Dynamic Pricing and Energy Management Strategy for EV Charging

Stations under Uncertainties

Chao Luo, Yih-Fang Huang and Vijay Gupta

Department of Electrical Engineering, University of Notre Dame, Notre Dame, Indiana, U.S.A.

Keywords:

Electric Vehicle, Charging Station, Dynamic Pricing, Energy Management, Dynamic Programming,

Renewable Energy Integration.

Abstract:

This paper presents a dynamic pricing and energy management framework for electric vehicle (EV) charging

service providers. To set the charging prices, the service providers faces three uncertainties: the volatility

of wholesale electricity price, intermittent renewable energy generation, and spatial-temporal EV charging

demand. The main objective of our work here is to help charging service providers to improve their total

profits while enhancing customer satisfaction and maintaining power grid stability, taking into account those

uncertainties. We employ a linear regression model to estimate the EV charging demand at each charging

station, and introduce a quantitative measure for customer satisfaction. Both the greedy algorithm and the

dynamic programming (DP) algorithm are employed to derive the optimal charging prices and determine how

much electricity to be purchased from the wholesale market in each planning horizon. Simulation results show

that DP algorithm achieves an increased profit (up to 9%) compared to the greedy algorithm (the benchmark

algorithm) under certain scenarios. Additionally, we observe that the integration of a low-cost energy storage

into the system can not only improve the profit, but also smooth out the charging price fluctuation, protecting

the end customers from the volatile wholesale market.

SYMBOLS

N: total number of planning horizon.

s

j

: the j-th EV charging station.

p

k j

; charging price of the j-th charging station in

the k-th horizon.

c

k

: electricity wholesale price in the k-th horizon.

E: electricity storage capital.

R

k

: total revenue in the k-th horizon.

o

k

: electricity purchase in the k-th horizon.

d

k j

: charging demand at the j-th charging station

in the k-th horizon.

G

k

: overall customer satisfaction.

β: weighting parameter of customer satisfaction.

α: shape parameter for customer satisfaction

function.

ω: shaping parameter for customer satisfaction

function.

φ

k

: total charging demand in the k-th horizon.

Q

k

: stress imposed on power grid due to EV

charging in the k-th horizon.

o

ref

: reference electricity purchase (average

electricity purchase).

o

max

: maximum electricity purchase.

µ: weighting parameter of electricity purchase

fluctuation.

I

k

: electricity storage at the beginning of the k-th

horizon.

u

k

: renewable energy generation in the k-th

horizon.

W

k

: electricity storage cost in the k-th horizon.

η: unit electricity storage cost.

Π

k

: total utility in the k-th horizon.

γ

i, j

: price elasticity parameter.

J

k

(I

k

): maximum aggregated utility from the k-th

horizon to the last horizon.

1 INTRODUCTION

Recent innovations in battery and powertrain tech-

nology have served as a catalyst for expediting

Luo, C., Huang, Y-F. and Gupta, V.

Dynamic Pricing and Energy Management Strategy for EV Charging Stations under Uncertainties.

In Proceedings of the International Conference on Vehicle Technology and Intelligent Transport Systems (VEHITS 2016), pages 49-59

ISBN: 978-989-758-185-4

Copyright

c

2016 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

49

the proliferation of electric vehicles (EVs). EVs

exhibit many advantages over the internal combustion

engine (ICE) vehicles, including lower operation cost,

higher fuel conversion efficiency, and reduced or

eliminated tailpipe emission (Simpson, 2006; IEC,

2007). The American market share of plug-in EVs

in new registered cars increased from 0.14% to

0.37% in 2012, 0.62% in 2013, and 0.72% in 2014

(Electric Drive Transportation Association, 2015).

According to Navigant Research, the global light duty

EV market is expected to grow from 2.7 million

vehicle sales in 2014 to 6.4 million in 2023 (Navigant

Research, 2014). EVs will play a significant role

in transportation electrification. Nevertheless, the

limited driving range and the long charging time are

still the major obstacles to the proliferation of EVs.

The “range anxiety” is like the Sword of Damocles

for EV owners. More charging stations need be

established to alleviate the “range anxiety”. In

addition, the profitability of the EV charging industry

is another critical issue that should be considered.

The EV charging industry needs a promising business

model to bring more private investors into this

industry instead of solely relying on financial support

or incentives from governments. The effective and

efficient management of charging infrastructure is at

the heart of the EV charging industry. The objective

of this paper is to provide guidelines for charging

service providers make informed and optimized

decisions on pricing and energy management so

as to coherently improve profits, enhance customer

satisfaction, and reduce uncertainties or risks.

Currently, there is a plethora of literature aiming at

addressing the dynamic pricing issue of EV charging

stations. Yan et al. proposed a multi-tiered real-

time pricing algorithm for charging stations by taking

into account both the day-ahead predicted electricity

price and the real-time load information (Yan et al.,

2014). However, they did not consider the possibility

that EV owners may change their charging behavior

in response to the varying prices. Han et al.

presented a dynamic pricing and scheduling scheme

for EV charging stations while considering grid-to-

vehicle (G2V) and vehicle-to-grid (V2G) (Han et al.,

2012). They used a Stackelberg game to characterize

the strategic interactions between the “selfish” EV

owners and the charging stations. However, they only

considered a single charging station in their model.

In (Ban et al., 2012), a price control method was

employed to guide EVs to different charging stations

while satisfying the predefined QoS and maintaining

power grid stability. The authors used a multi-queue

system to model the arrival and departure of EVs.

Nevertheless, they treated the charging station as a

profit-neutral entity, which may not be an appropriate

assumption for the real market. In (Martirano et al.,

2014), the authors proposed a scheme called the

“Interactive Energy”, for the dynamic pricing and

electricity delivery of the EV charging services based

on the status of the microgrid. However, the overall

customer satisfaction was not considered in their

analysis. The pricing models proposed in (Rahbari-

Asr et al., 2013) and (Guo et al., 2014) did not

incorporate the renewable energy (like wind power or

solar power), which is becoming an important energy

source. In (Guo et al., 2016), the authors addressed

a two-stage framework for the economic operation of

a microgrid-like electric vehicle parking deck using

a stochastic approach and model predictive control

(MPC).

Our work is motivated by the fact that the

charging service providers face many uncertainties

when determining the appropriate charging prices

and managing the electricity storage. In this paper,

we consider three types of uncertainties that the

service providers may face: (1) the uncertainty of

spatial-temporal charging demand at each charging

station, (2) the uncertainty of renewable energy

generation, and (3) the uncertainty of the electricity

price at the wholesale market. We also assume that

a charging service provider operates a network of

charging stations. As a mediator in the power grid,

the service provider purchases the electricity from

the wholesale market and resells it to EV owners.

We also assume that the service provider owns a

storage system that stores the excessive electricity

temporarily. Additionally, the service provider can

harvest the distributed renewable energy generation,

and use it as a supplementary energy source for EV

charging.

In our study here, we first employ a linear

regression model to estimate the EV charging

demand. Specifically, the customer’s price elasticity

coefficients, reflecting the customer’s sensitivity to

charging price variation, will be estimated using

historical data. Subsequently, we apply the Dynamic

Programming (DP) computation algorithm to derive

the optimal charging prices and how much electricity

to be purchased from the wholesale market based on

the current electricity storage and renewable energy

forecast.

The main contribution of this paper is a

computation framework to help the EV charging

service provider calculate the optimal charging prices

and determine the appropriate amount of electricity to

purchase from the wholesale market in each planning

horizon. Our computation framework can deal with

the three aforementioned uncertainties and is aimed

VEHITS 2016 - International Conference on Vehicle Technology and Intelligent Transport Systems

50

at striking a balance among the profit, customer

satisfaction, and the power grid stability.

2 PROBLEM FORMULATION

In our model, we postulate that there is an EV

charging service provider operating a network of

charging stations. As a mediator between the power

grid and the end customers (i.e., EV owners), the

charging service provider purchases electricity from

the wholesale market at the day-ahead prices, and

resells it to EV owners at the retail charging price.

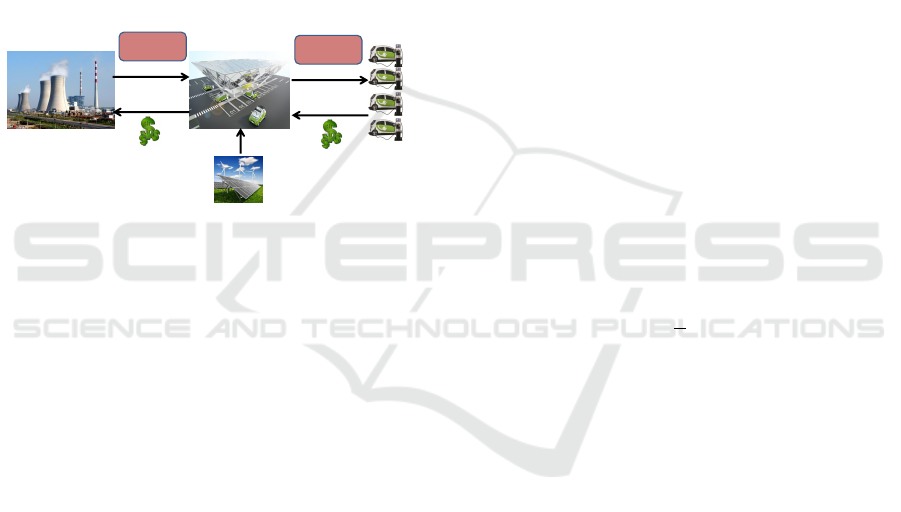

Figure 1 depicts a general business model for EV

charging.

Electric vehicles

Power plants Charging service provider

Renewable energy

MWh

kWh

Wholesale

Retail

Figure 1: The EV Charging Market.

2.1 Profit of The Service Provider

The worldwide deregulation of electricity market

(e.g., PJM Interconnection, ERCOT in USA, New

Zealand, Singapore, UK markets, etc.) gives

birth to the prosperous forward markets and day-

ahead markets. The Independent System Operator

(ISO) or the Regional Transmission Organization

(RTO) calculates the day-ahead market prices through

an auction between the power generators and the

retailers using the locational marginal pricing (LMP)

scheme (Huisman et al., 2007; Treinen, 2005; Frame,

2001). We assume that the charging service provider

is one of the retailers, buying electricity from the

wholesale market and reselling it to EV owners.

Let S = [s

1

,s

2

,··· ,s

L

] denote the set of charging

stations. We divide a day into N planning horizons

(stages). At the beginning of each horizon, the service

provider updates the charging prices, and calculates

how much electricity needs to be purchased from

the wholesale market. We allow charging prices

vary among different charging stations. Let P

k

=

[p

k1

, p

k2

,··· , p

kL

](k = 1, 2,· ·· ,N) be the charging

price vector in the k-th horizon, and o

k

be the

electricity purchase. Currently, the day-ahead market

prices are calculated on a hourly basis, so N = 24. Let

C = [c

1

,c

2

,··· ,c

N

] denote the day-ahead wholesale

market prices. The total profit of the service provider

in the k-th horizon is given by

R

k

=

L

∑

j=1

p

k j

d

k j

− c

k

o

k

(k = 1,2, ·· · ,N), (1)

where d

k j

is the charging demand at the j-th charging

station in the k-th horizon, and

∑

L

j=1

p

k j

d

k j

is the total

revenue, and c

k

o

k

is the cost of electricity purchased

in the k-th horizon.

2.2 Customer Satisfaction Evaluation

The charging service provider attempts to achieve

the goals of improving the profits, enhancing the

customer satisfaction, and maintaining power grid

stability. Poor customer satisfaction may hinder

the wide adoption of EVs, thus, affecting the

development of the entire EV industry. In this sense,

the charging service provider cannot be a myopic

profit squeezer that maximizes the profit at the

expense of customer satisfaction. Various customer

satisfaction evaluation methods have been studied in

(Yang et al., 2013; Fahrioglu et al., 1999; Faranda

et al., 2007). In this paper, we use a quadratic function

to characterize the overall customer satisfaction of the

entire population of EV owners, denoted by G

k

.

G

k

= β

ωφ

k

−

α

2

φ

2

k

, 0 ≤ φ

k

≤ E (2)

where β is the weighting parameter and E is the

capacity of the electricity storage system, ω and α

are the shape parameters of this quadratic function.

The variable φ

k

is the total electricity consumption

(charging demand) of all EV owners in the k-th

horizon which is defined as

φ

k

=

L

∑

j=1

d

k j

. (3)

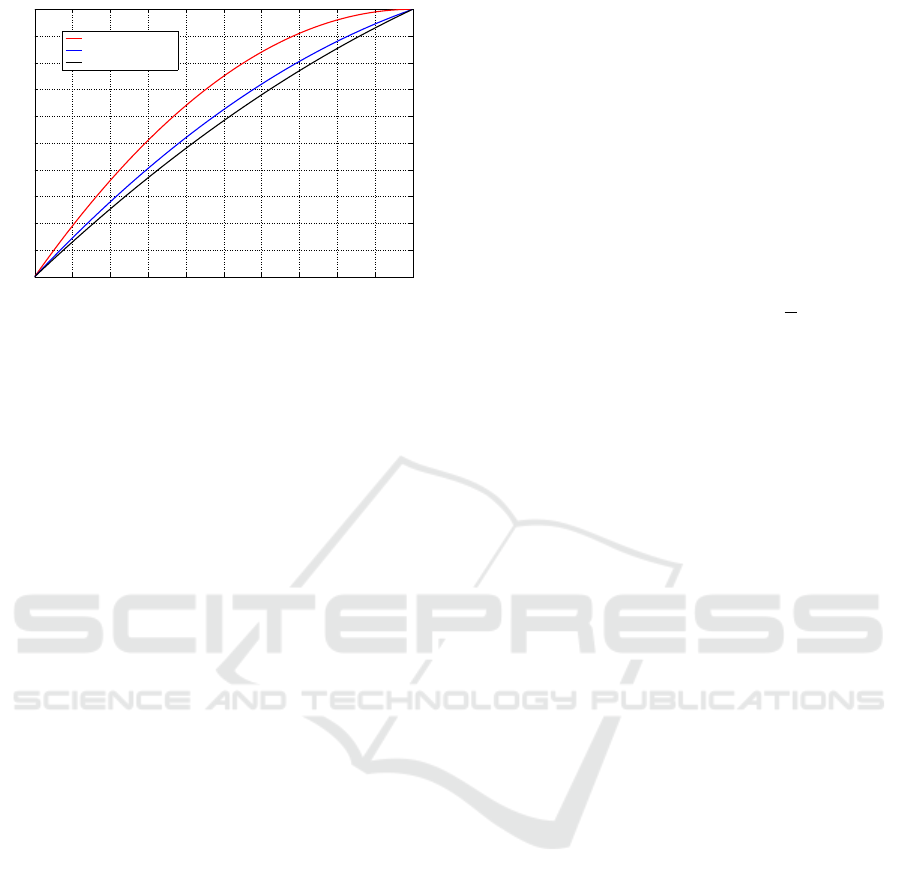

The quadratic functions with different combina-

tions of ω and α are shown in Figure 2. We observe

that the quadratic function has a minimum value of

0, suggesting that the EV owners are very “unhappy”,

and a maximum value of 1, suggesting that the EV

owners are very “happy”. Additionally, Equation

(2) is a non-decreasing concave function with a non-

increasing first-order derivative. The overall customer

satisfaction grows as the total electricity consumption

increases. However, the decreasing growth rate

suggests that the customer satisfaction tends to get

saturated as the electricity consumption increases.

Dynamic Pricing and Energy Management Strategy for EV Charging Stations under Uncertainties

51

0 20 40 60 80 100 120 140 160 180 200

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

φ

k

(MWh)

Customer satisfaction

ω=0.01,α=0.00005

ω=0.0075,α=0.000025

ω=0.0067,α=0.0000167

Figure 2: Customer Satisfaction Functions (E = 200).

2.3 Impact of EV Charging on Power

Grid

Many studies (Lopes et al., 2011; Kinter-Meyer et al.,

2007; Scott et al., 2007) have shown that large-scale

simultaneous EV charging presents many challenges

to the existing power grid pertaining to severe power

loss, power grid stability, frequency drift, and voltage

fluctuation, etc. In the electric power system,

the networked generators cooperatively adjust their

outputs to balance the supply and the demand and

maintain the power quality. Generally, the power

generators hope that the load is predictable and

relatively stable (or at least slow-varying). If the

load fluctuates too much, the power generators have

to ramp up and down frequently, resulting in low

efficiency and high maintenance cost. As a result,

we do not want the electricity purchase from the

wholesale market o

k

to fluctuate too much which

may create a heavy “burden” on the power grid. We

formulate the penalty of EV charging in the following

way

Q

k

= µ(o

k

− o

ref

)

2

, (4)

where o

ref

is a reference purchase (or average

electricity purchase) and o

k

is the electricity

purchased in the k-th horizon. The variable µ is

the weighting parameter reflecting the sensitivity of

electricity purchase fluctuation.

2.4 Cost of Electricity Storage

We assume that the charging service provider has an

electricity storage with a capacity of E(MWh). Let I

k

denote the electricity in the storage at the beginning of

the k-th horizon, and let u

k

be the renewable energy

generation (i.e. wind power or solar power). Here

u

k

is the predicted renewable energy. The electricity

storage cost in the k-th horizon is given as follows

W

k

= η(I

k

+ u

k

+ o

k

−

L

∑

j=1

d

k j

), (5)

where

∑

L

j=1

d

k j

is the total charging demand in the k-

th horizon, and η($/MWh) is the unit storage cost.

The storage cost includes capital cost, maintenance

cost, and power loss due to energy conversion.

Finally, the total utility of the service provider in

the k-th horizon is given as

Π

k

= R

k

+ G

k

− Q

k

−W

k

=

L

∑

j=1

p

k j

d

k j

− c

k

o

k

+ β

ωφ

k

−

α

2

φ

2

k

−

µ(o

k

− o

ref

)

2

− η(I

k

+ u

k

+ o

k

−

L

∑

j=1

d

k j

),

(6)

Note that the total utility consists of four

components—total revenue, customer satisfaction,

power grid influence, and electricity storage cost. The

values of β and µ reflect the weights of customer

satisfaction and EV charging penalty in the total

utility function.

Our objective here is to maximize the overall

utility by solving the following optimization problem.

(P

∗

1

,o

∗

1

,··· ,P

∗

N

,o

∗

N

) = argmax

P

1

,o

1

,···,P

N

,o

N

(

N

∑

k=1

Π

k

)

,

s.t.

0 ≤ o

k

≤ o

max

;k = 1,2,··· , N

p

k j

≥ 0; j = 1,2, ·· · ,L

I

k

+ o

k

−

∑

L

j=1

d

k j

≥ 0

I

k

+ o

k

−

∑

L

j=1

d

k j

≤ E

d

k j

≥ 0; j = 1,2, ·· · ,L

(7)

where P

k

and o

k

are , respectively, the charging price

vector and electricity purchase in the k-th horizon.

To resolve this problem, we are facing two major

challenges: (1) accurately estimate the charging

demand φ

k

, and (2) solve the large-scale optimization

problem in a more efficient way. In the following

sections, we will discuss these problems in more

details.

3 SPATIAL-TEMPORAL

CHARGING DEMAND

ESTIMATION

In this section, we consider the estimation of the

charging demand φ

k

. The charging demand function

VEHITS 2016 - International Conference on Vehicle Technology and Intelligent Transport Systems

52

characterizes the customer’s responsiveness to the

fluctuation of charging prices, for EV owners may

adjust their charging demand or schedule in response

to the variation of charging prices.

In the initial phase of the optimization framework,

we do not have the information of the EV owner’s

responsiveness to the charging prices. We thus apply

a linear regression model to learn and predict the

charging demand φ

k

. For each charging station j( j =

1,2,··· , L), the charging demand is expressed by

d

k1

= γ

0,1

− γ

1,1

p

k1

+ γ

2,1

p

k2

+ ··· +γ

N,1

p

kN

+ ε

k1

,

d

k2

= γ

0,2

+ γ

1,2

p

k1

− γ

2,2

p

k2

+ ··· +γ

N,2

p

kN

+ ε

k2

,

.

.

.

d

kL

= γ

0,L

+ γ

1,L

p

k1

+ γ

2,2

p

k2

+ ··· −γ

N,L

p

kN

+ ε

kL

,

(8)

where γ

0, j

( j = 1, 2,· ·· ,L) is the intercept of the j-th

linear regression equation, and γ

i, j

= γ

j,i

(i 6= j) are the

cross-price elasticity parameters, reflecting how the

change of the charging price of station j can influence

the charging demand at station i. And γ

i,i

is the self-

price elasticity parameter, reflecting how the change

of the charging price of station i can influence its own

charging demand.

In this work, we employ the recursive least

square (RLS) (Proakis, 2007) method to estimate the

elasticity demand parameters from historical data. Let

W

j

= [γ

0, j

,γ

1, j

,··· ,γ

N, j

] denote the price elasticity

parameter vector relevant to charging station j( j =

1,2,··· , L). Applying the RLS algorithm, we have

the following update formula

e

k j

= d

k j

− P

T

k

W

j

,

g

k j

=

H

(k−1) j

P

k

λ+P

T

k

H

(k−1) j

P

k

,

H

k j

= λ

−1

H

(k−1) j

− g

k j

P

T

k

λ

−1

P

k

,

W

j

← W

j

+ e

k j

g

k j

,

(9)

where e

k j

is the prediction error and λ is the forgetting

factor. In initialization, H

0 j

is the identity matrix and

P

0

is an all-zero vector.

Note that Equation (8) captures both the spatial

and temporal fluctuation of charging demand. The

difference in population density, traffic flow, and

urbanization level may result in the spatial fluctuation

of charging demand. Thus, we use different linear

regression equations to estimate different charging

stations. On the other hand, the use of RLS algorithm

enables us to characterize the temporal fluctuation of

charging demand. It keeps track of the most recent

changes in customer’s charging behavior because the

price elasticity parameters will be updated once a new

data is observed.

4 PRICING POLICIES: GREEDY

ALGORITHM VS DP

ALGORITHM

Note that Equation (7) is a complex optimization

problem with N(L+1) decision variables and N(2L +

3) constraints. It is mathematically cumbersome

and hardly feasible to solve this problem in a

brute force manner. One approach is to divide the

original optimization problem into N independent

subproblems. Each horizon corresponds to a

subproblem, and then employ the greedy search

algorithm. This idea will be further discussed in

Subsection 4.1.

On the other hand, we observe that the original

problem exhibits the properties of overlapping

subproblems and optimal substructure, which can

be exploited to solve this problem more efficiently.

Here, we apply the dynamic programming (DP)

computation algorithm to the original problem. DP

is a computation algorithm of solving a large-scale

complex problem by partitioning it into a set of

smaller and simpler subproblems (Cormen et al.,

2001; Bertsekas, 2000). By solving and combining

these subproblems in a forward (bottom-up) or

backward (top-down) fashion, we can obtain the

solution to the original problem. In contrast to the

brute force approach, DP can significantly accelerate

computation speed and save storage. We will discuss

DP in Subsection 4.2.

4.1 Greedy Algorithm

The original optimization problem in Equation (7)

aims to maximize the total utility over N horizons.

The control variables are “chained” in the sense that

the decision variables in the previous horizon can

influence the decision variables in the current horizon.

For simplicity, we ignore the correlation between

adjacent horizons, and try to maximize the utility in

each individual horizon. Specifically, we attempt to

solve the following problem in the k-th horizon,

(P

∗

k

,o

∗

k

) = argmax

P

k

,o

k

{

Π

k

}

s.t.

0 ≤ o

k

≤ o

max

;k = 1,2,··· , N

p

k j

≥ 0; j = 1,2, ·· · ,L

I

k

+ o

k

−

∑

L

j=1

d

k j

≥ 0

I

k

+ o

k

−

∑

L

j=1

d

k j

≤ E

d

k j

≥ 0; j = 1,2, ·· · ,L

(10)

where P

k

and o

k

are , respectively, the charging price

vector and electricity purchase in the k-th horizon. We

Dynamic Pricing and Energy Management Strategy for EV Charging Stations under Uncertainties

53

will use the greedy algorithm as a benchmark in the

simulations.

4.2 Dynamic Programming Algorithm

Note that the hourly-based wholesale electricity

prices are only posted day ahead. We analyse the

dynamic pricing problem with finite horizons (stages)

with N = 24. The system dynamics are expressed by

the evolution of some variables, or the system’s state

variables, under the influence of the decision variables

at the beginning of each horizon (stage) (Bertsekas,

2000; Nemhauser, 1996). The system dynamics are

expressed by the following evolution equation

I

k+1

= I

k

+ u

k

+ o

k

− φ

k

= I

k

+ u

k

+ o

k

−

L

∑

j=1

d

k j

= f (I

k

,u

k

,P

k

,o

k

),k = 1, 2,· ·· , N

(11)

where I

k

is the state variable, representing the

electricity storage at the beginning of the k-th

horizon. The variables u

k

and o

k

are, respectively, the

renewable energy and the electricity to be purchased

from the wholesale market. The charging demand

in the k-th horizon is φ

k

. Note that φ

k

is actually

a function of the charging price vector P

k

, and the

decision variables of the system are (P

k

,o

k

). The

aggregated utility of the service provider from the first

horizon to the Nth horizon is given by

Π

N+1

(I

N+1

) +

N

∑

k=1

Π

k

(I

k

,P

k

,o

k

), (12)

where Π

N+1

(I

N+1

) is the terminal utility incurred at

the end of the process. We can assign a heuristic value

for the terminal utility. The maximum utility J

1

(I

1

) is

given by the following form

J

1

(I

1

) =

max

P

1

,o

1

,···,P

N

,o

N

(

Π

N+1

(I

N+1

) +

N

∑

k=1

Π

k

(I

k

,P

k

,o

k

)

)

,

(13)

Furthermore, the utility J

1

(I

1

) can be calculated in a

recursive manner as follows

J

1

(I

1

) = max

P

1

,o

1

{

Π

1

(I

1

,P

1

,o

1

) + J

2

(I

2

)

}

, (14)

or

J

1

(I

1

) = max

P

1

,o

1

{

Π

1

(I

1

,P

1

,o

1

) + J

2

( f (I

1

,u

1

,P

1

,o

1

))

}

,

(15)

where J

2

(I

2

) is given by

J

2

(I

2

) =

max

P

2

,o

2

,···,P

N

,o

N

(

Π

N+1

(I

N+1

) +

N

∑

k=2

Π

k

(I

k

,P

k

,o

k

)

)

,

(16)

We can apply Equation (15) recursively from the Nth

horizon backward to the first horizon to derive the

solution J

1

(I

1

). The detailed derivation of Equation

(13) to Equation (15) is given in Appendix.

Let X

k

= [p

k1

, p

k2

,··· , p

kL

,o

k

]

T

denote the deci-

sion variables. Moreover, the recursive DP formula

can be rewritten as one of quadratic programming as

follows,

J

k

(I

k

) = max

X

k

∈Z(X

k

)

n

1

2

X

T

k

QX

k

+ B

T

k

X

k

+ r

k

o

, (17)

where Z(X

k

) is the feasible solutions derived from the

constraints in Equation (7). The matrix Q is given by

−2γ

1,1

− αβΓ

2

1

··· 2γ

1,L

− αβΓ

1

Γ

L

0

2γ

2,1

− αβΓ

2

Γ

1

··· 2γ

2,L

− αβΓ

2

Γ

L

0

.

.

.

.

.

.

2γ

L,1

− αβΓ

L

Γ

1

··· −2γ

L,L

− αβΓ

2

L

0

0 ··· 0 −µ

(18)

where Γ

j

( j = 1, 2,· ·· , L) is

Γ

j

= −γ

j, j

+

L

∑

i=1,i6= j

γ

j,i

. (19)

B

k

is

B

k

=

γ

0,1

+ (η +βω)

∑

N

j=1

γ

1, j

− αβΓ

0

Γ

1

.

.

.

γ

0,L

+ (η +βω)

∑

N

j=1

γ

L, j

− αβΓ

0

Γ

L

−c

k

− η +2µo

ref

,

(20)

where Γ

0

is

Γ

0

=

L

∑

i=1

γ

0,i

. (21)

r

k

is

r

k

= − η(I

k

+ u

k

) + βφ

k

− µo

2

ref

+

(η + βω)Γ

0

−

αβ

2

Γ

2

0

+ J

k+1

(I

k+1

),

(22)

where J

k+1

(I

k+1

) is the total aggregated utility

starting from the (k + 1)th horizon to the Nth horizon,

which can be calculated using the DP recursive

formula. We can treat J

k+1

(I

k+1

) as a constant value

when we calculate J

k

(I

k

).

VEHITS 2016 - International Conference on Vehicle Technology and Intelligent Transport Systems

54

5 DYNAMIC PRICING AND

ENERGY MANAGEMENT

FRAMEWORK SUMMARY

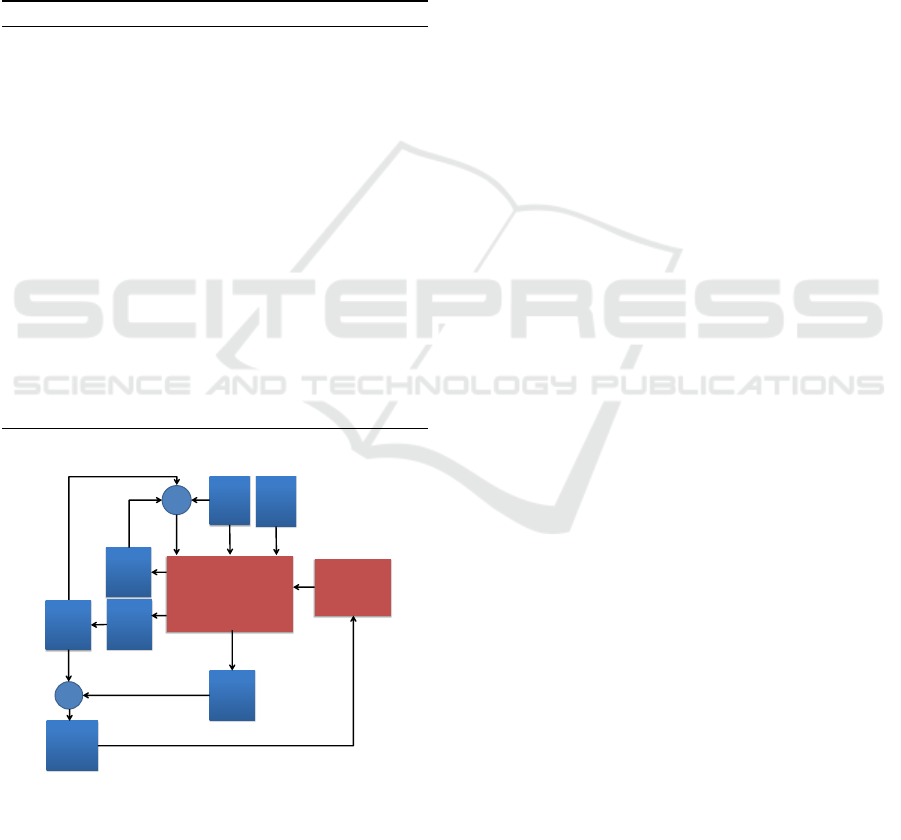

There are two principal modules in the dynamic

pricing and energy management framework: the

charging demand prediction module and the DP

module. Figure 3 illustrates the schematics of the

framework. They work collaboratively to make the

optimal decisions on charging prices P

k

and the

electricity purchase o

k

for the service provider. The

algorithm is summarized below:

Algorithm 1: Dynamic Pricing and Energy Management.

Input:

1: The electricity storage (system state), I

k

;

2: The renewable energy prediction

u

k

,u

k+1

,··· ,u

N

;

3: The wholesale electricity prices, c

k

,c

k+1

,··· ,c

N

;

Output: The new system state I

k+1

, the charging

prices P

k

, and electricity purchase o

k

;

4: Load the price coefficients γ

k

i, j

(i, j = 1, 2,· ·· ,N)

from linear regression module into the DP engine

module;

5: The DP engine takes the inputs and generates the

outputs P

k

,o

k

using Eq. (17);

6: Compute the charging demand prediction error

e

k

= φ

k

−

ˆ

φ

k

. Apply the RLS method to update

the price coefficients γ

k+1

i, j

= f (γ

k

i, j

,e

k

);

7: Update the electricity storage I

k+1

= I

k

+ u

k

+

o

k

− φ

k

; return I

k+1

,P

k

,o

k

;

Dynamic

Programming Engine

Linear

Regression

Model

Predicted

Charging

Demand

k

ˆ

Purchase

Electricity

k

o

Purchase

Electricity

k

P

Actual

Charging

Demand

k

+

_

Prediction

Error

k

e

Renewa

ble

Energy

k

u

Wholes

ale price

k

c

+ +

_

k

I

Input:

Output:

System state:

k

u

k

c

k

P

k

o

k

I

Figure 3: Dynamic Pricing and Energy Management

Algorithm

6 SIMULATION RESULTS AND

DISCUSSIONS

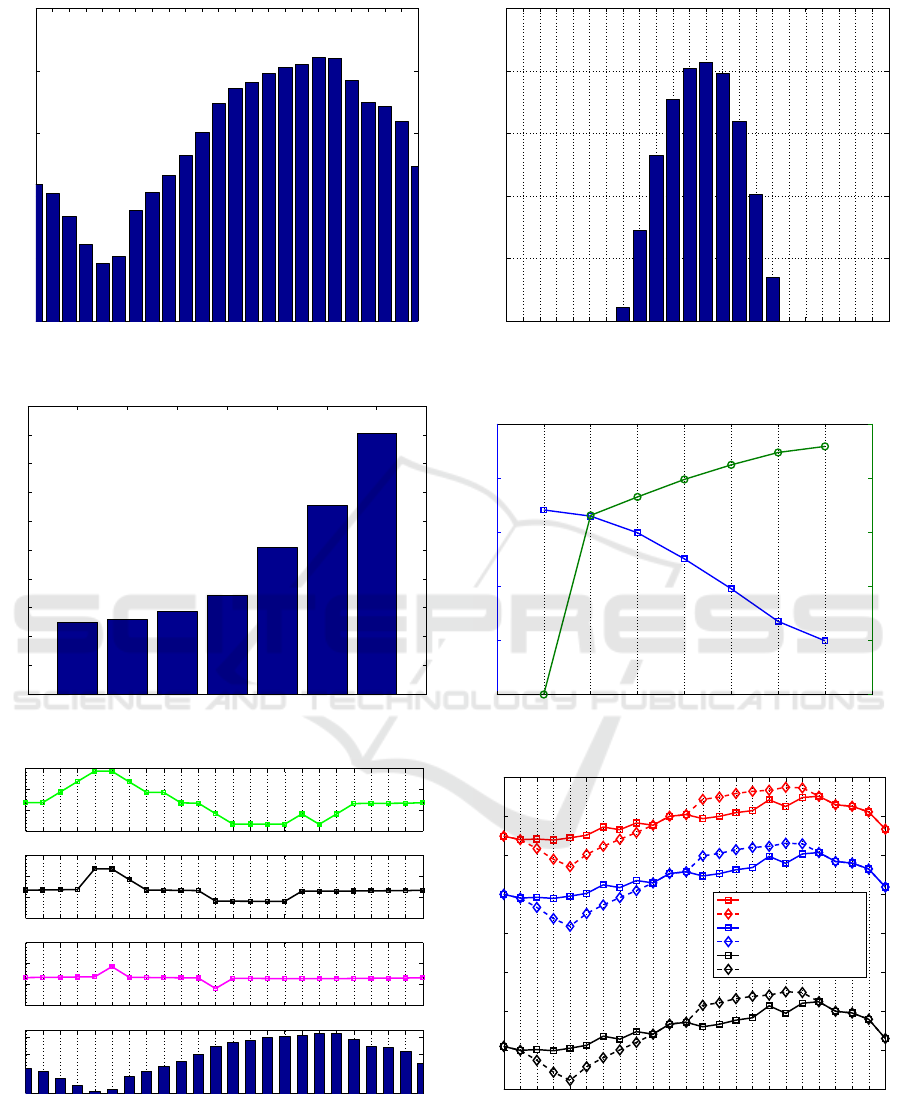

The simulation parameters are given in Table 1. We

use the historical data of the PJM day-ahead market

in our simulations, see Figure 4. We use the solar

radiation data from the National Solar Radiation

Data Base (National Renewable Energy Laboratory,

2015) as a proxy of the predicted renewable energy

generation. For simplicity, we assume that the

solar cell efficiency is 20%. The renewable energy

generation prediction is shown in Figure 5. We notice

that the solar power generation begins at 8:00 and

ends at 17:00 with a peak at 13:00.

6.1 DP Algorithm versus Greedy

Algorithm

We use the greedy algorithm as the benchmark, and

compare DP algorithm with the greedy algorithm.

Figure 6 shows the profit increase of DP algorithm

(using greedy algorithm as the benchmark). The

simulation reveals that DP algorithm achieves up

to 9% increase in profit in contrast to the greedy

algorithm. The reason why DP algorithm can achieve

a higher profit is that it exploits the information of

the entire hourly day-ahead prices and the renewable

energy prediction to make optimized decisions at each

horizon. The decisions made in each horizon are

optimized so that the aggregated profit over multiple

horizons is maximized. In contrast, the greedy

algorithm is a myopic algorithm because it only

maximizes the profit in the current horizon without

considering the day-ahead prices and the renewable

energy generation in the future. Comparing the

computational complexity of the two algorithms,

we note that greedy algorithm has a linear time

complexity O(N), while DP algorithm has a quadratic

time complexity O(N

2

), where N is the number of

planning horizons. Therefore, DP algorithm achieves

a higher profit (better performance) at the cost of

increased computing time.

6.2 Tradoff between Profit And

Customer Satisfaction

This section considers how the profit and customer

satisfaction change as the customer satisfaction

weighting parameter β increases from 0 to 30000 with

an interval of 5000. From Figure 7, we observe that

as β increases, the customer satisfaction increases

and the profit suffers a significant decrease. It

is clear that the charging service provider should

Dynamic Pricing and Energy Management Strategy for EV Charging Stations under Uncertainties

55

Table 1: Simulation Parameters.

Coefficient Description Unit Value

N Number of horizons - 24

E Energy storage capacity MWh 200

ω Customer satisfaction para. - 0.01

α Customer satisfaction para. - 5e-5

β Satisfaction Parameter - 0, ···, 30000

µ Power grid impact parameter - 0.1

η Storage cost $/MWh 0.5, 1.0, 1.5

o

ref

Reference purchase MWh 40

make a tradeoff between profit maximization and

customer satisfaction improvement by choosing a

proper weighting parameter β.

6.3 The Aggressive or Conservative

Electricity Purchase Strategy

The electricity storage system enables the charging

service provider to purchase extra electricity from the

wholesale market when the wholesale price is low,

and store the unsold electricity for future use when

the wholesale price is high. In this simulation, we

analyze how this “buy low and sell high” strategy

may change as the energy storage cost increases. In

Figure 8, the first three subplots are the electricity

purchase with different energy storage costs (η =

0.5,η = 1.0,η = 1.5 ), and the last subplot is the

day-ahead wholesale market prices. From Figure

8, we make three observations: (1) The average

electricity purchase is 37 MWh in each horizon; (2)

When η = 1.5, the electricity purchase almost does

not change. This suggests that the service provider

becomes conservative in electricity purchase as the

storage cost increase. In other words, the service

provider cannot improve the profit through “buy low

and sell high” strategy due to the high storage cost;

(3) When η = 0.5 and η = 1.0, the service provider

is likely to purchase more electricity during low-

price horizons (from 3:00 to 8:00), and purchase less

electricity during high-price horizons (from 11:00 to

19:00). Generally speaking, low electricity storage

cost spurs the service provider to adopt an aggressive

electricity purchase strategy.

6.4 Smoothing Price Fluctuation via

Electricity Storage System

In this section, we investigate the correlation between

the charging prices and the electricity storage cost. In

the simulation we have 20 charging stations in total,

and we randomly choose 3 charging stations to plot

Figure 9. The solid lines represent the charging prices

with low storage cost (η = 0.5), and the dash lines are

the charging prices with high storage cost (η = 1.5).

First, we notice that different charging stations

have different charging prices. Second, the charging

prices with high storage cost are more volatile than

those with low storage cost. When the wholesale

prices are low (from 1:00 to 8:00), the charging prices

with high storage cost are lower than those with low

storage cost. When the wholesale prices are high

(from 12:00 to 19:00), the charging prices with high

storage cost are higher than those with low storage

cost. The reason for the difference is that when the

storage cost is low, the service provider can have more

electricity reserved in the storage system which can be

used in the future when the wholesale electricity price

is high. Therefore, the charging prices stay relatively

stable over time. As the storage cost increases,

electricity storage becomes expensive. Without the

“buffer effect” of the electricity storage system, the

EV owners are exposed to the varying charging price

which is directly influenced by the wholesale market.

Hence, a low-cost energy storage system can not only

increase the total profit but also act as a buffer to

smooth out the fluctuation of the charging prices.

7 CONCLUSION

In this paper, a DP based pricing and energy

management framework for EV charging stations is

studied. The proposed framework aims to strike a

balance among three conflicting goals of improving

the total profit, enhancing the user satisfaction, and

reducing the EV charging impact on the power grid.

In this study here, we incorporate the electricity

storage system and the renewable energy generation

as an energy supplement. To solve the optimization

problem, we apply the DP algorithm to calculate the

charging prices and the electricity purchase for each

planning horizon. The simulation results show that

the DP algorithm can obtain higher profits compared

with the greedy algorithm. In addition, we observe

VEHITS 2016 - International Conference on Vehicle Technology and Intelligent Transport Systems

56

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

10

15

20

25

30

35

Time

Prices($\MWh)

Figure 4: PJM Electricity Wholesale Prices.

0

1

2

3

4

5

6

7

8

9

10

Profit Gain (Percentage)

β = 0

2.6%

2.9%

3.4%

5.1%

6.6%

9.1%

2.5%

β =5000

β = 10000

β = 15000

β = 20000

β = 25000 β = 30000

Figure 6: DP Profit Increase Percentage.

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

10

30

50

70

η=0.5

Purchase(MWh)

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

10

30

50

70

η=1.0

Purchase(MWh)

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

10

30

50

70

η=1.5

Purchase(MWh)

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

15

20

25

30

Time

Prices($/MWh)

Figure 8: Electricity Purchase with Different Storage Cost.

that the electricity purchase is heavily influenced by

the wholesale prices and the energy storage cost.

A low-cost energy storage system is beneficial for

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

0

5

10

15

20

25

Time

Renewable energy (MWh)

Figure 5: Hourly Renewable Energy Generation.

0

2

4

6

8

10

x 10

4

Profit

0

0.1

0.2

0.3

0.4

0.5

Customer satisfaction

β = 0

β =5000

β = 10000

β = 15000

β = 20000 β = 25000

β = 30000

Figure 7: Total Profit vs Customer Satisfaction.

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

62

64

66

68

70

72

74

76

78

Time

Prices($/MWh)

Charging station 7, η=0.5

Charging station 7, η=1.5

Charging station 18, η=0.5

Charging station 18, η=1.5

Charging station 21, η=0.5

Charging station 21, η=1.5

Figure 9: Charging Prices with Different Storage Cost.

improving the profit and stabilizing the charging

prices.

Dynamic Pricing and Energy Management Strategy for EV Charging Stations under Uncertainties

57

ACKNOWLEDGEMENTS

This work has been partially supported by the

National Science Foundation under grants CNS-

1239224, ECCS-1550016, and CPS-1544724.

REFERENCES

Ban, D., Michailidis, G., and Devetsikiotis, M. (2012).

Demand response control for phev charging stations

by dynamic price adjustments. 2012 IEEE PES

Innovative Smart Grid Technologies, pages 1–8.

Bertsekas, D. (2000). Dynamic Programming and Optimal

Control (2nd ed.). Athena Scientific, Belmont,

Massachusetts.

Cormen, T., Leiserson, C., Rivest, R., and Stein, C. (2001).

Introduction to Algorithm (2nd ed.). MIT Press &

McGraw-Hill.

Electric Drive Transportation Association (2015). Electric

drive sales dashboard. Available at: http://

electricdrive.org/index.php?ht=d/sp/i/20952/pid/

20952. [Online].

Fahrioglu, M., Fern, M., and Alvarado, F. (1999). De-

signing cost effective demand management contracts

using game theory. Proc. of IEEE Power Engineering

Society 1999 Winter Meeting, 1:427–432.

Faranda, R., Pievatolo, A., and Tironi, E. (2007). Load

shedding: A new proposal. IEEE Transactions on

Power Systems, 22(4):2086–2093.

Frame, J. (2001). Locational marginal pricing. 2001 IEEE

Power Engineering Society Winter Meeting 2001,

1:377–382.

Guo, Y., Liu, X., Yan, Y., Zhang, N., and Su, W. (2014).

Economic analysis of plug-in electric vehicle parking

deck with dynamic pricing. 2014 IEEE Power and

Energy Society General Meeting, pages 1–5.

Guo, Y., Xiong, J., Xu, S., and Su, W. (2016). Two-stage

economic operation of microgrid-like electric vehicle

parking deck. accepted by IEEE Transactions on

Smart Grid (to appear).

Han, Y., Chen, Y., Han, F., and Liu, K. J. R. (2012). An

optimal dynamic pricing and schedule approach in

v2g. Proceedings of The 2012 Asia Pacific Signal and

Information Processing Association Annual Summit

and Conference, pages 1–8.

Huisman, R., Huurman, C., and Mahieu, R. (2007).

Hourly electricity prices in day-ahead markets.

SciVerse ScienceDirect Journals, Energy Economics,

29(2):240–248.

IEC (2007). Efficient electrical energy transmission and

distribution. Available at: http://www.iec.ch/news

centre/onlinepubs/pdf/transmission.pdf. [Online].

Kinter-Meyer, M., Schneider, K., and Pratt, R. (2007).

Impacts assessment of plug-in hybrid electric vehicles

on electric utilities and regional u.s. power grids: Part

i:technical analysis. Online Journal of EUEC, 1.

Lopes, J., Soares, F., and Almeida, P. (2011). Integration

of electric vehicles in the electric power system.

Proceedings of the IEEE, 99(1):168 – 183.

Martirano, D. L., Devetsikiotis, M., and Pietra, B. (2014).

Interactive energy: an approach for the dynamic

pricing and dispatching of ev charging service. The

40th Annual Conference of the IEEE - Industrial

Electronics Society, IECON 2014, pages 3556–3562.

National Renewable Energy Laboratory (2015). Na-

tional solar radiation data base. Available at:

http://rredc.nrel.gov/solar/old data/nsrdb/. [Online].

Navigant Research (2014). Electric vehicle market

forecasts global forecasts for light duty hybrid,

plug-in hybrid, and battery electric vehicle sales

and vehicles in use: 2014-2023. Available at:

http://www.navigantresearch.com/research/electric-

vehicle-market-forecasts. [Online].

Nemhauser, G. (1996). Introduction to Dynamic

Programming. John Wiley and Sons, Inc.

Proakis, J. (2007). Digital Signal Processing (4th ed.).

Pearson Prentice Hall, Upper Saddle River, N.J.

Rahbari-Asr, N., Chow, M.-Y., Yang, Z., and Chen, J.

(2013). Network cooperative distributed pricing

control system for large-scale optimal charging of

phevs/pevs. The 39th Annual Conference of the IEEE

- Industrial Electronics Society, IECON 2013, pages

6148–6153.

Scott, M., Kintner-Meyer, M., Elliott, D., and Warwick, W.

(2007). Economic assessment and impacts assessment

of plug-in hybrid vehicles on electric utilities and

regional u.s. power grids. part ii. Online Journal of

EUEC, 1.

Simpson, A. (2006). Cost-benefit analysis of plug-

in hybrid electric vehicle technology. The 22nd

International Battery, Hybrid and Fuel Cell Electric

Vehicle Symposium and Exhibition (EVS-22).

Treinen, R. (2005). Locational marginal pricing (lmp):

Basics of nodal price calculation. Available

at: http://www.caiso.com/docs/2004/02/13/

200402131607358643.pdf. [Online].

Yan, Q., Manickam, I., Kezunovic, M., and Xie, L. (2014).

A multi-tiered real-time pricing algorithm for electric

vehicle charging stations. 2014 IEEE Transportation

Electrification Conference and Expo, pages 1–6.

Yang, P., Tang, G., and Nehorai, A. (2013). A game-

theoretic approach for optimal time-of-use electricity

pricing. IEEE Transactions on Power Systems,

28(2):884–892.

APPENDIX

Given the following optimization problem

J

k

(I

k

) =

max

P

k

,o

k

,···,P

N

,o

N

(

Π

N+1

(I

N+1

) +

N

∑

j=k

Π

j

(I

j

,P

j

,o

j

)

)

.

(23)

VEHITS 2016 - International Conference on Vehicle Technology and Intelligent Transport Systems

58

Note that I

j+1

= I

j

+ u

j

+ o

j

− φ

j

;( j > k), so I

j+1

is

a function of I

j

,o

j

,and P

j

. We can prove that I

j+1

is actually a function of (I

k

,o

k

,o

k+1

,o

j

,P

k

,··· ,P

j

) by

recursively applying the formula to substitute I

j

. Then

we can rewrite Equation (23) as follows,

J

k

(I

k

) = max

P

k

,o

k

,···,P

N

,o

N

Π

N+1

(I

N+1

)+

N

∑

j=k

Π

j

(I

k

,P

k

,··· ,P

j

,o

k

,··· ,o

j

)

= max

P

k

,o

k

(

Π

k

(I

k

,P

k

,o

k

)+

max

P

k+1

,o

k+1

,···,P

N

,o

N

Π

N+1

+

N

∑

j=k+1

Π

j

)

= max

P

k

,o

k

Π

k

(I

k

,P

k

,o

k

) + J

k+1

(I

k+1

)

,

(24)

where J

k+1

(I

k+1

) is given by

J

k+1

(I

k+1

) = max

P

k+1

,o

k+1

,···,P

N

,o

N

(

Π

N+1

+

N

∑

j=k+1

Π

j

)

.

(25)

Dynamic Pricing and Energy Management Strategy for EV Charging Stations under Uncertainties

59