Risk Early-Warning Model of High-Tech Entrepreneurial Enterprise

Based on BP Neural Network

Xiaofeng Li

1

, Wang Tian

1

and Ke Wu

2

1

Department of Management science, School of Business, Sichuan University, Chengdu 610064, P.R. China

2

Department of enterprise management, School of Business, Sichuan University, Chengdu 610064, P.R. China

{f_author, t_author}lixiaofeng@scu.edu.cn

Keywords: High-tech, Entrepreneurial enterprise, BP Neural network, Risk early warning.

Abstract: Entrepreneurship is a high-risk activity. In the entrepreneurial process, it may cause a significant loss or

even bankruptcy for entrepreneurial enterprise if entrepreneurial enterprise cannot prevent and control risk

effectively. Therefore, it is very necessary to use scientific and effective methods to estimate and control the

early risk of entrepreneurial enterprise. In this paper, the index system of the risk early warning of high-tech

entrepreneurial enterprise was built. Then based on artificial neural network theory, the BP neural network

model of high-tech entrepreneurial enterprise’s risk early warning was established, and the relevant

algorithm was proposed too. With good ability of fault-tolerance and adaptability, this model avoids the

subjectivity of the man-made interference in the course of risk early warning, which provides a new

approach for the risk early warning of high-tech entrepreneurial enterprise. The result of empirical research

indicates that the risk early warning model of high-tech entrepreneurial enterprise based on BP neural

network is strongly scientific, practical and effective, thus it is worthy being popularized and applied.

1 INTRODUCTION

With the development of society and technology,

people are paying more attention to the technology

content of the products, and more and more

scientists and technicians start their businesses on

high-tech projects. However, high-tech

entrepreneurship is an activity of high risk for the

entrepreneurs. The uncertainty of external

environment, the difficulty and complexity of the

project and the limitation of the entrepreneurs’

ability could possibly lead to a delay, a halt or a

failure. According to some references in the United

States, entrepreneurial success rate is less than 25%,

while high-tech entrepreneurial success rate is less

than 10% (Motiar Rahman, Kumaraswamy, 2003).

So, it is very necessary to build an efficient risk

early warning system of high-tech entrepreneurial

enterprise for the management of entrepreneurial

risk.

At present, entrepreneurship risk management

has attracted more and more scholars' attention.

Consequently, some achievements have been

obtained (Zhongrui Wang, Shaojun Ma, Yitian Xu,

2003; Yuhua Li, Hongwen Lang, 2004; Pena I,

2002; Shimizu, Katsuhiko, 2012). In those papers,

the risk early warning model of entrepreneurial

enterprise is built mainly by Fuzzy Evaluation

Method, ANN(Artificial Neural Network),

Multivariate Statistical Analysis and Zeta Model.

These methods need to rely on historical samples

and expert experience, the learning of early warning

knowledge is indirect and inefficient. Besides,

dynamic early warning capability is Inadequate. As

a result, the predictions are not perfect enough. So, it

is necessary to apply other technologies and analysis

methods to research the risk early warning of

entrepreneurial enterprise. Using the method of

ANN (Artificial Neural Network), this paper

establishes the BP neural network model of high-

tech entrepreneurial enterprise’s risk early warning.

The empirical research indicates that this model has

adaptive ability, learning ability and capability of

dealing with non-linear problems, which provides a

new approach for the risk early warning of

entrepreneurship.

The paper is organized as follows. In section 2,

the index system of the risk early warning of high-

tech entrepreneurial enterprise is built. In section 3,

the traditional BP artificial neural network is

introduced. In section 4, based on artificial neural

network theory, the BP neural network model of

13

Wu K., Tian W. and Li X.

Risk Early-Warning Model of High-Tech Entrepreneurial Enterprise based on BP Neural Network.

DOI: 10.5220/0006442900130018

In ISME 2016 - Information Science and Management Engineering IV (ISME 2016), pages 13-18

ISBN: 978-989-758-208-0

Copyright

c

2016 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

13

high-tech entrepreneurial enterprise’s risk early

warning is established. As an application of model,

we discuss a consumption level forecast problem in

section 5. Some concluding remarks are finally

given in section 6.

2 THE RISK EARLY WARNING

INDEX SYSTEM

High-tech entrepreneurial enterprise refers to new-

born enterprises engaged in the research and

development of the advanced technologies,

producing high-tech products and representing the

direction of future industrial development. High-tech

entrepreneurial enterprise is characterized by high

investment, high risk and high yields (Zhi Zhuo,

2006). Risk early warning of high-tech

entrepreneurial enterprise is to research on the

important indexes that reflect the operations of the

entrepreneurial enterprise by applying certain

methods and obtain the actual risk profile. To

achieve this, a risk early warning index system of

entrepreneurial enterprise is required in the first

place. There are many factors that influence normal

operation of the high-tech entrepreneurial enterprise

and the relations among the factors are complex. So,

the following principles should be followed:

(1) Comprehensive principle. The index system

should have a wide coverage and be able to

completely reflect the practical results and existing

problems of the risk early warning management.

(2) Sensitive principle. The index system is

required to reflect the risk precisely and sensitively

and embody the true state of the enterprise’s

operation in time.

(3) General principle. High-tech entrepreneurial

enterprise has different types of risk in different

growth periods, so the index system must have high

ability of generalization and be able to reflect the

most essential features.

(4) Measurable Principle. The index system is

required to be represented by precise and

quantitative numerical values which derive not only

from empirical research but also from expert

evaluation.

(5) Irrelevant principle. Cut down the relevant

relations and overlapping area between the indexes

as far as possible and reduce the correlation to a

minimum.

According to the principles above, the factors

that influence the normal operation of the enterprise

are classified into several parts that form the frame

of the index system. By sending questionnaires,

interviewing experts and referring to some literature

at home and abroad (Yanping Yang, 2005; Qun Xie,

Xiaozhe Yuan, 2006; Rennan. M, Schwartz .E,

2006; Fengchao Liu, Yuandi Wang, 2004), the

frame is subdivided, supplemented and deleted in

detail. Finally, the index system is built, as is shown

in table 1.

Table 1: The risk early-warning index system of High-

Tech entrepreneurial enterprise.

First-class index

Second-class index

environmental risk

industrial policy

legal environment

industrial status

technical risk

technical advancement

technical reliability

technical substitutability

ability of research and

development

market risk

market demand

market share

sales growth

competitor capability

barriers to entry

financial risk

fund-raising ability

sales profit rate

internal rate of return

financial management

capacity

human resources risk

employee overall quality

employee turnover rate

core Taff Turnover

possibility

management risk

management capability of

entrepreneurial team

stability of entrepreneurial

team

social resources of

entrepreneurial team

ISME 2016 - Information Science and Management Engineering IV

14

ISME 2016 - International Conference on Information System and Management Engineering

14

3 BP NEURAL NETWORK

ARCHITECTURE AND

ALGORITHM

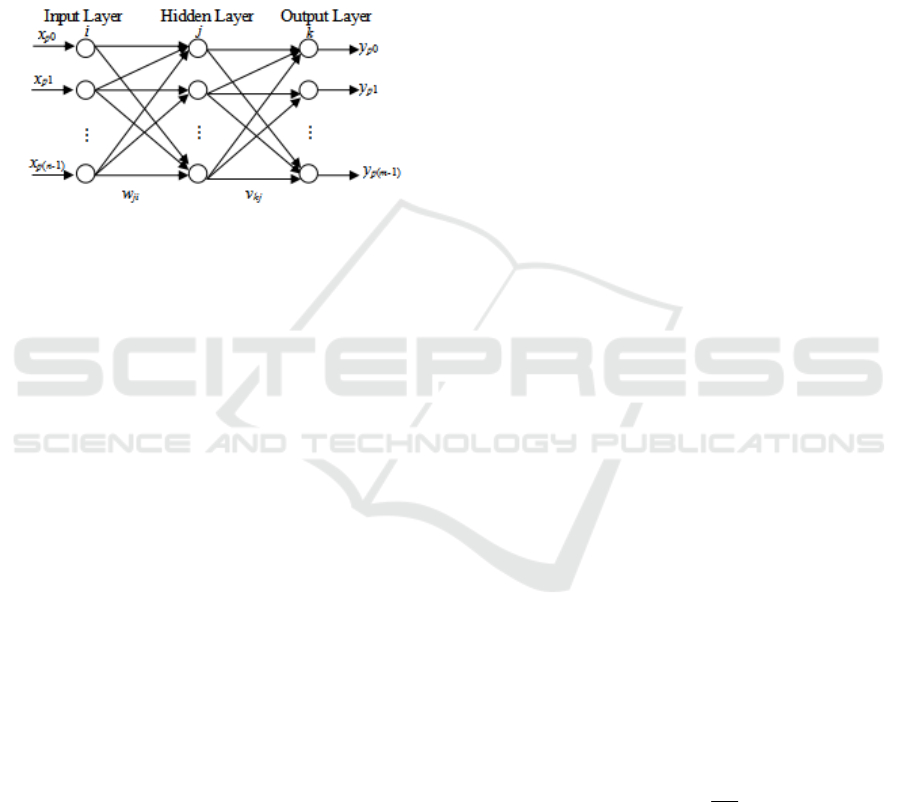

A standard back propagation neural network is

shown in Figure 1. The first layer consists of n input

nodes. Each of the n input nodes is connect to each

of the r nodes in the hidden layer. The r output nodes

of the hidden layer are all connected to each of the m

node in the output layer.

Figure 1: A standard BP artificial neural network.

BP is a supervised learning algorithm for

multilayer networks (Naiyao Zhang, Pingfan Yan,

1998). The algorithm aims at minimizing the MSE

between the actual output of the network and the

desired output. Gradient descent search is user in

BP. In BP learning, a set of patterns of the form

<x

1

,…,x

n

, y

1

,…, y

m

>, where x

1

,…, x

n

are the

components of the input vector and y

1

,…, y

m

are the

components of the desired output vector, is

repeatedly given to the network until the learning of

weights converges (Liming Zhang, 1993).

If the BP neural network has N nodes in each

layer, The transfer function is the sigmoid function,

, the training samples involve M different patterns

(Xp, Yp), P=1,2,…M. Corresponding the Input

sample P, let netpj represent the input total of node j,

let O

pj

represent the output value, that is

The error between input values and output values

is as following:

The revise connection weights of BP neural

network are as following:

⎢

⎢

⎣

⎡

−

=

∑

.)(

;))((

nodesinputtheingcorrespondWnetf

nodesoutputtheingcorrespondOdnetf

kjpkpj

pjpjpj

δ

δ

Where η represents the learning rate, it can

increase convergence in speed, α represents the

momentum coefficient. The value of a is a constant,

it affects the connection weights of next step. Details

of the traditional BP artificial neural network

algorithm can be found in the original paper by

Jingwen Tian and Meiquan Gao (Naiyao Zhang,

Pingfan Yan, 1998).

The input/output problem of one set of samples is

changed by the traditional BP network model into a

nonlinear optimization

problem with a very common

algorithm---Gradient Descent. This traditional model

has strong ability of problem identification and can

reduce the errors to a minimum theoretically for the

simulation of complex and nonlinear models.

However, this traditional model still has some

drawbacks (Liqun Han, 2002), so we improve it and

put forward the BP neural network of self-adjusted

all parameters learning algorithm (Xiaofeng Li,

2003). The new algorithm can not only accelerate

the convergence speed of the network but also

optimize the network topology and enhance the

adaptability of the BP neural network.

4 THE MODEL ARCHITECTURE

OF EARLY RISK WARNING

4.1 The Risk Early Warning Index

Assignment Method

In section 2, the risk early warning index system of

high-tech entrepreneurial enterprise is built, but most

second-class indexes are hard to be represented

directly by numbers. We can adopt the fuzzy

statistical method to find out the functions and get

the valuations of these second-class indexes.

Comment set consisting of evaluation levels

in descending order is V= {excellent, fine, ordinary,

bad} = {A

1

, A

2

, A

3

, A

4

} = {1, 2, 3, 4}.

According to fuzzy statistics, the experts involved

in the evaluation are required to grade the indexes.

Next, we count the frequency m

it

of each index u

i

belonging to grade A

t.

Let us denote

n

m

it

t

i

=

)(

μ

)(t

i

μ

represents the degree of index u

i

belonging

to grade A

t.

Let us denote

(1) (4)

14

/

/

ii i

RA A

μμ

=++L

R

i

represents the value of index u

i.

∑

=

=

N

j

pjjipj

OWnet

0

)(

pjpj

netfO =

∑∑

−== 2/))((

2

pjpjp

OdEE

))1()(()( −−++= tWtWOtWW

jijipjpjjiji

αηδ

Risk Early-Warning Model of High-Tech Entrepreneurial Enterprise based on BP Neural Network

15

Risk Early-Warning Model of High-Tech Entrepreneurial Enterprise based on BP Neural Network

15

4.2 BP Neural Network Model

Architecture

Based on the traditional ANN (Artificial Neural

Network), the BP network model architecture of

early risk warning of high-tech entrepreneurial

enterprise is divided into three layers:

(1)Input layer: The input variables are the

second-class indexes of the index system (shown in

table 1), so there are 22 input layer nodes. Then, the

indexes are given values using the evaluation

method illustrated in section 4.1. These values

would be learning samples of the BP network.

(2)Hidden layer: When it comes to the selection

of the number of hidden layer nodes, referring to the

BP neural network of self-adjusted all parameters

learning algorithm that is mentioned in paper [15],

we set the number of nodes large enough at the

beginning. Then, the network will learn by itself

until we get the appropriate number of nodes.

(3)Output layer: The early risk warning of high-

tech entrepreneurial enterprise is a process from

qualitative analysis to quantitative analysis and back

to qualitative analysis. This model converts the

qualitative to quantitative output. Then, we warn the

risks according to the comment set and output. The

risks are classified into four levels: safe, light,

serious, and dangerous. These levels can be

represented by the output vectors (1,0,0,0), (0,1,0,0),

(0,0,1,0), (0,0,0,1). So, the number of output layer

nodes is four.

4.3 BP Neural Network Model

Algorithm

The BP neural network model algorithm is as

follows:

Step 1: Give values to the indexes and input

them as variables to the neural network.

Step 2: Set the number of input nodes and

initialize the parameters (including the learning

accuracy

ε

, the prescribed number of iterative

steps M,the upper limit of hidden layer nodes,

learning parameter b, momentum coefficient a, the

number of initial hidden layer nodes a should be

large.)

Step 3: Input the learning samples and make the

values of sample parameters [0, 1].

Step 4: Give random numbers between -1 and 1

to the initial weighting matrix.

Step 5: Train the network with the modified BP

method.

Step 6: Judge whether or not the number of

iterative steps is exceeding the prescribed. If yes,

end; If no, go back to step 5 and continue learning.

Step 7: Collect the values of the indexes and

process these data to make them [0, 1].

Step 8: Input the processed data to the trained BP

neural network and get the output.

Step 9: Warn the risk early of the entrepreneurial

enterprise according to the output and the risk level

comment set.

5 EMPIRICAL RESEARCH

We select 17 high-tech entrepreneurial enterprises in

SiChuan high-tech industrial zone; Chi Tong Digital

LLC(Q1); DI Zhong Digital LLC (Q2); Guang Hua

Science and Technology LLC(Q3); Chen Jing

Electronics(Q4); Hui Jin Science and Technology

LLC(Q5); Gao De Software(Q6); Tian Sheng

Science and Technology LLC(Q7); Data System

LLC(Q8); Network Educational Technology(Q9);

Communication Technology Company(Q10); Kai

Yuan Information LLC (Q11); Hua Run Science and

Technology LLC(Q12); Bo Yu Tong Da LLC

(Q13); Global Technology (Q14);Traffic

Engineering Company(Q15); Internet of Energy

Company (Q16); Xing Ge Science and Technology

LLC(Q17); The experts are invited to evaluate the

operation risks of these entrepreneurial enterprises

by using Delphi method and AHP method. We come

to a conclusion: the risk level of Q1、Q2、Q7、

Q13 is ‘safe’; the risk level of Q3、Q4、Q8、

Q9、Q14 is ‘light’; the risk level of Q5、Q10、

Q11、Q15 is ‘serious’; the risk level of Q6、

Q12、Q16、Q17 is ‘dangerous’. We take 12

enterprises at the top of the list as the training

samples of BP network model and the last 5

enterprises as the prediction samples.

5.1 BP Neural Network Training

The BP neural network architecture is built by 22-

30-4 (The number of input layer nodes is 22, the

number of hidden layer nodes is 30, the number of

output layer nodes is 4). We initialize the network

(the upper limit ε=0.0002, learning rate, η=0.5,

Inertia Parameter a=0.1), give values to the indexes

of risk early warning of the 12 high-tech

entrepreneurial enterprises (Q

1

-Q

12

) and input the

processed data to the BP network model. Then the

network is trained by the modified BP learning

algorithm and the network architecture becomes 22-

15-14. At the same time, we get the optimized

network weight matrix.

ISME 2016 - Information Science and Management Engineering IV

16

ISME 2016 - International Conference on Information System and Management Engineering

16

5.2 Risk Early Warning

Now, it is time to early warn the risk of the

enterprises Q

13

、Q

14

、Q

15

、Q

16

、Q

17

utilizing the

trained neural network. Give values to the risk early

warning indexes of the 5 high-tech entrepreneurial

enterprises, input the processed data to the trained

BP neural network and get the output of risk early

warning. As is shown in

table 2 and table 3, the

predictions of BP neural network accord with the

practical ones completely, which indicates that this

risk early warning model feasible and effective.

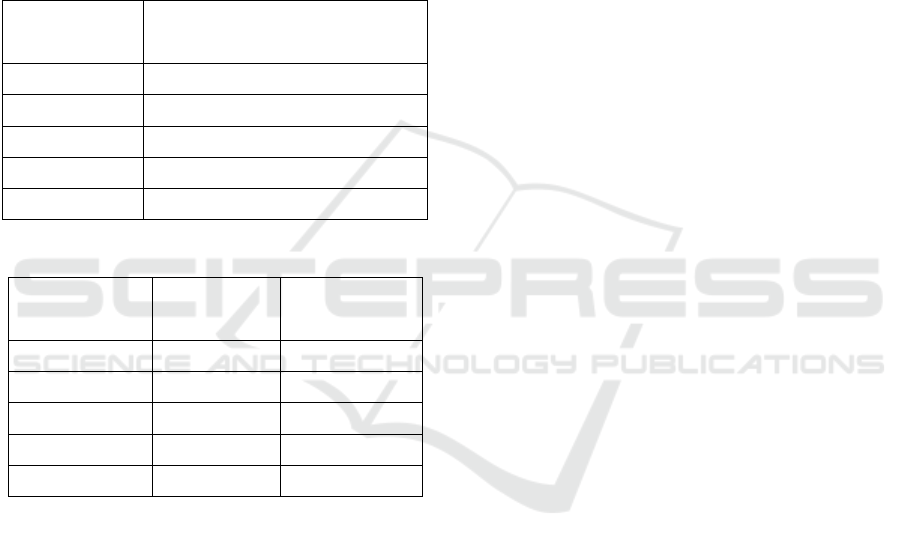

Table 2: BP neural network output.

High-tech

Entrepreneurial

Enterprise

Network Reasoning Output

Q

13

(0.9985 0.0023 0.0362 0.0078)

Q

14

(-0.0059 0.9911 0.0038 0.0011)

Q

15

(0.0131 –0.0016 1.0005 0.0077)

Q

16

(0.2201 0.0415 –0.0562 0.9991)

Q

17

(-0.0072 0.0035 0.0009 0.9589)

Table 3: BP neural network reasoning.

High-tech

Entrepreneurial

Enterprise

Network

Predictions

Practical Risk

Level

Q

13

Safe Safe

Q

14

light light

Q

15

Serious Serious

Q

16

Dangerous Dangerous

Q

17

Dangerous Dangerous

6 CONCLUSIONS

From the analysis above, we come to the following

conclusions.

(1)This paper builds a risk early warning model

of high-tech entrepreneurial enterprise by taking

advantage of the self-organization ability, self-

adjustment ability and self-learning ability of BP

neural network. This model has a good effect on the

risk early warning of these enterprises. The

influence of human factors and fuzzy randomness

brought by human evaluation can be eliminated,

which makes the evaluations more objective and

accurate.

(2)This paper takes the values of the risk early

warning indexes as the learning samples of the

model. These samples will dynamically learn

evaluating and reasoning by themselves. With time

passing and samples increasing, further study and

dynamic tracking will be carried out.

(3)Nonlinear functions that applies to the

complex, nonlinear and dynamic economy system

are used in BP neural network, which gets rid of the

linear analysis tools in classical economics and

provides more accurate information. So, this method

has great advantage over the traditional ones and

provides an effective path for risk early warning of

entrepreneurial enterprises.

ACKNOWLEDGEMENTS

This research was supported by the national social

science foundation of China, No.16BGL024.

REFERENCES

Fengchao Liu, Yuandi Wang, 2004. Evaluation Mode of

Risk Investment Based on Principal Component

Analysis. Science & Technology Progress and Policy,

(3): 65-67.

Liming Zhang, 1993. Artificial neural network model and

its application, Fudan University Press. Shanghai, 1st

edition.

Liqun Han, 2002. Artificial neural network theory,

designing and application. Chemical Industry Press.

Beijing, 2

nd

edition.

Martin T. Hagan, Howard B. Demuth, Mark Beale, 1996.

Neural Network Design, PWS Publishing Company,

Thomson Learning.

Motiar Rahman, M., Kumaraswamy, M., 2003. Risk

management trends in the construction industry:

moving towards joint risk management. Engineering

Construction and Architectural Management, 9(2):

131-151.

Naiyao Zhang, Pingfan Yan, 1998. Neural Networks and

Fuzzy Control, Tsinghua University Press. Beijing, 1

nd

edition.

Pena I, 2002. Intellectual Captital and Business Venture

Success. Journal of Intellectual capital, (3): 180-198.

Qun Xie, Xiaozhe Yuan, 2006. A review of the evaluation

system of venture investment projects. Science and

Technology Management Research, (8): 182-187.

Rennan. M, Schwartz. E, 2006. Evaluating National

Resource Investments. Journal of Business, 58(1):

135-157.

Shimizu, Katsuhiko, 2012. Risks of Corporate

Entrepreneurship: Autonomy and Agency Issues.

Organization Science, 23(1): 194-206.

Xiaofeng Li, 2003. The establishment of forecasting

model based on BP neural network of self-adjusted all

parameters. Forecasting, 20(3): 69-71.

Risk Early-Warning Model of High-Tech Entrepreneurial Enterprise based on BP Neural Network

17

Risk Early-Warning Model of High-Tech Entrepreneurial Enterprise based on BP Neural Network

17

Yanping Yang, 2005. Risk law of high-technology venture

investment. Science and Management of S.& T., (03):

78-82.

Yuhua Li, HongWen Lang, 2004. Research on fuzzy

overall evaluation model for investment risks in high-

tech projects. Journal Harbin Univ .Sci.& Tech, 9(1):

72-75.

Zhi Zhuo, 2006. Research on risk management theory,

China Financial Press. Beijing, 1st edition.

Zhongrui Wang, Shaojun, Yitian Xu, 2003. On the method

of fuzzy and synthetic judgment to judge the risk of

high-tech projects. Journal of Shihezi University

(Philosophy and Social Science), 3(3): 59-62.

APPENDIX

Xiaofeng Li (1972-), male, post doctoral, research

interests include entrepreneurial management,

project management, etc.

[E-Mail:] Lixiaofeng@scu.edu.cn

ISME 2016 - Information Science and Management Engineering IV

18

ISME 2016 - International Conference on Information System and Management Engineering

18