Formal Analysis of E-Cash Protocols

∗

Jannik Dreier

1

, Ali Kassem

2

and Pascal Lafourcade

3

1

Institute of Information Security, Department of Computer Science, ETH, Zurich, Switzerland

2

University Grenoble Alpes, Verimag, Grenoble, France

3

University Clermont Auvergne, Limos, France

Keywords:

E-Cash, Formal Analysis, Double Spending, Exculpability, Privacy, Applied π-Calculus, ProVerif.

Abstract:

Electronic cash (e-cash) aims at achieving client privacy at payment, similar to real cash. Several security

protocols have been proposed to ensure privacy in e-cash, as well as the necessary unforgery properties. In

this paper, we propose a formal framework to define, analyze, and verify security properties of e-cash systems.

To this end, we model e-cash systems in the applied π-calculus, and we define two client privacy properties and

three properties to prevent forgery. Finally, we apply our definitions to an e-cash protocol from the literature

proposed by Chaum et al., which has two variants and a real implementation based on it. Using ProVerif, we

demonstrate that our framework is suitable for an automated analysis of this protocol.

1 INTRODUCTION

Although current banking and electronic payment

systems such as credit cards or, e.g., PayPal allow

clients to transfer money around the world in a frac-

tion of a second, they do not fully ensure the clients’

privacy. In such systems, no transaction can be made

in a completely anonymous way, since the bank or

the payment provider knows the details of the clients’

transactions. By analyzing a client payments for, e.g.,

transportations, hotels, restaurants, movies, clothes,

and so on, the payment provider can typically deduce

the client’s whereabouts, and much information about

his lifestyle.

Physical cash provides better privacy: the pay-

ments are difficult to trace as there is no central au-

thority that monitors all transactions, in contrast to

most electronic payment systems. This property is the

inspiration for “untraceable” e-cash systems. The first

such e-cash system preserving the client’s anonymity

was presented by David Chaum (Cha83): a client

can withdraw a coin anonymously from his bank and

spend it with a seller. The seller can then deposit

the coin at the bank, who will credit his account. In

this protocol coins are non-transferable, i.e., the seller

cannot spend a received coin again, but has to deposit

it at the bank. If he wants to spend a coin in another

∗

This research was conducted with the support of the “Dig-

ital trust” Chair from the University of Auvergne Founda-

tion.

shop, he has to withdraw a new coin from his account,

similar to the usual payment using cheques. In con-

trast, there are protocols where coins are also trans-

ferable, i.e., coins do not need to be deposited directly

after each spend, but can be used again, e.g., (OO89;

CGT08).

To be secure, an e-cash protocol should not only

ensure the client’s privacy, but must also ensure that a

client cannot forge coins which were not issued by the

bank. Moreover, it must protect against double spend-

ing – otherwise a client could try to use the same coin

multiple times. This can be achieved by using on-

line payments, i.e., a seller has to contact the bank

at payment before accepting the coin, however it is

an expensive solution. An alternative solution, which

is usually used to support off-line payments (i.e., a

seller can accept the payment without contacting the

bank), is revealing the client’s identity if he spent a

coin twice. Finally, exculpability ensures that an at-

tacker cannot forge a double spend, and hence incor-

rectly blame an honest client for double spending.

In the literature, many e-cash protocols have been

proposed (Cha83; CFN90; Dam90; DC94; Cre94;

Bra94; AF96; KO01; FHY13). For example, Abe

et al. (AF96) introduced a scheme based on partial

blind signature, which allows the signer (the bank) to

include certain information in the blind signature of

the coin, for example the expiration date or the value

of the coin. Kim et al. (KO01) propose an e-cash

system that supports coin refund and assigns them a

65

Dreier J., Kassem A. and Lafourcade P..

Formal Analysis of E-Cash Protocols.

DOI: 10.5220/0005544500650075

In Proceedings of the 12th International Conference on Security and Cryptography (SECRYPT-2015), pages 65-75

ISBN: 978-989-758-117-5

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

value, based again on partial blind signature.

At the same time, many attacks have been found

against various existing e-cash protocols: for ex-

ample Pfitzmann et al. (PW91; PSW95) break the

anonymity of (Dam90; DC94; Cre94). Cheng et

al. (CYS05) show that Brand’s protocol (Bra94) al-

lows a client to spend a coin more than once with-

out being identified. Aboud et al. (AA14) show

that (FHY13) cannot ensure the anonymity and un-

linkability properties that were claimed.

These numerous attacks triggered some first work

on formal analysis of e-cash protocols in the com-

putational (CG08) and symbolic world (LCPD07;

SK14). Canard et al. (CG08) provide formal defi-

nitions for various privacy and unforgeability proper-

ties in the computational world, but only with man-

ual proofs as their framework is difficult to automate.

In contrast, Luo et al. (LCPD07) and Thandar et

al. (SK14) both rely on automatic tools (AVISPA

2

and ProVerif (Bla01), respectively). Yet, they only

consider a fraction of the essential security properties,

and for some properties Thandar et al. only perform a

manual analysis. Moreover, much of their reasoning

is targeted on their respective case studies, and cannot

easily be transferred to other protocols.

Contributions: This paper fills the gaps of previ-

ous formal verification work. Inspired by other do-

mains such as e-voting (BHM08; DKR09; DLL12),

e-auctions (DLL13), and e-exams (DGK

+

14), we

propose a more general formalization for non-

transferable e-cash protocols in the applied π-

calculus (AF01). Our definitions are amenable to au-

tomatic verification using ProVerif (Bla01), and cover

all crucial privacy and unforgery properties: Weak

Anonymity, Strong Anonymity, Unforgeability, Dou-

ble Spending Identification, and Exculpability. Fi-

nally, we validate our approach by analyzing the on-

line protocol proposed by Chaum et al. (Cha83), as

well as, a real implementation based on it (Sch97).

We also analyze the off-line variant of this e-cash sys-

tem (CFN90).

Outline: In Section 2, we model e-cash protocols in

the applied pi-calculus. Then, we specify the security

properties in Section 3. We validate our framework

by analyzing the on-line and off-line e-cash systems

by Chaum et al. (Cha83; CFN90), and the imple-

mentation based on the on-line protocol (Sch97) in

Section 4. In Section 5, we discuss our results and

outline future work.

2

www.avispa-project.org

2 MODELING E-CASH

PROTOCOLS

We model e-cash protocols in the applied π-calculus,

a process calculus designed for the verification of

cryptographic protocols. We refer to the original pa-

per (AF01) for a detailed description of its syntax and

semantics.

In the applied π-calculus, we have a Dolev-Yao

style attacker (DY83), which has a complete control

to the network, except the private channels. He can

eavesdrop, remove, substitute, duplicate and delay

messages that the parties are sending to one another,

and even insert messages of his choice on the public

channels.

Parties other than the attacker can be either hon-

est or corrupted. Honest parties follow the protocol’s

specification, do not reveal their secret data (e.g., ac-

count numbers, keys etc.) to the attacker, and do

not take malicious actions such as double spending

a coin or generating fake transactions. Honest parties

are modeled as processes in the applied π-calculus.

These processes can exchange messages on public or

private channels, create fresh random values and per-

form tests and cryptographic operations, which are

modeled as functions on terms with respect to an

equational theory describing their properties.

Corrupted parties are those that collude with the

attacker by revealing their secret data to him, tak-

ing orders from him, and also making malicious ac-

tions. We model corrupted parties as in Definition 15

from (DKR09): if the process P is an honest party,

then the process P

c

is its corrupted version. This is

a variant of P which shares with the attacker chan-

nels ch

1

and ch

2

. Through ch

1

, P

c

sends all its inputs

and freshly generated names (but not other channel

names). From ch

2

, P

c

receives messages that can in-

fluence its behavior.

An e-cash system involves the following parties:

the client C who has an account at the bank, the seller

S who accepts electronic coins, and the bank B, which

certifies the electronic coins. E-cash protocols typi-

cally run in three phases:

1. Withdrawal: the client withdraws an electronic

coin from the bank, which debits the client’s ac-

count.

2. Payment: the client spends the coin by executing

a transaction with a seller.

3. Deposit: the seller deposits the transaction at the

bank, which credits the seller’s account.

In addition to these three main phases, some systems

allow the clients

SECRYPT2015-InternationalConferenceonSecurityandCryptography

66

(a) to return coins directly to the bank without using

them in a payment, for instance in case of expira-

tion, or to re-distribute the coins denominations,

and

(b) to restore coins that have been lost, for instance

due to a hard disk crash.

As these functionalities are not implemented by all

protocols, our model does not require them. More-

over, we assume that the coins are neither transferable

nor divisible.

We define an e-cash protocol as a tuple of pro-

cesses each representing the role of a certain party.

Definition 1. (E-cash Protocol). An e-cash protocol

is a tuple (B, S,C, ˜n), where B is the process executed

by the bank, S is the process executed by the sellers,

C is the process executed by the clients, and ˜n is the

set of the private channel names used by the protocol.

To reason about privacy properties we use runs of

the protocol, called e-cash instances.

Definition 2. (E-cash Instance). Given an e-cash

protocol, an e-cash instance is a closed plain process:

CP =ν

˜

n

0

.(B|Sσ

ids

1

|. . . |Sσ

ids

l

|

(Cσ

idc

1

σ

c

11

σ

ids

11

|. . . |Cσ

idc

1

σ

c

1p

1

σ

ids

1p

1

)|

.

.

.

|(Cσ

idc

k

σ

c

k1

σ

ids

k1

|. . . |Cσ

idc

k

σ

c

kp

k

σ

ids

kp

k

))

where

˜

n

0

is the set of all restricted names which in-

cludes the set of the protocol’s private channels ˜n; B

is the process executed by the bank; Sσ

ids

i

is the pro-

cess executed by the seller whose identity is specified

by the substitution σ

ids

i

; Cσ

idc

i

σ

c

i j

σ

ids

i j

is the process

executed by the client whose identity is specified by

the substitution σ

idc

i

, and which spends the coin iden-

tified by the substitution σ

c

i j

to pay the seller with the

identity specified by the substitution σ

ids

i j

. Note that

idc

i

can spend p

i

coins.

To improve the readability of our definitions, we

introduce the notation of context CP

I

[ ] to denote

the process CP with “holes” for all processes exe-

cuted by the parties whose identities are included in

the set I. For example, to enumerate all the ses-

sions executed by the client idc

1

without repeating

the entire e-cash instance, we can rewrite CP as

CP

{idc

1

}

[Cσ

idc

1

σ

c

11

σ

ids

11

|. . . |Cσ

idc

1

σ

c

1p

1

σ

ids

1p

1

].

Finally, we use the notation C

w

to denote a client

that withdraws a coin, but does not spend it in a pay-

ment: C

w

is a variant of the process C that halts at the

end of withdrawal phase, i.e., where the code corre-

sponding to the payment phase is removed.

3 SECURITY PROPERTIES

We define three properties related to forgery: Un-

forgeability, Double Spending Identification, and Ex-

culpability. Moreover, we formalize two privacy

properties: Weak Anonymity and Strong Anonymity.

3.1 Forgery-related Properties

In an e-cash protocol a client must not be able to cre-

ate a coin without involving the bank, resulting in a

fake coin, or to double spend a valid coin he withdrew

from the bank. This is ensured by Unforgeability,

which says that the clients cannot spend more coins

than they withdrew.

To define unforgeability we use the following two

events:

• withdraw(c): is an event emitted when the coin

c is withdrawn. This event is placed inside the

bank process just after the bank outputs the coin’s

certificate (e.g., a signature on the coin).

• spend(c): is an event emitted when the coin c is

spent. This event is placed inside the seller pro-

cess just after he receives and accepts the coin.

Events are annotations that mark important steps in

the protocol execution, but do otherwise not change

the behavior of processes.

Definition 3. (Unforgeability). An e-cash protocol

ensures Unforgeability if, for every e-cash instance

CP, each occurrence of the event spend(c) is preceded

by a distinct occurrence of the event withdraw(c) on

every execution trace.

If a fake coin is successfully spent, the event spend

will be emitted without any matching event withdraw,

violating the property. Similarly, in the case of a suc-

cessful double spending the event spend will be emit-

ted twice, but these events are preceded by only one

occurrence of the event withdraw.

In the rest of the paper, we illustrate all our notions

with the ”real cash” system (mainly coins and ban-

knotes) as a running example. We hope that it helps

the reader to understand the properties but also to feel

the difference between real cash and e-cash systems.

Example 1. (Real Cash). In real cash, unforgeabil-

ity is ensured by physical measures that make forging

or copying coins and banknotes difficult, for example

by adding serial numbers, using special paper, ultra-

violet ink, holograms and so on.

Since a malicious client might be interested to cre-

ate fake coins or double spend a coin, it is particu-

larly interesting to study Unforgeability with an hon-

est bank and corrupted clients. A partially corrupted

FormalAnalysisofE-CashProtocols

67

seller, which e.g., gives some information to the at-

tacker but still emits the event spend correctly, could

also be considered to check if a seller colluding with

the client and the attacker can results in a coin forg-

ing. Note that if the seller is totally corrupted then

Unforgeability will be trivially violated, since a cor-

rupted seller can simply emit the event spend for a

forged coin, although there was no transaction.

In case of double spending, the bank should be

able to identify the responsible client. This is ensured

by Double Spending Identification, which says that a

client cannot double spend a coin without revealing

his identity.

To deposit a coin at the bank the seller has to

present a transaction which contains, in addition to

the coin, some information certifying that he received

the coin in a payment. A valid transaction is a trans-

action which could be accepted by the bank, i.e., it

contains a correct proof that the coin is received in a

correct payment. The bank accepts a valid transaction

if it does not contain a coin that is already deposited

using the same or a different transaction.

In the following, we denote by TR the set of all

transactions, and we define the function transId

which takes a transaction tr ∈ TR and returns a pair

(s, c), where s identifies tr and c is the coin involved

in tr. Such a pair can usually be computed from a

transaction. We also denote by ID the set of all client

identities, and by D a special data set that includes the

data known to the bank after the protocol execution,

e.g., the data presents in the bank’s database.

Definition 4. (Double Spending Identification). An e-

cash protocol ensures Double Spending Identifica-

tion if there exists a test T

DSI

: TR × TR × D 7→ ID ∪

{⊥} satisfying: for any two valid transactions tr

1

and tr

2

that are different but involve the same coin

(i.e., transId(tr

1

) = (s

1

, c), and transId(tr

2

) =

(s

2

, c) for some coin c with s

1

6= s

2

), there exists p ∈ D

such that T

DSI

(tr

1

,tr

2

, p) outputs (idc, e) ∈ ID × D,

where e is an evidence that idc withdrew the coin c.

Double Spending Identification allows the bank to

identify the double spender by running a test T

DSI

on

two different transactions that involves the same coin.

For example, consider a protocol where after a suc-

cessful transaction the seller gets x = m.id + r where

id is the identity of the client (e.g., his secret key),

r is a random value (identifies the coin) chosen by

the client at withdrawal, and m is the challenge of the

seller. So, if the client double spends the same coin

then the bank can compute id and r using the two

equations: x

1

= m

1

.id +r and x

2

= m

2

.id +r. The data

p could be some information necessary to identify the

double spender or to construct the evidence e. This

data is usually presented to the bank at withdrawal or

at deposit. The required evidence depends on the pro-

tocol. Note that e is an evidence from the point of

view of the bank, and not necessarily a proof for an

outer judge. Thus, the goal of Double Spending Iden-

tification is to preserve the security of the bank so that

he can detect and identify the responsible of double

spending when happens. Note that, if a client with-

draws a coin and gives it to an attacker which double

spends it, then the test returns the identity of the client

and not the attacker’s identity.

Example 2. (Real Cash). In real cash, double spend-

ing is prevented by ensuring that notes cannot be

copied. However, Double Spending Identification is

not ensured: even if a central bank is able to iden-

tify copied banknotes using, e.g., their serial numbers,

this does not allow it to identify the person responsi-

ble for creating the counterfeit notes.

Double Spending Identification gives rise to a po-

tential problem: what if the client is honest and

spends the coin only once, but the attacker (e.g., a

corrupted seller) is able to forge a second spend, or

what if a corrupted bank is able to simulate a coin

withdrawal and payment i.e., to forge a coin with-

drawal and payment that seems to be made by a cer-

tain client. For instance, in the example mentioned

above, the two equations are enough evidence for the

bank. However, if the bank knows id he can gener-

ate the two equations himself and blame the client for

double spending. So, to convince a judge, an addi-

tional evidence is needed, e.g., the client’s signature.

If any of the two situations mentioned above is

possible, then a honest client could be falsely blamed

for double spending, and also it gives raise to a cor-

rupted client which is responsible of double spend-

ing to deny it. To solve this problem we define Ex-

culpability, which says that the attacker, even when

colluding with the bank and the seller, cannot forge

a double spend by a certain client in order to blame

him. More precisely, provided a transaction executed

by a client idc, the attacker cannot provide two differ-

ent valid transactions which involves the same coin,

and the data p necessary for the test T

DSI

to output the

identity idc with an evidence. Note that Exculpabil-

ity is only relevant if Double Spending Identification

holds: otherwise a client cannot be blamed regardless

of the ability to forge a second spend or to simulate a

coin withdrawal and payment, as his identity cannot

be revealed.

Definition 5. (Exculpability). Assume that we have

a test T

DSI

as specified in Def. 4, i.e., Double Spending

Identification holds, and that the bank is corrupted.

Let idc be a honest client (in particular he does not

double spend a coin), and ids be a corrupted seller.

Then, Exculpability is ensured if, after observing a

SECRYPT2015-InternationalConferenceonSecurityandCryptography

68

transaction made by idc with ids, the attacker can-

not provide two valid transactions tr

1

,tr

2

∈ T that are

different but involve the same coin c, and some data

p such that T

DSI

(tr

1

,tr

2

, p) outputs (idc, e) where e is

an evidence that idc withdrew the coin c.

The intuition is: if the attacker can provide two

transactions tr

1

,tr

2

such that T

DSI

(tr

1

,tr

2

) returns a

client’s identity (that is, the two different valid trans-

actions involve same coin), then it was able to forge

(at least) one transaction since the honest client per-

forms (at most) one transaction per coin.

If after observing a transaction executed by a

client idc, the attacker can provide a different valid

transaction which involves the same coin, and the re-

quired data p, then the test will return the identity idc

with the necessary evidence, thus the property will

be violated. Similarly, in the case where the attacker

can forge a coin withdrawal and payment seems to

be made by a client idc, then the attacker can obtain

two transactions satisfying the required conditions,

together with the necessary data p, so that the test will

return the identity idc with an evidence.

Note that, Double Spending Identification and Ex-

culpability are only relevant in case of off-line e-cash

systems where double spending might be possible.

Example 3. (Real Cash). As Double Spending Iden-

tification is not ensured in real cash, exculpability is

not relevant: any client that posses a counterfeit ban-

knote can plausibly deny that he produced this note.

3.2 Privacy Properties

We express our privacy properties as observational

equivalence, a standard choice for such kind of prop-

erties. We use the labeled bisimilarity (≈

l

) to express

the equivalence between two processes (AF01). In-

formally, two processes are equivalent if an attacker

interacting with them observer has no way to tell them

apart.

To ensure the privacy of the client, the following

two notions have been introduced by cryptographers

and are standard in the literature e.g., (CG08; Fer94;

Sch97).

1. Weak Anonymity: the attacker cannot link a client

to a spend, i.e., he cannot distinguish which client

makes the payment.

2. Strong Anonymity: additionally to weak

anonymity, the attacker should not be able

to decide if two spends were done by the same

client, or not.

In (CG08), Weak Anonymity is defined as the follow-

ing game: two honest clients each withdraw a coin

from the bank. Then one of them (randomly chosen)

spends his coin to the adversary. The adversary al-

ready knows the identities of these two clients, and

also the secret key of the bank. It wins the game if

it guesses correctly which client spends the coin. In-

spired by this definition, we define Weak Anonymity

in the applied π-calculus as follows:

Definition 6. (Weak Anonymity). An e-cash

protocol ensures Weak Anonymity if for any

e-cash instance CP, any two honest clients

idc

1

, idc

2

, any corrupted seller ids, we have

that: CP

I

[Cσ

idc

1

σ

c

1

σ

ids

|C

w

σ

idc

2

σ

c

2

|S

c

σ

ids

|B

c

] ≈

l

CP

I

[C

w

σ

idc

1

σ

c

1

|Cσ

idc

2

σ

c

2

σ

ids

|S

c

σ

ids

|B

c

], where c

1

,

c

2

are any two coins (not previously known to the

attacker) withdrawn by idc

1

and idc

2

respectively,

I = {idc

1

, idc

2

, ids, id

B

}, id

B

is the bank’s identity,

and C

w

is a variant of C that halts at the end of the

withdrawal phase.

Weak anonymity ensures that a process in which

the client idc

1

spends the coin c

1

to the corrupted

seller ids

1

, is equivalent to a process in which the

client idc

2

spends the coin c

2

to the corrupted seller

ids

1

. We assume a corrupted bank represented by

B

c

. Note that the client that does not spend his coin

still withdraws it. This is necessary since otherwise

the attacker could likely distinguish both sides during

the withdrawal phase, as the bank is corrupted and

typically the client reveals his identity to the bank at

withdrawal so that his account can be charged. We

also note that we do not necessarily consider other

corrupted clients, however this can easily be done by

replacing some honest clients from the context CP

I

(i.e., other than idc

1

and idc

2

) with corrupted ones.

Example 4. (Real Cash). Real coins ensure weak

anonymity as two coins (assuming the same value

and production year) are indistinguishable. How-

ever, banknotes do not ensure weak anonymity ac-

cording to our definition, as they include serial num-

bers. Since the two clients withdraw a note each,

the notes hence have different serial numbers which

the bank can identify. In reality this is used by cen-

tral banks to trace notes and detect suspicious ac-

tivities that, e.g., could hint at money laundering.

Note however that banknotes ensure a weaker form of

anonymity: if two different clients use the same note,

one cannot distinguish them.

Strong Anonymity is defined in (CG08) using the

same game as for Weak Anonymity, with the differ-

ence that the adversary may have previously seen

some coins being spent by the two honest clients ex-

plicitly mentioned in the definition. We define Strong

Anonymity as follows:

Definition 7. (Strong Anonymity.) An e-cash pro-

tocol ensures Strong Anonymity if for any e-cash in-

FormalAnalysisofE-CashProtocols

69

stance CP, any two honest clients idc

1

, idc

2

, any cor-

rupted seller ids, we have that:

CP

I

[|

0≤i≤m

1

Cσ

idc

1

σ

c

i

1

σ

ids

|

0≤i≤m

2

Cσ

idc

2

σ

c

i

2

σ

ids

|

Cσ

idc

1

σ

c

1

σ

ids

|C

w

σ

idc

2

σ

c

2

|S

c

σ

ids

|B

c

] ≈

l

CP

I

[|

0≤i≤m

1

Cσ

idc

1

σ

c

i

1

σ

ids

|

0≤i≤m

2

Cσ

idc

2

σ

c

i

2

σ

ids

|

C

w

σ

idc

1

σ

c

1

|Cσ

idc

2

σ

c

2

σ

ids

|S

c

σ

ids

|B

c

]

where c

1

and c

1

1

. . . c

m

1

1

are any coins withdrawn by

idc

1

, c

2

and c

1

2

. . . c

m

2

2

are any coins withdrawn by

idc

2

, I = {idc

1

, idc

2

, ids, id

B

}, id

B

is the bank’s iden-

tity, and C

w

is a variant of C that halts at the end of

the withdrawal phase.

Strong Anonymity ensures that the process in

which the client idc

1

spends m

1

+ 1 coins, while idc

2

spends m

2

coins and additionally withdraws another

coin without spending it, is equivalent to the process

in which the client idc

1

spends m

1

coins and with-

draws an additional coin, while idc

2

spends m

2

+ 1

coins. The definition assumes that the bank is cor-

rupted, and that the seller receiving the coins from the

two clients idc

1

and idc

2

is also corrupted. Note that,

we consider C

w

to avoid distinguishing from the num-

ber of withdrawals by each client.

Again, we can replace some honest clients from

CP

I

by corrupted ones.

Example 5. (Real Cash). Again, real coins ensure

strong anonymity as, assuming the same value and

production year, two coins are indistinguishable. Yet,

for the same reason as in weak anonymity, banknotes

do not ensure strong anonymity according to our def-

inition: the serial numbers allow an attacker to iden-

tify the different clients.

We note that any protocol satisfying Strong

Anonymity also satisfies Weak Anonymity, as Weak

Anonymity is a special case of Strong Anonymity for

m

1

= m

2

= 0, i.e. when the two honest clients do not

make any previous spends.

4 CASE STUDY: CHAUM’S

PROTOCOL

David Chaum proposed the first (on-line) e-cash sys-

tem in (Cha83) based on blind signatures, and an off-

line variant of the protocol is proposed in (CFN90).

A real implementation based on these two variants,

allowing users to make purchases over open networks

such as the Internet, was put in service by DigiCash

Inc. The corporation declared bankruptcy in 1998,

and was sold to Blucora

3

(formerly Infospace Inc.).

3

http://www.blucora.com/

The on-line protocol implemented by DigiCash is pre-

sented in (Sch97).

In the following, we describe and analyze both the

on-line and the off-line variants of the protocol, as

well as, the on-line protocol implemented by Digi-

Cash. For this we use ProVerif an automatic tool that

verifies cryptographic protocols (Bla01). All the ver-

ification presented in the paper are carried out on a

standard PC (Intel(R) Pentium(R) D CPU 3.00GHz,

2GB RAM).

4.1 Chaum’s On-line Protocol

The Chaum On-line Protocol was proposed

in (Cha83) and detailed in (CFN90). It allows a

client to withdraw a coin blindly from the bank, and

then spend it later in a payment without being traced

even by the bank. The protocol is “on-line” in the

sense that the seller does not accept the payment

before contacting the bank to verify that the coin

has not been deposited before, to prevent double

spending. We start by giving a description of the

protocol.

Withdrawal Phase: To obtain an electronic coin,

the client communicates with the bank using the fol-

lowing protocol:

1. The client randomly chooses a value x, and a co-

efficient r, the client then sends to the bank his

identity u and the value b = blind(x, r), where

blind is a blinding function.

2. The bank signs the blinded value b using a signing

function sign and his secret key skB, then sends

the signature bs = sign(b, skB) to the client. The

bank also debits the amount of the coin from the

client’s account.

3. The client verifies the signature and removes

the blinding to obtain the bank’s signature s =

sign(x, skB) on x. The coin consists of the pair

(x, sign(x, sk

B

)).

Payment (and Deposit) Phases: To spend the coin

1. The client sends the pair (x, sign(x, sk

B

)) to the

seller.

2. After checking the bank’s signature, the seller

sends the coin (x, sign(x, sk

B

)) to the bank to ver-

ify that it is not deposited before.

3. The bank verifies the signature s, and that the coin

is not in the list of deposited coins. If these checks

succeed the bank credits the seller’s account with

the amount of the coin and informs him of accep-

tance. Otherwise, the payment is rejected.

SECRYPT2015-InternationalConferenceonSecurityandCryptography

70

Modeling in ProVerif: We use ProVerif to per-

form the automatic protocol verification. ProVerif

uses a process description based on the applied π-

Calculus, but has syntactical extensions and is en-

riched by events to check reachability and corre-

spondence properties. Besides, it can check equiva-

lence properties. As explained above, we model pri-

vacy properties as equivalence properties, and we use

events to verify the other properties.

The equational theory depicted in Table 1 models

the cryptographic primitives used within Chaum on-

line protocol. It includes well-known model for digi-

tal signature (functions sign, getmess, and checksign).

The functions blind/unblind are used to blind/unblind

a message using a random value. We also include the

possibility of unblinding a signed blinded message, so

that we obtain the signature of the message – the key

feature of blind signatures.

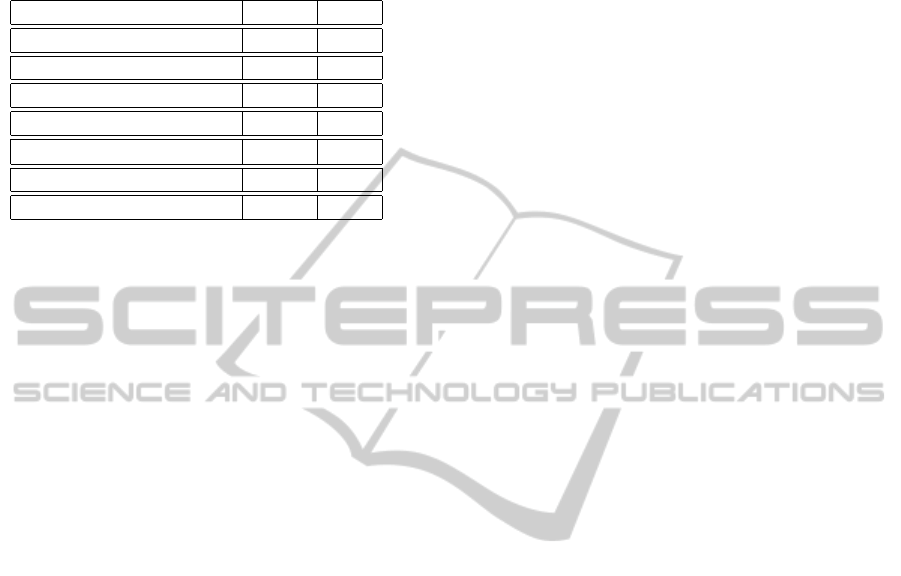

Table 1: Equational theory.

getmess(sign(m, k)) = m

checksign(sign(m, k), pk(k)) = m

unblind(blind(m, r), r) = m

unblind(sign(blind(m, r), k), r) = sign(m, k)

Analysis: The result of the analysis is summarized

in Table 2.

We model Unforgeability as an injective corre-

spondence between the two events withdraw and

spend, they are placed in their appropriate positions,

according to the Def. 3, inside the bank and seller

processes respectively. We consider a honest bank

and honest seller but corrupted clients. We assume

that the bank sends an authenticated message through

private channel to inform the seller about a coin ac-

ceptance. Otherwise, the attacker can forge a mes-

sage which leads the seller to accepting an already

deposited coin. However, ProVerif still finds an at-

tack against Unforgeability when two copies of the

same coin spent at the same time. In this case the

bank makes two parallel database lookups to check if

the coin was deposited before. If the parallel deposit

was not finished yet and thus the coin is not yet in-

serted in the database, then each lookup confirms that

the coin was not deposited before which results in ac-

ceptance of two spends of the same coin. This attack

may be avoided with some synchronization like lock-

ing the table when a coin deposit is initiated and then

unlocking it when the operation is finished. ProVerif

does not support such an feature. Protocols that rely

on state could be analyzed using the Tamarin Prover

4

4

http://www.infsec.ethz.ch/research/software/

tamarin.html

Table 2: Analysis of the Chaum on-line protocol.

A X indicates that the property holds. A × indicates that

it fails (ProVerif shows an attack).

Property Result Time

Unforgeability × < 1s

Weak Anonymity X < 1s

Strong Anonymity X < 1s

thanks to the SAPIC

5

tool (we keep this for future

work).

Note that corrupted clients cannot create a fake

coin as the correspondence holds without injectivity.

Double Spending Identification and Exculpabil-

ity are not relevant in the case of on-line protocols

as their countermeasure against double spending is

the on-line calling of the bank at payment, and thus

they do not have any kind of test to identify double

spenders.

For privacy properties, we assume a corrupted

bank and a corrupted seller, but honest clients.

ProVerif confirms that the privacy of the client is

preserved, as both Weak Anonymity, and Strong

Anonymity are satisfied. This due to the fact that the

coin is signed blindly during the withdrawal phase,

and thus cannot be traced later by the attacker even

when colludes with the bank and the seller. Note that,

for Strong Anonymity, we consider an unbounded

number of spends by each client and one spend that

is made by either the first client or by the second one.

4.2 DigiCash On-line Protocol

The on-line protocol implemented by DigiCash Inc.

is outlined in (Sch97). It has the same withdrawal

phase as Chaum on-line protocol, except that the

client sends an authenticated coin to be signed by the

bank, however the paper does not specify the way of

authentication. We ignore this authentication as its

purpose is to ensure that the bank debits the correct

client account. Hence, we believe that it does not ef-

fect the privacy and unforgeability properties (analy-

sis confirms that as we can see in Table 2). The pay-

ment and deposit phases are different from those of

Chaum on-line protocol. They are summarized as fol-

lows:

Payment (and Deposit) Phases in DigiCash:

1. The client sends to the seller pay =

enc((id

s

, h(pay-spec), x, sign(x, sk

B

)), pk

B

)

which is the encryption, using the public key of

the bank pk

B

, of the seller’s identity id

s

, hash of

5

http://sapic.gforge.inria.fr/

FormalAnalysisofE-CashProtocols

71

Table 3: Analysis of DigiCash on-line protocol.

A X indicates that the property holds. A × indicates

that it fails (ProVerif shows an attack).

Property Result Time

Unforgeability × < 1s

Weak Anonymity X < 1s

Strong Anonymity X < 1s

the payment specification pay-spec (specifica-

tion of the sold object, price etc), and the coin

(x, sign(x, sk

B

)).

2. The seller signs (h(pay-spec), pay) and sends it

along with his identity id

s

to the bank.

3. The bank verifies the signature, decrypts pay then

verifies the value of h(pay-spec) and that the coin

is valid and not deposited before. If so it informs

the seller to accept the coin, and to reject it other-

wise.

Modeling in ProVerif: Additionally to the equa-

tional theory of the Chaum on-line protocol (Ta-

ble 1), the equational theory of DigiCash on-line

protocol includes well-known model of the public

key encryption represented by the following equation:

dec(enc(m, pk(k)), k) = m.

Analysis: The result of analysis of DigiCash on-

line protocol using ProVerif is summarized in Ta-

ble 3. ProVerif shows the same results as obtained

for Chaum on-line protocol. Namely, it shows that

Weak Anonymity, and Strong Anonymity are satisfied,

and it outputs the same attack presented in Section 4.1

against Unforgeability. Again Double Spending Iden-

tification and Exculpability are not relevant.

Note that, obtaining the same result for the two

protocols, even that they have different payment and

deposit phases, confirms that the blinding signature

used during the withdrawal phase plays the key role

in preserving the privacy of the client, as claimed by

David Chaum.

4.3 Chaum’s Off-line Protocol

The off-line variant of the Chaum protocol is pro-

posed in (CFN90). It removes the requirement that

the seller must contact the bank during every pay-

ment. This introduces the risk of double spending a

coin by a client.

Withdrawal Phase: to obtain an electronic coin,

the client randomly chooses a, c and d, and calcu-

lates the pair H = (h(a, c), h(a ⊕ u, d)), where u is the

client identity and h is a hash function. The client then

proceed as in the Chaum on-line protocol but with x

(the potential coin) replaced by the pair H. Namely,

the client blinds the pair H and sends it to the bank.

Then the bank signs and returns it to the client. The

main difference from the Chaum on-line protocol is

that the coin has to be of the following form

(h(a, c), h(a ⊕ u, d))

where the client identity is masked inside it. This aims

to reveal the identity if the client later double spends

the coin. In order for the bank to be sure that the client

provides a message of the appropriate form, Chaum et

al. used in (CFN90) the well known “cut-and-choose”

technique. Precisely, the client computes n such a pair

H where n is the system security parameter. The bank

then selects half of them and asks the client to reveal

their corresponding parameters (a, b, c and r). If n is

large enough the client can cheats with a low proba-

bility.

At the end of this phase the client holds the elec-

tronic coin composed of the pair H, and the bank’s

signature S = sign(H, sk

B

). The client also has to

keep the random values a, c, d which are used later to

spend the coin.

Payment Phase:

1. To make the payment, the client presents the pair

H and the bank’s signature S to the seller. The

seller checks the signature, if it is correct then he

chooses and sends a random binary bit y, a chal-

lenge, to the client. The client returns to the seller:

• The values a and c if y is 0.

• The values a ⊕ u and d if y is 1.

2. The seller checks the compliance of the values

sent with the pair H. If everything (the signature

and the values) is correct, the payment is accepted.

At the end of the payment phase, the seller holds the

pair H, the signature S, the values of either (a, c) or

(a ⊕ u, d), and the challenge y. All these data together

compose the transaction the seller has to present to

the bank at deposit.

Note, in case where n pairs are used for the coin,

the challenge y will be n bit string and for each bit

either the corresponding values of (a, c) or (a ⊕ u, d)

are revealed to the seller.

Deposit Phase:

1. The seller contacts the bank and provides it with

the transaction (H, S, y, (a, c)) or (H, S, y, (a ⊕

u, d)).

SECRYPT2015-InternationalConferenceonSecurityandCryptography

72

2. The bank checks the signature and also whether

the values (a, c) or (a ⊕ u, d) correspond to their

hash value in H. If any of these values is incor-

rect, the fault is on the seller’s part, as he was able

to independently check the regularity of the coin

at payment. If the coin is correct, the bank checks

its database to see whether the same coin had been

used before. If it has not, the bank credits the

seller’s account with the appropriate amount. Oth-

erwise, the bank rejects the transaction.

Chaum off-line protocol does not prevent double

spending, however it preserve client’s anonymity only

if he spend a coin once.

Note that, a double spender can be identified when

the coin has the form (h(a, c), h(a ⊕ u, d)). How-

ever, the bank can simulate the coin withdrawal and

payment (as the bank knows the identities of all the

clients), thus the bank can blame a honest client for

double spending. As a countermeasure, the authors

propose to concatenate two values z and z

0

with u in-

side the pair H to have (h(a, c), h(a⊕(u, z, z

0

), d)) and

provide to the bank, at withdrawal, additionally the

client’s signature on h(z, z

0

).

Modeling in ProVerif: To mode the Chaum off-

line protocol in ProVerif, in addition to the equational

theory used for the Chaum on-line protocol (Table 1),

we use the function xor to represent the exclusive or

(⊕) of two values. Given the first value, the sec-

ond value can be obtained using the function unxor.

Such an – admittedly limited – modeling for ⊕ oper-

ator is sufficient to catch the functional properties of

the scheme required by Chaum off-line protocol, but

does not catch all algebraic properties of this opera-

tor. However, there are currently no tools that sup-

port observational equivalence – which we need for

the anonymity properties – and all algebraic proper-

ties of ⊕. Kuesters et al. (KT11) proposed a way

to extend ProVerif with ⊕. Their tool translates a

model of the protocol to a ProVerif input where all

⊕ are ground terms to enable automated reasoning.

However, this tool can only deal with secrecy and au-

thentication properties, and does not support equiva-

lence properties. The xor function is only used to hide

the client’s identity u using a random value a (a ⊕ u),

which we model as xor(a, u). The bank then uses a

to reveal the client’s identity u if he double spends a

coin. This is modeled by the following two equations

unxor(xor(a, u), a) = u

unxor(a, xor(a, u)) = u

which represents the various ways: ((a ⊕ u) ⊕ a) = u,

or (a ⊕ (a ⊕ u)) = u. We always assume that identity

is the second value, and this is how we model it inside

honest processes.

Analysis: As expected ProVerif confirms that Un-

forgeability is not satisfied, a corrupted client can

double spend a coin. In fact the seller cannot know

whether a certain coin is already spent or not, he ac-

cepts any coin that is certified by the bank. However,

a collusion between the client and the attacker cannot

lead to forging a coin.

In case of double spending, the bank

may receive two transactions of the form

tr

1

= (h, hx, sign((h, hx), skB), 0, a, c) and

tr

1

= (h, hx, sign((h, hx), skB), 1, xor(a, u), d).

The bank can apply a test to obtain the iden-

tity u. This is done using the unxor function as

unxor(xor(a, u), a) = u. The evidence here is show-

ing that the identity of the client is masked inside

the coin. This can be done thanks to the values of

(a, c, xor(a, u), d) which are initially known only

to the client. Spending the coin only once reveals

either (a, c) or (xor(a, u), d) which does not allow

to obtain the identity u. Note that, if the two sellers

provide the same challenge, the two transactions will

be exactly equal. In this case no double spending is

detected, and the second transaction will be rejected

by the bank which considers it as a second copy of

the first transaction. In practice this can be avoided

with high probability if n pairs coin is used and thus

n bits challenge. Note that ProVerif consider all the

possibilities.

We model the output of an identity and an evi-

dence of the test T

DSI

by an emission of the event OK,

and event KO otherwise. To say that Double Spend-

ing Identification is satisfied we should have that the

test T

DSI

does not emit the event KO for every two

valid transactions tr

1

, tr

2

that are different but in-

volves the same coin, i.e., it always emits event OK

for such transactions. ProVerif shows that the test can

emit the event KO for certain two transactions satisfy

the required conditions. Actually, a corrupted client

can withdraw a coin that does not have the appropri-

ate form (e.g., client’s identity is not masked inside

it), thus the bank cannot obtain the identity in case

of double spending. Note that, if the bank only cer-

tifies coins with the appropriate form at withdrawal

(i.e., of the form (h(a, c), h(a ⊕ u, d))), then the prop-

erty holds, ProVerif confirms that. Again, in practice

applying the “cut-and-choose” technique can guaran-

tee with high probability that the coin is in the appro-

priate form. However, applying this technique using

Proverif does not make any difference since ProVerif

works under symbolic world which deals with possi-

bilities and not with probabilities. For instance, the

FormalAnalysisofE-CashProtocols

73

Table 4: Analysis of Chaum off-line protocol.

A X indicates that the property holds. A × indicates

that it fails (ProVerif shows an attack).

(∗) Only coins with the appropriate form are considered.

(†) After applying the countermeasure.

Property Result Time

Unforgeability × <1s

Double Spending Identif. × <2s

Double Spending Identif.

∗

X <2s

Exculpability

∗

× < 6s

Exculpability

†

X < 6s

Weak Anonymity X <1s

Strong Anonymity X <1s

attacker still can guess the pairs that the bank will re-

quest to reveal and construct them in the appropriate

form, but cheat with the others which will compose

the coin.

We analyze Exculpability in case where only coins

of appropriate forms are considered i.e., the case

where Double Spending Identification holds. ProVerif

confirms that a corrupted bank can blame a honest

client. The bank can simulate the withdrawal and

the payment since the bank knows the identity of the

client. Thus it can obtain two transactions satisfying

the required conditions. This is due to the fact that

the evidence obtained by the test, which is showing

that the client’s identity is masked inside the coin, is

not strong enough to act as a proof. However, the at-

tacker cannot re-spend a coin withdrawn and spent by

a honest client.

After applying the countermeasure that is includ-

ing some terms z and z

0

so that the client signs h(z, z

0

),

ProVerif confirms that Exculpability holds. Applying

the countermeasure results in a new test which takes,

in addition to the two transactions, the client’s sig-

nature on h(z, z

0

). The test shows, in case of double

spending, that the identity u and the preimage (z, z

0

)

of the hash signed by the client are masked inside the

coin. This represents a stronger evidence which acts

as a proof that the client withdrew the coin since the

bank cannot forge the client’s signature.

We note that, Ogiela et al. (OS14) show an attack

on Chaum’s off-line protocol: when a client double

spends a coin, the sellers can forge additional transac-

tions involving the same coin, so that the bank cannot

know how many transactions are actually result from

spends made by the client and how many are forged

by the sellers. In such a case, according to our defini-

tion, Unforgeability does not hold since the client has

to spend the coin at least twice. Yet, corrupted sell-

ers can blame a corrupted client who double spends a

coin for further spends. Moreover the bank can still

identify the client and punish him as the bank can be

sure that he at least spend the coin twice.

Concerning privacy properties, ProVerif shows

that Chaum off-line protocol still satisfies both Weak

Anonymity and Strong Anonymity.

To sum up, ProVerif confirms the claim about pre-

serving client’s anonymity. ProVerif also was able to

show that a client can double spend a withdrawn coin

but cannot forge a coin, and that the bank can iden-

tify the double spender if the coin is in the appropri-

ate form. ProVerif also shows, in case of coin with

appropriate form, that the bank can simulate a with-

drawal and payment, and thus can blame him for dou-

ble spending. After applying the countermeasure no

attack against Exculpability is found.

5 CONCLUSIONS

E-cash protocols can offer anonymous electronic pay-

ment services. Numerous protocols have been pro-

posed in the literature, and multiple flaws were dis-

covered. To avoid further bad surprises, formal veri-

fication can be used to improve confidence in e-cash

protocols. In this paper, we developed a formal frame-

work to automatically verify e-cash protocols with re-

spect to multiple essential privacy and forgery proper-

ties. Our framework relies on the applied π-calculus

and uses ProVerif as the verification tool. As a case

study, we analyzed the on-line protocol proposed by

Chaum et al. , as well as, a real implementation based

on it. We also analyze the off-line variant of this

system. We confirm some claims and known weak-

nesses. We also identified that some synchronization

is necessary in case of on-line protocols to prevent

double spending.

As future work, we would like to investigate fur-

ther case studies and to extend our model to cover

transferable protocols with divisible coins. Also we

would like to use the tool SAPIC based on Tamarin,

in order to see how it can help to analyze e-cash pro-

tocols.

REFERENCES

Sattar J. Aboud and Ammar Agoun. Analysis of a known

offline e-coin system. International Journal of Com-

puter Applications, 2014.

Masayuki Abe and Eiichiro Fujisaki. How to date blind

signatures. In Advances in Cryptology - ASIACRYPT

’96, Korea, November 3-7, 1996, Proceedings, vol-

ume 1163, pages 244–251. Springer, 1996.

Mart

´

ın Abadi and C

´

edric Fournet. Mobile values, new

names, and secure communication. In The 28th Sym-

SECRYPT2015-InternationalConferenceonSecurityandCryptography

74

posium on Principles of Programming Languages,

ACM, UK, 2001.

M. Backes, C. Hritcu, and M. Maffei. Automated verifica-

tion of remote electronic voting protocols in the ap-

plied pi-calculus. In CSF, 2008.

Bruno Blanchet. An efficient cryptographic protocol ver-

ifier based on prolog rules. In 14th IEEE Computer

Security Foundations Workshop (CSFW-14), Canada,

2001.

Stefan Brands. Untraceable off-line cash in wallets with

observers (extended abstract). In Proceedings of the

13th Annual International Cryptology Conference on

Advances in Cryptology, CRYPTO ’93, pages 302–

318, London, UK, UK, 1994. Springer-Verlag.

David Chaum, Amos Fiat, and Moni Naor. Untraceable

electronic cash. In Advances in Cryptology: Proceed-

ings of CRYPTO ’88, pages 319–327. Springer New

York, 1990.

S

´

ebastien Canard and Aline Gouget. Anonymity in trans-

ferable e-cash. In Applied Cryptography and Network

Security, ACNS, USA, pages 207–223, 2008.

S

´

ebastien Canard, Aline Gouget, and Jacques Traor

´

e. Im-

provement of efficiency in (unconditional) anonymous

transferable e-cash. In Financial Cryptography and

Data Security, 12th International Conference, FC,

Mexico. Springer, 2008.

David Chaum. Blind signatures for untraceable payments.

In Advances in Cryptology: Proceedings of CRYPTO

’82. Springer US, 1983.

Giovanni Di Crescenzo. A non-interactive electronic cash

system. In Algorithms and Complexity, Second Ital-

ian Conference, Italy, volume 778 of Lecture Notes in

Computer Science, pages 109–124. Springer, 1994.

Chang Yu Cheng, Jasmy Yunus, and Kamaruzzaman Se-

man. Estimations on the security aspect of brand’s

electronic cash scheme. In 19th International Confer-

ence on Advanced Information Networking and Appli-

cations AINA, Taiwan, 2005.

I. B. Damg

˚

ard. Payment systems and credential mecha-

nisms with provable security against abuse by indi-

viduals. In Proceedings on Advances in Cryptology,

pages 328–335. Springer-Verlag, 1990.

Stefano D’Amiano and Giovanni Di Crescenzo. Methodol-

ogy for digital money based on general cryptographic

tools. In Advances in Cryptology - EUROCRYPT ’94,

Workshop on the Theory and Application of Crypto-

graphic Techniques, Italy. Springer, 1994.

Jannik Dreier, Rosario Giustolisi, Ali Kassem, Pascal

Lafourcade, Gabriele Lenzini, and Peter Y. A. Ryan.

Formal analysis of electronic exams. In SECRYPT,

Austria, 2014, pages 101–112, 2014.

S. Delaune, S. Kremer, and M.D. Ryan. Verifying privacy-

type properties of electronic voting protocols. Journal

of Computer Security, 17(4):435–487, jul 2009.

J. Dreier, P. Lafourcade, and Y. Lakhnech. A formal tax-

onomy of privacy in voting protocols. In ICC, pages

6710–6715, 2012.

Jannik Dreier, Pascal Lafourcade, and Yassine Lakhnech.

Formal verification of e-auction protocols. In Prin-

ciples of Security and Trust, POST, pages 247–266.

Springer, 2013.

D. Dolev and Andrew C. Yao. On the security of public key

protocols. Information Theory, IEEE Transactions on,

29(2):198–208, 1983.

Niels Ferguson. Single term off-line coins. In Advances

in Cryptology, Lecture Notes in Computer Science

- EUROCRYPT ’93, volume 765, pages 318–328.

Springer-Verlag, 1994.

Chun-I Fan, Vincent Shi-Ming Huang, and Yao-Chun Yu.

User efficient recoverable off-line e-cash scheme with

fast anonymity revoking. Mathematical and Com-

puter Modelling, 2013.

Sangjin Kim and Heekuck Oh. Making electronic refunds

reusable, 2001.

Ralf K

¨

usters and Tomasz Truderung. Reducing protocol

analysis with xor to the xor-free case in the horn the-

ory based approach. Journal of Automated Reasoning,

2011.

Zhengqin Luo, Xiaojuan Cai, Jun Pang, and Yuxin Deng.

Analyzing an electronic cash protocol using applied

pi calculus. In Applied Cryptography and Network

Security, 5th International Conference, ACNS, China,

2007.

Tatsuaki Okamoto and Kazuo Ohta. Disposable zero-

knowledge authentications and their applications to

untraceable electronic cash. In Proceedings on Ad-

vances in Cryptology, CRYPTO ’89, pages 481–496.

Springer-Verlag New York, Inc., 1989.

Marek R. Ogiela and Piotr Sulkowski. Improved cryp-

tographic protocol for digital coin exchange. In

Soft Computing and Intelligent Systems (SCIS), pages

1148–1151, 2014.

Birgit Pfitzmann, Matthias Schunter, and Michael Waidner.

How to break another provably secure payment sys-

tem. In EUROCRYPT ’95, International Conference

on the Theory and Application of Cryptographic Tech-

niques, France, pages 121–132, 1995.

Birgit Pfitzmann and Michael Waidner. How to break

and repair A ”provably secure” untraceable payment

system. In CRYPTO ’91, 11th Annual International

Cryptology Conference, USA, pages 338–350, 1991.

Berry Schoenmakers. Basic security of the ecash pay-

ment system. In In Applied Cryptography, Course

on Computer Security and Industrial Cryptography,

pages 201–231. Springer-Verlag, LNCS, 1997.

Aye Thandar Swe and Khin Khat Khat Kyaw. Formal anal-

ysis of secure e-cash transaction protocol. In Inter-

national Conference on Advances in Engineering and

Technology, Singapore, 2014.

FormalAnalysisofE-CashProtocols

75