Isomorphism in the Banking Industry of the Regional Development

Banks in Indonesia

Ferry Novindra Idroes, Ernie Tisnawati Sule, Popy Rufaidah and Diana Sari

Universitas Padjadjaran Jl. Dipati Ukur 46, Bandung, Indonesia

{ferry.idroes, erniesule, popy.rufaidah.pasca}@gmail.com, diana.sari@unpad.ac.id

Keywords: Isomorphism, Coercive, Normative, Mimetic, Regional Development Bank, BPD.

Abstract: Isomorphism is an industry pressure on companies to be uniform through coercive, normative and mimetic

mechanisms. Banking is an industry that has strong isomorphism. This study aims to investigate isomorphism

in the banking industry of the Regional Development Bank (BPD) group in Indonesia. This research uses

mixed method research design. The first stage is to collect questionnaire data on top management and financial

data from 26 BPDs for quantitative data analysis. Quantitative data processing uses partial least square-

structural equation model (PLS-SEM) to observe the relationship between the coercive, normative and

mimetic dimensions of isomorphism variable. The second stage is the collection of information through in-

depth interviews and focus group discussions with BPD leaders, the Association of Regional Banks

(Asbanda), and the Financial Services Authority (OJK) to review the results of the quantitative. The results

show that mimetic isomorphism pressure has the greatest influence in creating uniformity in the industry. The

success of one company in marketing and operating will soon be imitated by competitors and in turn create

uniformity in the industry. The findings suggest that the BPD industry environment situation in Indonesia is

waiting and seeing the actions that competitors undertake to be imitated if they show superior performance.

1 INTRODUCTION

This study is about the environmental pressure on the

banking industry. The banking industry nature is in

the pressures of the industrial environment against

strong corporate individuals that lead to strong

uniformity or isomorphism. Uniformity due to

environmental stress is neutral as it occurs to every

individual in the industry, where the difference is how

each individual responds to the pressure of uniformity

(DiMaggio and Powell, 1983: 149; Deephouse, 1996:

1024). Isomorphism is divided into three category,

namely; (I) coercive uniformity or coercive

isomorphism, (ii) normative uniformity or normative

isomorphism, and (iii) mimetic uniformity or mimetic

isomorphism (DiMaggio and Powell, 1983: 150).

Strict regulation forces an industry to experience

a high degree of isomorphism. Isomorphism enforced

by regulation with the imposition of sanctions is a

coercive isomorphism mechanism. Regulatory

pressures are carried out by regulators, Bank

Indonesia (BI) and the Financial Services Authority

(Otoritas Jasa Keuangan-OJK) as well as policies,

procedures and limits established by head office

(Deephouse 1996: 1024; Haveman and Wang, 2013:

18). Strict application of certification makes banking

actors have a high degree of isomorphism in the

industry. Isomorphism through certification and

accreditation is a normative uniformity mechanism

(Haveman and Wang, 2013: 31). Isomorphism of

views and behavior in the banking industry has a high

degree of isomorphism. Isomorphism through logic,

views, behaviors and actions is applicable to the

mimetic uniformity mechanism (Haveman and

Wang, 2013: 33).

The situation is faced by the banking industry

which focuses on banks belonging to the Regional

Development Bank (BPD) group in Indonesia. A

group of banks organized under the law to provide

financing for the implementation of regional

development efforts in the framework of the national

development. The population of banks belonging to

the BPD group is 26 banks. When viewed from

isomorphism, the posture and performance of the

banks should be equal or at least on average with a

low standard deviation. In fact, the banking posture

and performance are highly unbalanced. Based on

table 1, it can be seen that the inter-BPD does not have

a uniform performance. For example, the total assets

of PT BPD Jawa Barat dan Banten, Tbk are about 20

452

Idroes, F., Sule, E., Rufaidah, P. and Sari, D.

Isomorphism in the Banking Industry of the Regional Development Banks in Indonesia.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 452-457

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

times the total assets of PD BPD Sulawesi Tenggara.

This gives an idea that the inter-BPD itself is not at

the same level of playing field. This difference in

situation will be an interesting finding in this study

where the situation of isomorphism does not

necessarily make it uniform.

Previous research on isomofism focuses more on

exposure to isomorphism occurring in various

industries. This research would like to see how BPD

adapt to isomorphism that occurs in the industry.

Adaptability will release individual BPDs from

uniform pressure and produce better performance.

The findings of this study are expected to contribute

to the idea of how good the adaptation of firms in the

face of isomorphism in the industry.

The main purpose of this research is to investigate

the isomorphism in BPD banking industry in

Indonesia. The purpose of the study is to explain the

results of the study of how BPDs adapt to

isomorphism to produce better performance. The

study was conducted on all BPDs in Indonesia from

July to October 2016 by sending questionnaires to

respondents and conducting interviews to informants.

This study uses the banks incorporated in the category

of BPD in Indonesia as its unit of analysis. The unit

of observation is the management of each bank, in

this case the President Director or any party

authorized to represent the President Director.

Furthermore, this article will be structured as

follows: First, the development of the literature used

in the entire study. Second, the discussion of research

motodology conducted. Third, the explaination of the

findings resulted in the research. Fourth, the

recommendations of implications, limitations and

direction for subsequent research.

2 LITERATURE REVIEW

Based on the concepts from previous research

journals, the recapitulation of isomorphism concept

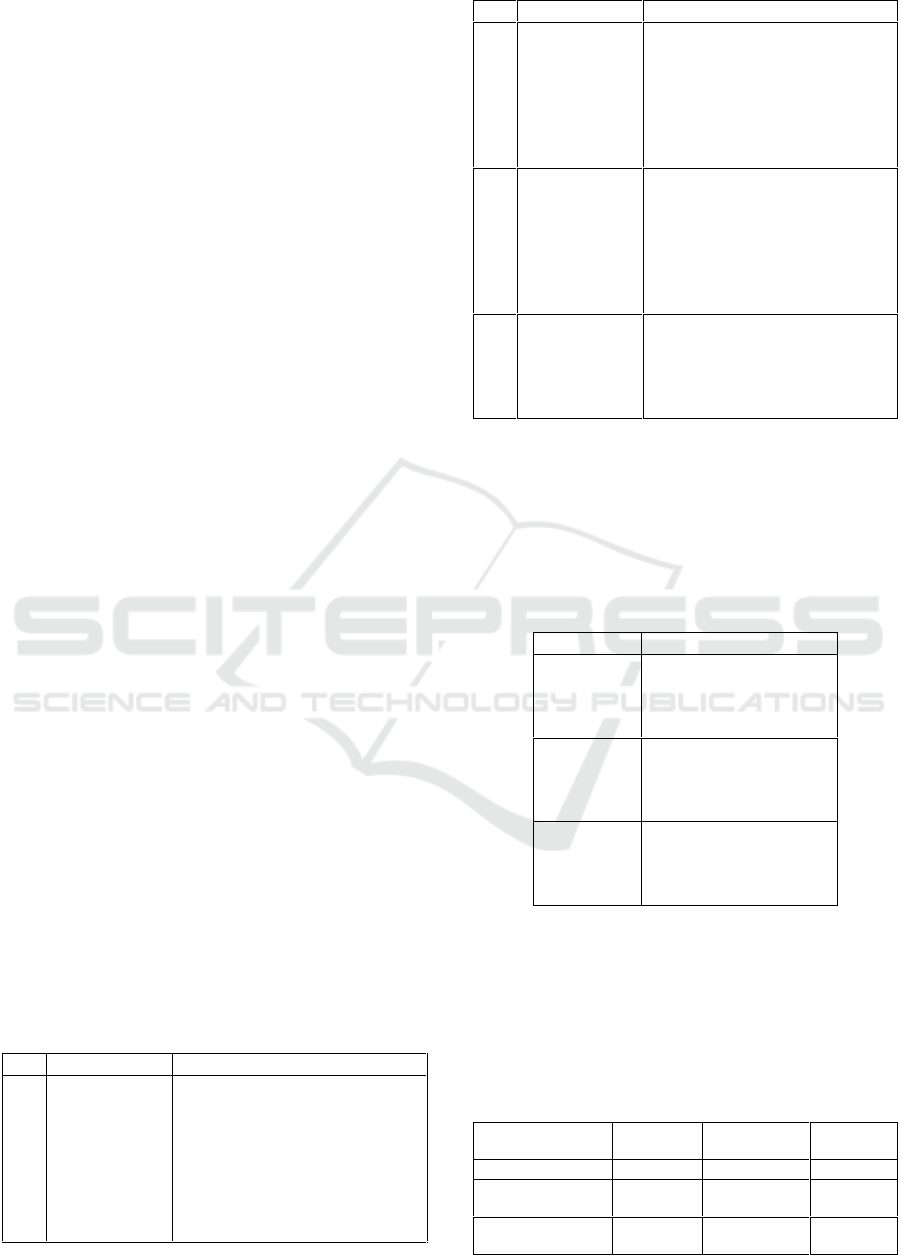

definitions is outlined in table 1 below:

Table 1: Recapitulation of isomorphism concept

definitions.

No

Researcher(s)

Concept Definitions

1

DiMaggio

and Powell

(1983: 150)

Three concepts isomorphism

occur, namely 1) coercive,

which came from legitimacy

problem and political influence;

2) mimetic, which came from

uncertainty and how we respond

to it; and 3) normative, which is

associated with professionalism

No

Researcher(s)

Concept Definitions

2

Bromley and

Meyer (2014:

14)

Isomorphism is a concept that

explains the increase of

uniformity among members in

an organizational field, and can

also explain the process of

blurring across sector

boundaries.

3

Francis,

Harper and

Kumar (2016:

4)

Isomorphism based on

institutional theory is in

conformity with institutional

norms and values, which buffer

companies from environmental

turbulence and increase survival

opportunities.

4

Shabana,

Buchholtz

and Carroll

(2016: 1)

Isomorphism through three

stages namely coercive

isomorphism, normative

isomorphism and mimetic

isomorphism.

Source: Summary of findings from previous research.

The unit analysis in this research is service

industry, i.e. banking, especially BPD as the object of

research. The construct of dimensions and indicators

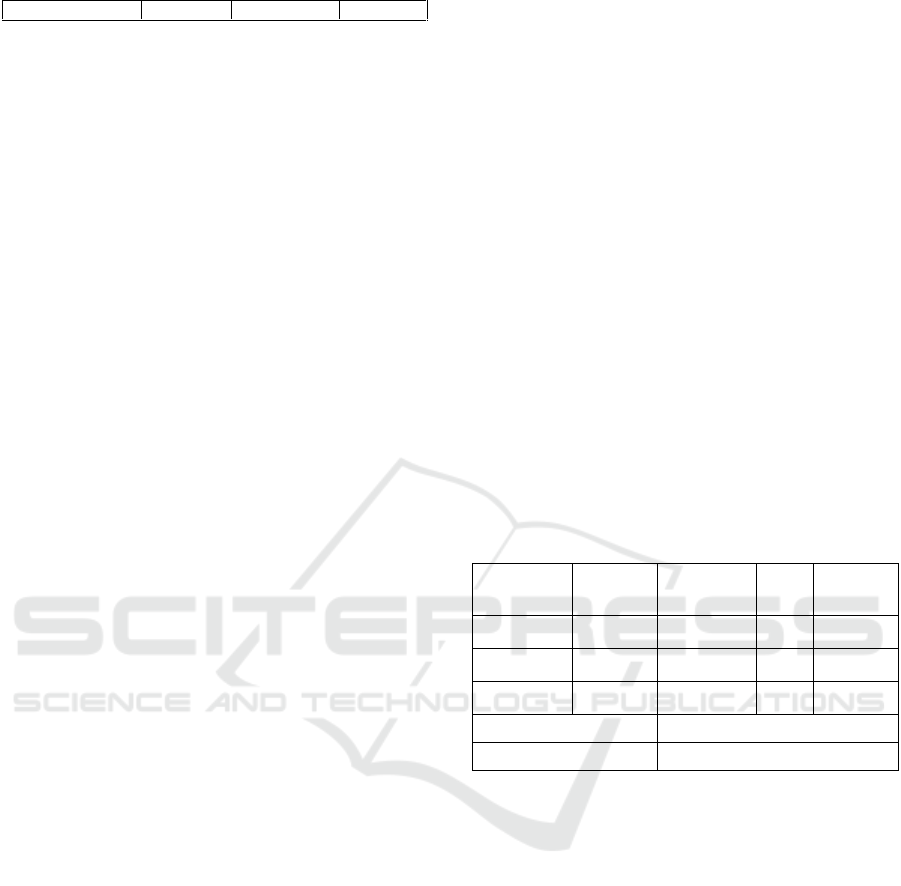

is shown in table 2 below:

Table 2: Construct of dimensions and indicators of

isomorphism variable.

Dimensions

Indicators

Coercive

Utilization

Regulations

Laws

Sanctions

Normative

Social obligations

Eligibility

Certifications

Best practices

Mimetic

Taken for grantedness

Shared beliefs

Shared logics

Shared understanding

Source: Summary of previous studies.

Based on the recapitulation of isomorphism

concept and the construct of variable, the typology of

environmental isomorphism against individual

companies in the industry can be summarized. The

summary is as presented in table 3 below:

Table 3: Typology of isomorphism.

Types of

Isomorphisme

Coercive

Normative

Mimetic

Triggers

Authority

Society

Individual

Individual

Response

Forced

Awareness

Volunteer

Level of

Uniformity

High

Medium

Low

Isomorphism in the Banking Industry of the Regional Development Banks in Indonesia

453

Legitimacy

Obedience

Acceptability

Success

Source: Summary of previous studies.

Based on the typology of isomorphism, the

research hypotheses are as follows:

Coercive isomorphism is done with compulsion

to achieve compliance with the authorities.

Normative isomorphism is done with awareness

to achieve acceptability in society.

Mimetic isomorphism is done voluntarily to

achieve individual success.

3 METHODS

Based on the secondary data from BI and OJK, the

population of all BPDs in Indonesia until March 24,

2017 is 26 BPDs. Given the small number of

population, then this research uses all 26 BPDs in

Indonesia. The domain of this research is in

management strategy that emphasizes on observation

of top management behavior in managing

organization. Thus, the observation unit in this study

is the top management of all BPDs namely the

President Director.

Recognizing that this study has a small population

size and the potential consequences that the predictive

validity of the study is lower, the solutions undertaken

to strengthen the research findings are: (1) The

sampling method is censused to 26 BPDs and (2)

Interviews and FGDs are conducted intensively to

produce a thick description in the discussion of

research findings. So in this research, the mixed

research method becomes very relevant to be

implemented.

This research uses explanatory design a two-

phase mixed method, where the first phase involves

collecting and analyzing quantitative data and the

second phase includes qualitative data collection and

analysis done to strengthen the result of quantitative

research (Creswell, 2013: 203).

In QUAN process using PLS-SEM. PLS-SEM

can still be implemented for small data, if the

population surveyed is small and the consequence of

predictive validity is lower (Hair et al., 2014: 48).

Further, Hair et al. (2014: 16) provides a detailed

description of the key characteristics of PLS-SEM-

related data. It is said that the data size for PLS-SEM:

(1) Unidentified problem with small sample size, (2)

In general, although the sample is small, PLS-SEM is

still able to produce high-quality statistical analysis;

and (3) The bigger the data, the expected estimation

of the research the more precise (consistent).

The process of sending and collecting

questionnaires was conducted throughout July-

August 2016. The mechanism of distributing and

collecting questionnaires was through Asbanda. Of

the 26 questionnaires sent to all BPDs, all were

returned and answered in full by the respondents.

Details of respondents who answered the

questionnaire were: 12 BPD President Directors, 4

BPD Directors 8 BPD Division Leaders, 1 BPD Sub-

Division Leader and 1 BPD Section Head.

All indicators can also be stated reliable with

Composite Reliability (CR) value of 0.937 and

Average Variance Extracted (AVE) value of 0.663.

Both of these reliability indices have values greater

than the minimum limit of 0.70 for CR and 0.500 for

AVE. The CR value of 0.845 states that 84.5% of the

mimetic dimension variation can be explained by its

indicators and the AVE value of 0.646 states that

64.6% of all indicators’ variation can be well

explained by the mimetic dimension. This indicates

all reliable indicators for measuring the mimetic

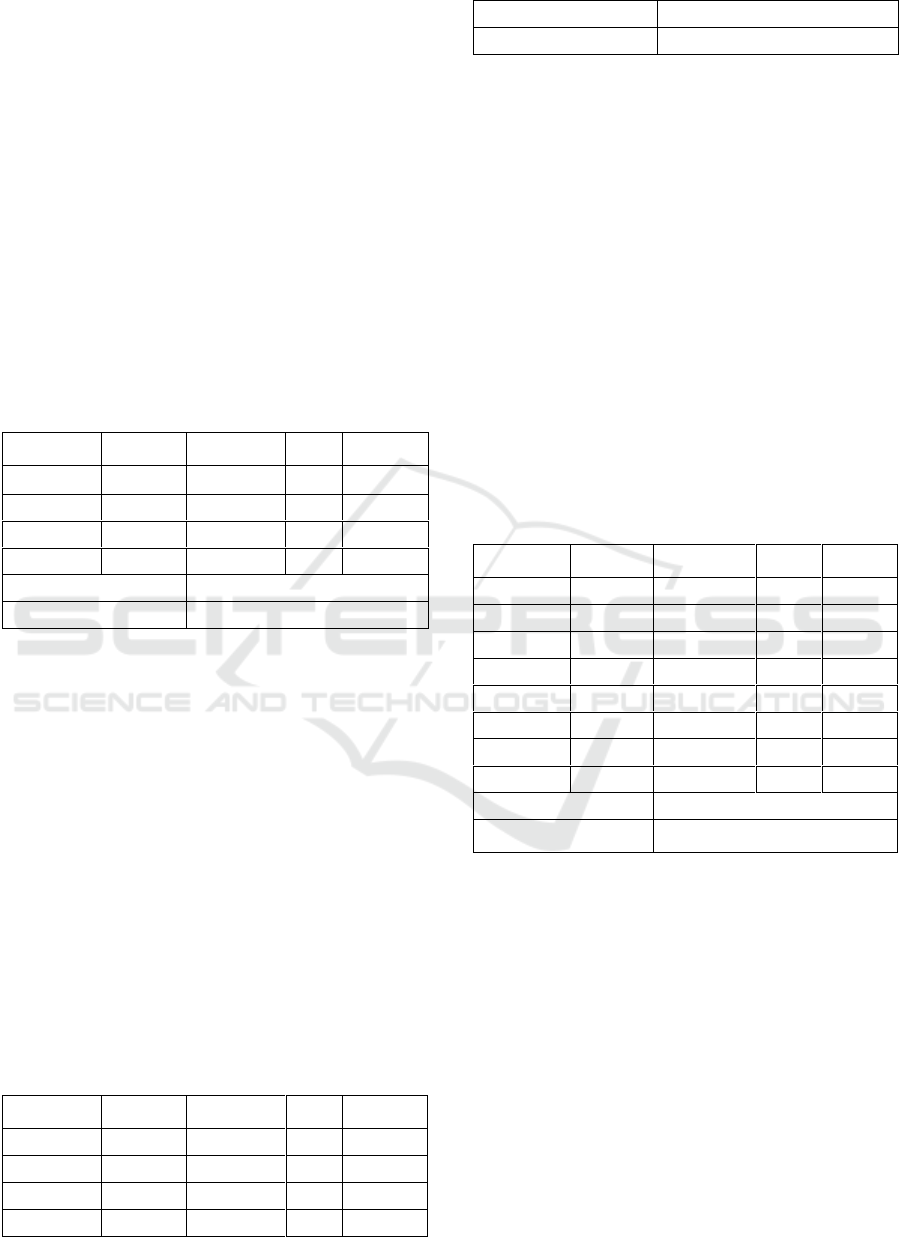

dimension. The result is as presented in table 4 below:

Table 4: Measurement model of isomorphism variable.

Dimensions

Manifest

Variables

Standardized

Loadings

R

2

Variance

Error

Coercive

Isomorphism

1.1

0.746

0.557

0.443

Normative

Isomorphism

1.2

0.752

0.566

0.434

Mimetic

Isomorphism

1.3

0.904

0.817

0.183

CR

0.845

AVE

0.646

Source: Quantitative result of the study.

The result of measurement model for

isomorphism variable shows that all dimensions have

factor loadings greater than 0.500, thus all dimensions

are concluded as valid in measuring the isomorphism

variable. In addition to valid, the three dimensions

can also be declared reliable with CR and AVE values

greater than 0.700 and 0.500 respectively. Based on

the calculation results, it can be seen that the

dimension of mimetic isomorphism is the dimension

with the largest factor loading, which means that this

dimension is most closely related to isomorphism

variable.

In the QUAL data collection process, the

confirmation of the problem formulation is done by

conducting FGDs with banking experts to confirm the

findings in the quantitative phase and to get input on

what, how and why this occurred as a result of the

quantitative findings.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

454

The descriptions of the results of the questionnaire

were further confirmed with in-depth interviews,

focus group discussions and direct observations

conducted from May 2016 to March 2017. In-depth

interviews were conducted to the President Directors,

Directors and Executive Officers of several BPDs.

Focus group discussion was conducted to Asbanda

and OJK leaders.

4 RESULTS

The variables of isomorphism were measured using

three dimensions: coercive, normative and mimetic

dimensions.

Table 5: Measurement model of coercive isomorphism

dimensions.

Indicators

Manifest

Variables

Standardized

Loadings

R

2

Error

Variance

Indicator-1

X1

0.794

0.631

0.369

Indicator-2

X2

0.779

0.608

0.392

Indicator-3

X3

0.698

0.487

0.513

Indicator-4

X4

0.833

0.694

0.306

CR

0.859

AVE

0.605

Source: Quantitative result of the study.

The indicator most closely related to the coercive

dimension is "Understand that any violation of the

law has consequences of strict sanctions against its

offenders" with a factor loading of 0.833. This means

that the coercive dimension is more perceived as an

understanding of the law violation that has strict

consequences. The R

2

value of 0.694 states that

69.4% of this factor variation can be explained by the

coercive dimension.

All indicators can also be stated reliable with CR

value and AVE value. The CR value of 0.859 states

that 85.9% of the coercive dimension variation can be

explained by its indiactors and the AVE value of

0.605 indicates that 60.5% of all indicators’ variation

can be well explained by the coercive dimension.

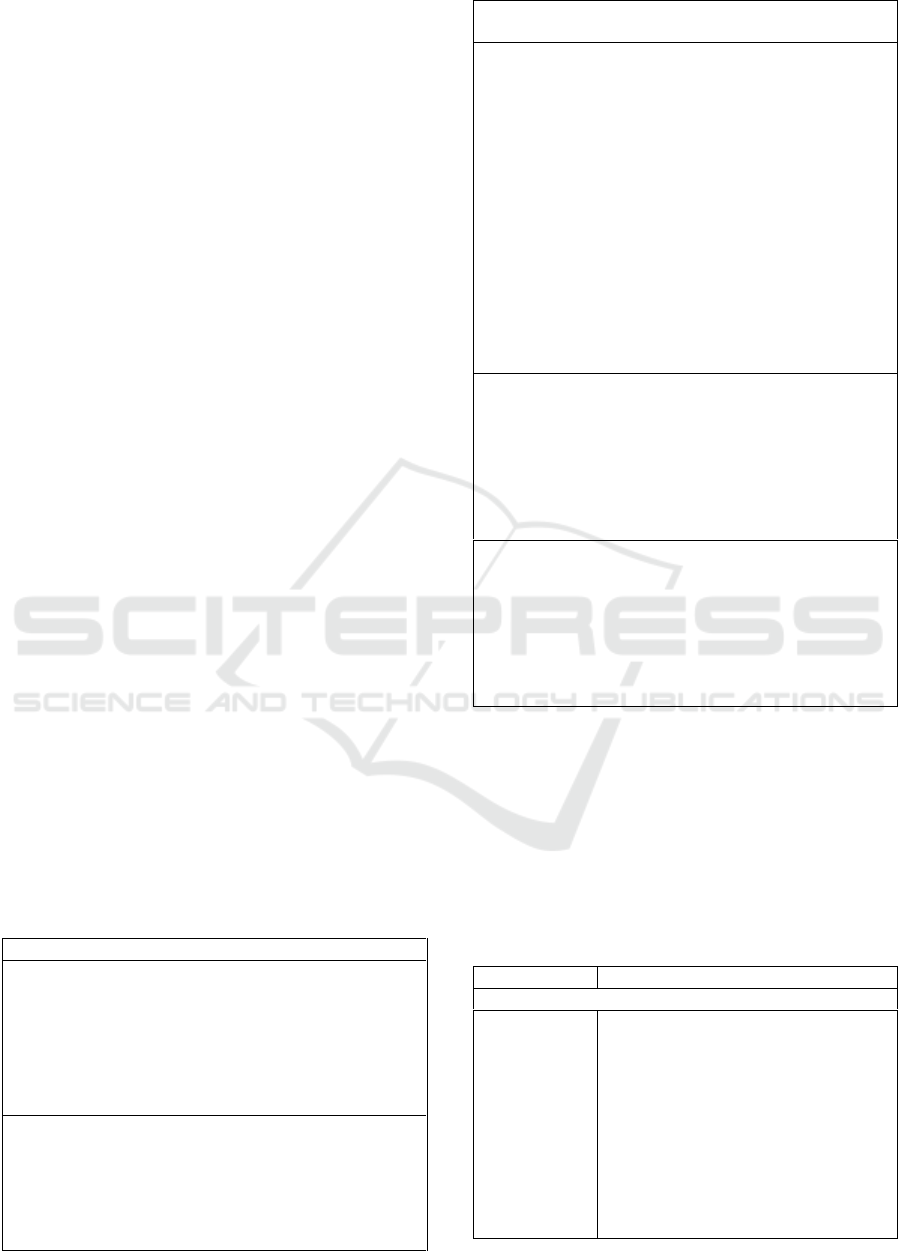

Table 6: Measurement model of normative isomorphism

dimensions.

Indicators

Manifest

Variables

Standardized

Loadings

R

2

Error

Variance

Indicator-6

X6

0.719

0.517

0.483

Indicator-7

X7

0.828

0.686

0.314

Indicator-8

X8

0.776

0.603

0.397

Indicator-9

X9

0.924

0.855

0.145

CR

0.887

AVE

0.665

Source: Quantitative result of the study.

The indicator most closely related to the

normative dimension is "Implement best practices

applicable to the banking industry such as

governance, risk management and compliance

(GRC)," with a factor loading of 0.924. This means

that the normative dimension is more perceived as the

implementation of best practices applicable to the

banking industry. The R

2

value of 0.855 states that

85.5% of this factor variation can be explained by the

normative dimension.

All indicators can also be stated reliable with CR

value and AVE value. The CR value of 0.887 states

that 88.7% of the normative dimension variation can

be explained by its indicators and the AVE value of

0.665 states that 66.5% of all indicators’ variation can

be well explained by the normative dimension.

Table 7: Measurement model of mimetic isomorphism

dimensions.

Indicators

Manifest

Variables

Standardized

Loadings

R

2

Error

Variance

Indicator-10

X10

0.967

0.935

0.065

Indicator-11

X11

0.967

0.935

0.065

Indicator-12

X12

0.967

0.935

0.065

Indicator-13

X13

0.945

0.893

0.107

Indicator-14

X14

0.460

0.212

0.788

Indicator-15

X15

0.724

0.524

0.476

Indicator-16

X16

0.693

0.480

0.520

Indicator-17

X17

0.627

0.393

0.607

Composite Reliability (CR)

0.937

Average Variance Extracted

(AVE)

0.663

Source: Quantitative result of the study.

The indicators most closely related to the mimetic

dimension are (1) "Conducting all operational

activities in accordance with the Standard Operating

Procedures on the marketing of products that are

prevalent in the banking industry", (2) "Conducting

all operational activities in accordance with the

Standard Operating Procedures on the marketing of

services that are prevalent in the banking industry and

(3)" Conducting all operational activities in

accordance with the Standard Operating Procedures

on the implementation of product operations that are

prevalent in the banking industry "with a factor

loading of 0.967.

All indicators can also be stated reliable with CR

value of 0.937 and AVE value of 0.663. The CR value

Isomorphism in the Banking Industry of the Regional Development Banks in Indonesia

455

of 0.937 states that 93.7% of the mimetic dimension

variation can be explained by its indicators and the

AVE value of 0.663 states that 66.3% of all

indicators’ variation can be well explained by the

mimetic dimension. This indicates all reliable

indicators for measuring the mimetic dimension.

4 DISCUSSION

Isomorphism in the banking industry especially BPDs

in Indonesia is mimetic isomorphism. Mimetic

isomorphism is the behavior of mutual imitations

between business actors creating isomorphism in the

end. The advantages of products and services from a

bank will soon be imitated by competitor banks, so

that the benefits are temporary and not sustainable.

The actual situation in the banking industry

including BPDs in Indonesia is (i) the marketing of

products and services is in accordance with the SOPs

that are prevalent in the banking industry and (ii) the

operation of products and services is in accordance

with the SOPs that are prevalent in the banking

industry.

Table 5 and 6 provide information that is beyond

the dimension of mimetic isomorphism,

isomorphism-based variables consisting of normative

isomorphism and coercive isomorphism. Normative

isomorphism has the highest indicator of best

practices applied to the banking industry. Whereas

coercive isomorphism has the highest indicator of

understanding that any violation of the law has

consequences of strict sanctions against its offenders.

Based on the description per indicator of the

dimensions of mimetic isomorphism described in

table 7, the following table 8 presents the key strategy

prescriptions facing isomorphism in the industry.

Table 8: Prescriptions of primary strategies facing

isomorphism in industry.

Strategy Level and Strategy Prescriptions

Corporate Level

Set the organization's vision of whether to go beyond,

equal or behind the industry average to be more clear

in the preparation of missions and goals.

Make updates of SOPs on marketing and operations

of products and services offered by benchmarking

against role models banks.

Business Level

Competitive - Updating best practice in products and

services with the nearest competitor banks. If equal or

better, do a competitive strategy.

Cooperative - Updating best practice in products and

services with the nearest competitor banks. If the

bank lose, work with partners to improve

competitiveness.

Functional Level

Marketing - Updating best practice products and

services with competing banks. Aggressive if it has a

competitive advantage.

Finance - Provide adequate attention and support to

the competitive environment situation. Support

should be based on effective and efficient cost-benefit

principles.

Operational - Updating best practices of products and

services with competing banks. Prioritize effective

and efficient operations with a focus on achieving the

vision-missions-goals of the bank.

HR - employee ownership is fast responsive and

solutive in the face of competitive environmental

pressures.

Shareholders

Provide full support to management in order to win the

competition in the industry in line with the joint

consensus between management and shareholders. Full

support in the form of additional capital until the

regulations are aligned. Based on the full support

provided, there is a measurable and objective reward-

punishment for management.

Regulator and Bank Supervisor

Establish anticipatory regulations (regulations and

circulars) in following the development of products and

services of the banking industry in particular and the

financial industry in general. Anticipatory regulation is

very important in preventing the occurrence of risks in

the implementation of products and services offered by

banks.

Source: Quantitative result of the study.

Based on the description per indicator of the

dimensions of coercive isomorphism described in

table 5 and normative isomorphism described in table

6, the following table 9 presents the complementary

strategy prescriptions that can be applied by banks to

deal with isomorphism in the industry.

Table 9: Prescriptions of complementary strategies facing

isomorphism in industry.

Dimension

Strategy Prescriptions

Dimension: Normative Isomorphism

Implement

best practices

in the banking

industry

Banks shall make updates and

implement best practices that could be

applied to the banking industry in

particular and the financial industry in

general. Best practices are required to

be implemented so that banks are not

alienated from the bank's business

community nationally and

internationally. This may refer to

national practices (under the

supervision of BI and OJK) and

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

456

international practices (under the

supervision of BIS or BC).

Dimension: Coercive Isomorphism

Understand

that any

violation of

the law has

consequences

of strict

sanctions

against its

offender

Regulations and legislation are

established to regulate social order.

Banks as part of the public are exposed

to the obligation to comply and

implement them. Bank regulations

refer to the PBI-SEBI and POJK and

the specialized SEOJK, as well as

higher hierarchical rules and

legislation. Banks must regularly

update.

Source: Quantitative result of the study.

This research has one main limitation, i.e the

small scope of research that is limited to the BPD

group in Indonesia. In addition, this study has not

examined the adaptability of the isomorphism offered

for the implementation of the strategy towards the

improvement of performance. Given the banking

industry is loaded with isomorphism, it is important

to do research on isomorphism, implementation

strategies and company performance simultaneously.

It would be more useful if the research was conducted

on a broader scope of banking within a country.

REFERENCES

Bromley, P. Meyer J. W. 2014. “They Are All

Organizations’ : The Cultural Roots of Blurring

Between the Nonprofit, Business, and Government

Sectors”, Administration & Society, online first, DOI :

10.1177/ 0095399714548268.

Creswell, J. W. 2013. Research design: Qualitative,

quantitative, and mixed methods approaches (4 ed.).

Los Angeles: Sage publications.

DiMaggio, P. J., Powell, W. W. 1983. ‘The iron cage

revisited: institutional isomorphism and collective

rationality in organizational fields’. American

Sociological Review, 48, 147–60.

Deephouse, D. L. 1996. Does Isomorphism Legitimate?.

Academy of Management Journal, 4, 1024-1039.

Francis, B., Harper, P., Kumar, S. 2016. The Effect of

Institutional Corporate Social Responsibility on Bank

Loans. Business and Society, 1-33.

Hair, Jr., J. F., Hult, G. M., Ringle, C. M., Sarstedt, M.

2014. A Primer on Partial Least Squares Structural

Equation Modeling (PLS-SEM). Sage Publications.

Haveman, H. A., Wang, Y. 2013. Going (More) Public:

Institutional Isomorphism and Ownership Reform

among Chinese Firms. Management and Organization

Review, 9(1), 17–51.

Shabana, K. M., Buchhotz, A. K., Carroll, A. B. 2016. The

Institutionalization of Corporate Social Responsibility

Reporting. Business and Society.

Isomorphism in the Banking Industry of the Regional Development Banks in Indonesia

457