The Impact of Purchasing Pattern after Increasing Cigarette Taxes to

National Health Status and Health Insurance in Indonesia

Dini Rahma Yanti

Faculty of Public Health, Universitas Airlangga, Mulyorejo, Surabaya, Indonesia

dinirahmayanti96@gmail.com

Keywords: Tobacco smoking, Purchasing pattern, Cigarette taxes, Health status, Health insurance.

Abstract: Tobacco smoking had been an international health issue for many decades. Tobacco kills more than 7

million people each year and more than 1 billion smokers live in low- and middle-income countries.

Indonesian has been known as one of the country with lowest cigarette taxes. It leads to a significant decline

in health status and an increase the burden of national health insurance. The discourse to raise cigarette

taxes in September 2017 later will be an effective solution to reduce the number of smokers in Indonesia

and pressing down the purchasing pattern. Using a literature review of several related research and, the

result shows that purchasing pattern after increasing cigarette in another country have an impact to national

health status and health insurance. Therefore, it is necessary to have a further analysis about the

implementation in Indonesia.

1 INTRODUCTION

Tobacco had been used in the early America and

significantly increases its popularity by the arrival of

Spain to America which also introduced tobacco to

the Europeans. The cigarettes shaped tobacco was

becoming popularized in the new world by the

industrial revolution era (Heckewelder, 2006). A

cigarette, or “cigaret”, is a small cylinder tobacco

leaves which had finely cut and rolled in thin paper

for smoking. Along with the spread, health problems

related to the use of cigarettes began to appear

(Wigand, 2006).

The literature shows that tobacco kills more than

half of its user. Tobacco also kills more than 7

million people each year which more than 6 million

of those deaths are the result of direct tobacco use.

Moreover, more than 1 billion smokers in the world

(80%) live in low and middle-income countries

(World Health Organization, 2017). Thus it can be

stated that cigarettes have caused a decline in the

quality of human health in general. While a

deterioration in the quality of health may impose

additional burdens on the financing of national

health insurance. Accordingly, WHO FCTC

(Framework Convention on Tobacco Control) stated

that Tobacco use caused serious disability and

significantly increases the risk of a number of

additional diseases not immediately linked to it such

as tuberculosis (Tobacco-Free Kids, 2017).

However, it is the wider economic and development

impacts of tobacco that must be better understood.

In Indonesia, there are approximately 57 million

active smokers, consist of around 63% men and 5%

women. Thus make Indonesia ranked third in the

world for total number of smokers. (Tobacco-Free

Kids, 2017). Indonesia also known as one of the

countries with low cigarettes taxes. Increasing

cigarette tax is expected to suppress the purchasing

pattern of Indonesian as a solution to improve health

quality and ease the burden of national insurance.

2 METHODS

In this research, a systematic literature review for

many researches around the world including

Indonesia will be used, using a keyword cigarettes

purchasing pattern, relation between smoking, health

status, health cost and national health insurance.

The hypothesis is that there is correlation between

cigarette’s purchasing pattern after increasing

cigarette taxes to national health status and national

insurance.

Yanti, D.

The Impact of Purchasing Pattern after Increasing Cigarette Taxes to National Health Status and Health Insurance in Indonesia.

In Proceedings of the 4th Annual Meeting of the Indonesian Health Economics Association (INAHEA 2017), pages 61-64

ISBN: 978-989-758-335-3

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

61

3 RESULTS

Result compiled from some journal researches

related to smoking behaviour, tobacco tax, health

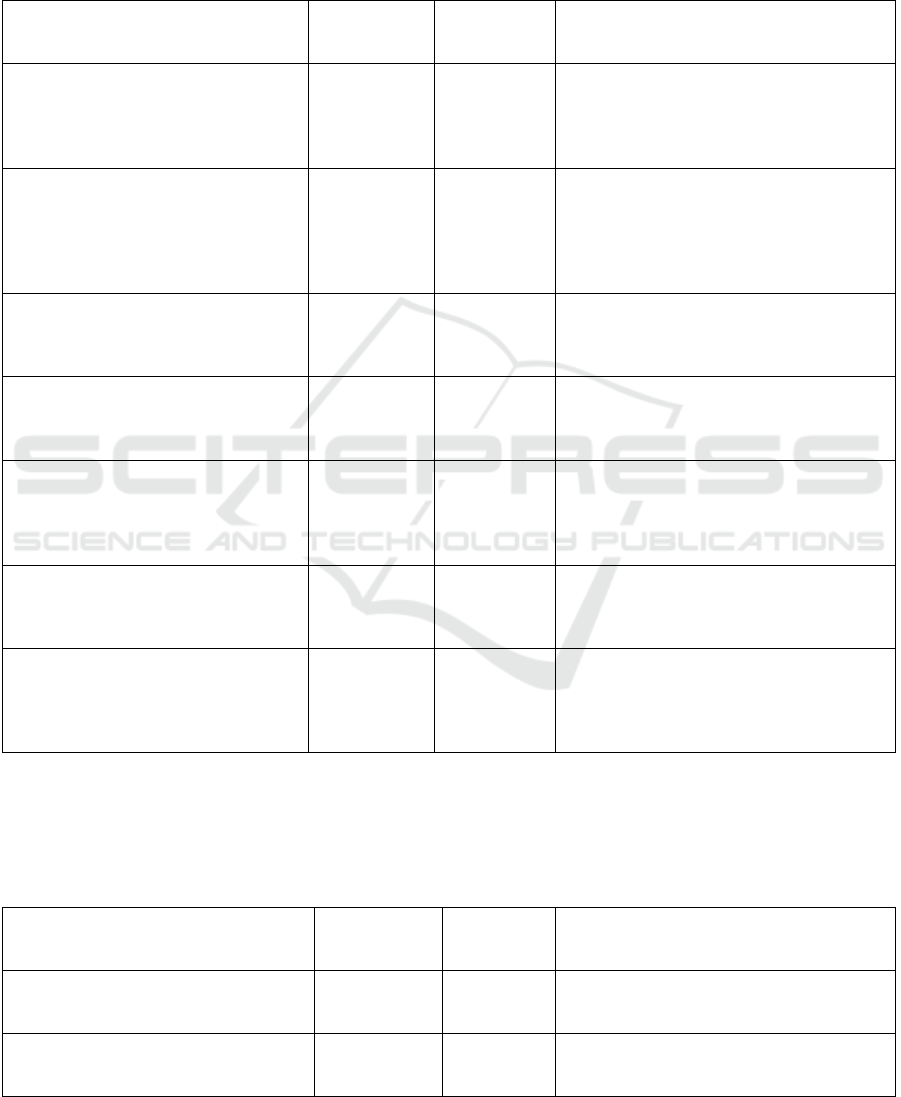

status, and health insurance. Table 1 is the research

compilation related to cigarettes purchasing pattern.

Table 1: Cigarettes Purchasing Pattern Research

Journal Tittle

Writer and

Published

Date

Research

Method

Result of the Studies

Purchasing Patterns and Smoking

Behaviours After a Large Tobacco Tax

Increase: A Study of Chinese

Americans Living in New York City

Jennifer

Cantrell,

MPA, DrPH

Candidate,

March 2008

Cross-

sectional

study

a. 54.7% of respondents is in at least one

tax-avoidance strategy.

b. Among the 216 smokers, changes in

smoking behaviour in response to the tax

increase is re

p

orted.

Effects of Tobacco Taxation and

Pricing on Smoking Behaviour in High

Risk Populations (US) : A Knowledge

Synthesis

Pearl Bader,

October 2011

Systematic

Review,

Expert panel

Raising cigarette prices through increased

taxes is a more effective tobacco control

policy measure for reducing smoking

behaviour among youth, young adults, and

persons of low socioeconomic status,

com

p

ared to the

g

eneral

p

o

p

ulation.

Cigarette Purchasing Patterns Among

New York Smokers

Kevin Davis,

March 2006

Analytic

Method

Smokers in New York are sensitive to

higher cigarette prices and reduce the

number of cigarettes they smoke when

p

rices are increased.

Raising Cigarette Taxes Reduces

Smoking, Especially Among Kids

Ann Boonn,

January 2017

Systematic

Review

Cigarette consumption from 1970 to 2015

show that there is a strong correlation

between increasing prices and decreasing

consum

p

tion.

Analysis of Product Influence, Price

And Promotion To The Result of

Purchase of Surya Cigarette (Study At

Universitas Kanjuruhan Malang

Indonesia

)

Dadang Tru

Nugroho,

2015

Multiple

Linear

Regression

Analysis

The product variables, prices and

promotions simultaneously affect the

buying decision.

Cigarette Taxes and Smoking

Kevin

Callison,

2014

Synthetic

control

approach

There is negative, small and significant

association between cigarette taxes and

either smoking participation or the average

number of daily cigarettes.

Promotion, Distribution, Price

Influence Against Purchase Decision

of Surreal Promild Cigarette : Study in

Indonesia

Jilly

Bernadette

Mandey, 2013

Multiple

Linear

Regression

Analysis

Promotion, distribution, and price have a

significant effect on purchasing decision,

while price has no significant effect to

purchasing decision.

A view study shows that there is correlation

between cigarette prices and cigarette taxes with the

purchasing pattern of cigarette. Therefor there is

some research showing the opposite result of those

hypotheses

.

Table 2: Smoking and Health Status Research

Journal Tittle

Writer and

Date

Publishe

d

Research

Method

Result of the Studies

Self-Rated Health Status and Smoking

Nouran

Mahmoud,

2011

Bivariate

Analysis

There is significant relationship between

self-rated health status and the exposure

variables smokin

g

status.

Public Health Implications of Raising

the Minimum Age of Legal Access to

Tobacco Products

Bonnie et al.,

2015

Literature

Review

Tobacco use is associated caused mortality

with several cases such as lung infections,

coronar

y

heart disease, chronic obstructive

INAHEA 2017 - 4th Annual Meeting of the Indonesian Health Economics Association

62

Journal Tittle

Writer and

Date

Publishe

d

Research

Method

Result of the Studies

p

ulmonar

y

disease and a variet

y

of cancers.

The result of the studies shows that there is a

correlation or relationship between smoking

cigarette and decreasing heath status. Thus, high

cigarette purchasing pattern will affecting smokers

heath status.

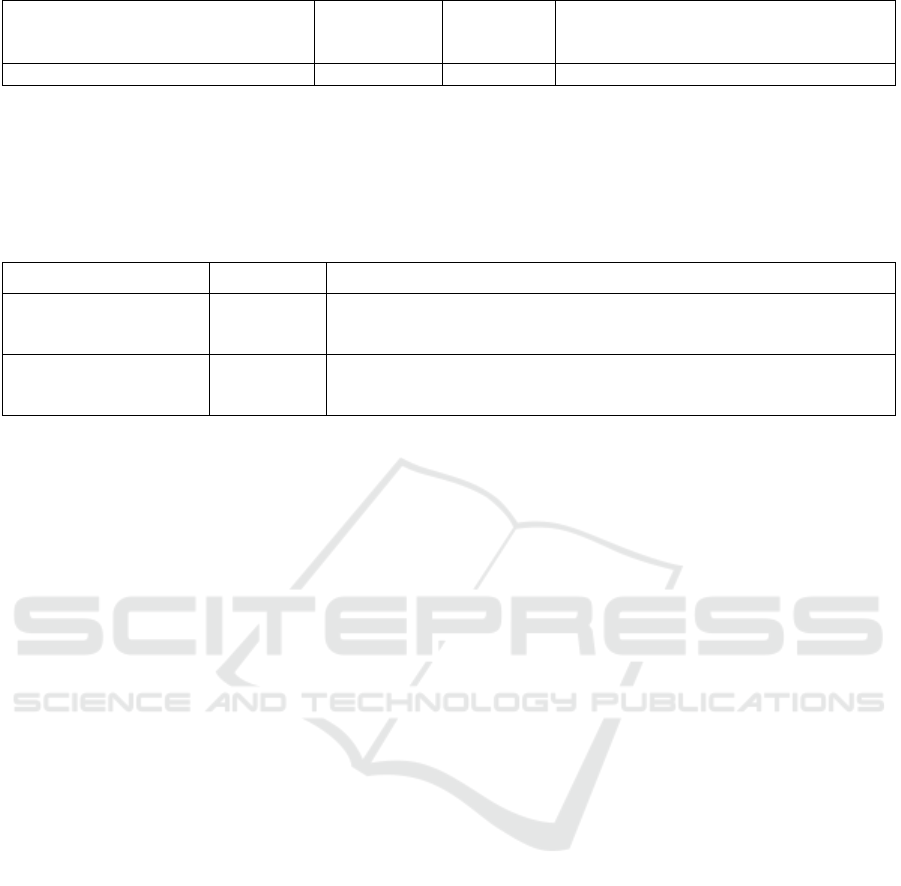

Table 3: Smoking and National Health Insurance Research

Literature Tittle Published Result of the Studies

Tobacco Cost to

Economy

WHO, 2013

Tobacco’s cost includes social, welfare and health care spending, higher

numbers of accidents and higher insurance premiums.

Info BPJS Kesehatan* ;

Dues Adjustment

BPJS, 2015

Raise cigarette taxes and allocate a portion for health financing the

community can increase the budget allocation for national health insurance.

* BPJS Kesehatan is Indonesian Health Insurance Program

The result of the studies shows that there is a

correlation or relationship between smoking

cigarette and burdening national health insurance.

Thus, low cigarette purchasing pattern and high

cigarette taxes will ease the burden.

4 DISCUSSION

Implementation of non-smoking areas in Indonesia,

especially in Surabaya has not fully run optimally as

a whole. There needs to be firm action in the form of

sanctions for those who violate the Regulation of No

Smoking Area. Related parties may create

promotions or enforce the latest model of tobacco

control on Non-Smoking Areas (KTR). Most

Indonesians love the latest information with the

latest. This will minimize the citizens of Indonesia

who consume cigarettes, They gradually follow the

process will understand that health is more important

and more apply the good tobacco control for us

together and encourage the movement of society to

create Indonesia free from smoke.

4.1 Purchasing Pattern after Increasing

Cigarettes Taxes

Based on the results of literature review studies

obtained some research results indicate that there is

a significant influence between price increases or

cigarette taxes with a decrease in purchases pattern

and smoking habits in the society (Bader et al.,

2011; Davis et al., 2006; Boonn, 2017; Nugroho et

al., 2015). However, view amount of research

proving that the correlation between the two

variables is weak and insignificant (Callison &

Kaestner, 2014; Mandey, 2013). This may be due to

differences in the characteristics of respondents,

research area and socio-economic levels. So it can

be concluded that increasing cigarette tax in one of

effective effort to pressing down cigarettes

purchasing pattern in many region including

Indonesia.

4.2 Smoking and Health Status

Some previous research results have illustrated the

existence of a negative influence between cigarette

consumption and health status, both self-health

status and national health status (Mahmoud, 2011;

Bonnie et al., 2015). Cigarette illnesses such as

coronary heart disease, lung infections, and chronic

obstructive pulmonary disease have become one of

the leading causes of death in the world. Both for

active smokers and second-hand smokers, health

problems that appear because the toxic substances in

cigarettes are endanger. Hopefully, by decreasing

cigarettes purchasing behaviour after increasing

cigarettes taxes will reduce the risk of smoking-

related diseases in Indonesia

4.3 Smoking and National Health

Insurance

Implementation of the national health insurance

system in the form of “BPJS Kesehatan” in

Indonesia is expected to provide maximum service

for the entire community. However, there is some

The Impact of Purchasing Pattern after Increasing Cigarette Taxes to National Health Status and Health Insurance in Indonesia

63

obstacles in the implementation of Indonesia's

national health system, one of them is the

operational BPJS Health in 2014 which experienced

an imbalance or mismatch in the ratio of claims, due

to the outgoing financing greater than the

contribution of the incoming premiums up to

103.88% (BPJS Kesehatan, 2015). Therefore it can

be predicted that lower cigarettes purchasing pattern

will be able to pressing down the cost-economy

which related to smoking-related disease. Besides,

the higher cigarette tax might be increase the budget

allocation to the national health system so as to

improve the quality of health service and maintain

the health insurance program continuity in Indonesia

5 CONCLUSIONS

Based on the results of several literature reviews

related cigarettes purchasing pattern can be

concluded that the increase in cigarette taxes may

have an impact on the decline of cigarette

purchasing pattern, so that will be one of the

effective solution to increase the national health

status and reduction the burden of national health

insurance in Indonesian.

REFERENCES

Bader, P., Boisclair, D. & Ferrence, R., 2011. Effects of

Tobacco Taxation and Pricing on Smoking Behavior

in High Risk Populations: A Knowledge Synthesis.

International Journal of Environmental Research and

Public Health, 8(11), pp.4118 - 4139.

Bonnie, R.J., Stratton, K. & Kwan, L.Y., 2015. Public

Health Implications of Raising the Minimum Age of

Legal Access to Tobacco Products. Washington: The

National Academies Press.

Boonn, A., 2017. Tobacco Free Kids Fact Sheets. [Online]

Available at: HYPERLINK

"https://www.tobaccofreekids.org/assets/factsheets/01

46.pdf"

https://www.tobaccofreekids.org/assets/factsheets/014

6.pdf [Accessed 1 September 2017].

BPJS Kesehatan, 2015. BPJS Kesehatan. [Online]

Available at: HYPERLINK "https://bpjs-

kesehatan.go.id/bpjs/" https://bpjs-

kesehatan.go.id/bpjs/ [Accessed 1 September 2017].

Callison, K. & Kaestner, R., 2014. Regulation. [Online]

Cato Instittute Available at: HYPERLINK

"https://object.cato.org/sites/cato.org/files/serials/files/

regulation/2014/12/regulation-v37n4-7.pdf"

https://object.cato.org/sites/cato.org/files/serials/files/r

egulation/2014/12/regulation-v37n4-7.pdf [Accessed

1 September 2017].

Cantrell, J., Hung, D., Fahs, M.C. & Shelley, D., 2008.

Purchasing Patterns and Smoking Behaviors after a

Large Tobacco Tax Increase: A Study of Chinese

Americans Living in New York City. Public Health

Reports, 123(2), pp.135-46.

Davis, K., Farrelly, M., Li, Q. & Hyland, A., 2006.

Cigarette Purchasing Patterns among New York

Smokers: Implications for Health, Price, and Revenue.

New York: New York State Department of Health.

Heckewelder, J.G.E., 2006. History, Manners, and

Customs of The Indian Nations Who Once Inhabited

Pennsylvania and The Neighboring States.

Philadelphia: Historical Society of Pennsylvania.

Mahmoud, N., 2011. Self-Rated Health Status and

Smoking. Master Thesis. San Diego: San Diego State

University San Diego State University.

Mandey, B.J., 2013. Promotion, Distribution, Price and its

Influence Towards Decision of Purchasing Surya

Promil Cigarette. Journal EMBA, 1(4).

Nugroho, D.T., Nurfarida, I.N. & Wilujeng, S., 2015.

Analysis Influence of Product, Price and Promotion

towards Consumer Decision on Purchasing Surya

Cigarette (Study in College Students of Universitas

Kanjuruhan Malang). Journal of Management Student

Research, 3(1).

Tobacco-Free Kids, 2017. Tobacco-Free Kids. [Online]

Available at: HYPERLINK

"https://www.global.tobaccofreekids.org/en/search?sa

=&sa=&q=tobacco+in+indonesian"

https://www.global.tobaccofreekids.org/en/search?sa=

&sa=&q=tobacco+in+indonesian [Accessed 1

September 2017].

Wigand, J.S., 2006. Additives, Cigaarette Design and

Tobacco Product Regulation. Kobe: Smoke Free Kids

Inc.

World Health Organization, 2013. Tobacco. [Online]

World Health Organization Available at:

HYPERLINK

"http://www.who.int/tobacco/en/atlas13.pdf"

http://www.who.int/tobacco/en/atlas13.pdf [Accessed

1 September 2017].

World Health Organization, 2017. World Health

Organization : Media Centre Tobacco. [Online]

Available at: HYPERLINK

"http://www.who.int/mediacentre/factsheets/fs339/en/"

http://www.who.int/mediacentre/factsheets/fs339/en/

[Accessed 1 September 2017].

INAHEA 2017 - 4th Annual Meeting of the Indonesian Health Economics Association

64