny, G., 2003. Optimal operations

planning under uncertainty by using probabilistic

programming. Foundations of Computer-Aided

Process Operations (FOCAPO 2003), Coral Springs,

FL.

Li, X., Gao, L., & Li, W., 2012. Application of game

theory based hybrid algorithm for multi-objective

integrated process planning and scheduling. Expert

Systems with Applications, 39(1), 288-297.

Lütke Entrup, M., Günther, H. O., Van Beek, P., Grunow,

M., & Seiler, T., 2005). Mixed-Integer Linear

Programming approaches to shelf-life-integrated

planning and scheduling in yoghurt production.

International Journal of Production Research, 43(23),

5071-5100.

Manupati, V. K., Deo, S., Cheikhrouhou, N., Tiwari, M.

K., 2012. Optimal process plan selection in networked

based manufacturing using game-theoretic approach.

International Journal of Production Research, 50(18),

5239-5258.

Mattik, I., Amorim, P., Günther, H. O., 2014. Hierarchical

scheduling of continuous casters and hot strip mills in

the steel industry: a block planning application.

International Journal of Production Research, 52(9),

2576-2591.

Missbauer, H., Uzsoy, R., 2011. Optimization models of

production planning problems. In Planning

Production and Inventories in the Extended Enterprise

(pp. 437-507). Springer US.

Mukhopadhyay, S. K., Setoputro, R., 2004. Reverse

logistics in e-business: optimal price and return policy.

International Journal of Physical Distribution &

Logistics Management, 34(1), 70-89.

Okada, A. The Nash bargaining solution in general n-

person cooperative games. Journal of Economic

Theory 2010, Vol. 145, pp 2356-2379.

Owen, G., 1995, Game Theory. In San Diego: Academic

Press. 447p.

Puello Pereira, N. & Ramírez Ríos, D.G., 2014. Un

modelo de juegos cooperativos aplicado a cadenas de

suministro para maximizar la competitividad de los

clusters. In Revista Ingeniare, Paper submitted for

publication.

Roth, A., 1988. The Shapley Value. In Cambridge

University Press, 1988. ISBN 0-521-36177-X.

Shi, J., Zhang, G., Sha, J., 2011. Optimal production

planning for a multi-product closed loop system with

uncertain demand and return. Computers &

Operations Research, 38(3), 641-650.

Widyadana, G. A., Wee, H. M., 2011. Optimal

deteriorating items production inventory models with

random machine breakdown and stochastic repair

ICORES2015-InternationalConferenceonOperationsResearchandEnterpriseSystems

154

time. Applied Mathematical Modelling, 35(7), 3495-

3508.

Yin, S., Nishi, T., & Zhang, G., 2013. A Game Theoretic

Model to Manufacturing Planning with Single

Manufacturer and Multiple Suppliers with

Asymmetric Quality Information. Procedia CIRP, 7,

115-120.

Zamarripa, M., Aguirre, A., & Méndez, C., 2012.

Integration of Mathematical Programming and Game

Theory for Supply Chaina Planning Optimization in

Multi-objective competitive scenarios. Computer

Aided Chemical Engineering,30, 402-406.

Zhou, G., Xiao, Z., Jiang, P., & Huang, G. Q., 2010. A

game-theoretic approach to generating optimal process

plans of multiple jobs in networked manufacturing.

International Journal of Computer Integrated

Manufacturing, 23(12), 1118-1132.

APPENDIX

Solution algorithm

Count = number of coalitions formed.

Count < 2

m

-1

begin

g = m, w= 0

For l = 1 to m

S

lg

= assign l to coalition S

v(S

lg

)=Max f(x)

Next l

w= w + m

Do while w <= Count

Do

z=1

h=g-1

For j = 1 to h

Do

S

wh

= j

For i = h+1 to g

S

wi

= j+z

v(S

wi

)= Max f(x

j

) jS

wi

z = z +1

Next i

w=w+1

while j+z = m

Next j

h= h-1

while h > 0

Loop

For l=1 to m

For r=1 to g

Calculate marginal payoffs

MV

r

= sum

r

[v(S

rl

)-v(S

rl

-l)]

Calculate p

r

Next r

Next l

Calculate shapley value SV

l

SV

l

=sum

l

[p

r

*MV

l

]

end

ACooperativeGameApproachtoaProductionPlanningProblem

155