An Agent-based System for Issuing Stock Trading Signals

Zheyuan Su and Mirsad Hadzikadic

Complex Systems Institute, University of North Carolina at Charlotte, 9201 University City Blvd., Charlotte, NC, U.S.A.

Keywords: Complex System Modelling, Agent-based Simulation, Stock Market, Performance Analysis, Stock Trading

Signals.

Abstract: Simulation-based models are becoming a promising research tool in financial markets. A general Complex

Adaptive System can be tailored to different application scenarios. This paper describes an application of a

Complex Adaptive System-based agent model in stock trades signalling. The model has been evaluated using

historical movement of Bank of America stock. Agents in the system are initialized using random decision

rules. Genetic algorithms and machine learning methods are utilized to reduce the sample space and improve

the decision rules. Final rules are generated via Monte Carlo simulation and modified with a market

momentum estimate. By following the advice suggested by the model. The hypothetical investors have

outperformed the S&P 500 index and buy-and-hold investors. Compared with benchmark agents with buy-

and-hold strategy on stock and index respectively, the model achieved higher return even in periods of stock’s

poor performance. The stock trade-signalling model is implemented using the Netlogo framework.

1 INTRODUCTION

Picking winning stocks is hard, sometimes

impossible, as both endogenous and exogenous

events influence the value of shares in any given

moment. However, this has not stopped many

investors to try to either time the market or establish

strategies that would provide them with long-term

gains. Consequently, there are day trading, technical

trading, value trading, fundamental trading, and

contrarian trading among many other strategies that

have been advanced over the years as potential

winning strategies in the stock market.

With the advent of computers and sophisticated

analytical techniques, many of the previously

mentioned approaches have been automated using

information technology tools, (Subramanian, 2007,

Saad, 1998, Teixeira, 2010) although with limited

success. In recent years, complex adaptive systems –

inspired methods, primarily using agent-based

modelling techniques, have been tried as a way to

simulate traders’ behavior and capture the intricacies

of stock trading (Kodia, Said and Ghedira, 2010).

This paper introduces an agent-based model for

signalling the opportune times for stock trading. The

system has been evaluated in the context of Bank of

America in the period from 1987 – 2014. The model

outperformed S&P 500 and buy-and-hold strategy.

2 BACKGROUND

Besides the ordinary active and passive investment

strategies, a simple momentum and relative-strength

strategy could outperform the buy-and-hold strategy

70% of the time tracing back to 1920s (Faber, 2010).

There will be another improvement for the

performance after adding a simple trend before taking

positions. Abovementioned methods are not effective

at the level of individual agents who are making

decisions in real time. They simply provide a way to

retroactively simulate market movements. Agent-

based modelling techniques offer the opportunity to

simulate rational trading individuals taking into

consideration their interactions. The Zero Intelligence

model (Farmer, 2005) shows that agent-based models

can produce a high fit to the real stock market. The

Complex Adaptive Systems (CAS) framework and

agent-based modelling (ABM) implementation offer

a natural approach to capturing interactions between

agents in the market place. There was a successful

implementation of ABMs in simulating the NASDAQ

market using a single stock (Darley and Outkin 2007).

In the NASDAQ market simulation model, Darley

and Outkin present a new paradigm for the financial

market. Their markets were treated as complex

systems whose behaviour emerges as a result of the

interactions among different agents. It shows an

overall picture of the market but not the issue of

352

Su Z. and Hadzikadic M..

An Agent-based System for Issuing Stock Trading Signals.

DOI: 10.5220/0005508203520358

In Proceedings of the 5th International Conference on Simulation and Modeling Methodologies, Technologies and Applications (SIMULTECH-2015),

pages 352-358

ISBN: 978-989-758-120-5

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

trading signals. In our model, we created a trading

environment to train agents. In the training stage,

agents will keep learning all the historical data. Then

in the testing stage, agents will issue the stock trading

signals that maximize profits based on their prior

learnt knowledge.

3 COMPLEX ADAPTIVE

SYSTEMS APPROACH TO

SIGNALING STOCK TRADES

Complex Adaptive System tools offer another option

to model nonlinear systems due to their ability to

capture the essence of distributed, self-organizing

social and natural phenomena characterized by

system’s component interactions and feedback loops.

Financial markets are complex systems (Johnson,

2003) with micro behaviors, interaction patterns, and

global regularities (Cappiello, 2006). ABMs can

model financial markets as a dynamic system of

agents. There already have been successful

implementations of ABM models in fields as diverse

as economics, government, military, sociology,

healthcare, architecture, city planning, policy, and

biology (Tesfatsion, 2006, Johnson, 2013, Dreau,

2009, Hadzikadic 2010, Su and Hadzikadic, 2014). In

financial market simulations, a large number of

agents engage repeatedly in local interactions, giving

rise to global markets (Raberto, 2001, Bonabeau,

2002).

In this paper we describe an ABM system that

issues a stock trading signal (buy, sell, or hold) for a

stock (Bank of America in our example). Agents trade

stocks based on the publicly available data from

January 2, 1987 to December 31, 2014. In addition,

agents will have the knowledge of the current status

of the stock market, be it bull or bear, based on the

recession data available from the National Bureau of

Economic Research (NBER). Here bull market

indicates a financial market of a group of securities in

which prices are rising or expected to rise. Bear

market denotes the opposite in financial market

terms. Agents use this information to select their

trading rules.

3.1 Agents

A collection of agents constitutes the “trading world”

in this ABM simulation. Agents are given a certain

amount of money at the model initialization stage.

Agents’ transactions are triggered by their decision

rules and the amount of capital they have. As they are

aware of the current market status, agents at each time

step choose between two sets of trading rules: bull

and bear market trading rules. Table 1 describes the

trading rules assigned to individual agents. The long

position in financial market is the action of buying a

security while the short position is the selling of a

security.

Table 1: Trading rules assigned to individual agents.

Buy-Threshold

Minimum price change required for

taking a long position

Buy-Period

Time window agents observe before

evaluating the Buy-Threshold

Sell-Threshold

Minimum price change required for

taking a short position

Sell-period

Time window agents observe before

evaluating the Sell-Threshold

The Table 2 describes agents’ decision rules in

detail.

For instance, if the values for buy-threshold and

buy-period for an agent are 0.2 and 30 respectively,

then the agent will take the following buying strategy:

IF the stock price goes up 20% in the past 30 trading

days, THEN take a long position on this stock.

Similarly, if the values for sell-threshold and sell-

period are 0.1 and 50 respectively, then the agent will

take the following selling strategy: IF the stock price

goes up less than 10% in the last 50 trading days,

THEN agent will take a short position. Also, short

selling is allowed at any point. An agent can short sell

any amount of stock up to their available cash

amount. IF none of these conditions are met, THEN

agents will keep the status quo, that is, a hold strategy

applies.

Market momentum is also an important factor that

will impact the agents’ decision rules. The more

agents are buying stocks, the higher bidding price.

The more agents are selling stocks; the stock

prices will tend to be low as agents are trying to

liquidate their inventories. In the model, agents will

issue trading signals based on the current market

momentum, thus making the trading signals more

consistent with the contemporary market status.

Agents will have access to current market latent

transaction information. As a result, the bandwagon

effect produces a significant impact on agent

transactions. The bandwagon effect simply means

that agent behaviors and beliefs, as well as their

consequences, spread around. Consequently, agents

will adjust their thresholds for both long and short

positions. In another words, if there is a huge number

of agents who are going to take a long position on

stocks, then they will increase their buy-

AnAgent-basedSystemforIssuingStockTradingSignals

353

Table 2: Agents’ Trading Rules.

threshold. At the same time, if the majority of agents

are interested in taking a short position on stocks, then

a substantial number of agents will correspondingly

decrease their sell-threshold as they try to liquidate

their assets as soon as possible. In order to control the

impact of market information, as well as the

momentum, agents are assigned a local variable

called self-confidence, which is randomly assigned at

the setup stage of the simulation. Self-confidence

controls how much each agent trusts other agents, and

how much it believes that the agents around are

accurate in their estimates. If an agent is totally self-

confident (self-confidence = 1.0), the agent only

follows its own trading rules and ignores the

information provided by other agents in the market.

In this model, the world is represented in 2

dimensions. Both X-axis and Y-axis range from -10

to +10. In this 20 x 20 world, agents have a local

variable named radius to define the distance within

which agents can reach out to other agents for

learning. This results in a trading decision rules

optimization. Each agent has a different value for its

radius in order to create a diversified trading

environment. At the same time, the radius reduces the

impact of unification among the agents by

differentiating their learning preferences.

3.2 Implementation

This stock position advising CAS model

wasimplemented using the Netlogo 5.1.0

programmable modeling environment (Wilensky

2009). Netlogo offers a user-defined grid and the

possibility of defining agents, normally called turtles

in NetLogo.

In this model, the exploration space for all

possible trading strategy combination is measured in

trillions. As the combination is extreme large, it has

huge impact on the computing speed of the

simulation. If all the combinations initialized in the

beginning of simulation, to provide a trade-off

between the computing speed and the space

exploration, we set the agent number to 1,000. All

transaction decision rules described in Table 1 are

randomized within the [-0.4,0.4] range for required

returns and within [0,100] range for the trading

periods. Self-confidence and aggressiveness at set to

0.3 and 0.001, respectively. However, in order to

maintain the possibility of exploring the whole search

space, a mutation mechanism is added, allowing a

subset of agents to mutate from [-0.4,0.4] to [-1,1] for

required returns and from [1,100] to [1,1000] for

trading periods. Agents are assigned the initial capital

in the amount of $50,000. The transaction cost is

fixed at $10 per transaction, thus forcing agents to

trade off for the opportunity costs. The mutation rate

is fixed at 0.1, which allows 10% of all agents to get

buy/sell threshold and buy/sell period generated in [-

1,1] and [1,1000] respectively. Also, interest will be

distributed at the end of each tick based on the amount

cash hold on hand.

In the model, we created two benchmark agents.

Benchmark agent 1 (BA1) always tracks and

replicates the action of the best performer in the

model. Benchmark agent 2 (BA2) tracks, weighs, and

replicates the top 10% best performers in the whole

system. For BA2, if the majority of the agents in the

10% top performers have a preference to buy, then

BA2 will take a long position. A short position

represents the opposite case. If the number of buy and

sell agents is equal, then hold strategy will be applied.

The complete simulation timeframe is divided

into 2 stages. Stage 1 is training phase in which agents

learn best individual trading strategies. Stage 2 is a

test stage. At the beginning of this stage Agents’

capital is reset to the initial value, while agents retain

all the rules they learned in the training phase. Agents

trade based on the strategies learned in Stage 1, while

attempting to maximize their profits.

Learning from other agents is disabled in the first

1,000 ticks, which leaves enough time for agents to

evaluate their initial trading strategies. After that,

agents learn throughout the rest of the simulation.

This mechanism allows agents sufficient time to

optimize their strategies throughout the volatilities of

the market, i.e. financial crises or huge price volatility

periods.

• Basic trading rules: rational + momentum

• Buy Rule:

– X > Y * (1 - self-confidence * momentum of buying)

in past Z

– Agents will buy

• Sell Rule:

– X < Y * (1 – self-confidence * momentum of selling)

in past Z

– Agents will sell

• Momentum ranges in [0, 1]

– Count how many people intend to buy/sell

– If no one is buying/selling, momentum of

buying/selling will be 0

– If everyone is buying/selling, momentum of

buying/selling will be 0

• X – Change in Stock Price

• Y – Buy/Sell Threshold

• Z – Buy/Sell Period

SIMULTECH2015-5thInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

354

We used a genetic algorithm for regenerating or

eliminating agents (Holland, 1975). A hatch and die

concepts of NetLogo were used to introduce new

agents or eliminating underperforming ones. Agents

who lose all their money are eliminated from the

environment. At the same time, new agents are

initialized and placed into the environment, thus

keeping the number of agents constant. This

mechanism makes sure that a robust simulation

environment and active trading among agents are

maintained.

4 RESULTS

In the stock trading signalling model, S&P 500 and

Bank of America (BAC) buy-and-hold strategies

were used as performance benchmarks. As the

timeframe of the data is from 01/02/1987 to

12/31/2014, different settings of training/test

experiments were conducted during the simulation.

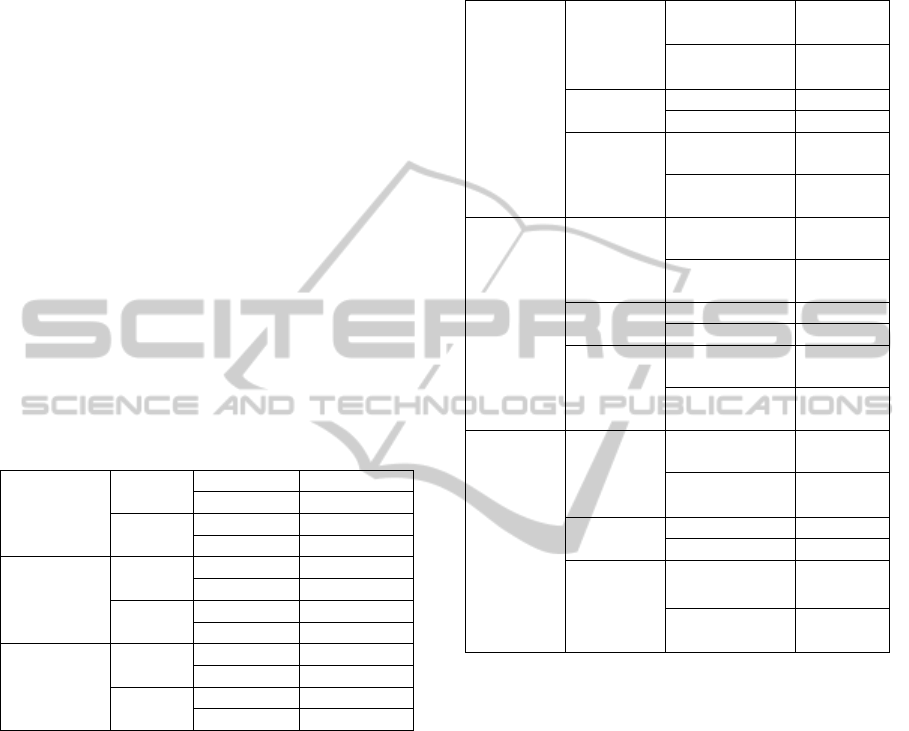

Table 3 shows three typical experiments.

Table 3: Experiment Setups.

Experiment 1

Training

From 01/02/1987

To 12/31/2014

Test

From N/A

To N/A

Experiment 2

Training

From 01/02/1987

To 12/31/2004

Test

From 01/02/2005

To 12/31/2014

Experiment 3

Training

From 01/02/1987

To 12/31/2011

Test

From 01/02/2012

To 12/31/2014

In experiment 1, agents are trading all the time

from 1987 to 2014. There is no test period, as agents’

capital is not reset during experiment. It indicates how

well agents perform in the maximum timeframe.

In experiment 2, the whole timeframe is divided

into 75% training and 25% testing tranches. In other

words, training stage is from 1987 to 2004, while the

test stage starts in 2005 and ends in 2014. This cut is

inspired by best practice in supervised learning.

As the underlying stock in the model is Bank of

America, which is in financial sector that was the

major cause of recent financial crisis, experiment 3

creates a bull market period for the testing stage in

order to test how well the model performs in a bull

market with less volatility in stock prices. As a result,

the training period is from 1987 to 2011, and the

testing period is from 2012 to 2014.

The results of the experiments are shown as below

in Table 4

Table 4: Experiment Profits in %.

Experiment

1

Benchmark

S&P 500

Buy & Hold

735.42%

BAC

Buy & Hold

664.53%

Benchmark

Agents

BA1 358.33%

BA2 581.12%

Model

Best

Performer

1,189.71%

Top 10% Best

Performers

718.44%

Experiment

2

Benchmark

S&P 500

Buy & Hold

73.3 %

BAC

Buy & Hold

- 50.4%

Benchmark

Agents

BA1 37.16%

BA2 71.29%

Model

Best

Performer

540.46%

Top 10% Best

Performers

88.89%

Experiment

3

Benchmark

S&P 500

Buy & Hold

61.88%

BAC

Buy & Hold

28.61%

Benchmark

Agents

BA1 71.85%

BA2 61.51%

Model

Best

Performer

374.02%

Top 10% Best

Performers

105.34%

It is obvious that the performance of the stock

trading signalling model is much better than a buy-

and-hold strategy on Bank of America stock. It even

outperforms the S&P 500, which shows an ascending

trend in the long term. As the Bank of America stock

has not recovered from the downfall of the last

financial crisis, it is a good test for evaluating the

performance of a simulation model, especially when

compared to S&P 500 index. Figures 1 through 3

show the comparisons between the model’s

performance and the buy-and-hold (BAH) strategy on

BAC and S&P 500 in a more intuitive way.

Experiment 1 indicates how well agents can

perform in the maximized timeframe. Agents are

trading based on their experience that accumulated

overtime. There is no capital reset during the

experiment 1, as we are trying to mimic the trading

situation in real life and give out a sense of the

maximum possibility of agents’ profitability. At the

same time, experiment 1 allows us to observe the full

story that happened during the whole timeframe while

AnAgent-basedSystemforIssuingStockTradingSignals

355

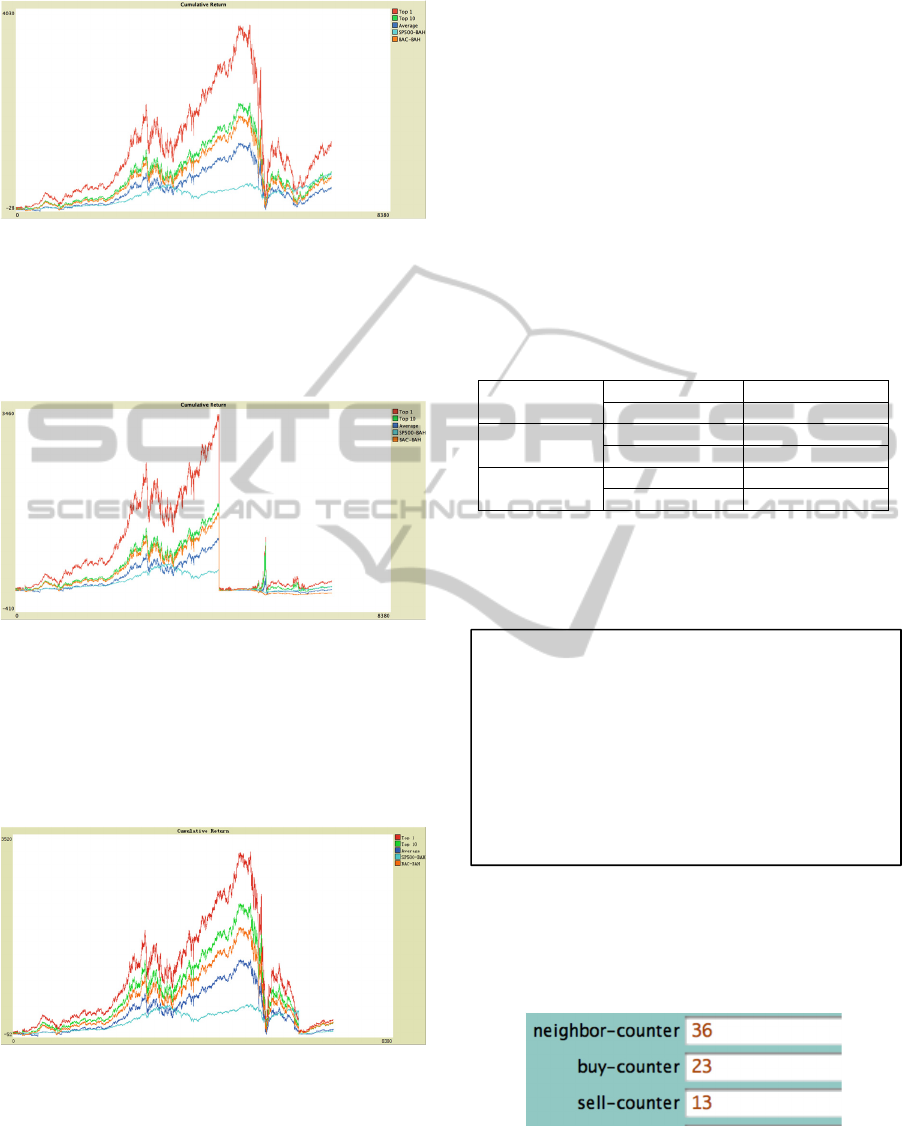

Figure 1: Experiment 1.

agents are trading. In Figure 1, the best performer

achieved the profit of 3,450% in 2007, right before

the beginning of the subprime mortgage crisis. All

agents suffered huge losses during this crisis and they

have not recovered even by the end of the simulation.

Figure 2: Experiment 2.

Experiment 2 resets agents’ capital in the first

trading day of 2005. Agents did well in the training

stage. In the test phase, agents secured significant

profits until the crisis happened. It took agents about

3 years to recover from the downfall incurred by the

crisis.

Figure 3: Experiment 3.

In the last experiment, agents’ capital was reset at

the beginning of 2012. In a pure bull market, the best

agent gained around 374% profit, which was 13.34

times more than the simple buy-and-hold strategy on

Bank of America stock.

However, it’s interesting to see that benchmark

agents (BA1 and BA2) underperformed their tracking

targets, the best performer and top 10% best

performers respectively. BA1 always replicates the

current market best performer’s action. BA2 mimics

the top 10% best performers’ action in the market.

One possible explanation is that the trading frequency

in bear market is much higher than that in the bull

market, as the higher transaction frequency enables

agents to secure the slight profit room in small price

changes. Although this strategy comes with higher

transaction costs, the extra profit can offset this

drawback. Table 5 shows this phenomenon through

the trading volumes.

Table 5: Trading Volumes in Shares.

Experiment 1

BA1 293,162

Best Performer 12,686

Experiment 2

BA1 113,770

Best Performer 6,851

Experiment 3

BA1 57,070

Best Performer 4,802

Table 6 shows the best trading decision rule set

derived from the experiments:

Table 6: Trading Rules for Best Performer.

The strategies above are the core decision rules for

issuing stock trading signals. However, the market

momentum turns the decision rules to actual

transaction thresholds, which are then used to help

agents make their moves.

Figure 4: Agent’s Built-in Variables for Momentum.

For example, the above figure (Figure 4) shows

an agent’s built-in variable for momentum. There are

36 agents around it. Out of these 36 agents, 23 want

For bull market:

• If the stock price goes down 37% in last 87 trading

days, take a long position.

• If the stock price goes up less than 20% in last 71

trading days, take a short position.

For bear market:

• If the stock price goes down 20% in last 10 trading

days, take a long position.

• If the stock price goes up less than 40% in last 61

trading days, take a short position.

SIMULTECH2015-5thInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

356

to buy and 13 want to sell. As the confidence is 0.3,

Table 7 shows the actual decisions in that particular

tick.

Table 7: Actual Decision Rules for Best Performer in a

Particular Tick.

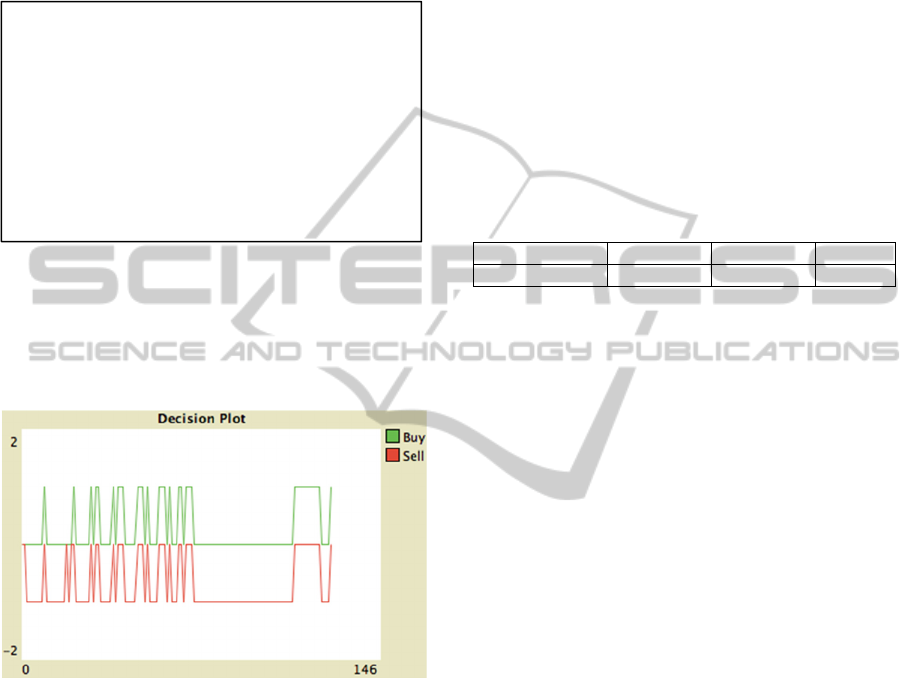

The following figure (Figure 5) is an example of

the actual stock trading signalling over time. When

the green line hits 1, the system advises a long

position. When the red line hits -1, then the model

advises a short position. If both lines stay at 0, then

hold strategy is applied.

Figure 5: Decision Plot Overtime.

5 ISSUES

In the experiment, agents’ learning too quickly was

one of the key issues. There is a variable called

aggressiveness which controls the degree of agents

learn from the difference between its and the best

agent’s performance. The aggressiveness was set to

0.1 while we introduced the learning component. That

is in each tick, each agent will learn the 10% of the

difference of trading rules between it and the top

performers in radius. As a result, uniformity spread

throughout the simulation. The best trader’s

performance was much less than 500%. This result

was way below the BAC buy-and-hold strategy.

Therefore, aggressive was decreased to eliminate

the uniformity among agents. Since the whole

simulation has only 7,053 ticks, if aggressiveness is

set too low then learning is not that effective in

changing agents’ decision rules. After several

hundred simulation runs aggressiveness was finally

set to its more optimal value of 0.001, in order to

reconcile the problem of diversity, learning speed,

and limited learning time.

What’s more, reducing aggressiveness increase

the correlation of return distribution between stock

trading signal issuing model and historical S&P 500.

Table 8 shows the correlation in different settings of

aggressiveness.

Table 8: Correlation of annual return between stock trading

signal issuing model and historical S&P 500 data.

Aggressiveness 0.1 0.01 0.001

Correlation 0.43 0.46 0.54

6 DISCUSSION, CONCLUSIONS

AND FUTURE WORKS

Computer simulations allow us to see the behind-the-

scene actions of the agents, and then to generate the

best stock transaction strategies based on the

interaction of agents. Comparing the model

performance with the buy-and-hold strategy of S&P

500 and BAC stock, the CAS stock-trading model

shows a much higher return on a single stock trading

in the same timeframe.

However, the momentum, a measure of the overall

market sentiment (Scowcroft and Sefton, 2005), plays

an important role in the CAS stock stock-trading

model. All the rules are adjusted based on the market

momentum in a specific time tick. With the benefit of

momentum, the performance of the stock-trading

model is far better than a simple buy-and-hold

strategy for both S&P 500 and BAC. In for the current

model, momentum is generated by the agents’ desire

to conduct transactions. Future refinements in the

momentum component will lay a key component in

improving the performance of the model.

We are currently working on several strategies for

improving the computation of the momentum

component. One is to extract the real time tweets from

Tweeter and to run a sentiment analysis on those

tweets. Then the signals from Twitter will be attached

to the current momentum component. Another one is

to use the transactions volume to deduce the historical

drive in the market and plug it into the current

momentum mechanism, leading to a more precise

For bull market:

• If the stock price goes down 29% in last 87 trading

days, take a long position.

• If the stock price goes up less than 18% in last 71

trading days, take a short position.

For bear market:

• If the stock price goes down 18% in last 10 trading

days, take a long position.

• If the stock price goes up less than 34% in last 61

trading days, take a short position.

AnAgent-basedSystemforIssuingStockTradingSignals

357

forecast about the upcoming market movements. In

return, agents can anticipate the changes in the future

investors’ actions and adjust their transaction

strategies to maximize profits.

The continuing refinement of the decision rules,

will see a replacement of the single stock trading

signaling mechanism with a multiple stock position

advising one. As a result, this model will have

practical values in the portfolio management as well.

This improved CAS model can be very helpful with

defining different parameters that best characterize

agents’ trading strategies, discovering and suggesting

suitable positions for different stocks at different

times, and discovering the factors affecting an

optimal portfolio management strategy. Finally,

agents in the future system will be categorized into

individual investors and institutional investors, as the

impact of their transactions differ in the real world.

Another version that allows agents to take

historical data for the training stage is under

development. By the end of the timeframe, agents

will use real-time data to conduct potential

transactions. We believe that agents will be able to

influence the market as we create a portfolio that trade

based on the agents’ signals. In return, agents will

change their trading behaviors corresponding to their

feedback from the market.

ACKNOWLEDGEMENTS

The authors thank the Complex Systems Institute

research group at UNC Charlotte for helpful

discussions, and the IT services at UNC Charlotte for

their provision of High Performance Clusters for our

research.

REFERENCES

Su, Z., Hadzikadic, M., 2014, 5

th

World Congress on Social

Simulation, Application of Complex Adaptive Systems

in Portfolio Management, WCSS 2014 Proceedings.

Tesfatsion, L., 2006. Handbook of Computational

Economics. Agent-based Computational Economics. A

Constructive Approach to Economic Theory. Vol. 2. pp.

831-880.

Johnson, L., Hadzikadic, M., Whitmeyer, J., 2013. The

Future Engaging Complexity and Policy: Afghanistan

Citizen Allegiance Model. International Journal of

Humanities and Social Science. Vol.3. No.10.

Dreau, D. Stanimirov, D.; Carmichael, T.; Hadzikadic, M.

2009, An agent-based model of solid tumor progression.

Bioinformatics and Computational Biology. Vol. 5462.

Holland, J., 1975. Adaption in Natural and Artificial

Systems.

Wilensky, U., 1999, Netlogo, Centre for Connected

Learning and Computer-Based Modeling.

Northwestern University, Evanston, IL.

Fishman, G., 1995. Monte Carlo: Concepts, Algorithms,

and Applications. Springer.

Faber, M., 2010. Relative Strength Strategies for Investing.

Cambria.

Barnes, J. 2003. Active vs. Passive Investing. CFA

Magazine. Jan 2003: 28-30.

Scowcroft, A., and Sefton, J., 2005. Understanding

momentum. Financial Analysts Journal, 64-82.

Johnson, N., Jefferies, P., and Hui, P., 2003. Financial

market complexity. OUP Catalogue.

Cappiello, L., Engle, R., and Sheppard, K., 2006.

Asymmetric dynamics in the correlations of global

equity and bond returns. Journal of Financial

econometrics, 4(4), 537-572.

Raberto, M., Cincotti, S., Focardi, S., & Marchesi, M., 2001.

Agent-based simulation of a financial market. Physica

A: Statistical Mechanics and its Applications, 299(1),

319-327.

Bonabeau, E., 2002. Agent-based modeling: Methods and

techniques for simulating human systems. Proceedings

of the National Academy of Sciences of the United

States of America, 99(Suppl 3), 7280-7287.

Hadzikadic, M., Carmichael, T., and Curtin, C., 2010.

Complex adaptive systems and game theory: An

unlikely union. Complexity, 16(1), 34-42.

Kodia, Z., Said, L., and Ghedira, K., 2010. A study of stock

market trading behavior and social interactions

through a multi agent based simulation. Agent and

Multi-Agent Systems: Technologies and Applications

(pp. 302-311). Springer Berlin Heidelberg.

Subramanian, H., Ramamoorthy, S., Stone, P., and Kuipers,

B., 2006. Designing safe, profitable automated stock

trading agents using evolutionary algorithms.

Proceedings of the 8th annual conference on Genetic

and evolutionary computation (pp. 1777-1784). ACM.

Saad, E., Prokhorov, D., and Wunsch, D., 1998.

Comparative study of stock trend prediction using time

delay, recurrent and probabilistic neural networks.

Neural Networks, IEEE Transactions on, 9(6), 1456-

1470.

Teixeira, L., and De Oliveira, A., 2010. A method for

automatic stock trading combining technical analysis

and nearest neighbor classification. Expert systems

with applications, 37(10), 6885-6890.

Farmer, J., Patelli, P., and Zovko, I., 2005. The predictive

power of zero intelligence in financial markets.

Proceedings of the National Academy of Sciences of

the United States of America, 102(6), 2254-2259.

Darley, V., and Outkin, A., 2007. NASDAQ market

simulation: insights on a major market from the science

of complex adaptive systems. World Scientific

Publishing Co., Inc.

SIMULTECH2015-5thInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

358