Role of Tobacco Industries in the National Econom

y

Desi Purnama Wulandari

Faculty of Public Health, Universitas Airlangga, Mulyorejo, Surabaya, Indonesia

e-mail: desipurnama14@gmail.com

Keywords: Tobacco, Taxes, Industry.

Abstract: The tobacco industry widely covers the primary raw material sector including tobacco leaves, cloves and the

cigarette processing sub-industries. The role of the tobacco commodity is prominent in the national

economy as a source of state revenue from excise tax. The value of the tax revenues from year to year

continues to increase. The increase in the tobacco excise tax is due to the policy of increasing the retail price

of tobacco and thus, the cost of tobacco excise. The purpose of this study is to find out how big the

influence of the tobacco industry is on the national economy. This paper uses analytical methods paired with

a qualitative methodology. The results have concluded that the tobacco industry on the one side plays a role

in the national economy and on the other hand, has a negative impact on public health and the environment.

The government's assertiveness to protect people against the negative impact of cigarettes is needed through

measures to increase cigarette prices, increase the cigarette taxes, and to further the cigarette promotion

restrictions in cigarette advertisements and sponsorship activities involving young people. The conclusion is

that the government should seek other solutions to improve the national economy aside from cigarette taxes.

1 INTRODUCTION

Tobacco is one of the agricultural commodities that

has a high economic value, even aside from the

products produced from processed tobacco. The

development of the tobacco processing industry that

has occurred in Indonesia is inseparable from the

consumption of tobacco products. The demand for

high-tobacco processed products is gives a boost to

the tobacco processing industry because of the desire

for continued production and the subsequent profits.

The dependence of the tobacco processing industry

on the domestic market makes the tobacco

processing industry relatively stable, especially

concerning the main raw materials used by the

industry. The price of the raw materials, especially

tobacco, is not affected by the price in the world

market.

The small and medium scale elements of the

cigarette industry can suffer losses due to the

decrease in cigarette consumption by the community

due to FCTC regulations (Framework Convention

on Tobacco Control). These regulations aim to

protect the current and future generations from the

health, social, environmental, and economic

consequences of tobacco consumption and exposure

to second-hand smoke. Not only does the tobacco

industry have a negative impact, but so does the

tobacco farming sector as the main provider of

cigarette production input. The phenomenon of the

tobacco processing industry is interesting to examine

in relation to how its role in the economy comes face

to face with health issues in Indonesia.

2 METHODS

The methods in this study were the qualitative

approach, executed by collecting secondary data, i.e.

data obtained from an agency related to the research

focus. The purpose of this research study was to

know how big the influence of tobacco industry in

relation to the national economy. This is as well as

the economic impact of the tobacco processing

industry on other sectors of the economy.

3 RESULT

3.1 The Tobacco Industry to the Indonesia’s

Economy

The tobacco industry in relation to Indonesia's

economy is very influential. In Figure 1, the income

Wulandari, D.

Role of Tobacco Industries in the National Economy.

In Proceedings of the 4th Annual Meeting of the Indonesian Health Economics Association (INAHEA 2017), pages 165-167

ISBN: 978-989-758-335-3

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

165

of farmers per hectare in the central cigarette

industry and their income from tobacco has

amounted to Rp 48 million. The average income of

most tobacco farmers in 2012 amounted to Rp 57

million and in 2013, this amounted to Rp 54 million.

Figure 1: Income of farmers per hectare in cigarette

industry centre in 2013

Figure 2: Farmers' income (Rp million / ha) -

national average

3.2 Growth of cigarette industry in

Indonesia.

The average annual growth of cigarette sales is

estimated to be 5.4% over the last 6 years (2009-

2014). It is estimated that the value of cigarette sales

reached 276 trillion in 2014, of which 113 trillion

was excise. The average growth rate of cigarette

sales is 14.6% higher than other industries. This has

increased the average price of cigarettes per year

(2009-2014) by 8.7%.

Figure 3: Cigarette sales (2009-2014)

3.3 Contribution of cigarette industry to tax

revenue

Indonesia's tobacco industry through CHT (Excise

on Tobacco Products) for the last 5 years has

accounted for an average of 9.2% of the total tax

revenue or Rp 443 trillion in the period 2010-2014.

This makes excise tax one of the main contributors

towards state income from taxes. 9.8% of the total

tax revenue in 2014 came from tobacco taxes. The

highest excise increase occurred in 2012 by 23.6%.

Figure 4: Excise and growth

Figure 5: Comparison of cigarette prices with other

countries.

INAHEA 2017 - 4th Annual Meeting of the Indonesian Health Economics Association

166

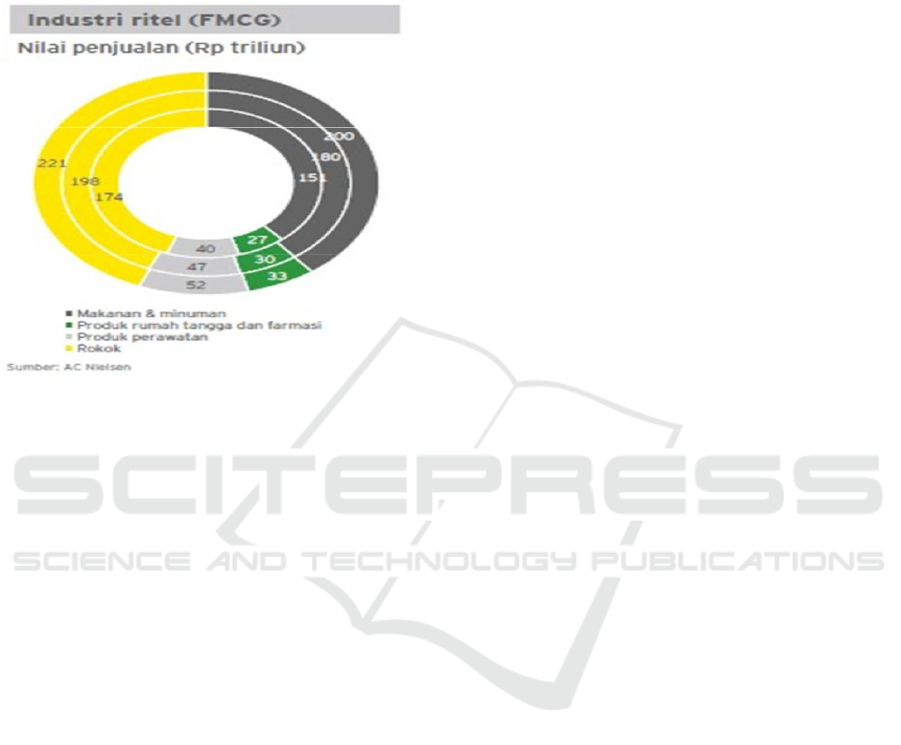

The estimated value of the contribution of the

tobacco industry to traditional traders in 2014

amounted to Rp 206 trillion. Meanwhile, sales of

cigarettes to the total sales value of FMCG in 2014

reached 43.7%. (Figure 6)

Figure 6:Total sales value of FMCG

4 DISCUSSION

Some of the phenomena associated with the tobacco

sector and tobacco industry in Indonesia are 1) that

the tobacco production has declined an average of

5.98% per year, 2) that the consumption of cigarettes

increases with population and income, 3) that the

tobacco and cigarette industry sector accounts for

about 7% of domestic revenues, but exhausts more

than the foreign exchange, 4) dislikes the absorptive

sector of labour in other sectors, which is a

considerable multiplier output of the sector and 5)

that the tobacco sector has a strong thrust against the

downstream sectors, and the cigarette industry sector

strongly pushes the downstream sector (Hadi and

Friyanto, 2008).

The large number of cigarette excise taxes as a

source of state income has become a pro-contra

debate over the call for tobacco farmers to switch to

other farm enterprises on the land that is owned. As

a raw material for the tobacco industry, the need for

tobacco will probably never cease, so there must be

a development effort to open up new avenues. In

addition to these direct economic benefits, the

indirect economic benefits are also very large in the

retail sector, associated with kiosks, and the

upstream industries of cigarettes such as paper mill

auxiliary materials and others. In the process of

developing tobacco cultivation, there is the fertilizer

industry, pesticides, herbicides, and others. The

restriction and cessation of tobacco plantations will

have a chain impact on the tobacco industry, other

component suppliers from different industries,

industrial workers, wholesalers and retailers who

will all suffer huge losses.

5 CONCLUSION

In Indonesia, the tobacco industry is faced with a

difficult situation. On one side, it plays a role in the

national economy and on the other side, it has a

negative impact on public health and the

environment. The role of tobacco in the national

economy can be seen from the contributions of the

cigarette industry towards the tax revenue of

Indonesia.

Indonesia is a country that serves as a cigarette

market for national and global cigarette producers,

due to its large population, high population growth

rate, and population participation rate, especially in

relation to young smokers. Indonesia's cigarette

industry is mostly owned by large and foreign

investors, so that the value added is enjoyed by the

big and foreign investors, while the Indonesian

people only receive the negative impacts from

cigarettes.

REFERENCES

EY. 2015. Kajian Singkat Potensi Dampak Ekonomi

Industri Rokok di Indonesia. EY Global Organization.

Hendaryati, D. D., Yanuar A. 2016. Statistik Perkebunan

Indonesia 2015-2017 Tembakau. Secretariate of

Directorate General of Estate Crops.

Peraturan Pemerintah Republik Indonesia Nomor 109

Tahun 2012 Tentang Pengamanan Bahan Yang

Mengandung Zat Adiktif Berupa Produk Tembakau

Bagi Kesehatan

Hadi, Prajogo U. and Friyatno, S., 2008., The Role of

Cigarettes Sector and Cigarettes Industry in

Indonesian Economic. Journal of Agro Economy.

PSEKP, Bogor.

Rachmat, M. 2010. Pengembangan Ekonomi Tembakau

Nasional: Kebijakan Negara Maju Dan Pembelajaran

Bagi Indonesia. Analisis Kebijakan Pertanian.

Volume 8 No. 1: 67-83

Undang-Undang Republik Indonesia Nomor 39 Tahun

2007 Tentang Perubahan Atas Undang-Undang

Nomor 11 Tahun 1995 Tentang Cukai

Undang-Undang Republik Indonesia Nomor 36 Tahun

2009 Tentang Kesehatan

Role of Tobacco Industries in the National Economy

167