The Influence of Profitability, Liquidity and Market Value on Stock

Returns

Research to Mining Companies on Indonesia Stock Exchange from 2012 To 2016

Rosmayanti Rosmayanti, Imas Purnamasari and Heraeni Tanuatmodjo

Prodi Pendidikan Akuntansi, Universitas Pendidikan Indonesia, Bandung, Indonesia

rosmayanti121@gmail.com

Keywords: Profitability, Liquidity, Market Value, Stock Return.

Abstract: This research purpose to prove the influence profitability, liquidity and market value to towards the stock

return at mining companies listed on Indonesia Stock Exchange. This study consists of independent

variables and dependent variables. The independent variables in this research are profitability, liquidity and

market value, while the dependent variable in this research is stock return. The profitability variable is

measured by Return on Assets (ROA), the liquidity variable measured by the Current Ratio (CR), the

variable of market value measured by Price to Book Value (PBV) and Stock Return variable is measured

with capital gain. This research design used quantitative research with descriptive study with verification

method. The population in this research is mining companies listed on the Indonesia Stock Exchange (BEI)

of 36 companies. The technique for collecting samples is based on purposive sampling to get 10 companies.

Statistical analysis used in this research is multiple linear regression analysis with regression significance

test (Test F) and significance test of regression coefficient (t test). F test results show that the regression

model can be used to make conclusions that illustrate profitability, liquidity and market value to stock

returns. The result of t test statistic shows that profitability and liquidity have no effect on stock return,

while market value have positive effect to stock return.

1 INTRODUCTION

The main objective of investors to invest their funds

in the capital market is to obtain a reward or return.

Return by Margaretha (2011: 62) is "expected gains

from investments." High return of stock will give a

positive signal for market related to the level of

profits earned from investing, the higher the stock

return, the higher the demand of investors to the

stock, but conversely the lower stock returns for

investors, the demand will drop.

The mining sector is a driving sector of economy

in Indonesia. Quoted from Indonesia investmen.com

(2015), In 2008 the global financial crisis that

caused commodity prices to decline so quickly. The

financial crisis impacted the mining sector for

commodity exports contribute more than 50% of

Indonesia's total exports. In the 2nd half of 2009

until early 2011 coal prices rebounded sharply. The

decline in global economic activity has reduced

demand for coal, thus causing a decrease in coal

prices since the beginning of 2011. It gives affect

stock prices in the mining sector, which indirectly

affect stock returns received by investors. Stock

returns that are strongly influenced by the existence

of the phenomenon is the value of capital gains.

Stock returns in the form of capital gains in mining

companies listed on the Stock Exchange from 2012

to 2015 is described in Table 1.

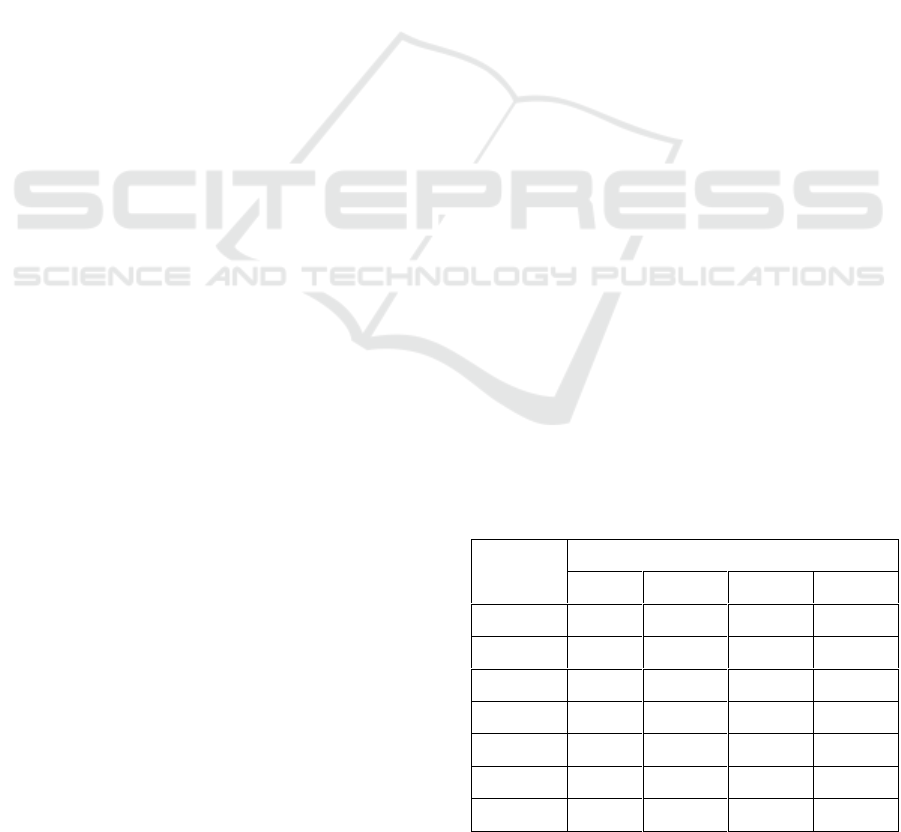

Table 1: Stock return in mining company from 2012 to

2015.

Code

Stock Return

2012

2013

2014

2015

ADRO

-0.10

-0,31

-0.05

-0.50

ARII

-0.01

-0.44

-0.47

-0.11

ATPK

-0.22

1.09

-0.23

-0.07

BORN

-0.35

-0.68

-0.71

0,00

BRAU

-0.53

-0.05

-0.66

0.30

EARTH

-0.73

-0.49

-0.73

-0.38

BYAN

-0.53

0.01

-0.22

0.18

Rosmayanti, R., Purnamasari, I. and Tanuatmodjo, H.

The Influence of Profitability, Liquidity and Market Value on Stock Returns - Research to Mining Companies on Indonesia Stock Exchange from 2012 To 2016.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 415-420

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

415

Code

Stock Return

2012

2013

2014

2015

GOD

-0.36

0,00

0,00

0,00

DOID

-0.77

-0.40

1.10

-0.72

GEMS

-0.13

-0.08

-0.08

-0.30

Source: Indonesia Stock Exchange (2017) (Data

processing)

From table 1 obtained information that a lot of

issuers who are in the mining sector had a negative

return. Negative returns are called with capital loss.

Capital loss occurs if the stock price this year is

lower than last year's, which the capital loss be an

indication of poor performance of the company. The

emergence of a capital loss will result in reduced

investor confidence to invest and make it possible

for investors to shift investments in other listed

companies are considered more profitable. Lack of

interest of investors to invest in mining companies

will decrease the amount of funds obtained from the

mining sector, capital market, it will disruption to

the company's operations and the worst effects of

company bankruptcies.

Based on the presentation, it is necessary to

study the factors of stock returns. By knowing the

factors of stock returns, the company can prevent

low stock returns. Resmi (2002: 280) stated that

“there is one important factor that affects investors

in investing namely financial performance." The

financial performance can be measured by financial

ratios.

Previous research on the effect of financial

performance on stock return is research conducted

by Parvati and Sudiartha (2016) in manufacturing

company shows that profitability ratio, liquidity

ratio, and market value ratio have positive and

significant influence to stock return while leverage

ratio has significant negative effect to return while

research conducted by Raningsih and Son (2015) on

food and beverage companies shows that

profitability and leverage ratios have a positive

effect on stock returns, liquidity ratios have a

negative effect on stock returns, while the ratio of

activity and firm size has no effect on stock return.

Another study conducted by Akbar (2015) shows

that Price Earnings Ratio (PER) and Debt to Equity

Ratio (DER) have a negative effect on stock return,

while Price Book Value (PBV) has a positive effect

on stock return.

In this study researchers will focus the research

on financial ratios. This is based on previous

research where financial ratios have different effects

on stock returns, thus motivating researchers to

compare this research with previous research on

different objects and years. In addition, financial

ratios are a tool used in fundamental analysis

techniques, where fundamental analysis is much

taken into consideration by investors to invest in

companies that fall into the blue-chip category, this

is in line with the object of research used by

researchers namely the mining sector. This study

was conducted to determine how the influence of

profitability, liquidity and market value to stock

return.

2 LITERATURE REVIEW

2.1 Signalling Theory

Everything is done by the company containing the

information. Information is an important element for

investors and businessmen because the information

will provide an overview of companies in the past

and in the future. It is in line with the signaling

theory or the theory of signaling. According

Jogiyanto (2008: 392) "information published as an

announcement will give a signal to investors in

making investment decisions." The financial report

is one of the signals given by the management to the

owners as a form of accountability.

The signal given company can be a good (good

news) and also be bad (bad news) for external

parties. Announcement of the amount of stock

returns can be considered as a good signal and may

also be considered as a bad signal. Stock Return that

generate capital gains will be received positively by

market and increase investor confidence that the

company has good prospects in the future. While the

stock returns that result capital, loss will be

considered as a bad signal to the market, because the

company is considered to have poor performance

and not a good prospect.

2.2 Stock Return

Stock Return defined as a return value of stock

investment activities. Samson (2006: 291) states that

"stock return is income expressed as a percentage of

the initial capital investment." These advantages can

be either dividend or capital gain (loss). Another

opinion expressed by Margaretha (2011: 62) that

"return is the expected profit from an investment that

can be expressed in the currency or percentage."

Stock Return is divided into two, namely are

realization return and expected return. Return

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

416

expectations is the expected return, while the actual

return is the return that actually happened. In this

study, researchers will use the actual stock returns.

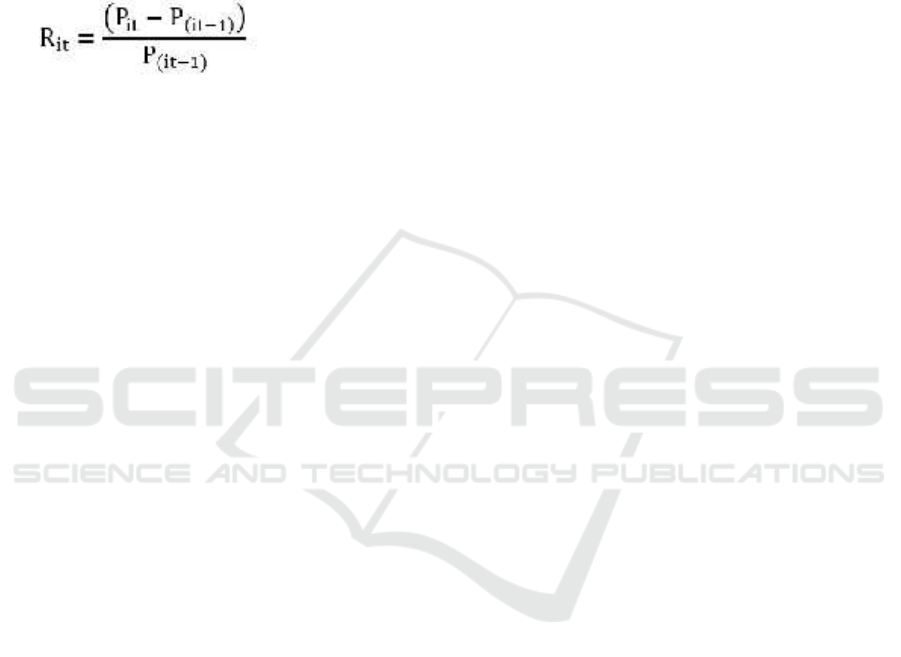

Actual stock returns generated from the difference

stock price current year with the previous year,

divided by the share price of the previous year.

Actual stock returns also used by investors to

determine the expected return in the future. The

amount of actual stock returns or the actual return is

calculated by:

(Ali, 2010: 71)

Information:

Ri: value capital gains i in period t

Pit: The closing price of the stock i in period t

Pit-1: The closing price of the stock i in period t-1

(previous)

Return have a direct relationship with the risk,

the higher the return obtained, the higher the risk to

be borne. Therefore, investors should really consider

the risks in investing activities.

2.3 Profitability

Profitability related to profit or gain. The company's

main purpose is to generate profit formed.

According Harahap (2008: 219) "Profitability is the

company's ability to profit through all available

resources, sales, cash, assets, capital." Gitman

(2009: 61) states "Profitability as a group, reviews

these measures enable the analyst to evaluate the

firm's profits with respect to a given level of sales, a

certain level of assets, or the owner's investments. "It

can be interpreted profitability is a group that is used

to evaluate the company's profit in relation to sales,

the value of assets or investment property.

Companies who have high profitability indicates

the company has a good performance, so as to

enhance the company's future prospects. It thus

reinforced by the statement Hadi (2011: 135) "the

better the profitability ratio, the better illustrate the

ability of the high profitability of companies that

eventually investors will earn a good return."

Furthermore, Ang (1997: 33) states that "the greater

the ROA shows better performance, since the greater

the return value."

2.4 Liquidity

Liquidity is derived from the liquid or illiquid,

which means easy to be liquefied. Definition of

liquidity according Gitman (2009: 54) "Liquidity is

ability to satisfy its short-term obligations."

According Harahap (2008: 219) "Liquidity is the

ability of the company completed all the short-term

needs."

Companies are able to meet short-term

obligations of the company can be said to be illiquid,

and vice versa if the company is unable to meet its

short-term obligations, the company is said to be

illiquid. The company should have good liquidity, as

liquidity will describe the company's ability to

completed short-term obligations. With the expected

high liquidity, the company is also able to provide a

high stock returns. Thus, the opinion in accordance

with the statement of Murhadi (2013:34) on the

effect of liquidity on stock returns are "assets with

high liquidity will provide the expected return is also

high."

2.5 Market value

The market value by Azis (2015: 85) is "stock prices

in the stock market at a time determined by the

demand and supply of the stock price of market

participants." According Sudana (2011: 24) "the

ratio of market value is the performance appraisal

shares of companies that have been traded in the

capital market." Myers (2003: 286) states" the

market value is the amount that investors are willing

to pay for the shares of the firm. "

The market value describes the achievements of

companies in the capital market. Good company is a

company that has shares at a high price. It is an

attraction for investors to invest because investors

assume if shares purchased today will increase the

price in the future, so that investors will have benefit

from the difference between the purchase price

shares at the current price the stock sold. According

Tandelilin (2010: 51) "if the securities to increase

the price, then the investor will get additional profit

from the difference in prices that occurred." From

the above it can be concluded that the market value

will have an effect on stock returns. This is because

the stock return is the difference between the current

share price sold and stock price when purchased.

The higher the stock price will lead to higher margin

thus obtained stock returns greater.

3 METHODOLOGIES

The research design used descriptive and

verification. Descriptive method used in this study to

describe of profitability, liquidity, market value and

The Influence of Profitability, Liquidity and Market Value on Stock Returns - Research to Mining Companies on Indonesia Stock Exchange

from 2012 To 2016

417

stock returns in mining companies listed on the

Stock Exchange in 2012-2016. While the

verification method used in this study to test the

effect profitability, liquidity and market value of the

stock return in mining companies listed on the Stock

Exchange in 2012-2016.

The independent variable of this research is

profitability, liquidity and market value. The

dependent variable used is return stock. The

population in this study is the mining sector

companies listed on the Indonesia Stock Exchange

amounted 36 company. Sampling technique used in

this research is purposive sampling with certain

criteria and obtained a sample of 10 the company for

five years from 2012-2016 so that the observation

data in this research were 50 data.

4 RESULT AND DISCUSSION

4.1 The Influence Profitability on Stock

Return in Mining Company Listed

in Indonesia Stock Exchange from

2012 to 2016

ROA is the ratio between profit after tax of the

company with total assets of the company at a

certain period. ROA level is said to be healthy if

they are above 9%. However, ROA conditions in

mining companies listed on the Indonesia Stock

Exchange in 2012 until 2016 can be said to be

unhealthy, because many companies have value

ROA below 9%. The results of multiple linear

regression obtained regression coefficient

profitability have value -0.009872. This suggests

that no effect profitability on stock returns. ROA

coefficient value -0.009872 means that any increase

in the profitability of one per cent, it will be

followed by decrease in stock returns amounted to

0.009872.

However, after the regression coefficient

significance test (t test), the t value of profitability is

-0.573128 with probability equal to 0.5700. Because

the value of t arithmetic ≤ t table, then profitability

has no effect on stock returns in mining companies

listed on the Indonesia Stock Exchange in 2012-

2016. It is known that significant value is greater

than the expected significant level, so it is not

significant because 57.00% over the expected

provision of 5%. This suggests that the increase or

decrease in profitability does not affect on stock

returns.

Rejection of this hypothesis can be seen because

many companies are experiencing unhealthy

profitability during the period 2012 to 2016. It is

said is not healthy because the average value of

ROA mining company during 2012 through 2016

were below the limit of minimum standards that

have been established which is 9%. Companies that

suffered losses would cause the company ROA

value is negative, this is because the value of ROA is

calculated by comparing the profit after tax to total

assets in the company.

The research data also shows the movement of

the ROA value is inversely proportional to the

movement of the stock return, the higher average

value of ROA, the average stock return is lower.

Based on the results of data processing discovered

that the average ROA in 2012 amounted to 7.61

while the average stock return in 2012 amounted to -

0.29, so even in 2013 when the average ROA

declined to 1.99, the mean average stock returns

increased to 0.05. ROA company will give a

negative signal to the market, which will be received

by investors. Negative ROA is an indication that the

company has a bad prospect in the future, so that it

will be accepted as bad information or bad news by

investors.

The results of this study are not consistent with

the theory of reference stated by Hadi (2011) which

states that the better the profitability ratio, the better

illustrate the ability of the high profitability of

companies that eventually investors will earn a good

return. Furthermore, Ang (1997) also argues that the

greater the ROA shows better performance, since the

greater the return value.

4.2 The Influence of Liquidity on Stock

Return in Mining Company Listed

in Indonesia Stock Exchange from

2012 to 2016

Based on research data that has been processed can

be seen that the value of the Current Ratio mining

company located in unsanitary conditions, this is

because the current ratio minimum value the

company is 2. The result of multiple linear

regression testing regression coefficient values

obtained -0.141415, this have meaning any increase

in liquidity by one percent, it will be followed by a

decrease in stock returns 0.141415. However, after

the regression coefficient significance test (t test),

obtained t value liquidity variables is -0.269642 with

probability 0.7889. Because the value of t arithmetic

≤ t table, then liquidity has no effect on stock

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

418

returns. Its mean that increase or decrease of

liquidity level has no effect on the increase or

decrease in stock returns. Liquidity significance

value is greater than the expected significant level,

meaning there is significant due to mistakes by

78.89% over the expected conditions.

Rejection of this hypothesis can be seen from the

variable conditions of liquidity and stock returns in

2012-2016. The average of liquidity mining

companies in 2012 amounted to 2.28 while the

average stock return of -0.29. In 2013 the average

liquidity decreased to 1.96 while stock returns

increased to 0.05. So even in 2014 and 2015, the

movement of liquidity is not in line with the

movement of the stock return. In addition, the

rejection of the hypothesis due to the company's

liquidity level information is not taken into

consideration by investors in investing.

The results of this study are not consistent with

the theory of reference which states that assets with

high liquidity will provide a high expected return. In

addition, Rahardjo (2006) also states that the criteria

for companies that have a strong financial position is

able to meet the obligations to outside parties in a

timely manner. The higher a company's ability to

meet its obligations, then the company can be said to

be strong in financial position and increase the

confidence of investors to invest.

4.3 The Influence of Market Value on

Stock Return in Mining Companies

Listed in Indonesia Stock Exchange

from 2012 to 2016

The market value is ability investors to pay per one

share. The market value is the description of the

company's achievements in the capital market. The

market value in this study were measured with a

Price to Book Value (PBV). PBV is the ratio

calculated comparing between the market price of

shares and book value. The increase in the stock

price will be made either by the investor

information, so it can increase the demand of

investment. This indicates that the market value will

have positive influence on stock returns.

The test results of multiple linear regression

obtained regression coefficient value of the market

value is 0.900131. 0.900131 coefficient value means

that the market value has increased one, then stock

returns will increase by 0.900131, and vice versa if

the market value has decreased once the stock

returns will also be decreased by 0.900131. After

testing the significance of regression coefficients (t

test), the value of t arithmetic market value is

5.831465 with probability equal to 0.0000. Because

the value of t count> t table, then the market value

positive effect on stock returns. Significance value

less than the market value of the expected significant

level, so that means significant because mistakes

zero percent under the provisions of 5%.

The results of this study indicate that the market

value of a positive effect on returns, meaning each

an increasing rate of the stock market stock returns

received by investors are increasingly rising. The

positive influence shows that the market value has a

direct relationship with stock returns. On average

PBV for four years from 2012 to 2015 decline.

However, the average PBV values can still be said to

be good, it is because the average value of PBV

shows the value of more than 1. During the years

2012 to 2016, the average PBV highest value

achieved in 2016 with an average value of 1.97

PBV.

This study is in line with the theory of reference

stated by Brigham and Houston (2010) which states

that the company viewed favorably by investors is

sold with a high MBV. The higher MBV, the higher

the investors' assessment of the company. Ang

(1997) also argues that the higher the value, the

higher PBV company was appraised by investors

compared to the funds invested in the company.

Additionally, Tandelilin (2010) also revealed a

similar security that if the price increases, then the

investor will receive additional profit from the

difference in prices that occurred.

5 CONCULUSION

The conclusions in this research are the profitability

in the mining company listed on the Indonesia Stock

Exchange in 2012-2016 are in the unhealthy

conditions. Liquidity in mining companies listed on

the Indonesia Stock Exchange in 2012-2016 are in a

healthy condition. The market value of mining

companies listed on the Indonesia Stock Exchange

in 2012-2016 are in a healthy condition.

Stock Return in mining companies listed on the

Indonesia Stock Exchange in 2012-2016 are in a

pretty healthy state. Profitability has no effect on the

Stock Return in Mining Company listed on the

Indonesia Stock Exchange in 2012-2016. Liquidity

has no effect on the Stock Return in Mining

Company listed on the Indonesia Stock Exchange in

2012-2016. The market value has positive influence

on Stock Return in Mining Company listed on the

Indonesia Stock Exchange in 2012-2016.

The Influence of Profitability, Liquidity and Market Value on Stock Returns - Research to Mining Companies on Indonesia Stock Exchange

from 2012 To 2016

419

REFERENCES

Ali, A. R., 2010. Financial management, Partners Media

Discourse. Jakarta.

Akbar, R., 2015. Effect of Price Earnings Ratio (PER),

Price Book Value (PBV) and Debt to Equity Ratio

(DER) of the Stock Return. JESTT Vol. 2 No. 9, 698-

713.

Ang, R., 1997. Book Smart Indonesian Capital Market,

Media Staff. Jakarta.

Aziz, M., 2015. Investment Management Fundamental,

Technical, Investor Behavior and Stock Return,

Deepublish. Yogyakarta.

Brigham, B., Houston, H., 2010. Basics of Financial

Management, Four Salemba. Jakarta.

Gitman, L. J., 2009. Principles of Managerial Finance,

Pearson. Boston.

Hadi, I. F., 2009. Portfolio Theory and Investment

Analysis, Alfabeta. Bandung.

Harahap, S. S., 2008. Critical Analysis of Financial

Statements, PT Raja Grafindo Persada. Jakarta.

Indonesia Stock Exchange, 2017. Financial Statements

and Annual [online]. http://www.idx.co.id [2

November 2016].

Indonesia Investments, 2015. Coal [online].

http://www.indonesia-investments.com/

id/bisnis/komoditas/batu-bara/item236 [25 March

2017]

Jogiyanto, J., 2008. Portfolio Theory and Investment

Analysis, Yogyakarta BPFE. Yogyakarta.

Margaretha, F., 2011. Financial Management for Non-

Financial Managers, Erland. Jakarta.

Murhadi, W. R., 2013. Effect of Idiosyncratic Risk and

Liquidity Shares on the Stock Return. ISSN 1411-

1438 JMK, VOL.15, NO.1, MARCH 2013, 34.

Myers, B., 2003. Principles of Corporate Finance, Mc

Graw-Hill Companies.

Parvati, R. A., Sudiartha, G. M., 2016. Influence

Profitability, Leverage, Liquidity and Market Rate of

Return Shares Manufacturing Company. E-Journal of

Management Udayana University, Vol. 5, No.1 ISSN:

2302-8912, 385-413.

Rahardjo, S., 2006. Tips to Build Wealth Assets, PT Elex

Media Komputindo. Jakarta.

Raningsih, N. K., Son, I. M., 2015. Effect of Financial

Ratios and Company Size in Stock Return. E-Journal

of Accounting, University of Udayana Vol.13. No.2

ISSN: 2302-8556, 582-598.

Resmi, S., 2002. Keterkaitan Kinerja Perusahaan dengan

Return Saham, Jurnal Akuntansi Manajemen dan

Sistem Akuntansi (6) pp 280.

Samson, M., 2006. Capital Markets and Portfolio

Management, Erland. Jakarta.

Sudana, I. M., 2011. Corporate Financial Management

Theory and Practice, Erland. Jakarta.

Tandelilin, E., 2010. Portfolio and Investment Theory and

Applications, Canisius. Yogyakarta.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

420