OptiHealth: A Recommender Framework for Pareto Optimal Health

Insurance Plans

Fernando Boccanera and Alexander Brodsky

Computer Science Department, George Mason University, Fairfax, VA 22030, U.S.A.

Keywords: Recommender, Personalization, Health Insurance Plan Choice, Decision Support Systems, Pareto Optimality.

Abstract: Choosing a health insurance plan, even when the plans are standardized, is a daunting task. Research has

shown that the complexity of the task leads consumers to make non-optimal choices most of the time. While

a number of systems were introduced to assist the selection of health insurance plans, they fail to significantly

reduce the main causes of poor decisions. To address this problem, this paper proposes OptiHealth, a

recommender framework for Pareto optimal selection of health insurance plans. The proposed framework is

based on (1) actuarial analysis of medical data and a method to accurately estimate the expected annual cost

tailored to specific individuals, (2) finding and presenting a small number of diversified Pareto optimal plans

based on key performance indicators, and (3) allowing decision makers to iteratively conduct a trade-off

analysis.

1 INTRODUCTION

A decision on choosing a health insurance plan

should not be taken lightly. Such a decision has major

implications for a person’s health, finance and well-

being. At an individual or family level, the financial

implication is significant with some individuals

spending a large share of their income on healthcare.

Choosing a plan is a complex task. Sometimes

there are dozens or even hundreds of plans to choose

from, each with a set of features. A large body of

evidence shows that individuals select health plans

poorly even when the number of plans is small. The

main causes of poor decisions found in the literature

(Hibbard et al, 1997), (Johnson et al, 1993),

(McWilliams et al, 2011), (Tversky, Kahneman,

1974) are complexity, excessive number of choices,

inability to estimate health outcomes, cognitive bias

and high cognitive load. The result is that consumers

end up using simplified heuristics and fail to make a

Pareto optimal decision that is best suited to their

needs.

To help consumers choose health plans, a number

of Decision Support Systems have been developed

and are publicly available. In section 3 we analyze six

widely used systems which are representative of the

state of the art for health plan selection. These

systems are simplistic in nature; they basically

provide a list of all available plans sorted by a

particular plan feature such as deductible. Our

conclusion is that none of them significantly reduces

the main causes of non-optimal decision making.

To address this gap, we propose a recommender

framework for Pareto optimal selection of health

insurance plans called OptiHealth. Designed to

overcome the main causes of human errors or biases,

the framework comprises a detailed decision

methodology and a recommender to guide a decision

maker through the entire health plan selection

process. It extracts demographic and health

information from the user and employs an algorithm

to match this information with actuarial medical data

in order to predict the healthcare utilization for the

upcoming year. It estimates the total annual expected

cost for each plan and then recommends a small

number of Pareto optimal plans. It allows decision

makers to iteratively conduct a trade-off analysis, and

presents alternatives that improve key performance

indicators while minimizing the increase in the

expected cost. The recommender guides decision

makers to the preferred trade-off among Pareto

optimal alternatives.

The contributions of this paper are as follows.

First, we analyze the root causes of non-optimal

decisions and identify desirable features of a technical

solution. Second, we design a method to estimate the

total annual cost of health plans based on actuarial

patient data. Third, we develop recommender

Boccanera, F. and Brodsky, A.

OptiHealth: A Recommender Framework for Pareto Optimal Health Insurance Plans.

DOI: 10.5220/0006334905990609

In Proceedings of the 19th International Conference on Enterprise Information Systems (ICEIS 2017) - Volume 1, pages 599-609

ISBN: 978-989-758-247-9

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

599

framework that addresses the desirable features and

produces Pareto optimal recommendations best

suited to decision makers’ needs.

The paper is organized as follows: Section 2 is an

overview of health insurance in the United States and

the issues that surround health insurance decision-

making. Section 3 proposes a set of desirable features

in a Decision Support System and evaluates six

widely used public systems. Section 4 shows the

recommender framework through an example.

Section 5 discusses the personalization of plan cost

estimation. Section 6 describes the architecture of the

recommender framework. Section 7 describes

potential future research and concludes the paper. We

use the terms “Framework” or “recommender

framework” to describe our decision methodology

and the term “recommender” to refer to the system at

the core of the Framework.

2 OVERVIEW OF THE DECISION

TO SELECT A HEALTH

INSURANCE PLAN

In the United States, health care is delivered almost

exclusively by private medical providers such as

hospitals, doctors and pharmacies. Access to health

care is facilitated by private insurance companies

through health insurance plans. The menu of plans to

choose from depends on a person’s eligibility,

employment status and what the employer offers. The

set to choose from range from a handful of plans to

hundreds of plans. As the number of choices increase,

so does the difficulty of making a decision, which can

cause cognitive overload.

A health insurance plan is a complex product. In

general, a plan has a menu of benefits, limitations,

charges a premium and imposes cost-sharing like

deductibles, copays and coinsurance. A copay is a

fixed dollar amount paid for a particular service while

coinsurance is a percentage of the service cost that the

insurer is responsible for. Deductible is an amount the

beneficiary pays before coinsurance kicks in (copays

are not subject to deductible). Insurance plans limit

the risk of a catastrophic financial loss by instituting

a ceiling that the insured is responsible for. This is

called maximum out-of-pocket and does not include

premiums.

Choosing a health insurance plan is a daunting

task even when the plans are standardized in terms of

coverage, as is the case of the plans in the U.S.

exchanges of the Patient Protection and Affordable

Care Act (ACA). The reason is two-fold: there are

dozens of plan characteristics to take into

consideration, plus it requires the estimation of future

utilization of health services as well as the total

annual cost for each plan. This difficulty is well

established in the literature and was acknowledged by

(Frakt, 2014).

A large body of evidence shows that individuals

select non-optimal health plans even when the set of

choices is small. (Quincy, 2012) conducted consumer

testing studies and claimed that participants struggled

to assess the overall coverage of a plan and had

difficulty understanding cost-sharing concepts and

what they meant in their particular case. (Abaluck et

al, 2011) evaluated the choices of elders across their

insurance options under the Medicare Part D

Prescription Drug plan. They found that study

participants placed much more weight on plan

premiums than on expected out-of-pocket costs. Their

partial equilibrium welfare analysis implied that

welfare would have been 27 percent higher if patients

had all chosen rationally, demonstrating not only that

participants chose a plan poorly but also overweighed

the premium factor. (Heiss, 2013) confirmed these

findings; their study suggests that fewer than 25% of

individuals enrol in plans that are ex-ante as good as

the least costly plan specified by the (Medicare Plan

Finder, 2016) tool made available to seniors by the

Medicare Administration, and that consumers on

average had expected excess spending of about $300

per year.

One might argue that the root cause of the above

findings was cognitive decrease due to aging, but

other studies found similar effects in younger

populations. (Johnson, 2013) examined how well

people make plan choices versus how well they think

they do. They conducted six experiments asking

subjects to choose the most cost-effective plan using

websites modelled on health exchanges. Participants

had to estimate the number of doctor visits and the

out-of-pocket costs, and choose between a set of four

or eight plans. The results matched earlier studies

showing that unassisted, and without any tool,

consumers made non-optimal health plan decisions.

They selected the best option only 42% of time with

four plans and 21% with eight. Also these non-

optimal choices cost the 4-plan group $200 more per

year.

The issues we identified with unassisted health

plan decision making are: heavy cognitive load,

cognitive bias, inability to estimate health outcomes

and simplified heuristics.

Heavy Cognitive Load

A substantial body of work in cognitive science,

social psychology, behavioral economics and

ICEIS 2017 - 19th International Conference on Enterprise Information Systems

600

decision science demonstrates how individuals

process and use information for decision making.

This body suggests that the integration of different

types of information and values into a decision is a

very difficult cognitive process and only a small

amount of variables can be processed (Hibbard et al,

1997a). (Slovic, 1982) conducted a study were

participants were asked to make predictions based on

5, 10, 20 and 40 variables. He discovered that as more

information was available, the confidence of

participants increased but the reliability of their

choices decreased. When individuals had more

information, their ability to process it consistently

declined. Cognitive psychology explains this

phenomenon in terms of cognitive load, which refers

to the mental effort to solve a problem. A heavy

cognitive load typically creates an error.

A study by (McWilliams et al, 2011)

demonstrated the heavy cognitive load effect caused

by a health plan decision. They studied Medicare

Advantage plan choice and found that enrolment

decreased when more than thirty plans were

available. Retirees didn’t enrol due to the heavy

cognitive load associated with choosing a plan from a

large number of options.

Cognitive Bias

(Johnson, 1993) studied whether biases in probability

assessment and perceptions of loss affect consumers’

decisions about insurance. They found out that study

participants made hypothetical choices that violated

basic laws of probability and value and exhibited

distortions in their perception of risk and framing

effects. In particular, participants were reluctant to

purchase policies with higher deductibles in part due

to framing the deductible as a segregated loss, which

causes loss aversion. Framing is a type of cognitive

bias (Tversky, Kahneman, 1974).

Inability to Estimate Health Outcomes

Choosing a plan requires an estimation of future

utilization of health services, that is, the type, quantity

and cost of services. This of course requires an

estimation of probabilities which is not easy to do

even in the presence of actual sample data. To

estimate future utilization, it’s also necessary to

estimate the probability that new health conditions,

called morbidities, will be acquired during the plan

year. Once this utilization is estimated, it can be used

to calculate the expected cost for every alternative

plan. These calculations require the use of publicly

available data and expertise that is outside the reach

of all but a small group of individuals.

Simplified Heuristics

(Hibbard et al, 1997b) found that consumers have

limits on how much information they can readily

process and as a result, they simplify the decision

process, often eliminating certain choices or details

and taking heuristic shortcuts (Tversky, Kahneman,

1974) that may lead to erroneous decisions.

Simplified heuristics explain (Abaluck et al,

2011) finding that elders placed much more weight

on plan premiums than on expected out-of-pocket

costs. Calculating expected costs require significant

effort, so decision makers replaced a complex task

with a simpler one: choose the plan with the cheapest

premium.

In summary, the problems identified above with

the unassisted decision making of health plans are:

Decision errors caused by complexity, high

number of choices and inability to estimate

health outcomes.

Decision errors caused by cognitive bias and

simplified heuristics

3 CONSUMER BEHAVIOR,

EXISTING DECISION

SYSTEMS AND DESIREABLE

FEATURES

(Scanlon, 1997) reviewed 35 studies of consumer

health plan choice. “Almost all authors found price to

have a statistically significant negative effect on the

probability of enrolling in a health plan”. Consumers

also favor plans with better benefits over those with

less benefits all else being the same. Some studies

found that consumers differ on their choices

according to their age, gender and health status. This

suggests that consumers need to avoid overweighting

price in their decision making.

In the (Johnson et al, 2013) only one group,

Columbia MBA students, performed reasonably well.

When researchers provided calculation aids to the

non-MBA groups, the performance of these groups

improved to the level of the MBA students. This

suggests that tools and a well-organized decision

process are desirable, which was corroborated by

(Hibbard et al, 1997b) Their study suggested the

following desirable features in a Decision System: 1)

reduction of the processing burden; and 2) a method

that rationalizes the process. x

Based on the above research and the issues

described in Section 2, we propose the following

OptiHealth: A Recommender Framework for Pareto Optimal Health Insurance Plans

601

desirable features in a Decision Support System for

Health Plan Selection:

1. Reduce to a minimum the amount of information

the user needs to process.

2. Use total estimated cost as the main decision

factor as opposed to premium cost alone.

3. Anticipate and help users take risk into

consideration.

4. Personalize risk and cost estimation.

5. Guide users step by step through a rational

process that involves a small number of

recommended plans.

We now evaluate existing Decision Support

Systems against the set of desirable features above.

Wechose a subset of representative systems that are

publicly available.

Table 1 shows which feature each system

satisfies. The tools that implement the most desirable

features are PBGH/CalPERS and CMS Plan Finder.

Checkbook is the only tool that estimates medical

utilization and takes risk into consideration. No

system guides users step by step through a rational

decision process.

4 RECOMMENDER

FRAMEWORK BY EXAMPLE

We propose a recommender framework to reduce the

causes of non-optimal decision making and address

the deficiencies of the existing Decision Support

Systems (DSS) for health plan selection.

The recommender framework introduced in this

paper was designed to satisfy the five criteria outlined

on Section 3. It takes risk into consideration by

estimating the total expected cost of each plan at

various probability levels. Once the total cost and risk

are estimated, it uses key performance indicators

(KPIs) like premium and deductible to recommend a

small number of Pareto optimal plans that have the

minimum expected cost. After the plans are

recommended, it allows the user to conduct trade-off

analysis between the expected cost and the KPIs. The

trade-off analysis is implemented through a critique

technique to improve a particular KPI. The user

iteratively improves KPIs until he is satisfied with the

recommendation

The Framework assumes that the decision maker

is an individual adult, not a family, that the individual

utilizes only in-network plans and that the medical

coverage of each plan is standardized, that is, all plans

cover the same health conditions. For simplification

purposes, it only considers cost KPIs; quality and

availability of providers are not considered although

the Framework can be extended to consider these

non-cost factors. has the following components:

1. Presentation of plan risk profiles

2. Recommendation based on the total estimated

plan cost

3. Trade-off analysis capability

4. Final plan selection

We now explain the recommender framework

through an example; the implementation details are

described in Sections 5 and 6.

Health plans have many characteristics, most of

them related to cost sharing. Table 2 shows the cost

of in-network services for two hypothetical health

plans. We use in-network cost-sharing because they

provide the highest benefits.

Table 1: Evaluation of Existing Decision Support Systems.

System

1.Reduce cognitive

load

2.Use total

estimated cost

3.Consider risk

4. Personalize

5.Guide

users

(eHealthInsurance, 2016)

individuals and small business

N

N

N

No health status

N

(PBGH/CalPERS, 2016)

California gov. employees, retirees

y

User enters

utilization

N

Some health status

N

(Massachusetts Health Connector, 2016)

State of Massachusetts residents

Y

N

N

Some health status

N

(CMS Medicare Plan Finder, 2016)

Medicare Beneficiaries

Y

User enters

utilization

N

Y

N

(Healthcare.gov, 2016)

(Anyone)

Y

Low, med, high

utilization

N

No health status

N

(Consumer Checkbook, 2016)

Federal employees and retirees

N

Y

Y

No health status

N

ICEIS 2017 - 19th International Conference on Enterprise Information Systems

602

Table 2: Hypothetical In-network Cost Sharing.

Features

Plan A Cost

Plan F Cost

Annual Premium

$4,140

$5,160

Deductible

4,000

$3,300

Out of Pocket Max

$6,454

$4,310

Primary Care Visit

$25

No charge

Specialist Visit

$35

$35

Diagnostic Service

No charge

No charge

Ambulance

No charge

$50

Emergency Room

30%

$100

Inpatient Facility

$200/admission

10%

Inpatient Physician

No charge

$200

Outpatient Facility

$50

20%

Generic Drug

No charge

$10

Brand Drug

$35

20%

Table 3: Common Morbidities.

High blood pressure

Coronary heart disease

Angina

High cholesterol

Diabetes

Arthritis

Chronic Bronchitis

Asthma

Cancer

. . . . .

Table 3 shows a partial list of common health

conditions or morbidities that we use to calculate risk

and medical utilization. Morbidities, also called

Health Conditions, significantly contribute to the

utilization of medical services. In other words, they

are the drivers of medical utilization. We adopt the

comprehensive set of morbidities from the Medical

Expenditure Panel Survey Household Component

(MEPS-HC), published in 2013 by the Agency for

Healthcare Research and Quality.

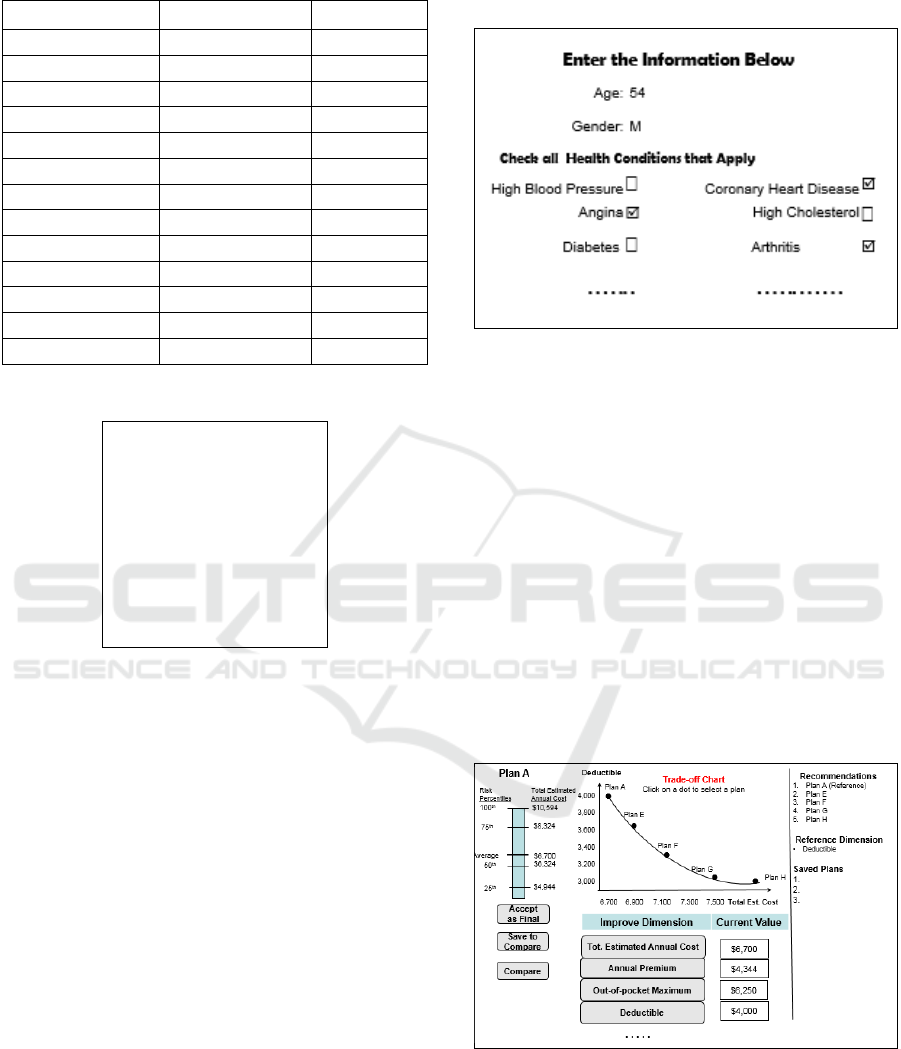

At the very start the recommender shows the

screen in Figure 1 where the user enters personal

information like age, gender and health conditions

(morbidities). In our example, the user is a 54-year-

old male. For simplicity, only a subset of health

conditions is shown.

Based on the personal information extracted in

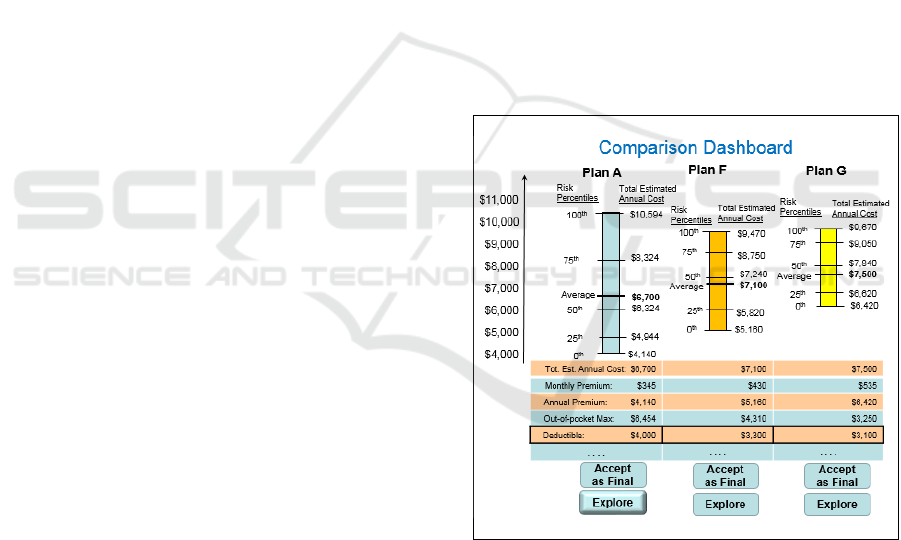

Figure 1, the user is presented with the Exploration

Dashboard exemplified in (Figure 2).

The Exploration Dashboard presents five Pareto

optimal recommendations including Plan A, which

has the minimum total estimated annual cost (TEAC).

Plan A is the Reference Plan because the other

recommendations use it as a reference.

Figure 1: User Input.

The top center panel contains the Trade-off Chart

showing the Reference Plan (Plan A) plus four other

recommended plans. The x-axis shows the TEAC

while the y-axis initially shows the Deductible KPI.

Each dot is a plan, with the Reference Plan as the

leftmost dot, and the plans are shown in increasing

order of TEAC. The four recommended plans from E

to H are the plans that have deductibles lower than

Plan A and TEAC closest to Plan A.

The recommended plans are Pareto optimal that

is, no other KPI, called dimension, can be improved

without increasing the TEAC. This means that Plan

A’s $4,000 deductible cannot be improved without

increasing the TEAC, that is, to improve the

deductible it’s necessary to trade-off TEAC, hence

the name Trade-off Chart.

Figure 2: Exploration Dashboard.

The framework deals with the uncertainty of

future medical utilization, by estimating the

probability distribution of the TEAC. The distribution

is showing in the profile bar for Plan A on the top left

panel. The left side of the plan profile bar shows

OptiHealth: A Recommender Framework for Pareto Optimal Health Insurance Plans

603

quartiles while the right side shows the TEAC for the

corresponding quartile. The profile is a proxy for risk.

For example, for Plan A, the user has a 25% chance

of spending $4,944 during the plan year while the

average spending is $6,700. The TEAC is based on:

1) the cost sharing of a particular plan; 2) an estimate

of the utilization of medical services and 3) an

estimate of the cost of services. The estimations are

based on historical data from actual patients with

health conditions, age and gender similar to the user.

The lower center panel shows the cost-sharing

values for the dimensions of the Reference Plan and

come from Table 2. The right panel displays all

recommended plans, the chosen reference dimension

and the plans saved for comparison if any.

As the name implies, the Exploration Dashboard

allows the user to explore different plans, their

dimensions and conduct trade-off analysis. The user

can:

1. Accept the Reference Plan as the final selection.

2. Save the Reference Plan for comparison.

3. Compare the last three saved plans.

4. Choose another Reference Plan by clicking on the

dot corresponding to the desired plan on the chart.

5. Improve (reduce) the value of a particular

dimension by clicking on the corresponding button.

Let’s say the user wants to improve (reduce) the

out-of-pocket maximum. He/she clicks on the button

labelled “Out-of-pocket Max” and the system

responds by recreating the Trade-off Chart with Out-

of-pocket Maximum in the y-axis. The new chart

would show the top-5 plans with Out-of-pocket

Maximum equal or lower than the Reference Plan.

The Trade-off Chart allows the user to conduct a

trade-off analysis prior to making a final selection.

It’s a trade-off because improving any dimension

increases the TEAC because the recommended plans

are Pareto optimal.

If the user selects a new Reference plan in the

Trade-off Chart, then the profile bar on the left and

the bottom center panel are updated to reflect the

selected plan.

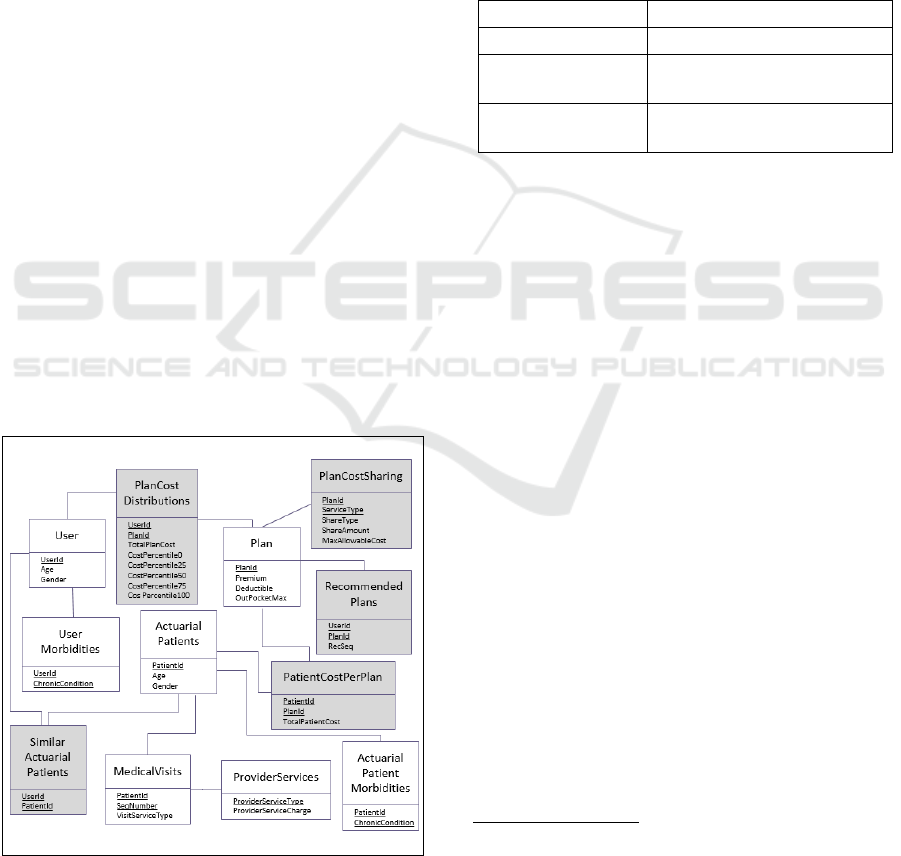

If the user clicks on the “Compare” button, then

the Comparison Dashboard is displayed (Figure 3). It

shows the last three saved plans side by side. The top

panel displays the profile bars while the bottom panel

displays the values for the plan dimensions. The

comparison is useful for conducting risk analysis, for

example, if a particular user thinks that his medical

utilization for the next year will be below average,

then Plan A is the optimal plan because it has the

lowest total cost for each quartile. On the other hand,

if the utilization will be way above average, then Plan

F has the optimal risk profile.

The Comparison Dashboard allows the user to

accept a particular plan as final or to conduct further

analysis by clicking on the Explore button. The idea

behind exploration is that the user likes a particular

recommendation but wants to further analyze it and

perhaps improve some of the plan dimensions.

If the user presses Explore for plan A, the screen

in Figure 2 is shown. The process repeats until the

user clicks on the “Accept as Final” button in either

dashboard.

For an individual with zero medical utilization,

the TEAC is just the premium consequently Plan A in

Figure 3 is optimal. For an individual with an

extremely high utilization, the total cost is the

premium plus the out of pocket maximum so Plan F

is optimal. For an individual with moderate

utilization, the optimal plan usually is the one with the

least total cost although the system allows the user to

perform a trade-off analysis prior to making the final

selection.

Figure 3: Comparison Dashboard.

5 PERSONALIZED PLAN COST

ESTIMATION

The estimation of personalized plan costs is required

for the creation of the risk profiles and trade-off

charts, which are produced by the system and shown

on the Exploration and Comparison Dashboards

(Figures 2 and 3).

ICEIS 2017 - 19th International Conference on Enterprise Information Systems

604

It is a non-trivial task to estimate the future

medical utilization, i.e., medical services like those in

Table 2 that the user may need during the health plan

period of coverage. To estimate future medical

utilization, we need to take into account key drivers

such as demographics (age, sex) and health

conditions like those in Table 3.

Our approach uses patient historical data to

produce a subset of real patients that have health

conditions similar to the user. We estimate the cost of

a given plan as the average cost of the plan over all

patients in the historical database that are similar to

the user in terms of his/her medical utilization drivers.

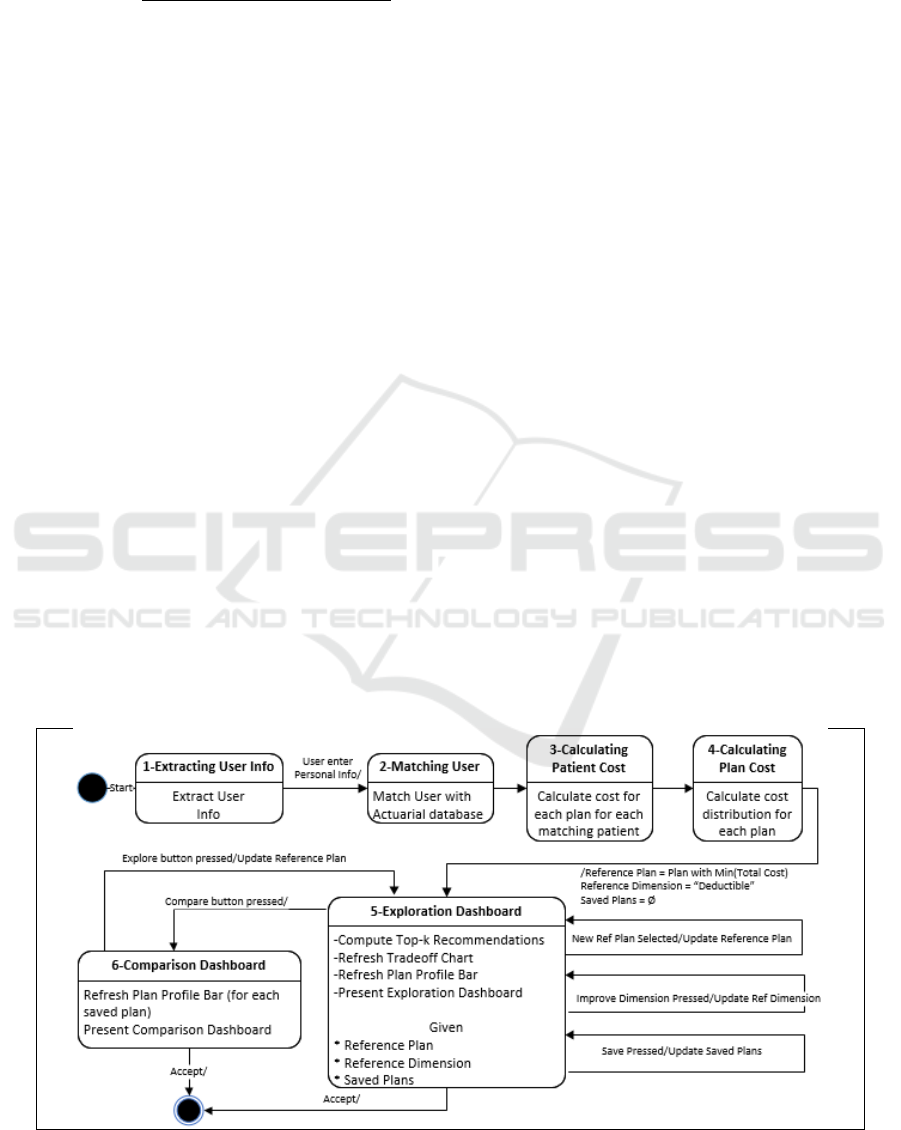

5.1 Data Model

We assume that three datasets exist: 1) historical data

from actual patients; 2) cost data from providers; and

3) plan data from insurance companies. We capture

these datasets in the model shown in Figure 4. Each

relational table is represented by a rectangle with the

name above the line and the data elements below.

Data elements that are components of the primary key

are underlined.

The User and the UserMorbidities tables

represent a user of the system while the Plan table

represents all insurance plans available to the user.

The ActuarialPatients, ActuarialPatientsMorbidities

and MedicalVisits tables capture actual patients and

their medical utilization, while ProviderServices

captures the provider charge for each type of service

utilized by the actual patient. The tables with a shaded

background are produced by the recommender while

the tables with no shade are given.

Figure 4: Database Model.

5.2 Data Source

We use two data sources to populate the historical

patient data in the recommender database: the

Medical Expenditure Panel Survey (MEPS)

Household Component (HC) and the Medical

Provider Component (MPC) from the Agency for

Healthcare Research and Quality. We chose these

datasets because they are the most complete source of

data on the cost and use of health care and health

insurance coverage in the United States. The raw data

that we use from the MEPS is shown in Table 4.

Table 4: MEPS-HC and MEPS-MPC Data.

Demographics

Age, gender, …

Chronic Conditions

All in Table 3 and more

Utilization

For each type of service, # of

utilizations

Expenditure

For each type of service, total

charge by provider

The ActuarialPatients and

ActuarialPatientsMorbidities come directly from

MEPS-HC while ProviderServices comes from

MEPS-MPC.

The MedicalVisits is based on the MEPS-HC but

is not a direct mapping. The problem with the raw

MEPS-HC dataset is that it does not capture the

individual visits to medical providers. Instead, it

captures the aggregate number of utilizations for each

service type as well as the aggregate cost

consequently it cannot be used directly to calculate

the total utilization cost. Another issue is that

providers calculate cost for each instance of

utilization in the order that they occur. We address

this problem by averaging two approximations of the

medical visits’ sequence where the first sequence

leads to the minimum cost and the second sequence

leads to the maximum cost. This is explained in more

detail in subsection 5.3.

5.3 Calculation of Personalized Plan

Cost

We now formalize the calculations to estimate

personalized plan costs. Personalized means that the

estimation is based on attributes of the user of the

system.

Given the following:

OptiHealth: A Recommender Framework for Pareto Optimal Health Insurance Plans

605

-

We want to compute:

Computations:

First, we produce the SimilarActuarialPatients

table, which is the set of Actuarial Patients similar to

the user.

Note that the user morbidities are given at the

beginning of the period of coverage. In the MEPS-HC

data, the actuarial morbidities are captured in Round

1 of interviews prior to any medical utilization

actually happen. Because both user and actuarial

patients’ morbidities are ex-ante, we can use the

similarity matching equation above.

Second we calculate, for a particular patient, the

cost for the visits that do not exceed the deductible.

Note that until the deductible is reached, the patient

pays the full charge for coinsurance-based services up

to the maximum allowed by the plan. The cost for

copay-based services is always a flat fee.

For all ap in SAP(u),all p in P,all v from 1 to NoVisits(ap),

Third, we calculate the cost for the first

coinsurance visit that exceeds the deductible.

Fourth, we calculate the cost for the remaining

visits that exceed the deductible.

Fifth, we calculate the total estimated cost for all

visits for patient ap, which is capped by the out of

pocket maximum for the plan.

Sixth, we estimate the TEAC for user u, which is the

average utilization cost of all similar actuarial patients

plus the premium. This result is used to populate the

ICEIS 2017 - 19th International Conference on Enterprise Information Systems

606

TotalPlanCost attribute of the PlanCostDistribution

table.

Because the MEPS data does not have the precise

sequence of medical visits for an actuarial patient, we

create two sequences of vst(ap,v); one that leads to the

minimum cost for patient ap and another that leads to

the maximum cost. The computations above are then

performed for each sequence and the results are

averaged. This means that the variable

PatientCost(ap,p) used in the computation of

PlanCost(u,p) is the average cost of both sequences.

5.4 Plan Risk Profile

Figure 2 and 3 show the risk profile bars for several

plans. A profile bar is a proxy for risk. The left side

shows quartiles while the right side shows the total

estimated annual cost for the corresponding quartile.

Quartiles are percentiles at quarter intervals, in

our case 0, 25, 50, 75 and 100. We calculate the

distribution of the cost and then the quartile ranks and

populate the PlanCostDistribution table.

6 RECOMMENDER

FRAMEWORK

ARCHITECTURE

The recommender is modelled by the UML Statechart

in Figure 5. The system is a constraint-based

conversational recommender with two phases. In the

first phase (states 1 to 4), the system computes a small

number of recommendations while in the second

phase (states 5 and 6), it interacts with the user to

refine the recommendations in a feedback loop.

In State 1, the system presents the screen in Figure

1 and the user enters his/her age, gender and health

conditions (the morbidities in Table 3). In State 2, the

system matches the user’s age, gender and

morbidities to the ActuarialPatients data to determine

the set of similar patients and produces the

SimilarActuarialPatients table according to the

calculations in Section 5.3. The given data in the

MEPS-based tables are interpreted as implicit

preferences, that is, by using a particular health care

service, the MEPS-HC surveyed patients expressed a

need, which is a hard preference.

In State 3, the system calculates the actual cost for

each plan for each similar patient using the formal

model described in Section 5.3. In State 4 step 1, the

cost per patient per plan is sorted and the total

estimated annual cost for each quartile level is

computed for each plan. These various costs comprise

the plan risk profiles and these profiles are

personalized because they are based on the

information the user provided.

In State 4 step 2, the dominated plans are removed

from the Personalized Plan database. Given a set of

plans P and a set of dimensions D, we say that plan

p P is dominated if it can be improved in at least

one dimension without sacrificing any other

dimension, i.e.,

)

Where

means strictly better on

Figure 5: Recommender System UML Statechart.

OptiHealth: A Recommender Framework for Pareto Optimal Health Insurance Plans

607

dimension

d

and

means better or

equivalent on dimension

.

In State 4 step 3, the top plan, namely the

Reference Plan, is calculated. The top plan is the plan

with the minimum Total Estimated Annual Cost. The

Reference Dimension is set as “Deductible” while the

set of Saved Plans is initialized as null. From State 4

on, the state of the system is determined by the

following state variables: Reference Plan, Reference

Dimension and Saved Plans.

State 5 is the Exploration Dashboard, which is the

core of the system. Upon entry to the Exploration

Dashboard, the system:

1. Computes the top-5 recommendations.

2. Refreshes the Trade-off Chart.

3. Refreshes the Plan Profile Bar.

4. Presents the Exploration Dashboard (Figure

2).

The computation of the top-5 recommended plans

in State 5 step 1 is as follows:

1. Top recommendation r

0

= Reference Plan

2. For every i = 1 to 4, r

i

is the plan with the lowest

total expected cost higher than r

0

and r

i

(reference

dimension) r

0

(reference dimension)

The top-5 recommendations are Pareto optimal

because all dominated plans were removed in State 4

step 2.

In State 5 step 2, the system refreshes the trade-

off chart. In step 3, it uses the Reference Plan to

refresh the plan profile bar and in step 4 it displays

the Exploration Dashboard (Figure 2).

From the Exploration Dashboard, if the user

clicks the “Accept as Final” button, the process ends.

If the user clicks “Save for Compare”, the systems

adds the Reference Plan to the set of Saved Plans. If

a plan in the Trade-off Chart is clicked, that plan

becomes the Reference Plan and the Exploration

Dashboard state is entered again, which forces the

recalculation of the top-5 recommended plans.

If a dimension button is pressed, the Reference

Dimension is updated and the Exploration Dashboard

state is re-entered. Pressing a dimension button

critiques the corresponding dimension, that is,

improves it. Because the recommended plan is Pareto

optimal, there is no other plan that has a lower total

cost for the same dimension, consequently the user

has to trade-off a lower dimension for a certain

increase in the TEAC.

If the “Compare” button is pressed the system

then enters State 6, the Comparison Dashboard. Upon

entry to the Comparison Dashboard, the system

refreshes the Plan Profile Bar for each saved plan and

then presents the Compare Dashboard (Figure 3). The

top panel displays the profile bars while the bottom

panel displays the values for the plan dimensions. The

comparison is useful for conducting risk analysis.

From the Comparison Dashboard, if the user

clicks on “Explore”, the plan selected is set as the

Reference Plan and the system enters the Exploration

Dashboard state. If the user clicks the “Accept as

Final” button, the Reference Plan becomes the chosen

plan and the process ends.

7 CONCLUSION

This paper proposes OptiHealth, a recommender

framework for the selection of Pareto optimal health

insurance plans. OptiHealth was designed to

overcome the main causes of human errors or biases

as well as the limitations of current Decision Support

Systems. The recommender uses actuarial data to

estimate the total annual cost for each plan and then

recommends a small number of Pareto optimal plans.

It allows the decision maker to iteratively critique

specific parameters of a plan, and presents

alternatives that improve the critiqued parameters

while minimizing the increase of the expected cost.

The iterative critique process guides the decision-

maker to the preferred trade-off among Pareto

optimal alternatives.

We claim that the proposed recommender

framework achieves the five desirable features. It 1)

reduces cognitive overload; 2) uses total estimated

cost as the main decision factor; 3) takes risk into

consideration; 4) personalizes risk and total cost; and

5) guides users through a rational process that

involves a small number of recommended Pareto

optimal plans.

Future research could improve the similarity

matching formula by allowing patients that have

similar but not identical morbidities, use a range of

ages instead of a single one and use other

demographic parameters. Other improvements would

be to generalize the Framework to handle an entire

family instead of a single individual and to relax the

assumption that all plans have the same coverage.

Future research also could develop a prototype of the

recommender.

REFERENCES

Abaluck, J., Gruber, J., 2011. Choice Inconsistencies

among the Elderly: Evidence from Plan Choice in the

Medicare Part D Program. American Economic Review,

101(4): 1180-1210.

CMS Medicare Plan Finder, 2016. https://www.medicare

.gov/find-a-plan/questions/home.aspx

ICEIS 2017 - 19th International Conference on Enterprise Information Systems

608

Consumer Checkbook, 2016. https://www.checkbook.org/

newhig2/hig.cfm

eHealthInsurance, 2016. https://www.ehealthinsurance.com/

Frakt, A., 2014. Choosing a Health Plan is Hard, Even for

a Health Economist (me). The Incidental Economist

blog, October 29, 2014.

Heiss, F., Leive, A., McFadden, D., Winter, J., 2013. Plan

selection in Medicare Part D: Evidence from

administrative data, Journal of Health Economics,

Elsevier, vol. 32(6), pages 1325-1344.

Healthcare.gov, 2016. https://www.healthcare.gov/

Hibbard, J., Jewett, J., Legnini, M., Tusler, M., 1997a.

Choosing A Health Plan: Do Large Employers Use The

Data? Health Affairs, vol. 16, no. 6, pp. 172-180.

Hibbard, J., Slovic, P., Jewett, J., 1997b. Informing

consumer decisions in health care:implications from

decision-making research. Milbank Quarterly

75(3):395–414.

Johnson, J., Hershey, J., Meszaros, J., Kunreuther, H.,

1993. Framing, probability distortions, insurance

decisions. Journal of Risk and Uncertainty 7: 35–51.

Johnson, E., Hassin, R., Baker, T., Bajger, A., Treuer, G.,

2013. Can Consumers Make Affordable Care

Affordable? The Value of Choice Architecture. PLoS

ONE 8(12): e81521.

Massachusetts Health Connector, 2016.

https://betterhealthconnector.com/

Medical Expenditure Panel Survey, 2013. Agency for

Healthcare Research and Quality. U.S. Department of

Health & Human Resources.

http://meps.ahrq.gov/mepsweb/

McWilliams, J., Afendulis, Christopher, McGuire, T.,

Landon B., 2011, Complex Medicare Advantage

Choices May Overwhelm Seniors, Health Affairs,

2011;30(9):1786–94.

PBGH/CalPERS, 2016.

https://calpers2015.chooser2.pbgh.org/

Quincy, L., 2012. What's Behind the Door: Consumer

Difficulties Selecting Health Plans. Health Policy

Brief, January 2012, Consumer Union.

Scanlon, D., Chernew, M., Lave, J., 1997. Consumer Health

Plan Choice: Current Knowledge and Future

Directions. Annual Review Public Health 1997, 18:507-

28

Slovic, P., 1982. Toward Understanding and Improving

Decisions. Human Performance and Productivity: Vol.

2, Information Processing and Decision Making, ed.

W.C. Howell and E.A. Fleishman (Hillsdale, N.J.:

Erlbaum, 1982), 157–183.

Tversky, A., Kahneman, D., 1974. Judgment under

Uncertainty: Heuristics and Biases. Science 27 Sep

1974: Vol. 185, Issue 4157, pp. 1124-1131. DOI:

10.1126/science.185.4157.1124.

OptiHealth: A Recommender Framework for Pareto Optimal Health Insurance Plans

609