Mobile Data Service Adoption and Use from a Service Supply

Perspective

An Empirical Investigation

Krassie Petrova, Stephen G. MacDonell and Dave Parry

School of Engineering, Computer and Mathematical Sciences, Auckland University of Technology,

55 Wellesley St. E., Auckland 1010, New Zealand

Keywords: Mobile Services, Mobile Applications, Service Supply, Stakeholder Views, Thematic Analysis.

Abstract: The paper presents the findings of an empirical study of the views of a selection of mobile data service

(MDS) supply chain participants about anticipated MDS customer requirements and expectations, and about

the MDS environment. Applying an inductive thematic analysis approach, the study data are first

represented as a thematic map; the thematic map is then used to formulate propositions that contribute an

MDS supplier perspective to models investigating MDS customer adoption and use.

1 INTRODUCTION AND

BACKGROUND

Mobile data services (MDS) are designed,

developed, provided and consumed within a mobile

service ecosystem in which MDS suppliers and

MDS customers interact and create service value

Becker et al., (2012), (Basole and Karla, 2012;

Dennehy and Sammon, 2015). The MDS ecosystem

has a complex structure. On the one side, it includes

mobile technology providers (e.g., mobile network

operators – MNOs and mobile device vendors), and

MDS developers and providers such as banks

offering mobile banking services, and mobile

application (“app”) developers distributing their

apps through mobile app marketplaces (Petrova and

MacDonell, 2010; Ryu et al., 2014). On the other

side, the MDS ecosystem comprises a highly

heterogeneous customer space, with customer

segments determined by both demographic and

attitudinal factors (Floh et al., 2014).

1.1 MDS Customers

The extant literature is rich in empirical studies of

MDS adoption and use from a customer perspective.

MDS customer decisions to adopt, use , and

continue to use an MDS have been studied

extensively applying existing and well-validated

technology adoption models (Sanakulov and

Karjaluoto, 2015; Ovčjak et al., 2015). However, a

number of more recent studies consider MDS

adoption from a service, rather than from technology

perspective (Thong et al., 2011). The approach is

based on the premise that mobile technology use is

subsumed by MDS use (Becker et al., 2012) as the

technology users conceptualized in traditional

information systems research have become instead

“service consumers” (Tuunanen et al., 2010).

Consequently, customer perceptions about service

value and service quality have been studied as

important factors influencing customer intention to

adopt, use, and continue to use MDS (Kuo et al.,

2009; Tojib and Tsarenko, 2012; Kim et al., 2013).

Perceived service value reflects customer

perceptions regarding the overall utility of a service

based on the customer’s assessment of the perceived

service benefits and disadvantages, and perceived

service-associated “sacrifices” (cost of acquisition)

(Schilke and Wirtz, 2012). Therefore, in order to

ascertain a particular service’s potential to generate

customer demand (leading to actual service use), it is

important to understand what specific value the

different customers of a particular MDS attach to it

(Bouwman et al., 2009).

According to Bina et al. (2007), customers value

mobile services that enhance both the utilitarian and

the hedonistic aspects of the their everyday life style.

However, it is also observed that demographically

different customer groups may have different

preferences with respect to MDS type, content and

86

Petrova, K., MacDonell, S. and Parry, D.

Mobile Data Service Adoption and Use from a Service Supply Perspective - An Empirical Investigation.

DOI: 10.5220/0005966100860097

In Proceedings of the 13th International Joint Conference on e-Business and Telecommunications (ICETE 2016) - Volume 2: ICE-B, pages 86-97

ISBN: 978-989-758-196-0

Copyright

c

2016 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

interface (Lee et al., 2009; Constantiou et al., 2007),

and that the demographic segments are relatively

narrow (Oh et al., 2008).

Service use, in particular, may be also

significantly influenced by perceived service quality.

Akter et al., (2013) define perceived mobile service

quality as an overall judgment about a service’s

“excellence”. Customer perceptions about service

quality (i.e., perceptions about how the service

performs with respect to content, interface,

navigation, and visual appeal) have been found to

influence both perceived service value, and

perceived post-use satisfaction (Kuo et al., 2009).

Overall, throughout the process of MDS

adoption and continued use, customers make

decisions significantly influenced by their

perceptions about service value, and by their

experiences with service performance and quality.

Through actions based on these decisions (i.e.,

considering a service, using it occasionally or

regularly, or discontinuing use) MDS customers

interact with MDS suppliers; MDS customers may

even have an impact on the regulatory environment

through their participation in consumer groups

(Camponovo and Pigneur, 2003).

1.2 MDS Suppliers

There has been limited work to date that considers

MDS adoption and use from an MDS supplier

perspective. The opinions of MDS providers with

respect to MDS success/failure are investigated in

(Carlsson and Walden, 2002; Scornavacca and

McKenzie, 2007). Further examples include service-

specific explorations such as Okazaki’s (2005)’s

study of the perceptions of senior executives about

using mobile technology as an advertising channel,

analyses of merchants’ attitudes towards mPayment

(Mallat and Tuunainen, 2008; Hayashi and

Bradford, 2014), and a study of managers’

perceptions about SMS-based marketing (Li and

McQueen, 2008). A comparative analysis of the

views of MDS suppliers and customers is provided

in Xinyan et al., (2009) and Akesson’s (2007)

investigations of mPayment and mobile media

content provision, respectively.

The reviewed studies indicate that perceptions

about customer needs and behaviour, and

perceptions about the context in which the service is

offered influence MDS supplier decisions about

investment in service development. In addition, the

findings of the last two studies indicate that

customer and service provider opinions and views

with respect to the importance and role of MDS

adoption factors may differ; corroborating results

(from a study of mobile communication services) are

reported in (Abu-El Samen et al., 2013). The

findings form the literature provide support for the

assumption that underpins the research presented

here, namely, that MDS supplier perceptions about

customer demand for MDS influence the MDS

development and provision.

More specifically, it is contended that MDS

supplier perceptions about the targeted customer

group requirements and expectations affect the MDS

value proposition with respect to service

functionality, design, and pricing model, and that

perceived customer demand represents MDS

supplier knowledge and understanding of both

existing and potential customers’ needs for MDS,

their quality of service expectations and daily

lifestyle related requirements, and the relevant

service and regulatory environment.

1.3 Research Aim and Questions

Based on the analyses above it is suggested that a

better understanding of MDS supplier perceptions

about customers may contribute to a better

understanding of supplier–customer interactions in

the MDS ecosystem, including the development of

the MDS value proposition and its acceptance by

customers. The research presented here aims to

propose an MDS supplier perspective on MDS

customer adoption, as supported by the outcomes of

an empirical investigation of the views of MDS

suppliers about customer demand for MDS. Three

specific research questions guide the empirical

investigation:

1. What are MDS supplier views about customer

expectations, requirements, and attitude drivers?;

2. What are MDS supplier views about the value of

customer mobility support features of MDS?

3. What are MDS supplier views about the mobile

service supply and regulatory environments?

As asserted earlier in (Petrova and MacDonell,

2010), an MDS supplier perspective on what

customers need, want, expect, and get from MDS

may complement prior studies that mainly looked at

MDS adoption and use from a customer perspective.

The current study that contributes a set of

propositions that can be used to extend MDS

adoption and use models.

The rest of the paper is organised as follows: the

next section outlines and justifies the research

approach, and describes the data gathering, coding

and analysis processes. Sections 3 and 4 present and

Mobile Data Service Adoption and Use from a Service Supply Perspective - An Empirical Investigation

87

discuss the findings. Section 5 highlights the study

contributions and limitations, and suggests

directions for further research.

2 RESEARCH METHOD

The study aims to achieve an understanding of a

phenomenon (i.e., how MDS supplier perceptions

about customers may influence MDS adoption) from

the view point of the research participants; therefore,

it was considered appropriate to apply a qualitative

investigating approach that followed a “from the

ground up” (Creswell, 2007) logic. As the MDS

supplier space includes different types of

organisations, the adopted research method was

collective case study (Onwuegbuzie and Leech,

2007); because of the exploratory nature of the

investigation the data were analysed inductively

(Patton, 2002). An inductive thematic analysis

process (Braun and Clarke, 2006) was developed;

applied systematically and interactively, it allowed

to identify the patterns and the themes emerging

across the data set. Thematic networks (Attride-

Stirling, 2001) were constructed and used to

organise the emerging themes in a thematic map,

and interpret the findings further.

2.1 Study Setting

The empirical investigation took place during the

period 2010-11 in Bulgaria. At the time of the study

the mobile telecommunications sector included three

MNOs (subscriber penetration rate of 141% -

http://en.wikipedia.org/wiki/List_of_mobile_networ

k_operators_of_Europe).

The MNOs had already started offering MDS

such as mobile payment (mPayment)

(http://paper.standartnews.com/en/article.php?d=200

7-08-02&article=5980) while a number of software

houses had engaged in developing mobile games and

other mobile entertainment applications

(http://gdsbulgaria.com/en/Studios). The regulatory

and legislative infrastructure included the provisions

of the Communications Regulation Commission

(Pook, 2008) and specific pieces of legislation such

as the Law on electronic commerce and the Law of

fund transfers, and electronic payment instruments

and payment systems.

2.2 Research Instrument and Sample

Semi-structured interviews (Myers, 2009) were

adopted as the primary method for data gathering,

chosen because of the need for flexibility while

talking to a diverse range of participants. The

questionnaire was tested in a pilot study; the work of

Tilson et al., (2008) provided a useful reference. The

final version contained five background questions

and 12 knowledge/opinion/value judgment questions

about MDS value proposition, anticipated customer

attitude and MDS acceptance behaviour, and the

service and regulatory environment.

The study participants were recruited from

amongst the employees of companies and

organizations involved in MDS design, development

and provision. To ensure that participants were able

to offer well-informed opinions, the study sought to

recruit individuals with significant expertise who

were both knowledgeable about the area of the

investigation, and were involved in decision making

at their respective place of employment.

A total of 52 individuals matching the profile

above, from 13 organizations, were issued

invitations; eventually, 12 individuals from eight

organizations accepted to be interviewed. Nine

participants were employed by “large” companies

(staff above 250) while three worked for “small”

ones (staff between 50 and 250, applying the

European Union definitions for small and medium

enterprises). It occurred that five participants (MD1-

MD5) were involved predominately in roles related

to software development and MDS design, while the

remaining seven participants (MP1-MP7) were more

closely associated with MDS content development,

provision, and aggregation. The sample size was

deemed adequate for a single case study; it exceeded

significantly the four to five participants

recommended by Creswell (2007) but allowed to

represent the different MDS supplier types.

2.3 Data Coding and Analysis

The interviews were transcribed (six transcripts were

translated from Bulgarian into English) and stored

electronically. The coding started with developing a

set of deductive codes based on the research topic

and applying them in order to gain an initial

understanding of the data. Next the data were

interpreted and coded inductively employing in vivo

coding (Saldaña, 2012). A rigorous iterative coding

protocol was developed and followed in order to

preserve traceable links between data, interpreted

data meanings, and data codes. The coded data were

organised into a multilevel data dictionary.

Ultimately, 413 data meanings were extracted,

interpreted and assigned a code; the code labels and

definitions were kept close to the data meanings.

ICE-B 2016 - International Conference on e-Business

88

Similarly coded data were grouped together under a

“super code”. The final version of the data

dictionary contained data supporting 99 super codes

grouped in five mutually exclusive groups of related

coded meanings (categories): (i) CUSTOMERS

(perceptions about customer space characteristics

including attitudes, behaviours, requirements, and

expectations), (ii) SERVICE SUPPLY & DEMAND

(perceptions about MDS supply space characteristics

including service value and viability), (iii)

TECHNOLOGY (perceptions about technology

opportunities and limitations), (iv) REGULATORY

ENVIRONMENT (perceptions about the regulatory

environment), and (v) UNCERTAINTY (what

participants felt uncertain about).

3 FINDINGS

The coded data were iteratively and systematically

re-examined in order to identify and define an initial

set of emerging themes. The emerging themes were

organised into a thematic map, and the key points

made by the participants were extracted.

3.1 Emerging Themes

The emerging themes were identified through

pattern coding, searching for semantically related

super codes; the super codes were methodically

considered with respect to forming discernible

patterns that may be interpreted as a coherent theme.

The set of semantic relationships (adapted from

Gibson and Brown, 2009) included “Associated

with”, “Aspect of”, “Cause of/Result of”, “Contrast

with”, and “Attribute of”.

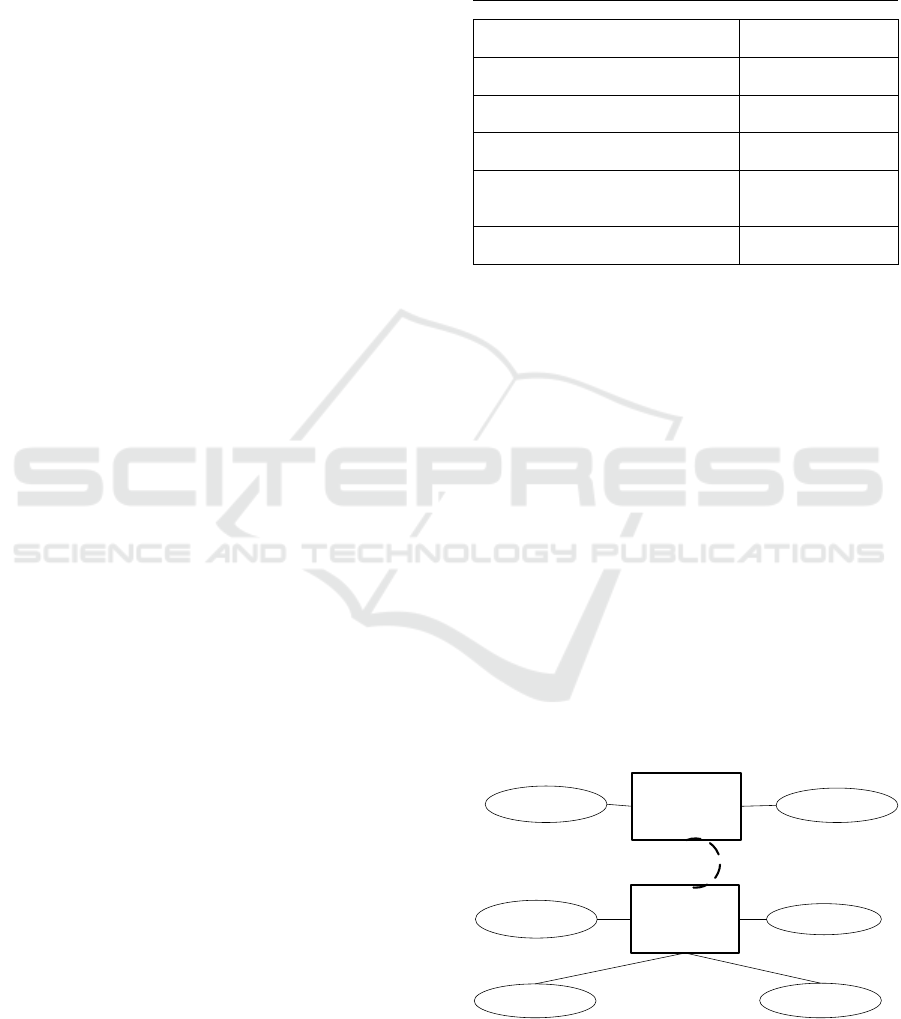

As shown in Table 1 (first column), a total of 13

themes emerged; the themes did not overlap across

the data, as each super code could be associated with

one theme only. Brief theme descriptions are

provided in the Appendix; the labels of the super

code associated with each theme highlight the

theme’s key characteristics.

At the next step of the analysis the data

supporting the emerging themes were searched for

similarities or shared ideas that could be used to

interconnect the themes. Six similarity clusters were

identified and used to define six higher level

“organizing” themes (Table 1, second column).

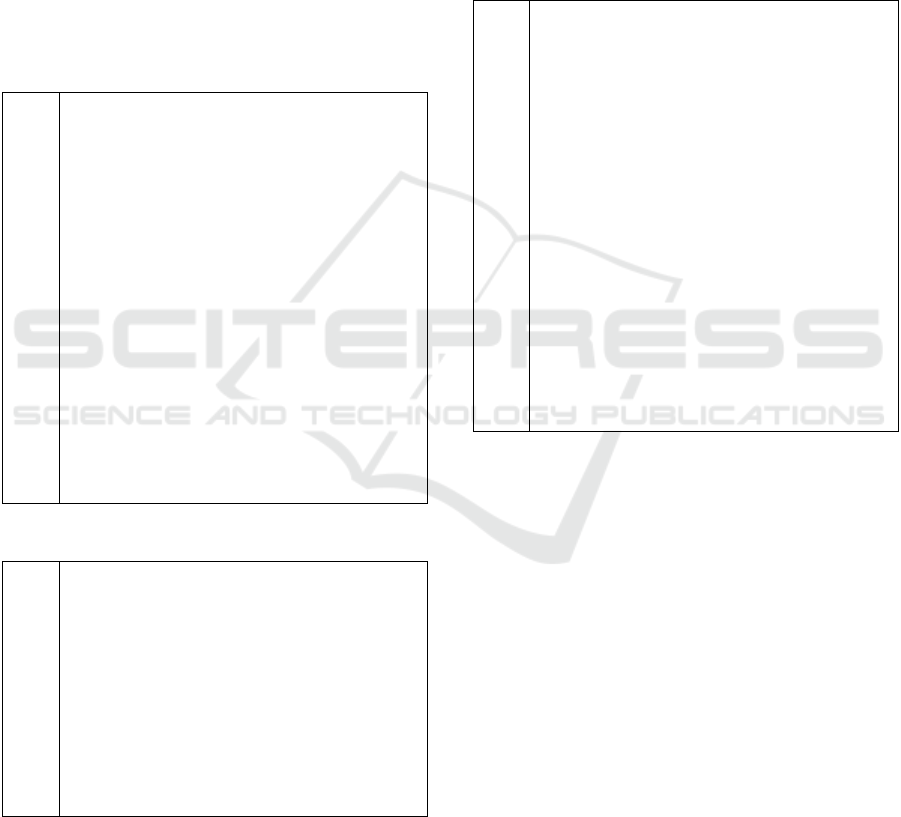

Finally, the supporting data were examined again

in order to determine the top-level theme grouping -

the overarching “global” themes epitomizing the key

points, or main meanings of the data. Figure 1 shows

the overall outcome of the analysis: a thematic map

representing the original data set as two related

thematic networks, each centred on one of the two

global themes described below; the illustrating data

codes are referenced to the cited participants.

Table 1: Emerging and organising themes.

Emerging themes Organizing Themes

Difficult customers;

Customer segmentation

Customers differ

Attractive services;

User friendly services

Customers require

Need for service;

Service value

Customers expect

Personal goals;

Free services

Customers prefer

Optimistic providers;

Service innovation;

Reg. environment opportunistic

Opportunities and

challenges

Operators as a barrier;

Operators threatened

Barriers

3.2 Global Theme “Customers

Demand”

Global theme “Customers demand” pertains to the

characteristics and behaviour of potential and actual

MDS customers as perceived by the study

participants, and the effect of these perceptions on

MDS supply. Organising theme “Customers differ”

(for data quotes, see Table 2) reveals that MDS

suppliers perceive customers as distrustful and

conservative in their attitude, while having a wide

range of different requirements and expectations.

Therefore, the customer market is perceived as very

segmented and hard to satisfy; the situation is

exacerbated by a certain lack of sufficient

understanding of what customers really want. From

an MDS supplier perspective, the mobile service

industry may not be offering the services customers

need, or expect, i.e., there may exist a misalignment

between MDS supply and MDS demand.

Figure 1: Thematic map.

CUSTOMERS

DEMAND

Customers prefer

Customers differ

Customers require Customers expect

SERVICE PROVIDERS

FACE

Opportunities &

challenges

Barriers

Mobile Data Service Adoption and Use from a Service Supply Perspective - An Empirical Investigation

89

Further insights into MDS supplier perceptions

about MDS customer requirements and expectations

are offered by the organising themes “Customers

require”, “Customers expect” and “Customers

prefer” (data quotes related to each theme are

provided in Tables 3, 4 and 5). First, the data

indicate that according to MDS suppliers, customers

would be interested in new services that were not

just innovative but also engaging, easy to access and

use, and well supported. From an MDS supplier

perspective, significant effort is required in order to

overcome the inherent technology limitations and

develop MDS attractive enough to compete with

similar services developed for personal computers.

Table 2: “Customers differ” - data quotes.

MD3

MP1

MD5

MD1

MD3

MD4

“security first…the majority of users don’t easily

rely on innovations”;

“Inertia of older consumers, expressed in fear and

resistance against innovations and

developments”;

“it is difficult to persuade customers to break with

the old routines and influence them towards

adopting new innovative products if the need to do

so is not urgent”;

“Yes, there are [segments] and their expectations

are different”;

“Consumers can be divided into groups of

expectations …some seek security and usability,

other entertainment, facility, etc.”;

“to offer something new and better... not an easy

task…there are no clear criteria exactly what the

market wants… mobile applications are relatively

new, but despite this… the ‘saturation’ effect is

visible”;

“Development of new services is going ahead of

demand”.

Table 3: “Customers require” - data quotes.

MD2

MP5

MD3

MP7

MD4

MP3

“Interesting ideas that would motivate people to

use new development”;

“The service has to be ‘modern’:

“contribute to a richer user experience”;

“user-friendly…easy and fast accessibility and

support 24 hours a day”;

“Developers… are restricted by the limited

resources of the mobile device… so, with much

less options an application has to be developed

that does not defer drastically to those, made for

PCs”;

“Innovations are needed so that the application is

[made] attractive”.

Second, MDS supplier perceive customers as

expecting services of high value and with a clear

value proposition that balances quality and cost.

Perceived customer expectations include well

designed services that meet specific customer needs,

make innovative use of connectivity, offer

compatibility across devices and platforms, provide

privacy protection, and are reasonably priced.

Furthermore, customer judgement is perceived as

influenced by external factors such as peer opinion,

and the [lack] of sufficient knowledge about MDS.

From an MDS supplier perspective, the challenge is

to make sure that customers understand the MDS

value proposition and associate it with a perceived

service need.

Table 4: “Customers expect” - data quotes.

MP2

MP7

MD5

MP3

MP2

MP4

MD1

MP5

“added value… has direct impact on the

customer”;

“Customer attitude is affected [by] does it add

value to the service”; "Internet banking now

works well and customers want it on their mobile

phones”;

“for health apps, customers are …willing to pay

more and price is not such a big issue”;

"…offer connection to any kind of other devices –

TVs, cars to be operated via mobile phone”;

“good mobile software performance”;

“information about the availability of such a

service and how to use it”;

“Compatibility with various OS as Android,

Windows Mobile”;

“safety of the personal information and the user’s

data”;

“price and quality”;

“Can only be convinced by opinions …friends who

have good impressions”; Becoming aware of the

need for a certain service…implied need through

advertisement”.

Specific MDS service characteristics that

(according to MDS suppliers) customers perceive as

adding value to MDS include meeting personal

requirements for convenience and availability (e.g.,

saving time) , being able to choose from a range of

services, and opportunities for customer

involvement. Furthermore, customers are perceived

as preferring functionality over feature overload,

with service availability and high network

performance quality the other top preferences. From

an MDS supplier perspective, the viability of

developing and providing value-adding MDS is

affected by customer attitude towards paying for

MDS. Here, participants differed in their views:

according to some, customers would be willing to

pay for a service they felt was valuable while others

saw customers as not prepared to pay “too much” for

a service anyway.

The uncertainty affects MDS supplier decisions

about how to approach service design and

implementation – to invest significantly in MDS that

satisfy customer requirements and expectations

ICE-B 2016 - International Conference on e-Business

90

about service value, or to offer less valuable, low

cost service versions that are more likely to be

accepted and may help create a critical customer

mass. However, participants expressed reservations

about the acceptance of free MDS: they perceived

potential MDS customers as discerning and likely to

consider a free MDS as one of a lesser value.

Table 5: “Customers prefer” – data quotes.

MD3

MP6

MP2

MP1

“the convenience to be able to do whatever you

want, whenever and wherever you want -

something very important because it saves time”;

“Innovation is very important in this sector; the

customer has the choice how to get something

done”;

“customer to be able to control, monitor and act

pro-actively…the product features and the

product flexibility always prevail vs. the ‘fashion

design’…24/7 service availability and support”;

“Accessibility at any time and from anywhere to

information resources as well as speed in

obtaining information”.

MD5

MP7

MD4

MD2

“What really matters is the value that the mobile

product brings and how desired the solution is”;

“Private users usually are not ready to pay a

considerable price and the cost-value relation is

an especially important part of their motivation

to purchase the product”;

“I firmly believe that a given free product can

give much more profit with its popularity, than a

product that is paid and because of this – less

used/less known”;

“free applications attract the interest of people,

but if they are not well made and sufficiently

functional, as is usually the case with free stuff,

the user would rather not use that application or

would consider buying the paid version, which

will have a much better good maintenance”.

3.3 Global Theme “Service Providers

Face”

In global theme “Service providers face”

participants talk about the dynamics of the MDS

supply sector and the MDS supply environment. The

focal points are the opportunities and challenges in

developing and offering new MDS, the barriers

faced by MDS providers, and the role of MNOs.

According to organizing theme “Opportunities

and challenges” (for data quotes, see Table 6), the

increased affordability of smart phones and the

relatively supportive regulatory environment create

opportunities for MDS development (e.g., services

targeting niche areas of customer needs, services

that complement existing ones). The MDS supply

environment is dynamic and competitive, therefore,

profitability should be considered from a strategic

perspective. Both being innovative and staying

ahead of competitors, and following successful

innovators are viable options, provided that the

service offers a satisfactory customer experience.

However, MDS development faces two major

challenges. The first challenge relates to the still

considerable inherent limitations of the mobile

technology. While these limitations can be overcome

by innovative service design, MDS developers need

a better knowledge of the targeted customer segment

(as discussed in the first global theme) in order to

align the level of service interface sophistication

with the level of customer comfortableness with the

technology. The second challenge is specific to the

case context. The relatively small local market may

not be conducive to developing innovative services

as there exists an uncertainty about service viability

exacerbated by the segmented customer market and

customer attitude towards paid MDS (also discussed

in the first global theme).

Table 6: “Opportunities and challenges” – data quotes.

MD4

MD5

MP3

MP7

MP2

MP7

MP7

MP6

MD4

MP7

“with…smartphones…becoming cheaper, mobile

technologies will get more attractive”;

“the regulatory environment is relatively

supportive, except for … private data abuse in

terms of location based services and private

person location information”;

“a forthcoming boom …is to be expected”;

“it is often easy for the developers of a mobile

application to fill a ‘niche’ in the market”;

“[good] user experience always brings more

benefit and affects the customer’s satisfaction”;

“where a product is similar to other offered by

other providers, its competitiveness requires

more added value and more specific and

eloquent advantages”;

“In Bulgaria our mobile service is among the

first ones which makes it especially valuable for

customers”;

“as companies are striving to be the best, they

develop services not orientated mainly towards

…profit, but … important for the image”;

“Having in mind the limitations of mobile

devices [that…still do exist], it is important to

know who exactly the users… will be…the

…service has to be in precise conformity with

their technical knowledge and potentialities”;

“The Bulgarian mobile market is small in

comparison to bigger countries with a larger

number of users… new solutions are offered

relatively late here”.

According to organizing theme “Barriers” (for

data quotes, see Table 7), mobile operators are not

too interested in providing and/or supporting MDS

and prefer to focus instead on their traditional

services. The still relatively high mobile data cost

represents a significant barrier to MDS development

Mobile Data Service Adoption and Use from a Service Supply Perspective - An Empirical Investigation

91

and provision as it affects negatively MDS customer

adoption and MDS viability. However, the

environment is becoming more competitive; fearing

revenue loss, MNOs may become more interested in

MDS development and provision.

From a MNO’s point of view mobile operators

should sustain their leadership role in the MDS

supply sector; an inherent impediment to the

implementation of innovative ideas is the lack the

flexibility caused by organizational complexity and

slow internal processes This increases the risk

associated with MNOs involvement in MDS

development and provision.

Table 7: “Barriers” – data quotes.

MD4

MD5

MP2

MP4

MP7

“Operators are rather in the way of mobile

applications distribution… internet traffic has the

lowest priority in mobile devices in comparison with

telephony… Who would want an application that

would work only if it had free resources not used for

telephony…Mobile internet prices…are making the

use of applications expensive and thus

unattractive…the investment in mobile applications

is still not very profitable”;

“The highest profit is made by standard

services…because of competition prices are falling

down and the operator has to be innovative and

constantly work on its services”;

“facing the treat to lose the customers loyalty and

become only the transport link to the end-user

services…the telecom operators should have the

leading role having in mind that the connectivity is

important” ;

“new services may be useful as well as a threat and

that is why they need to have a role in these

services”;

“The time needed for planning and designing a

mobile application is too long…the service is no

longer attractive or needed in the time of its

launching … there are other similar services”.

4 DISCUSSION

The findings of the data analysis highlight the key

points made by participants. We explore them

further by addressing the research questions and

developing propositions for a follow up empirical

investigation of MDS adoption and use. With

respect to positioning the propositions within the

extant literature on MDS customer adoption and use

we refer both to empirical work, and to work that

critically reviews prior results. As already mentioned

the literature on MDS supplier perceptions with

respect to MDS adoption is scarce; therefore, we

compare our findings to the outcomes of Shieh et

al.’s (2014) investigation. Shieh et al. examined the

relevant literature, extracted a range of factors found

to be affecting MDS customer adoption, and asked a

group of mobile telecommunication experts,

knowledgeable about MDS, to rank the factors

according to their perceived importance; the authors

report on factors ranked from one (most important)

to ten only.

The key points made in first global theme allow

to address explicitly the first two research questions

(i.e., MDS supplier views about customer

expectations, requirements, and attitude drivers, and

about the value of customer mobility support

features of MDS). Overall the data suggest that

according to MDS suppliers, customer attitude

towards MDS adoption and use is driven by

perceptions of service value, based on customers’

considerations about how much they need a

particular service, and how well the service is

expected to perform (or has performed).

In prior empirical research about customer

adoption of MDS perceived value is considered as

directly influencing customer intention to use and

actual use of MDS. Two dimensions - mobility

support and mobile technology performance related

features are identified in (Johansson and Andersson,

2015) and in (Al-Debei and Al-Lozi, 2014; Ervasti,

2013), respectively.

Our data indicate that customers are perceived as

not differentiating between the technologies used

rather considering mobile services as a specific new

type of online (Internet) services. Furthermore,

customers are perceived as evaluating the service

proposition according to their needs; while they

would expect services to take advantage of

innovative features such as anywhere/any time

access customers assess services primarily with

respect to meeting their specific requirements and

personal goals. These findings are similar to Shieh et

al., (2014) – in their study the factors related to

mobility support (“service accessibility” and “real-

timeliness”) are at the bottom of the ranking table (in

8

th

and 9

th

position, respectively).

While perceived service need varies with

individuals’ lifestyles, and also according to the

characteristics of specific customer market

segments, the dimensions of perceived service

quality are more uniform and include service

delivery quality (i.e., service availability and

support), and service performance quality (i. e.,

service functionality and service design, including

the user-friendliness of the interface). Partial

corroboration of these findings can be found in

(Shieh et al., 2014) where “network coverage”, and

“comprehensive customer service” are ranked 6

th

,

and 4

th

, respectively. However the constructs service

ICE-B 2016 - International Conference on e-Business

92

design and service functionality are not explicitly

included in the models reviewed.

We formulate the following propositions that

reflect MDS supplier views on customer attitudes

and expectations with respect to service value:

P1: Perceived service value influences positively

attitude towards MDS adoption.

P1.1: Perceived service need influences

positively perceived service value.

P1.2: Perceived mobility support influences

positively perceived service need.

Empirical research about customer adoption and

use of MDS also includes system quality (related to

performance quality) as an indirect factor

influencing (Ovčjak et al., 2015). In (Shieh et al.,

2014) two related factors – signal quality and

transmission speed, are ranked 2

nd

and 7

th

,

respectively. We formulate the following

propositions that reflect MDS supplier views with

respect to service quality:

P2.1: Perceived service delivery quality

influences positively perceived service value.

P2.2: Perceived service performance quality

influences positively service value.

It was shown that two opposing views emerge

with respect to customer acceptance of service cost:

according to some, customers would be prepared to

accept the service cost if the service meets their

expectations and requirements while according to

others, customers will always prefer a low cost/free

service to a paid one regardless of the perceived

value. Furthermore, in the case of MDS that

compete with similar services offered through other

channels, customers have a choice, and may prefer a

non-mobile version of the service based on cost

comparison.

Extant research has been inconclusive about the

role of perceived cost in MDS adoption and use. For

example, perceived cost is not explicitly included in

the model proposed by Troshani and Hill (2008)

which is based on a synthesis of prior research; in

the review by Sanakulov and Karjaluoto (2015),

while perceived cost is not found to influence MDS

adoption and use in mobile banking and mobile

learning studies, it is found to affect MDS adoption

and use in studies that do not focus on particular

services. Furthermore, in (Ovčjak et al., 2015)

perceived cost is part of the proposed conceptual

model for the adoption of mobile information

services but is not a factor in the mobile

entertainment, and mobile transaction conceptual

adoption models. However, the participants in

(Shieh et al., 2014) consider cost important

(“handset prices and transmission fees” are ranked

4

th

).We formulate the following propositions that

reflect MDS supplier views on customer attitude

towards MDS cost:

P3.1: Perceived service cost influences perceived

service value.

P3.2: Perceived service cost influences attitude

towards MDS adoption.

Global theme “Service providers face” provides

insights into the third research question (i.e., MDS

supplier views about the mobile service supply and

regulatory environment). We look at how MDS

supplier views about the service and regulatory

environment relate to the propositions developed

earlier, and allow to formulate new propositions.

First, participants are well aware of the

complexity of the customer market and the need to

deal with the high customer expectations but are

somewhat uncertain about what customers really

want. However participants are relatively optimistic

about the future of MDS seeing it as driven by rapid

technological progress that generates need for new

services. These views provide support for

proposition P1.1 developed earlier.

Second, an MDS supply environment related

factor affecting MDS adoption is the high network

access cost (supporting propositions P3.1.and P3.2).

Mobile technology limitations also play a role as

they make it difficult to achieve service design

comparable (in terms of design quality) with other

online services (supporting proposition P2.2).

Third, participants consider MDS viable in the

long term and see market opportunities such as

developing very specialized services (supporting

proposition P1) and taking advantage of innovative

technology opportunities to distribute services and

reach the target customer market (supporting

proposition P2.1).

Furthermore, participants identify offering an

innovative service ahead of other competitors as an

opportunity to develop a financially viable service.

While customers’ personal attitude towards

innovation is considered in empirical work, e.g., in

mobile banking adoption studies (Shaikh and

Karjaluoto, 2015); similarly personal innovativeness

is included in the conceptual model for mobile

transaction services adoption in (Ovčjak et al.,

2015), but not in their mobile information and

mobile entertainment conceptual adoption models.

We formulate the following proposition reflecting

MDS supplier views about the role of innovation as

a service design characteristic:

P2.3: Innovative service design and functionality

influences perceived service need.

Mobile Data Service Adoption and Use from a Service Supply Perspective - An Empirical Investigation

93

Finally, mobile network operators are seen as

reluctant to support MDS; the implications related to

perceived quality of service delivery are captured by

proposition P2.2. The regulatory environment is

seen as mature (with some applicable legislation

already in place), and relatively supportive, or at

least not presenting any significant obstacles to

MDS development and deployment. It may be

inferred that according to participants there is no

need for any specific further development in the

regulatory environment space.

The propositions developed above contribute

towards the development of an MDS customer

adoption model that takes into account the views of

MDS suppliers. The introduction of a new variable

(service need). in proposition P1, and service

specific variables (service delivery quality as

determined by perceived service availability and

support, and service performance quality as

determined by perceived service design and

functionality in propositions P2.1 and P2.2,

respectively) is in line with suggestions that there is

a need for new constructs and relationships when

studying the adoption and use of advanced

technologies (Sanakulov and Karjaluoto, 2015).

Propositions P2.1 and P2.2 can be considered as

a specific instance of the relationship between

quality and value as synthesised in (Cronin et al.,

2000); proposition P2.3 refers to service

innovativeness as a catalyst to service adoption

through its influence on perceived service need and

is, therefore, a facilitating condition (Rao and

Troshani, 2007). Last, the dual approach to

considering perceived service cost as both a value

forming factor (proposition P3.1), and an attitude

driver (proposition P3.2), may lead to a better

explanation of its role specifically with respect to

MDS adoption.

5 CONCLUSIONS

In this paper we present the findings of an empirical

study that looks at MDS provision and adoption

from the view point MDS suppliers, based on a

single case study. The study contributes to the

understanding of how MDS supply stakeholders

develop the related service value proposition – a

direction for further research suggested by Shaikh

and Karjaluoto (2015). More specifically, this study

develops propositions that may add an MDS supply

perspective to existing MDS customer adoption and

use models by considering customer perceived

service need, and delivery and performance quality

as major drivers of customer perceived service

value.

With respect to practical implications, the

findings of the study imply that MDS need to be

developed with one or more specific customer

segments’ existing or potential needs in mind, and

with focus on overall service performance, customer

experience, and customer engagement. Second,

MDS suppliers should seek partnerships and

collaborations with infrastructure providers (e.g.,

MNOs) in order to develop more affordable

services, and increase customer service awareness.

The study has two major limitations. First,

empirical data were collected in 2010; however there

is evidence to suggest that the context of the study

has not changed significantly compared to 2010

(e.g., Kraleva et al., 2016, Otuzbirov and Aleksiev,

2015); therefore, the findings may still be relevant.

Second, the study is set in a specific country context,

and draws inferences from the interpretation and

inductive analysis of qualitative data; therefore,

extending the findings to other contexts and further

theory building may need conducting similar

investigations in different settings, based on the

same theoretical assumptions and applying the

methodology developed and tested, including the

data coding scheme.

Other directions for further research include

empirically validating the propositions, studying

factors that influence MDS supplier perceptions, and

investigating how MDS suppliers may see customers

as participants in the process of innovative service

value co-creation, for example, adapting the

consumer value co-creation framework proposed in

(Tuunanen et al., 2010). Finally, it would be of

interest to investigate how the prevailing MDS

business models facilitate the development of an

acceptable MDS value proposition, by integrating

the findings of this study with existing frameworks

e.g., Sharma and Gutiérrez’s (2010) mobile

commerce business model evaluation framework.

REFERENCES

Abu-El Samen, A. A., Akroush, M. N., Abu-Lail, B. N.,

2013. Mobile Servqual: A Comparative Analysis of

Customers' and Managers' Perceptions. International

Journal of Quality, Reliability Management. 30 (4).

P.403-425.

Akesson, M., 2007. Value Proposition in M-Commerce:

Exploring Service Provider and User Perceptions. In

GMR'07, 6th Annual Global Mobility Roundtable.

Akter, S., D’ambra, J.,Ray, P., 2013. Development and

Validation of an Instrument to Measure User

ICE-B 2016 - International Conference on e-Business

94

Perceived Service Quality of Mhealth. Information,

Management. 50 (4). P.181-195.

Al-Debei, M. M., Al-Lozi, E., 2014. Explaining and

Predicting the Adoption Intention of Mobile Data

Services: A Value-Based Approach. Computers in

Human Behavior. 35. P.326-338.

Attride-Stirling, J., 2001. Thematic Networks: An

Analytic Tool for Qualitative Research. Qualitative

Research. 1 (3). P.385-405.

Basole, R. C., Karla, J., 2012. Value Transformation in the

Mobile Service Ecosystem: A Study of App Store

Emergence and Growth. Service Science. 4 (1). P.24-

41.

Becker, A., Mladenow, A., Kryvinska, N., Strauss, C.,

2012. Aggregated Survey Of Sustainable Business

Models For Agile Mobile Service Delivery Platforms.

Journal of Service Science Research. 4 (1). P.97-121.

Bina, M., Karaiskos, D., Giaglis, G. M., 2007. Factors

Affecting Actual Usage Patterns of Mobile Data

Services. In GMR'07, 6th Global Mobility Roundtable.

Bouwman, H., Carlsson, C., Walden, P., Molina-Castillo,

F., 2009. Reconsidering the Actual and Future Use of

Mobile Services. Information Systems and e-Business

Management. 7 (3). P.301-317.

Braun, V., Clarke, V., 2006. Using Thematic Analysis in

Psychology. Qualitative Research in Psychology. 3

(2). P.77-101.

Camponovo, G., Pigneur, Y., 2003. Business Model

Analysis Applied To Mobile Business. In Iceis'03, 5th

International Conference on Enterprise Information

Systems. P.173-183. Scitepress.

Carlsson, C., Walden, P., 2002. Mobile Commerce: A

Summary of Quests for Value-Added Products and

Services. In Bled'02, 15th Bled Electronic Commerce

Conference.

Constantiou, I. D., Damsgaard, J., Knutsen, L., 2007. The

Four Incremental Steps toward Advanced Mobile

Service Adoption: Exploring Mobile Device User

Adoption Patterns and Market Segmentation.

Communications of the ACM. 50 (6). P.51-55.

Creswell, J. W., 2007. Qualitative Inquiry and Research

Method: Choosing Among Five Approaches, Sage.

Thousand Oaks, Ca.

Cronin, J. J., Brady, M. K., Hult, G. T. M., 2000.

Assessing the Effects of Quality, Value, and Customer

Satisfaction on Consumer Behavioral Intentions in

Service Environments. Journal of Retailing.

76. P.93-

218.

Dennehy, D., Sammon, D., 2015. Trends in Mobile

Payments Research: A Literature Review. Journal of

Innovation Management. 3 (1). P.49-61.

Ervasti, M., 2013. Understanding and Predicting Customer

Behaviour: Framework of Value Dimensions in

Mobile Services. Journal of Customer Behaviour, 12

(2-3). P.135-158.

Floh, A., Zauner, A., Koller, M., Rusch, T., 2014.

Customer Segmentation Using Unobserved

Heterogeneity in the Perceived-Value–Loyalty–

Intentions Link. Journal of Business Research 67.

P.974-982.

Gibson, W., Brown, A., 2009. Working With Qualitative

Data, Sage. Thousand Oaks, Ca.

Hayashi, F., Bradford, T., 2014. Mobile Payments:

Merchants’ Perspectives. Economic Review (Federal

Reserve Bank of Kansas City). 99 (2). P.33-55.

Johansson, D., Andersson, K., 2015. Mobile E-Services

State of the Art and Focus Areas for Research.

International Journal of E-Services and Mobile

Applications. 7 (2). P.1-24.

Kim, Y. H., Kim, D. J., Wachter, K., 2013. A Study of

Mobile User Engagement (Moen): Engagement

Motivations, Perceived Value, Satisfaction, and

Continued Engagement Intention. Decision Support

Systems. 56. P.361-370.

Kraleva, R., Stoimenovski, A., Kostadinova, D., Kralev,

V., 2016. Investigating the Opportunities of Using

Mobile Learning by Young Children in Bulgaria.

International Journal of Computer Science and

Information Security. 14 (4). P.51-55.

Kuo, Y.-F., Yen, S.-N., Wu, C.-M., Deng, W.-J., 2009.

The Relationships among Service Quality, Perceived

Value, Customer Satisfaction, and Post-Purchased

Intention in Mobile Value-Added Services. Computers

in Human Behaviour, 25 (4), P.887-896.

Lee, S., Shin, B., Lee, H. G., 2009. Understanding Post-

Adoption Usage of Mobile Data Services: The Role of

Supplier-Side Variables. Journal of the Association of

Information Systems. 10. P.860-888.

Li, W., Mcqueen, R. J., 2008. Barriers to Mobile

Commerce Adoption: An Analysis Framework for a

Country-Level Perspective. International Journal of

Mobile Communications. 6 (2). P.231 - 257.

Mallat, N., Tuunainen, V. K., 2008. Exploring Merchant

Adoption of Mobile Payment Systems: An Empirical

Study. E-Service Journal. 6 (2). P.24-57.

Myers, M. D., 2009. Qualitative Research in Business,

Management, Sage. London.

Oh, S., Yang, S., Kurnia, S., Lee, H., 2008. The

Characteristics of Mobile Data Service Users in

Australia. International Journal of Mobile

Communications. 6 (2). P.217-230.

Okazaki, S., 2005. Mobile Advertising Adoption by

Multinationals: Senior Executives' Initial Responses.

Internet Research. 15. P.160-180.

Onwuegbuzie, A. L., Leech, N. L., 2007. Sampling

Designs in Qualitative Research: Making the

Sampling Process More Public. The Qualitative

Report 12 (2). P.238-254.

Otuzbirov, R., Aleksiev, G., 2015. Competitive Market

Opportunities for Telecommunication Services in

Bulgaria. Trakia Journal of Sciences. 13 (1). P.301-305.

Ovčjak, B., Heričko, M., Polančič, G., 2015. Factors

Impacting the Acceptance of Mobile Data Services –

A Systematic Literature Review. Computers in Human

Behavior. 53. P.24-47.

Patton, M. Q,. 2002. Qualitative Research, Evaluation

Methods, Sage. Thousand Oaks, Ca.

Petrova, K., Macdonell, S. G., 2010. Mobile Services and

Applications: Towards A Balanced Adoption Model.

In Mauri, J. M., Balandin, S. (Eds.), Mobicom'10, 4th

Mobile Data Service Adoption and Use from a Service Supply Perspective - An Empirical Investigation

95

International Conference on Mobile Ubiquitous

Computing, Systems, Services and Technologies.

Pook, L. A., 2008. Evaluation of the Information and

Communications Infrastructures of Bulgaria and

Romania Following their Accession to the EU.

Journal of East-West Business. 14 (2). P.147-157.

Rao, S., Troshani, I., 2007. A Conceptual Framework and

Propositions for the Acceptance of Mobile Services.

Journal of Theoretical and Applied Electronic

Commerce Research. 2. P.61-73.

Ryu, M. H., Kim, J., Kim, S., 2014. Factors Affecting

Application Developers’ Loyalty to Mobile Platforms.

Computers in Human Behavior. 40. P.78-85.

Saldaña, J., 2012. The Coding Manual for Qualitative

Researchers, Sage. Thousand Oaks, Ca.

Sanakulov, N., Karjaluoto, H., 2015. Consumer Adoption

of Mobile Technologies: A Literature Review.

International Journal of Mobile Communications. 13

(3). P.244-275.

Schilke, O., Wirtz, B., 2012. Consumer Acceptance of

Service Bundles: An Empirical Investigation in the

Context Of Broadband Triple Play. Information,

Management. 49 (2). P.81-88.

Scornavacca, E., Mckenzie, J., 2007. Unveiling Managers'

Perceptions Of The Critical Success Factors for Sms

Based Campaigns. International Journal of Mobile

Communications. 5 (4). P.445-456.

Shaikh, A. A., Karjaluoto, H., 2015. Mobile Banking

Adoption: A Literature Review. Telematics and

Informatics 32 (1), P.129-142.

Sharma, S., Gutiérrez, J. A., 2010. An Evaluation

Framework for Viable Business Models for M-

Commerce in the Information Technology Sector.

Electronic Markets. 20. P.33-52.

Shieh, L.-F., Chang, T.-H., Fu, H.-P., Lin, S.-W., Chen, Y.-

Y. 2014. Analyzing the Factors that Affect the

Adoption of Mobile Services In Taiwan. Technological

Forecasting and Social Change. 87. P.80-88.

Thong, J. Y. L., Venkatesh, V., Xu, X., Hong, S.-J., Tam,

K.-Y., 2011. Consumer Acceptance of Personal

Information and Communication Technology

Services. IEEE Transactions of Engineering

Management. 58 (4). P.613-625.

Tilson, D., Lyytinen, K., Sorensen, C., Liebenau, J., 2008.

Coordination of Technology and Diverse

Organizational Actors during Service Innovation - The

Case of Wireless Data Services in the United

Kingdom. In GMR'08, 7th Annual Global Mobility

Roundtable. Acm.

Tojib, D., Tsarenko, Y., 2012. Post-Adoption Modeling of

Advanced Mobile Service Use.

Journal of Business

Research. 65 (7). P.922-928.

Troshani, I., Hill, S. R., 2008. A Proposed Framework for

Mobile Services Adoption: A Review of Existing

Theories, Extensions, and Future Research Directions.

In Karmakar, G., Dooley, L. S. (Eds.) Mobile

Multimedia Communications: Concepts, Applications

and Challenges, Igi Global. Hershey, Pa.

Tuunanen, T., Myers, M. D., Cassab, H., 2010. A

Conceptual Framework for Consumer Information

Systems Development. Pacific Asia Journal of the

Association for Information Systems. 2 (1). P.47-66.

Xinyan, Z., Wei, G., Tingjie, L., 2009. Study On

Consumer Demands and Merchant Participation

Motives of Mobile Payment Services in China. In

ICIS'09, 2nd International Conference on Interaction

Sciences. Acm.

APPENDIX

Emerging Themes

“Difficult customers”

Customers difficult to satisfy, conservative.

Customer market difficult; Customers

conservative/inertia; Customers distrustful of innovation;

Customers distrustful of phones; Customers prefer well

known services; Segmentation by age – young customers;

Segmentation by attitude to innovation; Expectations

about quality high; Expectations difficult to meet;

Expectations for choice of services; Service to surpass

existing ones; Services not different from existing ones;

Lack of knowledge about customers.

Customer segmentation

Customer market very segmented

Segmentation by specificity of requirements;

Segmentation by age; Segmentation by self-efficacy;

Segmentation by socio-economic status; Segmentation is

multidimensional; Customers do not mix entertainment

and serious business; Decision influenced by cost – not;

Decision influenced by cost; Narrow customer base.

Attractive services

Appealing design and innovative features attract

customers

Expectations for appealing service design; Expectations

for rich experience; Services that are attractive to

customers; Free trial increases popularity; Free services

attractive if modelled on successful paid ones; Paid

services less attractive; Customer motivation needed to

stimulate development.

Free services

Free services draw customer attention

Decision influenced by cost ongoing; Decision influenced

by service affordability; Expectations for low service

cost; Free services valued; Low cost service valued; Free

services not reliable; High service cost due to high data

cost; Free services profitable if very popular; Service

with some free functions may be successful; Cheap

applications already available.

Need for service

Services are viable if customers see them as meeting their

specific needs

Decision influenced by how much a service is needed;

Decision influenced by marketing; Service needs to be

meeting a need; Service not useful; Service not meeting a

need not valued; Attractive use scenarios exist.

ICE-B 2016 - International Conference on e-Business

96

Emerging Themes (cont.)

User friendly services

Customers require services to be ‘friendly

Customers require services to be friendly; Decision

influenced by ease of use; Service needs to be easy to use;

Usability valued.

Personal goals

Customers choose services based on personal goals

Service needs to focus on personal mobility; Service

needs to meet personal goals; Service saturation;

Anytime/anywhere services valued; Customer

empowerment; Services matching personal lifestyle

valued.

Service value

Customers look for service value

Decision influenced by added value; Decision influenced

by comparison; Decision influenced by compatibility;

Decision influenced by cost-effectiveness; Decision

influenced by service quality; Decision influenced by

social norm. Expectations for high service performance;

Expectations for service value; Expectations for support;

Service needs to be convenient; Connection with other

devices valued; Paid services with support valued;

Security fears.

Optimistic providers

Service providers believe in the future of mobiles services

Current use; Need for entertainment services; Changing

market; Competition; Environment; First on the market;

User experience; Viability potential; Successful models

exist.

Service innovation

Mobile technology offers potential that can be captured

through innovative approaches

Limitations due to device design; Technology not

available yet; Technology limits architecture; Service

needs to be technologically implementable; Potential

opportunities; Opportunities offered by device design;

Opportunities to distribute services; Opportunities to

support customers; Uncertainty about technology

Regulatory environment opportunistic

Regulatory environment not restrictive, offers

opportunities

Regulations exist that are also applicable; No regulations;

Regulation needed – some; Regulatory environment - lack

of awareness; Regulatory environment supportive;

Regulatory environment moderately supportive;

Regulatory environment changing.

Operators as a barrier

Mobile network operators act as a barrier to mobile

service development

Operators as a barrier to service; High investment cost;

Lack of operator support for development; Low quality of

service due to lack of operator support.

Operators threatened

Mobile network operators are facing a threat

Loosing competitive advantage; [Other] Players;

Uncertainty about MNOs.

Mobile Data Service Adoption and Use from a Service Supply Perspective - An Empirical Investigation

97