An Interbank Market Network Model based on Bank Credit Lending

Preference

Tao Xu, Jianmin He and Shouwei Li

School of Economics & Management, Southeast University, Southeast University Road, Jiangning District, Nanjing, China

Keywords: Complex Network, Interbank Market, Network Structure, Credit Lending Preference.

Abstract: An interbank market network model based on bank credit lending preference is built in this paper to explain

the formation mechanism of interbank market network structure. As well, we analyze the impact of credit

lending risk preference on network topology structure, which includes degree distribution, network

clustering coefficient, average shortest path length and network efficiency. Simulation results demonstrate

that the accumulation degree follows dual power law distribution with credit lending risk preference

parameter value equal or greater than 1, while the accumulation degree follows power law distribution with

credit lending risk preference parameter value smaller than 1. The interbank market network shows small

world topology property. With the increasing of bank credit lending risk preference, the average shortest

path length decreases but network efficiency improves, which enhances the stability of the network.

1 INTRODUCTION

In the banking system, complex network

relationships are formed through interbank lending,

payment and settlement, discount and guarantee.

The interbank market allows liquidity exchanges

among financial institutions through facilitating the

allocation of the liquidity surplus to illiquid banks,

but also provide channel for risk contagion, which

might trigger a domino effect. The subprime crisis

broke out in the US financial market in August

2007, which quickly evolved into global financial

crisis, resulting in a large number of bank failures

and great damaged to the stability of the financial

system.

Complex network theory is an important tool for

complex systems modelling, and has been applied to

statistical physics, life sciences, social sciences and

many other fields. Random network (Burda et al.,

2004), small-world networks (Watts and Strogatz,

1998; Newman and Watts, 1999) and scale-free

networks (Barabási and Albert, 1999) are common

complex network topologies. In the economic

system, the complex network theory has been used

for modelling in the fields of e-commerce (Reichardt

and Bornholdt, 2005), network transactions

(Garlaschelli and Loffredo, 2004), the stock market

(Boginski et al., 2005; Bonanno et al., 2004; Huang

et al., 2009) and other areas of modelling. The

interbank market exhibits high degree of complexity,

with different network structures, such as money

centre structure (Freixas et al.

, 2000), complete

market and incomplete market (Allen and Gale,

2000), etc.

There have been lager number of empirical

research literature on interbank market network

structure topology, such as degree distribution,

average path length of the network, clustering

coefficient, etc. Souma et al. (2003) modelled

Japanese business network and found scale-free

property through empirical results. Boss et al. (2004)

analyzed Austrian interbank market and found that

the degree distributions followed power law

distribution, interbank liability network showed a

community structure, a low clustering coefficient

and a short average path length. Iori et al. (2008)

found the structure of Italian interbank market was

fairly random and changed with time. Iori et al.

(2007) showed that the Italian interbank consists of

two communities, one mainly composed by large

and foreign banks, the other composed by small

banks. Cajueiro and Tabak (2008) found that the

Brazilian interbank network structure had a weak

community structure and high heterogeneity. Tabak

et al. (2009) built Brazilian interbank market with

minimum spanning tree method and showed that the

private and foreign banks tended to form clusters

within the network and that banks with different

Xu, T., He, J. and Li, S.

An Interbank Market Network Model based on Bank Credit Lending Preference.

DOI: 10.5220/0005734201570162

In Proceedings of 5th the International Conference on Operations Research and Enterprise Systems (ICORES 2016), pages 157-162

ISBN: 978-989-758-171-7

Copyright

c

2016 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

157

sizes were also strongly connected and tended to

form clusters.

In recent years, researchers began to explore the

interbank market network structure formation

mechanism. Inaoka et al. (2004) presented a

procedure to extract a network structure described

by a power-law degree distribution from a set of

records of transactions. Li et al. (2010) introduced a

network model of an interbank market based on

interbank credit lending relationships and found

some typical structural features such as a low

clustering coefficient and a relatively short average

path length, community structures, and a two-power-

law distribution of out-degree and in-degree.

In summary, the present simulation methods for

constructing an interbank market can be divided into

the following categories: (1) Establishing an

interbank market network by setting a fixed link

probability; (2) By setting a linking threshold, credit

links are created if the given threshold is exceeded;

(3) By assuming that the interbank network of a

particular network architecture (such as scale-free

networks, dual power rate networks, small-world

networks, etc.). From the above analysis, we can see

that the current model construction methods have

not taken bank behaviours such as assets and

liabilities into consideration. But empirical results

demonstrate that the formation of credit lending

links between banks is related to the banks

behaviours. Banks with different credit lending

scales are strongly connected and tend to form

clusters (Tabak et al., 2009). In this paper, an

interbank credit lending network model is

constructed through designing a probability

associated with bank lending scale and risk

preference. Then, we analyze the topology property

of network and the influence of risk preference on

network structure.

The remainder of this paper is organized as

followed. The model is presented in part 2,

simulation analysis is shown in part 3, and finally

conclusions are conducted in part 4.

2 THE MODEL

In this paper, a directed graph ),( EVG is used to

denote interbank market network, where the vertex

set

V represents the set of all banks and the set

E

is

a collection of edges which represent the interbank

credit lending relationships. A directed edge

ji

e

,

exists between nodes Vji , , if and only if

bank

i is the creditor bank of bank j . Assuming

that the total bank number

NV || , and

i

N denotes

the set composed by neighbours of bank

i . l

represents the total interbank lending scales, and

i

l

is the lending scale of bank

i , satisfying

i

ll

.

Based on the empirical results (Boss et al.,

2004), it is assumed that bank credit lending scale

follows power-law distribution:

llP ~)(

, where

is power law parameters. So, the interbank market

network we build is composed by a large number of

small banks and a few large banks. The specific

process to construct the interbank market network is

listed as follows:

1) Initialization: Generating the total number of

N banks and lending scales followed by

power-law distribution.

2) The construction process of interbank credit

lending relationships: The connection

probability

ij

p of bank i )1( Ni

and bank j

),1( ijNj

depends on their lending

scales:

))2//(exp(1

ijjiij

llllp

,

where

denotes bank credit lending risk

preference coefficient, where

),0[

.

The interbank relationship connection probability

]1,0())2//(exp(1

ijjiij

llllp

, as the

inequality

2//2//

ijjiijji

llllllll

and

0

. The probability gets the minimum when

ji

ll

and gets the maximum when

ji

ll or

ji

ll

. Obviously, the connection probability

ij

p

increases monotonically with parameter

.

3 SIMULATION RESULTS

In this paper, the parameters are initialized as

follows: The total bank number

200N , the

power-law parameter

87.1

(Boss et al., 2004),

and the bank credit risk preference coefficient

01.0

, 1.0

, 1

, 10

and

100

,

respectively.

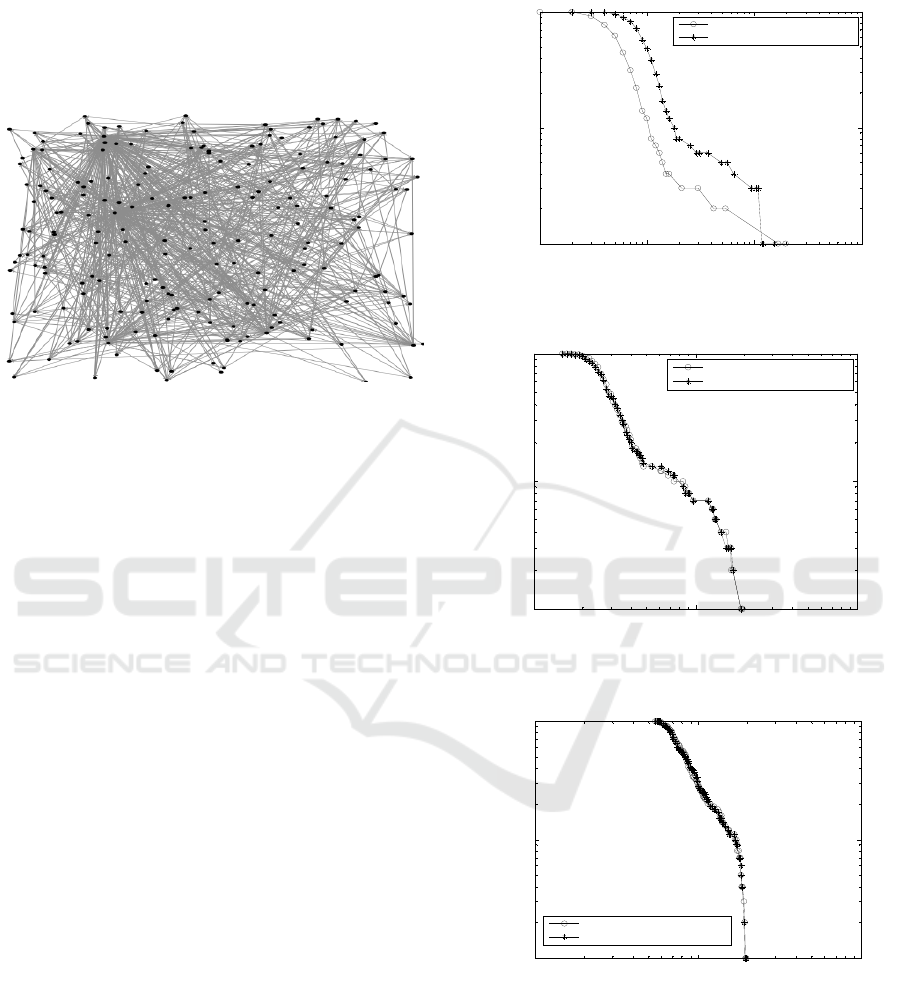

The interbank market structure calculated by the

model with

01.0

is given in Figure 1, in which

nodes denote banks and edges represents credit

lending links between banks. It can be found from

figure 1 that the banks which have large credit

lending scales get bigger degree than those with

small ones. This is because the number of banks

with large credit lending scales is much smaller than

those with small ones and the credit lending scales

ICORES 2016 - 5th International Conference on Operations Research and Enterprise Systems

158

of banks are generated by power-law distribution.

From the model, it can be known that banks with

different credit lending scales establish connections

more easily than those with the similar ones. So big

banks show large degree and small banks get small

degree.

Figure 1: An interbank market network structure.

3.1 Degree Distribution

In this paper, we let

i

d ,

in

i

d

,

out

i

d

denote the degree,

in-degree and out-degree of bank

i respectively,

out

i

in

ii

ddd

. The degree distribution

)(kp

is

defined as the proportion of the nodes with degree

equals

k in the network. Cumulative distribution

kk

cum

kpkP

'

)()(

'

, represents he proportion of the

nodes with degree no less than

k in the network.

Figure 2-1 to figure 2-5 is the simulation results of

cumulative distribution with bank credit lending

parameter

01.0

, 0.1, 1, 10, 100, respectively.

It can been found from figure 2-1 to figure 2-5

that the cumulative distribution of the constructed

interbank network follows power-law distribution

with

1

, but the cumulative distribution obeys to

dual power-law distribution with

1

, which

demonstrate that few number big banks which have

large credit lending scales own the majority

interbank credit lending business while the large

number small banks with small credit lending scales

have the minority interbank credit lending business.

With the increment of credit lending risk preference,

the maximum of in-degree and out-degree improves

simultaneously. The dual power-law distribution

obeyed by cumulative distribution through

simulation experiments are consistent with the

empirical findings in Austria and Japanese interbank

(Boss et al., 2004; Souma et al., 2003) when

1

.

As well, with

1

, the power-law distribution of

cumulative distribution is in accordance with

Inaoka’s empirical results (Inaoka et al., 2004).

10

0

10

1

10

2

10

3

10

-2

10

-1

10

0

Degree

Cumulative probability

In-degree cumulative probability

Out-degree cumulative probability

Figure 2-1: Cumulative distribution with

01.0

.

10

1

10

2

10

3

10

-2

10

-1

10

0

Degree

Cumulative probability

In-degree cumulative probability

Out-degree cumulative probability

Figure 2-2: Cumulative distribution with 1.0

.

10

1

10

2

10

3

10

-2

10

-1

10

0

Degree

Cumulative probability

In-degree cumulative probability

Out-degree cumulative probability

Figure 2-3: Cumulative distribution with

1

.

3.2 Network Clustering Coefficient

The clustering coefficient of a node is used to

measure the connected probability of two

neighbours of the node in an undirected graph. The

network clustering coefficient is the average of the

clustering coefficient of all nodes in the network.

An Interbank Market Network Model based on Bank Credit Lending Preference

159

10

2.11

10

2.15

10

2.19

10

2.23

10

2.27

10

-2

10

-1

10

0

Degree

Cumulative probability

In-degree cumulative probability

Out-degree cumulative probability

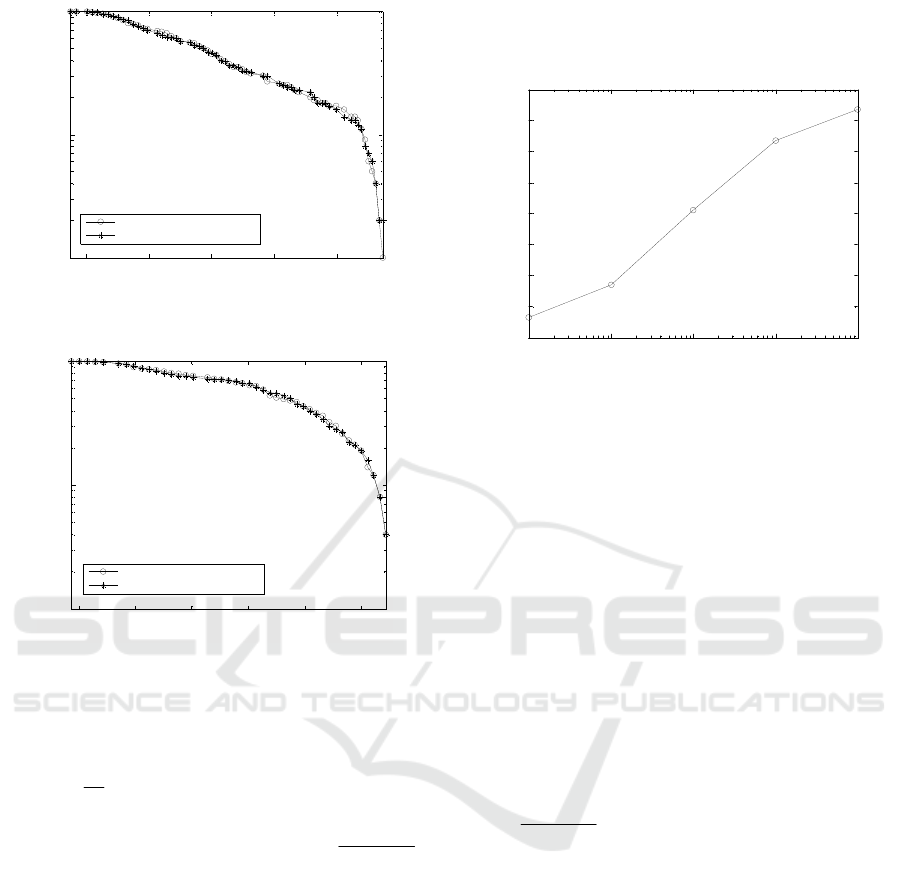

Figure 2-4: Cumulative distribution with 10

.

10

2.19

10

2.21

10

2.23

10

2.25

10

2.27

10

2.29

10

-2

10

-1

10

0

Degree

Cumulative probability

In-degree cumulative probability

Out-degree cumulative probability

Figure 2-5: Cumulative distribution with 100

.

We let

C denote network clustering coefficient, and

i

c represent the clustering coefficient of node i ,

thus

N

i

i

c

N

C

1

1

. From the definition of node

clustering coefficient, we can get

)1(

2

ii

i

i

dd

E

c

,

where

i

E represents the number of connected edges

between neighbours of node

i . The directed graph

should be transformed to be an undirected one

before computing network clustering coefficient,

since the clustering coefficient is defined in an

undirected graph. Figure 3 shows logarithmic plot of

network clustering coefficient relationship and bank

credit lending risk preference.

It can be known from figure 3 that the clustering

coefficient of interbank credit lending market

network monotonically increases with bank credit

lending risk preference. The explanation for this is

that the probability to build credit lending

relationships improves with the increment of bank

credit lending risk preference. From the definition of

network clustering coefficient , it is easy to

understand that network clustering coefficient

increases monotonously with the connection

probability.

10

-2

10

-1

10

0

10

1

10

2

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

C

Figure 3: Relation between network clustering coefficient

and

.

3.3 Average Shortest Path Length

The shortest path length between two nodes is used

to measure the distance of the two nodes. The

shortest path

ij

d

from node i to node j is defined

as a simple path starting from node

i , and sinking in

node

j , which has the shortest nodes number. The

shortest path length

ij

d

from node

i to node

j

is

the edge number of the shortest path. Obviously, in

an undirected graph, the shortest path length

ij

d

from node

i to node j equals he shortest path

length

ji

d

from node j to node i . The average

path length of the network can be calculated as

ji

ijG

d

NN

L

)1(

1

. To simplify the calculation

of the average shortest path length of the network,

the interbank market network is transformed into an

undirected graph. The relationships between the

average path length of the interbank market network

and bank credit lending preference is shown in

figure 4.

From figure 4, it can be found that the

constructed interbank market network is a small

world network with average path length less than 2.

The average path length decreases monotonously

with bank credit lending preference coefficient,

since the potential paths between any two nodes

increase with the growth of credit links number in

the network. The results of interbank markets

network structure in Mexico, USA and the Great

Britain (Martínez-Jaramillo et al., 2010; Soramäki et

al., 2007; Becher et al., 2008) also shows small

ICORES 2016 - 5th International Conference on Operations Research and Enterprise Systems

160

world property, which are the same as the finding of

this paper.

10

-2

10

-1

10

0

10

1

10

2

1

1.1

1.2

1.3

1.4

1.5

1.6

1.7

1.8

1.9

2

Average shortest path length

Figure 4: Relations between average path length and

.

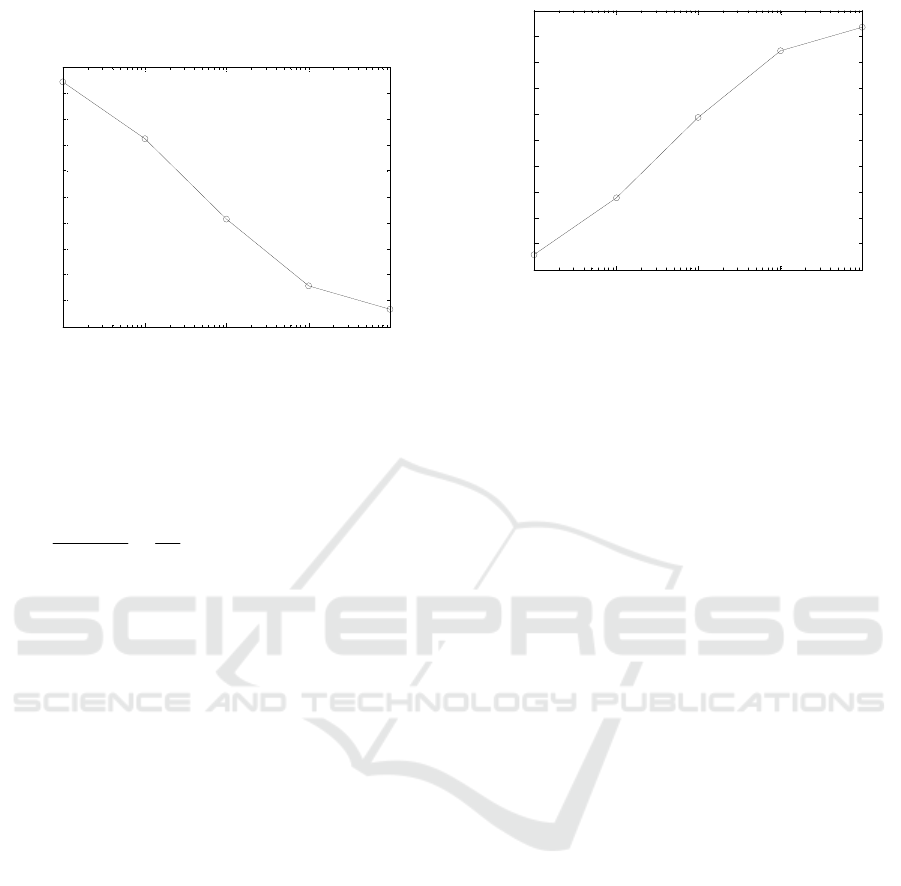

3.4 Network Efficiency

Network efficiency is another approach to measure

the capacity of a network, and can be computed by

ji

ij

G

dNN

E

1

)1(

1

, where

ij

d is the shortest path

length from node

i to node j . From the definition

of network efficiency, we can conclude that network

efficiency can apply not only to describe a

connected graph but also represent a non-connected

graph connections. Similarly as calculating the

average shortest path length, the interbank market

network should also be transformed into an

undirected graph when computing network

efficiency. Simulation results are shown in figure 5.

It can be seen from figure 5 that network

efficiency increase monotonously from 0.55 to 0.97

with the increment of bank credit lending preference

and network efficiency approaching to 1 when

1

. The reason for this is that the connection

probability increases with the improvement of bank

credit lending preference, which results in more

interbank linkages in the interbank network. Then,

there will be more potential paths between any two

nodes as the addition of network edges and the

shortest path length of them may be shorter in the

meanwhile.

4 CONCLUSIONS

In this paper, an interbank market network is

constructed based on bank lending credit scales

followed by power-law distribution. Simulation

10

-2

10

-1

10

0

10

1

10

2

0.5

0.55

0.6

0.65

0.7

0.75

0.8

0.85

0.9

0.95

1

Network efficiency

Figure 5: Relations between network efficiency and

.

experiments demonstrates that interbank credit

lending market network has small world property

and follows power-law distribution with bank credit

lending risk preference parameter value smaller than

1, while follows dual power-law distribution with

the same parameter equal or greater than 1. With the

increment of bank credit lending preference, the

average shortest path length decreases and network

efficiency increases, which improves the capacity

and stability of the network.

The results of this paper have some policy

guidance. On one hand, when liquidity shortage

occurred in the interbank market, bank regulars can

adopt positive policies to guide banks to increase

credit lending risk preference for prospering

interbank market. On the other hand, when interbank

market exhibits excessive prosperity, bank

regulators should strengthen the interbank market

supervision, and guide banks to reduce risk

preferences in order to prevent potential systemic

risks.

ACKNOWLEDGEMENTS

This work is supported by the National Natural

Science Foundation of China (No. 71371051 and

71201023) and College Postgraduates Research

Innovation Program of Jiangsu Province

(KYZZ15_0067).

REFERENCES

Allen, F., & Gale, D., 2000. Financial contagion. Journal

of political economy, 108(1), 1-33.

Barabási, A. L., & Albert, R., 1999. Emergence of scaling

in random networks. Science, 286(5439), 509-512.

An Interbank Market Network Model based on Bank Credit Lending Preference

161

Becher, C., Millard, S., & Soramaki, K., 2008. The

network topology of CHAPS Sterling.

Boginski, V., Butenko, S., & Pardalos, P. M., 2005.

Statistical analysis of financial

networks. Computational statistics & data

analysis, 48(2), 431-443.

Bonanno, G., Caldarelli, G., Lillo, F., Miccichè, S.,

Vandewalle, N., & Mantegna, R. N., 2004. Networks

of equities in financial markets. The European

Physical Journal B-Condensed Matter and Complex

Systems, 38(2), 363-371.

Boss, M., Elsinger, H., Summer, M., & Thurner 4, S.,

2004. Network topology of the interbank

market. Quantitative Finance, 4(6), 677-684.

Burda, Z., Jurkiewicz, J., & Krzywicki, A., 2004.

Statistical mechanics of random graphs. Physica A:

Statistical Mechanics and its Applications, 344(1), 56-

61.

Cajueiro, D. O., & Tabak, B. M., 2008. The role of banks

in the Brazilian Interbank Market: Does bank type

matter?. Physica A: Statistical Mechanics and its

Applications, 387(27), 6825-6836.

Freixas, X., Parigi, B. M., & Rochet, J. C., 2000. Systemic

risk, interbank relations, and liquidity provision by the

central bank. Journal of money, credit and banking,

611-638.

Garlaschelli, D., & Loffredo, M. I., 2004. Fitness-

dependent topological properties of the world trade

web. Physical review letters, 93(18), 188701.

Huang, W. Q., Zhuang, X. T., & Yao, S., 2009. A network

analysis of the Chinese stock market. Physica A:

Statistical Mechanics and its Applications, 388(14),

2956-2964.

Inaoka, H., Takayasu, H., Shimizu, T., Ninomiya, T., &

Taniguchi, K., 2004. Self-similarity of banking

network. Physica A: Statistical Mechanics and its

Applications, 339(3), 621-634.

Iori, G., De Masi, G., Precup, O. V., Gabbi, G., &

Caldarelli, G., 2008. A network analysis of the Italian

overnight money market. Journal of Economic

Dynamics and Control, 32(1), 259-278.

Iori, G., Reno, R., De Masi, G., & Caldarelli, G., 2007.

Trading strategies in the Italian interbank

market. Physica A: Statistical Mechanics and its

Applications, 376, 467-479.

Li, S., He, J., & Zhuang, Y., 2010. A network model of the

interbank market.Physica A: Statistical Mechanics and

its Applications, 389(24), 5587-5593.

Martínez-Jaramillo, S., Pérez, O. P., Embriz, F. A., & Dey,

F. L. G., 2010. Systemic risk, financial contagion and

financial fragility. Journal of Economic Dynamics and

Control

, 34(11), 2358-2374.

Reichardt, J., & Bornholdt, S., 2005. Economic networks

and social communities in online-auction sites (No.

physics/0503138).

Soramäki, K., Bech, M. L., Arnold, J., Glass, R. J., &

Beyeler, W. E., 2007. The topology of interbank

payment flows. Physica A: Statistical Mechanics and

its Applications, 379(1), 317-333.

Souma, W., Fujiwara, Y., & Aoyama, H., 2003. Complex

networks and economics. Physica A: Statistical

Mechanics and its Applications, 324(1), 396-401.

Tabak, B. M., Cajueiro, D. O., & Serra, T. R., 2009.

Topological properties of bank networks: the case of

Brazil. International Journal of Modern Physics

C,20(08), 1121-1143.

Watts, D. J., & Strogatz, S. H., 1998. Collective dynamics

of ‘small-world’networks. Nature, 393(6684), 440-

442.

ICORES 2016 - 5th International Conference on Operations Research and Enterprise Systems

162