On Detection of Bitcoin Mining Redirection Attacks

Nicolas T. Courtois

1

, Pinar Emirdag

2

and Zhouyixing Wang

1

1

Computer Science, University College London, London, U.K.

2

Independent Market Structure Professional, London, U.K.

Keywords:

e-Payment, Crypto Currencies, Bitcoin, Double-spending attacks, Hash Functions, Man-In-the-Middle

Attacks, Stratum Protocol.

Abstract:

In this paper we study the question of centralisation in bitcoin digital currency. In theory bitcoin has been

designed to be a totally decentralized distributed system. Satoshi Nakamoto has very clearly postulated that

each node should be collecting recent transactions and trying to create new blocks (Satoshi08). In bitcoin

transactions are aggregated in block in order to authenticate them and form an official ledger and history of

bitcoin transactions. In practice as soon as expensive ASIC bitcoin miners have replaced general-purpose

hardware, production of bitcoins and the validation of transactions has concentrated in the hands of a smaller

group of people. Then at some moment in early 2012 an important decision was taken: the Stratum protocol

was designed (Palatinus12) which took a deliberate decision to move the power of selecting which transactions

are included in blocks from miners to pool managers. The growing difficulty of mining and large standard

deviation in this process (Rosenfeld13; CourtoisBahack14) made that majority of miners naturally shifted to

pooled mining. At this moment bitcoin ceased being a decentralized democratic system. In this paper we

survey the question of a 51% attacks and show that there is a large variety of plausible attack scenarios. In

particular we study one particularly subversive attack scenario which depends on non-trivial internal details

of the bitcoin hashing process. How does it compare with the current mining practices? We have study the

Stratum protocol in four popular real-life mining configurations. Our analysis shows that pools could very

easily cheat the majority of people. However the most subversive versions of the attack are NOT facilitated

and could potentially be detected.

1 BITCOIN AND HASH POWER

Bitcoin is a collaborative virtual currency and pay-

ment system. It was launched in 2009 (Satoshi08).

Bitcoin implements a certain type of peer-to-peer fi-

nancial cooperative without trusted entities such as

traditional financial institutions. Even though it has

been in operation for nearly 6 years since early 2009

(Satoshi08) it remains an experimental rather than a

mature electronic currency system. The security of

bitcoin is based on the idea that bitcoin participants

verify the correctness of all bitcoin transactions and

include them in ’blocks’ of data, which cryptographi-

cally authenticate them using a hash function. Net-

work participants which specialize in this task are

called miners because they are paid in freshly created

bitcoins for this work of cryptographic hashing. How-

ever they are only paid if their work is later accepted

by the majority of other miners and other participants,

which creates strong incentives to be honest.

Many hundreds of millions of dollars have been

invested in bitcoin mining in the recent 18 months.

In contrast bitcoin adoption has not been such a great

success recently. The number of bitcoin peer-to-peer

network nodes has been in steady decline and has

reached critically low levels, less than 6,000 which

is actually also much less than the number of bitcoin

miners(!), cf. (Cawrey14; Courtois14). The usage of

bitcoin as a currency for ordinary commercial trans-

actions has NOT increased either,

cf. Section 2.5 of (Courtois14).

1.1 Incredible Hash Rate Increase

The combined power of bitcoin mining machines has

nearly doubled each month and overall it has been

multiplied by an incredible 1000 factor in the last 12

months prior to April 2014, cf. (Courtois14) and in

the recent months it was still increasing by at least 50

% month after month, incredibly fast.

A 1000-fold increase in hash power, and further

steady increase each month is a very disturbing fact.

This is unheard of in new technology business, and

clearly much faster than the Moore’s law. How-

ever this growth is NOT a pure technology improve-

ment curve. This tremendous increase was due to a

98

T. Courtois N., Emirdag P. and Wang Z..

On Detection of Bitcoin Mining Redirection Attacks.

DOI: 10.5220/0005245600980105

In Proceedings of the 1st International Conference on Information Systems Security and Privacy (ICISSP-2015), pages 98-105

ISBN: 978-989-758-081-9

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

combination of both technology factors and invest-

ment/market factors. On the technical side there was a

10,000 times improvement in energy efficiency of bit-

coin mining technology cf. (CourGrajNaik14a). On

the market size there was an increased interest in bit-

coin and a dramatic 10 times or more increase in bit-

coin market price at the end of 2013, cf. (Courtois14).

1.2 Hash Power and Security

The following citation seems to reflect a dominant

opinion in the bitcoin community. In (Sams14) we

read:

”The amount of capital collectively burned

hashing fixes the capital outlay required of an

attacker to obtain enough hashing power to

have a meaningful chance of orchestrating a

successful double-spend attack on the system

This is basically correct, however. It is NOT true

that one needs to match the total effort spend on hash-

ing by the whole planet in order to execute a double-

spend attack. One only needs to acquire substantial

hash power for a short time (say less than 1 hour)

which is easier, and rather through hash power dis-

placement than by permanently acquiring some very

substantial computing capability.

In general we point out that the security of the bit-

coin network does not increase as the combined hash

power in bitcoin grows. However high is the hash

rate, the cost to compute the next block for the next

10 minutes is approximately 25 bitcoins. We basi-

cally expect that miners operate near a financial equi-

librium point and the cost is nearly the same as the re-

ward which is 25 bitcoins per block. Now the money

at risk in this single block is nowadays typically at

least 1,000 bitcoins in each block. Roughly 40 times

more. This ratio is likely to grow with time because

of the bitcoin monetary policy cf. (CourGrajNaik14a;

Courtois14) which will in the future pay miners 12.5

bitcoins, and later even less, while the money at risk

can only increase with time if bitcoin is adopted by

more people and is more widely used. We see that in

bitcoin the risk is likely to increase with time, and the

ratio between money at risk and cost of mining does

NOT depend on the hash rate. Increased hash rate

does NOT increase the security.

1.2.1 Bitcoin vs. Bitcoin Clones

However a smaller hash rate means less security for

an alt-coin. Smaller crypto currencies are more fragile

and some have known a rapid erosion of their security

due to a decline in their hash power cf. (Courtois14).

1.2.2 Concentration of Hash Power

There is yet another problem. The hash power can be

acquired in a subversive way, by Man-In-The-Middle

(MITM) attacks. At this moment we have some 10

large mining pools which control some 75 % of all

hash power in bitcoin. These pools also concentrate

the discretionary “decision powers” regarding indi-

vidual bitcoin transactions, cf. Section 5.1 below.

Overall we discover that in current bitcoin the

large hash power provides a yet weak and highly

unsatisfactory protection against double spending at-

tacks. In this paper we analyse some specific attack

scenarios which allow double spending and later anal-

yse if they could really occur with the currently used

Stratum protocol.

2 THE LONGEST CHAIN RULE

According to the initial design by Satoshi Nakamoto

(Satoshi08) the initial bitcoin system is truly decen-

tralized. It could work in a totally asynchronous way

in very poor network propagation conditions. The

key underlying principle which allows to achieve this

objective is the Longest Chain Rule due to Satoshi

Nakamoto (Satoshi08):

1. At any moment of the history of bitcoin, miners

are trying to extend one existing block, and some-

times two solutions will be found.

We call this (rare) situation a fork.

2. Different nodes in the network have received one

of the versions first and different miners are trying

to extend one or the other branch. Both branches

are legitimate and the winning branch will be de-

cided later by consensus.

3. The Longest Chain Ruleof (Satoshi08) says that

if at any later moment in history one chain be-

comes longer, all participants should switch to it

automatically.

Bitcoin is quite stable in practice. Forks are rela-

tively rare, and wasted branches of depth greater than

one are even much less frequent, see Table 1 in (Cour-

toisBahack14). However forks could become more

frequent in poor network conditions or due to attacks,

cf. (CourtoisBahack14). It is remarkable that in bit-

coin literature this rule is taken for granted without

any criticism. The first observation is that this consen-

sus mechanism in bitcoin has two distinct purposes:

1. It is needed in order to decide which blocks ob-

tain a monetary reward and resolve potentially ar-

bitrarily complex fork situations in a simple ele-

gant and convincing way.

OnDetectionofBitcoinMiningRedirectionAttacks

99

2. It is also used to decide which transactions are

accepted and are part of official history, while

some other transactions are rejected (and will not

even be recorded, some attacks could go on with-

out being noticed, cf. (DeckerWatten14)).

In principle there is NO REASON why the same

mechanism should be used to solve both problems.

On the contrary. This violates one of the most

fundamental principles of security engineering: the

principle of Least Common Mechanism [Saltzer and

Schroeder 1975]. One single solution rarely serves

well two distinct problems equally well without any

problems.

We need to observe that the transactions are gen-

erated at every second. Blocks are generated every

10 minutes. In bitcoin the receiver of money is kept

in the state of incertitude for far too long and this

for no apparent reason. It is a source of instability

which makes people wait for their transactions to be

approved for far too long time, especially for larger

transactions.

3 IS THE LONGEST CHAIN

RULE HELPING THE

CRIMINALS AND ARE THERE

ALTERNATIVES?

We are now going to show a simple attack which al-

lows double spending. The attack is not very compli-

cated and we do not claim it is entirely new.

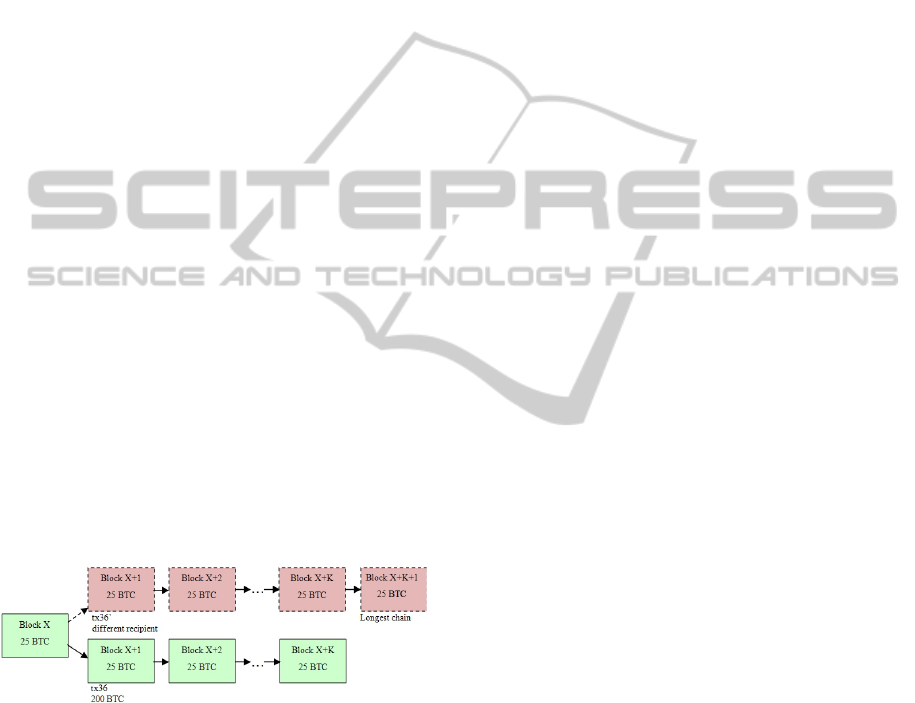

Figure 1: A simple method to commit double spending. The

attacker tries to produce the second chain of blocks in order

to modify the recipient of some large transaction(s) he has

generated himself. Arguably under the right conditions, this

is easy to achieve and clearly profitable. The only problem

is the timing: to produce these blocks on time requires one

to temporarily acquire very substantial computing power

such as more than 51 % at the expense of other miners or

other crypto currencies.

The attacker produces a fork in order to cancel

some transaction[s] by producing a longer chain in a

fixed interval of time, see Fig. 1. The attack clearly

can be profitable. In contrast the question of actual

feasibility of this attack is a complex one, it depends

on many factors and these questions are further stud-

ied in (Courtois14) and this paper.

Important Remark: The attack does NOT limit

to defraud people who would accept a single large

payment in exchange of goods or another quantity of

a virtual currency (mixing services, exchanges, some

sorts of shares). The attacker can in the same way is-

sue a large number of small transactions and cancel

all of them simultaneously in the same way.

3.1 Discussion

Our attack could be called a 51 % attack. This name

however is very highly misleading. There are many

very different things which can be done with 51 %

of computing power, for example running a mining

cartel attack (CourtoisBahack14) or undoing any sub-

set of past transactions. Very frequently we hear that

a 51 % attack require some very powerful entity to

”own” 51 % of bitcoin hash power and therefore it is

rather infeasible. In reality there is a much broader

range of attacks which are actually feasible in prac-

tice. The attacker does not need to own a lot of com-

puting power, he can rent it for a very short time. He

could also present himself as a mining pool and cheat

a large number of miners to participate in his attack.

Calling something a 51 % attack is also misleading

because a ratio between the hash rates at two differ-

ent moments does NOT have to be between 0 and 100

%. Crypto currencies need nowadays to compete with

other crypto currencies and hash power can instantly

be moved from one crypto currency to another and a

500 % attack is perfectly possible, cf. (Courtois14).

In the following sections we are going to analyse

the risks which result from this and similar attacks.

3.2 Feasibility

The most shocking discovery is that anyone can com-

mit such fraud and steal money. The attacker does

NOT even need to implement a Man-In-The-Middle

(MITM) attack. The redirection of the hash power can

be achieved also in another way which does would

at all look suspicious. They just need to rent some

hashing power from a cloud hashing provider. Bitcoin

software does not know a notion of a double spending

attack and if it occurs possibly nobody would notice:

only transactions in the official dominating branch of

the blockchain are recorded in the current bitcoin net-

work, cf. (DeckerWatten14). In a competitive market

they do not need to pay a lot for this. Not much more

than 25 BTC per block (this is because miners do not

mine at a loss, the inherent cost of mining per block

should be less than 25 BTC). The attacker just needs

ICISSP2015-1stInternationalConferenceonInformationSystemsSecurityandPrivacy

100

to temporarily displace the hashing power from other

users or other crypto currencies for a very short pe-

riod of time. This can be easy to achieve by paying

a small premium over the market price. The spare

hash power could also be obtained from older miner

devices which have been switched off because they

are no longer profitable. except for criminals able to

generate an additional income from attacks.

3.3 Cross-currency Attacks

There is yet another way to execute such attacks: to

offer a large number of miners a small incentive (as

a premium over the market price) to go mine for an-

other crypto currency, before the attack begins. This

can lead to massive displacement of hash power be-

fore the attack starts. Then at the moment when block

X+1 is mined following the notations of Fig. 1, the

double spending attack costs less. Thus we could have

something like a 500 % attack, much stronger than the

usual 51 % attack, cf. (Courtois14). Further advanced

attacks scenarios with malicious pool managers and

which can easily be combined with this preliminary

displacement of hash power are proposed and studied

in Section 4.1.

4 SUBVERSIVE ATTACK

SCENARIO H0

We examine the process of double hashing which

is used in bitcoin mining according to (CourGraj-

Naik14a; CourGrajNaik14b).

Figure 2: Bitcoin mining internals following (CourGraj-

Naik14a; CourGrajNaik14b).

One thing jumps to our attention. For every H0,

the miner needs to check many possible nonces. The

miners do NOT need to know the value of hashPre-

vBlock. They only need to know the value H0 which

changes very slowly and which could be computed

for them by the pool manager. Miners could be easily

made to mine without any precise knowledge about

which block they are mining on. Only an excessively

small number of miners, will actually manage to find

a winning block. Only these miners might be able

to know on which block they have mined as they

will see their block appear in the blockchain. How-

ever in practice they can see it ONLY if they have

also recorded all hundreds of thousands of shares pro-

duced by their miner and sent to the pool manager

over the weeks and months. We see that pool man-

agers CAN implement arbitrary subversive strategies,

for example accept certain transactions only to over-

throw them within less than one hour and accept an-

other transaction with another recipient. Nobody will

notice: miners will never know that they have been in-

volved in some major attacks against bitcoin such as

producing two different versions of the blockchain in

order to double spend some large amount of money.

Moreover even those miners who have produced win-

ning blocks and therefore will be made aware of the

previous block on which they have been mining, still

cannot claim they have participated in some sort of

attack. Fork events do happen in the bitcoin network.

4.1 Further Variants

The same attack works across digital currencies.

Miners may think that they mine bitcoin, while in fact

they are made to mine Unobtanium, and vice versa.

All this is the discretionary power of the pool man-

ager, this is due to the fact that one can mine only

knowing H0 and most of the time no other informa-

tion is disclosed to miners. In rare cases miners could

discover that they found a block for another crypto

currency which they have never mined. In practice

miners do NOT store vast quantities of H0 values with

which they have mined. Miner devices do NOT have

enough memory to store them.

4.2 Further Manipulation with

Deflected Responsibility

Our attack can also be made to work in the scenario

in which it is not possible for the attacker to corrupt

pool managers. It can be run in a different way in

which pool managers are going to corrupt themselves

and there will be no reason to accuse them of acting

with any sort of malicious or criminal intention. Ba-

sically it is possible for an attacker to manipulate the

price of a small crypto currency such as Unobtanium

OnDetectionofBitcoinMiningRedirectionAttacks

101

to be 10 % MORE profitable

1

than bitcoin mining.

Then we can hope that the pool managers themselves

are going to implement code to switch to this crypto

currency for a short time (real-time switching mech-

anism mining for the most profitable currency at the

moment). Pool manager can now re-direct 100 % of

the hashing power they command to another entity.

They are NOT going to tell this to miners and simply

pocket the difference, and they will still pay miners in

bitcoins. Again, in principle miners will probably not

notice.

4.3 The Unthinkable Double Spending

as a Service

In the bitcoin community there is already a service

bitundo.com which is trying to convince miners to

help to cancel other people’s bitcoin transactions on

demand. This is done by including a transaction

which is a genuine double spend transaction (sending

the same money to a different address). It incentivizes

miners to help to undo bitcoin transactions for a cer-

tain fee which can improve their mining income.

4.4 Can We Fix It?

The general question of potential abuse/redirection of

hash power and for-profit blockchain manipulation,

which we have explained above, is the central ques-

tion in this paper. The question whether this could and

also whether actually this should be fixed has been

discussed in bitcoin forums after our earlier paper on

this topic (Courtois14) was first made public:

” [...] making sure miners know what

block they’re building on would make certain

classes of attack (diverting pool miners to an-

other coin, using pool miners to build an un-

published blockchain, etc) which are currently

easy to make undetectably, leave incontrovert-

ible evidence.

That is a good idea and we should do it.”

Source: https://bitcointalk.org/index.php?topic=600436.ms

g6626004]msg6626004.

4.5 Solutions

The next question is how this problem can be fixed.

There are two sorts of solutions to this problem known

1

Typically such currencies are in a sort of equilibrium

situation in which the profitability is similar as for bitcoin

cf. (Courtois14).

to us: one method is to make sure that the attacks can-

not be executed: strict enforcement of standard pro-

tocols and detection of the attack (this paper) or the

hash process in bitcoin has to be modified in order to

proceed in a different way than on Fig. 2. This leads

to the notion of plaintext aware hashing, cf. Section

8.8. in (Courtois14). Plaintext aware hashing is an

attempt to find a purely cryptographic solution to this

problem: a method in which it would be impossible to

abuse miners and for miners it will be impossible to

claim that they could not know that they have partici-

pated in a large scale attack. The key idea is to make

final stages of hashing (as opposed to initial stages of

hashing only, cf. Fig. 2) on the hash of the previous

block in such a complex inextricable way (this is what

cryptography is good at) that we can be confident that

in order to compute a valid H2 the miner must know

hashPrevBlock.

5 CURRENT MINING PRACTICE

- STRATUM PROTOCOL

The Stratum algorithm was developed after Decem-

ber 2011 in order to specify a layer above the cur-

rent bitcoin network, (Palatinus12). The intention be-

hind this protocol was to distribute metadata which

are NOT recorded in the blockchain: for example:

signed messages about transactions (a potential pro-

tection against 51% attacks, wallets which rely on

queries from trusted nodes by ”light nodes”, etc. In

practice it primarily used for pooled mining as pools

and miners are now distinct entities on the network.

Messages are formatted in plain text JSON-RPC (Re-

mote Procedure Call) format. It is a line-based pro-

tocol using plain TCP sockets. This protocol became

necessary because previous solutions simply did not

scale up to allow to mine at higher speeds as implied

by ASIC mining cf. (Palatinus12). In absence of al-

ternatives it seems that all the miners worldwide has

adopted it.

5.1 The Control Shift

With Stratum miners cannot choose Bitcoin transac-

tions on their own. This according to the designer

himself, (Palatinus12). The author explained that in

his view ”99% of real miners dont care about trans-

action selection anyway”. and the miners only care

about the reward. This was a key point in history

where bitcoin became more centralized AND miners

lost control of what they mine.

We should note that the author has also thought

about alternatives, and he wrote:

ICISSP2015-1stInternationalConferenceonInformationSystemsSecurityandPrivacy

102

”I already have some ideas for Stratum min-

ing protocol extension, where miners will be

able to suggest their own merkle branch (I call

it internally ”democratic mining”), which will

solve such issues as centralized selection of

transactions. For now I decided to focus on

such a solution, which will fit to majority of

miners and do some extensions later.”

This ”democratic” version was never developed

by the author, however Stratum is not the only bitcoin

mining protocol.

5.2 The GBT Protocol

At the same time as Stratum protocol was developed,

a more decentralized solution GBT (GetBlockTem-

plate) or BIP022/23 was developed and standardized.

However Stratum was backed by a major mining pool

and GBT adoption suffered.

5.3 The Question of Entropy

In current bitcoin the probability that a random block

header is valid is approximately 2

−66

. However the

nonce in Satoshi code has only 32 bits, cf. Fig. 2.

Therefore miners must vary other fields in the mined

block in order to obtain sufficient entropy. In the-

ory miners could tamper with the ’ntime’ timestamp

which is another 32 bits, however this is not suffi-

cient (32+32 bits is less than 66) and it is NOT rec-

ommended at all, as this might very seriously confuse

the bitcoin self-adjustment mechanism, which makes

that the bitcoin clock functions at the right speed and

that bitcoins are mined every 10 minutes.

In practice miners vary the so called coinbase

transaction, which does not have a well defined role

in bitcoin. It can be seen as a way to publish a certain

long string of bytes which pertains to each 25 bitcoins

mined with the current block. It could be for example

used in digital notary services.

5.4 Initial Subscription

In this process a work will be authorized to mine and

will receive a unique value of ExtraNonce1 which

characterizes this worker and will appear in every

coinbase transaction processed by that worker. As-

suming that the pool manager is not able to somewhat

cheat and attribute the same ExtraNonce1 to several

workers, this mechanism allows to know which min-

ers have really mined a particular block. At this stage

the size of ExtraNonce2 is also fixed by the pool man-

ager server. It is typically 4 bytes. Together with

nonce on 32 bits cf. Fig. 2, this is sufficient in order

to span 2

64

different hashes. Knowing that the times-

tamp changes every second, unless a miner can do 2

64

hashes in one second, which would be faster than the

whole bitcoin network, this is sufficient for virtually

unlimited time (not shorter than until the Unix times-

tamp overflows).

5.5 Distribution of Work

Work is not directly sent to ASIC but to controllers

which typically are tiny PCs of type Rapsberry Pi.

Several ASICs can be connected to one controller.

This is done on the principle of pushing work from

time to time, and getting shares at a constant adjusted

rate of one approximate every 3 or more seconds (as

observed in real-life situations). We proceed as fol-

lows:

1. Work is sent to miner controllers. A prototype

block contains all the block data. This prototype

contains also a number of Merkle branches which

will be hashed together to from a Merkle root.

2. The controller just need to append his Extra-

Nonce1 (always the same) and a consecutive Ex-

traNonce2 on 4 bytes.

3. Then the controller can carry on mining for a very

long time, without contacting the server.

4. The controller generates the block header and

sends it to miners. Each miner tries 2

32

hashes

with all possible values for nonce as in Fig. 2.

5. Typically shares has some 32 zeros only. Depend-

ing on the difficulty level for this mining job, for

example 512 (a realistic value observed) one share

in 512 will have about 41 zeros, as 41 = 32+ 9 and

512 = 2

9

.

6. Such shares with about 41 zeros are transmitted to

the pool.

7. The difficulty is actually variable and can change

for example after 300 seconds. It is adjusted in

such a way that one controller sends less than

1 share every few seconds. This minimizes the

server load and yet allows to know the amount of

work contributed with sufficient precision, so that

miners are paid for their work. Miners may lose

at most a few seconds of work.

8. At any moment the current work suddenly be-

comes obsolete. This happens when a new block

was mined by anybody in the whole bitcoin net-

work worldwide. The server notifies immediately

and sends new work.

When a share is found the miner sends to the pool

manager the following data:

OnDetectionofBitcoinMiningRedirectionAttacks

103

1. its identity,

2. the job id

3. the timestamp

4. ExtraNonce2

5. nonce

From this the pool manager needs to recompute

the whole block header (all the other data were previ-

ously provided by him) and check that it has for ex-

ample at least 41 leading zeros.

5.6 Attack Feasibility Analysis

In this protocol the exact block used by the miner

is entirely determined by the pool manager and the

miners can change only a bit more than 8 bytes: Ex-

traNonce2, nonce, and potentially he could also gen-

erate an inaccurate timestamp (not recommended as

the pool manager could simply have a policy to reject

such shares).

Importantly, this prototype contains also a num-

ber of Merkle branches and it appears that all of them

must be used and the miner has no choice (at least this

was claimed by BTCGuild pool). We have checked 4

prominent pools: Eligius, Bitminter, Ghash and Dis-

cusFish, we have recorded the data exchaned with the

remote server when mining with these 4 pools. In all

the 4 cases we observed that the miner is given typi-

cally up to 11 hashes to form a Merkle tree. Individual

hundreds of hashes which form the whole Merkle tree

are NOT provided.

However another important element is provided.

In all the cases the previous hash is sent in cleartext.

If only instead H0 value was sent to the controller, as

suggested in Section 4, the possibilities for manipu-

lation would be very substantial. Given the previous

hash the miner can detect if there is an attack. He

needs to record incoming packets with method be-

ing ”mining.notify” and check if the second param-

eter after ”params” is the hash of the last block in the

blockchain. However the detection is not easy: Un-

happily most miners will not do these checks. This

typically requires specialized hardware (a Network

Tap) and software (e.g. Wireshark) to sniff network

packets. Therefore in practice miners could can still

be abused at any moment and maybe the attack, which

would be rather of short duration (a small multiple of

10 minutes) would not be detected.

We conclude that there isn’t currently a possibil-

ity for fraud such as 51 % attacks which would be im-

possible to detect without deviating substantially from

the widely used Stratum protocol.

6 CONCLUSION

In this paper we have looked at the question of miner

attacks with temporary displacement of hash power

in bitcoin digital currency. In early 2012 the Stratum

protocol has taken a deliberate decision to shift the

power of selecting which transactions are included

in blocks from miners to pool managers. This deci-

sion has stripped miners from the ability to decide on

which block they mine. In addition in Section 4 we

show that due to the technicalities in the exact hash-

ing mechanism in bitcoin, it is possible to design a

malicious mining protocol such that the attack cannot

be detected, not even in theory. However our attack

remains theoretical. Could the attack work with the

exact Stratum protocol as it is used in practice? In

this paper we have studied this protocol in details in

order to see if this type of attack could or not be im-

plemented in practice. We have analysed data sniffed

in the operation of 4 prominent bitcoin mining pools.

We have found that Stratum operates in such a way

that the attack COULD be detected if only miners do

the effort. They would need to permanently monitor

the packets exchanged over the network and check if

the hash of the previous block is correct.

This does NOT mean that the attack will be de-

tected, as most miners just mine and do not inspect

the data exchanged in the network. However the most

subversive man-in-the middle attacks such as our at-

tack of Section 4 are NOT facilitated with the cur-

rent protocol. We recommend that miners should be

very careful when mining with proprietary protocols

other than Stratum or in non-standard mining config-

urations as potentially they could be a part of a large

scale attack.

In this research we have discovered two quite sur-

prising things. First of all, the security of bitcoin

against double-spending attacks is now beyond the

scope of the strict open-source system and code cre-

ated by Satoshi, it depends on additional protocols

specified later. When Stratum was specified, it took

a critical decision to shift the decision of which trans-

actions are mined to the pools. This is precisely

what has led to the current excessive centralization

of bitcoin. Consequently bitcoin is no longer ex-

actly a decentralized open-source system. Crucial de-

cisions about the content of the bitcoin blockchain

now depend on a number of powerful stake holders

with vested interests Bitcoin is no longer a transpar-

ent open source system either. The software used by

pool managers is not open source, and for example

highly subversive forms of a 51 % attack (cf. Section

4) could be executed if some closed-source ASIC con-

trollers would have hidden commands which would

ICISSP2015-1stInternationalConferenceonInformationSystemsSecurityandPrivacy

104

allow them to hash with the value of H0 and with-

out knowing the previous block hash. This would

facilitate the attacks and it would be impossible for

a majority of miners to detect if they are part of an

attack. Miners would not even be able to determine

which pools are operating honestly, on which crypto

currency they are mining, and how their hash power

is used.

REFERENCES

Daniel Cawrey: What Are Bitcoin Nodes and Why Do We

Need Them?, 9 May 2014, http://www.coindesk.

com/bitcoin-nodes-need/

Nicolas Courtois, Marek Grajek, Rahul Naik: The Un-

reasonable Fundamental Incertitudes Behind Bitcoin

Mining, at http://arxiv.org/abs/1310.7935,

31 Oct 2013.

Nicolas Courtois, Marek Grajek, Rahul Naik: Optimizing

SHA256 in Bitcoin Mining, in proceedings of CSS

2014, Springer.

Nicolas T. Courtois, Lear Bahack: On Subversive Miner

Strategies and Block Withholding Attack in Bitcoin

Digital Currency, at http://arxiv.org/abs/

1402.1718, 28 January 2014.

Nicolas T. Courtois: On The Longest Chain Rule and Pro-

grammed Self-Destruction of Crypto Currencies, 20

May 2014, http://arxiv.org/abs/1405.0534.

Christian Decker, Roger Wattenhofer: Information propa-

gation in the bitcoin network, 13-th IEEE Conf. on

Peer-to-Peer Computing, 2013.

Christian Decker, Roger Wattenhofer: Bit-

coin Transaction Malleability and MtGox,

http://arxiv.org/pdf/1403.6676.pdf

Luke-Jr: getblocktemplate protocol, BIP

022 and BIP023, available from

https://en.bitcoin.it/wiki/Getblocktemplate.

Satoshi Nakamoto: Bitcoin: A Peer-to-Peer Electronic

Cash System, At http://bitcoin.org/bitcoin.

pdf

Robert Sams: The Marginal Cost of Cryp-

tocurrency, Blog entry at cryptonomics.org,

http://cryptonomics.org/2014/01/15/

the-marginal-cost-of-cryptocurrency/

Marek (slush) Palatinus, Stratum mining protocol, the

official documentation of lightweight bitcoin min-

ing protocol, https://mining.bitcoin.cz/

stratum-mining, developped in 2011-12. A com-

pact thrid-party description can also be found at

https://www.btcguild.com/new_protocol.php.

Meni Rosenfeld: Mining Pools Reward Methods, Pre-

sentation at Bitcoin 2013 Conference. http://www.

youtube.com/watch?v=5sgdD4mGPfg

Technical specification of the bitcoin protocol, 2009-

2014, https://en.bitcoin.it/wiki/Protocol_

specification

OnDetectionofBitcoinMiningRedirectionAttacks

105