Exploring Elements of Human Capital Development and Firm

Performance in the Financial Services Industry

Via Irhamny Az-Zahra and Dina Nurdiani Sapitri

Universitas Pendidikan Indonesia, Jl. Dr. Setiabudhi No. 229, Bandung, Indonesia

viairazzahra@student.upi.edu, dinanurdianis@gmail.com

Keywords: Flexibility, Adaptability, Competencies, Development of Organizational Competencies, Individual

Employability, Human Capital, Firm Performance.

Abstract: The purpose of this study is to examine the relationship between the elements of human capital with firm

performance. The elements that are expected to affect firm performance in financial services industry are

competence, flexibility, adaptability, development of organizational competencies, and individual

employability. Each component of the elements has different role in creating company’s human capital that

will determine the firm performance. The research uses a qualitative approach in which in-depth interviews

were performed to gain insights from top-level managers of the studied companies. Cross-case study

analysis was carried out to analyze the data. The results indicate that the five elements in human capital

have a significant and substantive influence on firm performance.

1 INTRODUCTION

The knowledge-based economy era highlights the

pursuit of new types of capital by companies,

namely human capital (HC). HC refers to the

knowledges, competencies, skills and other personal

characteristics acquired through individual’s way of

life which are then utilized for production of goods

and service. Thus, it can be said that human capital

affects organizations’ growth and sustainability

more than other resources (Hassan et al., 2017).

Human Capital Theory was developed by Becker

(1964) who views trainings to improve human

capital as another form of capital, thus expenditures

on it should be viewed as an investment with

valuable returns as opposed to a simple cost.

Wernerfelt (in Juwita and Anggraeni, 2007) also

included human capital as one of the most useful

resources to maintain competitive advantage

(Juwita, Anggraeni; 2007). According to the theory

of modern growth, the accumulation of human

capital is an important contributor to economic

growth. A numerous cross-country research has

extensively explored the significant contribution of

educational attainment to overall output production

in the economy (Soon, 2010). In general, human

capital is associated with skills and expertise of a

person in an organization.

The argument in the related researches is that the

current and potential human resources are an

important consideration in company’s development

as well as the implementation of the organization’s

strategic business plan.

Human capital-based performance assessment is

an interesting approach that needs to be developed

by companies. Human capital is one of the main

components of company's intellectual capital

(intangible assets). To date, the assessment of firm

performance mostly done based on company’s

physical resources (tangible assets). According to

Mayo (in Hakooma and Seshamani, 2017),

measuring firm performance from a financial

perspective is very accurate, but in fact, the basic

driver of the financial value is the human resources

(human capital) with all the knowledge, ideas, and

innovations they provide. Furthermore, human

capital is also the core of a company. Thus, human

capital can be understood as the skills, knowledge,

and abilities possessed by all peoples and those

needed in the labor market for the production of

goods and services (Hakooma and Seshamani,

2017).

The belief that the performance of individual

employees has implications for company-level

results has been prevalent among academics and

practitioners for years. The interest in the field has

recently intensified, however, as scientists have

404

Az-Zahra, V. and Sapitri, D.

Exploring Elements of Human Capital Development and Firm Performance in the Financial Services Industry.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 404-408

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

begun to argue that, collectively, company

employees can additionally provide a unique source

of competitive advantage that is difficult for

competitors to emulate. For instance, Wright and

McMahan (in Marimuthu et al., 2009), with the

reference to the theory of resource-based company

Barney in 1991, argue that human resources can

provide a sustainable source of competitive

advantage when the four basic requirements are met.

Human capital provides added value to company’s

production process at individual level while at the

same time plays an important role in strategic

planning, namely in creating competitive advantage

at organizational level (Marimuthu et al., 2009).

The financial services industry has undergone

dramatic changes in the last decade, with structural

and technological advances that put pressure on top

management to rethink their business strategy.

Financial globalization, increasingly fierce

competition, the development of Information and

Communication Technology (ICT), and deregulation

and regulation are the main drivers of the change

(Cabrita, 2008). In response to these changes, most

companies have embraced the concept in which

human capital plays a role as a competitive

advantage that will lead to higher performance.

Human resource development has become a part of

the overall effort to achieve cost-effective

performance as well as firm performance. Therefore,

companies need to understand human capital in

order to increase employee satisfaction, which

consequently will lead to better performance

(Marimuthu et al., 2009).

Research conducted by Garavan et al., (2001)

indicates that human capital has four main attributes,

namely: (1) flexibility and adaptability, (2)

competencies, (3) development of organizational

competencies, and (4) individual employability. The

research shows that these attributes in turn generate

added value for individual as well as organizational

outcomes. Finally, due to relational capital, there are

empirical evidences which display that employee

satisfaction, motivation and commitment have

positive impacts on employee satisfaction, loyalty

and retention, leading to higher corporate

productivity (Kaplan and Norton, 1996; Horibe,

1999). Researchers generally agree that the

rejuvenation of intellectual capital within the firm

requires a feeling of relational equality in order to

protect the organization from market obsolescence

(Håkansson and Snehota, 1995; Gibbert, Leibold

and Voelpel, 2001). Roos et. Al. (1997) argue that

employees produce ICs through their intellectual

competence, attitudes and agility. Bontis and Chua

(2000) state that competence includes skills and

education, while attitudes include employee's

behavioral elements.

2 METHODOLOGIES

The study uses a case study approach with the aim to

develop more specific Human Capital elements in

financial services industry. Case studies specifically

focus on a certain phenomenon that provide an in-

depth understanding of a particular event. The study

took place in four different private financial services

companies in Garut. The interview sessions in this

study were conducted between July and September

2017. The four financial services companies were

selected for the reason that the four companies

ranked in local’s top five financial services

companies. The financial services companies were

established and operated for over seven years.

The analytical unit of this research is top-level

managers such as senior managers who are

responsible for designing and managing companies’

strategies and operations. Their assessments and

suggestions regarding the variables that should be

included in Human Capital factors as well as their

impacts on firm performance will be considered to

be the most relevant answer of this research. It takes

about 90 minutes to conduct the informal interviews.

The population of this study is the top-level

managers of the four financial services companies

mentioned before. The study sample consists of a

total of nine individual respondents. Kiran (2008)

argues that nine is considered to be a sufficient

number of sample for a small-scale study. There is

no exact number or range of cases that can be used

as a guide for researchers, indicating that there are

no established rules regarding the sample sizes in

qualitative research (Hassan, Saleh, Kamaluddin and

Hamzah: 2017).

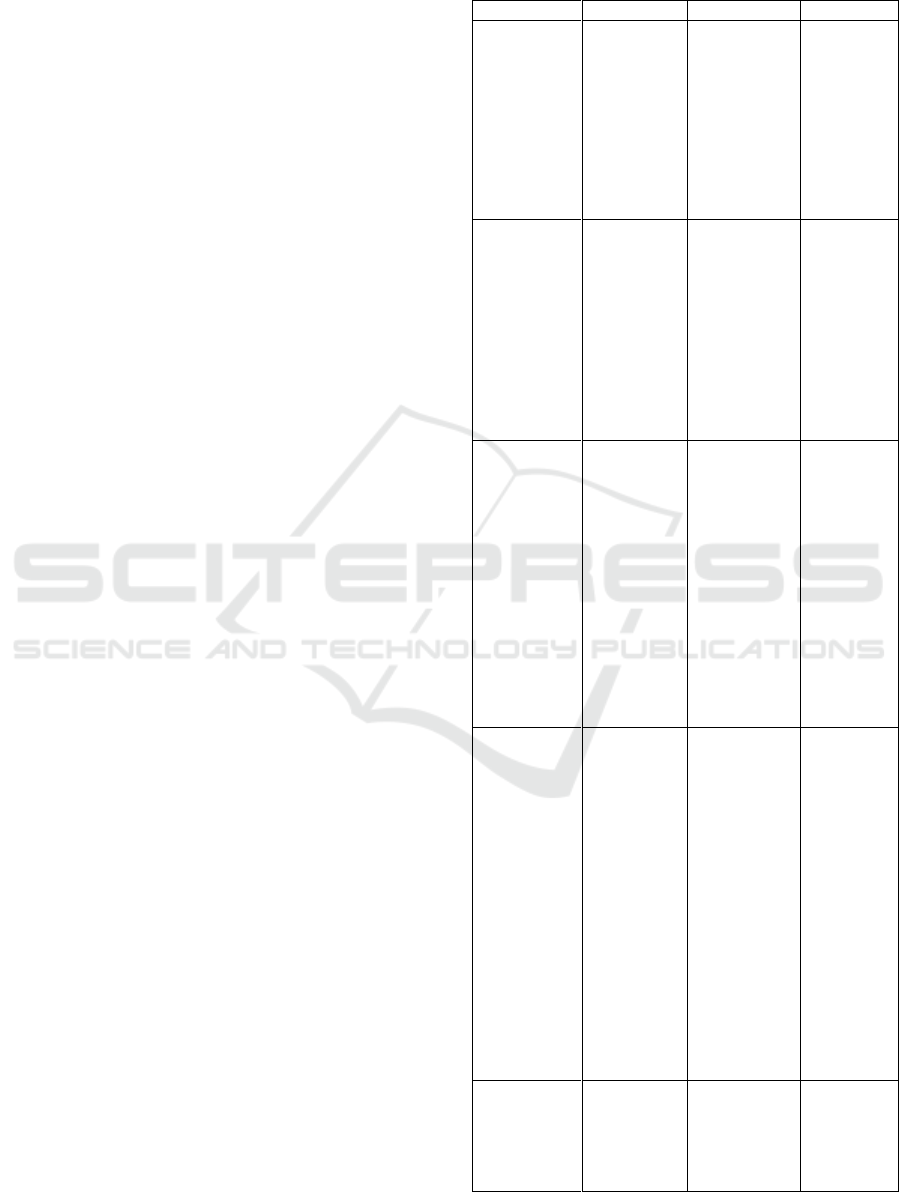

Table 1: List of financial service industry and interviewees

involved.

Employees

interviewed

Chief

executive

officer

(CEO)

Chie

operating

officer

(COO)

Huma

capital /

human

resources

manager

Total

FSC A

1

1

FSC B

1

1

2

FSC C

1

1

FSC D

2

2

Source : own resource, 2017

Exploring Elements of Human Capital Development and Firm Performance in the Financial Services Industry

405

The top-level managers interviewed in Financial

Services Company A and C are the CEOs of the

companies. CEOs occupy the highest positions in

the company, their primary responsibility is to

manage the overall operations and resources

including strategic decision making. Thus, a single

CEO representation is considered to be sufficient to

provide the information and assessment required in

this study. Due to unfortunate clash in the schedule,

COO and HRM representations of Financial

Services Company B were interviewed in place of

the CEO of the company. Finally, two HRM

representatives of Financial Services Company D

were interviewed to gain some insights from the

company. The interview was conducted directly. All

of the informations provided are sufficient to answer

the semi-structured questionnaires which were

compiled based on literature review. The

participants further ensure that the data provided will

not be used for any purpose other than this research

and that the confidentiality of the data will be kept.

3 RESULTS AND DISCUSSION

As elaborate as the elements of Human Capital can

be, the Human Capital can basically be seen as the

driving wheel of the organization, thus signify its

importance. The results of the interviews indicate

that the respondents consider Competencies and the

Development of Organizational Competencies as

human capital elements that play important roles in

firm performance. The main objective of financial

services industry is to achieve customer satisfaction

which will influence firm performance. Thus, the

respondents believe that employees’ soft skills in the

field of communication is a valuable competence

that will better support their work.

The findings of this study indicate that

companies in financial services industry do not

demand a correspending educational background

with the field of the companies. In regards to

customer service staffs, companies put more

emphasis on good communication skill as well as

employees adeptness and creativity in understanding

and providing informations about savings and loan

services provided by the companies. Daily morning

briefing and monthly evaluation are performed

regularly to measure how far the employees achieve

the expected performance. As stated in the

interview:

“... our main focus is the amiability of the employees

towards both the old and new customers...”

"... improvising employees in communicating has

became company's main service to hone employees’

soft skills ..."

"... the ability to adapt to new people poses a

challenge for the employees; the employees are

expected to appear like he or she has known the

customers for a long time ...”

As for the staffs who work as tellers, owing to the

fact that they directly deal with the system as well as

companies’ financial statements, they are expected

to have the basic computer skills needed, even if

they don’t have the educational background of the

discipline. Several cases of human error can be

immediately identified through monthly evaluations

as well as informal reports in the daily briefing.

"... the analysis and its accuracy in transaction

process become an important point for employees

owing to the fact that they will be faced with

unbalanced amount of money when they make any

mistake ..."

Nevertheless, the companies do not impose

different operational hours for different position. All

of the employees work with the same working hours

(Monday to Friday, from 8 am to 2 pm) while in

case of overtime, the employee will get

compensation in the form of overtime pay.

"... we value employees who prioritize their time and

thus spur other employees to be more disciplined ...”

Other findings of the study show that employees

receive educations and trainings in regards of related

themes. In addition to honing individuals’ capability,

the company also expect to dig the employees

competence deeper so that they can improve firm

performance. The four companies impose

sustainable training programs and are deeply

committed to the long-term career development of

their employees. The companies provide their

employees with facilities as well as leeways for

employees who wish to continue their education to a

higher level without diminishing any of their rights

as employees, as long as the employees do not

neglect his/her responsibilities.

"... the obligation of the employees is to get their job

done on time without leaving any work for the day

after, this is one of the expected impacts of the

training programs imposed to the employees..."

The companies realize that not all of their

customers can position themselves as their partners,

some of their clients - for instance – position

themselves as kings. Consequently, there are times

when customers would expect to be served in

employees’ break or lunch time.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

406

“... there are times when we find ourselves in that

kind of situation and we will just proceed the

transaction as a solution ...”.

As companies that engage in the financial

services industry, the performance of the companies

is not only measured from the performance of the

human capital, but also from the cash turnover of the

company. Credit transactions, among others, is one

of the products that made this financial services

industry. It is not unusual for the employees to be

challenged by customers who do not make their

payments in due time. “ ... here the flexibility of the

employees will be tested...”

The results of this study show that human capital

plays an important role in the financial services

industry. The results of the interviews indicate that

the four companies provide their employees with

opportunities to develop their competencies, some

amount of freedom to move, and supports from

senior managers. Feedback earned by the companies

for the provisions mentioned is the increased feeling

of happiness and productivity of the employees,

marked by the completion of all the work on time

which positively impact firm performance. On the

selection process, the companies are not only

focused on candidates’ high competencies, but also

give emphasize to the strong desire of the

individuals to improve their ability, skills, and

adaptibility to exercise the elements of human

capital they possess. Some companies have proven

the feasability of the principles regardless the

difficulty. Leaders are not expected to execute all the

tasks of the company in solitary, but to take the steps

needed so that the employees can overcome the

obstacles in work and complete all the tasks together

in accordance with the work portion of each field.

Nevertheless, the companies should established a

particular standard to manage the human capital

elements to prevent superficial understanding that

will lead to hasty decisions and policies as well as

exploring the elements in order to produce superior

resources and maintain their places as local’s four

best financial services companies.

3.1 Cross Case Analysis for the

Development of HC Elements in

Financial Service Industry

The results and data analysis of this study indicate

the existence of the companies’ efforts to develop

the basic elements possessed by their employees.

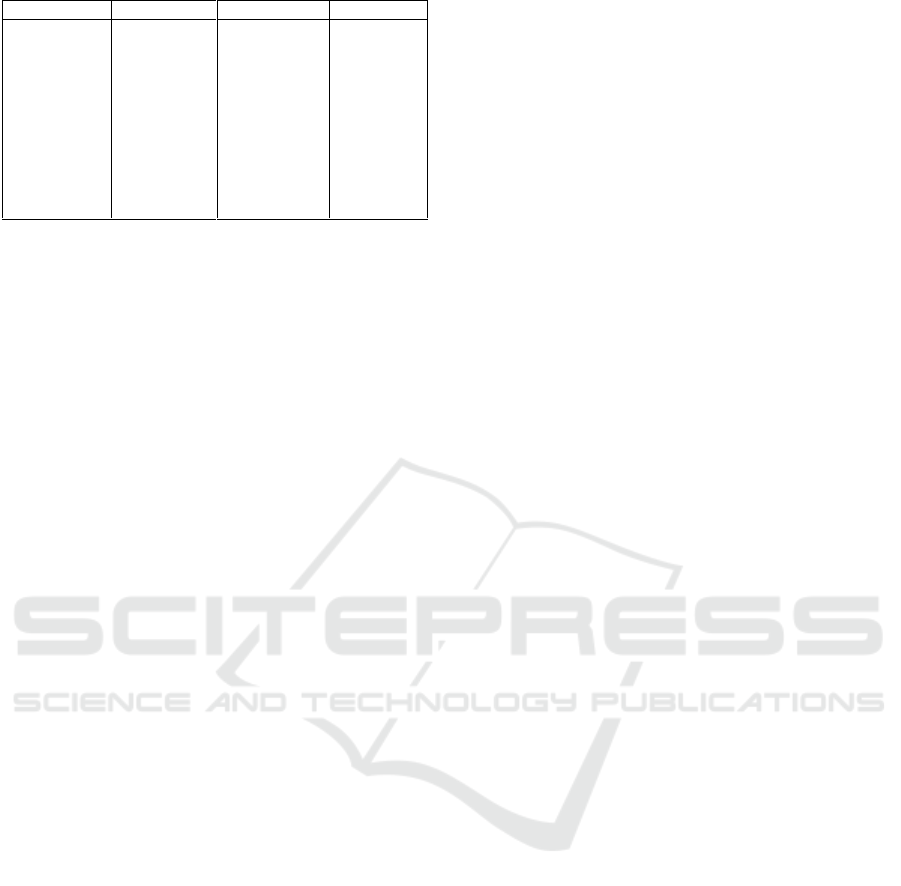

Table 2: Human capital elements for each financial service

industry.

FSI A

FSI B

FSI C

FSI D

Flexibility:

Employees’

readiness to

face changes in

company

policy

Flexibility:

Employees’

ability to keep

up with

organization

development.

Flexibility:

Employees’

readiness to

face the

decisions taken

by management

that require

employees to

quickly adjust.

Flexibility:

Employees’

readiness to

be

transferred.

Adaptability:

Is an important

element for

employees who

work as

frontlines.

Adaptability:

Is an

important

element,

especially for

dealing with

new

customers?

Adaptability:

Should be

balanced with

good

communication.

Adaptability:

Is a

favourable

element that

can be

valuable for

employees in

regards to

their monthly

evaluation?

Competencies:

Employees’

accuracy as

well as their

computer

ability.

Competencies:

Employees’

basic

financial

literacy as

well as their

improvement

in

accordance

with the

trainings given

by the

company.

Competencies:

Is an important

element that

differs depends

on employees’

responsibilities?

Competencie

s:

Favour

employees

with work

experience in

the field.

Development

of

Organizational

Competencies:

Employees’

capability to

understand the

basic of their

colleague’s

works that

leads to the

ability to cover

their

colleagues

absent

Development

of

Organizational

Competencies:

The obligation

to finish their

tasks on time.

Development of

Organizational

Competencies:

Employees’

multitasking

capability.

Development

of

Organization

al

Competencie

s:

Employees’

ability to

give their

contributions

to the

company, i.e.

the ability to

compile rules

of work

discipline.

Individual

Employability:

Employees’

capability to

deal with the

Individual

Employability:

Employees’

capability to

deal

Individual

Employability:

Employees’

loyalty as well

as their sense of

Individual

Employabilit

y:

Attendance

in internal

Exploring Elements of Human Capital Development and Firm Performance in the Financial Services Industry

407

FSI A

FSI B

FSI C

FSI D

impact of top-

level

management’s

decision.

with

complaining

customers, i.e.

to

first ask for

forgiveness

followed by

service

recovery.

responsibility to

finish the

designated

tasks.

meetings as

well as

monthly

performance

evaluations.

Overall, the top-level managers of the financial

services companies studied in this research

highlighted the importance of the elements of the

human capital, thus indicating the need to develop

the elements in order to improve firm performance.

The companies, in particular, emphasize the

importance of Competencies as well as the

Development of Organizational Competencies

attributes. The development of these elements will

develops employees’ potentials that will assist them

to improve their careers as well as improving firm

performance.

4 CONCLUSIONS

The results of this study indicates a significant and

substantive relationship between human capital and

firm performance. Furthermore, the elements of

human capital is shown to encourage the employees

to improve firm performance. The elements of

human capital development such as education,

training, work experience, and human resource

management must be in accordance with the

government agenda. The findings of this study may

not be able to perfectly represent the entire

population as it was done in a limited sample size;

thus limit the generalizability of the study (Gillies,

1998, Hassan, Saleh, Kamaluddin and Hamzah:

2017).

REFERENCES

Becker, G. S. 1964. Human Capital: A Theoretical and

Empirical Analysis, with Special Reference to

Education. Michigan: National Bureau of Economic

Research; distributed by Columbia University Press.

Bontis, N., Chua Chong Keow, W., 2000. Intellectual

Capital and Business Performance in Malaysian

Industries.

Cabrita, M. B., 2008. Intellectual Capital and Business

Performance in the Portuguese Banking Industry, Vol.

43., No 1-3., 213-237.

Garavan, T. N., Morley, M. M., Gunnigle, P., Collins, E.,

2001. Human Capital Accumulation the Role of

Human Resource Development. 48-68., ISSN 0309 -

0590.

Gibbert, M., Leibold, M., Voelpel, S. 2001. Rejuvenating

corporate intellectual capital by co-opting customer

compe-tence, Journal on Intellectual Capital, 2(2), pp.

109-126.

Håkansson, H., Snehota, I. 1995. Developing relationships

in business networks, Routledge, London.

Hakooma, N., Seshamani, V., 2017. The Impact of Human

Capital Development on Economics Growth in

Zambia: An Econometric Analysis, vol 5., ISSN 2348-

0386.

Hassan, H., Moch. Saleh, N., Kamaluddin, K., Hamzah,

N., 2017. Exploring Element Human Capital

Development of Private Hospital in Malaysia: A

Qualitative Approach, ISSN 2289-6589, vol 6., ISSUE

1., 167-177.

Horibe, F. 1999. Managing Knowledge Workers – New

Skills and Attitudes to Unlock the Intellectual Capital

in your Organisation. Toronto: John Wiley & Sons.

Juwita, S, P., Anggraini, F., 2007. The Influence of Human

Capital to Business Performance Through Costumer

Capital, Vol. 4., no 2., 229-250.

Kaplan, R. S., Norton, D. P. 1996. The Balanced

Scorecard – Translating Strategy into Action. Boston,

MA: Harvard Business School Press.

Kiran, K., 2008. Service Quality and Customer

Satisfaction in Academic Libraries Perspective from A

Malaysian University, vol 50. no. 4. 261-272.

Marimuthu, M., Arokiasany, L., Ismail, M. 2009. Human

Capital Development and Its Impact on Firm

Performance: Evidence from Development Economics,

vol 2/8., 266-272.

Roos, G., Roos, J. 1997. Measuring your company's

intellectual performance. Long Range Planning, 30(3),

413-426.

Soon, H. H., 2010. Human capital Development, ADB

Economics Working Paper Series No. 225, Asian

Development Bank.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

408