Organisational Aspects and Anatomy of an Attack on NFC/HCE

Mobile Payment Systems

Maurizio Cavallari

1

, Luca Adami

1

and Francesco Tornieri

2

1

S.E.Gest.A., Università Cattolica del Sacro Cuore, via Necchi 5, Milano (MI), Italy

2

BKG Laboratories, Verona (VR), Italy

Keywords: Organisation, Security, Mobile Payments, HCE, NFC, RFID.

Abstract: Near Field Communication (NFC) and contactless applications are increasing at unprecedented rate and

their value is being recognised by the financial industry (Ok et al., 2011). Attacks are also increasing and

they can compromise the business value on NFC applications (Murdoch and Anderson, 2010, Trend Micro,

2015). The present paper analyse the anatomy of possible attacks, uncovering vulnerabilities and suggesting

possible countermeasures. The value of the paper is found in the contribution to practical mitigation of risk

in the mobile payment financial business, with respect to the technology side. Host Card Emulation (HCE)

is a technology solution that permits the creation of a virtual representation of a smart card using only

software components, effectively eliminating the need for Secure Element hardware in the device.

NFC/HCE technologies has proved itself very vulnerable in a variety of aspects. The paper would go

through specific vulnerabilities and vulnerable situation, like: a non-secure-device/cloud communication

channel; access to data saved locally in wallet; reusability of token; use of fake POS; malware and fake

application; specific vulnerabilities of “Tap & Pay”; device/cloud decoupling. Countermeasures that have

been proved effective are offered to readers along with Organisational aspects to be taken into account.

1 INTRODUCTION

Host Card Emulation (HCE) is a technology solution

that permits the creation of a virtual representation

of a smart card using only software components,

effectively eliminating the need for Secure Element

hardware in the device (Smart Card Alliance, 2014).

Before going into detail about the concepts

characterizing HCE, a definition of the technology at

the basis of this solution is opportune: Near Field

Communication (NFC).

NFC is a technology that provides connectivity -

unlike its predecessors such as the contactless smart

card - two-way and short-range: when two NFC

devices (the initiator and the target) are matched

(within a radius of about 4cm), a peer-to-peer

connection between the two is created and both can

send and receive information (ISO/IEC 14443 A&B,

2011; JIS-X 6319-4, 2005).

NFC can be achieved directly via a chip

integrated in the device or through the use of a

special external adapter that exploits the ports of the

SD card or phone micro SD card. It is also possible

to make an NFC-enabled device communicate with a

passive NFC chip, called “tags”.

The main cases for using this communication

mechanism are mainly in the financial world: NFC-

enabled devices can be used in contactless payment

systems in the mobile environment. Google Wallet,

for example, allows users to store credit and loyalty

cards in a virtual wallet, and then use an NFC-

enabled device to make payments to terminals that

accept transactions channelled through the

MasterCard PayPass circuit.

The basic components necessary to make an

NFC transaction are (Halgaonkar et al., 2013):

• NFC Controller: An electronic component that

resides within the mobile device, by which it is

possible to communicate with another NFC

device (for example, a POS, i.e. Point Of Sale,

equipped to read contactless cards);

• Secure Element (S.E.): A secure physical space

that can be housed inside the SIM or the device

itself, rather than in removable hardware (micro-

SD Card), which hosts a payment application

called MCPA (Mobile Contactless Payment

Application). MCPA is an EuroPay, MasterCard,

685

Cavallari M., Adami L. and Tornieri F..

Organisational Aspects and Anatomy of an Attack on NFC/HCE Mobile Payment Systems.

DOI: 10.5220/0005477506850700

In Proceedings of the 17th International Conference on Enterprise Information Systems (WOSIS-2015), pages 685-700

ISBN: 978-989-758-097-0

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

Visa (EMV) compliant payment application,

very similar to the one installed in the microchip

on the majority of credit/debit cards. This is the

element in charge of emulating a payment card;

• Trusted Service Manager (TSM): The external

technology that deals with the provisioning of

the MCPA and its entire life cycle (and which

therefore has access to the Secure Element).

In this way, a payment transaction occurs in Card

Present mode, and the values of the Merchant

Service Charge (MSC), i.e. the amount the Acquirer

charges the merchant, are normally lower than those

for Card Not Present type transactions (Issovits and

Hutter, 2011).

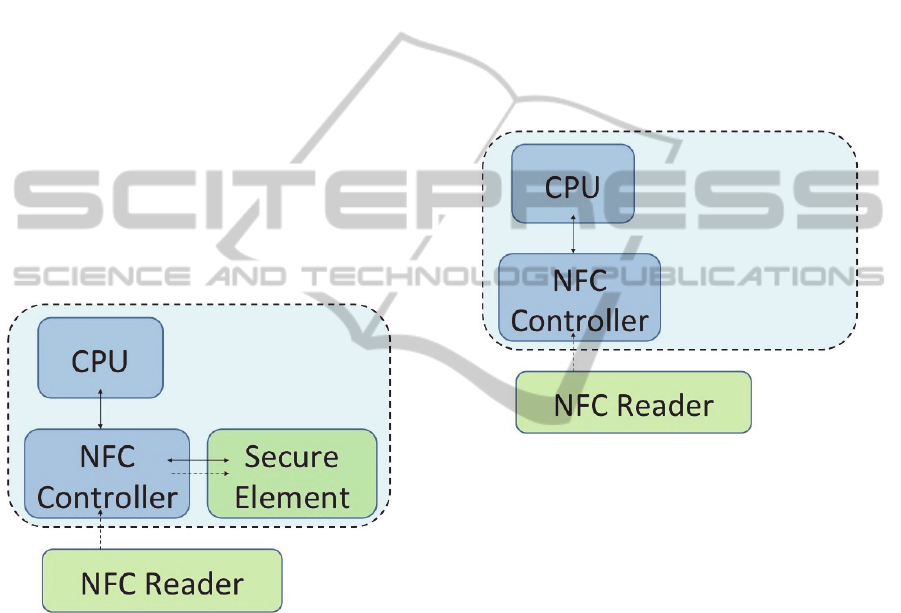

Note that in this approach, a smartphone NFC

chip is authorized to communicate only with

applications (MCPA) installed within the Secure

Element. A representation of the typical flow of a

transaction is shown in Figure 1: the card to be

emulated is made available by the Secure Element,

to which the NFC controller directs the data received

by the NFC reader (Patidar et al., 2011).

Figure 1: NFC Function.

NFC is widely used on terminals equipped with

version 4.0 (Ice Cream Sandwich), such as Google

Nexus and some devices manufactured by Samsung.

On the release of Android 4.4 (KitKat), Google

subsequently introduced support for secure

transactions based on NFC via Host Card Emulation,

as presented later in this chapter. In systems based

on iOS (Apple) the NFC chip is pre-installed in

Iphone 6 and Ipad Air 2 (the chip was missing in

earlier devices). The current market of mobile

payment systems is based on solutions designed for

Android OS, and marginally, due to diffusion, for

Windows Phone systems.

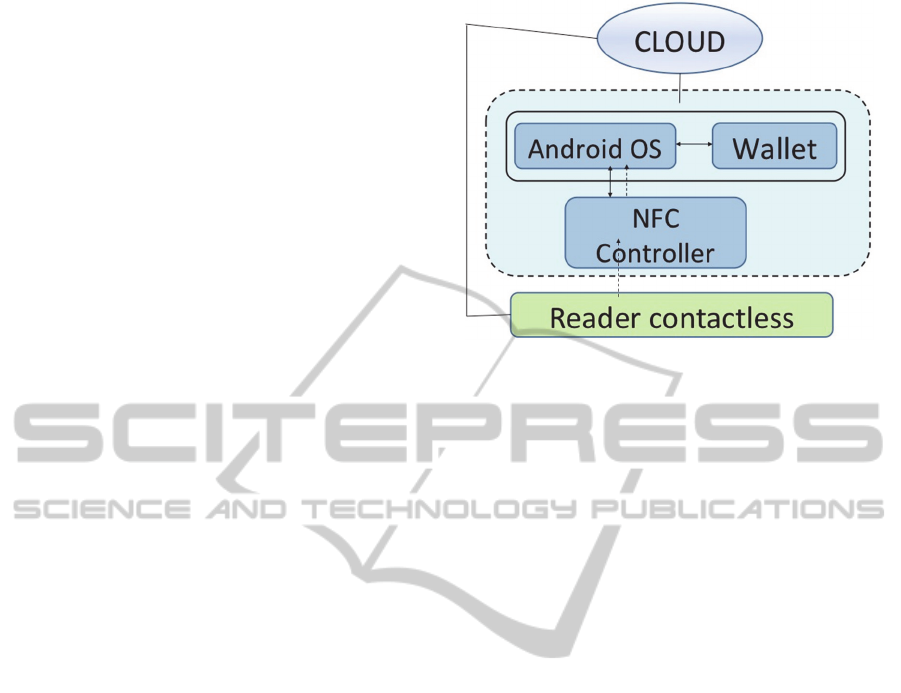

The Host Card Emulation solution permits the

creation of an exact, virtual representation of a smart

card using only software components, effectively

eliminating the need for Secure Element hardware in

the device (Hancke, 2007). In particular, HCE is

defined as the ability to exchange information via

NFC between a terminal (enabled for the exchange

of information with an NFC card) and a mobile

application configured to emulate the functionality

of an NFC card (Devendran et al., 2012). The

novelty lies in the fact that HCE enables the NFC

protocol to be routed directly through the operating

system of the device rather than being first

processed by Secure Element hardware, such as a

chip configured to act simply as a card, without

other possibilities. A representation of the

innovation introduced by HCE is shown in Figure 2.

Figure 2: HCE: elimination of the Secure Element.

HCE can therefore be defined as an open

architecture on which it is possible to develop

application solutions that have the possibility of

emulating the payment card and that interface

directly with the NFC Controller, without the need

to resort to Secure Element hardware available on

the device (Worstall, 2012). When a smartphone is

placed near the reader, the NFC Controller calls an

Android (HCE service) previously associated with

identifiers reserved for payment networks that

identify payment applications (at present no

information regarding the workings of the payment

solution for Apple products is available, as these not

yet on the market).

Having eliminated the need for Secure Element

hardware in the smartphone, card data to be

emulated is stored by the issuer authorisation centre

in the “cloud”: the payment application’s task is to

recover the information needed to make the payment

from the cloud. This shift, however, is not to be

considered only as a modification of the data flow

(data movement) but also as the renouncing of the

use of the secure hardware cryptographic capability

ICEIS2015-17thInternationalConferenceonEnterpriseInformationSystems

686

of the Secure Element, while storing and processing

such data in a secure session with the terminal: the

mobile device becomes a transducer that connects

the POS terminal with the image of the card stored

in the network (Verdult and Ois Kooman, 2011).

The current process between POS and Secure

Element is divided into two parts by delegating the

task (local) of the Secure Element to applications on

issuer card images (remote).

This solution also simplifies the chain, reducing

the role of third parties and enabling freedom from

mobile network operators and, contrary to what

happens with the classic NFC, from any kind of

conditioning by SIM or SD card, with a consequent

reduction in fees. At the same time, the current

network consisting of POS terminals, requires no

changes for using contactless cards or NFC-enabled

smartphones with Secure Element hardware.

Further advantages of the HCE solution also

include the simplification of the provisioning

process and a virtually unlimited storage capacity.

Access to provisioning data is possible online

through the use of simple login credentials to the

secure host. At the same time, the use of HCE

entails no theoretical limit to the storage of card data

as it is saved in the network (whereas the reserved

space in Secure Element hardware is limited by the

physical characteristics of the individual device).

Note that HCE payments can also be made even

where there is no cellular network. Whilst the

dislocation to the cloud of the Secure Element

implies the need for the terminal to access certain

data (e.g. payment token) hosted on the network

before being able to make the payment, in order for

the outcome of the payment to be unaffected by the

lack of a network connection, retrieval and renewal

of payment data occurs in the background, on a

continuous basis which is transparent to the user. In

this way, a mobile network connection is not

essential during the payment transaction

(Haselsteiner and Breitfuß, 2006; Jules and Weis,

2005a).

1.1 HCE Infrastructure

The HCE architecture in Android (shown in Figure

3) revolves around the concept of “HCE services”),

that run in the background without any user

interface. This is convenient since many HCE

applications (like loyalty cards) do not require the

user to launch any application to use the service, but

simply place the device near to an NFC reader to

start the service correctly and execute the transaction

in the background (Smith-Strickland, 2013).

Figure 3: High-level architecture.

When the user places the smartphone near to an

NFC reader, the Android operating system must be

able to identify which HCE service is going to be

contacted. To solve this problem, and to define a

means of selecting the wallet application required,

the concept of Application ID (AID) is used. These

AIDs are nothing more than a sequence of 16 bytes

that are well known and publicly recorded by the

major payment networks (such as Visa and

MasterCard), and used by Android to determine

which service the NFC reader is trying to contact.

Mastercard and Visa use the following AIDs:

• MasterCard “A0000000041010”

• Visa “A0000000031010”

In particular, note that the Android implementation

of HCE was created to allow simultaneous support

to other card emulation methods, including the use

of Secure Element hardware (the “standard” NFC).

This coexistence is based on the principle of “AID

routing”, according to which the NFC controller

maintains a routing table consisting of a list of rules,

each of which containing an AID and a destination

(which may be either the CPU running Android

applications or a Secure Element). The first message

sent by the NFC terminal contains the “SELECT

AID” command, which is intercepted by the NFC

controller, which then controls if the specified AID

belongs to at least one of its routing rules. If there is

a match, the destination in the routing rule selected

is identified as the recipient of the subsequent NFC

communication.

The main difference between the two routes then

resides in the recipients of the communications. If

the target is the Secure Element everything proceeds

in the traditional method of contactless payments via

NFC. If communication is HCE, the controller

OrganisationalAspectsandAnatomyofanAttackonNFC/HCEMobilePaymentSystems

687

routes the communication directly to the operating

system. Android considers as payment applications

all those HCE services that have declared, in their

manifest, the use of AIDs in the payment category.

Furthermore, Android contains a “Tap & Pay” menu

in its settings, which lists all these payment

applications. In this menu, the user can select the

default payment application to be used when the

smartphone comes into contact with a payment

terminal (POS).

1.2 HCE Support

Currently, payment solutions based on HCE are

supported by all those terminals enabled with NFC-

connections and which use Android 4.4 (the

benchmark platform for the entire industry) as the

operating system, given the spread of Android at the

expense of Windows Phone (NB. the NFC chip is

only a recent addition to Apple devices, iPhone 6).

In its implementation of HCE, Google (now

owner of the system) states that Android 4.4

supports many protocols and standards adopted by

the most common types of NFC readers, for which

contactless payment applications have currently

been developed. In particular, the new operating

system implements card emulation based on the

NFC-Forum ISO-DEP specifications (in turn based

on ISO/IEC 14443-4) and is able to handle the

Application Protocol Data Units (APDUs) defined

by ISO/IEC 7816-4.

2 LITERATURE REVIEW

Near field communication has been leading

important changes due to the methods in which

consumers purchase goods and services, and this

attracted a number of scholars and researchers to

investigate further on security aspects (Ozdenizci et

al., 2010). Slade, Mayes among other scholars,

researched into consumer adoption of proximity

mobile payments and NFC many different potential

commercial applications, ranging from marketing to

nutrition, transportation, gaming, and health care

(Slade et al., 2014; Mayes et al., 2009).

Using proximity payments, it is possible to

create a new link between physical materials and

digital information (Juels and Weis, 2005b).

Proximity payments are possible because, during the

last decade, industry had been developing the new

technology, Host Card Emulation (HCE), which

allow to create an exact virtual representation of

various electronic cards, eliminating physical

supports (Ok et al., 2011; Van Damme et al., 2009).

In one of the last work of Paya, “HCE vs

embedded secure element: relay attacks”, he

discussed a series of potential vulnerabilities on

HCE, that allows possible intrusion by malicious

attacker, related to outdated software and low

security levels (Paya, 2014). Other studies show

similar results, suggesting the relay attack is an

actual breach of NFC/HCE (Van Dullink and

Westein, 2013; Ozdenizci, 2010).

As a consequence the industry related association

“Smart Card Alliance” produced a white paper

“Host Card Emulation (HCE) 101” in which they

explained all possible implications concerned

payment application and security (Smart Card

Alliance, 2014, Honig, 2013, Juels et al., 2005).

The present paper is focused on the anatomy of

possible attacks, starting from a series of

contribution on NFC payments attacks, matching

more practically studies like Van Damme et al. and

Madlmayr et al. (Van Damme et al., 2009;

Madlmayr et al., 2008; Aigner et al., 2007) about

NFC mechanism and functioning, technical

exploration such as exposed by Ok et al, in which

we get a sense of real magnitude of NFC

applications (Ok et al., 2011; see also Suman, 2013).

The present research work is going through

specific analysis of vulnerabilities and vulnerable

situation, updating past research findings as Van

Dullink and Westein, where they research into

attacks using NFC enabled devices (Van Dullink

and Westein, 2013). Furthermore, is possible to

identify a range of possible implications on mobile

payment security that we describe based on past

research findings by Worstall, Nai-Wai and Li, Li et

al. (Worstall, 2012; Nai-Wai and Li, 2012; Li et al.,

2014).

Organisational aspects and literature about

behaviour, technology human-interaction, learning

and trust, are to be taken into account as the

organisation of attacks relay on human behaviour in

the first place and on technology and application

functioning, at second (Avison and Wood-Harper,

2003; Straub et al., 2008; Za et al., 2015).

3 ORGANISATIONAL ASPECTS

OF NFC/HCE SECURITY

Within academic literature we can observe a lack of

specific studies directly pointing to the relationship

between trust and flexibility and security and attack

on technology behavioural models (Hagen et al.,

ICEIS2015-17thInternationalConferenceonEnterpriseInformationSystems

688

2008, Cavallari, 2008, Juels and Wies, 2005a). The

novelty of the present paper is to link together the

established organisation science literature trust and

flexibility along with the extant literature on

information systems security (Cavallari, 2011;

Marzo and Castelfranchi, 2013).

Notable and renowned theories and authors’

conceptualisations about flexibility and information

systems security are regarded as the start for further

speculation (Avison and Wood-Harper, 2003). The

innovation of attack on NFC/HCE described in the

paper could have been identified with respect to

specific conceptual domains are then utilised to

build up a coherent organisational theoretical

framework (Straub et al., 2008).

In order to explore the flexibility of an

organisation we addressed the research regarding

organisation’s flexibility looking at the contextualist

approach by Pettigrew, which is relating flexibility

to organisational matters (Pettigrew, 1987, 2001).

Major contributions to the proposed theoretical

framework are coming from Burgelmann and Gupta

so to describe the baseline organisational conditions

in order to make effective the explained attack on

NFC/HCE (Burgelmann, 2002, Gupta, 2006).

Information security and specifically the

anatomy of attack described in the present work and

the organizational theories are in particular link and

shall not be regarded as two aspects of the patterns

to identify the attack, but as a whole behavioral path

which lead to secure (and possibly insecure, if the

whole picture is disregarded) transactions on mobile

payments.

The most appropriate theoretical organisation

science framework we found adequate is a

contextualist approach within change management,

proposed by Pettigrew and commented by recent

research. The major contribution is certainly the

intent to create “theoretically sound and practically

useful research on change”, that explores the

“contexts, content, and processes of change together

with their interconnectedness through time (cit.)”

(Pettigrew, 1987, 2001; Cavallari, 2011).

Research studies on organisation theory have

proven that the new types of attack on technology

are benefited by, and can be researched into the

exploitation and exploration learning theory (March,

1991, Gupta et al., 2006). Exploitation learning

comprises refinement, choice, production efficiency,

selection, implementation and execution; whilst

exploration learning includes search, variation, risk

taking, experimentation, play, flexibility, discovery

and innovation (Burgelmann, 2002; Spagnoletti and

Resca, 2008).

Empirical studies conducted by He and Wong

demonstrate that exploitation learning leads to the

development of operational capabilities, in the first

stage (He and Wong, 2004). In the second stage of

an exploration learning organization a more

participatory leadership style fosters

experimentation and risk taking (Straub, 2008). The

mentioned authors highlight that, within the

boundaries of organisation theory and information

systems security, exploration learning facilitates

flexibility permitting development of new processes,

and therefore new attacks on technology and

information systems – such as the mobile payments

infrastructure (He and Wong, 2004, Straub, 2008).

The basic distinction between organisational

learning and organisation adaptation is well

discussed by Fiol and Lyles and refined further by

Avison and Wood-Harper, as they show that change

do not necessarily imply learning (Fiol and Lyles,

1985; Avison and Wood-Harper, 2003).

Trust and dependence network has proven to be a

major organisational aspect to be taken into account

when dealing with learning, knowledge sharing and

innovation. This particular concept, i.e. trust, is

directly translated into human actions while dealing

with technologies, for instance with payment

applications provided by banks or issuers, and also

translated between applications/devices interaction

(Za et al., 2015).

Other organisation theory authors like Benner

and Tushmann, base their discussion on the

propositions of March and Levitt and then argue that

while process management activities are beneficial

for organizations in stable contexts, they are

inconsistent with incremental innovation and change

(Benner and Tushmann, 2003). So with respect to

the latter organisation research findings we shall

assume the identification of innovative and new

attacks shall come not from operational processes,

but rather on “out of the box” and parallel thinking

(March, 1991, Levitt and March, 1988).

4 SECURITY ASPECTS OF HCE

ATTACK

HCE provides that communications use the Android

operating system as a vector. This ensures the use of

some, albeit basic, security controls, such as the use

of sandboxes that prevent an application from

accessing data from another application. However,

these guarantees are void if the device is tampered

OrganisationalAspectsandAnatomyofanAttackonNFC/HCEMobilePaymentSystems

689

with (known as “rooting” in Android/Windows

Phone systems or “jailbreak” in Apple systems).

Note that there are various scenarios that can

lead to the root of a device, such as:

1. The user carries out the procedures necessary to

obtain root permissions on his phone;

2. Malware capable of tampering with the device,

taking advantage of vulnerabilities in the

operating system itself or in some drivers. In this

case the difficulty of introducing into the

operating system the necessary countermeasures

to mitigate those vulnerabilities must be

considered;

3. If lost or stolen, the device could be tampered

with to gain access.

A phone that has been tampered with no longer

makes security checks on transactions made by the

user, who will have total control of the phone and full

access to all memory partitions (and also those of the

system). A potential attacker would be able to access

all the critical information contained in the phone,

such as payment credentials that could be used to

conduct fraudulent transactions. Furthermore, a

malicious tampering application installed on a

mobile phone could gain full control of

communications (and carry out a Man-In-The-

Middle type of attack), and even control and interact

with other applications.

Finally, since the routing table of the NFC

controller can be changed by the operating system, a

malevolent application could cause Denial-of-

Service and silently go about changing all the NFC

service routes on the phone (normally, this would

require the explicit consent of the user).

The following analysis considers the hypothesis

that the device has not been tampered with and also

presents the principal vectors of attack; in a number

of cases the effective vulnerability with be explored.

4.1 Non Secure Device. Cloud

Communication Channel

The communication channel between smartphone

and the cloud platform that hosts payment services is

a critical factor in the infrastructure of the HCE

solution. Above all, it is used in the two critical

activities of Enrolment and Account Provisioning.

During the Enrolment phase, the user inserts the

card data, or selects one of those available in the

digital wallet, to request the service (McHugh and

Yarmey, 2012). This data, which is then forwarded to

the cloud platform, includes confidential details as:

• Name and place of birth of the cardholder;

• PAN (Primary Account Number);

• CVV2;

• Expiration date.

In some cases, the user may also be required to

choose an access code (called Consumer Device

Cardholder Verification Method, CDCVM), which

will in turn be forwarded to the cloud platform and

which will thereafter have to be entered directly in

the wallet application before making a payment, in

order to verify its authenticity.

After Enrolment, the system creates a binding

between application, smartphone and CDCVM and

is able to begin the process of Account Provisioning,

during which so-called “payment tokens” (virtual

PAN generated from an access PIN for the HCE

service) are generated. These tokens are then sent to

the smartphone to be stored and enable the user to

make transactions even when no mobile connection

is available.

If the channel connecting the smartphone with

the cloud service is not secure, an attacker could

intercept the data of the original card (such as PAN,

CVV2, and expiration date), for card cloning, and

even as the fundamental fields for the HCE service,

such as the CDVM and payment tokens. A possible

scenario: an attacker could install an untrusted CA

certificate on Android and so create a “MitM” (Man

in the Middle) attack (Momani and Hudaib, 2014,

Patidar and Bhardwaj, 2011). This situation could be

summarize in these steps:

1. An attacker creates a fake gateway

2. The fake gateway intercepts the TCP traffics and

sends to the device an untrusted Certificate

Authority (CA) certificate

3. The device owner installs the untrusted CA

certificate

4. The attacker intercepts the https traffics through

a proxy that generates an SSL certificate for each

host, signed by its own Certificate Authority

(CA) certificate.

5. The attacker can store and analyse the http/https

traffic

We reproduce an intercept enrolment https POST:

1. nome=Asked=*******&telefono=*******&

email_masked=****************%40icbp

i.it&email=EMAIL%40EMAIL.IT&password

=PASSWORD&confirmNewPassword=PASSWOR

D&name=NAME&surname=USERNAME&co=&cou

ntry=IT&zipcodeNoModify=20146&provin

ce=MI&city=MILANO&indirizzo=ADDRESS&

telefono_masked=**********&email_mas

ked=*****%40*****&name1=NAME&surname

1=USERNAME&co1=&country1=IT&zipcodeN

ICEIS2015-17thInternationalConferenceonEnterpriseInformationSystems

690

oModify1=20146&province1=MI&city1=MI

LANO&indirizzo1=ADDRESS&telefono_mas

ked=**********&email_masked=*****%40

****&c3=true&c8=true

4.2 Access to Data Saved Locally in

Wallet

The mobile application that acts as a wallet needs to

store information, linked to an account, which

enables it to interact with an NFC reader to complete

a contactless transaction and to provide the user with

summary information via a special user interface.

Storing information in the memory of the

operating system, rather than using a Secure

Element, has a number of issues, not only if the

smartphone is rooted. If local storage is not well

protected and access to the wallet restricted, a

malicious application could access data such as the

payment token provided to the smartphone during

Account Provisioning (or later Replenishment), and

also the credentials used to authenticate with cloud

services that serve as the Secure Element, the theft

of which would allow the replication of the

installation on another device (unless binding has

been established between the credentials and the

hardware on which they can be used).

A note should be made of users who uninstall the

mobile wallet application. In this scenario, all the

information previously saved must be safely deleted

from the device in order to avoid their discovery and

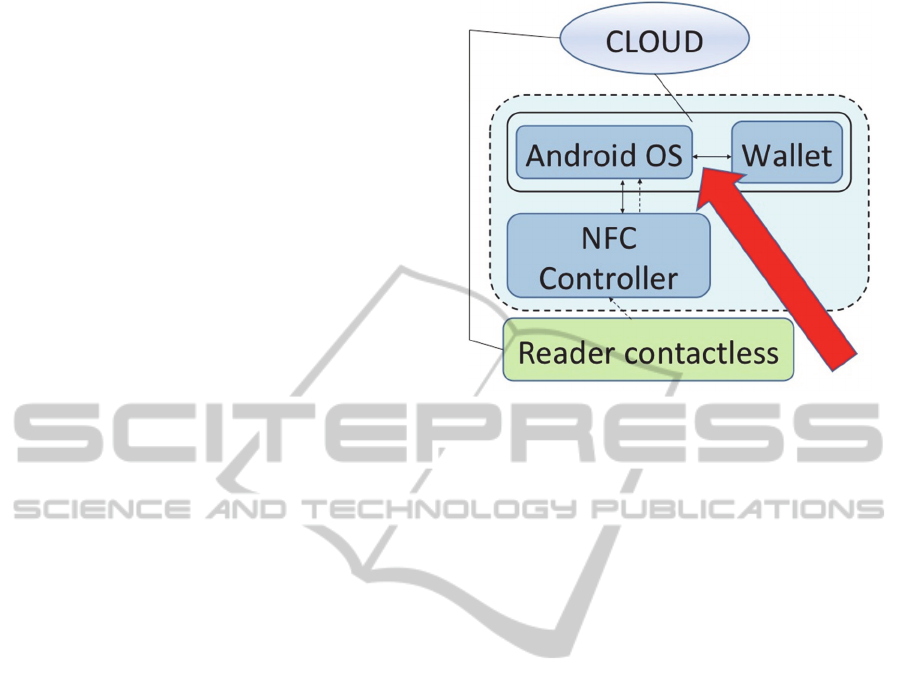

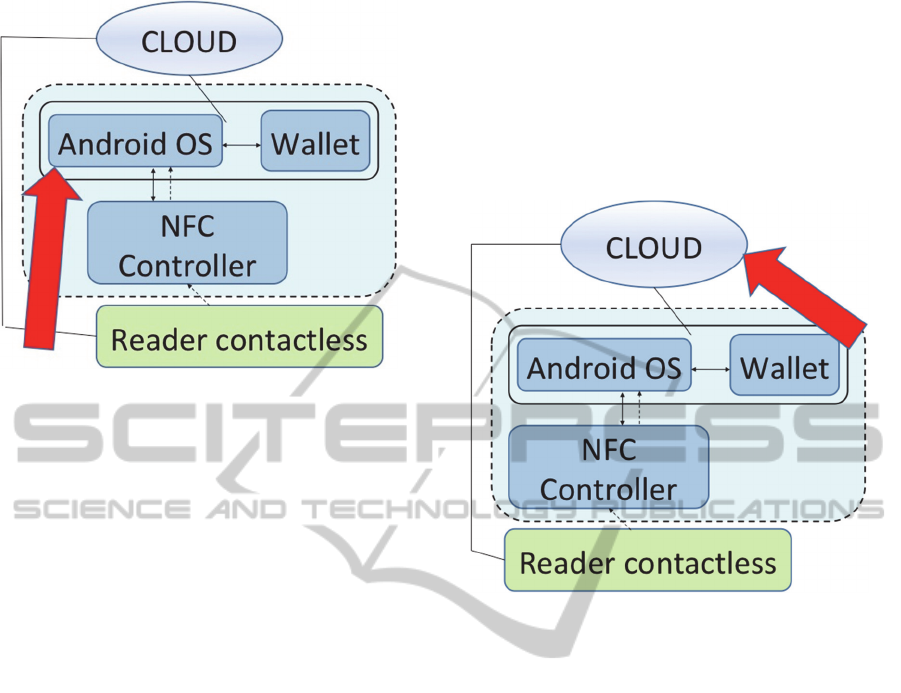

reuse. Figure 4 highlights the part of the architecture

vulnerable to the problem.

The issues afflicting Google Wallet (the system

for mobile payments developed by Google itself) are

an example of this type of attack (Worstall, 2012).

The Android application manager, when

uninstalling an application, deletes all data

(including the cache) belonging to it (Mulliner,

2009). In the case of Google Wallet, the user’s PIN,

saved in a common system file, was therefore

deleted. The problem lay in the fact that the card

data had not been saved in the file system of the

phone, but in the Secure Element, and consequently

not deleted with all the other data in the wallet.

This allowed anyone to remove the security PIN

simply by uninstalling the application, and to set one

of their own choice, during reinstallation. Once with

a new PIN, the attacker gains access to all the cards

previously saved on the Secure Element.

One possible countermeasure is linked to

limiting access to critical resources saved locally in

the application.

Figure 4: Area subject to vulnerability of data saved in the

local wallet.

There have been identified two possible

approaches:

a) in the first approach, advantage could be made

of storage hardware (supported in Android 4.3 and

later) available in some devices. This “hardware-

backed storage”, also called TrustZone, specifically

designed for storing data such as credentials,

provides an additional layer of security that makes

the extraction of contents impossible since even the

kernel of the operating system does not have access.

However, as not all smartphones, at the time of

writing, support storage hardware, we have

identified the:

b) second approach to mitigating this risk, albeit

without completely eliminating it, is to implement

mechanisms that supplement the safety features of

local storage.

Appropriate, preferably hardware-dependent,

encryption would create a link between the data to

be protected and the physical device on which it can

be used. This approach is recommended especially

for the safety of “credentials” (both in the traditional

sense and also in forms such as tokens, certificates,

etc.) used with the cloud platform. Encryption based

on the specific device would greatly mitigate the

consequences of the theft of these credentials,

because, having created a binding between the

credentials and the smartphone, an attacker would

also have to subvert the wallet application logic to

figure out how to bypass control over compliance

with the hardware (Nai-Wai and Li, 2012).

Finally, other mechanisms could be employed to

mitigate the risk posed by the use of local storage. In

OrganisationalAspectsandAnatomyofanAttackonNFC/HCEMobilePaymentSystems

691

addition to the process of “tokenization” (which

enables the replacement of the real PAN with

virtual, temporary surrogates), the adoption of

measures to check the identity of the user (by PINs

such as CDCVM or biometric factors), transaction

limits (spending limits, number of transactions

allowed in one time slot), and runtime checks by the

operating system to validate the integrity of the

device are appropriate (Hancke et al., 2013).

4.3 Reusability of the Token

The “tokenization” process could mitigate some of

the risks posed by the HCE solution.

Tokenization can be defined as the process by

which the number of a card (PAN) is replaced by a

virtual substitute, called “token”. In fact, a token can

be created by emulating the format of the original

PAN, so as to be indistinguishable for both a human

and also for POS payment terminals, which will treat

it as if it were a PAN received in a traditional

contactless transaction.

Figure 5 highlights evidence of the part of

architecture vulnerable to the problem.

Figure 5: Area subject to vulnerability from "reusability of

token".

Tokens must be saved by the application that

serves as a wallet on the device, where they are

nevertheless at risk. Storing payment tokens rather

than the original PAN, however, enables a reduction

in the amount of cardholder data in circulation. The

security of each token derives from practical

impossibility of working out the original PAN.

A further point of attention is given by the choice

of using “single-use” or “multi-use” tokens. Single-

use tokens are valid for a single transaction and are

thereafter invalidated. They can be used when it is

necessary to track the use of a PAN (real or virtual)

in multiple transactions, and can be generated, for

example, by performing the hash of the PAN with a

unique salt linked to the single transaction.

Multi-use tokens do not expire after a single

transaction, but can be reused, thus enabling a PAN

(real or virtual) to be traced over multiple

transactions. This type of token can be generated

using the hash of the PAN and a fixed salt for every

merchant, but distinct for each user. This being said,

an attacker could exploit a number of gaps in the

implementation of the system of tokenization to his

advantage. Some scenarios are listed below:

• An inadequately encrypted communication

channel between the smartphone and the

tokenization system would allow both the data of

the cardholder and the ties between PAN and

virtual tokens to be intercepted by an attacker and

used to clone the original card;

• A tokenization system that fails to validate the

user's identity, for example through

authentication, could be forced to generate new

tokens and send them to an untrusted recipient

and illegitimate user of the service;

• A process of generating tokens based on weak, no

secure cryptographic algorithms are vulnerable to

reversing techniques for tracking the original

PAN from which the token was created;

• An approach based on “multi-use” tokens that are

not specific for single transactions, would enable

the spending of the same token multiple times in

the event of their interception.

Early evidence of this type of attack occurred in

December of 2013 when the company Target was

the victim of a widespread attack that led to the theft

of data for 110 million users. The stolen data,

subsequently made available on the black market,

included highly critical information such as names,

email addresses, card numbers, expiry dates, CVV

codes and PIN numbers. The attack was carried out

by malware (called “BlackPOS”) that infected POS

terminals and exploited the lack of encryption to

intercept data received by the POS and forward it to

an external server. The attack could have mitigated

if the data had been encrypted before reaching the

POS terminal.

In a possible attack scenario an attacker could

extract the unique id device information (the App

stores the user credentials on the storage device)

through a malicious App, so:

cd /data/data/mobile.app/shared_prefs

cat user.xml

<?xml version='1.0' encoding='utf-8'

standalone='yes' ?>

ICEIS2015-17thInternationalConferenceonEnterpriseInformationSystems

692

<map>

<string

name="registrationId">APA91bH7fK9kb40Z

J3CTzWhewtJZd0daOqdYzGKGo86PvSRJXInmNp

bymMffXwn_n1L8y_OntyODQvhilz9oFo54FPCG

QNqQlLBG3yoCg_8Wo_1O4XOYAQXd_KMgd6OB5v

1Fz98LwnqXsrzmAvQGElve-

PLpDihtXA</string>

<string

name="deviceid">353166057013353</strin

g>

</map>

The security and robustness of a system of

tokenization mainly depends on the implementation

of certain critical components.

Starting from the infrastructure, end-to-end

encryption to protect data for its entire life cycle,

whilst in transit to the tokenization system and

preventing interception of cardholder data or

information regarding the PAN-token link, is of

critical importance.

The central system should only store the original

PAN and encryption keys after prior encryption, so

as to be compliant with PCI DSS requirements. New

tokens (during card Enrolment or Replenishment)

should only be available under certain conditions

(such as requiring user verification, or that the

sending of the token can only initiated by the issuer).

Therefore, the focus should be placed on two

features offered by the tokenization system: that of

“token generation” and that of “token mapping”.

“Token generation” is the process by which a new

token is created. The main requirement is that

deriving the original PAN from the token should so

complex as to be computationally impossible.

This can be achieved by using either a robust

encryption algorithm that in turn uses a suitable key

or a non-reversible mathematical function (such as a

hash function that uses a “salt”, or a randomly

generated number). In contrast, “token mapping” is

the process that maps a token to the original PAN

from which it was created.

It is important that, with a view to eliminate (or

at least limit) the storage of PANs, the tokenization

system should only provide merchants with a virtual

payment token and never the real PAN.

Note that if the “multi-use” token is selected,

mechanisms to verify and limit use are opportune.

These constraints may be based on the following

factors:

• Time to live: the period of time in which the

token can be spent;

• Number of transactions: the number of

transactions that can be performed with the token

in question;

• Total amount: the maximum amount of

spendable using the token in question;

• Country of use: to allow or inhibit the use of the

token.

Note that an attacker cannot modify these

transaction constraints, which are generated and

verified by the issuer in the central system, even if

he is able to install malware on the smartphone of

the victim.

The reference standard for payment channels,

mail order, telephone and e-commerce is known as

the Payment Card Industry Data Security Standard

(PCI DSS, 2006-2015). Since companies are

constantly at risk of losing sensitive data relating to

holders of credit or debit cards, resulting in the

possibility of incurring fines, lawsuits and bad

publicity, PCI DSS regulatory compliance is one of

the main objectives for companies that handle, store,

transmit or process credit card data.

PCI DSS standards apply wherever data is

stored, processed, or transmitted. Account data

consists of cardholder data plus Sensitive

Authentication Data, as follows. The PAN is the

determining factor in the applicability of PCI DSS

standard requirements. PCI DSS requirements are

applicable if a PAN is stored, processed or

transmitted: if the PAN is not stored, processed, or

transmitted, PCI DSS requirements do not need to be

considered. If the name of the card holder, the

service code and/or expiration date are stored,

processed or transmitted with the PAN, or are

otherwise included in the cardholder data, such data

must be protected in accordance with the

requirements of PCI DSS.

The PCI DSS represents a minimum set of

control objectives that may be reinforced by laws

and regulations at local, regional and sector levels.

Moreover, the legislative or regulatory requirements

may require specific protection of personally

identifiable information or other data elements (for

example, the name of the card holder), or define an

entity's disclosure practices related to consumer

information. Examples include legislation related to

consumer data protection, privacy, identity theft, or

data security. PCI DSS standards do not supersede

local or regional laws, government regulations or

other legal requirements.

4.4 Use of a Fake POS

The POS has a key role in the execution of

contactless transactions and can therefore be used by

attackers to force new transactions or intercept

confidential bank data. In fact, when a transaction is

OrganisationalAspectsandAnatomyofanAttackonNFC/HCEMobilePaymentSystems

693

initiated, the mobile device generates a contactless

transaction that includes various parameters (such as

the payment token and its expiry date), which it

forwards to the merchant’s POS via the NFC

interface (Mulliner, 2009). Figure 6 shows evidence

of the part of the architecture vulnerable to the

problem.

There are a number ways for an attacker to

attempt to create a “fake POS” with malicious

behaviour:

• External Fake POS: using an external device to

interface with the smartphone of the victim via

communication based on NFC protocol. In fact,

if such a fake POS correctly implements the

communication flow used by a legitimate POS,

the attacker would be equipped to interface with

the victim's smartphone, which would be unable

to tell the difference between the legitimate and

the fake POS.

• Internal Fake POS: using a malicious

application that interfaces directly with the API

of the NFC controller via the operating system.

In this case, an exchange of messages via NFC is

not even required and the attacker can interact

and directly drive the NFC controller by means

of the system API.

• Fake POS Application: using a malicious

application that interfaces directly and attempts

to interact with the wallet (if it offers APIs or

calling methods of interaction).

Going beyond the specific methods of

implementation and focusing the discussion on the

possible purposes of attack, first of all a fake POS

could be used to stimulate the artificial generation of

multiple transactions in rapid succession in order to

exhaust the payment tokens stored locally on the

smartphone and enable a Replenishment (by which

new tokens are supplied to the device). This, in

conjunction with an inadequately protected

communication channel with cloud (or backend)

services would allow the attacker to intercept the

information being exchanged (NFC Forum, 2013).

Furthermore, if multi-use tokens are used, the attack

itself would allow the attacker to accumulate a large

number of payment tokens for use later if controls to

bind the tokens to the user's identity and/or to the

specific transaction are not in place (Hancke et al.,

2013).

There are known cases, some of which are very

recent in which attackers were able to reverse

engineer a contactless payment and identify the

instructions and parameters exchanged between a

device and an NFC reader. Note that this would

permit a reliable reconstruction of the flow of

communications for implementation during the

creation of a fake POS (Atlassian Bitbucket, 2014).

Of particular note, furthermore, are the security

issues raised by a recent study, which stated that it

was possible to exploit a flaw in the contact-less

payment protocol, which allows transactions in the

UK, for example, of up to £20 without requiring the

user to enter the PIN (Emms et al., 2014). Moreover,

the researchers were able to induce the credit card to

transfer $ 999,999.99 in foreign currency to an

account owned by the attacker. The attack is based

on the use of a malicious POS, hosted on a mobile

terminal, which can be pre-set to transfer up to

999,999.99 units in each currency. This terminal can

then be exploited for transactions using other

smartphones close by, without asking users to enter

their PIN.

In order to mitigate the risk posed by a fake POS,

it is first of all necessary to prevent the mobile

wallet application from exposing interfaces that can

be called from other applications and to require the

application to check the origin of NFC

communications.

The overall risk may also be contained by the use

of virtual tokens with limited lifetime (or validity for

one single transaction). However, given the absence

in the literature of reports of vulnerability and

attacks made against cryptogram 10 (CVN 10),

together with the fact that cryptogram 43 (CVN 43)

has been specifically designed for HCE with CVN

10 as the starting point, the possibility of re-

spending tokens appears to be further reduced at the

time of writing.

Finally, and on the basis of the mentioned study

(Emms et al., 2014) and other research findings

(Hancke et al., 2009; Roland et al., 2012; Murdoch

and Anderson, 2010), the user's PIN should always

be requested in order to avoid the possibility of

transactions being carried out without the consent of

the cardholder.

4.5 Specific Vulnerability of the Wallet

In the HCE approach, the mobile application acting

as a wallet is the heart of the user experience and,

being the portion of the infrastructure directly

available to the end user, this is where potential

attackers will concentrate their efforts.

The first action that can be carried out is the

reverse engineering of the application, which, if not

well programmed, allows the attacker to identify the

presence of any defects that can lead to vulnerability

(Haselsteiner and Breitfuß, 2006).

ICEIS2015-17thInternationalConferenceonEnterpriseInformationSystems

694

A further critical point is unencrypted log

management, which is to be considered non secure as

anyone (including other applications) can interface

with the smartphone. Therefore, entering confidential

information (such as credentials, PIN, or tokens) in

the log would frustrate the efforts not only of using a

secure communication channel but also those of any

secure local mechanisms for saving critical data.

Figure 7a shows evidence of the part of the

architecture vulnerable to the problem.

Figure 6: Area subject to specific vulnerabilities of the

wallet.

The application must also ensure that the APDU

(Application Protocol Data Unit) commands have

been received exclusively by the NFC controller;

APDU commands received from any other

application should be rejected. If this should fail, an

application could send malicious commands to the

wallet, pretending to be POS terminal, for example.

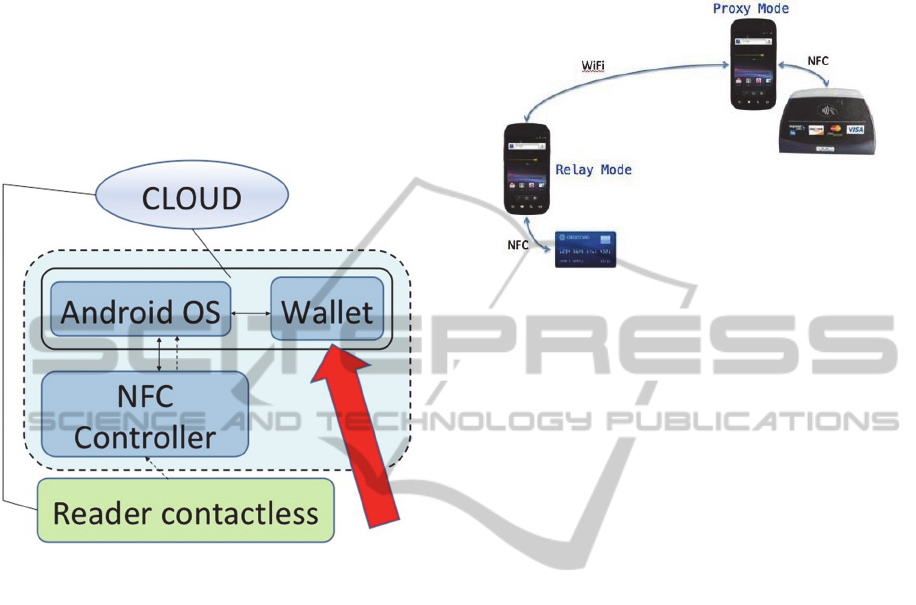

One attack scenario (called “Remote Relay”) that

takes advantage of the lack of control of the origin

of the APDU command was shown at Defcon early

as 2012 (Lee, 2012). In this situation, shown in

Figure 7a, a malevolent application installed on the

smartphone of the victim (relay) opens a

communication channel and waits for connections

from an application mate, i.e. proxy (Paya, 2014).

When in the presence of a NFC reader, the proxy

forwards all APDU commands it receives towards

the application relay, which in turn interfaces with

the credit card (real/virtual). Therefore, if the wallet

does not discriminate the origin of the APDU

commands, the victim can be made to make a

payment without his knowledge.

In order to mitigate reverse engineering

techniques, the application must ensure that the

source code, and where possible other assets, are

properly obscured.

Figure 7a: Diagram of a Remote Relay attack (source:

Lee, 2012).

Log management must avoid exposing (directly

or indirectly) any credential and/or identity token,

and only ever record information that is of no use to

a potential attacker, so that whole errors reported by

the operating system (such as stack traces) are not

saved at all. If necessary, logged information must

be encrypted. The application must also include

mechanisms to verify its own integrity and that of

the device on which it is installed. The application

must primarily be resilient to and also report cases of

tampering by other malicious applications on the

smartphone. Furthermore mechanisms are needed to

resist, identify and report if the smartphone is in

“Debug Mode” or if it has been rooted.

Other techniques to be adopted provide for

automatic checks to make sure that the latest version

is always available and that the application cannot be

installed on removable media (SD card). As

previously stated, it is appropriate that the application

verifies that APDU commands be received by the

NFC controller alone.

Furthermore, software should be developed using

best practices and avoiding deprecated methods (or

similar) to ensure that the life of the product is

compatible with the largest possible number of

updates to the operating system. Any functions

declared deprecated, should be replaced during the

development of updated versions.

Finally, once the application has been developed,

practices for code review and analysis of the

dynamics of the application are strongly

recommended to detect any bugs before release, as is

the supply of a secure distribution channel for the

application.

OrganisationalAspectsandAnatomyofanAttackonNFC/HCEMobilePaymentSystems

695

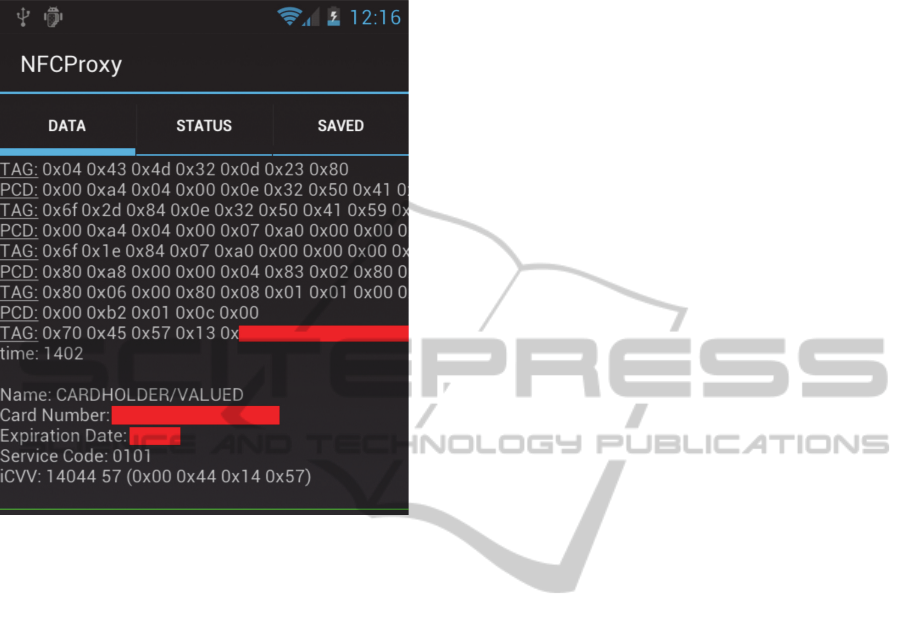

In this example, figure 7b, an intercept NFC

session payment (Lee, 2012):

Figure 7b: “NFC proxy” (source: Lee, 2012).

4.6 Malware and Fake Application

The presence of malware on the device hosting the

mobile wallet application permits various attack

scenarios, if the wallet has not been programmed to

block local attacks (i.e. attacks from other

applications).

As previously stated, a malicious application can

attempt to interface directly with the wallet by

simulating the NFC controller. This would allow the

malware to communicate with the wallet by sending

APDU commands, enabling the ability not only to

perform fuzzing to try to crash the application but

also to try to stimulate its functions.

Figure 7b shows evidence of the part of the

architecture vulnerable to the problem.

Malware could also have keylogger capabilities

to intercept everything that is typed by the user.

Especially during the Enrolment phases, if the user

were to enter the data to activate the HCE service for

a physical card, this would allow an attacker to

intercept such data and clone the card, for example.

Note that the same risk of access to user data input

applies by definition when using alternative terminal

keyboards, most of which, however, do not have

malicious behaviour. Should an inadequately verified

keyboard be used, the risk that the application stores,

and forwards confidential information to third parties

remains.

Special mention should be made of the

increasingly common practice of graphically

emulating a banking application to trick users. “Fake

apps”, as they are known, are able to copy the look

and feel of the “original” to induce users to enter

confidential data (such as bank details) are becoming

increasingly widespread. The Enrolment phase is

critical in this case too (Hancke et al., 2013).

It’s famous the attack on Santander, which

combined fake apps with malware. The malware in

question was called “FAKETOKEN”, which mimics

Santander's token generator. To access the (fake)

service, which does nothing but generate an error,

the user is prompted to enter the account password,

which is immediately sent to a predefined number

controlled by the attacker.

4.7 Specific Vulnerability of “Tap &

Pay”

“Tap & Pay” is a service offered by Android 4.4

that collects all virtual cards in one simply managed

menu on the smartphone. Note that the mobile wallet

must also be registered, and a declaration made, as

to use of an appropriate AID, and the payment

application listed in the “Tap & Pay” menu. The

wallet can be set by the user, as the default payment

method.

Figure 8 shows evidence of the part of the

architecture vulnerable to the problem.

If the “Tap & Pay” system itself has any

vulnerability, various issues as described below

might be encountered. If the “Tap & Pay” were

vulnerable an attacker could control the service by

first setting (or resetting) the default payment card

against the preferences of the victim.

The attacker could also redirect the target

destinations associated with the AIDs As a result he

may cause the failure of new transactions (thus

causing a “Denial of Service”), if there are

incompatibilities in the AID routing rules, or force

the operating system to let the user choose which

payment application to use, showing a list of

possible candidate applications, including malware.

In this case the mitigation of vulnerability in the

“Tap & Pay” service can hardly be referred back to

the HCE service but rather against Google, as the

promoter and developer of the Android platform.

The only precaution is to use the latest updated

versions of the Android operating system, which

would then include patches to mitigate any

vulnerability discovered in previous versions.

ICEIS2015-17thInternationalConferenceonEnterpriseInformationSystems

696

Figure 8: Area subject to vulnerabilities of “Tap & Pay”.

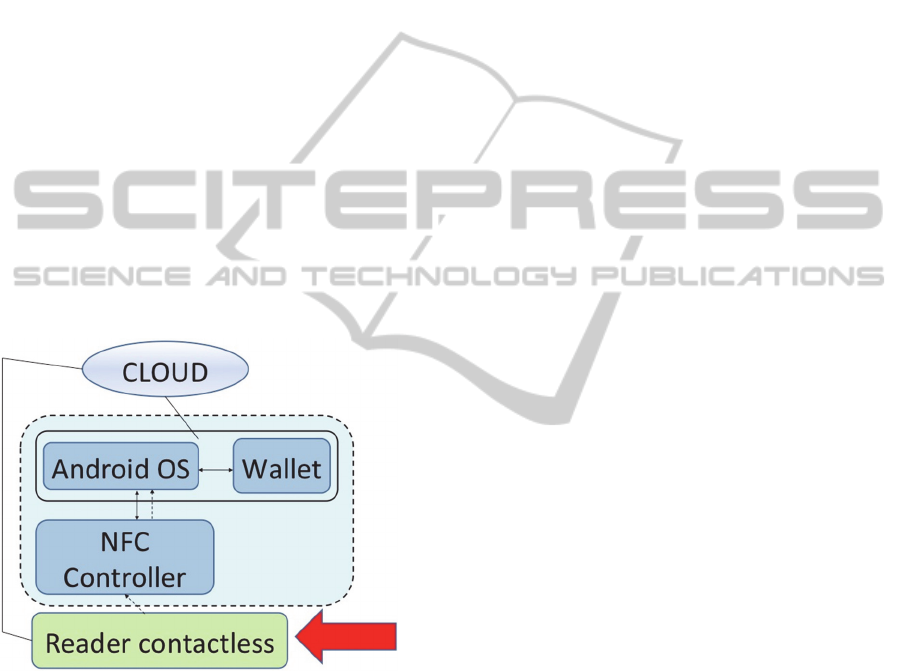

4.8 Device Cloud Decoupling

In a standard configuration, the cloud platform

interfaces with the smartphone via web services,

which are used to enable communication between

each.

If the system fails to carry out authentication, or

uses static credentials that are detectable by

analysing authentication requests (GET or POST),

interfacing with web services directly without using

a real wallet would be enabled. This would allow an

attacker to use both automated tools (like Nessus) as

well scripts created ad-hoc to generate fuzzing and

“stimulate” the API to identify any errors in the

management of data input, reverse communications,

and to reconstruct the flow of communication

between the cloud platform and the successfully

registered smartphone.

As a result, an attacker could connect to the

cloud platform by faking to be a device and attempt

operations to which he should not have access.

Mitigation of this type of issue involves securing

the route connecting the cloud platform (the “new”

Secure Element) to the smartphone by mutual

authentication of the parties (machine-to-machine)

and encryption of the data in transit.

Note that a critical point is also given by the

management of the access credentials to the cloud

platform. Card data migration to the cloud means a

change in the interpretation of the term strong

authentication: in this scenario, server access is

potentially enabled via simple credentials (username

and password), resulting in the loss of the

“something you have” factor. In order to re-establish

a comparable level of security it is necessary to

implement a complementary mechanism that

increases the robustness of authentication without

compromising user experience, such as the

“fingerprinting” of the device allowed to interact

with the web services offered by the cloud platform.

Moreover, it is appropriate that the login credentials

to the Secure Element in the cloud should be entered

on a “reasonably” frequent basis, for example at

every restart of the smartphone.

Figure 9: Area subject to vulnerability of “Device - Cloud

decoupling”.

5 CONCLUSIONS

The adoption of the tools and mitigation procedures

described in association with the scenarios outlined

above would enable an increase in the level of

security of a number of aspects of the HCE solution.

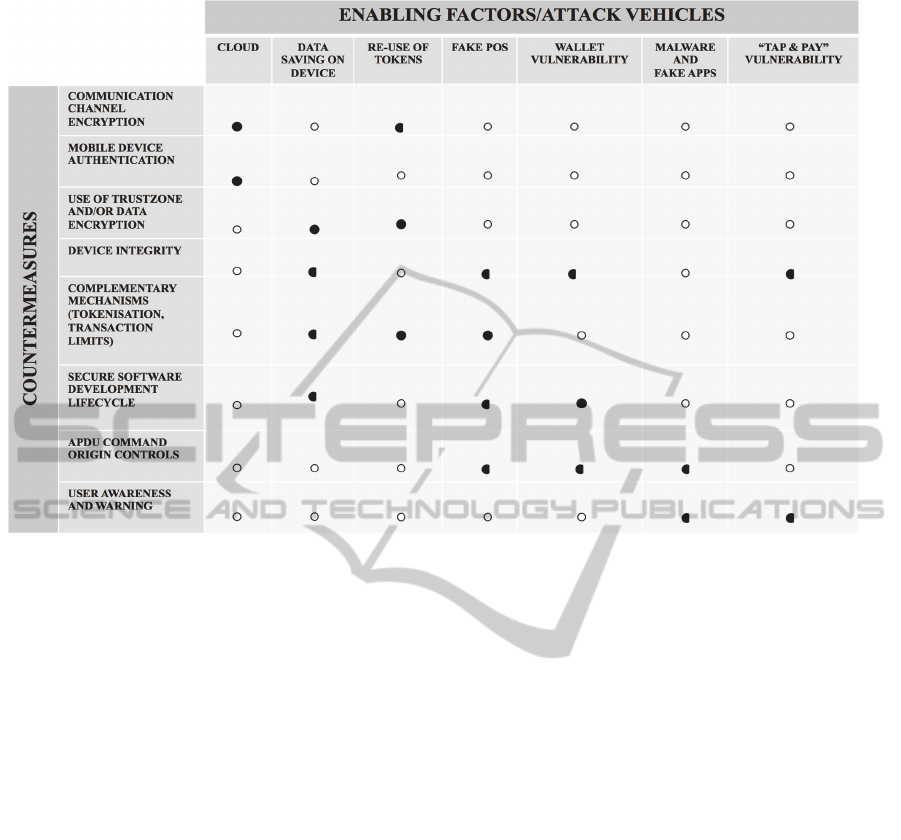

The schematic diagram Figure 10 shows the

potential level of countermeasure that these

instruments, configurations and procedures may

enable for each of the areas of attack identified in

this chapter

Note also the opportunity to evaluate the use of a

“Secure Mobile SDK”, a framework to assist the

development of the mobile wallet by providing APIs

that facilitate the use of security features. These

APIs enable the management of, for example:

root/jailbreak/emulator detection;

end-to-end encryption;

machine-to-machine authentication;

use of secure storage;

generation of One Time Password (time or

location based);

generation of unique device identifier;

OrganisationalAspectsandAnatomyofanAttackonNFC/HCEMobilePaymentSystems

697

Figure 10: Summary of countermeasures.

encrypted storage.

REFERENCES

Aigner, M., Dominikus, S., Feldhofer, M., 2007, “A

System of Secure Virtual Coupons Using NFC

Technology”, Proceedings of the Fifth Annual IEEE

International Conference on Pervasive Computing and

Communications Workshops (PerComW ‘07), pp.

362-366.

Atlassian Bitbucket, 2014, “Reverse engineering of

contactless NFC-EMV payments”,

<https://bitbucket.org/orbit-burg/nfc-

emv/wiki/Home>.

Avison, D., Wood-Harper, T., 2003 “Bringing social and

organisational issues into information systems

development: the story of multiview”. Socio-technical

and human cognition elements of information systems.

IGI Publishing Hershey, PA (pp. 5-21).

Benner, M.J., Tushman, M.L., 28 2003, “Exploitation,

exploration, and process management: The

productivity dilemma revisited”. Academy of

Management Review.

Burgelman, R.A., 47 2002, “Strategy as vector and the

inertia of coevolutionary lock-in”. Administrative

Science Quarterly.

Cavallari, M., 2008, “Human computer interaction and

systems security - an organisational appraisal”, in:

De Marco M., Casalino, N. (eds.), Interdisciplinary

Aspects of Information Systems Studies. p. 261-268,

Springer, Heidelberg.

Cavallari M., 2011, “Organisational Constraints on

Information Systems Security”, in: Emerging Themes

in Information Systems and Organization Studies,

Carugati A., Rossignoli C. (Eds.), 193-207 pp.,

Springer Physica Verlag Heidelberg.

Devendran, A., Bhuvaneswari, T., Krishnan, A.K., 05

2012, “Mobile Healthcare System using NFC

Technology”, IJCSI, Vol. 9, Issue 3, No 3.

Emms, M, Arief, B, Freitas, L, Hannon, J, van Moorsel, A,

12 2014, “Harvesting High Value Foreign Currency

Transactions from EMV Contactless Credit Cards

without the PIN”, CCS 2014.

Fiol, C.M., Lyles, M.A., 10 1985 “Organizational

learning”. Academy of Management Review.

Gupta, A.K., Smith, K.G., Shalley, C.E., 2006, “The

interplay between exploration and exploitation”.

Academy of Management Journal.

Hagen, J.M., Albrechtsen, E. et al., 2008, “Implementation

and effectiveness of organizational information

security measures”. Information Management &

Computer Security.

Halgaonkar, P.S., Jain, S., Wadhai, V.M., 2013, “NFC: a

Review of Technology, Tags, Applications and

Security”, IJRCCT, 2013, Vol 2, No 10, 2013.

Hancke, F., 11 2007, “Radio Frequency Identification, e

& i (Elektrotechnik und Informationstechnik)”, Vol.

124, No. 11, pp 404-408, Springer, November 2007.

Hancke, F., Mayes, K.E., Markantonakis, K., 10 2009,

“An overview of relay attacks in the smart token

environment that discusses attack implementations,

ICEIS2015-17thInternationalConferenceonEnterpriseInformationSystems

698

implications and possible countermeasures”,

Computers & Security, Vol. 28, Issue 7, pp 615-627,

Elsevier.

Hancke, F., Mayes, K., Mar 2013, “A Practical Generic

Relay Attack on Contactless Transactions by Using

NFC Mobile Phones” In: IJRFIDSC. 2, 1-4.

Haselsteiner, E., Breitfuß, K., 2006,“Security in Near

Field Communication (NFC) – Strengths and

weaknesses”, Proceedings of Workshop on RFID

Security (RFIDSec).

He, Z.L., Wong, P.K., 15 2004, “Exploration vs.

Exploitation: An empirical test of the ambidexterity

hypothesis”. Organization Science.

Honig, Z., 05 2013 “Samsung releases TecTiles 2 NFC

tags for Galaxy S 4, available for $15 today”.

ISO/IEC 14443-3:2011 A&B,

<http://www.iso.org/iso/catalogue_detail.htm?csnumb

er=50942>.

ISO/IEC 7816-4:2013,

<http://www.iso.org/iso/iso_catalogue/catalogue_tc/ca

talogue_detail.htm?csnumber=54550>.

Issovits, W., Hutter, M., 2011, “Weaknesses of the

ISO/IEC 14443 Protocol Regarding Relay Attacks”,

IEEE International Conference on RFID-Technologies

and Applications.

JIS-X 6319-4

http://www.proxmark.org/files/Documents/13.56%20

MHz%20-%20Felica/JIS.X.6319-4.Sony.Felica.pdf

Juels, A., Syverson, P., Bailey, D., 2005, “High-power

proxies for enhancing RFID privacy and utility”, G.

Danezis and D. Martin, editors, in: “Privacy

Enhancing Technologies (PET)”, 2005.

Juels, A., Weis, S., 2005a, “Authenticating pervasive

devices with human protocols”, Advances in

Cryptology – CRYPTO, pages 293–308. Springer-

Verlag, Lecture Notes in Computer Science, Volume

3621.

Juels, A., Weis, S, 2005b, “Defining strong privacy for

RFID”, Manuscript.

Lee, E., 2012, DEFCON 20, “NFC Hacking: The Easy

Way”, ref. NFC proxy, p. 20, http://korben.info/wp-

content/uploads/defcon/SpeakerPresentations/Lee/DE

FCON-20-Lee-NFC-Hacking.pdf”.

Levitt, B., March, J.G., 14 1988, “Organizational

learning”. Annual Review of Sociology.

Li, Y., Deng, R.H., Bertino, E., 2014, “RFID Security and

Privacy”, Elisa Bertino and Ravi Sandhu (Eds.), in:

Synthesis Lectures on Security, Privacy and Trust,

Morgan & Claypool Publishers.

Madlmayr, G., Langer, J., Kantner, C., Scharinger, J.,

2008, “

NFC Devices: Security and Privacy”, IEEE

The Third International Conference on Availability,

Reliability and Security, IEEE DOI

10.1109/ARES.2008.105.

March, J.G., 1991, “Exploration and exploitation in

organizational learning”. Organization Science.

Marzo, F., Castelfranchi, C., 2013, “Trust as individual

asset in a network: a cognitive analysis”. In:

Spagnoletti, P. (ed.) Organization Change and

Information Systems, LNISO vol. 2. Springer,

Heidelberg.

Mayes, K.E., Markantonakis, K., Hancke, F., 05 2009,

“Elsevier Information Security Technical Report”,

Vol.14, Issue 2, pp 87-95.

McHugh, S., Yarmey, K., 08 2012, “Near Field

Communication: Introduction and Implications”,

Weinberg Memorial Library, University of Scranton ,

Scranton, Pennsylvania , USA

Momani, M.H., Hudaib, A.AZ., 2014, “Comparative

Analysis of Open-SSL Vulnerabilities & Heartbleed

Exploit Detection”, IJCSS, Volume (8): Issue (4).

Mulliner, C., 2009, “Vulnerability Analysis and Attacks on

NFC-enabled Mobile Phones”, IEEE International

Conference on Availability, Reliability and Security,

IEEE DOI 10.1109/ARES.2009.46.

Murdoch, S., Anderson R., 01 2010, “Verified by Visa and

MasterCard SecureCode: or, How Not to Design

Authentication”. Financial Cryptography and Data

Security, pp. 42-45.

Nai-Wai, L., Li, Y., 2012, “Radio Frequency

Identification System Security”, Volume 8, Cryptology

and Information Security, IOS Press.

NFC Forum, 12 2013, “NFC and Contactless

Technologies”, <http://nfc-forum.org/what-is-

nfc/about-the- technology>, 2013

Ok, K., Aydin, M.N., Coskun, V., Ozdenizci, B., 2011,

“Exploring Underlying Values of NFC Applications”,

3rd International Conference on Information and

Financial Engineering IPEDR vol.12, IACSIT Press,

Singapore.

Ozdenizci, B., Aydin, M. N., Coskun, V., Ok, K., 2010,

“NFC Research Framework: A Literature Review And

FutureResearch Directions”, Proc. 14th IBIMA,

Istanbul, Turkey, 2010, pp. 2672-2685.

Patidar, P., Bhardwaj, A., 2011, “Network Security

through SSL in Cloud Computing Environment”,

IJCSIT, Vol. 2 (6) , 2011, pp. 2800-2803.

Paya, C., 05 2014, “HCE vs embedded secure element:

relay attacks (part V)”, Random Oracle,

<https://randomoracle.wordpress.com/2014/05/01/hce-

vs-embedded-secure-element-relay-attacks-part-v/>,

2014.

Pettigrew, A.M., 1987, “Context and action in the

transformation of the firm”. Journal of Management

Studies.

Pettigrew, A.M., 2001, Woodman, R.W., Cameron, K.S.

“Studying organizational change and development:

Challenges for future research”. Academy of

Management Journal.

PCI DSS, 2006-2015,

https://www.pcisecuritystandards.org/security_standar

ds/

Roland, M, Langer, J., Scharinger, J., 10 2012 “Practical

Attack Scenarios on Secure Element-enabled Mobile

Devices”, IEEE 4th International Workshop with

Focus on Near Field Communication, 2012. IEEE DOI

10.1109/NFC.

OrganisationalAspectsandAnatomyofanAttackonNFC/HCEMobilePaymentSystems

699

Slade, E., Williams, M., Dwivedi, Y., Piercy, N., 04 2014,

“Exploring consumer adoption of proximity mobile

payments”, JSM, Taylor & Francis, 2014.

Smart Card Alliance, 10 2014, “Host Card Emulation

(HCE) 101”.

Smith-Strickland, K., 10 2013, “National Australia Bank

Launches Funds Transfer Service Initiated by NFC

Peer-to-Peer Mode”, NFC Times, Oct. 3

rd

, 2013.

Spagnoletti P., Resca A., 2008, “The duality of

Information Security Management: fighting against

predictable and unpredictable threats”. JISS, Vol. 4 –

Issue 3.

Straub, D., Goodman, S., Baskerville, R., 2008, “Framing

of Information Security Policies and Practices”. In

Information Security Policies, Processes, and

Practices. D. Straub, S. Goodman and R. Baskerville

(eds.), Armonk, NY: M. E. Sharpe.

Suman, S., 09 2013, “NFC: an overview”, IJARCSMS,

Volume 1, Issue 4, September 2013.

Trend Micro, 01 2015, “Masque, FakeID, and Other

Notable Mobile Threats of 2H 2014”, http://about-

threats.trendmicro.com/us/mobile/monthly-mobile-

review/2013-08-mobile-banking-threats>.

Van Damme, G., Wouters, K., Preneel,B., 2009,

“Practical Experiences with NFC Security on mobile

Phones” in Proceedings of the RFIDSec’09 on RFID

Security, LNCS, Springer-Verlag, 13 pages, 2009.

Van Dullink, W., Westein, P., 02 2013, “Remote relay

attack on RFID access control systems using NFC

enabled devices”, Report, University of Amsterdam,

https://www.os3.nl/_media/2012-

2013/courses/rp1/p30_report.pdf.

Verdult, R., Ois Kooman, F., 2011,“Practical attacks on

NFC enabled cell phones”, IEEE Third International

Workshop on Near Field Communication, DOI

10.1109/NFC.2011.16

Worstall, T., 10 2012 , “Google Wallet's Security Hole”,

Forbes,

<http://www.forbes.com/sites/timworstall/2012/02/10/

google-wallets-security-hole/>.

Za, S., Marzo, F., De Marco, M, Cavallari, M., 2015,

“Agent Based Simulation of Trust Dynamics in

Dependence Networks”, in: Exploring Services

Science, LNBIP, Volume 201, Henriqueta Nóvoa and

Monica Drăgoicea (eds.), Springer.

ICEIS2015-17thInternationalConferenceonEnterpriseInformationSystems

700