Creditric Calculation Model in Micro Financing IB on the

Agricultural Sector in PT. BRI Shariah

Cudio Slamet Rajiansah, Eeng Ahman and Neni Sri Wulandari

Economics and Islamic Finance Department, Universitas Pendidikan Indonesia,

Jl. Dr. Setiabudhi No. 229, Bandung Indonesia

cudio.selamet.rajiansah@student.upi.edu, eengahman@yahoo.co.id, neni.wulandari@upi.edu

Keywords: Risk Analysis, Islamic Financing, Agricultural Sector.

Abstract: Micro-enterprises, especially the agricultural sector is one of the centers of attention in the development and

economy of Indonesia. One of the main problems in the agricultural sector is financing. Attention to the

agricultural sector businesses are considered less, than that the agricultural sector has a fairly high risk. The

purpose of this study was to analyze assessment with the principle of 5C, the risk of Islamic finance agriculture

and calculating potential losses in the agricultural sector of Islamic finance BRI Syariah UMS KK Outlet

Lembang. Bank BRI Syariah Lembang UMS KK Outlet is one of sharia institutions that provide microfinance

iB allocation to the agricultural sector. This study uses primary data and secondary data. This study was

conducted by quantitative descriptive method. Data analysis techniques to analyze the risks of Islamic finance

is done by using stages Enterprise Risk Management (ERM) and methods creditrisk +. The results showed

that BRI Syariah KK Lembang focus on 3C (character, capacity, and colleteral) and sharia. There are 31

events in the risk of Islamic micro financing in the agricultural sector. One incident contained in the

unacceptable level, this level is conducted and immediate action is needed to manage the risks, there is one

event that a customer fails to pay. This can happen because the business went bankrupt, failing to harvest the

influence of climate/weather, pests and fluktuaktif market price. Potential losses in the agricultural sector

microfinance bank BRI Syariah KK Lembang in estimates is high at 91.92%. Risk mitigation measures that

can be done is restructurin, disbursement of voluntary customer guarantee or together.

1 INTRODUCTION

Financing make a donation large enough in

channeling the funds given by the Islamic bank, one

of the financial institutions are aiming for

segmentation of micro enterprises especially the

agricultural sector, namely Bank Rakyat Indonesia

Sharia (BRIS). With one of his cash office is located

in Lembang Bank BRI Syariah KK Lembang.

The agricultural sector in the area of the Valley is

one of the Bank's target market segmentation BRI

Syariah KK Lembang given that the result of

agricultural trade in the Valley it sustains a wide

range of basic necessities in Bandung. But behind it

was the agricultural sector experienced a decrease in

Lembang price in the market, the weather also has a

very strong influence resulting in reduced crop yields

by 50% to 70%. (Suryana et al., 2016).

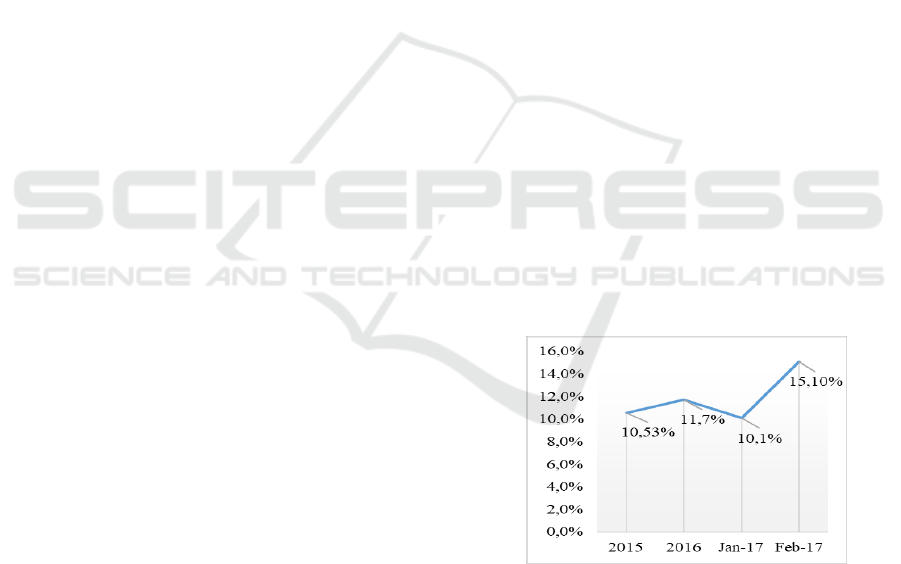

Figure 1: Nonperforming Finance BRI Syariah Outlet

Lembang.

Source: Bank BRISyariah UMS Outlet KK Lembang

(2017).

In figure 1, Non Performing financing (NPF) BRI

Syariah KK Lembang in 2015 to 2017 in February

have elevated her above NPF fairly high average level

of bank health, even to exceed the provisions of 5%

BI, one of which is present on the granting the

financing of the agricultural sector, bank BRI Syariah

446

Rajiansah, C., Ahman, E. and Wulandari, N.

Creditric Calculation Model in Micro Financing IB on the Agricultural Sector in PT. BRI Shariah.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 446-451

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

KK Lembang surely must be balanced with the risk

management, this position on reputation management

company in the League if it is able to control risk are

good then the reputation will go up, if not able to

control vice versa BRI Syariah KK Lembang his

reputation will plummet.

The need for a series of procedures and

management of financing feasibility risk facing

financial institutions including Islamic banks,

according to the research of Safitri and Hendry

(2015), more emphasis on the principle of prudence,

quickness, convenience and safety for Parties to the

customer or the bank. But according to Rahma Yudi

Astuti (2016) implementation of prudence here, that

the procedure for channelling financing and credits do

not based on raw or SOP guidelines alone but must

respond to the internal integrity of dabbling on the

process of channeling financing.

However, if seen from the distribution of

financing on the agricultural sector, according to

Rindi (2016) with focus on given micro financing on

the agricultural sector cut flowers in a bank BRI

Syariah Setiabudhi Bandung that the bank less

meticulous in analyzing the agricultural aspect of the

5 c of the customer, as well as his less monitoring and

follow up, against the customer who has provided the

financing so that the NPF bank increases can be said

that risk management in a bank BRI Syariah Bandung

Setiabudhi felt less. Lack of access to economic

resources, particularly funding for the agricultural

sector and the SMES in the country Nigeria and

hinder economic growth and development (Olaitan,

2006)

Based on the results of earlier research and the

problem then a writer interested in researching

microfinance risk management agriculture research

with the title of "Model of computation of Credit risk

+ in Micro financing iB On the agricultural sector at

PT. BRI Syariah UMS KK Outlet Valley". The

benefits of research conducted in particular bank BRI

Syariah is to optimize the Islamic financing in the

agricultural sector and can formulate a risk

management strategy in order to maintain

competitive edge excellent service bank BRI Syariah

and developing new innovations in the future.

2 LITERATURE REVIEW

According to of the Microcredit microfinance is a

program of giving small loans to poor people for self-

employment or business projects they run that

generate profit by allowing can guarantee the life of

the self himself and his family. Financing or financing

is the awarding of kucuran funding provided by one

party to the other party to support investment that has

meant well done by the party itself or an institution

(Muhammad, 2005). Characteristics of micro-finance

or microfinance, according to Abdul Rahim

(Rahman, 2010) among other lending on a small scale

to small entrepreneurs and small-scale lending apply

also to the poor.

Microfinance is designed to help the poor and

microfinance service providers are always related to

the granting of funds for a very poor community, the

microfinance scheme had operations since the year

1960-70s but already since a long time usage for

conventional microfinance is always involved,

whereas the majority of the poor who have low

incomes and the majority of Islam would still choose

access in islamic microfinance (Wilson, 2007).

Banking risk management as in the regulation of

Bank Indonesia No. 11/25/PBI/2010 on the

application of risk management for commercial banks

is a series of methodologies and procedures used to

identify, measure, monitor problem circumstances,

and manage risks arising from all activities or the

activities of a project business bank (Farida and

goddess, 2016). Enterprise risk management is a

system of management of risks faced by the

Organization in a comprehensive manner with the end

goal of increasing the value of the company (Laluma,

2011).

In addition, the granting of financing by type of

activity is financing institutions infuse funds that

often become the main cause of the financing

institutions face big problems (Siswanto, 1997). A

risk is an event or an event that in case of can impede

the achievement of the goals or objectives of a

company Division (Hery, 2015). Necessity of risk

management risk management is conducted, is a field

of study that exposes about how an organization

apply a measure in mapping the existing problems

with a variety of management approaches in a

comprehensive manner and systematic (Fahmi,

2015).

If humans are able to predict future events as this

is contrary to the provisions of the word Allah in

terms of Commerce was only Allah can predict profit

or loss and the man only as sought in the management

of risk in order to more was and alert in the

management of his business (Rivai and Ismal, 2013).

The word of God Surat Al Baqarah ayat Al-Baqara

verse 280 and 283:

“And if (the person who owes it) in the lurch, then

give respite until he widened"

Creditric Calculation Model in Micro Financing IB on the Agricultural Sector in PT. BRI Shariah

447

One of the tools of risk management is the

analysis of Enterprise Risk Management (ERM), is

defined as a process to manage risks of the company

as a whole to reach different types of risk, and lines

of business ((IBI) Ikatan Bankir Indonesia, 2015).

According to the COSO (2004) that the company

must apply the 8 stages of important components that

are interdependent and relate in risk management is

the internal Environment (Internal Environment),

goal Setting (Objective Setting), the identification of

event (Event Identification), the task is at risk (Risk

Assessment), response (risk Response), the activity

control (Control Activities, information and

communication (Information & Communication) and

monitoring (Monitoring). One of the analytical tools

to measure failure risk is Credit risk + model it for

analysis failure of risk which must be faced at a time

when the debtor was in a State of not being able to

pay his debts (CSFB, 1997). This is applied to

calculate the credit risk, where the distribution of

losses from the credit portfolio is reflected by the

frequency from the default (the frequency of event)

and the value of loans defaulted (severity of loss)

(CSFB, 1997).

3 METHODOLOGY

In accordance with the original purpose of this

research is to analyze the risk management over the

potential risk of micro financing iB on the agricultural

sector in the bank BRI Syariah KK Lembang. Objects

in this research was conducted at Bank Rakyat

Indonesia (BRIS) Sharia cash office. Based on the

objectives to be achieved, then the research is

descriptive research using quantitative directed. Data

sources used for this research in the form of primary

data and secondary data.

In this study the method of purposive sampling

will be imposed on the practitioner's role as informant

BRI Syariah KK Lembang. Upon consideration of the

chosen that respondents selected customer/trade in

the agricultural sector.

Data analysis techniques used in this research is a

descriptive analysis, i.e. the method of ERM with the

research phase are used in analyzing financing risk

management within the agricultural sector in BRI

Syariah KK Lembang consists of 8 components

Enterprise Risk Management (ERM) and to measure

the potential harm micro financing iB credit risk + is

calculated by the method of aiming to measure the

failure of risk which must be faced at a time when the

debtor was in a State of not being able to pay his

debts.

4 RESULTS AND DISCUSSION

The identification of the risks already mentioned

earlier then calculated or assessed with measurements

being an indicator of the size of the risk. The

possibility of risk or probability of risk impact risk

and then converted into the form of a score based on

the indicators on the impact of the risk, this will result

in a score of risk which further grouped in accordance

with the category level risk, and risk mapping done

by classifying into 4 levels of risk which comprises

unacceptable levels, issue, supplementary issue, and

acceptable (Hery, 2015).

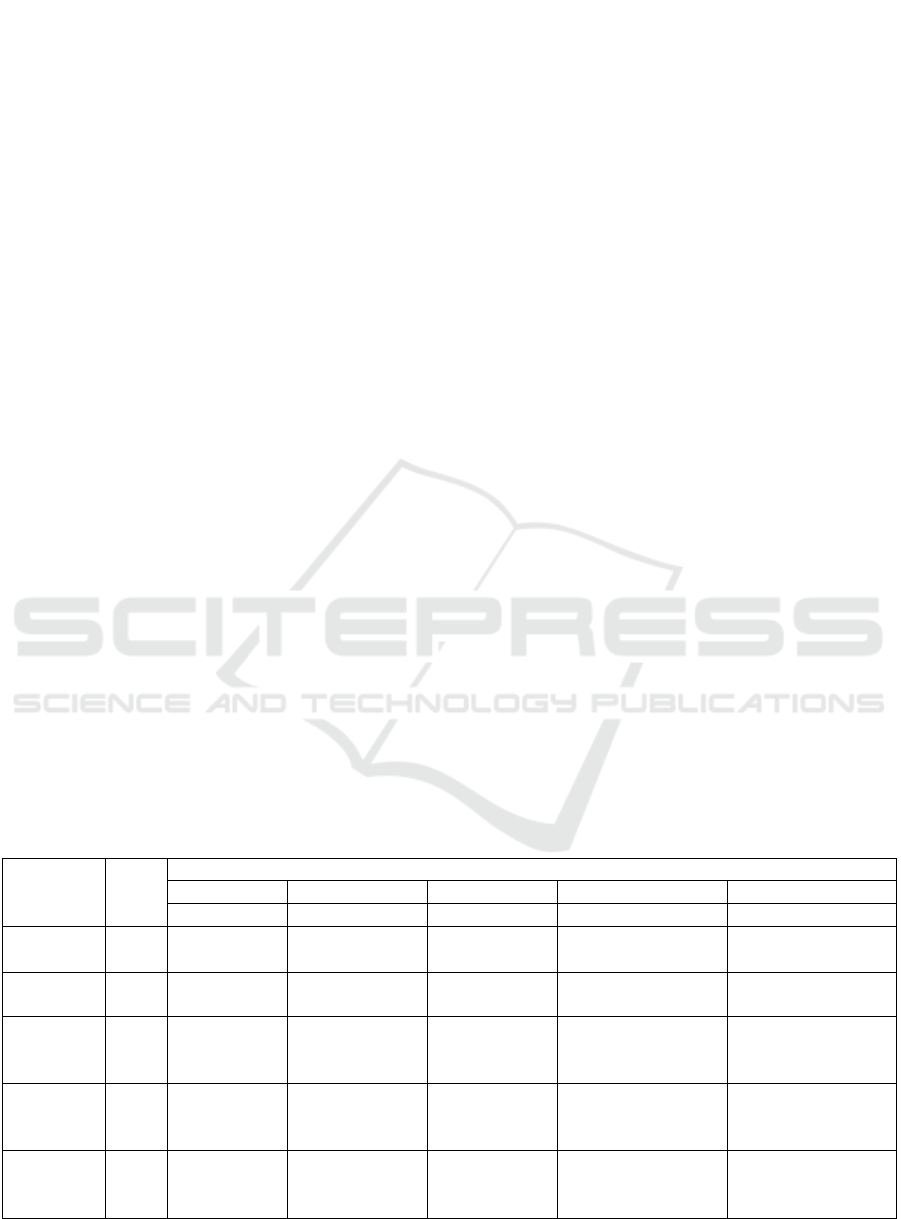

Table 1: Risk mapping.

Risk

Probability

Index

Risk Effect

Catastrophic

Significant

Moderate

Minor

Insignificant

5a

4a

3a

2a

1a

Catastrophic

5a

25

Unacceptable

20

Unacceptable

15

Unacceptable

10

Supplementary Issue

5

Supplementary Issue

Significant

4a

20

Unacceptable

16

Unacceptable (14)

12

Issue

8 Supplementary Issue

(3,8,12,16)a

4

Acceptable

Moderate

3a

15

Unacceptable

12

Issue

(13)a

9

Issue

(11,15,29)a

6

Supplementary Issue

(9,20,24,26,28)a

3

Acceptable

(17,21)

Minor

2a

10

Issue

8

Supplementary

Issue

6

Supplementary

Issue

4

Acceptable

2

Acceptable

Insignificant

1a

5

Issue

(1,4,7,22)

4

Acceptable

(6,10,19,23,27)a

3

Acceptable

(2,18,25,31)a

2

Acceptable

1

Acceptable

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

448

Table 1 is risk mapping, unacceptable levels of

depth, this level is done immediately and action

needed to manage risk, if the risk of this happening

obviously will have an impact is very detrimental to

the bank. Unacceptable levels of classification i.e. the

customer experience the default (the default) to the

bank or financing problem. Previous research

revealed that the respondent agriculture requires

funds for agricultural businesses although must face

various risks (Azis and Yusoff, 2014).

Of the 18 total financing the troubled debtors who

are in collected 2-5 i.e. Rp. 1,967,302,427. Then a

group of debtors agriculture bank BRI Syariah KK

Lembang grouped based on the assumption of

likelihood of default (probability of default), the next

step of determining the value of the value of the

recovery rate and the real loss, the real value of stop

loss value between zero (lowest) means there is no

loss at all, if exceeding the number one (highest)

means that the company facing a loss in the amount

of 100% RR and Riil Lost can see in table 2.

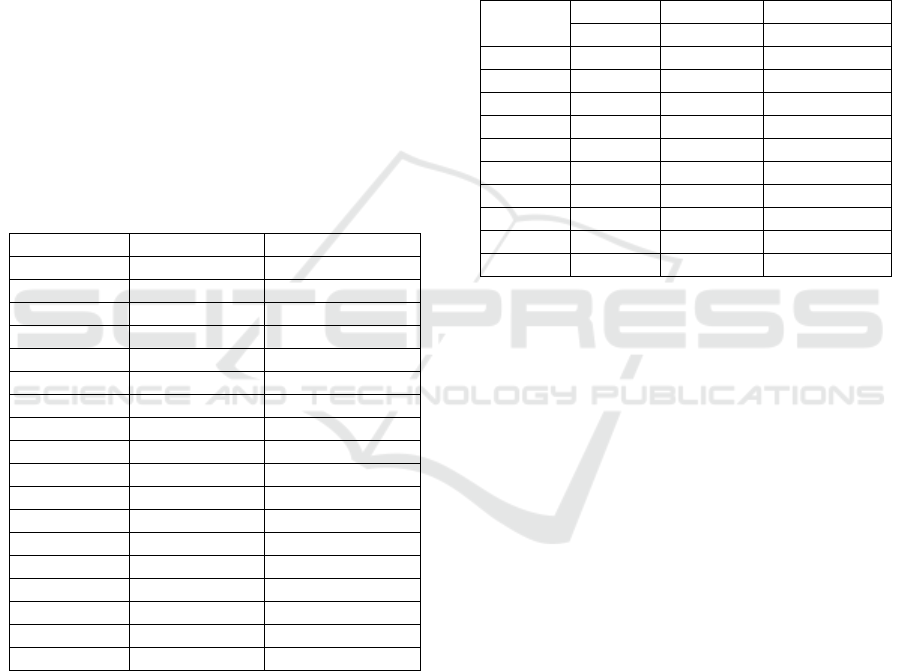

Table 2: RR and Riil Lost.

Costumer

RR

Riil Loss

A

0,38

0,62

B

0,14

0,86

C

0,21

0,79

D

0,90

0,10

E

0,51

0,49

F

0,31

0,69

G

0,64

0,36

H

0,39

0,61

I

0,16

0,84

J

0,38

0,62

K

0,92

0,08

L

0,51

0,49

M

0,69

0,31

N

0,52

0,48

O

0,67

0,33

P

0,29

0,71

Q

0,91

0,09

R

0,31

0,69

Source: Micro Finance IB Data, Processed

After determining the value of RR and the real

Loss, and then calculate the expected loss and

expected loss individually. After the calculations are

then retrieved a total of value of expected loss

amounting to Rp 675,477,523 appeal, thus, total

losses should be covered by the provision of company

bank BRI Syariah KK Lembang is amounting to Rp

675,477,523. After the results of the expected loss.

Then it can be resumed by calculating the expected

loss in each individual each classroom appeal that

appointed, divided so 10 classes in a group exposure

to 1 million, 10 million and 100 million.

The next step of determining the number of the

customer, the determination of the amount of the

debtor's gridlocked in the method of computation of

credit risk + use statistical analysis using the poisson

distribution. Authors using microsoft excel in a

calculation. Then retrieved the number of debtors

who could jam with 96% confidence level as follows

table 3:

Table 3: Determination of n-poisson distribution with the

default.

Class

1 Million

10 Million

100 Million

Poisson

Poisson

Poisson

1

0,830178

0,883795

0,71003

2

-

0,930397

-

3

0,735758

0,695369

-

4

-

-

-

5

-

0,930397

-

6

-

0,928661

-

7

0,761488

0,914098

-

8

-

0,739437

-

9

0,926907

-

-

10

-

-

-

Source: Research Result (2017)

The next step is the calculation of Unexpected

Loss (UL) loss due to non-payment borrowers who

should be controlled while not expected before. It

became the image of the magnitude of the potential

losses that will be faced by bank BRI Syariah KK

Lembang, the value of the loss that was not expected

and should be controlled normally total value of

unexpected loss bigger than expected loss.

The result of the calculation of the unexpected

loss showed the potential losses to the agricultural

sector amounted to RP. 731,280,608. The values

emerge from every 1 person debtor who could jam

from-1 million, 10 million, and 100 million. The

potential losses are more dominant in the appeals of

10 million with a value of Rp. 604.310.641. Last step

i.e. calculating economic capital calculation based on

obtained values economic capital, amounting to Rp.

55,803,085. So the capital should be provided due to

the unexpected loss is loss of Rp. 55,803,085.

As the event risk has been explained earlier that

the bank BRI Syariah events the most prominent risk

i.e. the customer hangs/default where the customer is

not able to reimburse the installment to the bank, then

the Act of monitoring/ monitoring for the troubled

financing is absolutely necessary. Abdullah (2013)

are trying to see the granting of financing on the

agricultural sector with comparison with

Creditric Calculation Model in Micro Financing IB on the Agricultural Sector in PT. BRI Shariah

449

manufacturing, construction and real estate in

Malaysia, it turns out the research stated that there is

a correlation and levels of his output is significantly

higher, in this study turns out to reap the results of

that research results have a positive impact towards

economic growth in Malaysia.

Significant relationship between the agricultural

sector and Islamic banking that provides ease of

different types of capital for farmers which means

improving the livelihood of the farmers, but farmers

face financing problematic in usability to the banking

Sharia (Hassan, 2012). The positive role of financial

institutions and provide solutions to access financing

on farmers so as to promote agriculture in Malaysia

(Mohd et al., 2015).

There is research done by Rashid (2013) the

results of his research mentioned that in Pakistan the

agricultural sector is still minimal funding and

climate also influence against the sustainability of the

agricultural business. This is a picture in the

agricultural sector to obtain running funding, whereas

if it is seen that the agricultural sector is quite large

participation in donations of food for humans.

Based on the research result Santeramo et al.

(2014) that the lack of massive intervention against

the agricultural sector to provide assistance in the

form of subsidies or funding his results the

agricultural sector at risk as heavy as productive

potential, vulnerability and food insecurity. That is on

offer in risk insurance contract here should be on the

increase.

The results of this study refers to the value of the

regression showed a significant positive relationship

but not between the company and the value of ERM.

These findings do not support the assumption that

increasing the value of ERM company, also showed

a significant negative relationship between the value

of the company, its size and profitability. (Tahir,

2011)

First, if the troubled financing the bank dug

deeply starting from character or Action monitoring

its efforts to providing supervision and coaching to

customers who default. Secondly, if business

borrowers into bankruptcy, damage caused by nature

and other external factors then it is done restructure.

The Act of monitoring i.e. monitoring, review

location customer efforts to see his efforts with the

purpose of knowing the level of health of his efforts,

then another to bank out fash or take over other to

bank.

If viewed from the pasca finding and the

disbursement of financing actions monitoring is done

by analyzing in an orderly start from character or

characters the customer effort, evaluation of

customer's financial reports on a regular basis, action

monitoring also can be done by plunging directly into

the customer's business location such as with

hospitality.

5 CONCLUSIONS

Based on the results of the study conducted by the

researchers, can be drawn the conclusion that the

results of the judging aspect 5 c (character, capacity,

capital, condition, coletteral) + Sharia, that BRI

Syariah KK Lembang focus more on 3 c (character,

capacity, colleteral) + Sharia. Furthermore, the results

of the identification of risk financing and operational

risks related to the agricultural sector in the bank BRI

Syariah KK lembang, either directly or indirectly

generate a risk event that consists of 31 16 event risk

13 financing of operational risk events, and 2 external

risk events.

Results for mapping and measuring the risks

associated with the agricultural sector with an

unacceptable level of risk events with 1 as the

customer experience a default to the bank because his

business into bankruptcy. After the results of the

calculation of the potential loss of Sharia financing

micro iB for the agricultural sector in the bank BRI

Syariah KK Lembang being estimated at RP.

731,280,608 this relatively high potential 91.92% if

compared with the total of his tray of Rp. 795.537.654

And further risk mitigation action that results in a set

of bank BRI Syariah KK Lembang, one of the major

risks in financing micro-iB is the financing

problematic/jammed. So the risk mitigation actions

that can be performed by bank BRI Syariah KK

Lembang IE restructure, customers guarantee

disbursement on a voluntary basis or together. Risk

mitigation actions can be done with monitoring at

regular intervals. This contribution deals with the

implications of the development of the theory in

economics, specifically on the measurement of the

probability of the risk with Enterprise Risk

Management (ERM) and measuring potential losses

with Creditrisk +.

REFERENCES

Abdullah, H., 2013. Financing in Islamic Banking Scheme:

Performance and Effect on Malaysian Output. Research

Journal of Finance and Accounting. 113-121 Vol.4,

No.4, ISSN: 2222-1697.

Astuti, R. Y., 2016. Penerapan Prinsip Kehati-hatian dalam

Penyaluran Pembiayaan dan Kredit pada Lembaga

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

450

Keuangan Mikro (Studi Multi Situs pada BMT Hasanah

Mlarak dan BRI Unit Mlarak, Ponorogo). Al Tijarah.

119-145 Vol. 2, No. 1, p-ISSN: 2460-4089.

Azis, Ab. M. R., Yusoff, M. M., 2014. Identifying Risks Of

Financing For Agro Projects In Islamic Banks.

International Journal of Technical Research and

Applications. 29-33 Volume-2, Special Issue 4, e-ISSN:

2320-8163.

COSO, 2004. Enterprise Risk Management - Integrated

Framework, Committee of Sponsoring Organizations

of the Treadway Commission. New York.

CSFB, 1997. Creditrisk+: A Credit Risk Management

Framework, Credit Suisse First Boston. London.

Fahmi, I., 2015. Manajemen Risiko, Teori, Kasus, dan

Solusi, Alfabeta. Bandung.

Farida, Dewi, V. S., 2016. The Analysis Of Risk

Management On Syariah Banking. Syariah Paper

Accounting FEB UMS. 164-174, ISSN: 2460-0784.

Hassan, M. T., 2012. Role of Islamic Banking in

Agriculture Development in Bahawalpur, Pakistan.

International Journal of Learning & Development.

123-135 Vol. 2, No. 3, ISSN 2164-4063.

Hery, 2015. Manajemen Risiko Bisnis Enterprise Risk

Management, PT Grasindo. Jakarta.

Ikatan Bankir Indonesia (IBI), 2015. Manajemen Risiko 3,

PT Gramedia Pustaka Utama. Jakarta.

Laluma, R. H., 2011. Analisis Manajemen Risiko untuk

Perusahaan Non-Keuangan United Grain Growers

(UGG). Jurnal Computech & Bisnis. 1-5 Vol. 5, No. 1,

ISSN: 1978-9629.

Mohd, S., Muhammad, H., Moi, M. R., 2015. Financial

Problems among Farmers in Malaysia: Islamic

Agricultural Finance as a Possible Solution. Asian

Social Science. 1-15 Vol. 11, No. 4, ISSN: 1911-2017.

Muhammad, 2005. Manajemen Pembiayaan Bank Syariah,

Akademisi Manajemen Perusahaan YKPN.

Yogyakarta.

Olaitan, D. M. A., 2006. Finance for Small and Medium

Enterprise Nigeria's Agricultural Credit Guarantee

Sceme Dund. Journal of International Farm

Management. 2-9 Vol. 3, No. 2, ISSN: 1816-2495.

Rahman, A. R., 2010. Islamic Microfinance: an Ethical

Alternative to Poverty Alleviation. Humanomics. 284-

295 Vol. 26 Iss 4.

Rindi, A., 2016. Analisis Manajemen Risiko Pembiayaan

(Mikro iB) Pada Sektro Pertanian Bunga Potong di

Bank BRI Syariah KCP SetiaBudi. Posidis Keuangan

dan Perbankan Syariah. Vol. 2, No. 1, ISSN: 2460-

6561.

Rivai, V., Ismal, R., 2013. Islamic Risk Management For

Islamic Bank, Gramedia Pustaka Utama. Jakarta.

Saeed, R., 2013. Islamic and Conventional Agri-Financing

in Pakistan. Scientific Papers Series Management ,

Economic Engineering in Agriculture and Rural

Development. 351-367 Vol. 13, Issue 2, P-ISSN: 2284-

7995.

Santeramo, F. G., 2014. Integrating Agricultural Risk

Management Strategies in Selected EU partner

countries: Syria, Tunisia, Turkey. Romanian Journal of

European Affairs. 23-35 vol. 14, No. 3.

Safitri, S., Hendry, A., 2015. Prosedur Analisis Kelayakan

Pembiayaan Mikro: Studi Kasus BRI Syariah

Prabumulih. Jurnal Ekonomi dan Perbankan Syariah.

Vol. 3. No.1, April 2015, ISSN: 2338-2783, 37-54.

Siswanto, S., 1997. Menangani Kredit Bermasalah:

Konsep, Teknik, dan Kasus, Pustaka Binaman

Pressindo. Jakarta.

Suryana, U., Yuneline, M. H., Kurniawan, G. I., 2016.

Pengembangan Model Penilaian dan Pengelolaan

Risiko Pada Usaha Sayur Kreatif di Bandung Barat.

Jurnal Ekonomi dan Manajemen STIE Dharma

Negara. Vol. I, No. 1, ISSN LIPI 2540-8364.

Tahir, I. M., 2011. The Relationship Between Enterprise

Risk Management (ERM) and Firm Value: Evidence

From Malaysian Public Companies. International

Journal of Economics and Management Sciences. 32-

41 Vol. 1, No. 2, ISSN: 2162-6359.

Wilson, R., 2007. Making Development Assistance

sustainable Throught Islamic Microfinance. IIUM

Journal of Economics and Management. 197-217 Vol.

15, No. 2.

Creditric Calculation Model in Micro Financing IB on the Agricultural Sector in PT. BRI Shariah

451