The Role of Account Representative in Securing the Tax Proceed

Harry Suharman, Evita Puspitasari and Siti Khaeryyah

Accounting Department, Faculty of Economics and Business, Universitas Padjadjaran, Bandung, Indonesia

Keywords: Account Representative Competency, Account Representative Independency, Tax Proceed, Tax Regulation.

Abstract: The main objective of the research is to study the influence of account representative competency and

independency in stimulating the tax payer in fulfilling their tax obligation so that the tax proceed can be secure

enough. The study takes place at one of the tax office in Bandung. The target population involves 34 account

representatives that work in the tax office as the respondents have become the focus of this research. The data

have been collected by using questionnaires. After having the data being tabulated then it is analyzed by using

multiple regressions. The result indicates that simultaneously both the account representative competency and

independency influence in securing of tax proceed. However partially the account representative

independency itself cannot influence the tax proceed.

1 INTRODUCTION

Having many years one of the governance’ major

source of income came from gas and oil. However,

now do not exist anymore due to non-renewable

resources. Every country should seek another source

of income in enable to cover all the requirement

expenses. Ones besides generating income through

improving trading or exports, tax burden may give

rise as a potential income for the government.

Therefore, they need to evaluate and identify several

aspects especially in tax policy and regulation.

With the tax payment, it is expected that the

government can build infrastructure and public utility

which may provide welfare and prosperity for the

community. However, the tax payer both individual

and business entity (corporate) should obey their

obligation to pay taxes. Otherwise, public goods and

services will be impossible to fulfill by the

government due to lack of financing.

According to the statute no 28 year 2007 article

no 1 concerning general provision and tax governance

that is an obligation for the individual and the

companies to contribute to the country and it can be

enforced without having direct utilities in sake of

community development and welfare. Within paying

the tax obligation, the community will receives

several benefits such as public goods and services

quality improvement, providing high quality

education, health insurance, building infrastructure,

specific economic zone, community development and

so on. In doing so, the government need a certain

action plan and tax policy that can improve awareness

and willing to pay taxes.

It has been claimed that the function of tax

includes budgetary and regulatory function. The first

function triggers to generate income as much as it

can. Several aspects and expenses require to be

accomplished. Government expenditure may take in

form of routine expenditures and development

expenditures. In a routine expenditures one should

considered and allocate the budget to finance several

expenses such as government employee expenses,

inventories expenses, maintenance and so on. While

developments expenditure requires high amount of

investment that will affect government’s income and

budget. Regulatory as a second function is concern in

regulating economic, social and political domain. The

main objective of this function gives rise to the

government with the authority and flexibility to

regulate economic development through fiscal policy.

For instance, to attract both domestic and foreign

investor special incentives in tax policy and treatment

have been given. A special attention and protection

are also have been given by the government through

duty customs regulation.

Besides the above two function, taxation also has

another mission as a stabilizer. Whereas the

government has an authority to carry out and ensure

that inflation can be control through certain

mechanism. In doing so, for instance, regulates the

circulation of money in the community, tax collection

and use of tax efficiently and effectively. Moreover,

tax function redistributes income in terms of

Suharman, H., Puspitasari, E. and Khaeryyah, S.

The Role of Account Representative in Securing the Tax Proceed.

In Proceedings of the 2nd International Conference on Economic Education and Entrepreneurship (ICEEE 2017), pages 291-298

ISBN: 978-989-758-308-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

291

financing the public interest such as infrastructure and

non- infrastructure development, providing field

work which may give rise to improving welfare.

Indonesian government in order to achieve

community welfare has considered managing tax

system and policy properly. Thus, Directorate

General of Taxation (DGT) as part of Minister of

Finance in Indonesia has an authority to change the

tax administration system from official system

assessment into self-assessment system. The former

system will state the rate and the amount of tax burden

that should be paid by the taxpayer in certain period.

However, with the latter system, the taxpayer has

latitude to state and calculate the amount of tax

burden, pay the tax and report by your own

concerning tax payment.

The Directorate General of Taxation, after having

particular evaluation on tax administration system

implementation, seems there is a need to make

improvement in several aspects due to the tax realm.

Therefore, the first tax reformation has been

conducted in 2002. This tax reformation focus on

three aspects which includes: (a) modernization of tax

administration; (b) Tax policy reformation; (c) both

tax extensification and intensification. Moreover, the

second tax reform have been stated in 2009 which

concentrate on tax system. The objective of this

reform is not only to improve tax compliance by the

tax payer but also triggers good governance in tax

administration. According to the previous head of

Directorate General of Taxation, Mochamad

Tjiptardjo (2009-2011) had revealed that the second

tax reform in line with the tax strategy as described

bellows:

• Continue reforming bureaucracy in Directorate

General of Taxation who has entered the second

stage.

• Provide incentive in particular group or sector

• Continue program mapping.

• Implement law enforcement

Furthermore, Mochamad expected the tax

strategy could be accomplished and the tax sector can

contributes state budget approximately 77% and the

comparison between the ratios of tax receipts to gross

domestic products 15%. The tax reforms are in no

doubt and enable to execute continually mapping

program. One form of reform in the field of taxation

by the government is to establish a modern tax office

(Kantor Pelayanan Pajak). The creation of modern tax

office make directorate general taxes always provide

excellent service to the taxpayer. However, an

individual or unit in tax department should be

appointed to do so. To achieve excellent service, the

directorate general tax provide extra service by

forming Account Representative (AR) in every tax

modern office,

According to Purwono (2010: 19) Account

Representatives serves as a bridge or mediator

between the taxpayer with the tax service office. An

account representative as it has been regulated by the

ministry of finance Republic of Indonesia

No.98/KMK/01/2006 which is then amended by the

regulation of finance minister No.79/PMK.01/2015

about account representative at the tax office. With

this regulation an account representative plays an

important role to cope with the second tax reforms’

strategy and secure the state budget revenue.

According to the above finance minister

regulation, an account representative in tax office are

the tax office employees itself that have been selected

and hired to supervised and provided consultation for

the taxpayer. Account representatives are trained to

be productive staff, to serve and have good tax

knowledge by getting education and training from

various sources. Through education and training is

expected to have an understanding of the business as

well as the needs of the taxpayer in conjunction with

tax obligations. Therefore, the role of account

representative is expected to improve taxpayer

compliance and have implications for increasing state

revenues from the tax sector. This is in line with the

research that has been conducted before. Researchers

such as (Sandi, 2010) and (wardani, 2011) pointed out

that the results of the survey showed that Account

Representative can improve taxpayer compliance

Similarly, researchers such as Rahmawati and Arya

(2013) with quantitative approach from the results of

their studies argued that the competence factor

service, service credibility and compliance control

material significantly influence taxpayer compliance

in KPP Pratama. Further Boihaqi, Kumadji and

Suhari (2015) reinforce the role of AR. The findings

of his research states that counselling, consultation

and supervision significantly influence corporate

taxpayers. Even supervisory variable is the dominant

variable in influencing taxpayer compliance in KPP

Madya Malang. Recently, (Farikha & Praptoyo,

2016) conducted a case study with a qualitative

approach. The findings also strengthen the opinion of

the researchers above by stating that the reporting rate

of tax returns increases each year which proves that

the awareness of taxpayers is increasing so that the

role of account representative as counselling,

consultation and supervisor in providing socialization

taxation more effective.

Despite several studies relating to the role of an

account representative claimed to have contributed to

the taxpayer's compliance rate both in calculating tax

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

292

liabilities and reporting in the form of tax returns and

then paying the tax payable to the state treasury. The

author is interested to study more about several

factors related to the competence and independence

of account representative.

2 LITERATURE REVIEW

2.1 Accounts Representatives

Reforms in the field of taxation have been made since

1984 in Indonesia in terms of policy (tax policy

reform). Similarly, from the administrative side (tax

administrative reform), tax reform has also been

carried out to accompany the reform of taxation

policy (tax policy reform). Through tax

administration reform, a new system is introduced:

Taxpayers (Wajib pajak or WP) self-account,

calculate, pay and self-report self-taxes, change the

old way in which the tax payable is determined

directly by the government (official assessment). In

the middle of 2012 is a milestone associated with the

reformation of taxation after 1983. This relates to a

significant change in the body of the directorate

general tax organization. The organizational structure

based on the type of tax has turned into a function-

oriented organizational structure. The implications of

this structure change give rise to an account

representative role. As stated above, account

representative has the duty to perform the function of

counselling, consultation and supervision. Based on

the regulation of the Minister of Finance No. 79 /

PMK / .01 / 2015 on Account Representative at the

Tax Office, It function has been separated into two

functions. The two functions include:

Account Representative that performs tax

service and consulting functions.

Account Representative that performs

supervisory function and excavates taxpayer

potential.

According to Purnomo (2015) Account

Representative who is in the Section of Supervision

and Consultation globally has a task and work that

can generally be divided into three types, namely:

As an authorized consultant appointed by DGT

which is free of charge (free) is provided to the

Taxpayer in order to obtain information and

simultaneously consultation related tax issues.

Administration / Clerical Work related to formal

service to Taxpayers' application, detailed in the

Standard Operation and Procedure of Settlement

of Application (SOP-AR).

Security of Tax Receipts, either, through

supervision and potential excavation.

Such strategic and tasks mandated by the DGT to

Account Representative show that the DGT gives

such great trust to Account Representative in carrying

out the vision and mission of the DGT. But the reality

in the Community Account Representative itself, not

all of one voice related belief given the DGT. Trust

given DGT to Account Representative in the form of

tasks and such a strategic job for the achievement of

organizational goals should be able to give positive

contribution in the form of pride of the trust. The

pride derived from such positive thoughts will

generate positive attitudes as well and eventually any

work that is mandated can be accomplished very well.

2.2 Account Representative

Competency

As has been known that the competence of a person

will be influenced and determined by the level of

knowledge and skill level. Both factors can be

realized through the achievement of formal and

informal education level. In addition, relevant work

experience will also contribute to the improvement of

skills and knowledge in a more professional direction.

According to (Meija, Balkin, & Caldi, 2010)

competence is a characteristic inherent in someone

who is associated with success. O "Hagan

emphasized that" Competence is the product of

knowledge, skill and values. To demonstrate that they

have met their needs, replaced by and critically

analyzed their practice and transferred know what,

skills and values in practices ".

Even competency requirements for an account

representative are stipulated in the Decree of the

Minister of Finance of the Republic of Indonesia

Number 68 / PMK.01 / 2008 concerning account

representative at Tax Office that has implemented the

Modern Organization which involves:

a) The lowest formal education graduate of

Diploma III;

b) The lowest rank at the proposed level is the

Level I regulator (Group II / d)

c) The lowest formal education of senior high

school and the lowest rank of the regulator (class

II / c) taking into account the availability of the

employees of the Directorate General of Taxes,

the workload, and potential tax revenues of the

KPP Pratama concerned.

Fulfilment of the requirements imposed on an

account representative results in a competent account

representative officer. Competence will give hope for

improvement of service function and consultation of

The Role of Account Representative in Securing the Tax Proceed

293

taxpayer. Mastery of good tax regulation will provide

convenience to study the objective conditions of

taxpayer business activities in order to obtain

information or provide consultative tax-related

issues. This consultative activity is expected to

stimulate the taxpayer compliance level in relation to

its obligation to perform the payment of tax payable

to the state.

Furthermore, the safeguarding of tax revenue can

even be increased through the supervision and

exploration of potential tax. Based on the above

explanation, then the hypothesis that requires

Fulfilment of the requirements imposed on account

representative results in a competent account

representative officer. Competence will give hope for

improvement of service function and consultation of

taxpayer. Mastery of good tax regulation will provide

convenience to study the objective conditions of

taxpayer business activities in order to obtain

information or provide consultative tax-related

issues. This consultative activity is expected to

stimulate the taxpayer compliance level in relation to

its obligation to perform the payment of tax payable

to the state. Furthermore, the safeguarding of tax

revenue can even be increased through the

supervision and exploration of potential taxes.

Based on the above explanation, then the

hypothesis that requires verification is as follows:

H1: Account Representative Competence affects the

security of tax revenue proceed.

2.3 Account Representative

Independency

As it is known that what is meant by independence is

a person or an entity that always shows impartiality

or has no interest in performing a certain assignment,

job or activity. This impartiality can be demonstrated

for various activities that do not in fact cause any

doubt or trigger suspicions of (a de facto) existence or

can be legally proven to have no relationship

(jurisdictionally). Even activities that will result in or

act which indicates the existence of a special

relationship should be avoided. For more details from

the audit point of view, Arrens et al (2012) as an

experts argues that independence is an unbiased view

of performing in auditing, evaluation of the results of

the examination or testing, and report the results of

audit findings. This impartial attitude can be shaped

in two perspectives:

Independence in the mental attitude

(independence in fact) which means the

accountant can maintain an impartial attitude in

carrying out the examination of the financial

statements

Independence in appearance (independent in

appearance) which means the accountant to be

impartial according to the perceptions of users

of financial statements.

This is also reinforced by the second common

standard of SA Section 220 (SPAP 2011) which

suggests that in all respects related to engagement,

independence in the mental attitude must be

maintained by the auditor. Likewise, the standard of

tax audit which has been regulated by the Director

General of Tax Regulation No. PER-23 / PJ / 2013

dated June 11, 2013 provides guidance that the

examiner should be independent, that is not easily

influenced by the circumstances, conditions, deeds

and / or taxpayers examined. Therefore, based on

these requirements then the propose hypothesis:

H2: The independency of account representative may

affect the security of tax revenue proceed.

2.4 Securing the Tax Proceed

As has been pointed out that the reform of the

structure and organization of the Directorate General

of Taxes solely is to be able to increase tax revenue.

Therefore, the existence of competent and

independent account representative Who are

competent and independent have the duty to carry out

supervision of taxpayer compliance obligations,

guidance / appeal to taxpayer and technical

consultation taxation, compilation of taxpayer

profile, reconciliation of taxpayer data in the

framework of intensification and evaluate the result

of appeal based on applicable provisions ( (Purnomo,

2015). Furthermore, the challenge of tax revenue can

basically be divided into 2 (two) sectors, which are:

a. routine acceptance challenges and

b. Challenges of extra-effort acceptance.

The Challenges of routine acceptance can be

made with supervision over:

• Comparison of tax payments per tax period

(apple to apple comparison)

• Business plan and project data from taxpayer

• DIPA Data (List of Budget Usage) of central

and regional treasurer

2.5 The Challenge extra effort

This challenge occurs in the light of there is a gap

between tax revenue estimation and the target set by

the tax office. Therefore, the challenge of exploring

the potential for increasing tax revenues through extra

effort can be grouped as follows:

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

294

a. Challenge taxpayers of certain entrepreneurs

(WP OPPT) and WP PP 46 of 2012.

b. Taxpayer Challenges with IDLP (Information,

Data, Reports and Complaints)

c. The Taxpayer Challenge does not report SPP

Tahunan PPh Badan.

d. Non-PKP Taxpayer Challenge.

3 METHODS

3.1 Empirical Design

This research seeks to obtain empirical data that

provides an overview and can explain the

presuppositions that require answers and have been

specified in the form of hypotheses. These

respondents include Account Representative in KPP

Madya Bandung. There are 34 people account

representative who are in the working area of KPP

Madya Bandung. Thus the samples used by the

researchers fall into the census category.

Data collection techniques were conducted by

field research (Field Research). Besides that also

made an instrument which hopefully will give answer

to primary data needed. Instruments used to obtain

empirical data in form of questionnaire. The design of

questionnaires consisting of questions that indicate

the variables studied have been arranged

systematically that will facilitate for researchers in the

tabulation and processing of empirical data.

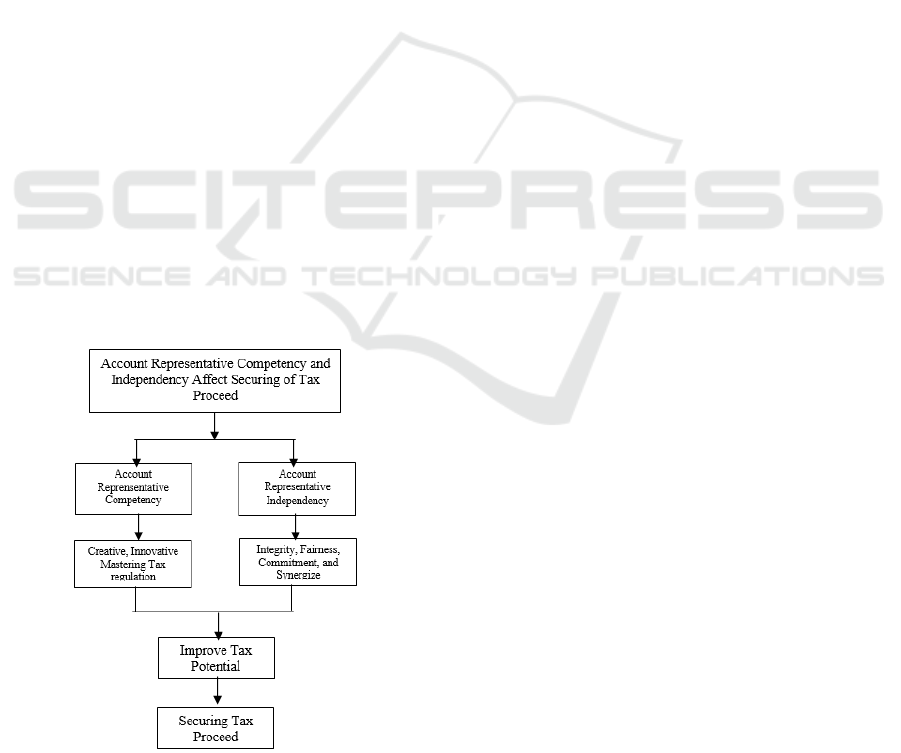

Below is the research model we use in this study:

Figure 1: Research model

4 RESULTS AND DISCUSSION

Before testing the classical assumption and

hypothesis testing, first it requires to test the validity

of data and reliability data. This test is necessary

because the type of research data is the primary data.

4.1 Test Validity Data

Testing the validity of the instrument using statistical

software, the value of validity can be seen in the

Corrected Item Total Correlation column. If the

correlation number obtained is greater than criticized

number (r arithmetic r table) then the instrument is

said to be valid. Based on the results of validity test

can be concluded that all items question to measure

research variables declared valid.

To test the validity of an instrument can be done

by comparing the value of the feasibility (r) of an

instrument with the critical r value specified

(Sugiyono, 2006), generally critical r is used to define

the validity limits of an instrument, whose value is set

at r = 0.3

4.2 Test Data reliability

After testing the validity, the next step is to test the

reliability of the data and to evaluate the value of

alpha Cronbach. Thus it can be stated that the

instrument device use to collect data is reliable.

Reliability test is performed indicating to what extent

the measuring device can be trusted. In general an

instrument is said to be good if it has coefficient

Cronbach’s alpha greater than 0.6. This indicates that

the research data are stated reliable.

4.3 Classic assumption test

This test includes testing of empirical data collected

from various respondents who have completed and

returned the questionnaire. The classical assumption

test basically wants to know whether the collected

data is normal, free from the possibility of

autocorrelation and, multicollinearity and,

heteroscedasticity. The data used in this research is

cross-section. Therefore, autocorrelation testing is

not necessary.

Based on the results of data normality test using

Kolmogorov-Smirnov test, it can be concluded that

the data has a normal distribution. This can be known

by comparing the value of Kolmogorov- Smirnov

1,129 with a significance level of 0.307. If

Kolmogorov Smirnov value significance greater than

0.05 it can be stated that the data has a normal

distribution. Furthermore, based on correlation test

results among independent variables, it can be seen

The Role of Account Representative in Securing the Tax Proceed

295

that the correlation between those variables is not

relatively high. No correlation exceeds 0.6, thus it can

be concluded that multicollinearity problem do not

exists among independent variables. This test is

supported by a relatively small VIF value that is

smaller than 5 and a tolerance value of not less than

0.1.

4.4 Simultaneously Hypothesis Test

After testing the classical assumption and obtained

the conclusion that the model can be used to perform

multiple regression analysis, then the next step to test

hypothesis. Hypothesis that will be tested is

competence Account Representative, Independence

Account Representative Effect on Security of Tax

Proceed both simultaneously and partially. Summary

of result of hypothesis test show that after testing the

classical assumption and obtained the conclusion that

the model can be used to perform multiple regression

analysis. Then the next step is to test hypothesis. The

hypothesis to be tested is the competence of Account

Representative, Independence Account

Representative Effect on Tax Reception Security.

Summary of hypothesis testing results show that from

table 1 Anova can be known research model on the

variables studied can be accepted. This can be seen

from the value of F arithmetic 7.045 with a

significance level of 0.03 is smaller than 0.05. The

value of F arithmetic shows the goodness of fit for the

propose research model.

Table 1: F-Test

Model F Sig.

1 Regression 7.045 .003

b

Therefore, according to the F test results it can be

stated that the result of the regression model shows

that there is significant influence of Representative

Account Competence, Independence of Account

Representative simultaneously on Security of Tax

Proceed at KPP Madya Bandung. However if the

study focus on the extent of independent variable

(Representative Account Competence, Independence

of Account Representative) that influence on Security

of Tax Proceed is 31% (see table 2). . The value of R

2

is between zero and one. The value of R

2

is between

zero and one. A small R

2

value means the ability of

independent variables to explain the variation of a

dependent variable is very limited. A value close to

one means the independent variables provide almost

all the information needed to predict the variation of

the dependent variable.

The two independent variables are not good

enough to predict and explain in order to improve the

security of tax proceed. It requires further study and

analysis of certain variables which may give rise to fit

the study, especially in trying to increase potential tax

income.

Table 2: Determinant Coefficient

Model R R Square Adjusted R Square

1 .559

a

.312 .268

If independent variable more than one, then it are

better to see the ability of variable predict the

dependent variable, the value used is adjusted value

R

2

that is 32%. In other words 32% change in tax

revenue can be explain by variable Account

Representative competence, Independence Account

Representative of 68% explained by other factors not

included in this study model.

4.5 Test partial hypothesis

To see the influence of each independent variable

partially on the Security of Tax Proceed, it can be

seen from the significance value t arithmetic. If the

significance value of t arithmetic is smaller than 0.05

then it can be stated that there is an influence of these

variables on the Security of Tax Proceed.

Table 3: t test Hypothesis

Unstandardized

Coefficients

Standardized

Coefficients

t Sig.

B Std.

Erro

r

Beta

(Constant) 12.531 2.386 1.328 .194

independenc

y

-.0.15 .115 -.048 -.312 .757

competency .111 .098 .570 3.688 .001

Based on the data in Table 3 above can be

assessed that t arithmetic for Account Representative

Competence is equal to 3.688 with significance of

0.001 count and for Independence Account

Representative of -0.312 with significance 0.757,

respectively. Thus from these results of data testing,

it can be stated that the independent variable has no

significant effect on the Security of Tax Proceed,

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

296

while the competence variable has a significant

influence on Tax Proceed Security.

The results of this study show that partially

Representative Account Competence significantly

influences the Security of Tax Proceed. Based on

these results note that the competence in this expertise

obtained from education and training can encourage

tax revenue through Account Representative

Expertise in conducting tax audits professionally. The

success of Account Representative in performing its

function is done through competence; the competence

of an Account Representative is measured by its

ability to execute and mastery of good tax regulation.

It is expected that one may provide convenience to

study the objective conditions of taxpayer business

activities. The main objective of these activities is to

obtain information or provide consultative tax-related

issues. By doing this it may stimulate the taxpayer

compliance level in relation to its obligation to

perform the payment of tax payable to the state.

5 CONCLUSIONS

Simultaneously the competency of account

representative and account representative

independence can influence the increase of security

of tax proceed although relatively low. The security

of tax proceed can be increased in terms of revenues

when examining beyond the two variables that have

been studied in this matter. Similarly, if viewed

partially the variable independency account

representative is not sufficient enough to be able to

stimulate the taxpayer in carrying out its tax

obligations.

Considering that this research involves only the

tax authorities, it is necessary to include the taxpayer

in the study of the variables that have been studied.

To be able to obtain a sound review of the results

related to the factors that can increase the potential

improvement in tax revenue following the security it

is advisable to add other variables beyond the

competence and independency account

representative. With the studying addition of

variables are expected to explain securing of tax

proceed better

REFERENCES

Arifin, G. 2016. Direktorat Jenderal Pajak kementrian

Keuangan. Retrieved Juni Senin, 2017, from Direktorat

Jenderal Pajak Web site: www.pajak.go.id

Boihaqi, I., Kumadji, S., & Suhari, M. 2015. Pengaruh

Fungsi Account Representative Terhadap Kepatuhan.

Jurnal Administrasi Bisnis=Perpajakan (JAB) Vol.5

No.2.

Direktorat Jenderal Pajak Kementrian Keuangan. 2016.

Retrieved June Monday, 2017, from Pajak web site:

WWW.Pajak.go.id

Farikha, I., & Praptoyo, I. 2016. Sosialisasi Peraturan

Perpajakan dan Kinerja Account Representative Kaitan

Dengan Kepatuhan Wajib Pajak. Jurnal Ilmu dan Riset

Akuntansi. Vol.5, No.3, Maret.

Irawan, R., & Sadjiarto, A. 2013. Pengaruh Account

Representative Terhadap Kepatuhan Wajib Pajak di

KPP Pratama Tarakan. Tax & Accounting Review,

Vol.3, No.2.

Meija, K. G., Balkin, D. B., & Caldi, R. L. 2010. Managing

Human Resources. Sixth Edition. Canada: Pearson

Education.

O'Hagan, K. 2007. Competence in Social Work Practice: A

Practical Guide fo Students and Profesional. Second

Edition. London: Jesica Kingsley Publisher.

Purnomo, J. 2015. Retrieved June Sunday, 2017, from

www.bppk.kemenkeu: .go.id

Purwono, H. (2010). Dasar-Dasar Perpajakan dan

Akuntansi Pajak. Jakarta: Erlangga.

Sandi, B. N. 2010. Analisis Pengaruh Pelayanan,

Pengawasan, dan Konsultasi Account Representative

terhadap Kepatuhan Wajib Pajak. Jakarta: Fakultas

Ekonomi dan Bisnis Universitas Negeri Sysrif

Hidayatullah.

Sugiyono. 2006. Metode Penelitian Pendidikan,

Pendekatan Kuantitatif, Kualitatif dan R & D.

Bandung: Alfabeta.

Wardani, E. S. 2011. Pengaruh Kualitas Pelayanan dan

Efektivitas Pengawasan Account Representative

terhadap Kepatuhan Formal Wajib Pajak. Surabaya:

Fakultas Ekonomi dan Bisnis Universitas Airlangga.

Arifin, G. 2016, Direktorat Jenderal Pajak kementrian

Keuangan. Retrieved Juni Senin, 2017, from Direktorat

Jenderal Pajak Web site: www.pajak.go.id

Boihaqi, I., Kumadji, S., & Suhari, M. 2015. Pengaruh

Fungsi Account Representative Terhadap Kepatuhan.

Jurnal Administrasi Bisnis=Perpajakan (JAB) Vol.5

No.2.

Direktorat Jenderal Pajak Kementrian Keuangan. 2016.

Retrieved June Monday, 2017, from Pajak web site:

WWW.Pajak.go.id

Farikha, I., & Praptoyo, I. 2016. Sosialisasi Peraturan

Perpajakan dan Kinerja Account Representative Kaitan

Dengan Kepatuhan Wajib Pajak. Jurnal Ilmu dan Riset

Akuntansi. Vol.5, No.3, Maret.

Irawan, R., & Sadjiarto, A. 2013. Pengaruh Account

Representative Terhadap Kepatuhan Wajib Pajak di

KPP Pratama Tarakan. Tax & Accounting Review,

Vol.3, No.2.

Meija, K. G., Balkin, D. B., & Caldi, R. L. 2010. Managing

Human Resources. Sixth Edition. Canada: Pearson

Education.

The Role of Account Representative in Securing the Tax Proceed

297

O'Hagan, K. (2007). Competence in Social Work Practice:

A Practical Guide fo Students and Profesional. Second

Edition. London: Jesica Kingsley Publisher.

Purnomo, J. (2015, May Tuesday). Retrieved June Sunday,

2017, from www.bppk.kemenkeu: .go.id

Purwono, H. (2010). Dasar-Dasar Perpajakan dan

Akuntansi Pajak. Jakarta: Erlangga.

Sandi, B. N. (2010). Analisis Pengaruh Pelayanan,

Pengawasan, dan Konsultasi Account Representative

terhadap Kepatuhan Wajib Pajak. Jakarta: Fakultas

Ekonomi dan Bisnis Universitas Negeri Sysrif

Hidayatullah.

Wardani, E. S. (2011). Pengaruh Kualitas Pelayanan dan

Efektivitas Pengawasan Account Representative

terhadap Kepatuhan Formal Wajib Pajak. Surabaya:

Fakultas Ekonomi dan Bisnis Universitas Airlangga.

http://www.bppk.kemenkeu.go.id/publikasi/artikel/167-

artikel-pajak/21137-optimalisasi-pelayanan-dan-

penerimaan-pajakoleh-account-representative/Selasa,

12 Mei 2015/21:46

http://nasional.kontan.co.id/news/kemkeu-benahi-tugas-

account-representative-pajak/senin, 27 April

2015/21:04 WIB

http://www.pajak.go.id/content/article/perlunya-reformasi-

pajak/ Selasa, 20 Desember 2016 - 13:34/diakses 2017-

06-18/01:07 AM (Arifin, 2016)

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

298