The Impact of Demand Correlation on Bullwhip Effect in a

Two-stage Supply Chain with Two Retailers

Jianhua Ji, Huafeng Li, Jie Zhang and Cuicui Meng

Antai College of Economics and Management, Shanghai Jiao Tong University, Shanghai, 200052, China

Keywords: Demand Correlation, Bullwhip Effect, Supply Chain, Supplier, Retailer.

Abstract: In a two-stage supply chain with two retailers, if they have correlated customer demand, forecasting based

on their respective history order might cause significant forecast inaccuracy. Current forecast methods

only use supply chain members’ own history demand information. However, when there are

multi-retailer’s having correlated demand, the common forecasting methods ignore the forecast error

caused by retailers’ interaction. Then, a question comes up that what is the relation between this forecast

error and the bullwhip effect. The present paper studies relation of multi-terminals’ demand correlation

and bullwhip effect in a two-stage supply chain with two retailers. Under centralized or decentralized

information, (1) the impact of retailers’ demand correlation on retailers’/supplier’s bullwhip effect is

studied; (2) the contrast of supplier’s and retailers’ bullwhip effect and the contrast of supplier’s/ retailers’

bullwhip effect under different information sharing condition are studied. The studies show that

multi-terminals’ demand correlation is a cause of supply chain’s bullwhip effect.

1 BACKGROUND

Today, modern supply chain faces more diversified

demands of customers, and more intense horizontal

competition among the parties in the same level of a

supply chain. Especially in a supply chain

producing a homogeneous product, demands of the

parties in the same level undoubtedly get affected

by their interaction. However, this correlation is not

considered in common forecasting methods, such as

moving average, exponential smoothing, or

empirical forecasting. For example, in one

community, there are often more than one

supermarket or convenience store, facing the same

group of customers and providing products same in

price, quality or service. It is obvious that demand

of these terminals should be highly correlated.

When the manager of such retail terminal makes

order based on one of the cited forecast method, if

he or she ignores this correlation, the forecast

inaccuracy would cause a severe inventory backlog

or stock-out.

What is the relationship between retail

terminals’ forecast inaccuracy caused by their

demand correlation and the supply chain’s bullwhip

effect? Or more specifically, what characters of

demand correlation are related to the bullwhip effect?

Under what circumstances (such as centralized

information or decentralized information) may

terminal demand correlation cause bullwhip effect?

Although substantial research has been done on

bullwhip effect in vertical supply chain, not much

research has been performed on bullwhip effect in

supply chain having horizontal competition. In the

present paper we focus on the relation between

demand correlation and bullwhip effect.

2 LITERATURE REVIEW

Lee et al. (1997) prove the existence of bullwhip

effect and describe it with AR (1) demand process.

Later, Lee et al. (2000) prove that bullwhip effect

can be reduced by supply chain information sharing.

Chen et al. (2000a) quantify the bullwhip effect

in a two-echelon supply chain with a single

manufacturer and a single retailer. They examine

the impact of forecasting (moving average

forecasting and exponential forecasting) and order

lead time on the bullwhip effect, and conclude that

bullwhip effect would exist if order lead time is not

zero and that the bullwhip effect would become

304

Ji J., Li H., Zhang J. and Meng C..

The Impact of Demand Correlation on Bullwhip Effect in a Two-stage Supply Chain with Two Retailers.

DOI: 10.5220/0005233003040313

In Proceedings of the International Conference on Operations Research and Enterprise Systems (ICORES-2015), pages 304-313

ISBN: 978-989-758-075-8

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

more severe with larger order lead time. Later, they

extend the conclusion into a multi-stage supply

chain, and reveal that information sharing reduce

but not eliminate the bullwhip effect.

Luong (2007) use a forecasting procedure that

minimizes the expected mean-square forecast error

to estimate the lead time demand, and conclude that

the variance of order will increase with increasing

order lead time. In a later paper, Luong and Phien

(2007) study the bullwhip effect based on a AR(2)

demand process, and extend it into a AR(p) demand

process. They find out that in different ranges of

autoregressive coefficients, the relation between

lead time and bullwhip effect become complicated

that the bullwhip effect does not always exist and

does not always increase when lead-time increases.

Li et al. (2006) research the impact of difference

demand process on the bullwhip effect, and

integrate a general ARIMA (p,d,q) demand process

into the model to analyze the validity of the

production-smoothing model. They find out the

anti-bullwhip effect and the so-called ‘lead-time

paradox’, and they also study the value of

information sharing in supply chain.

3 MODEL DESCRIPTION

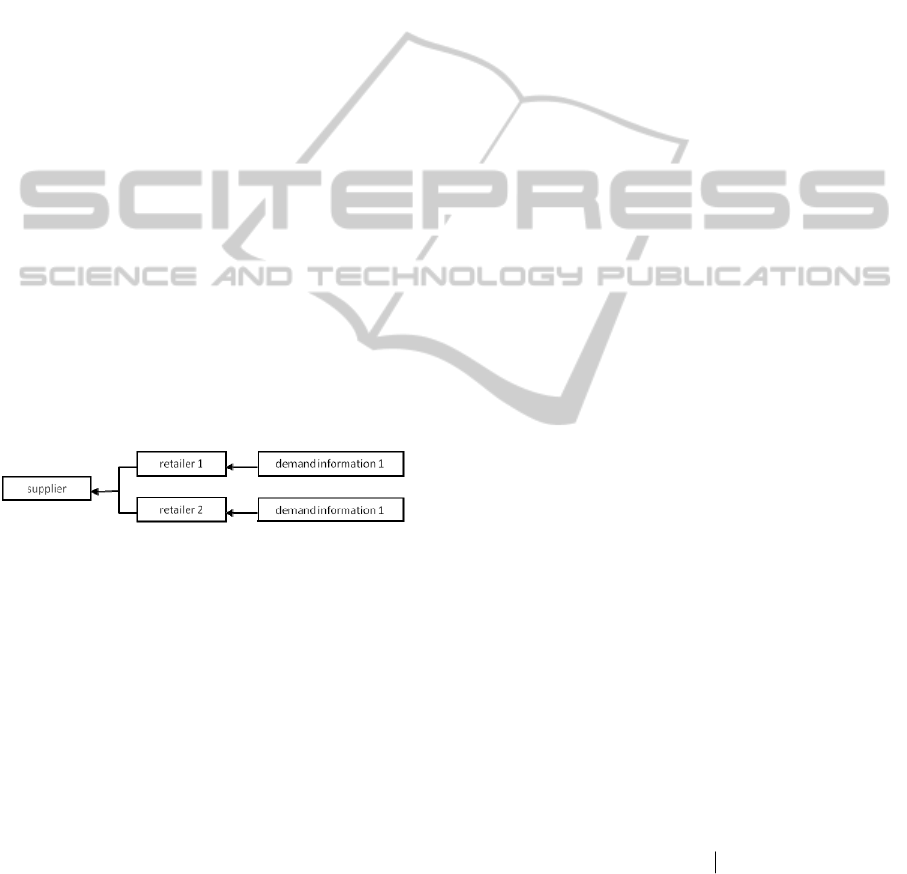

Figure 1: One Supplier and Two Retailers Structure.

In the above supply chain with one supplier and two

parallel retailers, there exists demand correlation

between the two suppliers. Here, the concept of

correlation is:

(1) At any period t, retailer 1’s demand

information is determined not only by its own

history demand but retailer 2’s history demand.

(2) At any period t, the random error part of

retailer 1’s demand information is correlated with

that of retailer 2’s. However, the random error part

of retailer 1’s demand information at period t1is

independent with that of retailer 2’s at a different

period t

2

. This assumption is in form of

12

,, ,, 12

,,

(, ) ( ,)

(, )0

it jt jt it

it jt

Cov Cov

Cov

,

(1)

Generally, at the end of period t, the two

retailers place order

,it

O (i=1,2) to the supplier

based on their current respective inventory position.

The supplier will ship the product once it receives

the order. Considering the transportation delay, we

assume that the shipment will arrive at the retailer at

the end of period (t+L), and here constant L means

the same order lead time of the two retailers.

4 DEMAND FORECAST AND

ORDER-UP-TO POLICY

As mentioned in the literature review, forecasting

methods used in most of the previous research on

bullwhip effect include the Moving Average

(MA),the Exponential Smoothing (ES) and the

optimal forecasting method (or Minimum Mean

Square Error forecast, MMSE forecast) (zhang 2004,

Heyman and Sobel 2003, Johnson and Thompson

1975, Chen et al. 2000). In practice, the MA is the

most common forecasting method. The advantage

of this method is that it is easy to use and that it is

good enough to determine the current change of

trend when accuracy is not strictly requested. The

main disadvantage is that the moving averages are

lagging indicators because the method assigns the

same weight rather than greater weight to the more

recent history data, while in practice the more

recent changing trend is more important. The ES is

relatively more suitable in short-to-medium term

forecasting for that it is more sensitive to recent

changing trend. However, it is not that easy to use

because it can be complex to choose a proper

smoothing factor. The optimal forecast method is

the MMSE forecast, which is suitable in

short-to-medium term forecast, sensitive to recent

changing trend, high in forecasting accuracy and the

most complex to use in comparison with other

methods.

We assume that the two retailers use the MMSE

forecast method to estimate the lead time demand.

At the end of period t, history demand sequence of

retail is

,1 ,2 , 1 ,

,

,... ,

i i it it

it

DD D DH

. Through the MMSE

forecast, we can get forecast of demand in next L

periods (here L is the lead

time),

, ,1,2 ,1,

, ... ,

it it it it L it L

FDDD D

, where

conditional expect

10

(,...)

ti

ti t t

D

ED D D D

.

We assume that the two retailers follow

order-up-to inventory policy. Their respective

order-up-to points are determined by lead time

demand forecast at the end of period t. Then we

have

,,1,2 , ,

ˆˆ ˆ

ˆ

...

it it it it L i it

yD D D Z

, where

,

ˆ

it

is

an estimate of the standard variance of retailer i’s

TheImpactofDemandCorrelationonBullwhipEffectinaTwo-stageSupplyChainwithTwoRetailers

305

forecast error during lead time L, and

i

Z

is a

constant measuring retailer i’s service level.

5 MODEL NOTATION

We assume that demand of the two retailers are

correlated, which is a 2-dimension AR(1) process.

1, 1 11 1, 1 12 2, 1 1, 2,

2211,1222,12,

,

ttttt

ttt

da d d d

ad d

(2)

1, 2,

,

tt

are i.i.d. following a distribution with

mean 0, and satisfies

12

2

,,,

,, 12 , ,

() , (, )

(,) , (, )0

it ii it jt

jt it it jt

Var Cov

Cov Cov

(3)

It is obvious that expression (2) becomes two

independent AR(1) processes when

12 21 12

0

.

For the stationary of AR process, we should

choose proper

11 12 21 22

,,,

to make the roots of

11 22 12 21

()()xx

locate in the unit circle.

Let

12

,

denote respectively the mean of the

two retailers’ demand, we have

22 1 12 2

1

11 22 12 21

11 2 21 1

2

11 22 12 21

(1 )

(1 )(1 )

(1 )

(1 )(1 )

aa

aa

(4)

To ensure the positive value of μ

1

and μ

2

, the

following condition should be satisfied:

1 2 22 12 2

11 21 1

0, 0,(1 ) 0,

(1 ) 0

aa a

a

(5)

To simplify expression (1), we

make

,,it it i

zd

, and (1) can be transferred as

1, 11 1, 1 12 2 , 1 1,

2, 21 1, 1 22 2, 1 2,

,

tt tt

tt tt

zz z

zz z

(6)

Denote,

1, 1,

2, 2,

,,

ti ti

ti

ti ti

ti

zy

ZY

zy

1

11 12

21 22

2

1, 1,

2,

2,

2

12

11

2

21

22

,,

,,

()

ti ti

ti ti ti

ti

ti

ti

A

d

DZ

d

Var

(7)

We get the matrix form of (1) as below, where the

characteristic root of A,

1

, or matrix E-A is

invertible.

11

,0

ti ti ti

ZAZ i

(8)

5.1 Bullwhip Effect of the Two

Retailers and the Supplier with

Centralized Demand Information

Centralized demand information means that

retailers share its history demand sequence

,it

H with

each other, so each retailer can forecast and make

order decision based on both retailers’ history

demand.

We substitute

121tL tL tL

ZAZ

for

1tL tL tL

ZAZ

in expression (6), and continue

this iteration to the end:

2

121

12

12 1

...

...

tL tL tL tL tL tL

LL L

tt t tLtL

ZAZ AZ A

AZ A A A

(9)

From

()0

ti

E

, we can have ()

L

tL t

EZ AZ

.

Because for any ARMA process, MMSE forecast of

demand of period t+i equals its conditional

expectation, the MMSE forecasts of

tL

Z

,

1tL

Z

…

1t

Z

are

1

11

,...,

LL

tL t tL t t t

Z

AZ Z A Z Z AZ

(10)

Then, the lead time demand forecast is

11

2

11

()

( ... )

()( )

LL

ti ti

ii

L

t

L

t

DZ

LAA AZ

LEAAAZ

(11)

The lead time demand forecast error is

11

12 2

12

1

()()

( ... ) ( ... )

... ( )

LL

ti ti ti ti

ii

LL L

tt

tL

tL

ZZDZ

AA E A E

AE

(12)

Variance of lead time demand forecast error is

11

12 12 '

22

'

()()

( ... ) ( ... )

( ... ) ( ... )

... ( ) ( ) +

LL

ti ti ti ti

ii

LL LL

LL

Var D D Var Z Z

A

AEAAE

AEAE

AE AE

’

(13)

Denote

1,

2,

t

t

t

o

O

o

as the matrix form of

retailers’ order quantity, and we have

ICORES2015-InternationalConferenceonOperationsResearchandEnterpriseSystems

306

Table 1: Parameter Description.

Parameter Description

1, 2,

,

tt

dd

The demand of Retailer 1,2at period t

1, 2,

,

tt

dd

The demand forecast of Retailer 1, 2 at period t

1, 2,

,

tt

The random variable of demand information faced by Retailer 1, 2 respectively at period t.

Here

2

ii

denote the variance of retailer i’s random variable,and

,

ij ji

denote the correlation of

two retailers’ random variable

,

s

t

The random variable of demand information faced by Supplier, let

,1,2,

s

ttt

11 22

,

The autocorrelation coefficient of Retailer 1, 2

12 21

,

The correlation coefficient describing the correlation between Retailer 1and 2

1, 2,

,

tt

oo

The order quantity of Retail 1, 2 at period t

1, 2,

ˆ

ˆ

,

tt

oo

The forecast order quantity of Retailer 1, 2 at period t

,

s

t

o

The order quantity of Supplier at period t, let

,1,2,

s

ttt

ooo

,

ˆ

s

t

o

The forecast order quantity of Supplier at period t, let

,1,2,

ˆ

ˆˆ

s

ttt

ooo

222

12

,,

s

M

MM

The measure of Bullwhip Effect of Retailer 1, 2 and Supplier

111

1

11

11

1

11

()( )

()( )

LL

tt

LL

tt t ti t

tti

ii

LL

ti t

ti

ii

AZ EA EA

OYY D D D D

ZZZ

(14)

Retailers’ forecast order quantity is

1

1

ˆ

L

tt

OAZ

(15)

Variance of retailers’ order quantity error is

11

ˆ

()(()( ))

L

tt t

Var O O Var E A E A

(16)

Let

11

()( )

L

BEAEA

,and then we have

2

'' '

11 12

2

21 22

ˆ

()()

tt tt

Var O O BE B B B

(17)

Assume that retailers’ order lead time L=1, and

we have

12

11 12

21 22

2

11 12 11 12 11 21

2

21 22 12 22

21 22

1

()( )

1

ˆ

()

11

11

tt

BEAEA EA

Var O O

(18)

Hence, we get the Bullwhip Effect of the two

retailers as the below:

1, 1,

2

1

1,

22 2 2

11 11 12 11 12 12 22

2

11

2, 2,

2

2

2,

22 2 2

22 22 21 22 21 21 11

2

22

ˆ

()

(1 ) 2 (1 )

,

ˆ

()

(1 ) 2 (1 )

tt

t

tt

t

Var O O

M

Var

Var O O

M

Var

(19)

Also, the Bullwhip Effect of the supplier is

s,

s,

2

s,

1, 2,

1, 2,

1, 2,

22

2211 21 11

22

11 22

22 12 22

12

11 21 22 12 12

()

()

()

()

(1 )

(1 ) /

2

2(1 )(1 )

t

t

s

t

tt

tt

tt

Var o o

M

Var

Var o o o o

Var

(20)

5.2 Bullwhip Effect of the Two

Retailers and the Supplier with

Decentralized Demand

Information

Decentralized demand information means that

retailers take each other as competitor and they do

not share information of history demand sequence.

Based on this assumption, each retailer can forecast

and make order decision based on only its own

history demand.

According to expression (6), we have

1, 11 1, 1 12 2, 1 1,

11 1, 1 12 21 1, 2 22 2, 2 2, 1 1,

11 1, 1 12 21 1, 2 12 22 2, 2 12 2, 1 1,

()

tt tt

ttttt

tt ttt

zz z

zzz

zz z

(21)

Now substitute

1, 1 11 1, 2 12 2, 2 1, 1tt tt

zzz

for

2, 2t

z

in the equation above, and we have

1, 11 22 1, 1

12 21 11 22 1, 2

1, 22 1, 1 12 2, 1

()

()

tt

t

tt t

zz

z

(22)

TheImpactofDemandCorrelationonBullwhipEffectinaTwo-stageSupplyChainwithTwoRetailers

307

Following the same procedure, we have

2, 11 22 2, 1

12 21 11 22 2, 2

2, 11 2, 1 21 1, 1

()

()

tt

t

tt t

zz

z

(23)

Let

1 11 22 2 12 21 11 22

,,

,1 ,1

,

it it jj ij

it jt

v

,

equation (22) and (23) become

,1,1 ,2,

2

it it it it

zz zv

(24)

Notice that each retailer only has its own history

demand sequence. From equation (22) and (23),

retailer i can estimate the auto-regression term in

the equation and the auto-correlation part in the

error term, while retailer i cannot estimate the

correlation part in the error term. Hence, neither of

the retailers can forecast the future demand based

on its own history demand sequence.

Lemma 1

Retailer i can use a stable and invertible ARMA

process to model its history demand.

,,

1,1 2,2 ,1

,1,2

it it i

it it it

zz z i

2

2

,, ,

,1

,

,1

() () 4 (, )

2(, )

it it it

it

i

it

it

Var v Var v Cov v v

Cov v v

,

where

1

i

, and the error term satisfies

(1)

,

0

it

E

(2)

'

'

,

,

22 2

,,

()0, ,

() ()/(1 )

it

it

it it i

i

Ett

EVarv

Based on Lemma 1, (22)and(23)become

1, 11,1 21,2 1, 11,1 2,

12, 1 22, 2 2, 2 2, 1

,

tt tttt

tttt

zz z z

zz

,

where

1, 2,

,

tt

are i.i.d.

Assume that retailers’ order lead time L=1, and

we can get the lead time demand forecast and

forecast error as below

,

,, ,

,,,

1,1 2,2 ,1

,,

()

,1,2

it i i

i

it it it

it it it

i

it it it

it it

dz

dd z

Ez H

zz

zi

(25)

Hence, we get the variance of two retailers’

order lead time demand forecast error

,1

,1

2

(),1,2

it

it

i

ddVar i

(26)

Under decentralized information

, retailer i’s

order quantity is

, , ,1 , , ,1 ,

2

,, 12,112,2

1,1 1 ,

()

(1 )

it it it it it it it i

it it i it it

iit i it i

dd zz

z

odz

zz

(27)

Retailers’ forecast order quantity is

2

,

12,112,2

1,1

ˆ

()

it

it it

ii

it

O zz

(28)

Variance of retailers’ order quantity error is

,

,, ,

1

22

,

1

ˆ

ˆ

(1 )

()(1 )

it

it it i it

it i

i

o

o

o

Var o

(29)

Hence, we get the Bullwhip Effect of the two

retailers as below

22

1

,,

2

2

,

(1 )

ˆ

()

i

i

it it

i

it

ii

Var o o

M

Var

(30)

Also, the Bullwhip Effect of the supplier is

s, 1, 2,

s, 1, 2,

2

,1,2,

22 22

11 1 12 2

22

11 22 12

()( )

() ( )

(1 ) (1 )

2

ttt

ttt

s

st t t

Var o o Var o o o o

M

Var Var

(31)

6 BULLWHIP EFFECT

ANALYSIS AND

COMPARISION

In this sector, we analyze the impact of demand

correlation on retailer and supplier Bullwhip Effect.

To eliminate the possible influence of other

parameters, we assume that

11 22 12 21 11 22

===

,,

. This assumption is

reasonable in practice, because in the same local

market there are often two retailers similar in both

market share and products sold.

6.1 Numerical Analysis of

2

i

M

under

Centralized Information

With conditions of centralized information, L=1,

and MMSE forecasting, the two retailers face

bullwhip effect as below

ICORES2015-InternationalConferenceonOperationsResearchandEnterpriseSystems

308

1,

1,

2

1

1,

22 2 2

11 11 12 11 12 12 22

2

11

2,

2,

2

2

2,

22 2 2

22 22 21 22 12 21 11

2

22

()

(1 ) 2 (1 )

()

(1 ) 2 (1 )

t

t

t

t

t

t

Var o o

M

Var

Var o o

M

Var

(32)

When

11 22 12 21 11 22

===

,,

, we

get

2

1

M

=

2

2

M

.

Then, it is obvious that

2

2

22

2

2

2(1 ) 2

,

2(1 )

,, ,12

ii ij jj

i

ij

ij ii ii

iii

ij

ij ii

dM

d

dM

i j and i j or

d

(33)

Let

2

0

i

ij

dM

d

,we get

2

(1 )

ij ii

ij

jj

。

From

1, 1

ii ij

,we get

01 2

ii

, so

2

/

iij

dM d

and

ij

have the same sign.

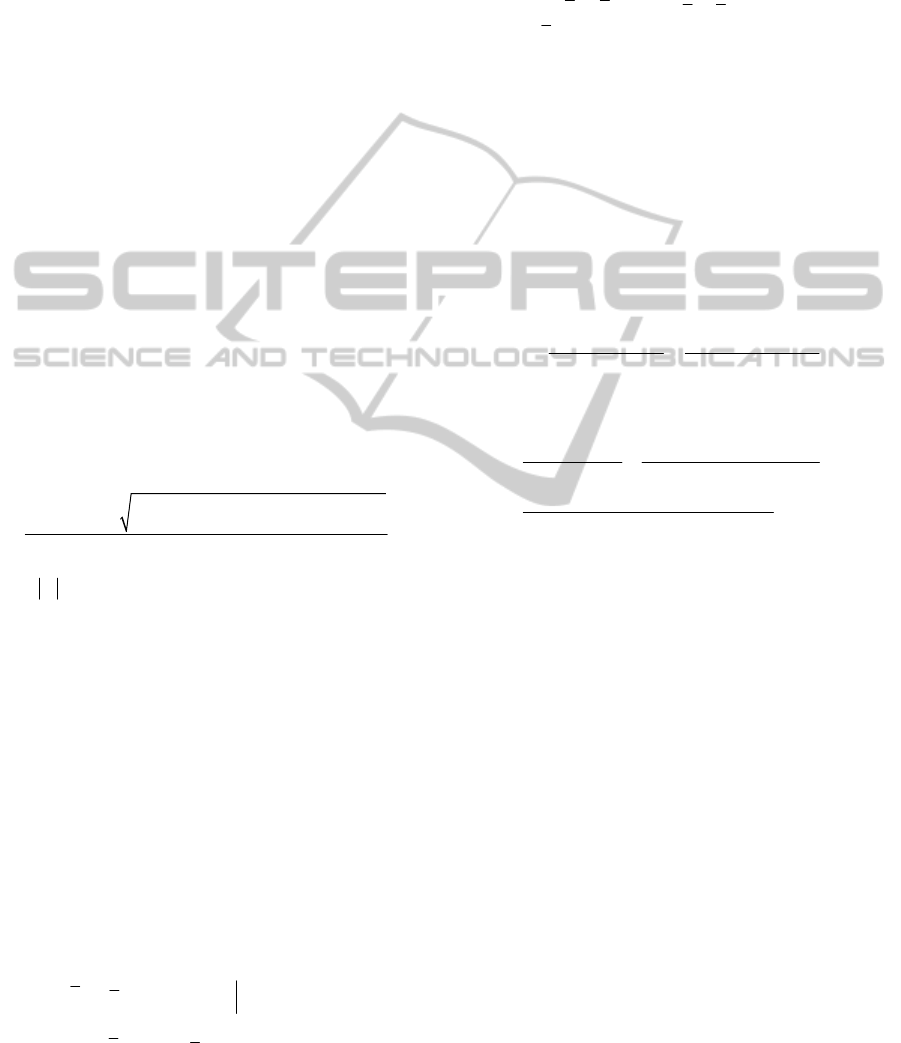

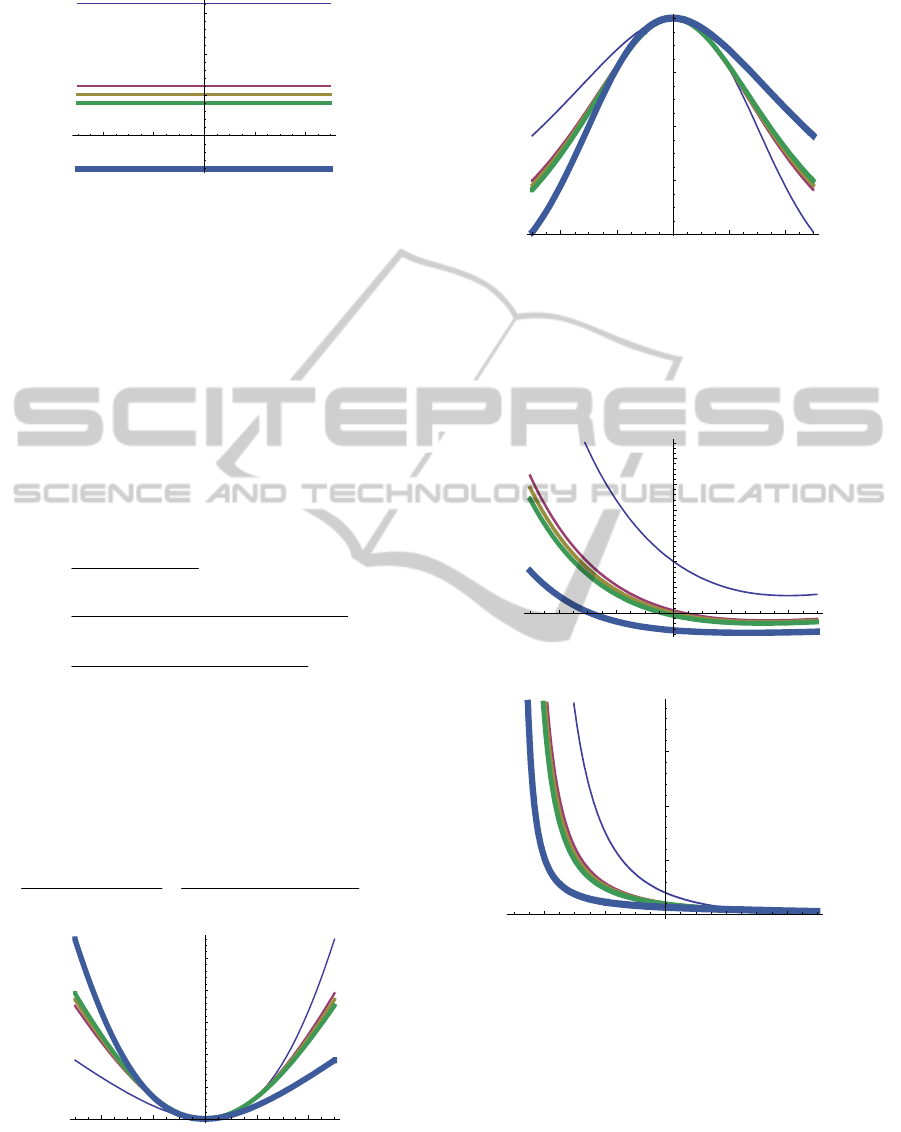

Figure 2, Figure 3 and Figure 4 display the

relation between Bullwhip Effect and demand

correlation under centralized information.

Let

11 22 11

10, 0.5, 0.5

. Notice that to

ensure the stability, let

12

0.5,0.5

(- )

.

2

1

M

varies

with

12

as shown in Figure2.

Let

11 22 11 22

10, 0.5, 0.5

. To ensure

the stability,

12

(0.5,0.5)

.

2

s

M

varies with

ij

as

shown in Figure3.

0.4

0.2 0.2 0.4

2.4

2.5

2.6

11

=0.5

,

12

= -10,-1,1,10

(thin->thick)

2

1

M

12

0.4

0.2 0.2 0.4

0.30

0.35

0.40

0.45

0.50

0.55

11

= -0.5

,

12

= -10,-1,1,10

(thin->thick)

12

2

1

M

Figure 2: Retailer’s Bullwhip Effect under Centralized

demand information.

0.4

0.2 0.2 0.4

1

2

3

4

11 22

=0.5,0.5

(thin->thick)

2

s

M

12

Figure 3: Supplier’s Bullwhip Effect under Centralized

demand information.

Next, compare the retailers’ bullwhip effect with

the supplier’s under centralized demand information,

when

11 22 12 21 11 22

===

,,

:

2

1

2

2

12 22

22 2 2 2

11 11 12 11 12 12 22 11

1

[(1 ) 2 (1 ) ] /

s

i

M

Ratio

M

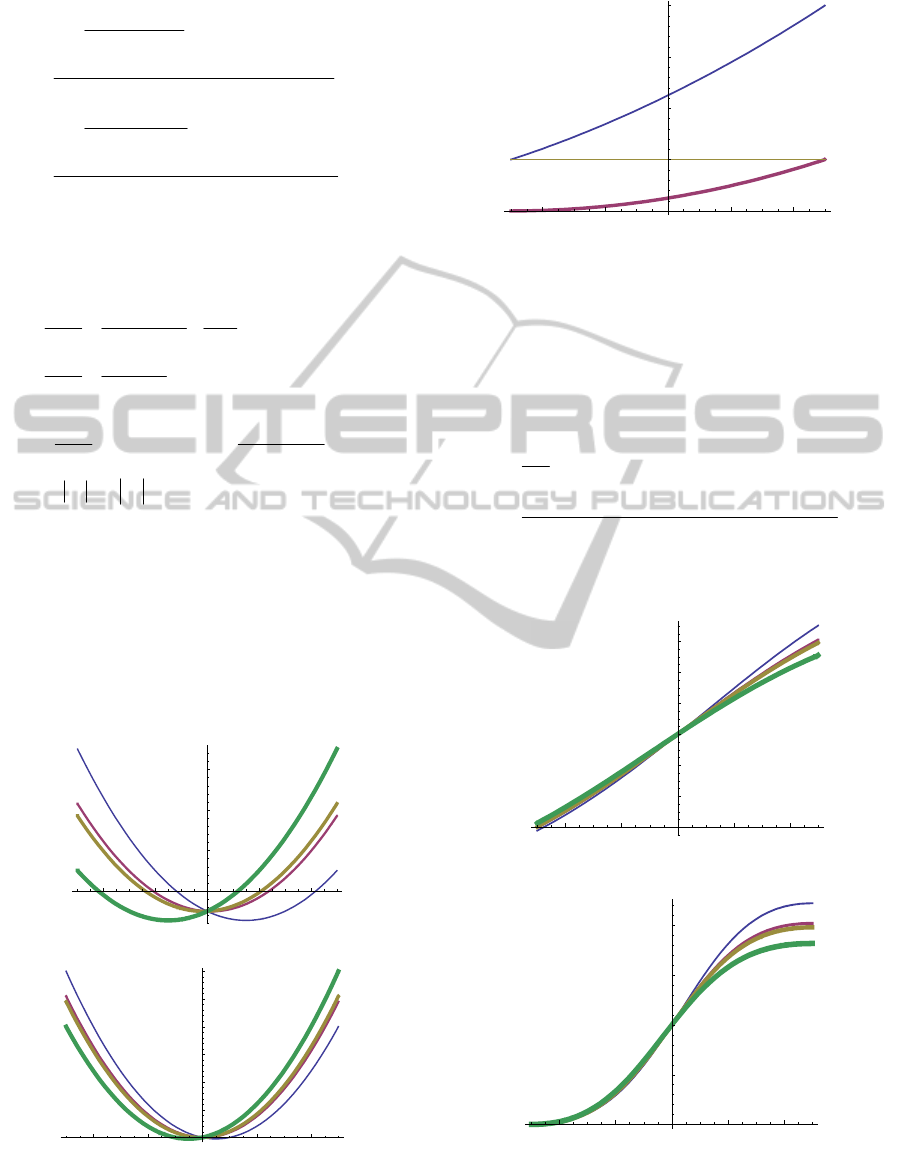

(34)

Let

11 22 11 22

10, 0.5, 0.5

,

1

Ratio

varies with

12

as shown in Figure 4.

0.4

0.2 0.2 0.4

0.6

0.8

1.0

1.2

1.4

1.6

11

=0.5

,

12

=-10,-1,1,10

(thin->thick)

12

Ration

1

0.4

0.2 0.2 0.4

0.5

1.0

1.5

2.0

11

=-0.5

,

12

=-10,-1,1,10

(thin->thick)

12

Ration

1

Figure 4: Bullwhip Effect Contrast under Centralized

demand information.

TheImpactofDemandCorrelationonBullwhipEffectinaTwo-stageSupplyChainwithTwoRetailers

309

6.2 Numerical Analysis of

2

i

M

under

Decentralized Information

With conditions of decentralized information, L=1,

and MMSE forecasting, the two retailers face

bullwhip effect as below

22

,

1

,

2

2

,

(1 )

()

it

ii

it

i

it ii

Var o o

M

Var

(35)

where

11122

22

,, ,,1

,,1

22

,, ,,1

2

() () 4 (, )

,1

2(, )

() () 4 (, )

2

it it it it

ii

it it

it it it it

i

Vv Vv Covv v

Cov v v

Vv Vv Covv v

(36)

When

11 22 11 22

10, 0.5, 0.5

,

2

1

M

varies with

12

as shown in Figure 5.

0.4

0.2 0.2 0.4

2.6

2.8

3.0

3.2

3.4

11

=0.5

,

12

=-10,-1,1,10

(thin->thick)

2

1

M

12

0.4

0.2 0.2 0.4

0.18

0.20

0.22

0.24

11

=-0.5

,

12

=-10,-1,1,10

(thin->thick)

2

1

M

12

Figure 5: Retailer’s Bullwhip Effect under Decentralized

demand information.

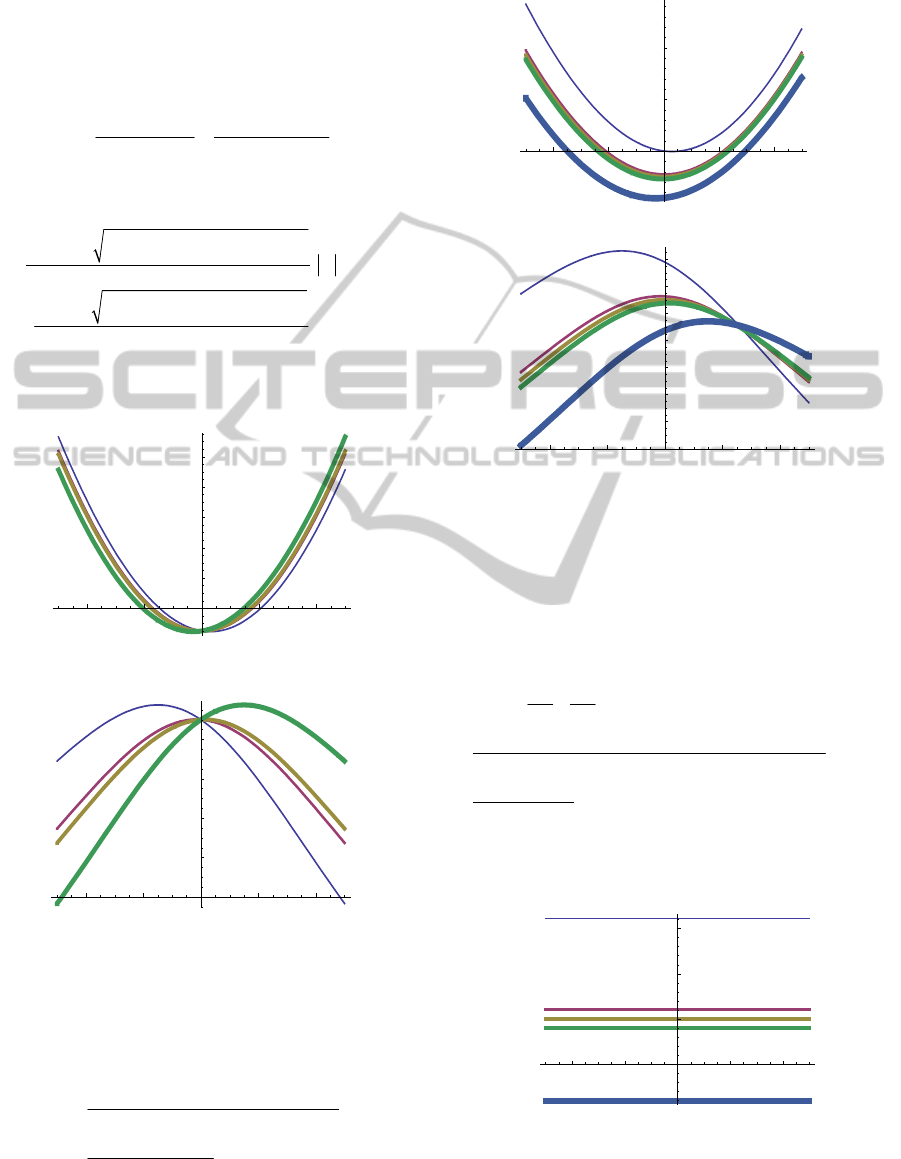

Under decentralized information, bullwhip

effect of the supplier is

22 22

11 1 1 2 2

2

22

11 22 12

22

11 1

22

11 22 12

(1 ) (1 )

2

2(1 )

2

s

M

(37)

When

11 22 11 22 12 21

10, 0.5, 0.5,

,

2

s

M

varies with

ij

as shown in Figure 6.

0.4

0.2 0.2 0.4

3.0

3.5

11

=0.5

,

12

=-10,-1,0,1,10

(thin->thick)

2

s

M

12

0.4

0.2 0.0 0.2 0.4

0.16

0.18

0.20

0.22

0.24

0.26

0.28

11

=-0.5

,

12

=-10,-1,0,1,10

(thin->thick)

2

s

M

12

Figure 6: Supplier’s Bullwhip Effect under Decentralized

demand information.

Under decentralized information,

if

11 22 12 21 11 22

===

,,

, we have

22

12

=

M

M .Now

we compare the retailers’ bullwhip effect with the

supplier’s.

22

2

22

1

22 22 2 2

1 1 1 1 2 2 11 22 12

22 2

11 1 11

2

11

22

11 22 12

n

[(1 ) (1 ) ] / ( 2 )

[(1 ) ] /

2

2

ss

i

MM

Ratio

MM

(38)

When

11 22 11 22 12 21

10, 0.5, 0.5,

,

2

nRatio

varies with

ij

as shown in Figure 7.

0.4

0.2 0.2 0.4

1.00

1.05

1.10

11

=0.5

,

12

=-10,-1,0,1,10

(thin->thick)

2

R

ation

12

Figure 7: Bullwhip Effect Contrast under Decentralized

demand information.

ICORES2015-InternationalConferenceonOperationsResearchandEnterpriseSystems

310

0.4

0.2 0.2 0.4

1.00

1.05

1.10

11

=-0.5

,

12

=-10,-1,0,1,10

(thin->thick)

2Ration

12

Figure 7: Bullwhip Effect Contrast under Decentralized

demand information (cont.).

6.3 Bullwhip Effect Contrast between

Centralized and Decentralized

Demand Information

In this section, we analyze the retailers’/supplier’s

bullwhip effect contrast between centralized and

decentralized information.

Let Ri represent the ratio of retailer i’s bullwhip

effect under centralized information to that under

decentralized information

2

2

22 2

1

22 22 2

22

1

22 22

()

()

[(1 ) ] /

[(1 ) 2 (1 ) ] /

(1 )

(1 ) 2 (1 )

i

i

i

ii ii

ii ii ij ii ij ij jj ii

ii

ii ii ij ii ij ij jj

M decentralized

R

M centralized

(39)

When

11 22 11 22 12 21

10, 0.5, 0.5,

,

we get

12

RR

, and

1

R

varies with

12

as shown

in Figure 8.

Let S represent the ratio of supplier’s bullwhip

effect under centralized information to that under

decentralized information

22

2

11 1

222

11 21 11 12

(1 )

()

()(1)()

s

s

M decentralized

S

M centralized

(40)

0.4

0.2 0.2 0.4

1.1

1.2

1.3

1.4

1.5

11

=0.5

,

12

=-50,-5,0,5,50

(thin->thick)

1

R

12

Figure 8: Retailer’s B.E. Contrast Between Centralized

And Decentralized D-I.

0.4

0.2 0.2 0.4

0.4

0.6

0.8

1.0

11

=-0.5

,

12

=-50,-5,0,5,50

(thin->thick)

12

1

R

Figure 8: Retailer’s B.E. Contrast Between Centralized

And Decentralized D-I (cont.).

When

11 22 11 22 12 21

10, 0.5, 0.5,

,

S varies with

ij

as shown in Figure 9.

0.4

0.2 0.2 0.4

1.5

2.0

2.5

3.0

3.5

4.0

11

=0.5

,

12

=-50,-5,0,5,50

(thin->thick)

12

S

0.4

0.2 0.2 0.4

5

10

15

11

=-0.5

,

12

=-50,-5,0,5,50

(thin->thick)

12

S

Figure 9: Supplier’s B.E. Contrast Between Centralized

And Decentralized D-I.

7 CONCLUSIONS AND

INSIGHTS

7.1 Main Conclusions

(1) Under decentralized information, when

ii

>0:

TheImpactofDemandCorrelationonBullwhipEffectinaTwo-stageSupplyChainwithTwoRetailers

311

2

i

M

,

2

s

M

is monotone increasing as absolute

value of

12

increases.

2

ationR

varies around 1, and its monotone

decreasing as

12

increases is not significant. This

situation indicates that

12

is not strongly related to

the amplification of bullwhip effect going up the

supply chain.

12

has little impact on bullwhip

effect.

(2) Under centralized information, when

ii

>0:

Bullwhip effect of retailer/supplier is monotone

increasing as

12

increases, and the amplification is

significant.

When

12

>0,

1

ationR

2

centr s

M /

2

centr i

M >1,and

1

ationR

is monotone increasing as

12

increases. It

means that the amplification of variance of order in

supplier stage is larger than that in retailer stage,

and this difference increases with the value of

12

.

This situation indicates that larger

12

will increase

the amplification of variance of order quantity

spreading to the upstream supply chain.

When

12

<0,

1

ationR

<1 , and

1

ationR

is

monotone increasing as

12

increases. It means

that the amplification of variance of order in

supplier stage is smaller than that in retailer stage,

and this difference decreases as

12

increases. The

impact of number of stages of supply chain on

bullwhip effect is not effected by

12

.

ij

has little impact on bullwhip effect.

(3) When

ii

<0,

12

and

12

both have little

impact on bullwhip effect.

7.2 Management Insights

To sum up, what we should pay attention to are as

following:

(1) When retailers’ demands are positive

correlated, no matter under centralized or

decentralized information, this correlation has

significant impact on retailers’/supplier’s bullwhip

effect.

(2) Under decentralized information, both

retailers’ and supplier’s bullwhip effect increases as

the absolute value of retailers’ demand correlation

increases, and bullwhip effect in supplier stage and

retailer stage are almost the same.

(3) Under centralized information, when

retailers’ demands are positive correlated, both

retailers’ and supplier’s bullwhip effect increases as

retailers’ demand correlation increases, and

bullwhip effect level in supplier stage is larger than

that in retailer level. It indicates that under

centralized information the impact of number of

supply chain stages on bullwhip effect is related

with the retailers’ demand correlation.

(4) Under centralized information, when and

only when retailers’ demands are negative

correlated (

0

ij

), the supplier’s bullwhip effect

will be less than retailers’. It indicates that under

centralized information supplier’s demand forecast

become more accurate as the result of retailers’

competition.

Hence, when retailers’ demands are correlated,

besides the well-known causes of bullwhip effect

(such as lead time, number of supply chain stages),

any member in the supply chain should consider the

impact of multi-terminals’ demand correlation on

bullwhip effect when making production plan.

Furthermore, under centralized information, when

retailers’ demand are positive correlated, the

bullwhip effect in supplier stage is higher than that

in retailers’ stage; on the contrary, under centralized

information, when retailers’ demand are negative

correlated, the bullwhip effect in supplier stage is

lower than that in retailers’ stage. These conclusions

provide theoretical reference about bullwhip caused

by terminals’ demand correlation for enterprises to

make production plan.

ACKNOWLEDGMENTS

This research is supported in part by National

Science Foundation of China Grants (70732003).

REFERENCES

Chen, F., Drezner, Z., Ryan, J.K., and Simchi-Levi,

D. (2000a), ‘Quantifying the bullwhip effect in a

simple supply chain’

, Management Science, 46 ,

436–443.

Chen, F., Ryan, J.K., and Simchi –Levi, D. (2000),

‘The impact of exponential smoothing forecasts

on the bullwhip effect’,

Naval Research

Logistics

, 47, 269–286.

Heyman, D.P. and Sobel, M.J. (2003), Stochastic

Models in Operations Research: Stochastic

Optimization (Vol.2),

New York: Courier Dover

Publications.

Johnson, G.D. and Thompson, H.E. (1975),

Optimality of myopic inventory policies for

certain dependent demand processes,

Management Science, 21, 1303–1307.

ICORES2015-InternationalConferenceonOperationsResearchandEnterpriseSystems

312

Lee H.L, Padmanabhan V. and Whang S. (1997),

Information Distortion in a Supply Chain: The

Bullwhip Effect,

Management Science, 43,

546-558.

Lee, H.L ,So K.C. and Tang, C.S. (2000), The value

of information sharing in a two-level supply

chain,

Management Science, 46, 626-643.

Li, G., Wang, S.Y. and Yu, G. (2006), A study on

bullwhip effect and information sharing in

supply chains,

Changsha: Hunan University

Press

. (in Chinese).

Luong, H.T. (2007), Measure of Bullwhip Effect in

Supply Chains With Autoregressive Demand

Process,

European Journal of Operational

Research

, 180, 1086-1097.

Luong, H.T. and Phien, N.H. (2007), Measure of

Bullwhip Effect in Supply Chains—The case of

high order Autoregressive Demand Process,

European Journal of Operational Research, 183,

197-209.

Zhang, X.L. (2004), The impact of forecasting

methods on the bullwhip effect,

International

Journal of Production Economics

, 88, 15-27.

TheImpactofDemandCorrelationonBullwhipEffectinaTwo-stageSupplyChainwithTwoRetailers

313