We Need to Discuss the Relationship

An Analysis of Facilitators and Barriers of Software Ecosystem Partnerships

George Valença

1

and Carina Alves

2

1

Departamento de Estatística e Informática, Universidade Federal Rural de Pernambuco, Recife, Brazil

2

Centro de Informática, Universidade Federal de Pernambuco, Recife, Brazil

Keywords: Software Ecosystems, Partnerships, System Dynamics, Strategies.

Abstract: Software ecosystems are a promising paradigm to develop and market software systems by means of

partnerships among companies. To ensure the healthy evolution of software ecosystems, companies must

define strategies that strength their partnerships. In this paper, we investigate the factors that drive the

evolution of software ecosystems formed by Small-to-Medium Enterprises. We present an exploratory case

study of two emergent software ecosystems in order to analyse the main facilitators and barriers faced by

participating companies. We adopt System Dynamics approach to create models expressing causal relations

among these factors. By understanding the facilitators that should be reinforced and barriers that should be

restrained, we believe that partners are better equipped to catalyse the success of their software ecosystems.

1 INTRODUCTION

Software ecosystems figure among the most recent

and relevant trends in IT industry. A software

ecosystem is as a set of businesses functioning as a

unit and interacting with a shared market for

software and services, together with the relationships

among them (Jansen et al., 2009). They involve the

interdependence and interrelation to external

partners and stakeholders with which a software

company collaborates and competes (Olsson and

Bosch, 2016). Software ecosystems promote the idea

of coopetition, when companies embrace

competitive collaborations and start to co-evolve

their products in a hub of local and/or global market

(Popp, 2013). By defining partnerships to engage in

this networked setting, companies acquire new

skills, share features and clients, and divide R&D

costs (Bosch, 2009). Moreover, they can cope with

financial, time and knowledge constraints (Khalil et

al., 2011). Successful examples of software

ecosystems include Apple’s iPhone and the range of

complementary apps developed by third-party

players available at Apple Store, Eclipse open

source ecosystem, among other platforms available

in the IT industry. The increasing growth of software

ecosystems confirms that companies co-existing in

the same market have recognised their need to

cooperate to survive in a turbulent environment.

This paper reports on an exploratory case study

of two emergent software ecosystems formed by

Small-to-Medium Enterprises (SMEs). The tight

relationships among these companies result from

frequent joint projects to integrate their ERP

software solutions and services. On the one hand,

SMEs must cope with limited financial and human

resources. On the other hand, they have flexible

organisational structure and motivation to explore

innovative business models. These aspects direct the

way SMEs define partnerships and position

themselves in a software ecosystem.

The motivation to conduct this research is to

investigate the factors that affect positively and/or

negatively the evolution of partnerships among

SMEs establishing a software ecosystem. We

achieved this goal by adopting System Dynamics

method (Senge and Kurpius, 1993) to analyse the

factors that nurture and/or hamper the partnerships.

The contribution of our study lies in describing these

factors and presenting diagrams expressing causal

relations among them. Besides, we present strategies

that enable software companies to understand what

drives the healthy evolution of their ecosystems.

This paper is organised as follows. Section 2

describes the conceptual background of the research.

Section 3 details the research method. Section 4

presents systemic diagrams by adopting System

Dynamics. Section 5 uses the diagnostic of the

Valença, G. and Alves, C.

We Need to Discuss the Relationship - An Analysis of Facilitators and Barriers of Software Ecosystem Partnerships.

DOI: 10.5220/0006231900170028

In Proceedings of the 19th International Conference on Enterprise Information Systems (ICEIS 2017) - Volume 2, pages 17-28

ISBN: 978-989-758-248-6

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

17

partnerships to delineate strategies that companies

can adopt to foster the evolution of the software

ecosystems, in light of literature in the field. Finally,

Section 6 presents final considerations.

2 CONCEPTUAL BACKGROUND

2.1 Software Ecosystems

Partnerships differ from more general business

relationships due to (i) firms’ degree of mutual

commitment, respect, trust and influence; (ii)

communication behaviour that involves transparency

and information sharing; and (iii) tendency towards

joint problem solving; among other properties (Mohr

and Spekman, 1994). They are the seed of a software

ecosystem by allowing external actors to customise

or complement the features of existing products, and

provide technical services (Cusumano, 2004).

This network changes the dominant logic of

doing business, based on integrated manufacturing,

in-house R&D and direct sales. Ecosystem partners

focus on innovative business models, which involve

novel ways for a firm to collaborate with external

agents and for them to create and capture value from

the network (Weiblen, 2015).

The actors of a software ecosystem have

different roles and responsibilities. Manikas and

Hansen (2013) provide an overview of the most

common actors in a software ecosystem, which

includes keystone, niche player, external developer

or third party developers, vendor or reseller,

customer and user. The keystone has a critical

function, since it guarantees the well-functioning of

the ecosystem. This player is responsible for running

the software platform, creating and applying rules,

processes and business procedures, setting and

monitoring quality standards, and orchestrating

actors’ relationships. Niche players are also central

to the ecosystem, as companies that use the platform

to develop or add components (e.g. apps) to it,

producing functionality that customers require. They

create or enhance capabilities that differentiate them

from other participants. Their importance lies in

complementing keystone work and influencing

decision-making in ecosystem management.

All actors are committed to a certain degree to

ensure their own health as well as their partners’

health in the ecosystem. Hence, ecosystem

prosperity represents their own prosperity. Hartigh

and colleagues (2006) argue the health of an

ecosystem is a way of assessing its strength at a

specific moment. Iansiti and Levien (2004) propose

a classification inspired on biological ecosystems to

define health as the extent to which an ecosystem as

a whole is durably creating opportunities for its

members and those who depend on it. The three

measures of health are productivity, robustness and

niche creation. Productivity indicates the ecosystem

ability to transform inputs into products and

services. Number of applications in an App Store is

a possible way of measuring the productivity of a

software ecosystem. Robustness indicates the

ecosystem capacity to deal with interferences and

competition pressure. The survival rate of ecosystem

members is a possible metric to assess this aspect.

Finally, niche creation represents the opportunities

for actors available in the ecosystem. It fosters

diversity by creating valuable resources and niches.

The number of new players around the platform is a

way to assess niche creation.

2.2 System Dynamics

System Dynamics (SD) provides understanding

about the structure and functioning of systems in

which we are embedded. The approach supports the

definition of high-leverage policies for sustained

improvement. System behaviour is represented by

graphical schemes that combine reinforcing and

balancing cycles formed by variables from studied

phenomena. Reinforcing loops are the engine of

growth and can be virtuous (situations that reinforce

in desired directions) or vicious (situations that start

badly and grow worse). Balancing loops maintain

the status quo of a given context. Many loops also

contain delays, which highlight consequences (i.e.

factor x foster factor y) that will gradually occur

(Senge and Kurpius, 1993).

These schemes can be associated with one or

more of the 13 existing generic system archetypes.

Each archetype has a script that guides the

interpretation of the investigated context (Senge and

Kurpius, 1993). The selection of an archetype

depends on how the related script properly describes

the studied phenomenon. This is done by identifying

contextual variables that hold cause and effect

relations that fit the archetype script. The use of

system archetypes is a rich technique to describe or

predict the behaviour of a system by drawing related

causal loops of variables from the studied scenario.

Hence, it is possible to either analyse a past situation

or forecast specific scenarios by identifying potential

traps and mitigating risks of occurrence. We

highlight that the effectiveness of SD approach

depends on the ability of researchers to reflect and

comprehend the reality under study.

ICEIS 2017 - 19th International Conference on Enterprise Information Systems

18

3 RESEARCH METHOD

Our multiple case study analysed the main drivers of

partnerships among Small-to-Medium Enterprises

participating in a software ecosystem. We translate

this goal in the following research questions (RQ):

RQ1 – What are the facilitators and barriers of

partnerships among software companies

participating in a software ecosystem?

RQ2 – How the facilitators and barriers

factors interact with each other?

RQ3 – What strategies can leverage the

success of the software ecosystem in light of

these factors?

To address these research questions, we

performed 2 case studies (Case Study I – CSI and

Case Study II – CSII) composed of 5 and 3 software

companies, respectively. We purposefully selected

them in order to obtain information-rich cases to

investigate the phenomenon of software ecosystem

partnerships in depth (Coyne, 1997).

3.1 Case Companies

CSI involved 5 partner companies from Recife,

Brazil, here named as Company A, Company B,

Company C, Company D and Company E (Table 1).

The companies integrate their products in frequent

joint projects, which are started by one or more

partners. By strengthening their relationships, the

partners have gradually created a software

ecosystem formed by the integrated software

systems developed by these complementary

companies. We initiated our study analysing the

partnership between Company A and Company B.

Preliminary interviews enabled us to identify other

relevant players: Company C, which is partner of

Company A and Company B; and Company D,

which is partner of Company B. We then mapped

Company E, as partner of Company D.

Table 1: Overview of Companies A, B, C, D and E.

Company Solutions

Company A ERP with 5 modules focused on retail

chains, distributors and wholesalers

markets

Company B ERP with 15 modules focused on

several market niches (e.g. healthcare,

oil and gas, sugar industry and

logistics)

Company C Information system with 3 modules

for pharmacies

Company D 10 information systems for hospitals

Company E Web portal for electronic quotations

CSII involved 3 software firms operating in

Recife and São Paulo, Brazil, here named as

Company F, Company G and Company H (Table 2).

They build a software ecosystem in which Company

F is the keystone and the main responsible for

sharing business deals with partners.

Table 2: Overview of Companies F, G and H.

Company Solutions

Company F ERP solutions with 60 modules for

hospitals and healthcare market

Company G 20 information systems for

laboratories

Company H Services to revamp software systems

in diverse markets

We started CSII by exploring the partnership

between Companies F and G, which involves the

integration of complementary healthcare solutions.

In addition, we mapped the partnership between

Company F and Company H, which is critical to

maintain the products of Company F.

3.2 Data Collection

We undertook open-ended and semi-structured

interviews to map the factors that enable and inhibit

a partnership in a software ecosystem, which we

name as facilitators and barriers. We interviewed 20

professionals in CSI (Table 3) and 7 professionals in

CSII (Table 4). The participants played both

technical and managerial roles.

Table 3: Interviewees from Companies A, B, C, D and E.

Company Function

Company A Project Manager, Business Analyst,

System Analyst.

Company B Project Manager, Product Manager,

Release Manager, Integration Team

Leader, Business Analyst, System

Analyst (2), Tester.

Company C Services Manager, Project Manager,

Business Analyst.

Company D Product Manager, Project Manager,

Solutions Architect, System

Architect, System Analyst.

Company E Operations and Deployment Director.

Table 4: Interviewees from Companies F, G and H.

Company Function

Company F Sales Director, Marketing Manager,

Product Owner, Business Analyst,

System Analyst.

Company G Marketing Manager.

Company H Operations Director.

We Need to Discuss the Relationship - An Analysis of Facilitators and Barriers of Software Ecosystem Partnerships

19

One author conducted and transcribed the 27

interviews. The transcripts were later analysed with

the other author to reach an agreed understanding

about the collected data and discuss the findings.

3.3 Data Analysis

We started data analysis by searching for barriers

and facilitators in interviews discourse. Then, we

mapped factors that were common to both cases, as

a means to represent key drivers of partnerships.

These factors are considered as variables in System

Dynamics method (Senge and Kurpius, 1993). We

listed and crossed them in a table to examine causal

relations among them. Once we identified a possible

relation in such causal matrix, we inserted a code d

or i to indicate that the variable in the line caused the

variable in the column in a directly (d) or inversely

(i) proportional form, respectively. We also labelled

each relation with the values 1 and 3 to indicate

standard weights related to causal relations intensity.

We crossed the factors considering interviews

evidence and our interpretation of facts.

Then, we created SD models to represent the

variables and correspondent relations. We

considered the most relevant variables (i.e. with

greater systemic power in the matrix). By selecting

variables with high values of influence, we also

avoided the complexity explosion that would result

from a large number of contextual variables and

relationships in the models. The subsequent step was

the identification of a subset of variables considered

as critical, based on our interpretation and

interviewees’ opinions. The resultant model presents

the barriers and facilitators to describe the dynamics

of the studied context in a graphical form. It denotes

leverage points and causal cycles that contribute to

or limit the healthy evolution of the ecosystem.

In a final step, we discussed the SD models in

evaluation interviews with the studied companies.

During this process, we asked participants (i)

whether the diagram represented the appropriate

elements (factors and relations), and (ii) whether

there were other elements to include. As a result, we

performed some punctual refinements in SD models.

4 SYSTEMIC VIEW OF

FACILITATORS AND

BARRIERS IN PARTNERSHIPS

In Section 4.1, we present the facilitators and

barriers that influence the partnerships among

companies of CSI and CSII. Section 4.2 describes

the SD models generated for our multiple case study.

The models present a synthesised view of

facilitators and barriers identified in the partnerships

of studied companies. Given the fact that companies

of CSI and CSII share similar contextual factors

(e.g. size, geographical location, ERP application

domain, types of partnerships), we opted to conduct

an integrated analysis of facilitators, barriers and the

resulting systemic archetypes of CSI and CSII.

4.1 Facilitators and Barriers

This section answers RQ1 by describing a set of

facilitators and barriers for the studied companies to

thrive in their software ecosystems. Facilitators (F)

are factors that can contribute to the creation and

growth of partnerships. Our analysis of CSI and

CSII revealed the following seven facilitators:

F1 – Personal and Geographical Proximity

Companies’ physical proximity promotes joint

projects among them: “since it (Company B) was

near, we took the software from Company B”, cited

the software architect from Company D. In

particular, companies that operate in the same region

understand the specific needs of this market. Hence,

geographically and personally close firms often

become relevant partners.

The joint projects start with strict professional

relationships among staff of partners companies (e.g.

managers in an integration project). Once these

interactions evolve to more personal relationships,

the companies can benefit from a good

communication channel and professionals that aim

to leverage the partnership. The arguments of the

marketing manager from Company G illustrate this

scenario: “since we have worked very well (and) I

already know several people from Company F, we

will try to grow this partnership; it is a

communication channel that facilitates a lot; the

partnership flows very well”.

It means that the closer personal relationship

between staff of partner companies catalyses their

collaboration, as the services manager from

Company C detailed: “I ‘hit the door’ of Company A

to talk to the president to seek business

opportunities”. Their personal relations facilitate the

execution of projects: “communication (with

Company B) flows well since this team worked

together in other projects; it emerged a friendship

outside the firm; this helps a lot”, argued the project

manager from Company A.

F2 – Respectful Attitude

Companies that keep a respectful attitude are

fostering their partnership. The marketing manager

ICEIS 2017 - 19th International Conference on Enterprise Information Systems

20

from Company G highlighted the relevance of a

good conduct: “these are companies that always

respected each other, which is very important;

Company F never mentioned anything (related to

paying) a commission; they are very professional

and Company G never offered anything to them”.

The companies appreciate such attitude of a partner,

which increases the trust on the other company.

F3 – Mutual Trust

Trust results from the close relationship of the firms,

sometimes a personal proximity of their members. It

is seen as a premise for a partnership to emerge, as

cited by the innovation manager from Company C:

“to establish a partnership, you already trust the

partner; you already have confidence, you know he

is responsible; it is a premise for you to establish a

partnership”.

The commercial director from Company F also

argued the dependence kept by partners requires full

reliability: “(we must have) total trust, because they

hold key knowledge of the code”. The trust factor

increases with actions that favour joint projects, such

as promptly treating systems integration problems.

The project manager from Company A clarified the

relevance of trust: “I’d rather have a less competent

but reliable partner than a super competent but

unreliable one”.

F4 – Openness for Technical and Business

Negotiation

Flexibility for business and technical negotiations is

a critical factor for a partnership to succeed, because

companies must guarantee a win-win approach.

Companies mentioned positive experiences with

partners who were open to discuss technical and

business issues. The marketing manager from

Company G discussed this fact: “there is this

technical part, when we can integrate (our systems)

very well; people get (access to) the necessary

channels, (where) people are open and available to

help us at any time”.

The project manager from Company D

exemplified the impact of this factor in a

relationship: “the partner approached us with

interest and humility; (another) partnership did not

evolve because the partner was inflexible”. The

commercial director from Company F also stressed

the importance of easily negotiating commercial

issues with partners: “any integration that I do

consumes time with maintenance, installation, or a

failure; (so) it is fair that part of it (payment) is

reverted to me; there are firms that are very open;

others (are) inflexible; this is very bad”.

Openness for negotiation is a common trend

among SMEs: “when there is the possibility to

negotiate is because they are firms of the same size;

in general, there is (openness for negotiation)”,

declared the operations director from Company B.

F5 – Effective Communication

Good communication is essential for an integration

project to succeed and thereby for a partnership to

evolve. It is important to establish adequate

communication channels and ensure the right people

are available to have technical or business

discussions with a partner. For instance, Company F

maintains an integration team, which has a wider

view of the integrations between its healthcare

solutions and other systems. The marketing manager

from Company G explains such facilitator: “we have

much trouble to get to the person who will develop

the integration; this is something that really makes it

(integration) difficult; the (partnership of) Company

G with Company F works because of the right

channels; it is the best (communication channel) we

have (with a partner)”.

F6 – Perceived Quality of Products and

Services

Quality of products and services is a criterion

considered by companies to select a partner, given

the relevance of quality for client satisfaction. For

instance, Company D considers the quality of a

partner team and services as a premise to establish a

partnership. Its project manager illustrated this

situation: “in addition to off the field factors like

'whether a partner has a qualified team, (we

analyse) whether his services desk is good’”.

The companies assess the quality of a system

from another vendor as an indicator to invest in a

new partnership. “A partner would hardly be invited

if beforehand we knew that he would not satisfy (our

quality criteria)”, cited Company F business

analyst. The marketing manager from Company G

explained the relevance of this factor: “they

recommend us because they know they will not have

problems in the integration; they will recommend a

firm to stay in their client; if it is a bad firm, which

gives many problems, the system crashes; it is worse

for them”. Low quality solutions can affect the

reputation of a company as a supplier, as described

by the commercial director from Company F: “the

quality of the product, its acceptance in the market

and how much it adds value (to mine)…; we need to

choose well our partners since (they) will, in a way,

influence our (system) routines and reputation”.

F7 – Availability of Standards/Technologies

to Support Systems Integration

By defining or adopting integration standards,

partners facilitate their collaboration, as illustrated

by the software architect from Company D: “the

‘Integrator’ has helped and now HL7 (international

standards for data transfer between healthcare

We Need to Discuss the Relationship - An Analysis of Facilitators and Barriers of Software Ecosystem Partnerships

21

systems) will help even more”. A common

integration infrastructure reduces mismatches among

products and rework in joint projects. “One of the

main gains we will have (with integration

technology) is to prevent us from redeveloping

integrations whenever someone knocks our door”,

argued the project manager from Company D. One

partner may develop the integration infrastructure or

it may emerge as a joint creation: “we are aligning

what one has with what the other has, what one may

add... Company C can contribute with definitions,

Company B with human resources, etc.”, explained

the release manager from Company B.

The following paragraphs present nine Barriers

(B) of studied partnerships. These factors are the

opposite view of facilitators: they weaken

companies’ relationships and disturb their joint

projects. Therefore, barriers may reduce the health

of their software ecosystems.

B1 – Inefficiency to Handle Integration

Problems

The non-involvement of a firm in the analysis of

system integration problems strongly weakens a

partnership: “(another) partnership did not evolve

(because) the partner was uncompromising and did

not resolve (the issue)”, explained the project

manager from Company D. Given the fuzzy

boundary among integrated systems, firms may try

to convince the partner that the problem is originated

in his system: “the partner often shifts the issue to

the other (company)”, declared the team leader from

Company B. Others simply prioritise other projects,

as reported by the project manager from Company

A: “sometimes the partner has more critical issues

in another project and leaves (ours) behind”. This is

common in the context of SMEs, which are often

overwhelmed, handling demands of multiple clients

with limited resources. Such low attention may also

happen because the partner does not see the client as

strategic: “sometimes partners do not give attention

since (the client) is not in their top customer base”,

cited the services manager from Company C.

When the client is not aware that multiple

vendors are providing the solution or simply does

not understand their duties in a joint project, it is

hard to know who to blame and appeal. Handling

integration issues demands a clear definition of roles

and responsibilities among partners. However, a

partner may refuse such managerial responsibility.

To avoid client dissatisfaction, some firms take

the duties of a partner not to jeopardise their

reputation. Company F currently treats this issue by

managing customer support, as described by the

commercial director: “we concentrate the support

within our firm and meet specific demands by

contacting the customers”. The lack of support

reduces companies’ trust in a partner, who is no

longer recommended to clients. “Our manager asks

not to contact Company B; we try to solve the issue

here; nowadays we do not recommend Company B”,

cited the systems analyst from Company D.

B2 – Unavailability of a Professional to

Manage Systems Integration

The absence of a permanent employee responsible

for the integrated solution is a problem, as described

by the product manager from Company B: “I

change part of the process, but this brings a big risk,

because you do not have someone in charge of the

whole (integration)”. Defining a professional as the

‘owner of the integration’ facilitate negotiations and

alignment of products, according to the services

manager from Company C: “we do not have this

guy, which would be the focal point; such confusion

and discussions would be minimised; (he would be

in charge of) communication and sharing of

information”

. The duties of an integration owner

include the identification of evolution needs due to

market demands and analysis of impact of product

changes in integrations. However, they cannot afford

his salary without a running project: “There must be

someone paying him, (but) we are project-oriented”,

cited the services manager from Company C.

B3 – Weak Commercial/Prices Alignment

The commercial alignment of the firms is critical for

a partnership to evolve: “this is crucial, because if

partner price is not feasible for the deal, we have to

look for another (product)”, argued the operations

director from Company B. Partners who define high

price weaken negotiations with clients. “(Product)

price affect negotiations; we have to talk to partner

board to lower costs; it hinders some partnerships”,

argued Company E’s operations and deployment

director. This attitude leads to gradual replacement

of these SMEs in the ecosystem or the development

of the complementary system by the other company:

“we normally sell with the software from Company

B, but their cost may turn the proposal expensive; if

we had a financial module, it would cheapen the

(final) system”, explained the system analyst from

Company D. The high prices asked by Company G

might derail their partnership. “We are pressuring

Company G to lower prices because they are moving

the market away; if we do not reach a consensus, I

would opt for another partner”, cited him.

Similarly, a vendor from Chile required a high

price to include its system in a joint project, which

increased the final price of the proposal and made

Company F rethink this partnership. “I chose to use

an ERP that was already adapted to Chile, (but) it

made my offer very costly; we negotiate, but it is

hard”, argued the commercial director. Due to the

partner’s size and position in the Chilean market,

ICEIS 2017 - 19th International Conference on Enterprise Information Systems

22

Company F was dependent on its system. Therefore,

the partner had bargaining power. “This is a world-

class player, much bigger than us; we can have a

policy to reduce (our prices), but they (decide) in

this case; they said ‘my price is this’; it is always

better (to align with smaller partners)”, added him.

B4 – Poor Strategic Alignment of Products

Strategic alignment of products is necessary for

partnerships to thrive. “It is very difficult to

reconcile strategies and portfolios; but it is also very

difficult to survive without (it)”, declared the product

manager from Company D. The project manager

from Company D reinforced this fact: “lack of

synchronisation is very negative”. As the scope of

systems integration grows, the dependence between

products increases, as highlighted by the system

analyst from Company B: “the conflict is: I’m

evolving and I can damage something there or there

may be a need and we are eliminating for disuse”.

So far, studied firms have not formally aligned

product strategies (e.g. roadmaps, releases) and are

not prepared to jointly evolve the systems: “one

thing that makes the partnership fragile is that when

I do my strategic planning, I do it independently of

them”, cited Company B operations director. The

challenge to ensure such alignment stem from the

fact that firms attempt to manage partnerships and

parallel demands with restricted resources: “it is

difficult to (align releases) since the partner has

things going on outside partnerships”, explained the

innovation manager from Company C.

The well-functioning of a product integration

must be ensured during the lifetime of the systems

from different vendors, which demands a technical

and strategic alignment. However, such convergence

may not be perceived in partners’ daily operation, as

argued by the commercial director from Company F:

“in all partnerships / integrations we had, there is a

great and natural difficulty: I have a product

evolving with a great speed and the partner cannot

follow it”. Product strategic alignment is essential in

software ecosystems, when there is a great mutual

dependence between firms. “In a simple integration,

I do not have to make roadmap alignment with him

(partner); with Company H, which has a framework

that needs to evolve over time, if we do not evolve

together, we go anywhere; some partnerships are

for survival”, argued him. The same occurs for the

technologies: “another issue is the technological

misalignment between products; when technology is

adherent (it is easy to integrate)”.

B5 – Overlap between Features Offered by

the Company and Potential Partners

Studied firms prioritise fully complementary

vendors; as such partnership does not require scope

negotiation (i.e. decide which feature will be

provided, in case it is available in both systems). The

commercial director from Company F explained this

fact: “(a problem emerges) when there is a conflict

of interests; when (partner’s) product is competing

with our (solution); it is forbidden to do this”. If a

vendor offers a system in the same domain of

interest of the firm, it has reduced chances to

become a partner. In this case, there may be punctual

collaborations: “in some situations we can even

establish an isolated partnership, but we do not

define the partnership in a fixed form (which) can be

used in any (client) environment”, cited him.

Company F aims to keep its independence on

partners in specific areas: “some areas are reserved

for us; we do not facilitate”. When the area is

strategic, the company develops the feature instead

of searching for a partner. This attitude stems from

the possibility that a partner has to decrease the

envisaged market share of Company F, as he argued:

“the main restriction (for a partnership) is if that

(system) enters an area in which I offer (solutions)

or want to offer; the company kills the possibility

that we have to grow in this market”.

B6 – Differences in Working Practices

In our case studies, some partners have very

different working practices: “we have releases

almost every fortnight; the partner says ‘I can only

(deliver it) in 3 months’; it is another pace, another

process”, detailed the project manager from

Company A. Such differences pose challenges to

joint development, as the services manager from

Company C explained: “if I tell him (partner client)

I deliver it (feature) in 6 months, he says it makes

sense; if I tell (it to) him (retailer client), he send me

away”. This situation makes Company C to have

slower deliveries with Company B: “it has to do

with culture; this was the difficulty with Company B;

all happened very methodically”, added the services

manager. Even the evolution of technologies can be

harmed, as the operations and deployment director

from Company E described: “sometimes we are well

ahead of partners; we want them to evolve and

sometimes (their processes) are too rigid”.

B7 – Limited Authority Over Partner’s

Development Team

The lack of authority of a firm over the partner’s

team is an issue faced by firms in joint projects.

“You have to manage a team (in charge of) another

system, from another firm over which you have no

authority; it is too complicated”, argued the project

manager from Company B. The project manager

from Company A detailed this fact: “when you take

on this role (project manager), it has the dependence

(on partners since) you do not have all that strength

We Need to Discuss the Relationship - An Analysis of Facilitators and Barriers of Software Ecosystem Partnerships

23

in other (software) factories”. Partners can restrict

the access to their teams, even when they have

collaborative projects. In general, the teams only

follow orders from their own firms, creating a weak

functional matrix: even when a project manager

leads the joint project, he must negotiate with

managers from the partners to forward demands. “I

have power over my (development) factory, but I

cannot impose (anything) in the factory of Company

B”, detailed the project manager from Company A.

B8 – Low Availability of Financial and

Human Resources

A firm with restricted financial and human resources

may hamper the development of partnerships, as it

involves several operational costs (e.g. travels) and

strategic investments (e.g. innovation projects). In

such cases, a firm is seen as unprepared for the

collaboration, according to the commercial director

from Company F: “if the partner has no capacity to

invest in systems integrations and products, it

compromises (the relationship) as he (partner)

cannot work with you”. As small-to-medium sized

firms, partners usually face big restrictions of

financial and human resources, affecting joint

projects. “It (Company B) suffers from lack of

resources and I cannot move on”, argued Company

A’s project manager. Firms that can invest in joint

projects support partnerships.

B9 – Short Expertise in integration projects

Although systems integration seems a common

practice for studied companies, in some situations

they lack such expertise, which may harm a new

partnership. The business analyst from Company F

explained this fact: “the firm with which we will

make the integration may already have the

(integration) know-how, the experience of doing

this, which we (may) not have, maybe not at the

same level”. Inexperienced and immature companies

may affect the success of integration projects.

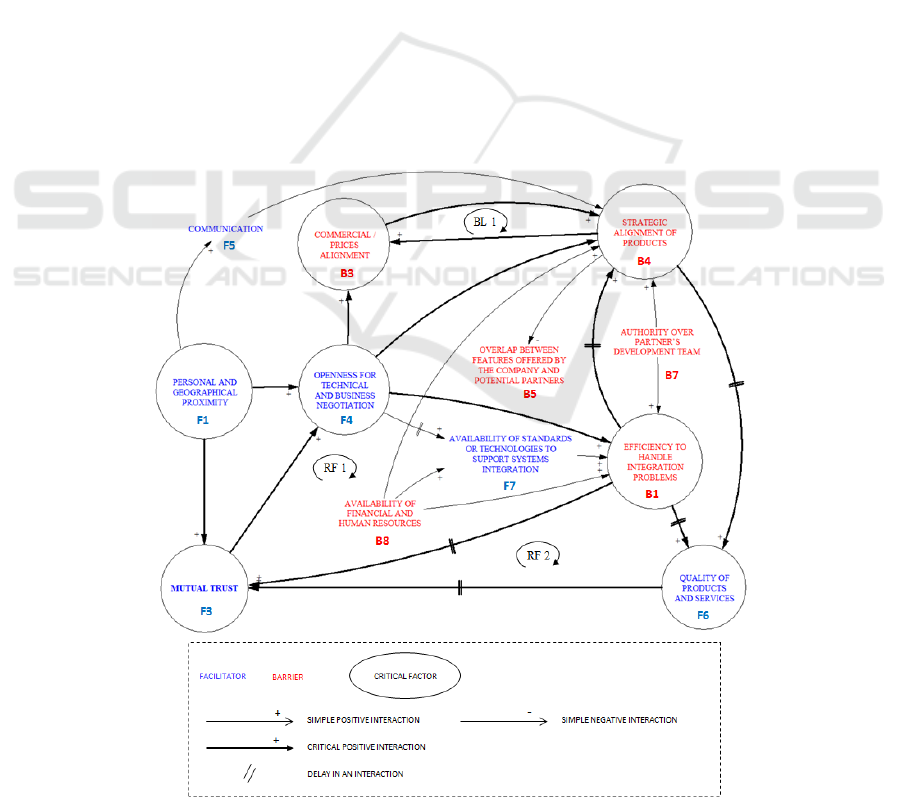

4.2 System Dynamics Models

This section answers RQ2 by presenting SD models

that analyse the causal relations among the previous

facilitators and barriers. Figure 1 shows a SD model

for the ecosystems from CSI and CSII. It consists of

a network of causal relations among 6 facilitators

(blue) and 6 barriers (red). It is important to notice

that we neutralised their names by eliminating

adjectives and/or adjusting the nouns. For instance,

we altered the barrier inefficiency to handle

Figure 1: SD model representing interactions among barriers and facilitators.

ICEIS 2017 - 19th International Conference on Enterprise Information Systems

24

integration problems to effectiveness to handle

integration problems, removing its negative form.

The colours of the factors indicate how they are

perceived in the studied context. This was a means

to simplify the analysis of causal relations and avoid

inappropriate logical comparisons. The model

represents factors that already exist (e.g. perceived

quality of products and services) and those that lack

in practice (e.g. commercial/prices alignment). The

arrows associating the factors indicate the influence

they may have on each other: the factor from which

an arrow leaves tends to promote the one in which

the arrow arrives. For instance, commercial/prices

alignment promotes strategic alignment of products

strategies and technologies. However, since both are

in red, one shall interpret it as weak

commercial/prices alignment reinforces the poor .

We highlight the most critical factors in circles

(relationships among them are also detached with

thick arrows), i.e. commercial/prices alignment,

effectiveness to handle systems integration issues,

personal and geographical proximity, strategic

alignment of products, openness for technical and

business negotiation, perceived quality of products

and services, and mutual trust. These factors were

obtained from interview evidence, such as the

arguments of the project manager from Company A

about a partner inefficiency to handle integration

problems: “this (occurrence of issues in the

integration) happens a lot; it is the biggest difficulty

when we have a partner”. The commercial director

from Company F also confirmed this fact: “this

(inefficiency to treat integration problems) is an

important challenge”. Another example lies in the

opinion of the operations director from Company B

regarding the poor alignment of prices among

partners: “this (lack of commercial alignment)

happens and we have to negotiate before (presenting

a proposal to the client); because if it is not feasible

we have to search for another solution; this is vital

for a partnership”.

From the SD model in Figure 1, we can perceive

the virtuous reinforcing loop RF 1, which leads

partners to effectively perform the joint projects.

The openness for technical and business

negotiations favours the availability of standards or

technologies to support systems integration among

partners, this in turn can contribute to partners’

effectiveness to handle systems integration

problems. This factor will further leverage their

mutual trust and facilitate future negotiations. A

wider view of this cycle is the virtuous reinforcing

loop RF 2, which includes the factor

perceived

quality of products and services by clients and

partners. This factor results from partners’

effectiveness to handle systems integration problems

and fosters their mutual trust. However, results from

the simple balancing cycle BL 1 may affect RF 2:

the weak commercial/prices alignment reduces the

already weak strategic alignment of products.

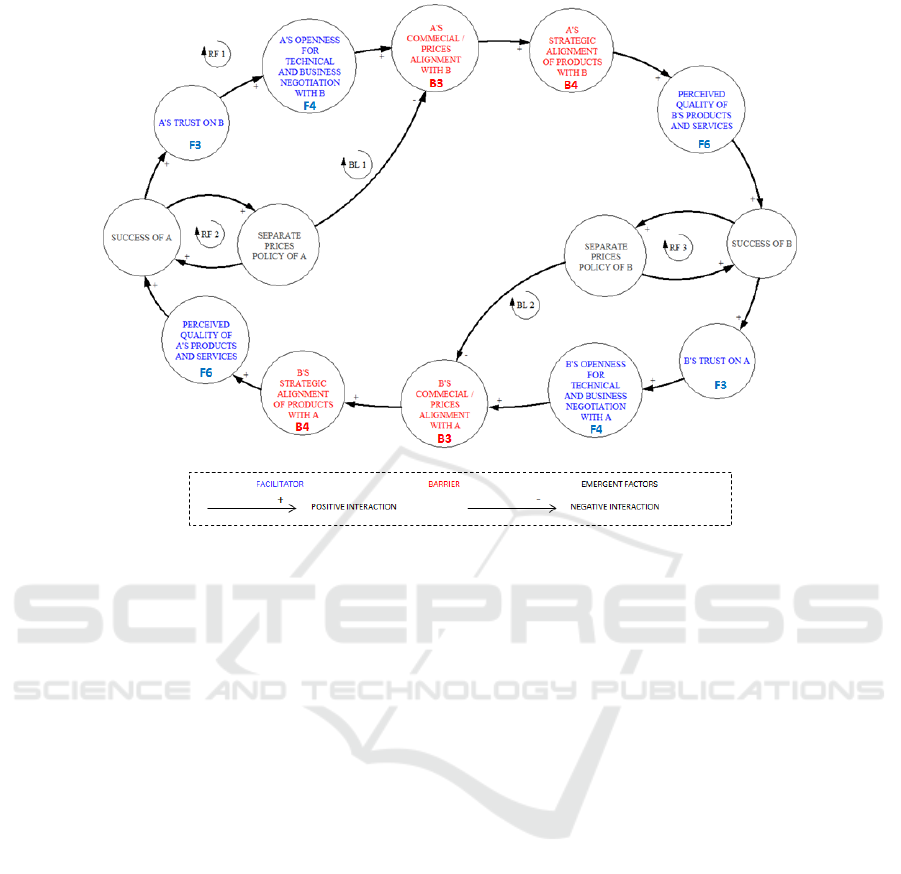

In Figure 2, we describe another representation

of the barriers and facilitators. This specific view

translates a system archetype called Accidental

Adversaries (AA). The AA illustrates a situation in

which two actors start a relationship aiming at

capitalising their power and reducing their

weaknesses. It is based on the idea of a healthy

collaborative environment that supports a goal that

cannot be achieved by parties individually.

However, issues arise when one or both parties take

actions they consider reasonable but that end up

supressing partner’s success. These harmful actions

foster a sense of antipathy and may even turn

partners into adversaries. This scheme synthesises

some challenges that partners face in the studied

software ecosystems.

In the AA archetype presented in Figure 2, the

names of the factors were adjusted to represent the

systemic action between two given partners in the

ecosystem. We also created four variables (in grey)

that were inferred from the situation at hand. In

short, the outermost virtuous reinforcing cycle RF 1

is a virtuous loop that promotes the evolution of

partnerships. In their turn, the virtuous reinforcing

cycles RF 2 and RF 3 mean individualistic actions

that bring unintentional consequences that ultimately

create the balancing cycles BL 1 and BL 2. These

balancing loops hold back the virtuous cycle of the

partnerships (RF 1). Hence, they represent negative

situations that restrict partnerships prosperity.

The former diagrams show that partners must be

open for negotiations. The separate price policy of

the firms is a barrier, as it hampers a partner to close

a deal. By fostering their commercial alignment,

partners enable the recurrence of joint projects. This

shall increase companies’ confidence in partnerships

prosperity. It is then likely to observe an increase in

the strategic alignment of products, which may

ultimately promote the quality of products and

services offered to clients. Hence, partners leverage

ecosystem health and each other success as vendors.

5 DISCUSSION

Based on the former SD models and considering

guidelines from the literature, we derive strategies to

strengthen the collaboration among partners and

We Need to Discuss the Relationship - An Analysis of Facilitators and Barriers of Software Ecosystem Partnerships

25

Figure 2: Accidental Adversaries system archetype representing interactions among barriers and facilitators.

support the healthy evolution of the software

ecosystems. Hence, we address RQ3. The strategy

S1 treats the barriers poor strategic alignment of

products (B4), overlap between features offered by

the company and potential partners (B5) and limited

authority over partner’s development teams (B7).

S1 – Partners Must Align Their Product

Strategies to Sustain Ecosystem Evolution

In a software ecosystem, a SME must try to align its

business models with that of partners. If this firm

has a power position, it may even succeed in putting

partners onto its desired path. Hence, the company

may lead others to want what it envisages (Yoffie

and Kwak, 2006). In some cases, studied SMEs

jointly analyse their commercial models (e.g. prices,

sales process). However, this is an informal initiative

of directors with closer relationships. Firms such as.

Companies A and C are trying to promote the

alignment of their product portfolios by sharing

market intelligence with partners. This practice

attaches partners to the ecosystem by fulfilling their

business expectations. It also implicitly directs them

Nowadays, software companies are expected to

provide an overall view of their products evolution

and decision-making about future product releases

(Suomalainen et al., 2011). By following this trend

and opening product roadmaps, partners embrace the

mutual dependence that is required in an ecosystem.

They start to give up the right of independently

defining new features and share this privilege with

others. Hence, studied firms shall enable ecosystem

partners to influence changes in roadmaps regularly.

If the product roadmaps in the ecosystem are not

correctly aligned, partners can have major problems,

e.g. integration mismatches, solutions mutually

competing and reduced co-innovation (Jansen et al.

2013). For example, there may be conflicts related to

features functioning or removal of features due to

supposed disuse by another system. To integrate

their products properly, partners should make joint

decisions regarding upcoming features.

Although a firm may gain the right to act as

integration coordinator in a specific collaboration

project, it does not exert sufficient control over

partner teams. Hence, the coordinating company

faces challenges to align the product releases of

multiple vendors and treat integration conflicts.

Partner companies can address this barrier by

adopting a technical orchestration strategy that

enables them to hold a new right: to access a partner

development team. By gaining authority over each

other’s teams, a company can plan future product

releases aligned with product evolutions from other

ecosystem participants. The alignment of integrated

solutions guarantees products’ correct operation and

reinforces companies’ expertise in the ecosystem.

Therefore, it increases the perceived quality of

ICEIS 2017 - 19th International Conference on Enterprise Information Systems

26

products and services (F6), which ultimately fosters

success of a company in the ecosystem, as perceived

in the archetype in Figure 2. To treat the barriers

inefficiency to handle integration problems (B1) and

poor strategic alignment of products (B4), partner

firms should also invest in the creation of a common

software platform. This gives rise to the strategy S2.

S2 – SMEs Forming an Ecosystem can

Jointly Develop a Software Platform

To address the challenges involved in the integration

of several products, partners can evolve their

specific integration mechanisms towards a platform.

This shared infrastructure may consist of services,

tools and technologies that ecosystem members can

use to enhance their performance (Iansiti and

Levien, 2004). It enables the composition of features

or services that can be accessed via common

interfaces (Isckia and Lescop, 2009). The platform

can enhance companies’ expertise by supporting the

development of valuable synergies and

complementary innovations for partners and clients.

SMEs shall start to evolve from a productisation to a

platformisation approach (Artz et al., 2010), which

is a strategic action to increase ecosystem health.

Companies would then address resource constraints

by attracting other suppliers to offer niche features,

fostering a vibrant and potentially larger ecosystem

around the platform.

Initially, the SMEs shall discuss how this

platform will be offered and managed. Since the

creation of this infrastructure represents an extra cost

that is not funded by clients, partners could opt for a

shared development and maintenance of the

platform. Another option could be to evolve one

firm’s platform. However, negotiations and disputes

around integration technologies may occur due to

advantages that firms perceive in having platform

ownership, e.g. become a keystone and control its

influence in the ecosystem (Harland and Wüst,

2012). The software platform can enhance

ecosystem productivity and robustness by enabling

firms to build and integrate solutions more naturally.

Communication (F5) is a key factor to deal with

the barrier poor strategic alignment of products

(B4). In light of that, we propose the strategy S3:

S3 – Partners Must Develop Effective

Communication Channels in the Ecosystem

Our studies revealed that partners must improve

their communication capabilities, as this process is

still unstructured and immature. Their challenge

resides in defining centralised and continuous

communication channels. For instance, the manager

of a joint project among the SMEs has great

difficulty to interact with teams from partners. We

observed that communication tends to be rich during

the peak of product integration projects. Then, it

gradually decreases and suddenly resumes as

problems emerge. We also noticed other problems in

the distribution of information among partners:

integration and functional requirements that are not

informed; artefacts that are not shared; problems that

last to be solved; and new feature releases that are

not reported to partners.

According to Jansen and colleagues (2009), one

of the challenges in a software ecosystem is indeed

to build common and efficient communication

channels, which enable the orchestration of partners.

To address this issue, Fricker (2010) recommends

the use of traceability, audit trails and computer-

supported collaborative work, for instance. These

are means to obtain effective knowledge sharing and

management among players in the ecosystem. By

guaranteeing effective interchange of information

(e.g. companies informing each other about product

technological advances and upcoming features),

partners can develop valuable complementary

solutions. This is essential to strengthen ecosystem

productivity as well as niche creation.

A final strategy proposed to the studied software

ecosystems targets the balancing cycle BL 1¸ which

may affect the positive cycle RF 2 in the SD model

presented in Figure 1. It means that the weak

commercial/prices alignment (B3) will reinforce the

poor strategic alignment of products (B4). To treat

these critical factors, we elaborate the strategy S4:

S4 – Partners Must Develop and Agree on a

Revenue Model for the Software Ecosystem

Studied companies argued that some partnerships

might not evolve due to mismatches in their

commercial strategies. In particular, some

companies believe that they can define prices

independently of partners. This situation makes the

integration of products hard or even unfeasible due

to incompatible prices. It reveals a potential lack of

commercial alignment (maybe due to a reluctance to

perform commercial negotiations) that jeopardise the

sustainable growth of partnerships.

A revenue model consists of one or more

revenue streams, which define the way to get

compensation from a good or service provided

(Hyrynsalmi et al., 2012). For instance, in the case

of software as a service, the client normally pays a

subscription fee (Popp, 2011). In an ecosystem

formed by big players such as Apple or Google, the

keystone is responsible for defining the revenue

model(s) adopted in the network, with which

external agents must be aligned.

In the studied scenario, the software ecosystem

partners can negotiate revenue models that are more

suitable for their context. They must ensure a win-

We Need to Discuss the Relationship - An Analysis of Facilitators and Barriers of Software Ecosystem Partnerships

27

win approach, with an egalitarian revenue model

that do not cause partners migration to other

networks, increasing software ecosystem robustness.

In addition, such strategy shall fund innovation and

subsidise new businesses, which can support niche

creation by participants (Moore, 1993).

6 CONCLUSION

Companies participating in a software ecosystem co-

create a collaborative network among their products.

The success of software ecosystems involves

managing a set of factors to foster the individual and

collective health of the network. By understanding

the positive and negative factors that affect

partnerships, companies can derive strategies that

leverage the facilitators while restraining the

barriers. This paper presented a multiple case study

of two software ecosystems. As contributions, we

created SD models to analyse the interactions among

facilitators and barriers. We also proposed a set of

strategies to promote the evolution of the networks.

Since these findings are applicable to other emergent

ecosystems formed by SMEs, we invite researchers

to assess our results and determine how closely their

contexts match that of the case studies.

As future work, we plan to perform additional

studies of similar software ecosystems. We believe it

is possible to identify a set of factors and SD models

that represent a pattern for such type of ecosystems,

allowing a further generalisation of findings.

REFERENCES

Artz, P. et al., 2010. Productization: transforming from

developing customer-specific software to product

software. In International Conference of Software

Business. Springer Berlin Heidelberg, pp. 90-102.

Coyne, I. T., 1997. Sampling in qualitative research.

Purposeful and theoretical sampling; merging or clear

boundaries?, Journal of advanced nursing 26 (3), pp.

623-630.

Cusumano, M. A., 2004. The business of software: What

every manager, programmer, and entrepreneur must

know to thrive and survive in good times and bad,

Simon and Schuster.

Fricker, S., 2010. Requirements value chains: Stakeholder

management and requirements engineering in software

ecosystems. In International Working Conference on

Requirements Engineering: Foundation for Software

Quality. Springer Berlin Heidelberg, pp. 60-66.

Harland, P. E., Wust, S., 2012. Strategic, brand and

platform requirements for an interactive innovation

process in business ecosystems. In Int’l Conference on

Engineering, Technology and Innovation, pp. 1-9.

Hartigh, E., Tol, M., Visscher, W., 2006. The health

measurement of a business ecosystem. In European

Chaos/Complexity in Organisations Network

Conference.

Hyrynsalmi, S., Suominen, A., Mäkilä, T., Järvi, A.,

Knuutila, T., 2012. Revenue models of application

developers in android market ecosystem. In 3

rd

Int’l

Conference of Software Business, pp. 209-222.

Iansiti, M., Levien, R., 2004. Strategy as ecology, Harvard

Business Review 82 (3), pp. 68-81.

Isckia, T., Lescop, D. Open innovation within business

ecosystems: a tale from Amazon.com,

Communications & Strategies 74, pp. 37, 2009.

Jansen, S., Finkelstein, A., Brinkkemper, S., 2009. A sense

of community: A research agenda for software

ecosystems. In 31st International Conference on

Software Engineering, pp. 187-190.

Jansen, S., Peeters, S., Brinkkemper, S., 2013. Software

Ecosystems: From Software Product Management to

Software Platform Management. In IW-LCSP@

ICSOB, pp. 5-18.

Khalil, M. A. T. et al., 2011. A Study to Examine If

Integration of Technology Acceptance Model's (TAM)

Features Help in Building a Hybrid Digital Business

Ecosystem Framework for Small and Medium

Enterprises (SMEs). In Frontiers of Information

Technology, pp. 161-166.

Manikas, K., Hansen, K. M., 2013. Software ecosystems –

a systematic literature review, Journal of Systems and

Software 86 (5), pp. 1294-1306.

Mohr, J., Spekman, R., 1994. Characteristics of

partnership success: partnership attributes,

communication behavior, and conflict resolution

techniques, Strategic Management Journal 15 (2), pp.

135-152.

Moore, J. F., 1993. Predators and prey: a new ecology of

competition, Harvard Business Review 71 (3), pp. 75-

83.

Olsson, H. H., Bosch, J., 2016. Collaborative Innovation:

A Model for Selecting the Optimal Ecosystem

Innovation Strategy. In 42th Euromicro Conference on

Software Engineering and Advanced Applications

(SEAA), pp. 206-213.

Popp, K.M., 2011. Hybrid revenue models of software

companies and their relationship to hybrid business

models. In Third International Workshop on Software

Ecosystems, pp.77-88.

Popp, K. M., 2013. Mergers and Acquisitions in the

Software Industry: Foundations of due diligence,

BoD–Books on Demand.

Senge, P. M., Kurpius, D., 1993. The fifth discipline: The

art and practice of the learning organization.

Suomalainen, T. et al., 2011. Software product

roadmapping in a volatile business environment,

Journal of Systems and Software 84 (6), pp. 958-975.

Weiblen, T., 2015. Opening Up the Business Model:

Business Model Innovation through Collaboration,

PhD Thesis. University of St. Gallen.

Yoffie, D. B., Kwak, M., 2006. With friends like these: the

art of managing complementors, Harvard Business

Review 84 (9), pp. 88-98.

ICEIS 2017 - 19th International Conference on Enterprise Information Systems

28