Building Coalitions of Competitors in the Negotiation of Multiparty

e-Contracts through Consultations

Anderson P. Avila-Santos, Jhonatan Hulse, Daniel S. Kaster and Evandro Baccarin

Department of Computing, University of Londrina, Londrina, PR, Brazil

Keywords:

Multiparty e-Contracts, Negotiation Protocol, Auction, Coalition, Consultation, Multiparty Negotiation,

Fairness.

Abstract:

This paper argues that software agents may build two kinds of coalitions in e-negotiation processes. The first is

the typical one in which the parties define roles, rights, guarantees before the negotiation starts. They act as a

team. Either the whole coalition succeeds in the negotiation or fails. In the second one, addressed by this paper,

the coalition members are competitors. They collaborate exchanging information before the negotiation trying

to align their strategies to some degree. Such collaboration only occurs because there is some particularity

(e.g., nearness) that can optimise their business processes if most of the coalition members succeed in the

negotiation. They aim at maximising their chances of success in the negotiation, but act solo. It is important

to note that the main challenge in this scenario lays on the fact that the coalition members are not bind to the

coalition. They may act within the negotiation differently from what they had agreed previously. This gives

rise to the concept of fairness, which is discussed in this paper. The paper also argues that the materialisation

of coalitions within a negotiation protocol fits better in a multiparty negotiation protocol. Thus, it extends the

SPICA Negotiation Protocol with the so-called consultations. The paper presents a study case that shows that

consultations can be benefic to the suppliers, the industry and the consumers.

1 INTRODUCTION

A coalition is an arrangement of two or more par-

ties who cooperate to attain a mutually desired out-

come (Guo and Lim, 2012). It may leverage a given

particularity common to a few negotiators in a way

that is advantageous to other parties besides those ne-

gotiators themselves.

In previous papers, we presented SPICA’s multi-

party contracts and negotiation protocol. If all clauses

were successfully negotiated, a multiparty contract is

signed by the involved parties. This paper extends

the negotiation protocol allowing that a few negotia-

tors, although competitors, organised in a coalition,

exchange information that may help their own deci-

sion making during the negotiation. Such an exten-

sion is made by means of the so-called consultations.

We argue that with minimal change in our negotiation

protocol, we have open a wide window of possibilities

of new patterns of negotiation.

The problem assessed in this paper is how to allow

members of a coalition exchange information and in-

tentions to achieve some kind of benefit within a mul-

tiparty negotiation, restricted that each of them plays

solo within the very negotiation. As a consequence,

only a subset of the coalition members may be suc-

cessful in the negotiation. One alternative would be

the members sign a subsidiary contract among them,

however, this alternative would oblige every member

to honor the subsidiary contract evenif one or more of

them do not win the subsequent negotiation. The ap-

proach we introduce in the paper is to allow members

of a coalition perform a “draft” negotiation, in a way

they may align their strategies, without obliging them.

This gives rise to the discussion about the fairness of

the coalition members.

To illustrate the problem, consider the negotiation

scenario depicted in Figure 1. There is a food com-

pany (FC) that produces granola. Among other in-

gredients, it needs to buy grapes. There are six grape

producers (G

1

. . . G

6

), however, none can individually

fulfil the whole amount of grapes needed by the in-

dustry. Thus, it will buy grapes from half of them.

Due to the geographic specificities, there are 2 groups

of grape producers: farms G

1

, G

2

and G

3

can share

the transportation means (they are on the fringes of

the road R

1

) and the others cannot. Thus, the farms

G

1

to G

3

intend to take advantage of their nearness

618

Avila-Santos A., Hulse J., Kaster D. and Baccarin E..

Building Coalitions of Competitors in the Negotiation of Multiparty e-Contracts through Consultations.

DOI: 10.5220/0005372506180625

In Proceedings of the 17th International Conference on Enterprise Information Systems (ICEIS-2015), pages 618-625

ISBN: 978-989-758-097-0

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

Figure 1: The Granola Company negotiation scenario.

and build an alliance among them to leverage their

competitiveness against the other producers. Never-

theless, as none of them is sure that will win the nego-

tiation with FC, signing a subsidiary contract to guar-

antee the transportation sharing is too risky.

The main contributions of this paper are: (1) it

proposes an extension of our multiparty negotiation

protocol that allows coalition member to exchange

not binding information about their intentions to im-

prove the negotiation process without exposing sensi-

ble information; (2) it shows that such informationex-

changing among the coalition member benefits other

parties besides the members themselves; (3) it shows

that the coalition members do better when they are

committed to the coalition.

This paper is organised as follows. Section 3

overviews a multiparty contract and a multiparty ne-

gotiation protocol we proposed previously. Section 4

extends SPICA with consultations. Section 5 presents

the implementation scenario described above. Sec-

tion 6 runs several experiments using this negotiation

scenario with and without consultation and assesses

the outputs. Section 7 presents related work. Finally,

Section 8 concludes the paper.

2 COALITIONS OF

COMPETITORS: A NEW

APPROACH

Coalitions among players of a givenindustry is a com-

mon practice. They may associate to make the local

market less inhospitable for all of them, to cut costs,

to increase profits, etc. However, such an association

is previously built in a way to protect their individual

interests. Different types of legal instruments, such

as contracts, covenants and treaties, are used to es-

tablish clear boundaries among the members. They

can carefully choose which information will be shared

and provide penalties in case of a misbehaviour.

There is another type of coalition, perhaps less or-

ganised, less structured in which the association do

not only depend on the members’ will, but also on

the events to come. We name this type as coalition of

competitors. For instance, in the scenario presented

in Sec. 1, a few farms are competitors, however none

of them is able to provide alone the amount of grapes

demanded by the food company. They can be more

competitive working together, expecting that all of

them will provide grapes for the food company. How-

ever, such expectancy will be confirmed (or not) by a

subsequent (future) negotiation in which other play-

ers also take part. In this case, only prudential trust

can be employed.

This paper focuses a few interesting questions that

arises in the second type of coalition, such as: in what

extent can a party trust in another coalition member?

Will it behaviour within the actual negotiation as the

coalition has sketched in advance? Is it worth to take

the risk of taking part of such coalition?

These questions give rise to another concept that

we refer as fairness. It expresses the level of confor-

mance of the actions a negotiator takes comparing to

what it promised to the coalition.

3 SPICA MULTIPARTY

CONTRACT AND

NEGOTIATION PROTOCOL

In this section, we present a glimpse of our multiparty

contracts and negotiation protocol. This brief explica-

tion provides to the reader a few concepts she needs

to understand our proposal.

The negotiation process is guided by a contract

template. Negotiators exchange messages that com-

ply with the SPICA negotiation protocol. One of the

negotiators is the so-called Leader, who coordinates

the negotiation process. If there is an agreement, a

contract instance is produced and signed. The negoti-

ation process may be helped by the so-called Notary.

It is a trustworthy third-party that, e.g., receives and

counts votes.

A contract template consists of a set of clauses

with blanks to be filled in. Such blanks are referred

to by the so-called properties and the negotiation pro-

cess aims at assigning values to them. Thus, a con-

tract instance is a contract template with its properties

successfully negotiated. The obligations (or rights)

stated in a clause may bind (or benefit) several part-

ners. Roughly, a clause is composed of a text that

describes the rights and obligations and two lists of

partners. The description is a plain text, but its words

may be prefixed by an ontology name that elucidates

the intended meaning of such word. Property names

may also be embedded in the text. In addition there

BuildingCoalitionsofCompetitorsintheNegotiationofMultipartye-ContractsthroughConsultations

619

are two lists with identifications: the so-called obliged

partners, i.e., the ones that should cooperate to ac-

complished the clauses provisions; the so-called au-

thorized partners those that will share its benefits.

An illustrative example of a clause for the scenario

proposed in Section 1 after it was negotiated is pre-

sented in Fig. 2. In a nutshell, this clause rules that

farms G1, G2 and G4 (obliged parties) must deliver a

given amount (property QTY) of grapes to FC (autho-

rized party) at a given price per ton (property PTON).

The values agreed within the negotiation are assigned

elsewhere in the contract.

text:

The @OBLIGED will deliver to

@AUTHORIZED the amount of #QTY tons of grapes

at the price of #PTON euros each ton.

obliged:

G1,G2,G4

authorized:

FC

Figure 2: A simplified clause.

Basically, a negotiation process runs as follows.

In general, the negotiation of a contract is a part of a

larger process that is controlled by another entity of

our framework, the so-called Coordination Manager

(CM) (Bacarin et al., 2004). Such a manager demands

that a given contract model be negotiated. A new ne-

gotiation instance is created and a leader negotiator is

chosen. This leader decides how the properties will

be negotiated. The leader chooses the most appropri-

ate style to negotiate the properties of a clause. In

our scenario, six farms competed (within an auction)

to deliver the grapes, but only the winners are nomi-

nated in the obliged list and will cooperateto provided

that total amount of grapes expected by FC, e.g., each

one will provide a third of QTY. Note also, that a few

of them are coalition members (G1 and G2), but G4

is not. A detailed discussion about our proposal for

multiparty contracts is outside the scope of this paper.

The protocol defines the messages and the data ex-

changed among the players of a negotiation. They

convey several parameters that tune up a specific ne-

gotiation, identify the sender and the receivers, and

help establishing correlation among messages. Only

the relevant parameters for the purpose of this paper

are presented.

3.1 Exchanging Data Types

Most of the negotiation messages build on two ba-

sic data types: Request For Proposals (RFPs) and Of-

fers. An RFP invitesanother party to negotiate a set of

properties. A negotiator A sends an RFP to a negotia-

tor B asking for a value for one or more properties.

More specifically, an RFP conveys three pieces of

data: a set of asked properties, a set of assigned prop-

erties and a restriction. The example below shows an

RFP written in a simplified notation. The RFP pro-

poses a value for

QTY

(3), asks a value for property

PTON

, but imposes that it would be lesser than 700.

≪{

QTY:3

}

,

{

PTON

}

,‘PTON

<

700’

≫

A negotiator A proposes a value to one or more

properties sending an Offer to a negotiator B. If ne-

gotiator B accepts it, both negotiators are committed

to the proposed values. A negotiator answers an RFP

sending back an Offer that assigns values to the asked

properties.

The example below shows an Offer that answers

the previous RFP. Note that this Offer does not change

the proposed value for property

QTY

(it should not)

and assigns the value 690 to property

PTON

.

[QTY=3, PTON=690]

RFPs and Offers are used to build several styles

of negotiation that boil down to three basic ones: bar-

gain, ballots, and auctions. Bargains are used within

bilateral negotiation, auctions are used when there

is competition among a few negotiator, and ballots,

when consensus among negotiators are needed. Other

styles (e.g., different flavours of auctions) are ob-

tained from different setups of these basic ones.

3.2 Negotiation Interfaces

The negotiation messages are defined by means of a

set of interfaces (Java, in the current implementation)

with methods to be implemented by the different ne-

gotiation players.

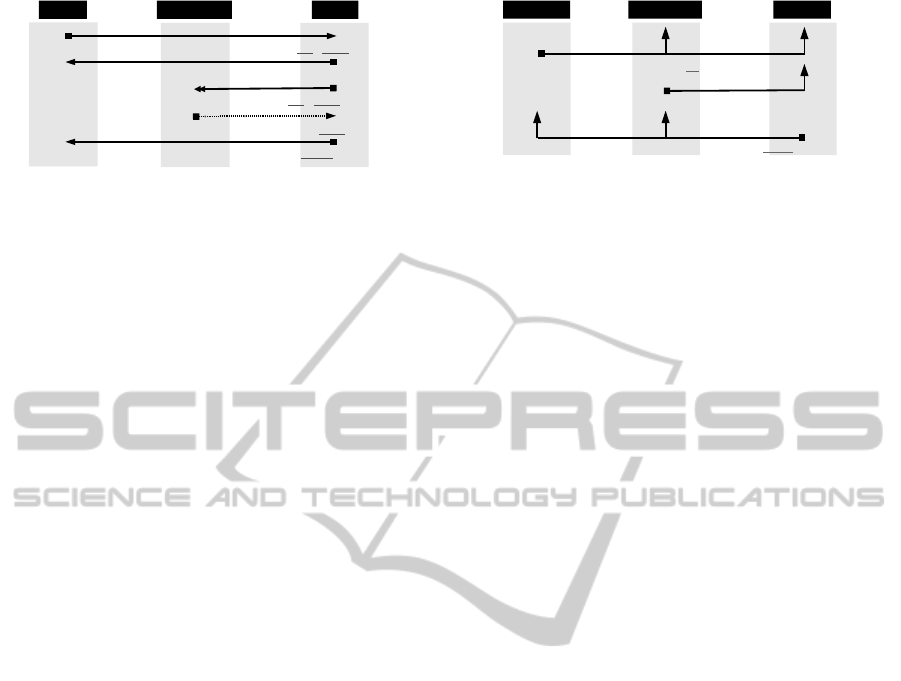

Figure 3 exemplifies the use of some of those in-

terfaces. It depicts the auction messages and the play-

ers. The players are: the Notary, the Leader negotiator

(FC) and other negotiators (farms). The exchanged

messages are represented by arrows (e.g., the first ar-

row depicts the sending of a message from Leader

to Notary). Each arrow has a caption that displays

the message sent (firstAnswerToProposal, in the ex-

ample). This caption presents the name and the main

parameters of the invoked method with a prefix that

identifies its interface (LeaderIF, in the example).

An auction is a sequence of the so-called auction

steps: (1) The Leader sends a firstAnswerToProposal

message asking the Notary to advertise and conduct

an auction. This message inform the Notary how

many bids (nbids) to collect (e.g., 3) within a given in-

terval t (e.g., 10s). The auction’s subject is described

either by an RFP or by an Offer. In the former, the

bidders propose values for asked properties (as usual

ICEIS2015-17thInternationalConferenceonEnterpriseInformationSystems

620

!

Figure 3: The steps of an auction in SPICA.

in English auctions); in the latter, the interested bid-

ders may agree to the proposal (as usual in Dutch

auctions). From now on, we will use RFP auctions.

(2) The Notary accepts the task (message willAuc-

tion) and broadcasts the RFP (message requestPro-

posal) and waits as demanded. The negotiators re-

ceive the RFP and (3) send Offers to the Notary in

response (message receiveProposal). The Notary col-

lects them and (4) sends them to the Leader (message

collectedAnswersToProposal). If the Leader guesses

it can have better bids, it may run another auction step

enhancing the restrictions stated in the RFP: in the ex-

ample it would try to decrease the grape price. For in-

stance, if the cheapest bid received within the auction

step proposed PTON=690, FC would ask the Notary

to conduct another step imposing that PTON<690.

Ballots have a similar pattern. Briefly, votes are

sent instead of bids. Bargains happen between only

two negotiators.

4 INCLUDING CONSULTATIONS

IN e-NEGOTIATION PATTERNS

The negotiators in a coalition use the so-called consul-

tations to exchange information about their intentions

or trying to establishing mutual consensus during the

negotiation process. It is important to note that the

consultation process happens “out the boundaries” of

the negotiation process and its results are not binding.

It means that a negotiator’s actions within the negoti-

ation process need not comply to its response within

a previous consultation.

We augmented the protocol with the so-called

consultation messages, specified by means of a few

new interfaces, which uses two exchanging data

types: Requests For Information (RFIs) and Informa-

tion (Info). We also provided a trusted third party to

help the consultation interactions, the so-called Medi-

ator.

An RFI is very similar to an RFP: it asks values

for properties, but also lower and upper bounds for

them. An Info is similar to an Offer: it proposes val-

ues for asked properties and also informs upper and

Figure 4: Pattern Summary of Intentions in SPICA.

lower bounds for them, however, the negotiator which

issued an Info is not committed to it.

The consultations may happen in two different

ways: (a) aiming at convergence of intentions; or (b)

agreeing on proposal. These patterns are described in

the following.

In convergence of intentions, the negotiators share

information and each of them makes its better effort

trying to align their strategies. For instance, in our

negotiation scenario, the negotiators inform their in-

dividual transportation cost and based the aggregated

mean value, they estimate how much they would save

if they shared the transportation means. Thus, each

negotiator make a more attractive individual offer to

the food company. This pattern as two flavours: (a)

Summary of Intentions; and (b) Burst of Intentions.

• Summary of Intentions: Figure 4 depicts this

kind of consultation. It is started by means of

the message consultTendency. Such message is

answered by a subsequent receiveVeiledIntention

message. This message does not disclose the

negotiator’s intentions to the group, but sends

them to the Mediator who summarises all received

intentions (e.g., calculate the mean value) and

broadcasts the summary to the group (message re-

ceiveIntentionSummary).

• Burst of Intentions: A negotiator asks other ne-

gotiators about their intentions regarding a spe-

cific issue. All negotiators broadcast their inten-

tions. It is not helped by a Mediator.

In the Agreeing on Proposal pattern, the negotia-

tors aim at a consensual answer for a specific issue. It

is similar to the Summary of Intentions pattern, but a

ballot is run to find such consensus.

5 TEST CASE: GRANOLA

COMPANY

This section presents the implementation of the ne-

gotiation scenario in Sec. 1. For brevity’s sake, the

focus of the paper lays on the negotiation of one item

(grapes) and the consultation pattern is the Summary

of Intentions.

BuildingCoalitionsofCompetitorsintheNegotiationofMultipartye-ContractsthroughConsultations

621

The negotiation Leader is the food company (FC)

which provides the contract model. FC wants to pay

the least price. Thus, it runs several auction steps

asking decreasing prices for the grapes. At the end,

FC will agree with the three best bids to provide the

grapes. Note that, there can be zero to three CC mem-

bers among the providers.

By their turn, the grape producers use decision

tables to assess the proposals they receive: for each

property each negotiator has a value (or a range of

values) it considers a “good deal” (i.e., the expected

value – EV) and for which it will always agree upon.

There are also values the negotiator will never agree

upon. Values in-between will be accepted with spe-

cific probabilities: the nearer to the expected value,

the higher the acceptance probability. Decision tables

keep such values and probabilities. Such strategy, al-

though simple, is quite effective to simulate the nego-

tiation.

A few of the grape producers can share the trans-

portation to enhance competitiveness (G

1

, G

2

and

G

3

). Thus, they compose a consultation community

(CC). The community’s negotiators may change (tem-

porarily) their expected values (EV) according to the

consultation result. It was implemented as follows.

Each CC member, besides its decision table, keeps

two pieces of information: the total production cost

(ToPC) and the percentage the transportation con-

tributes to the total cost (TRCp). Thus, the nego-

tiator’s expected profit (EP) is easily calculated as a

function of TPC, TRCp and EV.

Before negotiating the grapes, the CC runs a con-

sultation of the kind summary of intentions, as fol-

lows. (i) Each negotiator sends to the Mediator its

transportation cost. (ii) The Mediator returns to the

CC members the mean value (TRCm). (iii) The ne-

gotiators assume that TRCm will be the total trans-

portation cost for them. Such assumption considers

that a single truck load is able to transport the grapes

of all those producers, therefore it would be under-

used by a single producer. Since they will share the

transportation, each negotiator will chip in a third of

this value (they are 3 members). (iv) Next, they re-

calculate their expected value to have the same profit

margin they would have previously (EV’). (v) Finally,

the CC members partake the negotiation using the ad-

justed decision table.

It is noteworthy that the presentedconsultation did

not considered a property of the contract. Instead

of consulting about the value of the grapes (contract

property), the consultation was about another param-

eter that the negotiators could minimise if they could

take advantage of their geographical nearness (i.e, the

transportation cost).

The reasons for using a Summary of Intentions

were twofold: it aimed at maximising the win-win ap-

proach among the CC members and also hiding sen-

sible values.

Once consultation is not binding, the commitment

a negotiator has regarding to CC may vary. We refer

to the level of commitment of a negotiator as its fair-

ness: the more committed, the fairer. The measure of

fairness is a real number in the range [0, 1]: 0 means

that the negotiator is not committed at all to the con-

sultation results; 1 means that the negotiator is fully

committed to such results. To evaluate how the fair-

ness behaviour affects the performance of a CC, each

CC member keeps another piece of information: its

fairness (F). Every member will change its expected

value to ((F ∗ EV

′

) + (1− F) ∗ EV). Thus, in one ex-

treme a fully fair CC member (F = 1) will use the

recalculated expected value (EV’) as described previ-

ously. Conversely, a fully unfair member (F = 0) will

not change its decision table.

6 ASSESSMENT

We ran several experiments to assess the outcomes of

using consultations in the test case.

The experiments presented in this section address

the following questions.

1. Have the coalition members provided grapes to

the industry as a group more often than individ-

ually?

2. Has the profit of the each coalition member in-

creased when compared to the profit the farm had

before becoming a coalition member?

3. Has the procurement price decreased (for the in-

dustry)?

4. In what degree the level of commitment (fair-

ness) of the coalition members influence the re-

sults for a given individual member and for the

whole coalition?

The first and second questions assess whether the

coalition was advantageous for its members. The

third question tries to determine if the coalition con-

ferred benefits to the consumers. It supposes that,

once the industry obtains cheaper grapes, its products

can also cost less to the consumers. The last question

assesses the level of risk of using consultations, since

they do not imply strict commitments.

We built a basic setup that aimed at assessing the

first three questions by means of a batch of execu-

tions. In this setup, all CC members had their fairness

set to 1 (fully committed). To evaluate fairness, the

ICEIS2015-17thInternationalConferenceonEnterpriseInformationSystems

622

basic setup was run a second time now varying the

degree of fairness of the coalition members. All ex-

periments were executed 20 times (half with consul-

tations, half without them). In the following, we plot

and comment the achieved results.

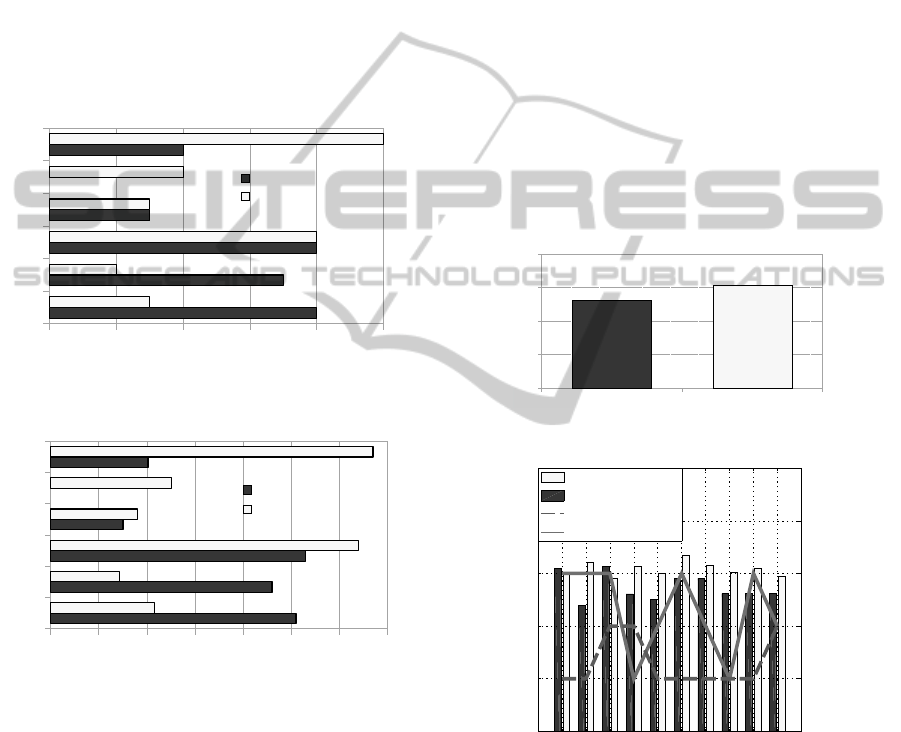

With regard to Question 1, Figure 5 shows how

many auctions a negotiator won (in percentage) com-

paring experiments with and without consultations.

That figure shows that the CC members, when stuck

to the consultation (F = 1), did no worse than not us-

ing consultation. In fact, all did better, but G3 that

had the same outcome. This result to G

3

is because it

already was quite competitive. This figure also shows

that G

6

is the most competitive negotiator among the

non CC members.

Figure 5: Winning negotiators with and without consulta-

tions.

Figure 6: Total profit achieved with and without consulta-

tions.

Question 2 is addressed in Figure 6, which shows

the sum of the profits attained by each negotiator

within 10 experiments. It is easy to notice that the

non CC members did much worse when the other ne-

gotiators were running consultations. It is notewor-

thy that G

3

did a slight bit worse when partaking the

consultation (again, because it was already competi-

tive). However, it would not know this fact before-

hand. Moreover, if G

3

is compared to G

6

(both the

most competitive in their groups), we can see that G

6

did much worse. Thus, if G

3

would have refused to

participate in the CC, G

6

could do it somehow and

their outcomes would be inverted.

Regarding Question 3, Figure 7 sums up the to-

tal value paid by FC within 10 experiments. FC has

clearly paid less when consultation was active. We

also wonder if the total value paid by FC was corre-

lated to the number of CC members that won a given

auction. Figure 8 was used to investigate such hy-

pothesis. This figure comprises bars and lines. A bar

represents to total value paid by FC in a given auc-

tion, and the lines shows how many CC members won

such an auction. For instance, in the first auction with

consultation FC paid a bit more than 60,000 to the

winners and all three CC members won that auction.

Conversely, in the first auction without consultations,

FC paid at most 60,000 to the winners and only one

of them was a CC member. There is no clear correla-

tion between the cost and the number of winning CC

members. However, this figure confirms that the only

existence of consultations brings the cost down due to

the competitiveness rising.

Figure 7: Total cost for the FC (∗10

3

).

1 2 3 4 5 6 7 8 9 10

45

50

55

60

65

70

Auction

Cost (x10^3)

0

1

2

3

Participants

Without consultation

With consultation

Without consultation

With consultation

Figure 8: Cost by auction instance and number of winning

coalition members with and without consultations.

In order to assess how fairness influenced the ne-

gotiation process (Question 4), we ran two experi-

ments. In the first (Figure 9), all CC members were

set with the same fairness and the total profit of

the CC member (after 10 negotiations) was summed

(solid blue line). Similarly, the profit of the non-

members was summed (dashed green line). This was

repeated for different fairness (0, 0.1, 0.2, ..., 1). For

BuildingCoalitionsofCompetitorsintheNegotiationofMultipartye-ContractsthroughConsultations

623

instance, when the CC members were set with F =

0.6, the total profit of the CC members was higher

than 80,000 and for non-member, less than 20,000.

This figure shows that the CC members do better al-

together when they are fair. In the second experiment

(Figure 10), two CC members had the same fairness

(F = 0.5) and the remainder (G

1

) had its fairness var-

ied. For each level of fairness, we ran 10 negotiations

and calculated the total profit G

1

gained. Its clear the

ascending pattern as G

1

become more fair, reaching

the maximum profit of more than 30,000 at F = 0.8.

! " #

"

$%

&

'

Figure 9: Total profit varying the fairness of all members.

Figure 10: Profit varying the fairness of only one member.

7 RELATED WORK

The notion of coalitions has been studied by the

game theory community for a long time and it has

proved to be a useful strategy (Horling and Lesser,

2004). It has gaining increasing interest by the Infor-

mation Technology community as an interaction pat-

tern to develop complex multi-agent systems. There

are a few software methodologies tailored to agent-

oriented systems that allow implementing this or-

ganisational paradigm (Isern et al., 2011). How-

ever, several proposals regarding automatic negotia-

tion employs case-specific implementations, such as

(Yu et al., 2013). Works that present more structured

implementations usually rely on negotiation protocols

and frameworks.

Most of the negotiation protocols are based on

bilateral interactions, e.g., (Shakun, 2005) and (Br-

zostowski and Wachowicz, 2014). However, collab-

orative organisations need negotiation protocols that

are multiparty and interactive (Darko-Ampem et al.,

2006). There are a few multiparty negotiation pro-

tocols in literature, e.g., (Fujita et al., 2012), (Klenk

et al., 2012) and (Szapiro and Szufel, 2014). These

works differ from ours, since they do not integrate

several styles of negotiation, namely,bargain, ballots

and auctions for the negotiation of a given multiparty

contract. In addition, our negotiation protocol also

provides a non binding coalition mechanism.

According to (Peleteiro, 2014), coalition forma-

tion is a process in which agents associate to achieve

a goal or to increase their performance, and is guided

by rules of formation. She also mentions the problem

of stability of a coalition, i.e., the level of incentive a

member has to withdraw (internal stability) the coali-

tion and a non-member has to join it (external stabil-

ity). Another aspect she considers is if the coalition is

statically or dynamically formed. In contrast with the

former, in the latter the agents are constantly willing

to change the coalition they belong to. A coalition

may be ruled by a leader that imposes its strategy.

According to (Yu et al., 2013), another issue regard-

ing coalition formation is how to allocate the profit

among its members.

Our protocol does not tackle the coalition forma-

tion problem, but supposes that it was somehow built

prior the negotiation and, most important, it does not

bind the members of the coalition.

Stability of coalitions is an issue worth of discus-

sion. In general, a coalition of agents behaves as a

block. Thus, internal and external stability is a clear

concept. Our proposal is quite different. A coali-

tion of competitors has three distinct moments. In

the first moment, the coalition members exchange in-

formation in order to be somehow aligned during the

actual negotiation. The second is the very negotia-

tion. In this phase, the coalition members may be

fair to that alignment or not. If they are fully unfair,

we can consider that they left the coalition (no inter-

nal stability). Conversely, if they are fully fair, they

stayed in the coalition. However, as we mentioned

previously, a coalition member can be partially fair.

In this case, the concept of stability becomes blurred.

Finally, the third moment is the coalition realisation,

i.e., the members that succeed the negotiation become

the signatories of the produced contract. Note that,

this realisation may also be partial, once a few of the

coalition members may fail in the negotiation.

Another difference of our approach for coalitions

is that there is no leader ruling or coordinating the

acts of the coalition members and there is no direct

allocation of profits among the members. In our case,

profits may be earned indirectly, e.g., by increasing

competitiveness. In addition, (Guo and Lim, 2012)

argues that coalitions are just formed to reduce the

ICEIS2015-17thInternationalConferenceonEnterpriseInformationSystems

624

intrinsic complexityof multiparty negotiations. In our

proposal, it is not an issue.

8 CONCLUSION

A coalition is referred as in the literature as an or-

ganised, framed, protected, as a solid and monolithic

block. It is materialised before the negotiation takes

place. It is as if the coalition was a big negotiator act-

ing in behalf of its individual parties.

This paper focused on a second kind of coalition,

that we called coalitions of competitors, which is a

more challenging, risky and fluid association of nego-

tiators. It differs from the previous one in four basic

features. First, the coalition is not formalised and ma-

terialised beforehand. In fact, a few negotiators intend

to build a coalition. They exchange information either

before or during the negotiation process to maximise

their chances of success. However, had they tuned

up their decision processes, each one negotiates by it-

self. Thus, the coalition is actually realised after the

negotiation. This leads to a second difference: it can

produce partial coalitions, as just a few of the coali-

tion members end up succeeding in the negotiation.

The third is that, since the coalition may succeed only

partially, a negotiator does not wish to commit to an

agreement that will bind it independently of the result

of the negotiation. Finally, as consequence, any coali-

tion member may act within the actual negotiation dif-

ferently from the previous coalition agreement.

We reified coalitions through the SPICA Negoti-

ation Protocol. This protocol was suitable for this

purpose once it implements multiparty negotiation

of multiparty contracts. The protocol was extended

to allow coalition members to exchange information

within a negotiation process by means of consulta-

tions. The effectiveness of such extension was as-

sessed by means of an experimental negotiation sce-

nario. The results were twofold: (a) the execution of

a bunch of experiments showed that exchanging in-

formation different from those present in the multi-

party contract being negotiated improved the outcome

to the negotiators (CC members and FC) as well as the

consumers of the product delivered by FC; (b) in gen-

eral, do better the members that are fair to the coali-

tion.

Future work includes assessing the other two con-

sultation patterns that were just mentioned in this pa-

per and improving the intelligence of the negotiators.

ACKNOWLEDGEMENTS

This research was partially supported by agencies

Fundac¸˜ao Arauc´aria, Capes and CNPq. We also thank

Prof. Caetano Traina Jr and Prof. Agma J.M. Traina

(GBDI, ICMC/USP) for sharing their resources.

REFERENCES

Bacarin, E., Medeiros, C., and Madeira, E. (2004). A Col-

laborative Model for Agricultural Supply Chains. In

CoopIS 2004, LNCS 3290, pages 319–336.

Brzostowski, J. and Wachowicz, T. (2014). Negomanage:

A system for supporting bilateral negotiations. Group

Decision and Negotiation, 23(3):463–496.

Darko-Ampem, S., Katsoufi, M., and Giambiagi, P. (2006).

Secure negotiation in virtual organizations. In

EDOCW ’06, pages 48–55. IEEE.

Fujita, K., Ito, T., and Klein, M. (2012). A secure and fair

protocol that addresses weaknesses of the nash bar-

gaining solution in nonlinear negotiation. Group De-

cis. and Negot., 21(1):29–47.

Guo, X. and Lim, J. (2012). Decision support for online

group negotiation: Design, implementation, and effi-

cacy. Decision Support Systems, 54(1):362 – 371.

Horling, B. and Lesser, V. R. (2004). A survey of multi-

agent organizational paradigms. Knowledge Eng. Re-

view, 19(4):281–316.

Isern, D., S´anchez, D., and Moreno, A. (2011). Organiza-

tional structures supported by agent-oriented method-

ologies. J. of Sys. and Soft., 84(2):169–184.

Klenk, A., Beck-Greinwald, A., Angst, H., and Carle,

G. (2012). Iterative multi-party agreement negotia-

tion for establishing collaborations. Service Oriented

Computing and Applications, 6(4):321–335.

Peleteiro, A. (2014). Dynamic Coalition Formation Mech-

anisms for Enacting and Sustaining Cooperation in

Multi-agent Systems (MAS). PhD thesis, Univ. of

Vigo.

Shakun, M. (2005). Multi-bilateral multi-issue e-nego-

tiation in e-commerce with a tit-for-tat computer

agent. Group Decis. and Negot., 14(5):383–392.

Szapiro, T. and Szufel, P. (2014). Simulated negotiation

outcomes through recommendation crowding. Group

Decision and Negotiation, 23(3):443–461.

Yu, F., Kaihara, T., and Fujii, N. (2013). Coalition for-

mation based multi-item multi-attribute negotiation of

supply chain networks. Procedia {CIRP}, 7:85–90.

BuildingCoalitionsofCompetitorsintheNegotiationofMultipartye-ContractsthroughConsultations

625