Aftermath of 2008 Financial Crisis on Oil Prices

Neha Sehgal

1

and Krishan K. Pandey

2

1

Jindal Global Business School, O. P. Jindal Global University, Sonipat, 131001, Haryana, India

2

College of Management & Economic Studies, University of Petroleum & Energy Studies, 248007, Dehradun, India

Keywords: Feature Selection, Mutual Information, Interaction Information, Neural Networks, Oil Price Forecasting.

Abstract: Geopolitical and economic events had strong impact on crude oil markets for over 40 years. Oil prices

steadily rose for several years and in July 2008 stood at a record high of $145 per barrel. Further, it plunged

to $43 per barrel by end of 2008. There is need to identify appropriate features (factors) explaining the

characteristics of oil markets during booming and downturn period. Feature selection can help in identifying

the most informative and influential input variables before and after financial crisis. The study used an

extended version of MI

3

algorithm i.e. I

2

MI

2

algorithm together with general regression neural network as

forecasting engine to examine the explanatory power of selected features and their contribution in driving

oil prices. The study used features selected from proposed methodology for one-month ahead and twelve-

month ahead forecast horizon. The forecast from the proposed methodology outperformed in comparison to

EIA’s STEO estimates. Results shows that reserves and speculations were main players before the crisis and

the overall mechanism was broken due to 2008 global financial crisis. The contribution of emerging

economy (China) emerged as important variable in explaining the directions of oil prices. EPPI and CPI

remain the building blocks before and after crisis while influence of Non-OECD consumption rises after the

crisis.

1 INTRODUCTION

Oil prices are dependent on numerous indicators but

there influence is subject to happening of

geopolitical and economic events. Oil prices steadily

rose for several years post 9/11 attacks and in July

2008 stood at a record high of $145 per barrel due to

low spare capacity. Further, due to global financial

crisis of 2008, oil prices plunged to around $43 per

barrel by end of 2008. In quarter 1 of 2009, OPEC

slashed production targets by 4.2 mmbpd and thus

oil prices rose from $43 per barrel to $91 per barrel

by end of 2011. The question that arises is whether

this rise or decline in oil price is entirely due to shift

in demand-supply framework or are there any other

political or economic indicators to blame? And if

there are other significant indicators driving oil

prices, how does the explanatory power and

contribution of factors driving oil prices changes

during booming and downturn period. A study by

Bhar and Malliaris (2011) concluded that price

increases during financial crisis of 2007-2009 were

so substantial that additional factors other than

demand and supply were needed to explain such

drastic shifts. Another study (Fan and Xu, 2011)

used break test to divide the price fluctuations in oil

markets after 2000 into three stages: January 2000-

March 2004, March 2004-June 2008 and June 2008-

September 2009. Their study has shown that in

different time periods, the main drivers of oil prices

changed and their direction and degree of influence

will change over time.

There is colossal collection of data for factors,

ranging from demand-supply, inventories, reserves

to varied market, is enormous and dynamic. An

important task is to discover knowledge by

identifying useful patterns (most influential and

informative set of factors driving oil prices) in data.

Till date, researchers employing structural or

financial models for predicting oil prices have

accounted for non-linearity, non-stationary or time-

varying structure of the oil prices but seldom have

focused on selecting significant features with high

prediction power. Most of the researchers have

considered predictor variables for oil price

prediction based on judgmental criterion or trial and

error method. Little attention is paid on selecting

most influential and informative factors and more on

assessing new techniques for oil price forecasting.

Therefore, feature selection plays an important role

in forecasting oil prices. An appropriate set of

Sehgal, N. and Pandey, K..

Aftermath of 2008 Financial Crisis on Oil Prices.

In Proceedings of the 7th International Joint Conference on Knowledge Discovery, Knowledge Engineering and Knowledge Management (IC3K 2015) - Volume 1: KDIR, pages 235-240

ISBN: 978-989-758-158-8

Copyright

c

2015 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

235

features can help in high prediction performance and

thus, due care should be taken to select a set of

relevant and non-redundant features However,

conventional feature selection methods require

number of features to be extracted or a strict

assumption of conditional independence, and still

couldn't provide the minimal set of features that are

most relevant and non-redundant for the study. The

basic assumption of conditional independence of

feature selection methods degrades the performance

of model if features are strongly inter-connected.

Most of the real world problems contain features

that are strongly inter-related to each other. Due to

above mentioned research gaps; there is lack of

robust feature selection method to select relevant

and non-redundant factors for oil price forecasting

which can incorporate complexities of crude oil

prices. Hence, to overcome the limitations of

existing pool of methods, this study used I

2

MI

2

feature selection algorithm when features are

strongly dependent on each other and are non-linear.

2 I

2

MI

2

ALGORITHM FOR

FEATURE SELECTION

The novel three stage feature selection method

called I

2

MI

2

algorithm is an extended version of MI

3

Algorithm (Sehgal and Pandey, 2014) build on

pillars of interaction information and mutual

information. It is used for selecting relevant and

non-redundant features that drive oil price. The

proposed algorithm consists of three stages. In the

first stage, mutual information is computed between

target variable and candidate inputs. The variables

are ranked based on normalized mutual information

value and the irrelevant features are filtered out

based on a threshold value. The selected variables

are the list of irrelevant but redundant features. To

overcome redundancy, in stage two, three-variable

interaction information is computed among the

selected features in stage one. The set of selected

features having negative interaction information are

used to filter out the redundant features.

The study incorporates the concept of interaction

information so as to filter redundant input variables

instead of correlation analysis or partial correlation

analysis. Interaction information is favoured over

correlation analysis as it measures non-linear

dependency. This stage provides list of features that

are relevant and non-redundant in nature. Further, in

the third stage, mutual information is computed

between the selected features from stage two and

ranked according to normalized mutual information

value. Depending on a threshold value, redundant

features in stage three are filtered according to

relevance rank in stage one. The selected features

are used to build neural networks for oil price

prediction. The performance of proposed feature

selection algorithm is compared with Correlation

based Feature Selection (CFS), Modified Relief

(MR) and Modified Relief + Mutual Information

(MR + MI) (Amjady and Daraeepour, 2009) feature

selection methods. The performance criterions used

for comparing I

2

MI

2

algorithm with other algorithms

are RMSE, MAE and MAPE.

The proposed algorithm I

2

MI

2

with GRNN as

forecasting engine has performed the best among all

other feature selection methods. I

2

MI

2

algorithm has

lowest RMSE, MAE and MAPE as 1.29, 0.96 and

2.51 respectively. The reason for the best

performance lies in the fact that the final selected

features from proposed algorithm are 100% non-

redundant and relevant for the study. Two stage (MR

+ MI) with CNN as forecasting engine as proposed

by Amjady and Daraeepour (Amjady and

Daraeepour, 2009) has not performed better than

proposed algorithm. I

2

MI

2

algorithm is fully

automatic algorithm and doesn’t require user to

specify the number of features to be selected. I

2

MI

2

algorithm can provide the minimal representative set

of features for regression problems in business,

biostatistics, applied energy and many more

disciplines.

3 NUMERICAL RESULTS

For analysing the different mechanism in the falling

and rising period of oil prices, two sub-periods are

considered: January 2004-July 2008 and August

2008-December 2012, before and after 2008

financial crisis, respectively. The data collected for

factors driving oil prices are classified into eight

major classes: Speculations (2), Supply (3-4),

Demand (5-8), Reserves (9-15), Inventory (16-18),

Exchange Market (19-22), Stock Market (23) and

Economy (24-26) as shown in Table 1. The features

are selected on the basis of extensive literature

review. For each sub-period, I

2

MI

2

algorithm is

applied to select minimal set of relevant and non-

redundant factors that leads to high prediction

performance for oil prices. General Regression

Neural Network model is used as forecasting

engines to analyse the explanatory power of selected

features and their contribution in driving oil prices.

The proposed methodology is used to forecast the

KDIR 2015 - 7th International Conference on Knowledge Discovery and Information Retrieval

236

new characteristics of oil prices one-month and

twelve-month ahead before and after the crisis. The

forecasts from the proposed methodology are

compared with EIA's STEO January 2013 onwards

forecast reports.

3.1 Sub-Period 1:

January 2004-July 2008

The goal of stage one is to provide relevant features

based on mutual information irrelevance filter. The

step by step procedures followed in stage 1 of

proposed I

2

MI

2

algorithm are as follows. The

candidate features (column 1) with the relevance

rank (column 2) and their normalized relevance rank

value (column 3) with the respect to maximum

mutual information with oil prices are shown in

Table 1. Column 4 provides the feature number.

Based on a low threshold value Th1, feature number

16, 5, 3 and 15 can be filtered out by relevance filter.

The goal of stage two is to provide non-redundant

and relevant features based on redundancy filter.

The three-variable interaction information between

target variable and features selected from stage 1 is

computed. Since interaction information I(Y, X

i

, X

j

)

is a symmetric measure; it cannot derive the

direction whether X

j

inhibits the correlation between

(Y, X

i

) or X

i

inhibits the correlation between (Y, X

j

).

Therefore, it become difficult to filter the redundant

variable from the set of relevant features (X

i

, X

j

)

when interaction information is negative. In this

thesis, this limitation of interaction information is

relieved by focusing on mutual information between

target and input variables I(Y, X

i

). The algorithm in

stage two starts with maximum relevance rank

variable from stage one. The variable EPPI(26) is

ranked first as evident from Table 1. Add X

26

to set

S

2

. For the first relevance ranked variable X

26

there

are seven set {Y, X

26

, X

j

} where j = {3, 4, 5, 8, 16,

17, 21} for which interaction information is

negative. The question that arises here is whether X

i

inhibits the correlation between Y and X

26

or X

26

inhibits the correlation between Y and X

i

. The

redundant variable is filtered by comparing mutual

information I(Y, X

26

} with I(Y, X

j

) for each j. The

results thus obtained in Table 1 shows that mutual

information I(Y, X

26

) > I(Y, X

j

) for each j.

Therefore, the variables X

j

for j = {3, 4, 5, 8, 16, 17,

21} are redundant variables and must be filtered out

from the list of relevant and non-redundant

variables. Similarly, the process holds for next

ranked variable X

25

from Table 1. The features thus

selected through stage two are shown in Table 2.

The numbers of candidate inputs (N) are reduced

from 25 to 11 in stage two; i.e. to less than 50% of

the actual number of input variables. The algorithm

in stage three starts with maximum relevance rank

variable X

26

from Table 1. By default, X

26

is

considered as part of final set. Now, consider the

next relevance rank feature X

25

.

According to the pre-specified threshold value

Th2, variables from stage two are filtered out based

on mutual information between features. Since

mutual information I(X

26

, X

25

) > Th2 , therefore, X

25

is filtered out by redundancy filter. The final

sentence of a caption must end with a period.

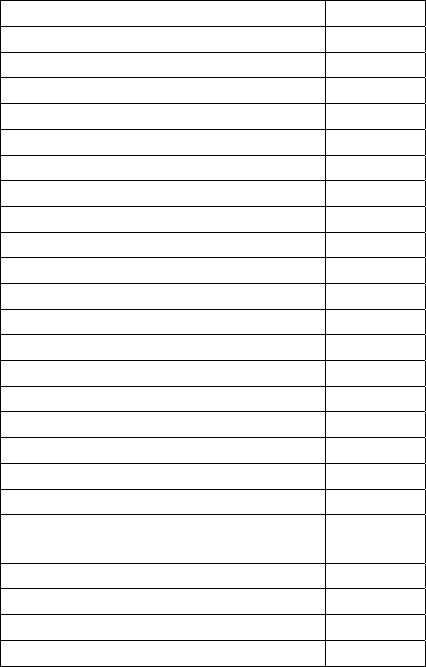

Table 1: Relevance rank based on stage one of proposed

algorithm.

Feature Rank, No.

EPPI (Producer price index) 1, 26

CPI (Consumer price index) 2, 25

NCPP (Speculations) 4, 2

GDP (U.S Gross domestic product) 5, 24

SPR (Strategic Petroleum Reserve) 6, 12

GU (GBP/USD) 7, 20

Non-OECD-C (Non-OECD consumption) 8, 7

EU (EUR/USD) 9, 22

DER (U.S. Dollar Exchange rate) 10, 19

RP (Reserve Production Ratio) 11, 11

OPEC-R (OPEC Reserves) 12, 14

RC (U.S. Refinery Capacity) 13, 18

OECD-R (OECD Reserves) 14, 13

OPS (OECD Petroleum stocks) 15, 10

CC (China consumption) 16, 6

OSC (OPEC Spare capacity) 17, 9

OPEC-S (OPEC Supply) 18, 4

IC (India Consumption) 19, 8

JU (JPY/USD) 20, 21

I-Non-OPEC

(Petroleum Import from Non-OPEC)

21, 17

I-OPEC (Petroleum Import from OPEC) 22, 16

OECD-C (OECD Consumption) 23, 5

Non-OPEC-P (Non-OPEC Production) 24, 3

CR (China Reserves) 25, 15

For the next relevant ranked feature X

m

, calculate

maximum mutual information Max(MI) between X

m

and previously selected candidates in set stage three

by redundancy filter. If Max(MI) > Th2 for any set,

then X

m

is filter out by redundancy filter. Otherwise,

X

m

is added to the final selected features set. The

algorithm will run iteratively for all 11 selected

variables from stage two. The final selected features

from the proposed I

2

MI

2

algorithm are EPPI (26),

Aftermath of 2008 Financial Crisis on Oil Prices

237

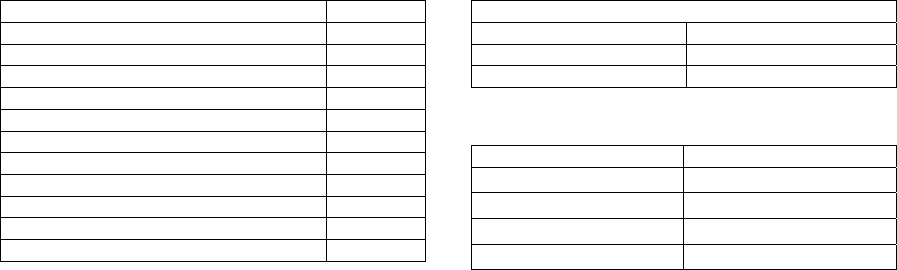

Table 2: Filtered features by redundancy filter in stage

two.

Filtered Feature (Stage 2) No., Rank

EPPI 26, 1

CPI 25, 2

DJI 23, 3

NCPP 2, 4

GDP 24, 5

SPR 12, 6

Non-OECD-C 7, 8

DER 19, 10

RP 11, 11

OPEC-R 14, 12

OECD-R 13, 14

NCPP (2), SPR (12), DER (19) and RP(11). Thus,

five out of twenty five variables were selected to

represent fluctuations in oil prices before the crisis.

The selected features are used as input variables to

General Regression neural networks forecasting

engine. The performance of proposed feature

selection algorithm with GRNN forecasting engine

is evaluated based on RMSE, MAE and MAPE. The

proposed ensemble model is used to forecast in-

sample and out-of-sample. Firstly, in order to

compare the model's capability with other models,

nearly 4.4-year (January 2004-July 2008) monthly

data is used for training and validation. In-sample

evaluations are shown in Table 3. The model is used

to produce one and twelve-month ahead out-of-

sample forecasts from August 2008 till July 2009.

To evaluate the performance of our model, we

compare it with forecasts shown in EIA's STEO

reports from August 2008 onwards. Out-of sample

evaluations are shown in Table 4. The proposed

methodology performed better in terms of MAE for

one-month ahead forecasts as compared to EIA's

STEO forecasts but not in terms on RMSE and

MAPE. It is evident from Table 4 that the proposed

model performed superior as compared to STEO

model for twelve-month ahead forecasts during

extreme complex and volatility phase of oil prices. It

also shows that the model does very well based on

input variables selected by proposed algorithm as

compared to EIA's STEO forecasts. The proposed

methodology performed more accurately in long-run

forecasting as compared to short-run when the

market is too complex and highly volatile. The

explanatory power for oil prices using five selected

features is 97.6% before the crisis, indicating that

the variable reduction is reasonable and that it will

have no essential influence on subsequent analysis.

Table 3: In-sample performance of proposed

methodology.

Proposed Methodolgy

RMSE 3.55

MAE 2.74

MAPE 4.13

Table 4: Out-of-Sample forecast comparison.

Model RMSE, MAE, MAPE

One-Month (Proposed) 8.24, 9.74, 13.27

One-Month(STEO) 6.85, 9.91, 10.82

Twelve-Month(Proposed) 31.9, 34.85, 63.3

Twelve-Month(STEO) 67.59, 62.49, 122.81

3.2 Sub-period 2:

August 2008 - November 2012

The proposed methodology is used to find most

influential and informative features using the same

methodology as discussed in section 3.2. The tables

corresponding to stage one (Table 5) and stage two

(Table 6) are shown for references are shown in

Appendix A. The final set of features of features

selected in this subgroup are EPPI(26), DJI(23),

CC(6) and CR(15). In-sample performance of

proposed methodology in this sub-period is shown in

Table 7. The results from Table 8 show superior

performance of our proposed model in comparison

to EIA's STEO model for both one-month and

twelve-month ahead forecasts. The MAPE for the

whole period (December 2012-November 2013) is

6.27 while RMSE and MAE are 6.47 and 6.30

respectively for twelve-month ahead time period.

Similarly, the MAPE is 2.12 while RMSE and MAE

are 2.64 and 2.01 for one-month ahead forecast

horizon. Our model performed well in both in-

sample and out-of-sample forecast horizons. The

explanatory power of oil prices using four selected

features is 93.8% after the crisis, indicating that the

variable reduction is reasonable and that it will have

no essential influence on subsequent analysis.

4 CONCLUSIONS

The detail regarding the factors contribution to oil

prices before and after 2008 financial crisis is as

follows. The importance of 11 variables (OPEC-S,

Non-OPEC-P, CC, Non-OECD-C, IC, OSC, OECD-

R, OPEC-R, CR, RC, JU) increases, 10 variables

(NCPP, Non-OECD-C, OPS, RP, SPR, I-OPEC, I-

Non-OPEC, DER, GU, EU, GDP) decreases and for

KDIR 2015 - 7th International Conference on Knowledge Discovery and Information Retrieval

238

4 variables (EPPI, CPI, DJI, OECD-C) remain

unchanged. The analysis reveals that various driving

factors show some new characteristics after the

financial crisis. Same is discussed as follows:

• EPPI and CPI have taken up first two positions

before and after crisis. Speculation position has

declined significantly after crisis due to high

fluctuation in oil prices.

• Influence of Non-OECD consumption has

increased after crisis but OECD consumption

remains at same pace.

• The explanatory powers of China consumption

and China reserves have increases and they both

have emerged as important variables driving oil

prices.

• The explanatory power of strategic petroleum

reserves and reserve-production ratios have

weaken after crisis.

• Global economic recession weaken US dollar

together with GU and EU exchange market. On

the other hand, JU exchange market power

increased post crisis.

• The explanatory power of imports from OPEC

declined whereas import from Non-OPEC

increased. Due to disturbance in oil market as

OPEC cuts target production, U.S is heading for

sustainable solutions.

Overall, before the crisis, NCPP, EPPI, DER,

SPR and RP were the major players that influence

oil prices volatility. Before the crisis, DER was the

major factor boosting change in oil prices together

with RP. SPR played a major role in influencing oil

prices due to disturbance created by cuts in OPEC

production or OPEC news. On the contrary, the

original mechanism of crude oil market was

destroyed by 2008 financial crisis and the

relationship of EPPI and DER with oil prices

strengthened after crisis. China consumption and its

reserves emerged as important influencing variables

in recent times. The supply-demand framework has

weaken after crisis and the influence of emerging

economies has increased.

REFERENCES

Bhar, R., & Malliaris, A. G. 2011. Oil prices and the

impact of the financial crisis of 2007–2009. Energy

Economics, 33(6), 1049-1054.

Fan, Y., & Xu, J. H. 2011. What has driven oil prices

since 2000? A structural change perspective. Energy

Economics, 33(6), 1082-1094.

Sehgal, N., & Pandey, K. K. 2014. The Drivers of Oil

Prices–A MI 3 Algorithm Approach. Energy Procedia,

61, 509-512.

Amjady, N., & Daraeepour, A. 2009. Design of input

vector for day-ahead price forecasting of electricity

markets. Expert Systems with Applications, 36(10),

12281-12294.

APPENDIX

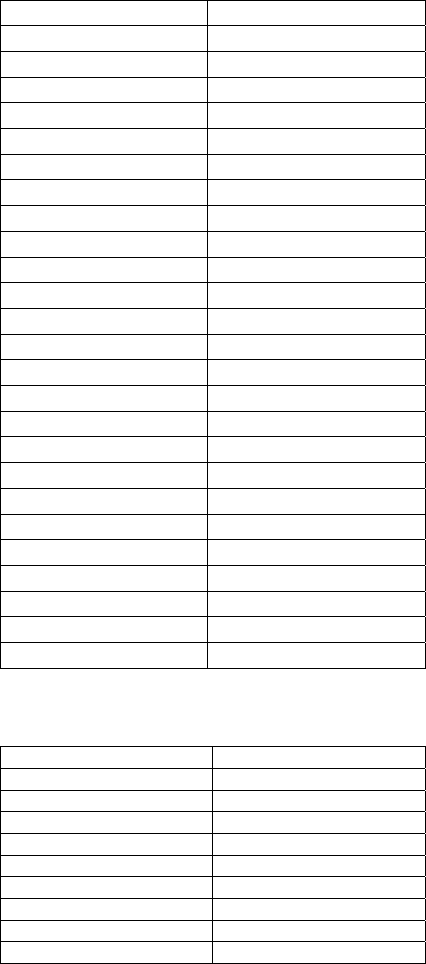

Table 5: Relevance rank based on stage one of proposed

algorithm.

Feature Rank, No.

EPPI 1, 26

CPI 2, 25

DJI 3, 23

CC 4, 6

Non-OPEC-C 5, 7

GDP 6, 24

IC 7, 8

OECD-R 8, 13

OPEC-S 9, 4

SPR 10, 12

OPEC-R 11, 14

RC 12, 18

OSC 13, 9

JU 14, 21

RP 15, 11

EU 16, 22

NCPP 17, 2

Non-OPEC-P 18, 3

I-Non-OPEC 19, 17

OPS 20, 10

DER 21, 19

GU 22, 20

OECD-C 23, 5

CR 24, 15

I-OPEC 25, 16

Table 6: Filtered features by redundancy filter in stage

two.

Filtered Features(Stage 2) No., Rank

EPPI 26, 1

CPI 25, 2

DJI 23, 3

CC 6, 4

OECD-R 13, 8

SPR 12, 10

OPEC-R 14, 11

RP 11, 15

CR 15, 24

Aftermath of 2008 Financial Crisis on Oil Prices

239

Table 7: In-sample performance of proposed

methodology.

Proposed Methodology

RMSE 4.41

MAE 3.41

MAPE 4.31

Table 8: Out-of-Sample forecast comparison.

Model RMSE, MAE, MAPE

One-Month (Proposed) 2.64, 2.01, 2.12

One-Month(STEO) 2.86, 3.51, 2.9

Twelve-Month(Proposed) 6.47, 6.3, 6.27

Twelve-Month(STEO) 9.81, 8.36, 8.31

KDIR 2015 - 7th International Conference on Knowledge Discovery and Information Retrieval

240