The Non-Bank Islamic Mortgage: Prospect and Challenges

Egi Arvian Firmansyah

Department of Management and Business, Faculty of Economics and Business, Universitas Padjadjaran, Bandung,

Indonesia

Keywords: Islamic Mortgage, Non-bank mortgage, riba-free, sharia compliance.

Abstract: As a relatively new movement, the non-bank Islamic mortgage is interesting to be researched in Indonesia

where most of the people are Muslims. This approach is believed to able to facilitate consumers to have a

house without having to worry about the usury and complexity in dealing with banks because the approach is

simpler by not involving the bank. This paper is a conceptual paper describing the issue prevalent in some of

the Indonesian cities, i.e. the non-bank Islamic mortgage. This paper tries to explore the future prospect of the

practice as well as the challenges faced by this movement in the years to come. As the research in the field is

currently uncommon, this paper is expected to open the gate for researchers to study the non-bank Islamic

mortgage. The results of this paper put recommendations for the businesses, customers, governments as well

as academician and researchers in the field of Islamic mortgage.

1 INTRODUCTION

A house is perhaps the most expensive asset that

human being can ever have. Thus, a house has always

been one of the primary needs and every Muslim has

to maintain this asset as the way of hifzum maal

(wealth maintaining). A relatively new approach in

purchasing a house is a non-bank Islamic mortgage.

This movement does not involve bank as in any

common practice of home mortgage which in

Indonesia is known as Kredit Pemilikan Rumah or

KPR. In the practice of non-bank mortgage, a home

buyer directly pays the installment to the developer or

home seller without the bank or any financial

institution as the credit lender. Currently, the-non-

bank mortgage approach is rather uncommon for

most people and only certain Muslims in some cities

already recognize it. To the author’s best knowledge,

the research in this field is still limited so this paper

sheds the light by trying to explore the prospect and

the challenges in the future in the context of Indonesia

as a developing nation.

Aside from running the business in accordance

with sharia rule, the businesses are now also trying to

cater the potential customers who set a priority in the

aspect of sharia compliance. The aspect of militancy

in buying a house is one of the foundations for some

Muslims because Riba (usury) must be highly

avoided and the sharia banks are considered less

sharia-compliant.

To cater the potential market prioritizing Islamic

compliance in the home transaction, there has been a

movement where some Muslim businessmen

introduced a mortgage without a bank. This

movement was first organized by a small group of

people in some Indonesia cities such as Bandung and

Depok. Often, they make online group such as

WhatsApp group for introducing the movement to the

people interested in buying a house but paying

attention to the sharia guidelines. To the author’s

observation, this movement is still relatively new but

it is quite common to be found in some websites,

blogs, and social media.

This paper first introduces the practice of non-

bank Islamic mortgage as outlined in the Introduction

section. The following section discusses some

literature in the field, followed by methodology. The

core of the paper, namely the prospects and the

challenges are presented in the findings section. The

final section concludes the paper briefly.

2 LITERATURE REVIEW

Islam guarantees the wealth ownership of every

Muslim as described in the holy Quran (An-Nisa/4:5).

Acquiring a house needs most of the sacrifice in terms

of money, efforts, time and attention. This is even

worst for those who live urban or big cities as the land

price increases more than the income does. The

220

Firmansyah, E.

The Non-Bank Islamic Mortgage: Prospect and Challenges.

In Proceedings of the 2nd International Conference on Economic Education and Entrepreneurship (ICEEE 2017), pages 220-224

ISBN: 978-989-758-308-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

research in the home mortgage is quite extensive as

has been done by several researchers in some

countries such as Hamid & Masood (2011) in

Pakistan, Amin et al. (2009) in Malaysia, and

Wulandari et al. (2016) in Indonesia.

Hamid & Masood (2011) concluded that there

are five most important factors considered by

customers in choosing Islamic mortgages, namely

sharia principle, fast, efficient service, price, bank

reputation, terms and conditions of product

flexibility. According to their research, the sharia

aspect is the first or most important.

Using cluster analysis, Amin et al. (2009) found

that bank customers can be divided into three clusters,

i.e. Cluster one consists of the customers who had a

tendency to select mortgage bank on the basis of

“service provisions”, cluster two consists of the

customers who had a tendency to select mortgage

bank on the basis of “elements of Sharia and Islamic

principles”, and cluster three consists of the

customers who showed a tendency to select Islamic

mortgage provider on the basis of “pricing”. They

suggested that the mortgage banks adjust their

strategies in adapting the needs of each cluster. In the

subsequent research, Amin et al (2017) examined

three factors, i.e. service quality, product choice and

Islamic debt policy and their influence on consumer

attitude (Amin et al. 2017). They found that consumer

attitude acts as a mediator of the relationships

between service quality, product choice, Islamic debt

policy and the Islamic home financing preference.

Wulandari et al. (2016) measured the pattern of

contract agreement process in order to map numerous

banks position in perceiving sharia conduct. They

found that there are four dimensions affecting the

contract agreement, namely fairness to the customer,

country regulation, perceived business practicality

and product characteristic.

Most of the research in Islamic home financing in

Indonesia and other countries such as Malaysia deals

with the common practice of home mortgage by

involving a bank. The practice uses the contract of al-

Bay’ Bithaman Ajil (BBA) and Musharakah

Mutanaqisah Partnership (MMP). BBA is basically a

murabahah contract based on buy-and-sell principle

while the MMP is a combination of musharakah

(partnership) contract and ijarah (rental) contract

where the financier’s equity follows a diminishing

balance method (Meera & Razak 2005). To the

author’s knowledge, the research in the field of non-

bank Islamic mortgage is still limited. Finding the

similar research topic in other countries is difficult

due to the relatively new approach of this non-bank

Islamic mortgage. Or, the term of this non-bank

Islamic mortgage might not be the same from one

country to another. The author so far only found the

Islamic mortgage research involving banks or other

financial institutions. Thus, this paper is expected to

add the literature of Islamic mortgage especially the

non-bank approach using Indonesia case. Asides, this

paper is expected to raise the awareness of the

readers, researchers, bankers, governments and

business practitioners on the non-bank Islamic

mortgage.

3 METHODS

This paper is a conceptual paper aimed at introducing

the practice of non-bank Islamic mortgage prevalent

recently in some cities in Indonesia. This paper is a

beginning of the further research and thus uses a

qualitative approach. The data are obtained from a

secondary source such as websites and journal

articles. The data are then synthesized to support the

author’s idea regarding the prospect and challenge of

non-bank Islamic mortgage in the context of

Indonesia.

4 RESULTS AND DISCUSSION

4.1 Prospect of Non-Bank Islamic

Mortgage

This section describes the prospect of the non-bank

Islamic mortgage specifically in Indonesia context as

a developing and the largest Muslim population

country. The supporting data are obtained mainly via

the internet including the websites, reports, news, and

others. To the author viewpoint, the prospect of the

non-bank Islamic mortgage is promising as can be

seen from the following facts:

4.1.1 The rising of the buying-selling

websites for home

The buying-selling websites provide a quite clear

information to the potential buyers before making a

purchasing decision. As in any e-business website,

the potential customers may go to several websites to

compare the price and collect as much as information

which is beneficial for making a purchase decision.

After getting on any of this website, the potential

customers can simply type ‘riba’ in the search bar and

they can find abundant information of the houses,

lands, and apartments to be leased or bought. By

The Non-Bank Islamic Mortgage: Prospect and Challenges

221

typing riba, the customers shall see many houses for

sale by using non-bank approach. Some of the

websites providing the non-bank Islamic mortgages

are www.rumahdijual.com, www.rumah123.com,

www.olx.com, www.lamudi.com, and

www.rumah.com. By searching using the keywords

‘tanpa riba’ (without riba), the potential costumers

shall find the houses which are offered by using non-

bank approach.

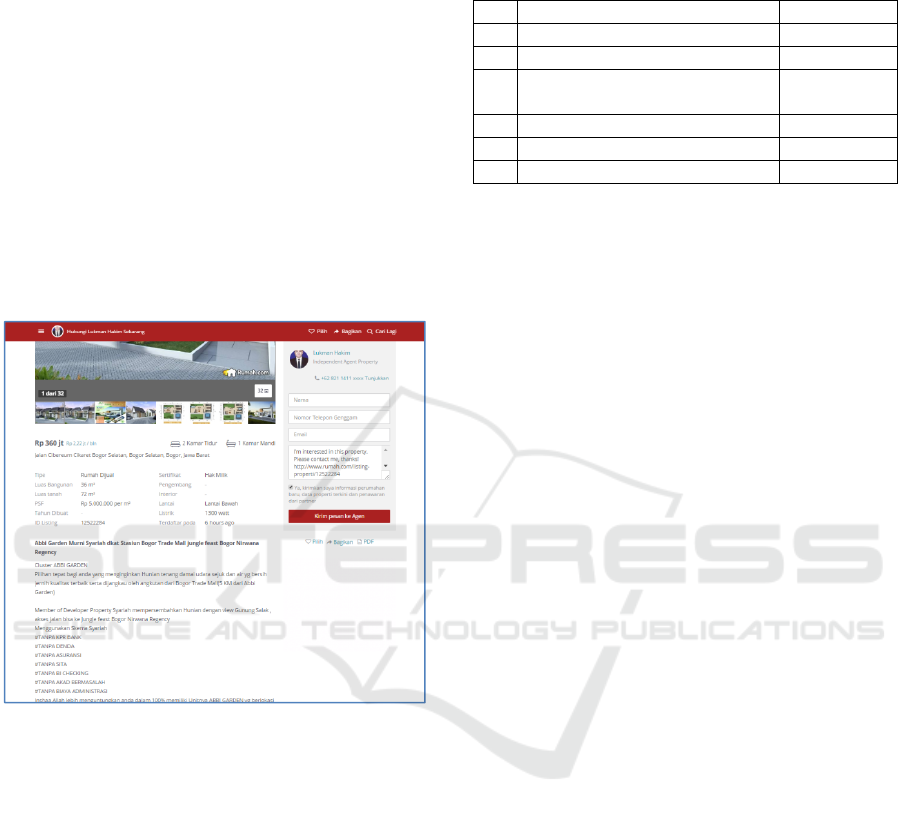

The tagline used by the developers of non-bank

mortgage is quite similar. They inform the customers

that the transaction is “riba-free”, there is “no bank’s

involvement”, “no penalty fee”, “no insurance”, “no

BI checking (central bank checking)”, and “no Akad

bathil (flaws agreement)”. The illustration of the

advertisement is as follows:

Figure 1: Screenshot of non-bank Islamic mortgage

advertisement

Source: http://www.rumah.com, 2017

The selling and buying websites have been rising

along with the development of other technological

advancements such as affordable smartphones and

faster internet access in most of the Indonesian cities.

Aside from customers, the sellers can now with ease

sell their houses, lands or apartments by using the

websites. The sellers of the house using non-bank

approach are usually the developers who care about

the ‘Islamicity’ of conducting business. In selling the

properties, they consider the compliance with sharia

as the most important aspect so it must be put on the

top list. Some of the developers or regencies found to

sell the house by using non-bank approach is shown

in Table 1.

Table 1: Developers/Regencies selling houses with non-

bank approach

No Developers/Regencies City

1 AFARA FIRST HILLS Bogor

2 Royal Orchid Villa Cimahi

3 Cicarita Tower West Bandung

Regency

4 Cluster ABBI GARDEN Bogor

5 Syamsa Dhuha Residence Depok

6 Town House Casa Mabda South Jakarta

Source: Author, 2017

Aside from those websites, the potential

customers can now learn more about the house they

are going to buy by asking and consulting to the

association. There are two associations providing

information about the housing and its sharia aspect.

These associations are Developer Properti Syariah

Indonesia (http://www.dpsi.or.id/) and Agen Properti

Syariah (http://propertysyariah.net/). Association

also educates the Muslims to use the mortgage which

is riba-free by holding seminar or workshop.

4.1.2 The progressive movement of Islamic

finance as a whole

The progressive movement of Islamic finance as a

whole can be seen by the growing number of

Indonesian banks opening the branch of their Islamic

ones. According to the report of OJK in March 2017,

namely “Sharia Banking Statistics”, there were 21

conventional banks which open the sharia business

unit (UUS) and there were 13 sharia commercial

banks (BUS). In fact, in the year 2005, there were

only three sharia commercial banks. The same thing

also happens to other financial institution, one of

them is Islamic insurance. One of the issues prevalent

recently is the opening plan of Sharia BPJS or

insurance (BPJS ONLINE 2016). The foundation of

Sharia BPJS is the awareness of Indonesian Muslims

to have insurance product which is sharia-compliant.

This product is initiated by the government. The work

to finalize the sharia BPJS lies on their shoulders and

if the product is completed, the fund collected will be

able to support the share of Islamic finance on a

national scale. Another thing is Islamic investment.

Currently, several securities firms open the platform

of Sharia-compliant investment allowing the

investors to only perform selling the stocks included

in Indonesia Sharia Stock Index (ISSI). The growing

concern for investing in Islamic stock has a share in

boosting people’s awareness in investing in an

Islamic way. Currently, there are 331 Islamic stocks

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

222

listed in Indonesia Sharia Stock Index (ISSI) where

the fund can be invested there.

4.1.3 More concerns in applying the sharia

rule in lives

Some of the manifestation of the concerns with sharia

rule are as follows: 1). the growing concern of by

wearing hijab for women. Presently, the industry of

hijab is skyrocketing. The number of hijab sellers and

the number of potential buyers are also high. Again,

technology has well facilitated this trend. Hijab

business is so popular among Muslim women in

Instagram, 2). In education, there are now increasing

university or college opening the major or study

program in Islamic economics and finance. In the last

ten years, there only a few Islamic finance program

study in Indonesia, 3) the most current movement

which shows the rising awareness to Islam is the

movement of 411 and 212 where the people

supported the government and lawmakers to uphold

the justice to the blasphemy case.

4.2 Challenges of Non-Bank Islamic

Mortgage

4.2.1 Longer tenor

The first challenge for the non-bank Islamic mortgage

is the tenor or the duration of installment which is

quite short. The maximum duration is averagely five

years whereas the regular mortgage or KPR may up

to 20 years, depending on the buyer financial profile

and preference. The short tenor of the non-bank

Islamic mortgage may hamper some people who have

limited monthly income. This short tenor is

understandable as the developers want to maintain the

liquidity. The home developers are not like banks

who have more cash or liquidity, thus they set the

tenor shorter. In order to cater more consumers who

need longer tenor, this short tenor is indeed the

challenge in the years to come. Thus, the developers

in non-bank mortgage need to consider to lengthen

the installment duration without hurting their

liquidity.

4.2.2 Shorter monthly installment

Aside from the short installment duration, the next

challenge is to have cheaper monthly instalment.

Currently, the home developers of non-bank Islamic

mortgage set the more expensive instalment to the

buyers. This makes sense because the tenor is shorter

so the instalment becomes higher, as explained in the

previous section. As an example, in the regular

Islamic mortgage, a customer may pay IDR 3.7

million for 15 years for the house he bought worth

300 million. While in the non-bank Islamic mortgage,

the monthly instalment may up to 7 million but in 5

years. In fact, both schemes may subject to the

negotiation between the homebuyer and the seller.

4.2.3 Meaning stronger liquidity

To the author’s observation, the sellers in the non-

bank Islamic mortgage often do not have sufficient

fund so their business scope is limited, compared to

the banks. In fact, this movement is also relatively

new so the player is only a few. To have more

liquidity for an expansion, the developer of non-bank

Islamic mortgage may partner with the fund owner

but not the bank, for example, cooperative or pension

plan.

4.2.4 Legal aspect

The next challenge is the assurance for customers.

This aspect is important because the customers need

the sense of safety, especially when spending much

money like buying a house. Based on the observation

on the buyers and sellers of non-bank Islamic

mortgage, the trust between the two parties is the key.

To evaluate the customer background, there is no

thorough check like in a bank. Again, the trust and

commitment between two are important. As the

aspect of sharia compliant is the main factor, the

honesty becomes the foundation of the transaction.

The current transaction already involves the notary to

record the transaction validity. Nonetheless, the

government rule or statute has not been set in

regulating the transaction. This is because until now,

the home transaction is often done via bank.

4.2.5 Lack of Data (e.g. NPL, successful rate

of the practice)

As the movement of non-bank Islamic mortgage is a

new approach, the record of non-performing loan is

not known yet. Knowing this number is important to

evaluate the success of the movement. This is

unknown because there is no report to the OJK

(financial service authority). If the movement grows

bigger, the author believes the government needs to

set up rule regulating this movement for the sake of

protecting the customer and also the seller or

developer. Besides, this is also intended to protect the

society as a whole.

The Non-Bank Islamic Mortgage: Prospect and Challenges

223

4.2.6 Competition with banks

The last point made regarding the challenge of the

non-bank Islamic mortgage is about competition. For

the developer side, this movement is simpler because

does not involve the bank. The developer may earn

more profit because the money from the buyer

directly goes to it. Indirectly, the developer cuts the

role of the bank thus the developer becomes the

competitor of the bank.

5 CONCLUSION

The non-bank Islamic mortgage has the chance to

flourish in the years to come as shown by some facts

explained previously. Nonetheless, this trend has also

some challenges making the growth go slowly. This

non-bank approach also puts the challenge to the

Islamic banks as the developers become their

competitors in terms of providing housing product.

Thus, Islamic banks need to redefine their mortgage

product in addressing the competition with the

developers of non-bank Islamic mortgage. The

government needs to make some regulations to

protect both the developers and customers of non-

bank Islamic mortgage. So, both parties can

eventually perform a safer transaction. The

academicians or researchers are highly encouraged to

study this movement because there are still more

things to be revealed in Indonesia and in other

Muslim countries. Besides, the practice of non-bank

Islamic mortgage is interesting because it is totally

different from the sharia-compliant mortgage

involving bank which is common in the academic

world.

This research has some limitations. To note, this

research is a conceptual paper without employing any

primary data. Thus, the further research may

distribute questionnaires to the home buyers using the

scheme of non-bank Islamic mortgage to find more

insight. In addition, this research is limited to the

context of Indonesia, thus the research in other

Muslim countries such as Malaysia and Pakistan may

be conducted.

REFERENCES

Al-Quran

Amin, H. et al., 2009. Cluster analysis for bank customers’

selection of Islamic mortgages in Eastern Malaysia.

International Journal of Islamic and Middle Eastern

Finance and Management, 2(3), pp.213–234. Available

at:

http://www.emeraldinsight.com/doi/abs/10.1108/1753

8390910986344.

Amin, H. et al., 2017. Consumer attitude and preference in

the Islamic mortgage sector: a study of Malaysian

consumers. Management Research Review, 40(1),

pp.95–115.

BPJS ONLINE, 2016. OJK Rampungkan BPJS Kesehatan

Syariah – BPJS Online. Available at: https://www.bpjs-

online.com/ojk-rampungkan-bpjs-kesehatan-syariah/

[Accessed May 4, 2017].

Hamid, A. & Masood, O., 2011. Selection criteria for

Islamic home financing: a case study of Pakistan.

Qualitative Research in Financial Markets, 3(2),

pp.117–130.

Meera, M.K.A. & Razak, D.A., 2005. Islamic Home

Financing through Musharakah Mutanaqisah and al-

Bay ’ Bithaman Ajil Contracts : A Comparative

Analysis. Review of Islamic Economics, 9(2), pp.5–30.

Wulandari, P. et al., 2016. Contract Agreement Model for

Murabahah Financing in Indonesia Islamic Banking.

International Journal of Islamic and Middle Eastern

Finance and Management, 9(2). Available at:

http://dx.doi.org/10.1108/IMEFM-01-2015-0001.

“Sharia Banking Statistics”. Published by Banking

Licensing and Information Department

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

224