A Linear Physical Programming Approach to Power Flow and

Energy Storage Optimization in Smart Grids Models

Gabriella Dellino

1

, Carlo Meloni

1,2

and Saverio Mascolo

2

1

Istituto per le Applicazioni del Calcolo (IAC) – CNR, Bari, Italy

2

Politecnico di Bari, Bari, Italy

Keywords: Optimal Power Flow, Energy Storage, Smart Grids, Planning, Optimization, Uncertainties.

Abstract: The Optimal Power Flow problem (OPF) plays a crucial role in the successful energy management of

modern smart grids. The diffusion of renewable energy sources poses new challenges to the power grid in

which integrated energy storage combined with green generation solutions can help to address challenges

associated with both power supply and demand variability. This work refers to a smart grid context and

proposes a time indexed OPF model considering storage dynamics, adopting a preference-based

optimization method with chance constraints to provide a suitable service level.

1 INTRODUCTION

Optimal Power Flow problem (OPF) plays a crucial

role in the successful management of modern power

grids.

The diffusion of renewable energy sources (even

in the demand side) poses new challenges to the

power grid in which integrated energy storage

combined with green generation solutions can help

to address challenges associated with both power

supply and demand variability (Chandy et al., 2010,

Koutsopoulos et al., 2011).

This paper reports on some optimization

modeling results of a research work which refers to a

smart grid context and proposes a time indexed

Optimal Power Flow (OPF) model which considers

storage dynamics and adopts a preference-based

optimization method (on the generation side) joined

with a chance constrained approach (on the demand

side) to provide a suitable level of service.

2 PROBLEM DESCRIPTION

The OPF is a class of constrained optimization

problems over a set of power/flow network variables

(Carpentier, 1962). In general the variables may

include active and reactive power outputs, generator

or bus voltages and phases; while the objective may

be the minimization of generation costs or the

maximization of user utilities or level of service; and

the constraints may be bounds on voltages or power

levels, or that the line loading not exceeding thermal

or stability limits. The OPF has been deeply studied

during the last decades and several optimization

techniques have been applied to both model and

solve it (Dommel and Tinney, 1968, Kallrath et al.,

2009).

In this paper, we develop a simple and general OPF

model with energy storage and study how storage

allows optimization of power generation across a

given time horizon considering an uncertain demand

and a system of preferences on the amount of

generated power.

The proposed OPF approach belongs to the family

of energy planning models (Huang et al., 2012,

Khalid and Savkin, 2010) and aims to find a one-

day-ahead energy production and distribution plan

determining:

a) how much load (i.e. demand) to satisfy;

b) when and how much power to draw from the grid;

c) when and how to charge the energy storage

system;

d) how to sell power back to the grid; while the goal

is to minimize the overall costs including energy,

devices and operations.

Besides OPF, which aims to search for the

conditions which give the lowest cost for energy

generation, storage and delivery, the implementation

of the planning results may be based on different

224

Dellino G., Meloni C. and Mascolo S..

A Linear Physical Programming Approach to Power Flow and Energy Storage Optimization in Smart Grids Models.

DOI: 10.5220/0005293602240231

In Proceedings of the International Conference on Operations Research and Enterprise Systems (ICORES-2015), pages 224-231

ISBN: 978-989-758-075-8

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

actuation strategies including Demand Shaping

(DS) and Energy Storage (ES).

The first is based on the (tentative) consumer

demand shaping through financial incentives;

encourages the consumer to: use less energy during

peak hours and/or shift the time of energy use to off-

peak times (i.e. night time, weekends). In the

approach based on Energy storage (ES) ad-hoc units

are required to store energy during off-peak hours

and to discharge (i.e., supply energy) during peak

hours (power leveling).

3 OPTIMAL POWER FLOW

INCREMENTAL MODELING

Developing the Optimal Power Flow model we

adopt an incremental approach interactively

involving decision-makers (e.g., as suggested by

Sierhuis and Selvin (1996)).

We start from a Conceptual Model (proposed by

Chandy et al., 2010) as the basis to develop more

complex and detailed models according to the needs

and the practice of the context.

3.1 Conceptual Model

The Conceptual Model refers to a Single-Bus and

Single-Generator case, but it can be extended to a

network, i.e., Multi-Bus and Multi-Generator cases.

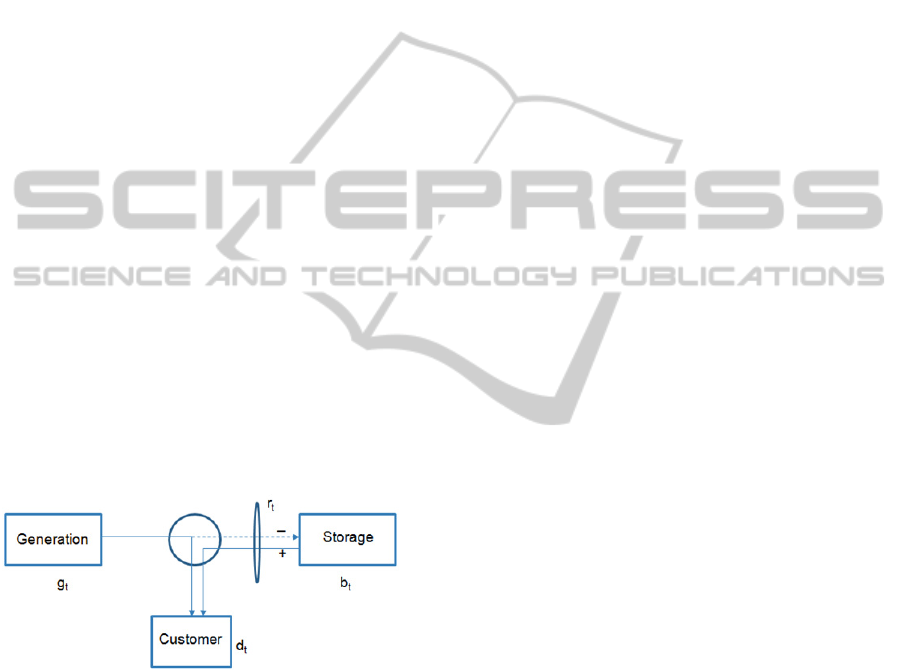

Figure 1: Reference scheme for the Conceptual Model

with respect to a single node

i

of the grid.

The OPF Conceptual Model refers to the scheme

depicted in Figure 1. It is a simple and general OPF

model with energy storage and time-varying

generation costs and power demand. It considers a

single generator connected to a single load; the so

called electric “per unit” DC model is assumed

leading to a simplified structure of the network in

which no reactive power is considered (Chandy et

al., 2010). The main difference from the classical

OPF is that storage allows optimization across time,

e.g. charge when the cost of generation is low and

discharge when it is high.

For each node i of the grid, the considered

Conceptual Model is a time-indexed optimization

problem characterized by a planning horizon

containing

T

time slots

t

(i.e.

t1,…,T

) of the same

length.

For each time slot t is known a value

d

t

for the

power demand. The variables of the problem are the

power

g

t

to be generate in time slot

t

, and the level

of charge

b

t

of the storage system in the time slot

t

,

which has a limited capacity of

B

. The energy flow

to and from the storage system is indicated as

r

t

, i.e.,

assuming positive values while batteries are

supplying energy and negative otherwise.

The considered optimization model includes a first

set of demand satisfaction constraints, and set of

constraints dealing with the level of charge of the

batteries, while all variables are required to be non-

negative.

The objective function is a cost to be minimized

containing a generation and a storage component.

The generation cost

can be assumed to be

quadratic and (possibly) time-varying. The

convexity of the cost function reflects a possible

decreased efficiency when producing very high

amounts of power (Chandy et al. 2010).

The storage cost

hb

t

is assumed to be dependent

only on the state of charge

b

t

(and not on the charge

or discharge rate); it can be formulated as a linear

penalty term for deviation from the desired target.

An additional component

kb

T

could be included to

represent an optional penalty for the deviation from

a final target value

b

T

(i.e.,

b

t

with

tT

) of the state

of charge.

The overall formulation leads to the following

mathematical program:

∑

(1)

subject to (for all t = 1,…, T):

(2)

(3)

0

(4)

0

(5)

0(6)

3.2 Case Study: Problem Setting and

Preliminary Results

We consider, as “basic” case study, a problem

introduced by Chandy et al. (2010) to illustrate the

characteristics of the Conceptual Model reported in

Section 3.1. This problem refers to a single-bus and

ALinearPhysicalProgrammingApproachtoPowerFlowandEnergyStorageOptimizationinSmartGridsModels

225

single-generator case under the assumption of an

electrical “per unit” DC model.

The considered planning horizon is

T24

hours

and each time step

t

has a duration of

1

hour.

According to the original model, the demand (in GJ

units) profile in the planning horizon is represented

by:

5010sin

(7)

The energy storage system is characterized by a

battery capacity

B25

GJ, and an initial level of

charge

b

0

12.5

GJ.

The additive components to the cost function

Z

−to

be minimized− are:

0.5

(8)

(9)

As proposed by Chandy et al. (2010), in our “basic”

case study some simplifications are included: i) the

last component, related to the final level of charge of

the batteries, is obmitted; ii) the cost coefficient is

constant in the planning horizon and fixed to

γ

t

1

for all

t

(invariant case) While the value of the

coefficient a was set to

2

.

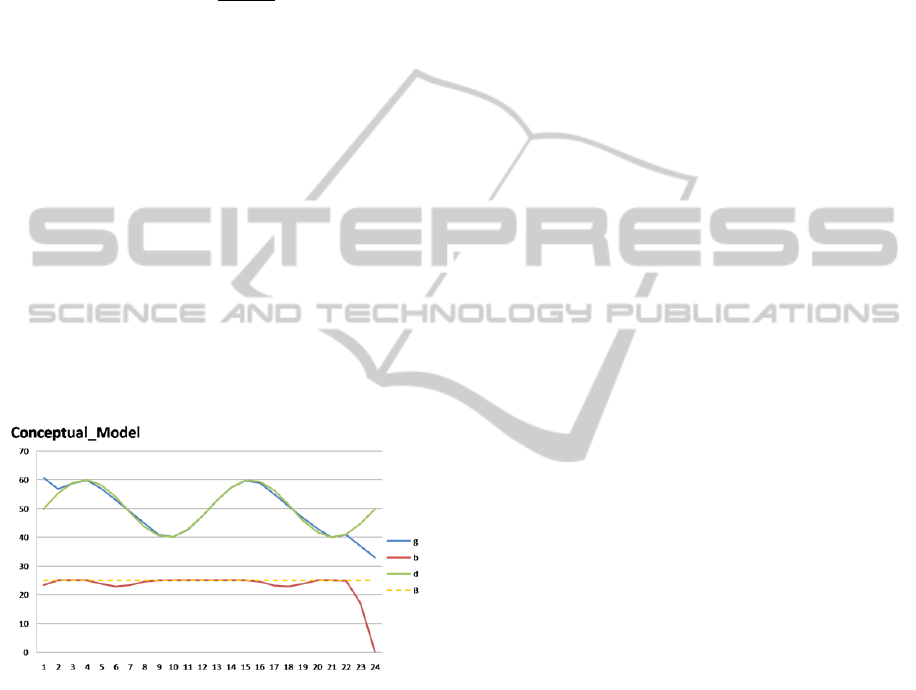

Figure 2: Conceptual Model Results for the basic case

study. The

x

-axis reports the time slots,

y

-axis indicates

power levels.

As depicted in Figure 2, according to Chandy et al.

(2010), the optimal generation

g

t

is linear when the

batteries charge and discharge, and follows the

demand when the storage system is at the maximum

level of charge. In the particular illustrative problem

setting, the storage system is hardly used at all and

appears quite oversized. In fact, it is mainly due to

the relative values of generation and storage costs

and their invariance in the planning horizon.

The energy storage system clearly needs a better

modeling to deal with the level of charge at the end

of the period. The decision-makers needs to consider

in the planning activities also the preference and

limitations on the generation-side and the possible

uncertainties on the demand-side.

3.3 OPF: Enhanced Models

Starting from the Conceptual Model, and on the

basis of the requirements defined in the application

context, we are working, together with the decision-

makers, on several modeling extensions mainly

devoted to address the following issues, which

compose our current research agenda:

1. Limitations on the flows to/from the storage

system in each time slot;

2. Generated flow possibly assumes negative values

(i.e., the Distribution System Operator (DSO)

should receive energy from the node);

3. Demand predictions possibly assume negative

values (i.e., customers should produce energy);

4. (Upper/Lower) Bounds on the amount of

generated energy (possibly negative), e.g.,

a) constant bounds;

b) time-dependent (yet known) bounds;

c) preferences (penalty based) on the level of

power generation;

5. Uncertainties affecting the demand forecasts

d

t

;

6. Storage system inefficiencies with respect to

holding, discharging and recharging phases;

7. Possible different energy sources;

8. More specific constraints related to the discharge

and recharge phases of specific classes of energy

storage systems;

9. Extension to a multi-generator and multi-bus

context.

In particular, in this work we address the modeling

issues related to points 4 and 5.

3.3.1 Uncertain Demand Forecasts

In general, uncertainties affecting the demand

forecasts

d

t

are described as prediction intervals and

error distributions (Box et al., 2008, Pflug and

Römisch, 2007, Narayanaswamy et al., 2012,

Conejo et al., 2010). On the basis of a demand

forecast, the planner receives, for each time slot, the

predicted value (i.e.,

d

t

), the prediction interval, and

the distribution of the values inside that interval.

On the basis of the forecasting values distribution

within the prediction interval (e.g., from

Autoregressive Integrated Moving Average

ICORES2015-InternationalConferenceonOperationsResearchandEnterpriseSystems

226

(ARIMA) or Support Vector Machines (SVM) time

series models) we adopt a chance constrained

approach (Charnes and Cooper, 1959) introducing a

new set of constraints −to replace constraints (2) in

the Conceptual Model (1)-(6)− in order to guarantee

a given probability of demand satisfaction:

Prg

t

r

t

d

t

1‐αfort1,...,T

(10)

They represent a set of Level-of-Service (LOS)

constraints and –noting that the uncertainty affects

only the r.h.s of each constraint– can be linearized

(Vanderbei, 2001) using the critical value

d

’

t

associated to

α

(i.e., the specific required level of

probability) through the probability density function

of the demand:

g

t

r

t

d'

t

fort1,...,T

(11)

Using these set of constraints instead of (2) leads to

a first enhanced model, hereinafter indicated as

EM1.

3.3.2 EM1: Additional Problem Settings and

Results

To test the enhanced model EM1, the basic case

study has been modified to consider the demand

uncertainties. The forecasted demand value (i.e., the

expected value) is assumed to be given by equation

(7) for each time slot

t

.

The effect of prediction uncertainties has been

modelled as a demand characterized in each time

slot by a normal distribution (other distributions can

be used instead) with mean given by the expected

value

d

t

(i.e., through equation (7)). Two different

scenarios has been considered. The first is

characterized, in each time slot, by a standard

deviation

σ

5%

0.05d

t

, while the second by

σ

10%

0.1d

t

. The probability of demand satisfaction

is set to obtain 3 scenarios for the level of service

(LOS):

70%

;

80%

and

90%

, respectively

(according to equation (10)).

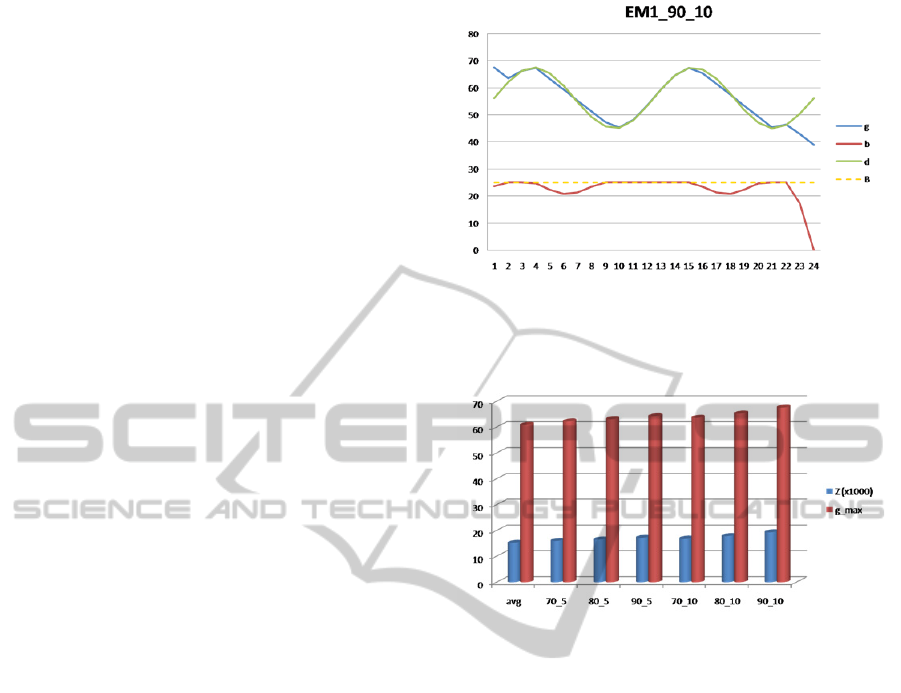

As an example, Figure 3 reports the results obtained

by EM1 in the scenario characterized by a LOS of

90%

and the higher demand variability.

Due to more severe demand requirements, the use of

the storage system increases in the optimal plan. The

optimal generation

g

t

holds an almost linear

behavior when the storage charges and discharges,

and still matches the demand when the storage

system is saturated. The storage system still calls

for a better consideration of the behavior at end of

the period.

Figure 3: EM1 Results for the case study with

LOS90%

and σ

10%

.

The

x

-axis reports the time slots,

y

-axis indicates

power levels.

Figure 4: EM1 results for all scenarios: costs

Z

and the

maximum generated power

g_max

.

Decision-makers acknowledge the practical

relevance of this approach on the demand-side but

they need to improve the model on the generation-

side to allow a better management of the amount of

generated energy.

More specifically, decision-makers find this models

not comfortable as the

g_max

is close (or even over)

the generation capacity of the node, and they are

called to negotiate additional power to/from other

nodes of the grid.

Figure 4 shows the results for all the scenarios in

terms of the total cost

Z

and the maximum generated

power

g_max

in the time slots within the planning

period. In this figure, the scenario indicated as “avg”

represents the base original scenario in which the

expected values of the demand

d

t

are considered for

each time slot (i.e., without demand variability).

Other different scenarios are indicated in the x-axis

with a label XX_Y, where XX represents the

required LOS, and Y the amount of demand

variability (i.e.,

σ

5%

or

σ

10%

).

ALinearPhysicalProgrammingApproachtoPowerFlowandEnergyStorageOptimizationinSmartGridsModels

227

3.3.3 A Preference-based Generation

Management

In their planning activity, decision makers are

subject to limitations in the amount of power that

can be generated. Clearly, this issue can be easily

addressed introducing a direct (and constant) bound

on all the

g

t

variables.

More in general, we can consider the case with time-

dependent (yet known) bounds in which, for each

node of the grid, we introduce a capacity

G

t

MAX

that

bounds the value of

g

t

. Nevertheless, decision

makers are used to reason in terms of operative

ranges, an approach which is only partially

supported by a quadratic model for the generation

costs as considered in the conceptual model and in

EM1.

The need expressed by decision makers suggest us

to setup a new enhanced model EM2 including the

generation management with preferences on the

different possible operative ranges.

In this modeling extension, these preferences are

taken into account by a (linear) progressive penalty

system.

The operative ranges in the feasible range

0,G

t

MAX

indicated by the decision makers are represented in

Figure 5 and are characterized as follows:

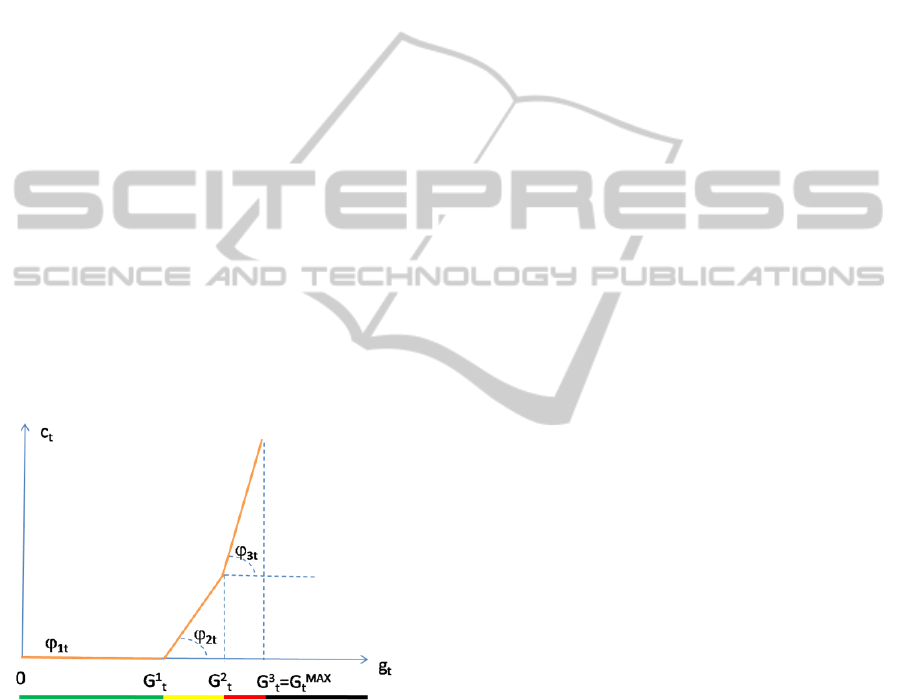

Figure 5: the generation cost

c

t

with a progressive linear

penalty system based on different operative ranges.

OPERATIVE_RANGE 1 (OR1):

0, G

1

t

this

operational region is “preferred” or

“desirable” and has an associated NULL

penalty (in Figure 5 it is indicated in green)

assuming

φ

1

t

0;

OPERATIVE_RANGE 2 (OR2):

G

1

t

, G

2

t

this

region is considered “tolerable” (indicated in

yellow in Figure 5), and has a penalty

described by a slope

φ

2

t

0;

OPERATIVE_RANGE 3 (OR3):

G

2

t

, G

3

t

these

values are “undesirable” (yet feasible, they

are marked in red in Figure 5) and have a

penalty represented by the slope

φ

3

t

, with

φ

3

t

0.

The level

G

3

t

coincides with

G

t

MAX

which indicates

the production capacity of the system, i.e., any

generation level

g

t

G

t

MAX

is not feasible (in Figure

5 it is indicated in black).

For any feasible value

g

t

of energy generated in the

time slot

t

, the cost is composed by a base-cost

given by c

t

g

t

and the additional penalty components

depending on the region belonging

g

t

.

The system of penalties is formulated introducing a

new set of constraints in the OPF model.

The first group of constraints takes into account the

generation capacity in each time slot:

1,…, (12)

For each

ORi

and for each time slot

t

, we introduce a

new set of variables

it

0

representing the

displacement in that operative range of the power

generated during the time slot

t

. These displacement

variables are required to satisfy, for each operative

region

ORi

with

i2

, the following constraints:

1,…, (13)

The additional (linear) contribute to the cost function

for each time slot

t

is given by:

∑

(14)

with

,

, and

0.

All these elements, in addition to the extensions

already considered in EM1 lead to a new enhanced

model we indicate hereinafter as EM2.

The weights

W

it

(and so slopes

φ

it

) are determined

on the basis of additional indications provided by the

decision makers.

More specifically, as the range limits define the

preference internally to each single time slot (i.e.,

intra-period), they suggest a particular One-Versus-

Other (OVO) rule to describe their inter-period

preferences.

In fact, they prefer to minimize “as a priority” the

number of “red” time-slots (i.e., those showing a

positive displacement in

OR3

) and the amount of

energy belonging in that region, and then those in

“yellow” (i.e., the time slots limiting the power

generation, at most, to

OR2

).

Overall, the preference based system

proposed/shared with the decision makers belongs to

ICORES2015-InternationalConferenceonOperationsResearchandEnterpriseSystems

228

the family of the so called Linear Physical

Programming (LPP) Models (e.g., see Messac,

1996).

3.3.4 EM2: Additional Problem Setting and

Results

To test the enhanced model EM2, the previous case

study has been enriched. Besides the consideration

of the demand uncertainties, the model of the energy

storage system has been modified considering a

battery capacity

B25

GJ, a battery initial level of

charge

b

0

0.8B

, and the following additional

constraint on the final level of charge:

(15)

and a new set of bounds on the minimum operative

level of charge, required to be at least

b

min

0.05B

:

1,…, (16)

The component of the cost function related to the

energy storage system is the same considered in

EM1, while the base-component of the power

generation cost is linear with a unitary cost given by

c

t

0.5

, considered as constant in all the time slots.

The components of the generation cost, related to the

preference system and the OVO rule, are determined

on the basis of the following

ORi

:

OR1:

0,50,

OR2:

50,57.5,

OR3:

57.5,60,

giving the weights

W

2

0.013

, and

W

3

1

.

The modeling of the demand behavior and its

variability are the same considered in the setting of

the previous case study, as well as the three

LOS

scenarios.

In general, due to the more challenge context, the

use of the energy storage system has increased in all

the considered scenarios playing an important role to

cope with periods characterized by higher demand

levels taking into account the generation constraints.

It is worth to note that the linearity of the generated

power when batteries are charging/discharging does

not hold for EM2. Moreover, the storage system

shows a satisfactory behaviour also in the terminal

phase of the considered planning period.

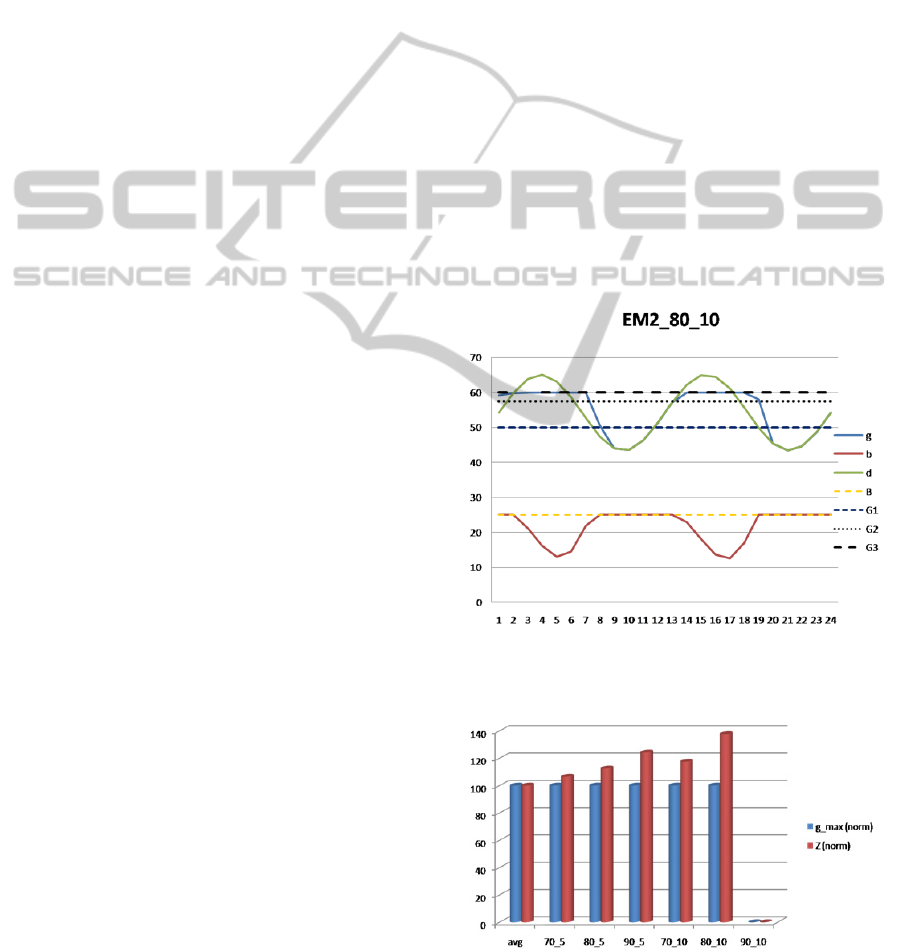

Figure 6 reports a representative sample of the

results obtained by EM2. In particular, the figure

refers to the scenario characterized by a LOS of

80%

and the higher demand variability and clearly shows

the power leveling effect of the energy storage

system which charges during off-peak hours and

discharges during peak hours.

Figure 7 shows the results for all the scenarios in

terms of the total cost Z and the maximum generated

power g_max in the time slots within the planning

period. Again, as in Figure 4, the scenario indicated

as “avg” represents the base original scenario

without the superimposed demand variability, while

other different scenarios are indicated with the same

XX_Y notation. In this case, all the results are

normalized w.r.t. the “avg” scenario and it is clear

how EM2 is able to give an almost constant g_max

among the different scenarios. As expected, these

results show costs increasing as the LOS and the

demand variability increase.

The decision makers, on the basis of the results

obtained by the enhanced model EM2, often

consider also different corrective actions including

demand shaping (on the demand-side), negotiation

to sell or buy energy (on the grid-side). EM2 gives

useful information to support these management

activities.

Figure 6: EM2 Results for the case study with

LOS80%

and

σ

10%

. The

x

-axis reports the time slots,

y

-axis

indicates power levels.

Figure 7: EM2 results (normalized w.r.t. the “avg”

scenario) for all scenarios: costs

Z

and the maximum

generated power

g_max

.

ALinearPhysicalProgrammingApproachtoPowerFlowandEnergyStorageOptimizationinSmartGridsModels

229

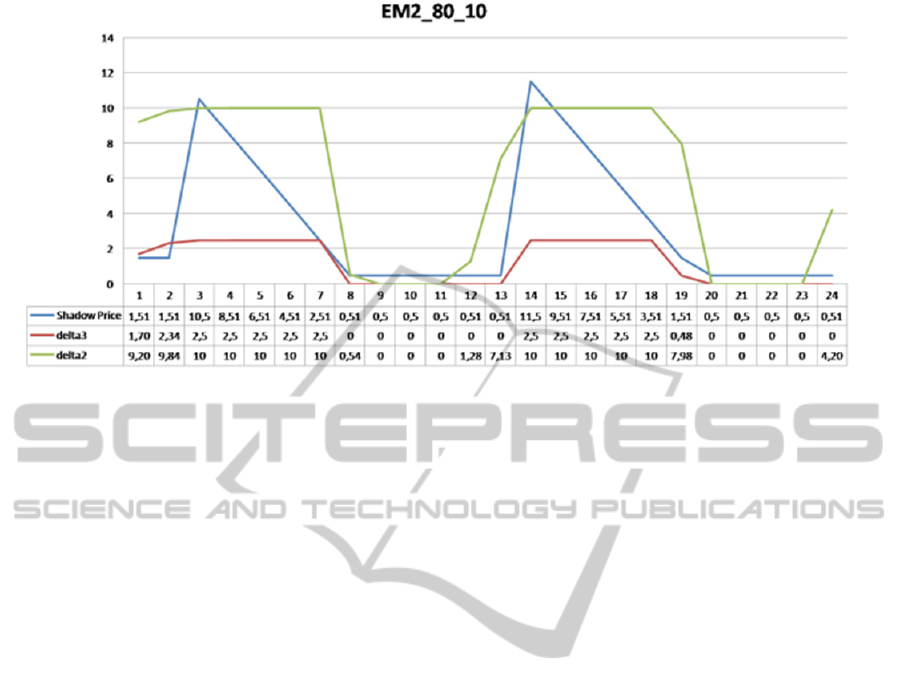

Figure 8: EM2 Results for the case study with LOS = 80% and σ10%. Displacements variables in OR2 and OR3, and

energy shadow prices in each time slot.

Firstly, these information are represented by the

displacement variables in the different operative

regions which indicate the level of production and

its severity in each time slot.

Secondly, this information can be easily

incorporated in a managerial dashboard joined with

an estimation of the marginal value of a power unit

(to sell or buy) in each time slot in the planning

horizon.

EM2 provides this kind of estimation in terms of

shadow prices associated to the demand (

LOS

)

satisfaction constraints. Figure 8 reports −for the

scenario with higher demand variability and a LOS

of

80%

− an example of these useful information in

numerical as well as graphical forms.

4 CONCLUSIONS

In this paper we develop an Optimal Power Flow

model adopting an incremental approach

interactively involving decision-makers.

We start from a simple conceptual model as the

basis to develop more complex and detailed models

according to the needs of the decision-makers trying

to bridging the gap between modeling and the

practice.

The interactive modeling development allows us to

individuate several directions to develop enhanced

models including the extension to networks (i.e.,

Multi-Bus and Multi-Generator cases); the

representation of relevant storage system

inefficiencies and more specific constraints related

to the discharge and recharge phases of specific

classes of energy storage systems.

ACKNOWLEDGEMENTS

This work was supported by the Project "RES

Novae" (Reti, Edifici, Strade - nuovi obiettivi

virtuosi per l'ambiente e l'energia), 2012-2015,

funded by MIUR (Italy).

REFERENCES

Box, G.E.P., Jenkins, G.M., Reinsel G.C., 2008, Time

Series Analysis: Forecasting and Control, 4th ed.

John Wiley & Sons.

Carpentier J., 1962, Contribution to the economic dispatch

problem, Bull. Soc. Franc. Electr.,vol. 3, no. 8, pp.

431-447.

Chandy, K.M., Low, S.H., Topcu U., Xu H., 2010, A

simple optimal power flow model with energy storage,

in Proc. of 49th IEEE Conference on Decision and

Control (CDC 2010), Atlanta, GA, pp. 1051-1057.

Charnes, A., Cooper, W.W., 1959 Chance constrained

programming, Management Science, 6, 73–80.

Conejo A.J., Carrión M., Morales J.M., 2010, Decision

making under uncertainty in electricity markets,

Springer International Series in Operations Research

and Management Science.

Dommel H., Tinney W., 1968, Optimal power flow

solutions, IEEE Transactions on Power Apparatus and

Systems, vol. 87, no. 10, pp. 1866-1876.

Huang, L., Walrand, J., Ramchandran, K., 2012, Optimal

Demand Response with Energy Storage Management,

in Proc. of IEEE Third International Conference on

ICORES2015-InternationalConferenceonOperationsResearchandEnterpriseSystems

230

Smart Grid Communications (SmartGridComm 2012),

Tainan, 61-66.

Kallrath J., Pardalos P.M., Rebennack S., Scheidt, M.,

2009, Optimization in the energy industry,,Springer.

Khalid, M., Savkin, A.V., 2010, Model predictive control

based efficient operation of battery energy storage

system for primary frequency control, in Proc. of 11

th

International Conference on Control Automation

Robotics Vision (ICARCV), 2248–2252.

Koutsopoulos, I., Hatzi, V., Tassiulas, L., 2011, Optimal

Energy Storage Control Policies for the Smart Power

Grid, in Proc. of 2011 IEEE International Conference

on Smart Grid Communications (SmartGridComm

2011), Brussels, pp. 475- 480.

Messac A., 1996, Physical Programming: Effective

Optimization for Computational Design, AIAA

Journal, 34(1). 149-158.

Narayanaswamy, B.; Garg, V.K.; Jayram, T.S., 2012,

Prediction Based Storage Management in the Smart

Grid, in Proc. of 2012 IEEE Third International

Conference on Smart Grid Communications

(SmartGridComm 2012), Tainan, 498-503.

Pflug G.C., Römisch W., 2007, Modeling and managing

risk, World Scientific.

Sierhuis, M., Selvin, A.M., 1996, Towards a Framework

for Collaborative Modeling and Simulation. Proc. of

the Workshop on Strategies for Collaborative

Modeling and Simulation, CSCW'96 Conference,

Boston, USA.

Vanderbei, R.J., 2001, Linear Programming: Foundations

and Extensions, 2nd ed.. Kluwer Academic Publishers,

Dordrecht, Netherlands.

ALinearPhysicalProgrammingApproachtoPowerFlowandEnergyStorageOptimizationinSmartGridsModels

231