Using a Predator-Prey Model to Explain Variations of Cloud

Spot Price

Zheng Li

1

, William Tärneberg

1

, Maria Kihl

1

and Anders Robertsson

2

1

Department of Electrical and Information Technology, Faculty of Engineering, Lund University, Lund, Sweden

2

Department of Automatic Control, Lund University, Lund, Sweden

Keywords: Cloud Computing, Cloud Spot Pricing, Cloud Spot Market, Predator-Prey Model.

Abstract: The spot pricing scheme has been considered to be resource-efficient for providers and cost-effective for

consumers in the Cloud market. Nevertheless, unlike the static and straightforward strategies of trading on-

demand and reserved Cloud services, the market-driven mechanism for trading spot service would be

complicated for both implementation and understanding. The largely invisible market activities and their

complex interactions could especially make Cloud consumers hesitate to enter the spot market. To reduce the

complexity in understanding the Cloud spot market, we decided to reveal the backend information behind

spot price variations. Inspired by the methodology of reverse engineering, we developed a Predator-Prey

model that can simulate the interactions between demand and resource based on the visible spot price traces.

The simulation results have shown some basic regular patterns of market activities with respect to Amazon’s

spot instance type m3.large. Although the findings of this study need further validation by using practical

data, our work essentially suggests a promising approach (i.e. using a Predator-Prey model) to investigate

spot market activities.

1 INTRODUCTION

The de facto Cloud market employs three types of

pricing schemes for trading on-demand service,

reserved service, and spot service respectively. With

the on-demand service pricing scheme, Cloud

consumers pay a fixed cost per service unit on an

hourly basis for necessary on-demand resources, and

an analogy of this pricing scheme is paying per view

from a video on demand (VOD) service. With the

reserved service pricing scheme, Cloud consumers

pay an upfront fixed fee to ensure discounted hourly

pricing for a long-term commitment of service

availability, and an analogy of this pricing scheme is

signing a two-year subscription of mobile service to

receive cheaper data plans with a free phone. These

two types of static pricing schemes both imply a

straightforward demand-resource relationship when

consuming Cloud services. In contrast, the spot

pricing scheme depends on potentially complicated

interactions between consumer demand and Cloud

resource. As specified by Amazon (Amazon, 2015a),

the price of Cloud spot service could frequently vary

driven by a market mechanism. An analogy of this

pricing scheme is the dynamic pricing in the

electricity distribution industry. Behind the price

variations, technically, a Cloud spot service

continuously evaluates its available resources and

monitors the coming demands, and then dynamically

sets spot prices to target predefined goals like revenue

maximization or utility efficiency.

Given the generally low utilization of Cloud

resources (Delimitrou and Kozyrakis, 2014),

although the two static pricing schemes are dominant

trading strategies in the current Cloud market (Al-

Roomi et al., 2013; Xu and Li, 2013), spot pricing has

been considered to be a significant supplement for

building a full-fledged market economy for the Cloud

ecosystem (Abhishek et al., 2012). However, it seems

that both providers and consumers are still hesitating

to enter the Cloud spot market. In fact, considering

the hard-to-predict and dynamic interactions between

demand and resource, the market-driven mechanism

for pricing spot service would require more effort and

managerial overheads for Cloud providers to

implement, and also result in psychological

difficulties for Cloud consumers to understand and

employ (Xu and Li, 2013). As can be seen, the

overwhelming majority of the existing Cloud

providers have not employed the spot pricing scheme

Li, Z., Tärneberg, W., Kihl, M. and Robertsson, A.

Using a Predator-Prey Model to Explain Variations of Cloud Spot Price.

In Proceedings of the 6th International Conference on Cloud Computing and Services Science (CLOSER 2016) - Volume 2, pages 51-58

ISBN: 978-989-758-182-3

Copyright

c

2016 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

51

yet (Zaman and Grosu, 2011), and the only spot

service provider Amazon is still using contests to

encourage more spot applications (Amazon, 2015a).

Therefore, being aware of the dynamic demands

and resources would be significantly helpful and

useful for both Cloud providers and consumers to join

the spot market. Unfortunately, the backend details

behind changing spot prices are invisible for most of

the market participants, and little work has focused on

the interactions between demand and resource.

Following the methodology of reverse engineering,

we tried to reveal the invisible knowledge from the

tangible spot prices. By imaging the Cloud spot

demand and resource as two species, i.e. predator and

prey respectively, we developed a Predator-Prey

model to investigate the demand-resource

interactions. Based on Amazon’s historical spot

prices, the simulation shows that our Predator-Prey

model is conceptually functional, although the

revealed information needs further validation in

practice. This paper introduces our developed

Predator-Prey model and uses its simulation to try

explaining the variations of Cloud spot price.

The contribution of our work is mainly twofold.

Firstly, this work suggests a promising approach (i.e.

using a Predator-Prey model) to investigate spot

market activities. To our best knowledge, this is the

first study that tries to visualize the interactions

between demand and resource in the Cloud spot

market. Although the current version of this Predator-

Prey model might still suffer from simple

assumptions, the logic of the whole work can be

reused and refined by others. Secondly, by using this

Predator-Prey model, our simulation has identified

some basic regular patterns of market activities with

respect to Amazon’s spot instance type m3.large

1

. For

example, spot resources could be accumulated

relatively slowly, while being saturated quickly after

reaching particular amounts. Such a phenomenon of

sharp drops of spot resources might indicate “herd

behaviors” of spot demands. Although this simulation

finding could not be practically assured at this current

stage, it have provided us a hypothesis to be tested in

the future.

The remainder of this paper is organized as

follows. Section 2 summarizes relevant studies that

have modeled demand and resource of Cloud spot

services by roughly classifying them into two types.

Section 3 elaborates our development details of the

Predator-Prey model of Cloud spot demands and

resources. By using Amazon’s spot price trace,

Section 4 describes our simulation work that reveals

________________________________

1

http://aws.amazon.com/ec2/instance-types/

basic information behind the changing spot prices.

Conclusions and some future work are discussed in

Section 5.

2 RELATED WORK

Although the backend details behind spot prices are

usually uncertain and even unknown, the demand

information and resource information are

fundamentally crucial for investigating various

problems ranging from service fault tolerance (from

the consumer’s perspective) to revenue maximization

(from the provider’s perspective). Therefore,

researchers and practitioners have employed different

techniques/assumptions to model the spot service

demand and resource to facilitate their studies. The

existing study approaches can be roughly classified

into three categories, as specified below.

(1) The first type of studies focuses on Cloud

demand and resource separately.

Demand Model-relevant Studies

When it comes to modeling demands, a common

practice was to replay recorded workload traces (e.g.,

(Shi et al., 2014)) or to run particular applications

(e.g., (Chohan et al., 2010)). However, this type of

practices would fail in emulating highly variable and

dynamic workload profiles and demand scenarios (v.

Kistowski et al., 2014). To address this limit, a simple

case was to treat demand as an independent

uncertainty parameter that contains the possible

amounts of server-hours required by an application

(Chaisiri et al., 2011). In sophisticated cases, demand

was imagined as job arrivals. For example, Abhishek

et al. (Abhishek et al., 2012) assumed that jobs

arrived sequentially according to a stationary

stochastic process with independent inter-arrival

time, while Mazzucco and Dumas (Mazzucco and

Dumas, 2011) assumed that jobs entered the spot

service according to an independent Poisson process

with a particular rate λ. Nevertheless, it is notable that

these studies did not consider the influence of

dynamic demands on spot prices in their modeling

work.

Resource Model-relevant Studies

As for modeling resource, some authors simply

assumed that the Cloud infrastructure could provide

infinite/unbounded spot resource (Chaisiri et al.,

2011; Kantere et al., 2011). However, a spot service

would only offer limited spare resources in practice.

As such, a predefined number of homogeneous

CLOSER 2016 - 6th International Conference on Cloud Computing and Services Science

52

processors/cores or virtual machines have been

widely used to constrain the amount of spot resources

(Mazzucco and Dumas, 2011; Xu and Li, 2013). Even

without specification, the spot service models like k

parallel M/M/1 queues (Abhishek et al., 2012) have

also implied limited resources (k VM instances in this

case) in the Cloud spot market. Similarly, this type of

studies did not consider the influence of available

resources on spot prices in their modeling work.

(2) The second type of studies focuses on the

relationship between spot price and demand/resource.

Price-demand Model-relevant Studies

Kantere et al. (Kantere et al., 2011) modeled the

price-demand dependency as second order

differential equations with constant parameters, and

they claimed that the involved constant parameters

could be estimated by using price-demand data sets to

perform curve fitting. As an important economics

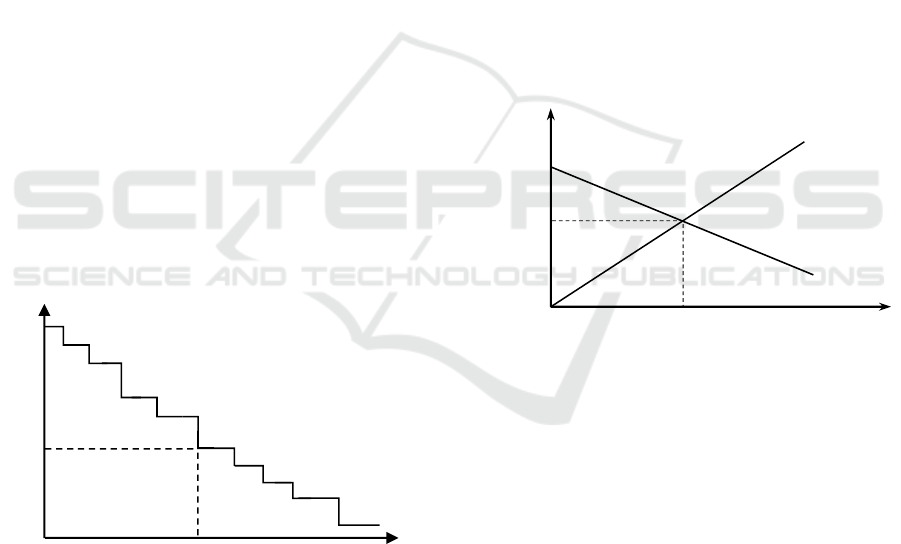

concept, the stair-shape demand curve has also been

used to represent the relationship between spot price

and quantitative demand. For example, Wang et al.

(Wang et al., 2013) employed a demand curve to

facilitate their time-average revenue maximization

study. The demand curve was supposed to be

maintained by sorting the requests according to their

bids in a descending order, as shown in Figure 1. An

interesting feature of this work is that the supply S is

defined as the accepted demand D at a particular time

slot, which partially emphasizes the relationship

between demand and resource of a spot service.

Figure 1: Sample demand curve (an adapted version from

(Wang et al., 2013)). The horizontal axis essentially scales

accepted demands in the original study.

Price-resource Model-relevant Studies

The connection between spot price and resource has

usually been reflected and/or modeled by using

service availability. For example, the lifetimes of spot

resources were modeled by building a Markov Chain

with edges being the probability of hourly-interval

price transitions (Chohan et al., 2010), which is

essentially an availability model; on the other hand,

the rate of events that terminate application runs due

to resource unavailability was considered to follow an

exponential distribution (Jangjaimon and Tzeng,

2015), which essentially indicates an unavailability

model.

(3) The third type of studies considers the

competitions among market participants from the

perspective of economics.

In these studies, Cloud spot pricing was treated as

various auctions and games to reach some

equilibrium. For example, the Prisoner Dilemma

game and the Generalized Nash Equilibrium (GNE)

game was employed to formulate the conflicts

between a provider and its consumers (Di Valerio et

al., 2013; Karunakaran and Sundarraj, 2013). The

games and auctions can intuitively explain the

influences of spot price and demand/resource on each

other, as shown in Figure 2. However, the equilibrium

tends to show a static relationship between demand

and resource instead of reflecting their dynamic

interactions along the time goes by.

Figure 2: Cloud spot pricing from the perspective of

economics (originally appears in (Li et al., 2015)).

Overall, despite the discussions in common sense,

to the best of our knowledge, little work has focused

on the interactions between demand and resource in

the Cloud spot market. Our work tries to reveal the

invisible demand-resource information through a

Predator-Prey model.

3 USING THE PREDATOR-PREY

MODEL TO EXPLAIN SPOT

PRICE VARIATION

Recall that spot price may fluctuate in real time driven

by the wax and wane of demands and resources. Given

the de facto Cloud spot market, however, we have little

knowledge about the changes in demands and

resources except for the most recent 90-day price trace

Spot Service Price

Spot

Resource

Demand

Spo

t

Resource

Supply

Quantity

Equilibrium

Demand

Price

P

max

P

S

supply S =

accepted demand D

at price P

S

S

D

Using a Predator-Prey Model to Explain Variations of Cloud Spot Price

53

disclosed by Amazon (Amazon, 2015a). To better

understand the market-driven mechanism for Cloud

spot service, it would be significantly helpful if the

backend information behind spot prices is also visible.

Since it is impossible for us to capture the real-

time demands and resources in the market, we

decided to use simulation to visualize their changes.

Considering that Amazon tends to hold a period of

time between different price points (Wee, 2011), we

regard Cloud spot service as a discrete-time system

(Åström and Murray, 2008). As such, if viewing the

interaction between demand and resource as the

relationship between predator and prey by analogy

with the two-species ecological system, then it would

be natural to employ a Predator-Prey model to realize

the simulation.

It is notable that, for investigating ecological

systems, the birth and/or death rates are key

components in any form of Predator-Prey model

(Berryman, 1992). Therefore, we start from

determining the birth and death rates of spot service

demand and resource before building the model.

3.1 Birth Rates of Demand and

Resource

Inspired by the explanations in (Xu and Li, 2013), we

define the “birth” of demands as new request arrivals,

which is expressed as a Poisson process with rate f(p),

and the birth rate f(p) represents the amount of spot

resources requested per unit time; while defining the

“birth” of resources as the leave of satisfied requests

and the release of available resources, which also

follows a Poisson process with rate g(p), and the birth

rate g(p) represents the amount of spot resources

released per unit time.

Mainly following the assumptions in the previous

work (Xu and Li, 2013), we treat the assumed demand

arrival and departure rate functions as demand and

resource birth rate functions respectively for the

potential Predator-Prey model, as shown in Equation

(1) and (2).

(

)

=

1−

(>0,>1,>1)

(1)

(

)

=1−

1−

(>0,>0,>0)

(2)

When it comes to setting values of the parameters,

we reuse the example value 5 for k (Xu and Li, 2013)

while resetting a and b to be 3. In particular, the value

of k constrains the ceiling amount of new-born

demands or resources, while setting a and b to be 3

can relax the transformed spot price p over an interval

wider than [0, 1] if necessary. Note that, to match the

birth rate functions, we transform original spot prices

by dividing them by their corresponding fixed (on-

demand) price. Take Amazon’s spot service for

example, since spot prices of a particular instance

type could be unexpectedly higher than the fixed

price (Wee, 2011), some high spot prices would be

greater than 1 after transformation, as demonstrated

in the middle column of Table 1. In this case, the

greater-than-one prices imply a clear discouragement

to spot resource employment. In addition, without

loss of generality, the bigger value of a and b can

Table 1: Transforming spot prices of Amazon’s Instance

type m3.large.

Original Spot

Price p

o

(USD $)*

Transformed

Spot Price p

Rounded p

0.043 0.279 0.279

0.1 0.649 0.649

0.14 0.909 0.909

0.15 0.974 0.974

0.228 1.481 1

0.5 3.247 1

The fixed price of instance type m3.large is $0.154.

*The data are from the same price trace as illustrated in Figure 5.

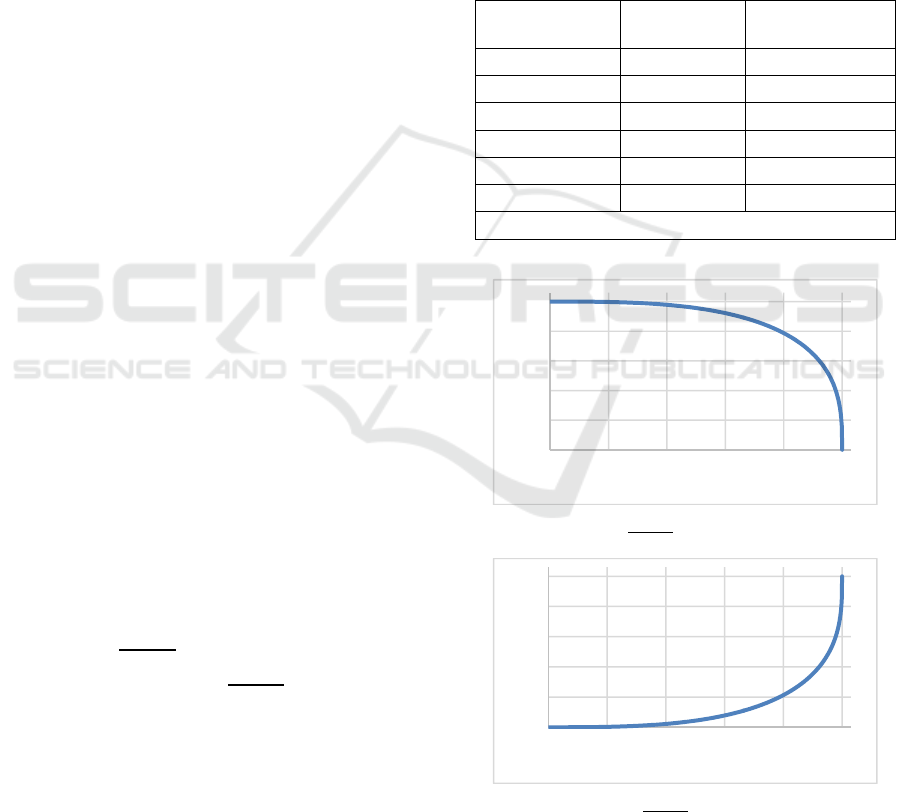

(a) Demand birth rate function:

(

)

=

1−

,=5,=3,=3).

(b) Resource birth rate function:

(

)

=(1−

1−

),=5,=3,=3).

Figure 3: Demand and Resource birth rate functions in the

Cloud spot market (an adapted version from (Xu and Li,

2013)).

0

1

2

3

4

5

0 0,2 0,4 0,6 0,8 1

Demand Birth Rate f(p)

Transformed Spot Price p

0

1

2

3

4

5

0 0,2 0,4 0,6 0,8 1

Resource Birth Rate g(p)

Transformed Spot Price p

CLOSER 2016 - 6th International Conference on Cloud Computing and Services Science

54

make the birth rate functions better align with “the

common psychology” emphasized in (Xu and Li,

2013), as shown in Figure 3: consumers would

quickly lose financial incentives to use spot service

when its price is approaching the fixed price, while

their demands may not be sensitive to the price

variation when spot service is far cheaper than the on-

demand option.

Furthermore, this transformation is more rational

than standardizing spot prices into the interval [0, 1],

because the standardization will lose the comparability

between spot prices and their corresponding fixed

price. To reduce the noise of the birth rate functions

when the transformed price p is higher than 1, we

further round p to 1 if p > 1 (cf. Table 1).

3.2 Death Rates of Demand and

Resource

The “death” of both demand and resource reflects the

consumption of Cloud spot service. We define that

resources are “dead” as soon as they are being

consumed; and demands are “dead” as soon as they

are being serviced, without waiting for their satisfied

moment.

To determine the demand death rate α and

resource death rate β, we resort to three intuitive

assumptions.

(1) We consider 80% as the death rate for resource

if there are more than acceptable amount of

demands, i.e. β = 0.8. In fact, due to the possible

risks of SLA violation and the inevitable

maintenance, Cloud providers would not be

interested in a resource utilization that approaches

100% (Puschel et al., 2007). On the contrary, an

average resource utilization of 80% has been

widely considered to be optimal (Puschel et al.,

2007; Wescott, 2013).

(2) If the demands are not enough to saturate the

optimal service capacity, the amount of dead

resource would be equal to the amount of dead

demand. In other words, the resource death rate

would be less than 80% in this case.

(3) Inspired by the Pareto distributions (80-20

rule) (Newman, 2005), we also set 80% as the

death rate for demand no matter whether or not the

demands are beyond the optimal service capacity,

i.e. α = 0.8. To unify both situations, we suppose

that some out-of-capacity demands would

eventually give up employing the spot service, and

thus they can also be considered to be dead

although without being serviced. In this case, it is

still possible to assume only 20% of demands left

for rebidding for the spot service in the next round.

In summary, we set the death rate to be 80% for both

spot demand and resource.

3.3 Predator-Prey Model of Demand

and Resource

Figure 4: Using a timeline to design the logic behind a

Predator-Prey model for spot demand and resource.

Based on a timeline of spot price variations, we

design the intuitive logic behind a Predator-Prey

model for recursively exhibiting the amount of

demand and resource, as shown in Figure 4. In detail,

we use D(t) and R(t) to refer to the amounts of

residual demand and residual resource respectively at

time t; while D(t+∆t) and R(t+∆t) respectively

represent the amounts of new demand and resource

after a period of time ∆t since t. In particular, ∆t

indicates the time span between two price-adjustment

points. Taking Amazon as an example, interestingly,

its spot service’s prices used to be adjusted hourly

(i.e. ∆t = 1 hour) (Wee, 2011), while the spot price

change frequency becomes multiple times per hour

recently (i.e. ∆t < 1 hour) (Guo et al., 2015). Note that

here we consider the Predator-Prey model by

following the logistic thinking of “principle of

population” (Berryman, 1992) instead of reusing the

difference equations that require interaction terms

(Åström and Murray, 2008). In other words, we claim

that the interaction between demand and resource has

been reflected by using their both birth and death

rates.

By further specifying the logic items with the

predefined birth and death rates, we define the

Predator-Prey Model of demand and resource in the

Cloud spot market, as shown in Equation (3).

(

+∆

)

=

(

)

+

(

)

×∆

−

(

)

×∆

(

+∆

)

=

(

)

+

(

)

×∆

−min(()×∆,()×∆)

(3)

To keep a consistent order of magnitude with the

predefined values for those birth rate functions (cf.

Figure 3), we set the initial amounts of spot demand

t t+∆t

Demand

at time t,

i.e. D(t)

Resource

at time t,

i.e. R(t)

Born demand

during ∆t

Dead demand

during ∆t

+

–

Demand at

time t+∆t,

i.e. D(t+∆t)

=

Born resource

during ∆t

Dead resource

during ∆t

+

–

Resource at

time t+∆t,

i.e. R(t+∆t)

=

Using a Predator-Prey Model to Explain Variations of Cloud Spot Price

55

and resource both to 5 at the starting point, i.e. D(0)

= 5 and R(0) = 5. Furthermore, we assume that the

price adjustment happens every unit time interval,

and the unit time intervals have uniformly regular

sizes, i.e. ∆t = 1 without necessarily considering the

unit representation. As such, the impact of time

interval ∆t can be ignored when calculating both the

birth and the death of spot demands and resources.

Overall, an example setting for initializing the

parameters of this model is specified in Equation (4).

(

)

=5×

1−

(

)

=5×1−

1−

(

0

)

=

(

0

)

=5,=

=0.8,∆=1

(4)

4 SIMULATION USING

AMAZON’S SPOT PRICE

TRACE

Given particular initialization settings (e.g., Equation

(4)), this Predator-Prey model can generate demand

and resource simulations corresponding to spot price

traces. To facilitate simulation, we implement the

Predator-Prey model into executable codes, as

specified in Algorithm 1. This straightforward

algorithm also shows that replicating our study would

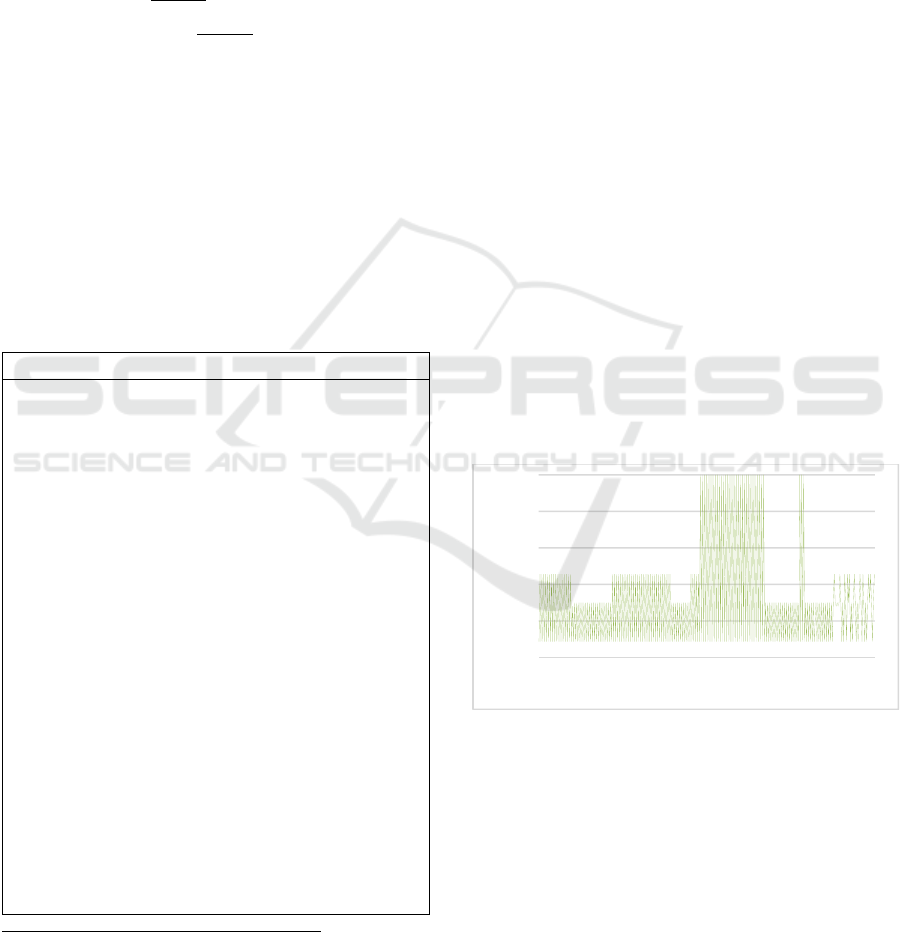

not be difficult. When it comes to the spot price trace,

we use Amazon’s Command Line Interface (CLI)

tool ec2-describe-spot-price-history (Amazon,

2015b) to collect historical spot prices of the instance

type m3.large whose price has relatively frequent

fluctuations at the time of writing. For the purpose of

conciseness, we only select a typical piece of data

(spot price records between 2015-03-12 00:01:10 and

2015-03-16 09:23:56) in the collected full trace

2

as

illustrated in Figure 5. Note that not all the historical

spot prices can be used to generate reasonable

simulations. Only frequently oscillating price traces

can fit in our Predator-Prey model. In fact, a piece of

flat price trajectory might indicate a lack of demands

during that time period, and therefore leading to few

demand-resource interactions. Such a scenario cannot

employ any Predator-Prey model, because it deviates

from the natural Predator-Prey rules.

Following the consecutive time series in the

selected price trace, the sequential amounts of

demand and resource can be calculated along with the

changing spot prices, as plotted in Figure 6. As

mentioned previously, we use the rounded

transformed prices for the calculations (cf. Table 1).

It is clear that, although we have made simplifying

assumptions for building this Predator-Prey model,

the simulation here can still help reveal basic

information behind spot prices. For example:

Figure 5: Amazon’s spot price variation trace between

2015-03-12 00:01:10 and 2015-03-16 09:23:56 (instance

type: m3.large, OS type: Linux/UNIX, zone: us-east-1b).

• Consumer demands remain at a low level when

the spot service is generally expensive.

• Spare resources remain at a low level when the

spot service is generally cheap.

• Spot resources would gradually be released

rather than a burst when the spot service is

becoming expensive.

0

0,1

0,2

0,3

0,4

0,5

1 51 101 151 201 251 301 351

Original Spot Price (USD)

Price Variation Points

Algorithm 1: Demand-Resource Interaction Simulation.

Input: Array of historical spot prices P = (p

1

, p

2

, p

3

, …, p

t

),

initial demand amount d

0

, initial resource amount r

0

, birth rate

factors a, b, k, demand death rate α, resource death rate β.

Output: Array of demand amount D = (d

1

, d

2

, …, d

t

), array of

resource amount R = (r

1

, r

2

, …, r

t

).

1: function D

BR

(p) //Demand birth rate at price p

2: ←×(1−

)

/

3: return f

4: end function

5: function R

BR

(p) //Resource birth rate at price p

6: ←×[1−(1−

)

/

]

7: return g

8: end function

9:

←

//Initial current demand amount at time t

10:

←

//Initial current resource amount at time t

11:

←0 //Initial new demand amount at time t+1

12:

←0 //Initial new resource amount at time t+1

13: ←∅∪

//Initial array of demand amount

14: ←∅∪

//Initial array of resource amount

15: for j = 1, 2, 3, …, t do

16:

←

+

−×

17:

←

+

−min{×

,×

}

18: ←∪

19: ←∪

20:

←

21:

←

22: end for

23: return D, R

2

The complete spot price trace with 24000 records of spo

t

instance type m3.large has been shared online:

https://docs.google.com/spreadsheets/d/1mBUItaGwsa44J5

DHLS0H mh9

Q

LK

j

O

Q

PTl7O

q

7aiuAc/

CLOSER 2016 - 6th International Conference on Cloud Computing and Services Science

56

• In contrast, the spot service capacity could

quickly be saturated by attracting demands at

low spot prices.

Figure 6: Demand and Resource simulation corresponding

to Amazon’s spot price variation trace between 2015-03-12

00:01:10 and 2015-03-16 09:23:56 (instance type:

m3.large, OS type: Linux/UNIX, zone: us-east-1b).

The first two simulation findings are aligned with

our common sense, while the others require further

validation in practice. In particular, the frequent sharp

drops of resources revealed by the fourth finding

might indicate the regular herd behaviours of spot

demands. Originally, herd behaviour refers to a

typical phenomenon when a group of individuals act

collectively without centralized direction, and it could

happen among animals as well as humans (Braha,

2012). By analogy, the herd behaviour of spot

demands could result from the same behaviour of

users when bidding for cheap Cloud spot resources.

Although it is difficult to make validation at this

current stage due to the lack of practical data, we can

treat this explanation as a hypothesis to be tested in

the future.

5 CONCLUSIONS AND FUTURE

WORK

Among the three typical pricing schemes in the de

facto Cloud market, spot pricing has been widely

accepted as the most resource-efficient strategy for

Cloud providers and the most cost-effective option

for Cloud consumers. Nevertheless, the spot pricing

scheme seems not to be popular yet for trading Cloud

resources, because the market-driven mechanism for

pricing spot service would be complicated both for

providers to implement and for consumers to

understand. Despite limited historical spot prices

disclosed by Amazon, the existing spot market

activities are generally invisible especially for Cloud

consumers.

To help better understand the operations in the

Cloud spot market, we developed a Predator-Prey

model to visualize the potential demand-resource

interactions based on the available spot price traces.

The simulation study has revealed some basic

information behind spot price variations, and also

proposed a hypothesis guiding us in future validation.

Overall, our work essentially shows that utilizing a

Predator-Prey model could be a promising approach

to reversely engineer spot market activities.

However, there is still a lack of practical data to

validate our simulation findings. Such a limitation

drives our future work along two directions. On the

one hand, we will gradually improve our Predator-

Prey model by employing relatively solid

assumptions. For example, more sophisticated

mathematical models can be used to represent the

death rates of demand and resource. On the other

hand, we will try to extract useful demand and

resource data from workload traces, and conduct

workload characterization to verify the findings of

this study.

ACKNOWLEDGEMENTS

This work is supported by the Swedish Research

Council (VR) for the project “Cloud Control”, and

through the LCCC Linnaeus and ELLIIT Excellence

Centers.

REFERENCES

Abhishek, V., Kash, I. A., and Key, P. (2012). Fixed and

market pricing for Cloud services. In Proc. 7th

Workshop on the Economics of Networks, Systems, and

Computation (NetEcon 2012), pages 157–162,

Orlando, FL, USA. IEEE Computer Society.

Al-Roomi, M., Al-Ebrahim, S., Buqrais, S., and Ahmad, I.

(2013). Cloud computing pricing models: A survey.

International Journal of Grid and Distributed

Computing, 6(5):93–106.

Amazon (2015a). Amazon EC2 spot instances.

https://aws.amazon.com/ec2/purchasing-options/spot-

instances/.

Amazon (2015b). ec2-describe-spot-pricehistory. http://

docs.aws.amazon.com/AWSEC2/latest/CommandLine

Reference/ApiReference-cmd-DescribeSpotPrice

History.html.

Åström, K. J. and Murray, R. M. (2008). Feedback Systems:

An Introduction for Scientists and Engineers. Princeton

University Press, Princeton, New Jersey.

Berryman, A. A. (1992). The origins and evolution of

predator-prey theory. Ecology, 73(5):1530–1535.

0

3

6

9

12

15

1 51 101 151 201 251 301 351

Amount

Price Variation Points

Demand Resource

Using a Predator-Prey Model to Explain Variations of Cloud Spot Price

57

Braha, D. (2012). Global civil unrest: Contagion, self-

organization, and prediction. PLoS ONE, 7(12):1–9.

Chaisiri, S., Kaewpuang, R., Lee, B.-S., and Niyato, D.

(2011). Cost minimization for provisioning virtual

servers in Amazon elastic compute Cloud. In Proc. 19th

Ann. IEEE Int. Symp. Modelling, Analysis, and

Simulation of Computer and Telecommunication

Systems (MASCOTS 2011), pages 85–95, Singapore.

IEEE Computer Society.

Chohan, N., Castillo, C., Spreitzer, M., Steinder, M.,

Tantawi, A., and Krintz, C. (2010). See spot run: Using

spot instances for MapReduce workflows. In Proc. 2nd

USENIX conf. Hot topics in cloud computing

(HotCloud 2010), pages 1–7, Boston, MA, USA.

USENIX Association.

Delimitrou, C. and Kozyrakis, C. (2014). Quasar:

Resource-efficient and QoS-aware cluster

management. In Proc. 19th Int. Conf. Architectural

Support for Programming Languages and Operating

Systems (ASPLOS 2014), pages 127–144, Salt Lake

City, Utah, USA. ACM Press.

Di Valerio, V., Cardellini, V., and Lo Presti, F. (2013).

Optimal pricing and service provisioning strategies in

Cloud systems: A Stackelberg game approach. In Proc.

6th IEEE Int. Conf. Cloud Computing (CLOUD 2013),

pages 115–122, Santa Clara, CA, USA. IEEE Computer

Society.

Guo, W., Chen, K., Wu, Y., and Zheng, W. (2015). Bidding

for highly available services with low price in spot

instance market. In Proc. 24th Int. ACM Symp. High-

Performance Parallel and Distributed Computing

(HPDC 2015), pages 191–202, Portland, Oregon, USA.

ACM Press.

Jangjaimon, I. and Tzeng, N.-F. (2015). Effective cost

reduction for elastic Clouds under spot instance pricing

through adaptive checkpointing. IEEE Transactions on

Computers, 64(2): 396–409.

Kantere, V., Dash, D., Franc¸ois, G., Kyriakopoulou, S.,

and Ailamaki, A. (2011). Optimal service pricing for a

Cloud cache. IEEE Transactions on Knowledge and

Data Engineering, 23(9):1345–1358.

Karunakaran, S. and Sundarraj, R. P. (2013). On using

prisoner dilemma model to explain bidding decision for

computing resources on the Cloud. In Proc. 13th Int.

Conf. Group Decision and Negotiation (GDN 2013),

pages 206–215, Stockholm, Sweden.

Li, Z., Zhang, H., O’Brien, L., Jiang, S., Zhou, Y., Kihl, M.,

and Ranjan, R. (2016). Spot pricing in the Cloud

ecosystem: A comparative investigation. Journal of

Systems and Software, 114: 1–19.

Mazzucco, M. and Dumas, M. (2011). Achieving

performance and availability guarantees with spot

instances. In Proc. 13th IEEE Int. Conf. High

Performance Computing and Communications (HPCC

2011), pages 296–303, Banff, Canada. IEEE Computer

Society.

Newman, M. E. J. (2005). Power laws, Pareto distributions

and Zipf’s law. Contemporary Physics, 46(5):323–351.

Puschel, T., Borissov, N., Mac´ıas, M., Neumann, D.,

Guitart, J., and Torres, J. (2007). Economically

enhanced resource management for Internet service

utilities. In Proc. 8th Int. Conf. Web Information

Systems Engineering (WISE 2007), pages 335–348,

Nancy, France. Springer-Verlag.

Shi, W., Zhang, L., Wu, C., Li, Z., and Lau, F. C. (2014).

An online auction framework for dynamic resource

provisioning in Cloud computing. In Proc. 2014 ACM

Int. Conf. Measurement and Modeling of Computer

Systems (SIGMETRICS 2014), pages 71–83, Austin,

Texas, USA. ACM Press.

v. Kistowski, J., Herbst, N., and Kounev, S. (2014).

Modeling variations in load intensity over time. In

Proc. 3rd Int. Workshop on Large Scale Testing (LT

2014), pages 1–4, Dublin Ireland. ACM Press.

Wang, P., Qi, Y., Hui, D., Rao, L., and Lin, X. (2013).

Present or future: Optimal pricing for spot instances. In

Proc. 33rd Int. Conf. Distributed Computing Systems

(ICDCS 2013), pages 410–419, Philadelphia, USA.

IEEE Computer Society.

Wee, S. (2011). Debunking real-time pricing in Cloud

computing. In Proc. 11th IEEE/ACM Int. Symp.

Cluster, Cloud and Grid Computing (CCGrid 2011),

pages 585–590, Newport Beach, CA, USA. IEEE

Computer Society.

Wescott, B. (2013). Every Computer Performance Book:

How to Avoid and Solve Performance Problems on The

Computers You Work With. CreateSpace Independent

Publishing Platform.

Xu, H. and Li, B. (2013). Dynamic Cloud pricing for

revenue maximization. IEEE Transactions on Cloud

Computing, 1(2):158–171.

Zaman, S. and Grosu, D. (2011). Efficient bidding for

virtual machine instances in Clouds. In Proc. 4th IEEE

Int. Conf. Cloud Computing (CLOUD 2011), pages 41–

48, Washington, DC, USA. IEEE Computer Society.

CLOSER 2016 - 6th International Conference on Cloud Computing and Services Science

58