Salt Seller

Realization of a Business Game

Felix Kiechle, Corinna Uhr, Mario Schlereth, Yao Zhang, Leon O. Burkard

Andreas C. Sonnenbichler and Andreas Geyer-Schulz

Institute of Information Systems and Marketing, Karlsruhe Institute of Technology, Zirkel 2, Karlsruhe, Germany

Keywords:

Salt Seller, Business Games, Gaming Simulation, Simulators, Business Simulation, Browser, Multi-player.

Abstract:

This paper describes the realization and implementation of a business game named Salt Seller. Salt Seller was

first described by John Sterman in 2014 and implemented for the MIT Sloan School of Management. However,

Sterman only provided a high-level description of Salt Seller and no low-level details about the realization or

the market model were revealed. Our first aim is to fill this gap. As our second contribution introduces a

generalized n-person framework for round-based games which serves as an abstract game architecture and

encapsulates the round synchronization mechanisms. Utilizing this framework we provide a detailed view

on a possible model of the market mechanisms for Salt Seller. We describe all the market functions which

are needed to calculate the game outputs in each period. Our work aims to improve decision making in

management and to support teaching. To support this third goal we implemented the game using modern web

technologies allowing us to use the game in students’ lessons at the KIT. All input and output parameters of

every round are stored in a database for later analysis of the players’ behaviour. Generally, our implementation

demonstrates how general round-based multi-player games can be realized in a browser, our architecture

supports various other 2-player round-based games.

1 INTRODUCTION

Simulations are an essential tool to teach pilots, power

plant operators, managers and experts in complex de-

cision situations. Simulations are used to train regu-

lar work processes as well as emergencies: Landing a

plane during a storm can be best trained with the help

of realistic simulators.

Management simulations are used to train man-

agers, experts, and students to get a better understand-

ing of the effects of decisions in complex systems, e.g.

markets and supply chains. One of the earliest exam-

ples is the Beer Distribution Game (Forrester, 1961;

Jarmain, 1963; Sterman, 1989). It demonstrates the

dynamics of a supply chain and illustrates the bull-

whip effect. Simulators and games like the Beer Dis-

tribution Game or the Salt Seller Game are designed

to teach management principles, strategy, dynamics

and sustainability.

The most complex decisions managers have to

make are price decisions in competitive markets. The

Salt Seller is one of the most basic simulators to

understand the general dynamics of stable markets

(Sterman, 2014, p.90ff.). It reduces the dimensions

of competition in industry to pricing giving ”partic-

ipants the opportunity to set prices for a commodity

in an important industry“ (Sterman, 2014, p.92) and

to experience the effects of their decisions on market

shares and profits. The salt seller 2-person game re-

duces complexity by the following assumptions: Con-

stant marginal production costs, symmetric cost struc-

ture, an undifferentiated product and a stable mar-

ket with low rates of entries or exits, slow demand

growth, slow technological changes and few oppor-

tunities for cost reductions. In spite of these strong

assumptions, ”understanding the basic dynamics of

such markets is fundamental“ (Sterman, 2014, p.92).

In the Salt Seller game the players represent two

salt producers who have the same factors of produc-

tion and who face the same marginal costs. They pro-

duce salt of the same quality and each of them has

enough capacity to cover the whole salt demand of

the world market. The only factor the players can in-

fluence is the price per ton and round (period) they

sell their salt at. Depending on this price in relation

to the price of the opponent their market shares, sales

127

Kiechle F., Uhr C., Schlereth M., Zhang Y., O. Burkard L., C. Sonnenbichler A. and Geyer-Schulz A..

Salt Seller - Realization of a Business Game.

DOI: 10.5220/0005503501270135

In Proceedings of the 12th International Conference on e-Business (ICE-B-2015), pages 127-135

ISBN: 978-989-758-113-7

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

and profits per round will be calculated. After a fixed

number of rounds the game ends and the player with

the highest total profit wins the game.

This paper is structured as follows: In section 2

the term business game is defined in relation to the

history of business games, other business games are

cited and related work is discussed. Section 3 gives a

brief review of the taxonomy of business games and

classifies Salt Seller. Section 4 introduces a general

framework for n-player round-based games. As ap-

plication of the general framework of section 4 we

describe in section 5 the Salt Sellers’ market model

which consists of parametrized market functions in

order to calculate the game’s outputs in each period.

The implementation which is presented in section 6 of

the market model functions and the multi-player ar-

chitecture has been done with the help of the Python

Web application framework Django (Django, 2015)

followed by an evaluation and a conclusion in section

7 and 8.

2 BUSINESS GAMES

A gaming simulation which can be traced back to a

Chinese war game Wei Qi (game of encirclement) as

far as 3000 BC consists of interactions among groups

of players (decision makers) placed in a predefined

setting and constrained by a set of rules and proce-

dures. In a gaming simulation a player fulfills a pre-

scribed role with a defined task in a particular realistic

situation (Hsu, 1989).

Business games (BGs) are games within a busi-

ness environment that can lead to one or both of

the following results: the training of players in busi-

ness skills (hard and/or soft) or the evaluation of

players’ performances (quantitatively and/or qualita-

tively) (Greco et al., 2013).

Triggered by the integration of developments in

war games, operations research, computer technol-

ogy and education theory, BGs arrived on the scene

in the late 1950s for example with development of the

American Management Association (AMA) decision

simulation game (Ricciardi and Marting, 1957). In

the following years games such as the Beer Distribu-

tion Game (Sterman, 1989; Jarmain, 1963; Forrester,

1961) or the Markstrat Simulation Game (Larr

´

ech

´

e

and Gatignon, 1977) were released and remained pop-

ular until today (Stratx Simulations, 2015). An ex-

haustive survey about the historical development of

the field of business games is presented by Wolfe

(Wolfe, 1993).

Today the field of business games is influenced

by current technology developments such as natu-

ral language and advanced graphics processing, new

business models like learning on demand and online

feedback mechanisms based on artificial intelligence

(Summers, 2004). BGs also serve as experimental en-

vironment for training artificial agents and for study-

ing deviations of human players from rationality. Fur-

thermore, BGs are used as incentives to make crowd

based online work (crowdsourcing) more attractive

and effective (Rokicki et al., 2014). They are imple-

mented by global enterprises like Google, Microsoft,

American Express, Caterpillar, etc. to train their em-

ployees and managers (Uskov and Sekar, 2014).

Since their inception the main purpose of BGs

has been to teach. Over the years BGs became very

popular in management education. Nowadays, al-

most every MBA program requires students to play

one or more management simulations, and BGs are

even more commonly applied at the undergraduate

level (Faria, 1998). In addition, role-playing in the

business context can improve soft-skills such as team

work, leadership, and practicing concepts and skills

used in strategic management, marketing, finance,

and project management.

3 GAME CLASSIFICATION OF

SALT SELLER

Eilon’s early taxonomy (Eilon, 1963) classifies BGs

according to design characteristics (computer/non-

computer, total enterprise/functional, ...) and ex-

pected use (management training, selling purpose, re-

search).

Other taxonomies focus on a specific aspect of a

game, such as the web technologies used in order to

provide distant education (Bernard, 2014) or the skills

that are mediated (product development, project man-

agement, logistic skills, risk management) (Riedel

and Hauge, 2011).

A complete taxonomy of BGs is presented by

Greco et al. (Greco et al., 2013) which combines and

extends previous work (Maier and Gr

¨

oßler, 2000;

Aarseth et al., 2003; Elverdam and Aarseth, 2007)

in this field. Greco et al. classify BGs along five

dimensions: application environment; elements of

the user interface; target groups, goals, and feed-

back; user relation; and model. Each dimension is

described by an enumeration of characteristics and

sub-characteristics. One game can be categorized

by a subset of characteristics. Below, Salt Seller is

classified according to this taxonomy.

Application Environment. Salt Seller is a stand-

alone simulation which means it is currently not

ICE-B2015-InternationalConferenceone-Business

128

integrated into any learning environment such as an

undergraduate teaching course. However, its modular

implementation and high configurability facilitate an

integration in the future. Salt Seller is played over

a computer network (LAN, Internet) on the HTTP

stack.

Elements of User Interface (UI). The user interface

of Salt Seller is browser based and includes texts and

charts. Gaming results and the complete decision

making process are stored in a database for further

investigation. The game behaves like a black box

since the user is not supposed to have detailed

information about the market mechanisms (= the

simulation model and the choice of parameters).

The game is round-based in contrast to e.g. a flight

simulator where interventions within the simulation

are almost continuous. Each round (period), the

players take quantitative decisions (price for salt).

Every player must enter his or her decision for the

next period independent from each other within a

certain time. The time frame to take a decision

is synchronized between all parties which means

the players act simultaneously. If one party does

not respond within the time frame the game will

be terminated so all parties have the same time to

reflect and take a decision. In contrast to alternating

rounds, e.g. chess, where one player decides after

the other, decisions in the Salt Seller game are made

simultaneously. Furthermore, since a timer counts

down the remaining time to submit a price, haste is

present; real time can alter the game state and remove

one player from the game if he takes too much time

for his decision.

Target Groups, Goals and Feedback. The goal

of Salt Seller is to achieve a higher total profit than

the opponent and to develop an understanding for

the behaviour of a duopoly market. The goal is not

absolute (fixed score on a scale) but relative to the

opponent. It is easy to explain and thus the game is

not restricted to a special target group as for example

economy students. Salt Seller is supposed to be a

teaching game and can also be used in research in

order to analyse the strategies of the players. Target

audience are undergraduate students or bright pupils

with minor economic prior knowledge. So far it

provides only basic feedback mechanisms like input

validation or status messages. Debriefing is not

provided either.

User Relation. In this implementation Salt Seller is

a two player game and teams are not supported. The

users are evaluated individually. Interaction between

the users is indirect since they submit their price

decisions independently from each other. There are

no means of direct interactions, e.g. an integrated

communication channel. Salt Seller has not the

character of a role-playing game, where users take

roles and interact socially with each other. Alliances

do not exist in competitive two-person games. There

is neither a players’ nor a developers’ community

(like a Facebook page, mailing list etc.). It is open

to the game moderator respectively the intention of

the game session in question whether communication

between the players is prohibited or not.

Model. The domain of Salt Seller is realistic in con-

trast to a fantasy game or a game which plays in

the past or in the future. All parts of the game be-

have deterministically even though some components

as the total salt demand could be modelled stochasti-

cally/randomly in the future (see section 8). The game

is not influenced by external data such as exchange or

inflation rates. It is highly configurable since all mar-

ket functions of the model are parametrized and can

be adjusted (see section 5).

4 GENERAL FRAMEWORK FOR

n-player ROUND-BASED

GAMES

In this section we introduce a general framework for

n-player round-based games by utilizing inputs, out-

puts, fixed parameters, result functions, an objective

function, and a stop condition. We will apply the Salt

Seller game to this framework in section 5.

We define a n-player round-based game through

the 6-tuple (In

t

,P,F ,Out

t

,ob j

t

,sc) with t ∈ T repre-

sents one round of all rounds T . We call a round also

turn or period.

• In

t

is a vector of inputs in turn t. E.g., in Salt

Seller the prices the two players choose for their

offer.

• P is a set of fixed parameters (constants), e.g. a

pre-defined number of rounds.

• F is a set of result functions transforming the state

from turn t to t + 1. We provide examples for the

Salt Seller game in section 5.

• Out

t

is a vector of outputs of turn t calculated by

inputs In

t

, parameters P, and the result functions

F .

• ob j

t

is an objective function weighting the outputs

related to the target of the game. In Salt Seller the

objective function is the cumulative profit over all

turns.

SaltSeller-RealizationofaBusinessGame

129

• sc is a stop condition. If the condition is met, the

game ends. In Salt Seller the stop condition is a

pre-defined number of turns.

Please note that in many games the players do not

receive complete information about all game describ-

ing variables. Additionally, P, F , and sc can be gen-

eralized and defined dependent on t as well, e.g. in

Skat F is defined differently when playing “Null”.

Furthermore, all tuple parts could also been made de-

pendent on the number of players n.

In each round, n players or a random number gen-

erator or a stochastic distribution submit l = |In

t

| in-

put values which results in the input matrix In

t

. We

assume l constant in t. Thus, In

t

is of the dimension

l × n. The domain of In

t

has to be chosen depend-

ing on the game, generally, R can be a good choice.

The output Out

t

is a matrix of the dimension k × n,

k = |Out

t

| is the number of outputs for n players, again

k is assumed constant in t. Like In

t

the domain of Out

t

is game-dependent.

The state transformation functions F are used to

calculate the outputs of a round t. Each f ∈ F is de-

fined as f : In

t

× P → Out

t

.

The result of the entire game for each player

i is defined with the (linear) objective function

ob j

t

: (Out

t

× W ) → R. W is a weighting vector of

dimension k.

It is:

ob j

t

=

t

∑

s=1

k

∑

j=1

w

j

∗ Out

s

ji

, for 1 ≤ i ≤ n, w

j

∈ W (1)

5 SALT SELLER GAME MODEL

This section describes our game and market model

of Salt Seller. It explains how the game’s outputs

of each round are calculated from its inputs. The

model consists of three parametrized functions which

are described further in the following three subsec-

tions. Subsection 5.5 shows how these functions work

together in order to calculate the outputs of a game

period.

5.1 Formal Game Model

Following the general game framework from section

4 we define Salt Seller as:

• In

t

= {price

1

t

, price

2

t

}

being two turn-dependent prices for players 1 and

2.

• P = {maxrounds,MC, SI,ZR,ZDP,ZDPr,MaxD}

MC being the marginal costs, SI sensitivity index,

ZR zero rate, ZDP zero delay percentage, ZDPr

zero demand price, MaxD maximal demand. All

parameters are covered in the next subsections.

• F is a set of 4 market functions: Market share

(equation 5), Sales (equation 6), Profit (equation

7), and total salt demand (equation 4). We refer to

the next subsections.

• Out

t

= {market share, sales, profit, total salt de-

mand};

• ob j

t

=

∑

t

s=1

∑

k

j=1

(w

j

∗ out

s

ji

), for i ∈ {1, 2};

with the weighting factor W = (0,0,1,0) since

only the output profit is maximized in Salt Seller’s

objective function. The objective function calcu-

lates the cumulative profit over all so-far player

periods for a player i.

• sc : t > maxrounds

The stop condition checks whether the current

round t is greater than the pre-defined number of

rounds maxrounds.

5.2 Market-Price-Sensitivity

This class of functions describes the market’s sensi-

tivity towards price differences between the two com-

petitors. It thus provides a mapping between the

price-ratio

p

1

p

2

or

p

2

p

1

and the market share of the first

or the second player. Please note, we omit the in-

dex t for the sake of readability, however, all prices

and ms (see below) are set per turn. In our model,

the market share is defined as the continuous function

ms: [1, ∞) → [0, 1].

ms(x) =

1

2

− zc

ms

∗ (x − 1)

1

/(2∗SI−1)

, 1 ≤ x ≤ ZR

0, x > ZR.

(2)

In this function, x is the price ratio of the higher

price divided by the lower price ( =⇒ x ≥ 1) and

ms(x) is the market share of the competitor with the

higher price. The zero coefficient zc and the Sensitiv-

ity Index SI are explained below. The market share

of the competitor with the lower price is calculated as

1 − ms(x). We denote the market share of player i by

ms

i

.

For the salt seller game Sterman (Sterman, 2014,

p.100) describes market-price-sensitivity as ”sensitiv-

ity of product attractiveness to price“. This corre-

sponds to the standard economic concept of the price

elasticity of demand. For the general problems of

measuring the price elasticity of demand we refer

to (Wilson, 1997). One approach is by experimen-

tal markets, see e.g. for scientific information (Neu-

mann, 2007). Function 2 is a simple approximation

of the price elasticity of demand.

ICE-B2015-InternationalConferenceone-Business

130

The rationale behind the function ms is the

following: At equal prices (x = 1) the market shares

are equal. We assume that a price ratio exists at which

all customers buy from one player only. We call this

the Zero Rate (ZR). The simplest price elasticity

of demand function is linear. In order to provide a

family of price elasticity of demand functions we

chose power functions, parameterized by the second

parameter SI. SI defines the speed of convergence.

For SI = 1 the function reduces to a linear function.

Sensitivity Index (SI). This parameter defines the

average sensitivity of salt customers towards price

differences between the two salt producers. It is

chosen from N. The higher the value of SI, the higher

the customers’ awareness for price differences. A

high value of SI thus signifies, that even small price

differences will lead to a huge gain of market share

for the price leader in the current period. At SI = 1,

ms is a linear function.

Zero Rate (ZR). This parameter defines the price

ratio from up to which the price leader will win the

complete market in the current period. For instance,

if ZR = 3 and p

1

= 50, p

2

≥ 150, the first competitor

will have a market share of 100% in the current

period. In figure 1 this is the crossing of the market

share function ms with the x-axis.

Zero Coefficient (zc

ms

). Find zc

ms

so that ms(ZR) = 0

for a fixed SI.

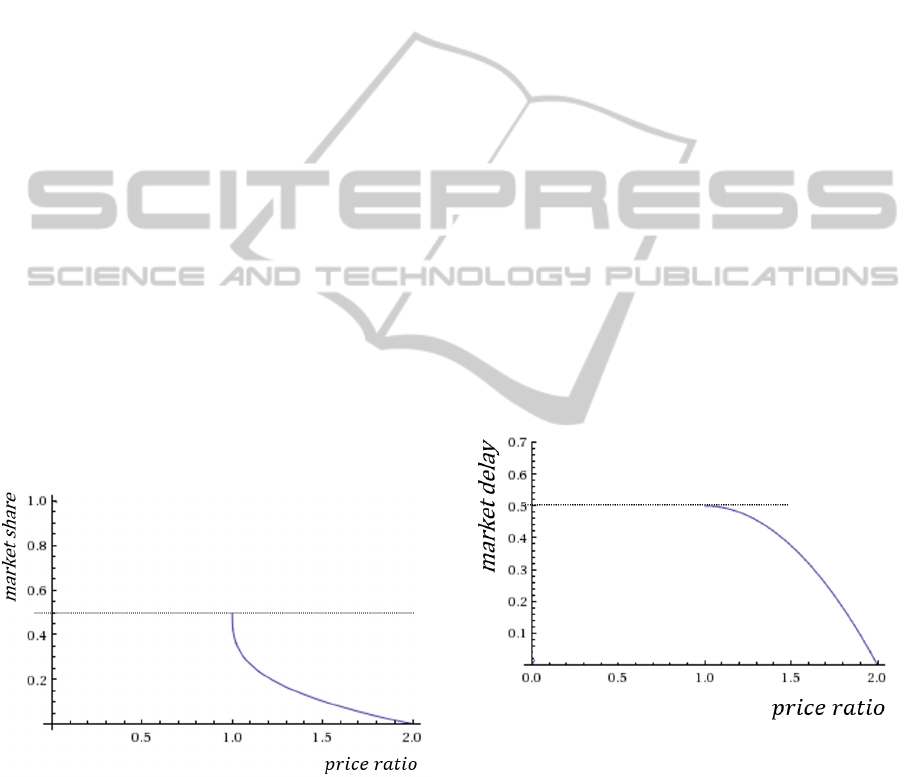

Figure 1: Market-price-sensitivity function for SI=2 and

ZR=2.

Figure 1 shows a plot of ms for SI = 2 and ZR = 2.

In this example, the derived zero coefficient zc

ms

is

1/2.

ms is easy to calibrate: It suffices to determine two

points of the function ms. This can be done either

by choosing proper values for ZR and SI or by ex-

perimental markets, as e.g. described in (Neumann,

2007).

5.3 Market Delay Percentage

To simulate a more realistic market behaviour the cus-

tomers in Salt Seller are divided into two groups: The

first group, the “early adaptors”, reacts immediately

to the latest price offers of the two salt producers. The

second group, the “conservatives”, reacts with a delay

of one period which means their buying decision de-

pends on the prices of the prior period (while actually

paying the new prices). This provides a simplified

model of a customer who once decided to buy from

one producer (based on the price situation back then)

and then just keeps on buying from the same producer,

no matter how the prices develop.

The distribution of these two groups again de-

pends on the price ratio. This follows the intuition

that a very big difference in the prices for salt will

alert even the most inattentive customer. The larger

the difference between both prices, the lower the per-

centage of conservatives, the lower the md p. In our

model, the market delay is defined as the continuous

function md p : [1,∞) → [0,1], with

md p(x) =

(1 − ZDP)−

− zc

md p

(x − 1)

2

,

1 ≤ x ≤ ZR

0, x > ZR.

(3)

Figure 2: Market-delay function for ZDP=0.5 and ZR=2.

In this function, x is the price ratio defined as in

the previous section and md p is the percentage of the

customers in the second group, thus md p(x) provides

the percentage of the conservatives. The percentage

of the early adaptors is calculated as 1 − md p(x).

Using the decreasing part of a negative parabola

function suited the simplified model of market delay

well. It decreases only slowly where both opponents

sell at similar prices. The more one player raises

his price above that of his competitor, the faster the

customers change groups and react to the big price

SaltSeller-RealizationofaBusinessGame

131

difference.

Zero Delay Percentage (ZDP). This parameter de-

fines the minimum percentage of customers that be-

long to group one.

ZR is defined as in the previous subsection. zc

md p

is calculated by md p(ZR) = 0. It determines the price

ratio from up to which every customer will be part of

the first group and nobody will buy from the more ex-

pensive producer anymore out of convenience. Figure

2 shows a plot of md p for ZDP = 0.5 and ZR = 2.

5.4 Market Demand

The market demand of the current period is defined as

demand(p

min

) = MaxD − zc

demand

∗ p

min

(4)

where p

min

is the price of the price leader. This is

a linear function, zc

demand

is calculated for a given

choice of the parameters Zero Demand Price ZDPr

and Maximal Demand MaxD.

According to the article ”The price of salt: Salt

sellers“

1

there are very different types of salt which

leads to prices between 40$ to 50$ per ton for de-icing

salt and 70,000$ per ton for a French high quality salt.

Furthermore the global consumption of salt is rising.

In 2018 the forecast for global demand is 324 million

tons per year

2

. To keep the simulation game simple a

fictive multifunctional salt and linear market demand

is used for the function above. Derived from the in-

formation about the salt market example values of 320

million tons per year for MaxD and 960$ per ton for

ZDPr are supposed to be realistic. However, we are

aware that salt is a essential good for every human

being, thus assuming a Zero Demand Price is a bit

unrealistic.

5.5 Output Calculation

Since market delay is taken into account the calcula-

tion of the market share of the current period does not

solely depend on the market-price-sensitivity func-

tion ms(x). Instead of that we have to calculate the

sum of the outcome of ms(x) with the price ratio of

the previous period weighted with the percentage of

the delayed customers from group two and the out-

come of ms(x) with the current price ratio weighted

with the percentage of customers without delay from

group one. Altogether we get for the market share

1

http://www.economist.com/node/15276675, retrieved on

20 Feb. 2015

2

http://www.reportlinker.com/p0788601-summary/World-

Salt-Market.html, retrieved on 20 Feb. 2015

MS of the price leader and p

h

= higher price and

p

l

= lower price in period t:

MS

t

= ms(

p

h

t−1

p

l

t−1

) ∗ md p(

p

h

t

p

l

t

)

| {z }

“conservatives

00

+ ms(

p

h

t

p

l

t

) ∗ (1 − md p(

p

h

t

p

l

t

))

| {z }

“early adaptors

00

(5)

where ms(x) and md p(x) are the market-price-

sensitivity and market delay function from the pre-

vious subsections. The market share for the other salt

producer in period t then calculates as 1 − MS

t

.

sales

i

t

= MS

i

t

∗ demand(p

min

t

) ∗ p

i

t

for i ∈ {1,2} (6)

The sales are calculated by multiplying the mar-

ket share with the total demand of salt which is de-

termined using equation 4 and multiplying that value

with the salt price of the player.

pro f it

i

t

= sales

i

t

− MS

i

t

∗ demand(p

min

t

) ∗ MC

for i ∈ {1,2} (7)

The profits can be determined by subtracting the

production costs from that value. The production

costs are calculated by again multiplying the market

share with the salt demand and multiplying that value

with the marginal costs which are another parameter

of Salt Sellers’s market model.

The player with the highest cumulative profit over

all periods wins the game.

6 IMPLEMENTATION

Running in a browser and dealing with the multi-

player issues of a round-based game were the two

main requirements for the implementation of Salt

Seller. The scalable Python Web framework Django

meets these requirements well.

Use of Python. Python is a lightweight scripting

language with a clean and elegant syntax. Its big

library and Object Oriented language model suites

well for a wide variety of applications and so it does

for web applications.

Model-view-Controller. Django follows the model-

view-controller software paradigm which separates

data model, data handling logic and user interfaces

from each other. This brings the advantage that one

ICE-B2015-InternationalConferenceone-Business

132

part can be developed and changed without affect-

ing the other. The framework also takes care for the

object-relational mapping (ORM) and introduces a

separation between the data model and the database

layer. Nearly all well-known relational database en-

gines are supported and can be used without changing

the data model.

6.1 Data Model

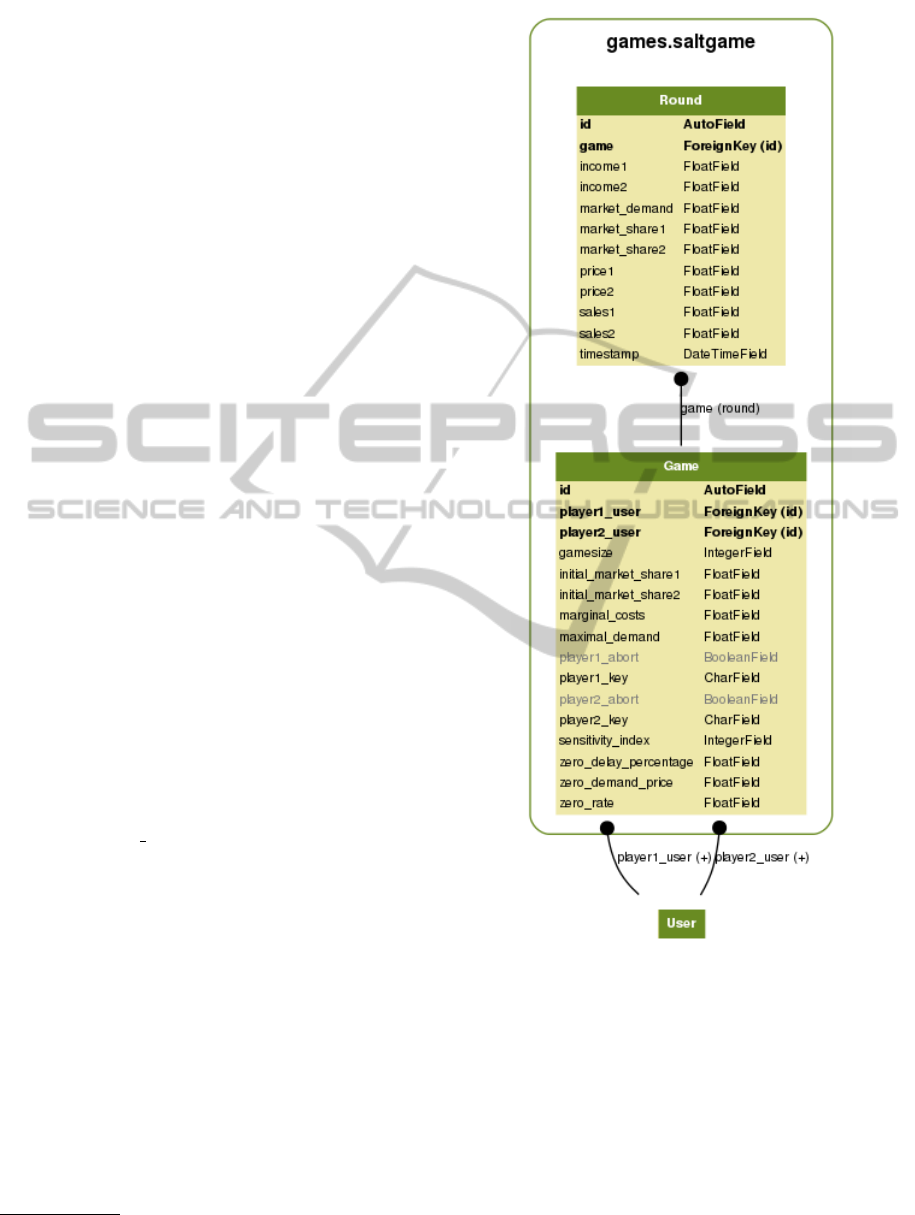

Figure 3 shows the data model of Salt Seller. Since it

is a round-based game it consists of the classes Game

and Round.

The class Game holds all the attributes which de-

scribe an instance of a game - like the values of the

parameters chosen for this specific game or the users

who are playing.

One game consists of as many rounds as specified

by the parameter maxrounds. The class Round con-

sists of the round-specific input and output attributes

like the prices for salt, market shares, sales, profits,

and total salt demand.

In its mapping from Python objects to relational

databases each class of Django’s model becomes a ta-

ble and each class variable becomes a column in the

database. Many-to-one relationships are translated

into foreign key relationships. Each round holds a

foreign key to one single game and since Salt Seller is

integrated into KIT’s infrastructure each game holds

the two foreign keys of the two players playing. Valid

users must be members of KIT.

Please note that the classes in Django’s model are

more than a sheer abstraction layer of the database.

Round and Game define methods as in any Object

Oriented language. A round for example has the

method calculate round which implements the result

functions F from section 5. It is then part of the

data handling logic (controller) to call this method of

a round object at the right time - namely after both

players have submitted their price decisions.

6.2 User Interface

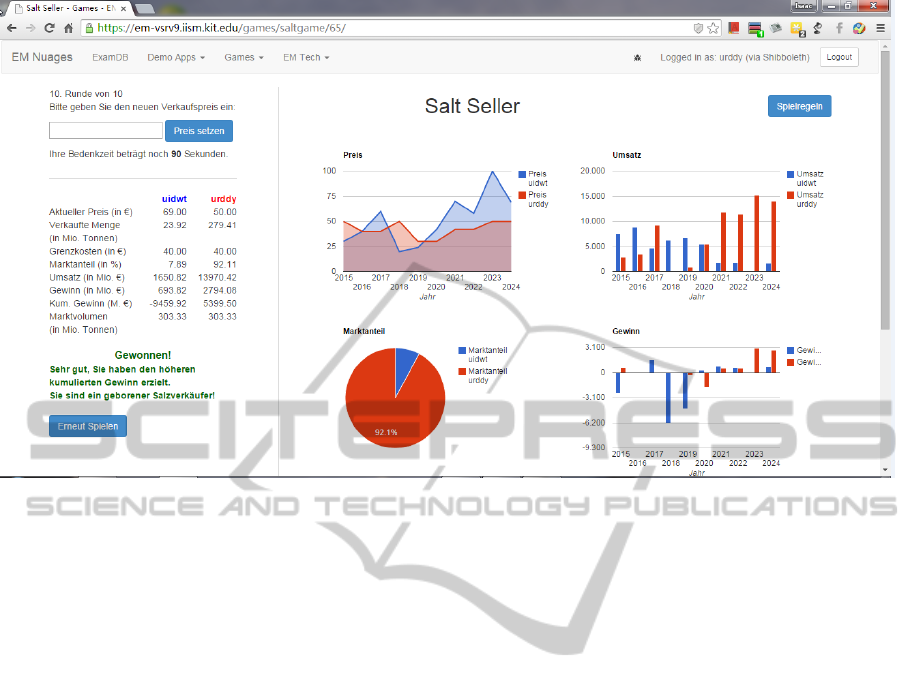

Figure 4 shows the user interface of Salt Seller. On

the left side the players can submit the salt price

and read information about the last round as well as

the marginal costs which stay the same during the

entire game. On the right side the Google Chart API

3

is used for visualizing the salt prices and the game

outputs.

3

https://developers.google.com/chart/, retrieved on 20 Feb.

2015

Figure 3: ER model of Salt Seller.

Location of the Game. The implementation de-

scribed above can be found at the KIT web site.

7 PRELIMINARY EVALUATION

Whenever Salt Seller is played, the complete game

history is stored to the database. This means that ev-

ery decision of a player, every output it created, every

parameter setting of the economic model as well as

time and user information can be retrieved for detailed

SaltSeller-RealizationofaBusinessGame

133

Figure 4: User interface (in German).

analysis later. So far, this capability was used for im-

plementation issues and for validation of the market

model. The next step is to use Salt Seller in class or

in laboratory experiments. While the students profit

from the lesson within a gaming environment, further

research can be done with the collected data. It will

be of use in order to analyse the strategies of the play-

ers as well as to observe strategy changes in response

to the behaviour of the opponent. Since Salt Seller is

already integrated into KIT’s infrastructure, the data

can be easily linked with further information about

the player such as age, field of study and so on. If

carried out in a laboratory, questionnaires can be used

to gather further demographic, psychological, socio-

logical, or strategy related information. Altogether,

the collected data will contribute to the understand-

ing of the behaviour of actors on a stable market. It

hopefully allows us to identify players with different

strategies (strategy families).

8 CONCLUSIONS

This paper gives a complete and detailed description

and implementation of the Salt Seller business game

of Sterman (Sterman, 2014). It shows how the sta-

ble market of Salt Seller can be modelled realisti-

cally considering effects like market delay or differ-

ent price-market-sensitivities. Sterman’s paper lacks

a detailed explanation of market mechanisms, func-

tions and parameters. A main contribution of our pa-

per is to fill those gaps by providing these details. Our

approach is fully parametrized which makes it highly

configurable. We include a short discussion about pa-

rameters, reasonable parameter values and their in-

fluence on game progression. Aside, we classify the

game following the scheme of Greco (Greco et al.,

2013).

The second major contribution of this work is the

proposition of a framework for a general n-person

round-based game as a 6-tuple of turn-based inputs,

fixed parameters, state transition functions, outputs,

objective function, and a stop condition.

As third contribution we implemented the game

as a browser game. Therefore a software architec-

ture was designed supporting various 2-player, round-

based, concurrently played, business games within

a browser. The architecture enables a later analysis

of all played games including details of input vari-

ables, parameters, and output variables of each round

as well as the overall game result. The chosen archi-

tecture is light-weight and adaptable and can act as

a blueprint for further 2-player round-based business

simulations. Consequently the implementation of the

game is available at the KIT web site for usage in Uni-

versity lectures, demonstration purposes and manage-

ment trainings.

Further work could be done to extend the mar-

ket model: Effects like the business cycle could

be modelled by introducing stochastic/random be-

haviour. Apart from that we plan to integrate the

Salt Seller game implementation into lectures for our

ICE-B2015-InternationalConferenceone-Business

134

students. This will allow us to analyze played game

strategies. However, before this the game needs to be

embedded in a learning environment including man-

uals and instructions for players and facilitators. Fur-

thermore, we think of including non-player charac-

ters, computer agents implementing machine learn-

ing algorithms for strategy learning. The architecture

can be extended to support an n- instead of a 2-player

base.

REFERENCES

Aarseth, E., Smedstad, S., and Sunnana, L. (2003). A multi-

dimensional typology of games. Level Up Conference

Proceedings, pages 48–53.

Bernard, R. R. (2014). Characterizing business games used

in distance education. Developments in Business Sim-

ulation and Experiential Learning, 33:124–130.

Django (2015). Django web framework (version 1.5).

https://djangoproject.com. [Computer Software; ac-

cessed 03-March-2015].

Eilon, S. (1963). Management games. Journal of the Oper-

ational Research Society, 14(2):137–149.

Elverdam, C. and Aarseth, E. (2007). Game classification

and game design construction through critical analy-

sis. Games and Culture, 2(1):3–22.

Faria, A. J. (1998). Business simulation games: Cur-

rent usage levels - an update. Simulation & Gaming,

29(3):295–308.

Forrester, J. (1961). Industrial Dynamics. Pegasus Com-

munications, MA, United States.

Greco, M., Baldissin, N., and Nonino, F. (2013). An ex-

ploratory taxonomy of business games. Simulation &

Gaming, 44(5):645–682.

Hsu, E. (1989). Role-event gaming simulation in manage-

ment education: A conceptual framework and review.

Simulation & Games, 20(4):409–438.

Jarmain, W. E. (1963). Problems in industrial dynamics.

M.I.T. Press, Cambridge.

Larr

´

ech

´

e, J.-C. and Gatignon, H. (1977). Markstrat – A

Marketing Strategy Game: Teaching Notes. Scientific

Press, Palo Alto.

Maier, F. H. and Gr

¨

oßler, A. (2000). What are we talking

about? - A taxonomy of computer simulations to sup-

port learning. System Dynamics Review, 16(2):135–

148.

Neumann, A. W. (2007). Price elasticity of digital scientific

information – a field experiment. IADIS International

Journal on WWW/Internet, 5(2).

Ricciardi, F. M. and Marting, E. (1957). Top management

decision simulation: The AMA approach. American

Management Association.

Riedel, J. and Hauge, J. B. (2011). State of the art of seri-

ous games for business and industry. In Proceedings

of the 17th International Conference on Concurrent

Enterprising (ICE), 2011, pages 1–8. IEEE.

Rokicki, M., Chelaru, S., Zerr, S., and Siersdorfer, S.

(2014). Competitive Game Designs for Improving the

Cost Effectiveness of Crowdsourcing. In Proceedings

of the 23rd ACM International Conference on Con-

ference on Information and Knowledge Management,

CIKM ’14, pages 1469–1478, New York, NY, USA.

ACM.

Sterman, J. (2014). Interactive web-based simulations

for strategy and sustainability: The MIT Sloan

learningedge management flight simulators, part i.

System Dynamics Review, 30(1-2):89–121.

Sterman, J. D. (1989). Modeling managerial behavior: Mis-

perceptions of feedback in a dynamic decision making

experiment. Management Science, 35(3):321–339.

Stratx Simulations (2015). Markstrat.

http://web.stratxsimulations.com/simulation/strategic-

marketing-simulation. [Online; accessed 03-March-

2015].

Summers, G. J. (2004). Todays business simulation indus-

try. Simulation & Gaming, 35(2):208–241.

Uskov, A. and Sekar, B. (2014). Serious games, gamifica-

tion and game engines to support framework activities

in engineering: Case studies, analysis, classifications

and outcomes. In 2014 IEEE International Confer-

ence on Electro/Information Technology (EIT), pages

618–623.

Wilson, R. (1997). Nonlinear Pricing. Oxford University

Press, Oxford.

Wolfe, J. (1993). A history of business teaching games

in english-speaking and post-socialist countries: The

origination and diffusion of a management education

and development technology. Simulation & Gaming,

24(4):446–463.

SaltSeller-RealizationofaBusinessGame

135