Integration of Load Shifting and Storage to Reduce Gray Energy

Demand

Iv´an S. Razo-Zapata

1

, Mihail Mihaylov

2

and Ann Now´e

2

1

Luxembourg Institute of Science and Technology, Esch-Sur-Alzette, Luxembourg

2

Vrije Universiteit Brussel, Brussels, Belgium

Keywords:

Smart Grid, Multi-Agent Systems, Load Shifting, Storage.

Abstract:

The smart grid concept offers an opportunity to design new environmentally friendly energy markets for re-

ducing CO2 emissions. To achieve this goal, we should increase the use and penetration of green energy while

softening our dependency on gray (non-environmentally friendly) energy too. In this work we show how load

shifting and storage can be incorporated into new energy markets to reduce gray energy consumption. We

used multi-agent-based simulations that are fed with real data to analyze the influence of load shifting and

storage to reduce gray energy demand as well as the behaviour of prices for gray and green energy. Results

suggest that reduction in gray energy consumption is feasible during peak times, i.e. up to 15%. Nonetheless,

if the amount of renewable resources is increased 50%, higher reductions can be achieved, i.e. up to 30%.

Furthermore, one of the findings also suggests that storage helps to keep the price of green energy low.

1 INTRODUCTION

Engineering smart grids is a challenging task that

must deal with new emerging actors, e.g. prosumers

1

as well as with complex interactions between people,

technology and natural systems (Schuler, 2010; Ram-

churn et al., 2012). Among those interactions, eco-

nomic and power flows are of utmost importance (van

Werven and Scheepers, 2005; Schuler, 2010).

Novel mechanisms have been already proposed to

not only optimize economic and power flows but also

improve the integration of renewable resources (Ilic

et al., 2012; Kok et al., 2005; Capodieci et al., 2011;

Mihaylov et al., 2014). Nonetheless, they have not

analyzed the potential use of load shifting and stor-

age to reduce gray energy demand and improve the

integration of renewable sources.

As a way to analyze such potential use, we take

NRG-X-Change as an example of a novel mechanism

that can benefit from load shifting and storage. NRG-

X-Change aims at promoting the trade and flow of

locally produced green energy within dwellings (Mi-

haylov et al., 2014). It offers to prosumers the pos-

sibility to trade their excess of green energy by us-

ing NRGcoins, which are virtual coins inspired by

the Bitcoin protocol (Nakamoto, 2008). Unlike Bit-

1

The term prosumer refers to energy consumers that can

also produce their own power.

coins, NRGcoins are generated by injecting green en-

ergy into the grid rather than using/spendig computa-

tional power (Mihaylov et al., 2014).

Although NRG-X-Change promotes the local

trade and consumption of green energy between resi-

dential consumers and prosumers, it does not guaran-

tee that green energy production fully matches con-

sumption. In fact, when green energy is not enough

to cover demand, consumers and prosumers will con-

sume gray (non-environmentally friendly) energy to

satisfy theirs needs and maintain a given level of com-

fort. To soften the dependency on gray energy, i.e.

reducing its consumption, load shifting and storage

capabilities can be integrated into NRG-X-Change.

In this way, “original gray consumption” can be cov-

ered using stored green energy or delayed until green

energy becomes available. Nonetheless, this inte-

gration is far from trivial, since it has been already

shown that such capabilities impact energy demand

and price (Pr¨uggler et al., 2011), which may poten-

tially inhibit trade and/or increase consumption.

In this work, we present preliminary results on

the integration of load shifting and storage capabil-

ities into NRG-X-Change. Using real consumption

and production data provided by a Belgian retailer,

we performed numerical simulations to analyze the

performance of storage and load shifting as well as

the impact on energy prices and the reduction of gray

154

Razo-Zapata, I., Mihaylov, M. and Nowé, A.

Integration of Load Shifting and Storage to Reduce Gray Energy Demand.

In Proceedings of the 5th International Conference on Smart Cities and Green ICT Systems (SMARTGREENS 2016), pages 154-165

ISBN: 978-989-758-184-7

Copyright

c

2016 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

energy consumption. Our simulations are based on

a multi-agent system that replicates the behaviour of

main stakeholders, i.e. energy retailers, consumers

and prosumers.

Results suggest that load shifting and storage can

reduce energy demand during peak hours. In this way,

a 15% reduction can be achieved within a typical Bel-

gian district that is on average composed of 60 house-

holds in which 10% are prosumers. Nonetheless, as

our results indicate, 30% reduction can be achieved

during peak hours if the number of prosumers reaches

50% within the Belgian market, which is a plausi-

ble scenario for the comming years (Rickerson et al.,

2014).

Furthermore, another finding suggests that storage

plays an important role to keep green energy prices

low as prosumers can inject and trade energy from

batteries, which provides a more constant supply of

green energy.

The rest of the paper is organized as follows. Sec-

tion 2 presents related work covering aspects such as

load shifting, demand response and negotiation strate-

gies for energy markets. Later on, Section 3 describes

green and gray energy markets as well as load shifting

and storage capabilities. Afterwards, Section 4 shows

preliminary results, whereas general conclusions and

future work are presented in Section 5.

2 RELATED WORK

2.1 Modifying Energy Consumption

Different strategies can be applied to modify the con-

sumption of energy. On the one hand, storage capabil-

ities can reduce demand for energy during critical pe-

riods by using green energy that has been previously

stored when green energy was abundant (Pr¨uggler

et al., 2011). On the other hand, demand response

(DR) capabilities can be used to reduce customers’

normal consumption pattern by shifting a percentage

of their demand to off-peak hours (Gottwalt et al.,

2011; Aghaei and Alizadeh, 2013). Different tech-

niques have been applied to support DR capabilities,

which can be roughly classified into three schemes:

1) Price based: in this scheme the price of energy

changes over time, which may motivate customers to

also change their consumption profile. 2) Incentive

or event-based: customers are rewarded for changing

their energy demand upon retailer’s requests. 3) De-

mand reduction bids: customers send demand reduc-

tion bids to energy retailers (Siano, 2014).

Although several DR techniques and programs

have been proposed in literature (Aghaei and Al-

izadeh, 2013; Siano, 2014) and implemented in pi-

lots (Niesten and Alkemade, 2016) respectively, they

all agree on an important issue: residential cus-

tomers offer a lower potential for demand reduc-

tion compared to commercial and industrial con-

sumers (Gottwalt et al., 2011; Aghaei and Alizadeh,

2013). Likewise, in (Gottwalt et al., 2011; Pr¨uggler,

2013), it is also reported that the economic benefits

are moderate for residential consumers compared to

the required investment. Consequently, as an attempt

to better reduce residential demand for gray energy,

we aim at enhancing DR techniques by using storage

capabilities. This combination will allow not only to

shift energy demand to time slots in which green en-

ergy is produced but also to slots in which storage de-

vices discharge green energy to be consumed.

2.2 Negotiation Strategies

Several mechanisms have been also proposed to trade

energy within smart grids. Nobel (Ilic et al., 2012)

applies a market mechanism in which prosumers offer

their excess of energy by submitting asks (sell orders)

while consumers submit bids (buy orders). They, both

prosumersand consumers, submit asks and bids based

on predictions about their expected production and

consumption respectively. Later on, asks and bids are

matched based on price, i.e. a scalar value. Like-

wise, PowerMatcher (Kok et al., 2005) uses a market

mechanism for matching supply to demand. Nonethe-

less, bids and asks are not scalar values but price

curves. An aggregator is in charge of grouping in-

dividual curves so that more supply and demand can

be matched. The orderbook then computes price equi-

librium to match aggregated asks and bids.

In (Capodieci et al., 2011), the authors propose

a mechanism in which energy is contracted by in-

dividual consumers and prosumers via negotiations.

Although no central mechanism rules the price of

energy, the energy retailer is in charge of assigning

prosumer-consumer pairs for negotiation. In a sim-

ilar vein, Wang and Wang have proposed adaptive

negotiation strategies to trade energy between smart

buildings and grid operators (Wang and Wang, 2013).

The trade takes the form of a bi-direcctional pro-

cess in which a seller, e.g. grid operator, continu-

ously adapts (submits) prices for energy (asks), while

a buyer replies with counter offers (bids). Bids and

asks can be adapted using the Adaptive Attitude Bid-

ding Strategy (AABS) or an improved version that

applies particle swarm optimization techniques (PSO-

AABS).

Similar to Nobel and PowerMatcher, NRG-X-

Change presents a market mechanism to locally trade

Integration of Load Shifting and Storage to Reduce Gray Energy Demand

155

energy between consumers and prosumers (Mihaylov

et al., 2014). It relies on prosumers injecting their

excess of green energy into the grid and trading

NRGcoins, which are used to pay for green energy.

In this way, prosumers injecting green energy are re-

warded with NRGcoins, whereas consumers must pay

for the usage with NRGcoins (Mihaylov et al., 2014).

To trade NRGcoins, consumers and pro-

sumers participate in a continuous double auction

(CDA) (Shoham and Leyton-Brown, 2008), where

buyers and sellers apply bidding strategies to sub-

mit bids and asks respectively. NRG-X-Change

originally uses the so-called adaptive attitude (AA)

strategy, which relies on short-term and long-term

attitudes for adapting to market changes (Ma and

Leung, 2007; Mihaylov et al., 2015). Briefly, a

short-term attitude encourages the agent to be eager

for more profit, i.e. selling at high prices or buying

at low prices, while a long-term attitude encourages

the agent to be eager for more transactions, i.e.

submitting low asks or high bids. Based on market

events (transactions, ’atractive’ bids and asks), AA

continuously updates an agent’s eagerness to sell or

buy items.

In this work, we use the NRG-X-Change to trade

green energy as it offers a novel mechanism that in-

centives prosumers to inject their excess of green

energy while promoting a transparent economic ex-

change via NRGcoins. To trade gray energy,however,

we apply a negotiation approach based on AABS as

this type of negotiation mimics retailer’s control on

gray energy prices, i.e. they establish prices based on

their private reservation price. The next section elab-

orates on these issues as well as on the overall archi-

tecture to support load shifting and storage.

3 ENERGY TRADE

Briefly, the electricity system (ES) is composed of all

systems and actors involvedin production, transporta-

tion, distribution and trade of electricity. This ES can

be divided into a commodity subsystem and a phys-

ical subsystem (van Werven and Scheepers, 2005).

The former covers all economic flows resulting from

electricity trade, whereas the physical subsystem con-

sists of all equipment that produces, transports and

uses the electricity.

In our case, as part of the commodity subsystem,

we assume the existence of green and gray energy

markets, which operate in parallel but use different

mechanisms. Moreover, the physical subsystem spec-

ifies the overall smart grid architecture as well as the

way storage and load shifting operate.

3.1 Commodity Subsystem

3.1.1 Green Energy Market

We use the NRG-X-Change approach to allow the

flow and trade of green (solar) energy between pro-

sumers (Mihaylov et al., 2014). We assume con-

sumers and prosumers are connected to the electric-

ity grid via a substation (see also Sect. 3.2). Ex-

cess of locally produced green energy is fed into the

grid and is withdrawn mostly by consumers. The

billing is performed in real-time by the substation us-

ing NRGcoins, which are independently traded on an

open currency exchange market for their monetary

equivalent.

NRGcoin is a virtual coin inspired by Bitcoin

whose main advantage is that it can be exchanged for

a specific quantity of green energy at any time. For in-

stance, if a prosumer injects 10 kWh right now, (s)he

will earn NRGcoins accounting for that amount of en-

ergy, based on the local supply and demand measured

by the substation (Mihaylov et al., 2014). Later on,

e.g. after few years, regardless of the NRGcoin mar-

ket value, theprosumer can use the same NRGcoins to

pay 10 kWh of green energy under similar energy sup-

ply and demand conditions as during injection (Mi-

haylov et al., 2014).

Unlike the original NRG-X-Change, to trade

NRGcoins, we use the Adaptive-Aggressiveness

(AAggressive) bidding strategy as it applies a learn-

ing approach, which has been shown to be very robust

in dynamic markets (Vytelingum et al., 2008). AAg-

gressive is composed of four basic blocks: equilib-

rium estimator, aggressiveness model, adaptive layer

and bidding layer (Vytelingum et al., 2008). Based on

historical record of prices, the equilibrium estimator

computes the target price for the trader, whereas the

aggressiveness model determines the trader’s risky

behaviour to submit high (low) bids (asks). The adap-

tive layer implements short-term and long-term learn-

ing to adapt the behaviour of the trader. While the

short-term learning updates the agent’s aggressive-

ness, the long-term learning modifies the agent’s bid-

ding behaviour. Finally, the bidding layer implements

a set of rules to determine whether the trader must

submit bids(asks) or not.

Parameter tuning for AAggressive is done as sug-

gested in (Vytelingum et al., 2008). Nonetheless, we

specified constraints for bids and limit prices. On the

one hand, minimum and maximum allowed bids in

the market are as follows. The minimum bid is 0.01

Euro, while the maximum bid is 0.215 Euro, which is

the estimated average price for residential customers

in Belgium during 2014 (VEA, 2014). On the other

SMARTGREENS 2016 - 5th International Conference on Smart Cities and Green ICT Systems

156

hand, limit prices for buyers and sellers were ran-

domly defined in the range 0.01 and 0.215 Euro.

3.1.2 Gray Energy Market

In (Mihaylov et al., 2014), the authors allow

prosumers trading green and gray energy with

NRGcoins. In this work, however, to trade gray

energy prosumers must pay in Euro. The main

motivation is that NRGcoins should be perceived

as assets that guarantee provision of green energy

only. Similar ideas have been previously explored.

For instance, ecolabels that inform customers on

whether some products and services are green or eco-

friendly (Room and Institute, 2010).

Since prosumers and consumers must consume

gray energy whenever there is a lack of green en-

ergy, prosumers and consumers use the AABS strat-

egy to negotiate prices for gray energy with the sub-

station (Wang and Wang, 2013). As described in Sec-

tion 2.2, the AABS strategy relies on a bi-direcctional

negotiation in which a buyer (prosumer/consumer)

submits bids (price willing to pay for energy) to a

seller (substation) that responds with asks (desired

selling prices). Once the buyer’s bid is equal to or

greater than the seller’s ask, an agreement has been

reached to trade energy among the two of them. The

final price for energy is the average between the bid

and the ask.

Substation decreases or increases their asks de-

pending on AABS selling strategy and the availabil-

ity of green energy. If green energy supply is bigger

than demand, the price for gray energy goes down,

otherwise it goes up. The idea is to discourage con-

sumers and prosumers of using gray energy. This

way, if gray energy price is higher than their reser-

vation price, they will try to shift loads. Nonetheless,

even if the price is high and green energy is not avail-

able, they will have to use gray energy anyway.

To decrease or increase gray energy prices, the

AABS’ L

2

parameter (Wang and Wang, 2013), which

is used to modify the substation’s reservation price, is

continuously adapted using Equation 1.

L

2

=

(

L

2

− α× (GS/PwD) if GS > PwD

L

2

+ α× (GS/PwD) otherwise

(1)

where GS is the supply of green energy, PwD

is the power demand and α is a random value be-

tween 0.001 and 0.005. The reservation price of

the substation is initially fixed at 0.2 Euro, which

changes depending on L2 and is a bit lower than the

maximum price for green energy (see Section 3.1.1).

Reservation prices for consumers and prosumers are

randomly determined between 0.15 and 0.30 Euro.

The rest of AABS parameters are tuned as suggested

in (Wang and Wang, 2013).

3.2 Physical Subsystem

3.2.1 Overall Architecture

In this work we use real-world data that has been pro-

vided by a Belgian energy retailer. The physical set-

ting contains prosumers that are equipped with so-

lar panels, which allows them to generate their own

power. Both, consumers and prosumers have smart

meters that report to the substation the amount of en-

ergy being absorbed from and injected to the grid. As

meters only report the injected energy after prosumers

satisfied their own demand, we do not have a full pic-

ture of the actual energy being produced. The same

applies for the absorbed energy that is reported to the

substation, i.e. we do not have information about the

overall energy being consumed by prosumers as part

of it is satisfied with their solar panels. Consequently,

we do not have information about prosumers’ internal

energy consumption and production but only about

energy flows between the meters and the substation.

Furthermore, the measurements take place every 15

minutes, which are standard time slots in the electric-

ity system (Bush, 2014).

3.2.2 Storage

In our setting we assume prosumers are the only ones

using batteries since they can generate their own en-

ergy and store their excess after satisfying own con-

sumption. Although commercial batteries offer stor-

age capabilities in the range of 4 to 13 kWh, we ran-

domly assign prosumers storage in the range of 4 to 7

kWh. E.g. Tesla’s powerwall offers storage of 7 and

10 kWh (Tesla, 2016), whereas Bosch’s offers stor-

age of 4.4 and 13.2 kWh (Bosch, 2016) respectively.

Moreover, to the best of our knowledge, only small

capacities per prosumer have been properly tested and

installed within current pilots. E.g. within the project

Grid4EU, home batteries with 4kWh capacity have

been already installed in the French region of Car-

ros (Grid4eu, 2016). Regardless of the capacity of the

battery, we assume they have an efficiency of 90%, for

both charge and discharge, which is a lower bound to

the efficiency already provided by commercial batter-

ies. E.g. Tesla and Bosch respectively report 93%

and 97.7% efficiency for storage solutions that also

include power inverters (Tesla, 2016; Bosch, 2016).

Integration of Load Shifting and Storage to Reduce Gray Energy Demand

157

3.2.3 Load Shifting

As previously reported in (Mert et al., 2008), loads

associated to devices such as washing machines, dish

washers, tumble dryers and air conditioners might

be “easily” shiftted since they not only account for

20% to 30% of the overall consumption (Paatero and

Lund, 2006) but also presented the highest willing-

ness to postpone start according to residential cus-

tomers (Mert et al., 2008). In this way, when green

energy is not available, we assume 20% to 30% of

consumers’ and prosumers’ loads can be shifted to re-

duce consumption of gray energy. Although loads can

be shifted to time slots in which green energy is abun-

dant, loads cannot be shifted for an unlimited amount

of time. Realistic times to postpone the start of loads

are between 30 min to 3 hours, i.e. 2 to 12 slots, as

reported in (Mert et al., 2008).

Likewise, we also assume a waiting time before a

consumer/prosumer can delay another load again. We

randomly assign waiting times to consumers and pro-

sumers in the range of 48 and 96 slots, which means

that they will have to wait at least half day before de-

laying another load. Furthermore, since consumers

and prosumers could all try to shift loads at the same

time, we need to avoid such case too as it may gener-

ate demand peaks at a further stage, e.g. when their

time slots expire and they need to re-start loads. To

this aim, whenever a consumer or prosumer wants to

start the shift of a load, (s)he can only do it with a

probability of 0.5. If probability is in her/his favour at

that time slot, (s)he can start shifting the load, other-

wise (s)he will have to try again in the next time slot.

In this way, we aim at constraining the start of load

shifting as well as at spreading controllable devices’

loads through a full day.

Finally, to allow load shifting, consumers and pro-

sumers use a “set and forget” approach in which they

pre-set the loads that can be shifted (e.g. washing ma-

chines, dish washers or tumble dryers) as well as the

time they can be delayed, i.e. a number between 2

and 12 slots. In addition, as load shifting depends on

whether green energy is available or not, we assume

that information about availability could be poten-

tially delivered via internet, sms, or display directly

on the appliance (Mert et al., 2008).

4 PRELIMINARY RESULTS

4.1 Simulation Settings

To understand the impact of load shifting and storage

for gray energy demand reduction and energy trade,

we use a multi-agent system that is modeled and im-

plemented in Repast simphony (North et al., 2013).

The multi-agent system is fed with real consumption

and production data provided by a Belgian energy

retailer. In our simulations, consequently, we use a

week of real consumption and production of electric-

ity within a typical Belgian district, which is com-

posed of 54 consumers and six prosumers equipped

with solar panels and batteries. Storage capacity

for batteries is randomly assigned between 4 and 7

kWh. Finally, due to the plausible increase of pro-

sumers within the electricity system, and as an at-

tempt to understand future scenarios, we also present

results for settings containing higher percentage of

prosumers (Rickerson et al., 2014).

4.2 Energy Consumption

In this section we present plots of the average amount

of gray and green energy being consumed by both

prosumers and consumers. We show values for a typ-

ical Belgian district, i.e. prosumers account for 10%

of households, as well as for futuristic/plausible set-

tings in which the percentage of prosumers are re-

spectively 30% and 50%. To achieve these percent-

ages, we fed real consumption and production data of

18 and 30 prosumers respectively in our simulations.

These numbers represent the 30% and 50% of house-

holds in a typical Belgian district (usually composed

of 60 households).

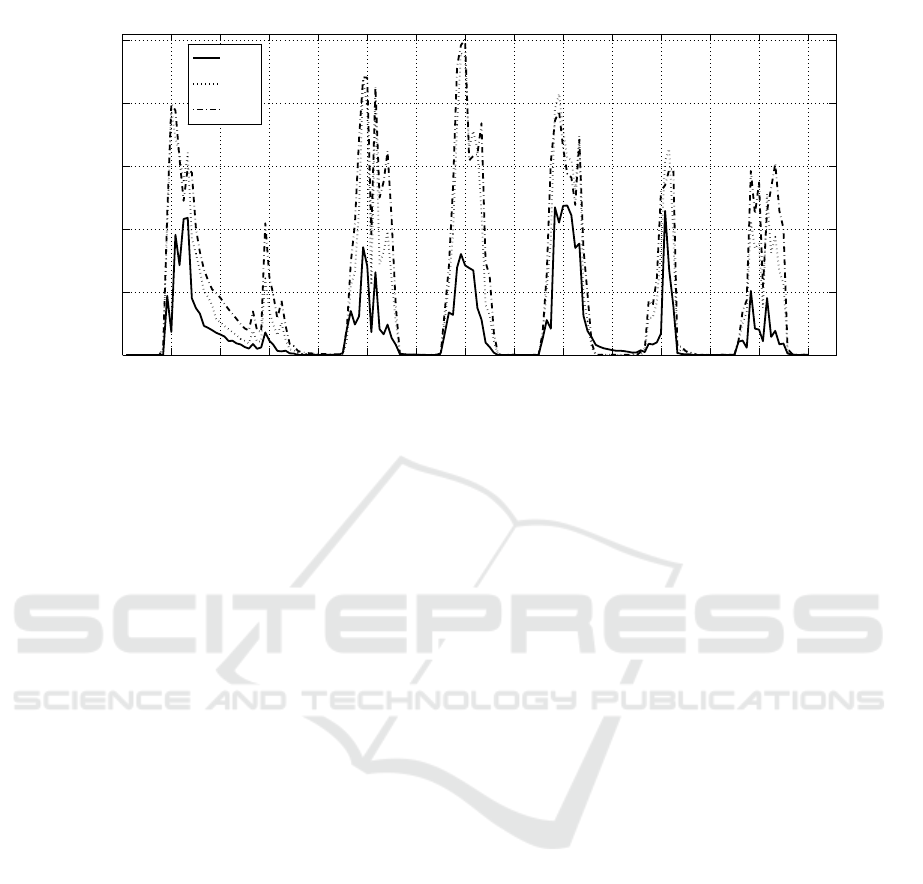

Figure 1 shows the average consumption of green

energy for different percentage of prosumers for a

whole week. As one can see, the more prosumers,

the more green energy being consumed. Although

main consumption occurs at daytime hours, when

prosumers inject their excess of production after cov-

ering their own demand, consumption of green energy

can also be observed at night time thanks to storage.

For instance, as seen in Figure 1, green energy con-

sumption is observed during night hours between the

first and second day.

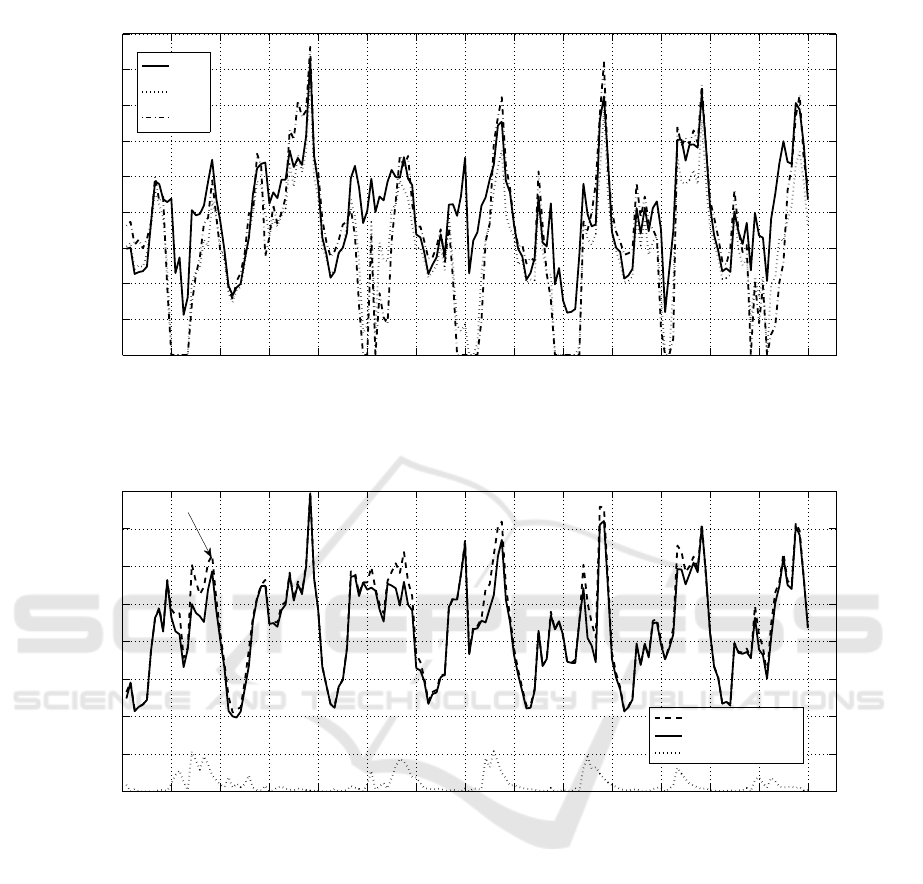

In the same vein, Figure 2 depicts the average con-

sumption of gray energy, which shows that the more

prosumers, the less gray energy is demanded during

daytime hours. Unlike, green energy consumption,

gray energy consumption occurs mostly at late after-

noon and early morning, when green energy is not

generated. Consequently, it is extremely important to

reduce the overall energy consumption during those

periods as prosumers and consumers will mostly use

gray energy.

SMARTGREENS 2016 - 5th International Conference on Smart Cities and Green ICT Systems

158

0

0.05

0.1

0.15

0.2

0.25

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

kWh

10%

30%

50%

Figure 1: Average consumption of green energy per household for different percentage of prosumers in a district. Note that

green energy can also be consumed at night time thanks to storage and load shifting.

4.3 Consumption Reduction

In order to determine whether reduction in consump-

tion can be achieved using load shifting and storage,

we have analyzed the overall consumption, i.e. green

and gray consumption, of a typical Belgian district for

a whole week. We measured the average energy con-

sumption when neither load shifting nor storage are

available (original consumption) as well as the case

when both are available (adapted consumption). Fig-

ure 3 shows both measures, original (dashed line) and

adapted (solid line) consumption, which represent the

average demand the susbtation is expected to face.

Moreover, it also shows the average reduction being

achieved (dotted line).

Although peak reduction can be achieved for some

days, such reduction is moderate as the highest re-

duction is around 0.05 kWh, which is approximately

a 15% reduction compared to the original consump-

tion. Nonetheless, most of the peak reduction takes

place at night time, when green energy is not gener-

ated, which implies that demand for gray energy will

most likely decrease.

As we also wanted to determine whether a higher

reduction can be achieved for future settings, we in-

creased the percentage of prosumers per district. Fig-

ure 4 shows the average reduction in districts contain-

ing 10%, 30% and 50% of prosumers. The highest

peak reduction is achieved by the district with 50%

prosumers and is above 0.12 kWh, which represents

a reduction of at least 30% compared to the origi-

nal consumption. Nonetheless, one must be aware

that such reduction is only possible by providing con-

sumers and prosumers with load shifting capabilities

as well as providing storage capabilities to prosumers.

The performance of both capabilities is described in

the following sections, i.e. Sections 4.4 and 4.5.

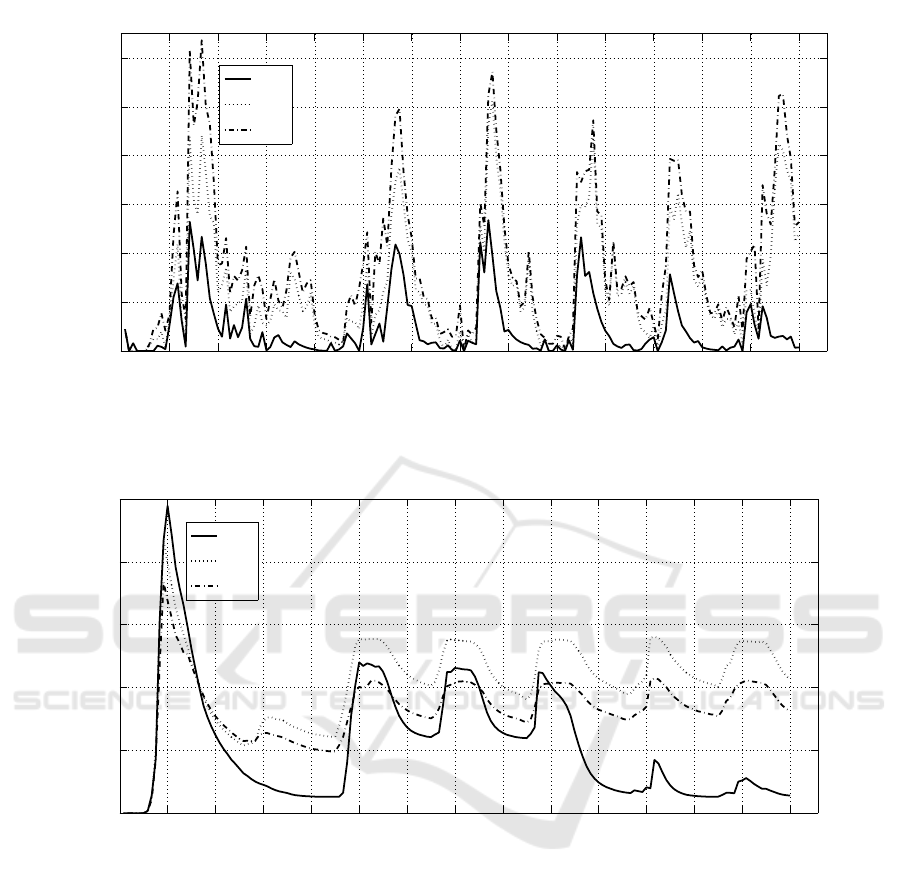

4.4 Storage

To determine how much green energy can be stored

after prosumers cover their own needs, we measure

the average state of charge (SOC), which indicates

the percentage of occupancy of prosumers’ batteries,

i.e. how full batteries are, where 0% = empty and

100% = full. Figure 5 shows the average SOC per

prosumer. It depicts three lines, one per each setting,

i.e. districts containing 10%, 30% and 50% of pro-

sumers. Batteries have capacities among 4kWh and

7kWh.

As it can be observed, batteries constantly charge

and discharge their energy to meet energy demand.

Discharge usually starts around late afternoon (the

hours when green energy production decreases),

whereas charge starts before noon. Furthermore, dis-

charge provides green energy to be consumed at night

time as observed in Figure 1.

Batteries, however, only reach full charge during

the first day. This aspect should be considered before

installing batteries with big capacity as they may not

always be filled, which means a waste of storage ca-

pacity. Likewise, two more findings should also be

considered. First of all, load shifting could help to fill

batteries as initial consumption can be delayed (see

Figure 6), which may give time to store green energy

as seen during the first day in Figure 5. The second

finding is related to the drop of production during the

second day. Drops in production will not allow batter-

Integration of Load Shifting and Storage to Reduce Gray Energy Demand

159

0

0.05

0.1

0.15

0.2

0.25

0.3

0.35

0.4

0.45

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

kWh

10%

30%

50%

Figure 2: Average consumption of gray energy per household for different percentage of prosumers in a district using storage

and load shifting. Note that when the percentage of prosumers is above 30%, consumption of gray energy reduces considerably

during daylight hours.

0

0.05

0.1

0.15

0.2

0.25

0.3

0.35

0.4

Day 1 Day 2 Day 3 Day 4 Day 5 Day 6 Day 7

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

kWh

Original Consumption

Adapted Consumption

Reduction

Peak reduction

Figure 3: Average values for original and adapted consumption (storage and load shifting capabilities) per household in a

typical Belgian district with 10% prosumers. The dotted line represents the average reduction in consumption per household.

ies to be completely filled as they will have to provide

green energy at night time. Moreover, since green

energy is also scarce due to production drops, more

loads would be shifted, which forces batteries to pro-

vide energy when the associated time slots expire.

In this way, as load shifting directly impacts on

the charge and discharge of batteries, an optimal plan-

ning of storage capacity that takes into account load

shifting is also required. Such planning will allow to

efficiently use storage (i.e. no waste of capacity) and

provide more flexibility for load shifting. Nonethe-

less, it is clear that storage helps to meet both original

and shifted demands. The performance of load shift-

ing is presented in the next section.

4.5 Load Shiftting

Although load shifting aims at curtailing energy de-

mand by delaying the start of controllable devices

(e.g. washing machines, dish washers and tumble dry-

ers), the delay cannot last for more than three hours,

i.e. up to 12 time slots (Mert et al., 2008). In this

way, our mechanism allows to shift chunks of energy

consumption whose dimensions are time and power

(watts). Shifted chunks have a time length of 2 to 12

time slots and a power given by the amount of de-

mand being curtailed (i.e. 20% to 30% of the overall

consumption). When the chunks of all consumers and

prosumers are aggregated, they can provide a consid-

SMARTGREENS 2016 - 5th International Conference on Smart Cities and Green ICT Systems

160

0

0.02

0.04

0.06

0.08

0.1

0.12

Day 1 Day 2 Day 3 Day 4 Day 5 Day 6 Day 7

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

kWh

10%

30%

50%

Figure 4: Average reduction in consumption per household using storage and load shifting capabilities for different percentage

of prosumers.

0

20

40

60

80

100

Day 1 Day 2 Day 3 Day 4 Day 5 Day 6 Day 7

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

State of Charge (%)

10%

30%

50%

Figure 5: Batteries’ average state of charge (SOC) per prosumer for different percentage of prosumers. 0% = empty and 100%

= full.

erable amount of curtailment per slot as depicted in

Figure 6.

Figure 6 shows the total demand being curtailed

per time slot for three districts composed of 10%,

30% and 50% prosumers respectively. The highest

amount of curtailment is observed in districts with

low percentage of prosumers, i.e. 10% and 30%. The

reason is that since green energy is scarce, i.e. prices

for green and gray energy go up (see also Section 4.6),

consumers and prosumers try to shift more loads. Fur-

thermore, as can be seen, it is possible to curtail up to

2kWh within a single time slot, e.g. before third day’s

noon.

Finally, regardless of the amount of demand be-

ing delayed, a shifted load is always re-started either

when green energy becomes available or before the

end of its time slot, so they are never delayed more

than three hours (12 time slots).

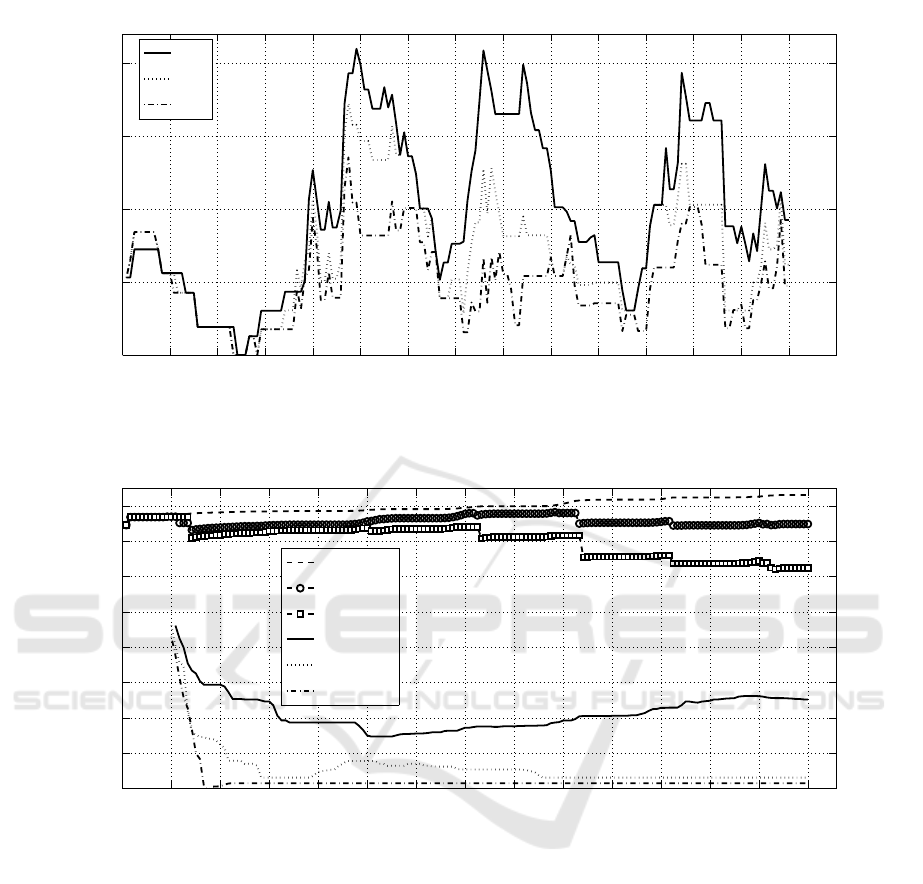

4.6 Price History

As not only energy-related measures are important to

understand smart grids, but also economic aspects, we

have also analyzed the price behaviour of both green

and gray energy. The analysis of energy prices pro-

vides an idea about the expected profits or losses in a

Integration of Load Shifting and Storage to Reduce Gray Energy Demand

161

0

0.5

1

1.5

2

Day 1 Day 2 Day 3 Day 4 Day 5 Day 6 Day 7

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

kWh

10%

30%

50%

Figure 6: Total demand being curtailed per slot over seven days.

0.12

0.14

0.16

0.18

0.2

0.22

0.24

0.26

0.28

Day 1 Day 2 Day 3 Day 4 Day 5 Day 6 Day 7

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

Euro/kWh

Gray10%

Gray30%

Gray50%

Green10%

Green30%

Green50%

Figure 7: Gray and green energy prices during a whole week for different percentage of prosumers. Gray energy prices are

mostly determined by the energy retailer but increase or decrease depending on green energy prices. Green energy prices are

ruled by the market and influenced by availability or scarcity of green energy.

given energy market.

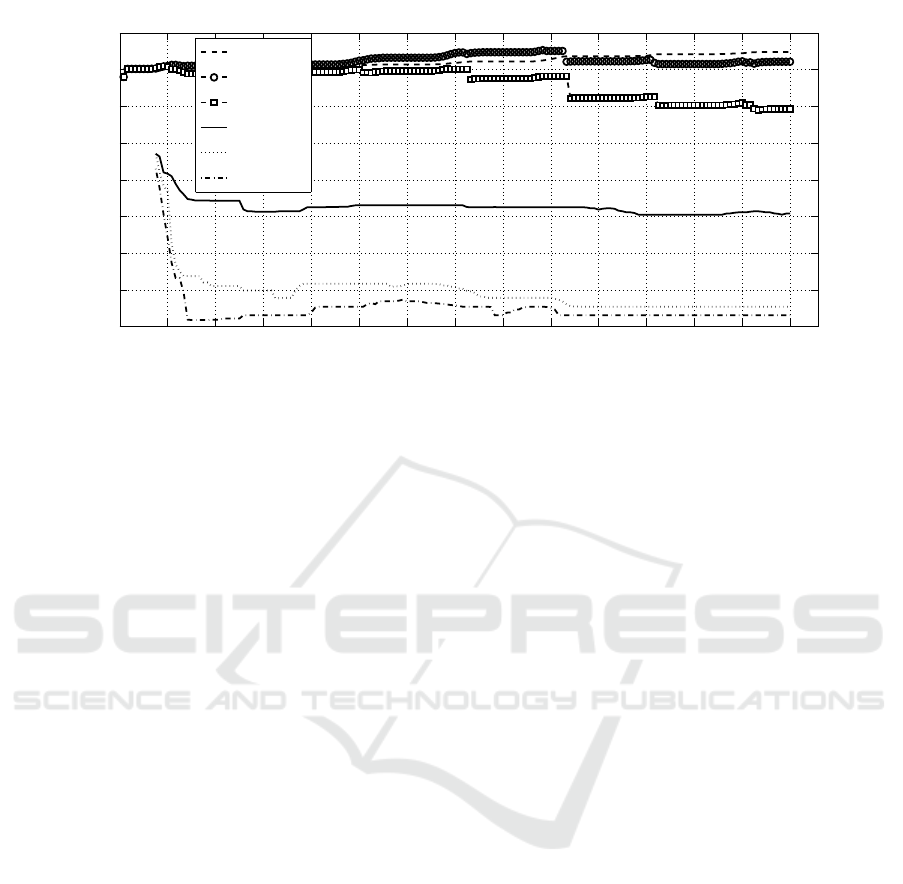

Figure 7 shows the behaviour of gray and green

energy prices. Gray energy prices are negotiated be-

tween the substation and consumers/prosumers as ex-

plained in Section 3.1.2, whereas green energy prices

come from a continuous double auction in which the

only participants are prosumers and consumers (see

Section 3.1.1).

On the one hand, the price for green energy shows

a clear pattern, the more prosumers in a district, the

cheaper the price. For instance, the price for green

energy when the district contains 50% of prosumers

is almost 0.12 Euro after the first day, whereas the

price when the district has 10% prosumers is around

0.16 Euro. Moreover, regardless of the percentage of

prosumers, green prices start relatively high and fall

as green energy becomes abundant.

On the other hand, as an attempt to discour-

age the use of gray energy, the substation increases

and decreases the price of gray energy based on

whether green energyis abundant or not (see also Sec-

tion 3.1.2). When abundant, the price for gray en-

ergy goes down. Otherwise, the price goes up. Con-

sequently, as seen in Figure 7, the gray energy price

follows the overall behaviour of green energy prices.

It drops when green energy prices drop and increases

SMARTGREENS 2016 - 5th International Conference on Smart Cities and Green ICT Systems

162

0.12

0.14

0.16

0.18

0.2

0.22

0.24

0.26

0.28

Day 1 Day 2 Day 3 Day 4 Day 5 Day 6 Day 7

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

12h

24h

Euro/kWh

Gray10%

Gray30%

Gray50%

Green10%

Green30%

Green50%

Figure 8: Gray and green energy prices during a whole week without storage facilities and for different percentage of pro-

sumers. Prices for green energy are slightly higher than in Figure 7.

otherwise, which is the kind of behaviour we want to

promote as consumers may be less willing to with-

draw energy during those periods.

Finally, we have also tested the behaviour of green

and gray energy prices when no storage capabilites

are used. Figure 8 shows the behaviour of both prices.

Although the overall behaviour is similar to the one in

Figure 7, one thing is clear,the prices for green energy

are slightly higher, which may suggest that storage

helps to keep the price of green energy low. In our

case, a possible explanation of the influence of stor-

age in energy prices is that prosumers discharge their

batteries when no green energy is generated, which

may keep relatively constant the supply of green en-

ergy, i.e. green energy is less scarce and its price does

not increase. Even though this aspect requires a more

elaborated analysis, energy retailers as well as pro-

sumers should acknowledge this when considering to

invest in storage facilities since they could directly in-

fluence energy prices, which may potentially offer a

good return on investment. In this way, retailers could

try to keep profitable prices, whereas prosumers may

try to ensure low prices when buying and high prices

when selling energy. Moreover, the impact of storage

in energy prices has been previously observed when

energy retailers are equipped with storage (Pr¨uggler

et al., 2011).

5 CONCLUSIONS AND FUTURE

WORK

We present the application of a multi-agent system

to analyze the impact of load shifting and storage to

reduce gray energy demand. In addition, we simu-

late energy markets in which green and gray (non-

environmentally friendly) energy are locally traded.

Green energy is traded using NRGcoins under the

NRG-X-Change mechanism, whereas gray energy is

traded in Euro via a bi-direcctional negotiation be-

tween an energy retailer and users of energy, i.e. con-

sumers and prosumers.

To reduce energy demand, users apply load shift-

ing and storage capabilities. Storage, however,is only

available for prosumers as they can generate and store

their own power.

Results show that reduction is possible mostly

during night time hours, when no green energy is gen-

erated. Although, the highest reduction takes place

when districts contain 50% of prosumers, (moderate)

reductions are also observed for lower percentages,

which encourages us to continue exploring more in-

telligent strategies to achieve higher reductions.

Moreover, as NRG-X-Change is a trading mech-

anism based on a double auction, i.e. several actors

trying to buy and sell resources, other mechanisms ap-

plying a similar approach may take advantage of our

results. For instance, in mechanisms such as Power-

Matcher, energy aggregators can further exploit the

use of storage to influence price curves by strate-

gically charging and discharging batteries. Further-

more, regarding the integration of load shifting and

storage, an analysis as the one presented here can be

done for other innovative energy markets, i.e. using

multi-agent systems and real data to explore future but

still realistic scenarios.

In this vein, our future work will focus on apply-

ing other strategies to exploit storage and load shift-

Integration of Load Shifting and Storage to Reduce Gray Energy Demand

163

ing. For instance, cooperative and coordinated ways

to charge and discharge batteries can be applied to

not only cope with demand but also influence energy

prices. Similarly, load shifting can also be coordi-

nated among prosumers and consumers. On the one

hand, we can make sure that they all do not delay or

re-start loads at the same time. On the other hand,

we can also maximize the amount of demand being

curtailed and provide more flexibility to retailers.

Additionally, we would like to investigate optimal

planning for storage location (e.g. retailers and nor-

mal consumers owning batteries) and capacity as it

can bring economic and energy-related benefits. The

former because storage owners can profit from trading

energy. The latter because well-dimensioned capacity

can provide better flexibility for load shifting.

Finally, regarding prices for gray energy, we want

to explore different pricing schemes, e.g. time-of-

use, critical-peak or real-time pricing. These schemes

could potentially provide better responses from cus-

tomers and improve energy balancing. Nonetheless,

the final message is that to enhance the integration of

renewables into the smart grid, combination of stor-

age and DR programs is worth exploring for eco-

nomic and environmental reasons (Niesten and Alke-

made, 2016).

ACKNOWLEDGMENTS

This research has been funded by the European

Union’s Seventh Programme for research, technolog-

ical development and demonstration under the grant

agreement number 324321, project SCANERGY. At

the time of writing, Iv´an Razo-Zapata was a postdoc-

toral researcher at VUB.

REFERENCES

Aghaei, J. and Alizadeh, M.-I. (2013). Demand response

in smart electricity grids equipped with renewable en-

ergy sources: A review. Renewable and Sustainable

Energy Reviews, 18:64 – 72.

Bosch (2016). Bpt-s 5 hybrid solar power stor-

age. http://bosch-power-tec.com/en/bpte/ pro-

dukte/storage

solutions/bpt s 5 hybrid/vs 5 hybrid.

[Online; accessed 04-February-2016].

Bush, S. F. (2014). Smart Grid: Communication-Enabled

Intelligence for the Electric Power Grid. IEEE Press.

Capodieci, N., Pagani, G. A., Cabri, G., and Aiello, M.

(2011). Smart meter aware domestic energy trad-

ing agents. In Proceedings of the IEEMC ’11 Work-

shop onE-energy Market Challenge, pages 1–10, New

York, NY, USA. ACM.

Gottwalt, S., Ketter, W., Block, C., Collins, J., and Wein-

hardt, C. (2011). Demand side management—a sim-

ulation of household behavior under variable prices.

Energy Policy, 39(12):8163 – 8174. Clean Cooking

Fuels and Technologies in Developing Economies.

Grid4eu (2016). Nice grid demonstrator. http://www.nice

grid.fr/. Online; accessed 04-February-2016.

Ilic, D., Da Silva, P., Karnouskos, S., and Griesemer, M.

(2012). An energy market for trading electricity in

smart grid Neighbourhoods. In 6th IEEE Interna-

tional Conference on Digital Ecosystems Technolo-

gies (DEST), pages 1–6.

Kok, J. K., Warmer, C. J., and Kamphuis, I. G. (2005). Pow-

ermatcher: Multiagent control in the electricity infras-

tructure. In Proceedings of the Fourth International

Joint Conference on Autonomous Agents and Multia-

gent Systems, AAMAS ’05, pages 75–82, New York,

NY, USA. ACM.

Ma, H. and Leung, H.-F. (2007). An adaptive attitude bid-

ding strategy for agents in continuous double auc-

tions. Electronic Commerce Research and Applica-

tions, 6(4):383 – 398.

Mert, W., Suschek-Berger, J., and Tritthart, W. (2008). Con-

sumer acceptance of smart appliances. Technical re-

port, EIE project Smart Domestic Appliances in Sus-

tainable Energy Systems (Smart-A).

Mihaylov, M., Jurado, S., Avellana, N., Razo-Zapata, I.,

Van Moffaert, K., Arco, L., Bezunartea, M., Grau, I.,

Ca˜nadas, A., and Now´e, A. (2015). Scanergy: a scal-

able and modular system for energy trading between

prosumers. In Proceedings of the International Con-

ference on Autonomous Agents and Multiagent Sys-

tems, AAMAS ’15, pages 1917–1918.

Mihaylov, M., Jurado, S., Van Moffaert, K., Avellana, N.,

and Now´e, A. (2014). Nrg-x-change: : A novel mech-

anism for trading of renewable energy in smart grids.

In 3rd International Conference on Smart Grids and

Green IT Systems (SmartGreens).

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic

cash system.

Niesten, E. and Alkemade, F. (2016). How is value created

and captured in smart grids? a review of the litera-

ture and an analysis of pilot projects. Renewable and

Sustainable Energy Reviews, 53:629–638.

North, M. J., Collier, N. T., Ozik, J., Tatara, E. R., Macal,

C. M., Bragen, M., and Sydelko, P. (2013). Com-

plex adaptive systems modeling with repast simphony.

Complex adaptive systems modeling, 1(1):1–26.

Paatero, J. V. and Lund, P. D. (2006). A model for generat-

ing household electricity load profiles. International

Journal of Energy Research, 30(5):273–290.

Pr¨uggler, N. (2013). Economic potential of demand re-

sponse at household level—are central-european mar-

ket conditions sufficient? Energy Policy, 60:487 –

498.

Pr¨uggler, N., Pr¨uggler, W., and Wirl, F. (2011). Storage and

demand side management as power generator’s strate-

gic instruments to influence demand and prices. En-

ergy, 36(11):6308 – 6317.

SMARTGREENS 2016 - 5th International Conference on Smart Cities and Green ICT Systems

164

Ramchurn, S. D., Vytelingum, P., Rogers, A., and Jennings,

N. R. (2012). Putting the ’smarts’ into the smart grid:

A grand challenge for artificial intelligence. Commun.

ACM, 55(4):86–97.

Rickerson, W., Couture, T., Barbose, G. L., Jacobs, D.,

Parkinson, G., Chessin, E., Belden, A., Wilson,

H., and Barrett, H. (2014). Residential prosumers:

Drivers and policy options (re-prosumers). Technical

report, International Energy Agency (IEA).

Room, B. and Institute, W. R. (2010). Global ecolabel

monitor 2010: Towards transparency. http://www.eco

labelindex.com/downloads/Global

Ecolabel Monitor

2010.pdf. [Online; accessed September,2015].

Schuler, R. (2010). The smart grid: a bridge between

emerging technologies society and the environment.

The Bridge, 40(1):42–49.

Shoham, Y. and Leyton-Brown, K. (2008). Multiagent sys-

tems: Algorithmic, game-theoretic, and Logical Foun-

dations. Cambridge University Press.

Siano, P. (2014). Demand response and smart grids—a

survey. Renewable and Sustainable Energy Reviews,

30:461–478.

Tesla (2016). Powerwall. http://www.teslamotors.com/

powerwall. [Online; accessed February,2016].

van Werven, M. J. and Scheepers, M. J. (2005). The chang-

ing role of energy suppliers and distribution system

operators in the deployment of distributed generation

in liberalised electricity markets. Technical report,

ECN-C–05-048, ECN.

VEA (2014). Vlaams energieagentschap - rapport 2013/2.

http://www2.vlaanderen.be/economie/energiesparen/

milieuvriendelijke/monitoring

evaluatie/2013/20130

628Rapport2013

2-Deel2Actualisatie-OT Bf.pdf.

[Online; accessed 23-September-2015].

Vytelingum, P., Cliff, D., and Jennings, N. (2008). Strate-

gic bidding in continuous double auctions. Artificial

Intelligence, 172(14):1700 – 1729.

Wang, Z. and Wang, L. (2013). Adaptive negotiation agent

for facilitating bi-directional energy trading between

smart building and utility grid. IEEE Transactions on

Smart Grid, 4(2):702–710.

Integration of Load Shifting and Storage to Reduce Gray Energy Demand

165