Structural Change and Labor Productivity Growth in Indonesia

Lilis Siti Badriah, Armida S. Alisjahbana, Kodrat Wibowo and Ferry Hadiyanto

Faculty of Economics and Business, Padjadjaran University, West Java, Indonesia

Keywords: Structural change; Input reallocation; Labor productivity growth.

Abstract: Structural changes indicate reallocation of inputs from less productive sectors to more productive sectors.

Some literature indicate that the impact of structural change could become a structural bonus for productivity

growth. However, the others indicate that structural changes could become a structural burden. This study

aims to examine the impact of structural changes on labor productivity growth in Indonesia and the

determinants of that growth. The methods used are shift-share analysis and panel data regression. The data

consist of total output and sectorial labors as well as other macro data from 30 provinces of Indonesia during

2003-2014. The combination of both methods show a corresponding result that structural changes have a

weak impact on labor productivity growth in Indonesia. This result implies the need for support of more

relevant government policies by improving the quality of human resources, investment, infrastructure, and

maintaining macroeconomic stability to get more benefits from structural changes.

1 INTRODUCTION

The data from the Central Bureau of Statistics (2013)

shows that there are changes in Indonesian economic

structure which is marked by the shifting of

dominance role of economic sector in GDP

formation, from agriculture sector to non-agriculture

sector, both from the output side and the labor side.

The interesting thing is the condition of the industry-

al sector. Despite the fact that the share of output

dominates in the formation of GDP, throughout 2004-

2013, the share shows a consistently decreasing trend

from 28.37% (2004) to 25.54% (2013). It shows that

the development in the industrial sector is stagnant

and even tends to decline. These conditions have an

impact on the performance of the Indonesian

economy, which can be seen, among others, from the

aggregate productivity indicators created. According

to data of Asian Productivity Organization (2014), the

growth of Indonesian TFP during 1970-2012 was

fluctuated with a downward trend. The average per

year was 0.9%. These conditions indicate that the

productivity which accompanies structural changes is

not sustainable. Whereas some literature reviews

indicate that manufacturing is “the engine of

economic growth” (McMillan et.al, 2014; Kaldor in

1960s in UNIDO, 2011; and Ocampo, 2005).

The structural changes indicate the reallocation of

production inputs, from less productive sectors to

more productive sectors. The process of reallocating

these inputs can have a significant positive effect on

productivity growth that encourages the economic

growth overall (the Structural Bonus Hypothesis).

Timer and Szirmai (2000) argue that the shifting of

resources from the early industry to the middle and

the late industries illustrates the process of techno-

logical improvement and encourages bonus for

aggregate productivity growth in the manufacturing

sector. This is in line with McMillan et.al (2014) that

any shift in resources from low productivity activities

to high productivity activities can result in structural

change bonus known as “growth-enhancing structural

change”. However, structural changes can also have

a weak impact and even a negative impact on the

growth of productivity (The Structural Bur-den

Hypothesis). Baumol’s Hypothesis of unbalanced

growth states that the difference between industries in

the opportunity to increase labor productivity (at a

certain level of demand) shifts the share of labor from

a “progressive” industry to a “stagnant” industry. In

the long-run, this condition tends to decrease the

prospect of per capita income growth (Baumol,

1967).

In 2003, Penender’s empirical study of industrial

structure and aggregate growth in OECD countries

Badriah, L., Alisjahbana, A., Wibowo, K. and Hadiyanto, F.

Structural Change and Labor Productivity Growth in Indonesia.

In Proceedings of the 2nd International Conference on Economic Education and Entrepreneurship (ICEEE 2017), pages 397-402

ISBN: 978-989-758-308-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

397

during 1990-1998, with shift- share analysis and

panel data regression model, showed determinants

affecting per capita output and its growth, i.e. changes

in economic structure, demographic, business cycle

conditions, labor market rigidity, physical capital

investment, and human capital development. The

results showed that on average, structural change had

a weak impact on the growth of aggregate labor

productivity (robust structural burden).

Carree (2003) did comment on Fagerberg (2000)

research on technological progress, structural change,

and productivity growth using ISIC 5 industry data

from 20 OECD countries, during 1972-1992, divided

into 4 sub periods. The results of Caree's study

showed that changes in industrial employment share

did not have a significant impact on productivity

growth, industrial employment share at the beginning

of the period had a significant positive effect on

productivity growth in highly technologically

progressive industries, and initial productivity levels

have a significant negative effect on productivity

growth. It means that the inter-industries technology

convergence has been occurred.

Concerning productivity growth, Paus (2004)

studied the growth of productivity in Latin America

by observing factors affecting productivity growth,

i.e. technological change (short and long run),

domestic technological capabilities and conductive

social and economic environment influenced by

macroeconomic and political stability, access to

techno-logical know-how, requisite physical

infrastructure, and human capital development.

Another factor that can affect productivity growth is

wages. According to the efficiency-wage theory, high

wages can make workers more productive (Mankiw,

2007).

Based on the phenomenon of structural changes

occurring in Indonesia, which are associated with

some relevant empirical study results, this research is

addressed to answer how does the structural change

influence the growth of labor productivity in

Indonesia and what are the determinant factors of that

labor productivity growth?

Previous empirical studies tend to focus on the

relationship between structural change and

productivity growth in the manufacturing sector of

some countries, focusing on industry data, or just

looking at interrelationships from shifting between

economic sec-tors. This study, therefore, observed the

relationship of structural change and productivity

growth occur-ring in one country (Indonesia) in more

depth, with research objects using sectoral data from

each province to capture detailed characteristics of

behavioral change in the Seconomy of various

provinces. Hence, it is expected to provide

recommendation for development policy makers in

Indonesia to get more benefits of the structural

change.

2 METHODS

2.1 Data

This study used panel data of 30 provinces during

2003-2014. The data obtained from the Central

Bureau of Statistics, including real GDP at constant

2000 prices; the number of sectoral and national

workers; the proportion of economic sector

contribution to GRDP; the proportion of workers; and

the productivity of workers in various economic

sectors, investment, average length of school,

infrastructure, inflation rate, and wages.

2.2 Research Model

2.2.1 Shift-Share Analysis Model

This model can show structural bonus or structural

burden conditions in relation between structural

change and productivity growth (Peneder, 2003).

This research adopted shift-share decomposition

model used by Peneder (2003), in which the factors

affecting labor productivity growth were decomposed

into static-shift effect, dynamic-shift effect, and

within-shift effect, by the following formula:

(1)

(2)

Where LP = labor productivity; By = base year of

study; Fy = final year of study; T = sigma, whole

sector i; Si = share of sector i workforce in total em-

ployment; i = 9 economic sectors: (1) agriculture; (2)

mining and quarrying; (3) industry; (4) Electricity,

Gas and Water Supply; (5) Construction; (6) Trade,

Hotel, Restaurant; 7) Transportation and

Communication; (8) Financial, Real Estate, and

Business Service; (9) Services.

The first part of equation (2) is the static-shift

effect. If the static-shift effect is positive value, it

indicates a structural bonus. The second part of that

equation is the dynamic-shift effect. If the dynamic-

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

398

shift effect is negative value, it indicates a structural

burden. The third part of that equation is the within-

shift effect that shows growth of labor aggregate

productivity assuming no structural shifts during the

initial year.

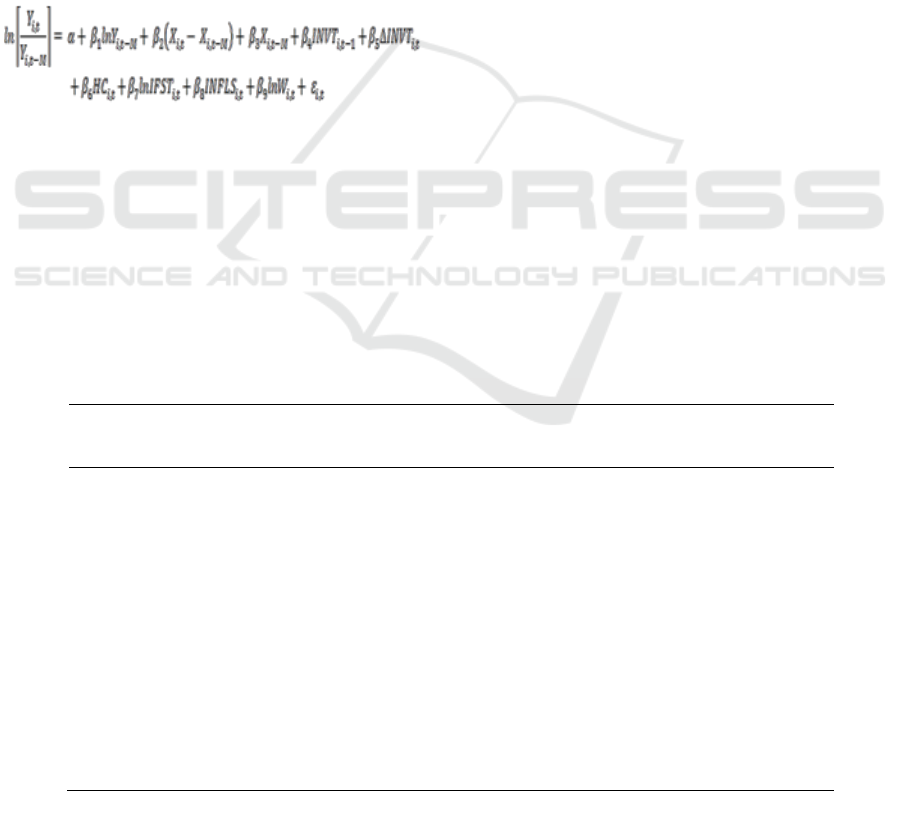

2.2.2 Econometric Analysis Model

To analyze the determinant factors of productivity

growth, this study adopted the model of Carree (2003)

with the addition of some relevant control variables

from Peneder (2003), Paus (2004), and other

researchers. The study period was divided into 4 sub-

periods, each consisting of 3 years (M = 3): 2003-

2005, 2006-2008, 2009-2011, and 2012-2014. The

division into four sub-periods was intended to capture

intra-period variations and to increase the sensitivity

of changes in business cycle (Carree, 2003). Thus, the

model of this study is as follows:

(3)

Where Ln (Yi,t)/(Yi,t-M) = growth in labor

productivity; Yi,t-M = initial labor productivity; Xi,t

- Xi,t-M = changes in labor share of the industrial

sector; Xi,t-M = initial labor share of the industrial

sector; INVTt-1 = total investment in previous

period; ΔINVT = total investment change; HC =

development of human capital, with indicator of the

average number of years in education; INFST =

Infrastructure, with indicator of length of provincial

road; INFLS = Inflation rate; W = Wage rate; M =

number of years range in a sub-period (4); i = i (rank

of) Province.

3 RESULTS AND DISCUSSION

3.1 Result of Shift-Share Analysis

The result of Shift-Share analysis of aggregate

economic sector can be seen in Table 1.

Based on Table 1, the growth of labor productivity

in Indonesia is influenced by static-shift effect,

dynamic- shift effect, and within-shift effect. In

aggregate, average labor productivity growth reached

0.8386. In line with previous research results

(Peneder, 2003, Fagerberg, 2000; Timmer and Szir-

mai, 2000; McMillan et.al, 2014), the within- shift

effect still dominates the contribution of labor

productivity growth. This means, the reallocation of

labor between sectors has only a weak net impact on

overall productivity growth.

The total static-shift effect is positive at 0.3665.

This means that sectors with high productivity levels

are able to attract more labor resources, increasing the

shares of the sectors in total employment. While on

the other hand, dynamic-shift effect is negative at -

0.1002. This means that the economic sectors with

high labor productivity growth are unable to manage

its shares of labor in total employment. It caused a

decline in the shares of labor. This condition indicates

that the share of employment shifts from a

progressive economic sector to an economic sector

has lower labor productivity growth.

Table 1: Decomposition of aggregate productivity growth in Indonesia, during 2003-2014 period.

Economic Sector

Labor

productivity

growth

Static shift

effect

Dynamic shift

effect

Within shift

effect

Total

0.8386

0.3665

-0.1002

0.5722

agriculture

-0.0691

-0.0423

0.1583

mining and quarrying

0.1060

-0.0430

-0.0732

industry

0.0354

0.0094

0.1264

Electricity, Gas and Water Supply

0.0060

0.0008

0.0015

Construction

0.0438

0.0090

0.0199

Trade, Hotel, Restaurant

0.0457

0.0192

0.1161

Transportation and Communication

-0.0149

-0.0388

0.2395

Financial, Real Estate, and Business

Service

0.1328

-0.0152

-0.0173

Services

0.0807

0.0005

0.0010

Source: Results of data processing (2017)

Structural Change and Labor Productivity Growth in Indonesia

399

Based on the decomposition of the economic

sectors, the value of static-shift effect is positive

while the dynamic-shift effect is negative. It can be

said that the structural changes in Indonesia shows

the tendency of structural burden, where labor

shifts from high productivity sector to low

productivity sector, although initially the sector

productivity level is high. Therefore, it can be said

that the structural bonus is relatively weak. This is

consistent with the conclusion of Peneder (2003).

3.2 Result of Econometric Analysis

The results of estimation model can be seen in

Table 2.

Based on the data in Table 2, the independent

variables in the equation model (1) only consist of

the main variables affecting the labor productivity

growth, whereas in the equation model (2), the

model (1) is expanded by 6 control variables.

Based on Table 2, in both equation models, initial

productivity variable and structural change

variables, i.e. changes in labor share of the

industrial sector and initial labor share of the

industrial sector, consistently show significant

negative values. The variable of initial labor

productivity with negative value significantly

indicates the existence of technological

convergence in the inter-provincial industrial

sector, affecting the growth of labor productivity of

the industrial sector in Indonesia. The results of

this study are in line with the research of Fagerberg

(2000) and Carree (2003).

Table 2: Estimation results of labor productivity growth (fixed effect model).

Dependent

Variables

Labor productivity growth of industrial sector

Model

1

2

Constanta

4.052843**

(11.98322)

4.456731**

(5.280394)

Y

i,t-M

-0.781214**

(-12.13188)

-0.854858**

(-18.42272)

SX

i,t

– X

i,t-M

-0.110918**

(-21.34025)

-0.132177**

(-39.61234)

X

i,t-M

-0.078727**

(-11.34640)

-0.102929**

(-18.55085)

INVTi

,t-1

0.005037**

(2.653326)

ΔINVT

i,t

0.005356**

(2.837547)

HC

it

0.135552**

(3.217918)

INFST

i,t

-0.136145*

(-1.669724)

INFLS

i,t

0.023453**

(17.44209)

W

it

0.000808

(0.040627)

R

2

Adjusted

0.875960

0.963714

F-Stat

27.26142

84.17206

Source: Data Processing, 2017

** = significant at α = 1%, * = significant at α = 10%.

The variable of industrial labor share change is

significant negative value in both models. This

means, the reallocation of labor moves towards the

industrial sector with lower productivity levels. The

variable of initial labor share is significant negative

value. This means, the reallocation of labor moves

towards the industrial sector with lower productivity

levels at the beginning of the period. Both variables

of structural change negatively affect the labor

productivity growth of industrial sector in Indonesia.

This indicates the occurrence of structural burden.

The results of these estimation are in line with the re-

search of Timmer and Szirmai (2000), Fagerberg

(2000), Peneder (2003), and Caree (2003) that

structural changes have a weak impact on improving

labor productivity growth. The estimation results are

also in line with the results of shift-share

decomposition analysis, which tends to prove the

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

400

structural burden hypothesis proposed by Baumol

(1967).

The variable of total investment in the previous

period and the variable of total investment change are

positive values significantly. These means that in-

vestment/capital deepening in short and long run term

have a significant positive impact on labor

productivity growth in the industrial sector. This

results are in line with Peneder (2003).

The variable of average number of years in

education, as a proxy of human capital, is positive

significantly. That is, the workers with higher

education will increase the growth of labor

productivity in the industrial sector. The results of this

study are in line with Fagerberg (2000), Jorgenson

and Stiroh (2001), Peneder (2003), and Paus (2004).

The variable of infrastructure, with proxy of

provincial road length, is negative significantly at α =

10%. This can happen because, based on existing da-

ta, road conditions in each province are different and

still inadequate. This condition causes complicated

congestion and distribution process, thus less sup-

porting economic activity, among others, causing the

increase of transportation/distribution cost which can

reduce net result of output value. In addition, based

on data from The Global Competitiveness Report

2016-2017 (The World Economic Forum, 2016),

Indonesia’s infrastructure performance is still

relatively low. Of the 138 countries studied,

Indonesia is ranked 80th for the overall infrastructure

aspect, while in terms of road quality, Indonesia is

ranked 75th.

The variable of inflation rate. As a proxy of

macroeconomic stability, is positive significantly.

This means, an increase in inflation rate will increase

the labor productivity growth. This result is different

from some existing studies that inflation has a

negative effect on economic performance (Jaret and

Selody, 1982; Clark, 1982; Hondroyiannis and Pa-

papetrou, 1997; Bitros and Heat, 2001; Tsionas,

2003a; Christopoulos and Tsionas, 2005). Neverthe-

less, Mankiw (2007) states that in terms of supply

side, inflation reflects an increase in aggregate

demand. It will encourage the company to increase its

production capacity to make a profit, as shown in the

dynamics of the aggregate supply curve, where there

is a positive relationship between the price and the

quantity of output. Indeed, to some extent, with-in the

relatively low level of inflation (less than 10%), it is

needed in order to encourage the supply side

development.

The variable of wage is insignificant positive

value. The wage rate indicator used in this study is

provincial minimum wage. The insignificant impact

of wage because the provincial minimum wage is

made as a reference for employers to determine

wages for their workers, so it is likely that many

employers who pay less than the provincial minimum

wage. The International Labor Organization (2015)

states that while it is the right of workers to receive

remuneration equal to the minimum wage, high levels

of vulnerability and informality in the labor market

and limited labor inspection capacity causing one-

third of workers receive wages less than the

provincial mini-mum wage. According to Mankiw

(2007), wage measurement should be based on total

compensation covering wages in cash and intangible

compensation (fringe benefit). In situations of

intangible compensation, such as pension funds and

health insurance being a major part of compensation,

wages in cash are generally not in line with

productivity.

4 CONCLUSIONS

The results of this study indicate that structural

changes in Indonesia that lead to the increasing role

of industrial sector in the formation of national out-

put is not necessarily able to increase labor

productivity in the respected sector. The structural

changes that occur tend to be structural burden, which

unfavourable for the growth of labor productivity of

industrial sector.

The results of this study imply that structural

changes occurring along with the economic growth

should be supported by various other elements. They

are relevant government policies as efforts to improve

the quality of human capital and to provide better

infrastructure through an adequate development

budget allocation, maintaining the stability of the

macro-economy through appropriate controlling of

inflation rate Hence, it may create conducive

conditions to encourage of capital accumulation

through various investment activities.

REFERENCES

Asian Productivity Organization. 2014. Productivity Data

book, Asian Productivity Organization. Tokyo: Keio

University Press Inc.

Central Bureau of Statistics. 2013. Statistik Indonesia.

Jakarta: BPS.

Baumol, William J. 1967. Macroeconomics of Unbalanced

Growth: The Anatomy of Urban Crisis. The American

Economic Review, (Vol. 57, No. 3), (Jun, 1967): 415-

426.

Bitros, C. C. and Panas, E. E. 2001. Is there an inflation

productivity trade-off? Some evidence from the

manufacturing sector in Greece. Applied Economics,

33, 1961–9.

Structural Change and Labor Productivity Growth in Indonesia

401

Carree, M.A. 2003. Technological Progress, Structural

Change, and Productivity Growth: A Comment.

Structural Change and Economic Dynamics 14 (2003):

109-115.

Christopolous, D. K. and Tsionas, E. G. 2005. Productivity

growth and inflation in Europe: Evidence from panel

cointegration tests. Empirical Economics (30):137–50.

Clark, K. P.1982. Inflation and the productivity decline.

American Economic Review, Papers and Proceedings

(72): 149-54

Fagerberg, Jan. 2000. Technological progress, structural

change, and productivity growth: a comparative stud.

Structural Change and Economic Dynamics 11 (2000):

393-411.

Hondroyiannis, G. & Papapetrou, E. 1997. Seasonality

cointe2wgration and the inflation, productivity and

wage growth relationship in Greece. Social Science

Journal (34): 235–47.

ILO. 2015. Indonesia: Upah dan produktivitas untuk

pembangunan berkelanjutan. International Labour

Organization, ASIA-PACIFIC DECADE

Jarrett, J. P. & Selody, J. G. 1982. The productivity inflation

nexus in Canada 1963–1979. Review of Economics and

Statistics (64): 361–7.

Mankiw, N. Gregory. 2007. Macroeconomics. 6

th

Edition.

New York: Worth Publisher.

McMillan, Margaret, Dani Rodrik, Inigo Verduzco-Gallo.

2014. Globalization, Structural Change, and

Productivity Growth, With an Update of Africa. World

Development (63):11-32.

http://dx.doi.org/10.1016/j.worlddev.2013.10.012).

Ocampo, J.A. 2005. The Quest for Dynamic Efficiency:

Structural Dynamics and Economic Growth in

Developing Countries. In Beyond Reforms: Structural

Dynamics and Macroeconomic Vulnerability, ed.

Ocampo, J.A., Santiago: Economic Commission for

Latin America and the Caribbean.

Paus, Eva A. 2004. Productivity growth in Latin Amerika:

The Limit of Neoliberal Reform, World Development

(Vol. 32, No. 3): 427-445.

Peneder, Michael. 2003. Industrial Structure and Aggregate

Growth, Structural Change and Economic Dynamics

14 (2003): 427-448.

Stiroh, Kevin J. 2001. What Drives Productivity Growth?

FRBNY Economic Policy Review, March 2001.

The World Economic Forum. 2016. The Global

Competitiveness Report 2016-2017.

Timmer, Marcel P. & Adam Szirmai, 2000. Productivity

growth in Asian manufacturing the structural bonus

hypothesis examined. Structural Change and economic

dynamic 11 (2000): 371-392.

Tsionas, E. G. 2003a. Inflation and productivity in Europe:

an empirical investigation, Empirical, 30, 39–62.

UNIDO. 2013. Industrial Development Report 2013.

Sustaining Employment Growth: The Role of

Manufacturing and Structural Change, Overview.

United Nations Industrial Development Organization.

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

402