Determinant Analysis on Muslims Perception towards Cash Waqf

A Study on Waqeef in Pusbang Wakaf Daarut Tauhid

Rida Rosida, Suci Apriliani, and Asma Arisman Dewi

Universitas Pendidikan Indonesia, Jl. Setiabudhi, Kota Bandung, Indonesia

{rida.rosida, suci.avril}@upi.edu, asma.arisman.dewi@student.upi.edu

Keyword: Islamic Philanthropy, Cash Waqf, Muslims Perception.

Abstract: Accumulation of cash waqf in Indonesia has not reached the maximum level despite its huge potential. The

fund estimated could reach by IDR 3 trillion. In fact, Indonesia, as the largest Muslim population in the world,

can benefit the fund as an alternative source of income as well as the endowment fund of ummah. But there

are several obstacles faced in the process of accumulation including the miss-perception as well due to the

lack of understanding about waqf concept. This researched is aimed to gain the information with regard

perception and to examine the understanding level of Muslims about cash waqf as well its determinants. In

general, this research is conducted by descriptive quantitative on objective condition of Muslims.

Furthermore, analytical quantitative tools employed in this study is Conformity Factor Analysis. The objects

of the observation are the Muslim participants known as waqeef in Pusbang Wakaf Daarut Tauhid Bandung.

It is expected that research shall contribute valuable information on the largest determinant in improving the

knowledge and enhancing the Muslim understanding level about cash waqf. Furthermore, the findings could

be benefited by the relevant regulators as well the stakeholders of Waqf institutions for developing cash waqf

in the future.

1 INTRODUCTION

Waqf institutions in recorded history have played a

significant role during the development of Islam

starting from the time of the Prophet Muhammad

until at the beginning of the twentieth century.

(Mohsin, 2013).

According to UUD No. 41 of 2014, waqf defined

as a waqeef legal action to divide some of his

ownership, to be used for a specific period according

to his interests for worship/religion purposes or

sharia general welfare.

Besides waqf in the form of fixed assets, there is

a cash waqf that becomes an alternative instrument

of state development. In fact, Indonesia as the largest

Muslim population country has the most significant

potential of this enormous cash waqf to fund

development, of course (Beik, 2013).

Cash waqf believed to making waqf can be

assembled with a higher fund. There are at least three

factors. First, cash waqf can be made in various

regions without borders and the benefits of cash waqf

can be enjoyed by the community anywhere. Second,

the cash waqf has a much more equitable and

mobilizable mobility in the society than the fixed

assets, so it is possible to overcome the problem of

poverty. Third, the cash waqf is a model of immortal

fund mobilization if managed professionally and

trustworthy (Ekawaty and Muda, 2015).

Regarding the law related to this cash waqf, Beik

(2015) mentioned the opinion of the majority of

scholars to allow waqf with cash. Among others:

Hanafi madhhab, Scholar of Syafii madhhab and

Hambali madhhab, Scholar of Maliki madhhab, and

Imam Az-Zuhri. Moreover, cash waqf in Indonesia

has been allowed by Fatwa of Majelis Ulama

Indonesia (MUI). The MUI's commission fatwa was

issued on May 11, 2002.

However, cash waqf meets various problems in

its development in Indonesia. Indonesian Waqf

Board (BWI) as a regulator institution in 2009 said

the amount of cash waqf managed by BWI is still less

than one billion. As per April 2013 acceptance of

cash waqf in BWI slightly increased to reach the

number of three billion (Havita, et al., 2014). On the

other hand, according to the calculation of the

chairman of BWI Mustafa Edwin Nasution (2005)

Indonesia should be collect funds of about IDR 3

Trillion per year with details as follows:

606

Rosida, R., Utami, S. and Dewi, A.

Determinant Analysis on Muslims Perception towards Cash Waqf - A Study on Waqeef in Pusbang Wakaf Daarut Tauhid.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 606-612

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Table 1: Indonesia cash waqf potential (IDR).

Income/

month

Total

Muslim

Cash

waqf

/month

Cash waqf

potential/

month

Cash

waqf

potential/

year

500.000 4 M 5.000 20 Billion 240 B

1M – 2M 3 M 10.000 30 Billion 360 B

2M – 5M 2 M 50.000 100 Billion 1,2 T

5M – 10M 1 M 100.000 100 Billion 1,2 T

Total 3 Trillion

Source: Nasution dan Hasanah (2005)

Following of that significant potential of cash

waqf in Indonesia, the government has begun to

accommodate the effort to develop this cash waqf

with the regulation of the application of cash waqf in

UUD No. 41 of 2004 and Government Regulation

No. 42 of 2006. But there are still many problems

found that cause the cash waqf fund not yet optimal,

even very far from its potential in Indonesia. One of

the reason is the level of public understanding of cash

waqf.

Hasanah (1997) said that the community's

understanding of waqf is insufficient when compared

with other Islamic philanthropy instruments such as

zakat, infaq or qurban. Therefore, Muslims rarely

practice it.

The low public understanding about cash waqf

proven by Marlina and Anggi (2015) research, which

examines the level of cash waqf knowledge of

Muslim in Surabaya, and the results show that more

than 50% of the Surabaya Muslim do not understand

even do not know cash waqf. The majority of

Indonesian people still consider that waqf is limited

only to the fixed asset, such as land and buildings

destined for places of praying, cemeteries, boarding

schools, orphanages and mere education (Medias,

2010).

Their research corroborated by Effendi (2007) in

his thesis entitled "Factors Affecting Perceptions of

Muzakki BAZNAS Dompet Dhuafa to Pay Waqf

through Cash Waqf" concluded that the lack of

interest in charity through cash waqf among others

due to their disagreement with scholar’s ijtihad who

allow donating through the cash waqf. Means, it is

proven that public perception is still assumed that

waqf can only be done to fixed assets.

2 LITERATURE REVIEW

The perception of cash waqf can interpret as a

process in which an individual chooses, organizes,

and translates the received information stimulus

about cash waqf resulting in a view or assessment.

Two factors affect a person's perception of cash waqf,

which is internal factors of one's individual and

external factors or objects of knowledge. Once the

stimulus or information is received, the stimulus or

data is selected. Internal factors that influence

perception selection include psychological needs,

background, experience, personality, values and

shared beliefs also self-acceptance. External factors

that affect perception are: intensity, size, contrast,

movement, repetition, familiarity and something

new. The process of understanding is formed within

a person, but perception is also influenced by

experience, learning process, and knowledge

(Pareek, 1996).

3 METHODOLOGY

The method to be used in this research is the

descriptive method of causality. Starting from

describing quantitatively about the perception of

Waqeef Pusbang Daarut Tauhiid Bandung.

Furthermore, it is equipped with an analysis of the

relationship between the observed measurements

with the previous factors, then tested statistically.

Analyzer used in this research is Confirmatory Factor

Analysis (CFA) that is a way to explore dominant

variable or indicator to form a factor forming society

perception about cash waqf which is relatively

straightforward (Stark, et al., 2006). In this case, the

factors that are suspected to have influence are the

level of education, the level of religiosity, the

involvement of religious organizations and the

literacy of Islamic economics.

4 RESULTS AND DISCUSSION

Results of data obtained from the questionnaire

distribution process will be presented as a general

description of the respondents' characteristics such as

age, sex, marital status, and occupation of

respondents’ DT waqeef.

Determinant Analysis on Muslims Perception towards Cash Waqf - A Study on Waqeef in Pusbang Wakaf Daarut Tauhid

607

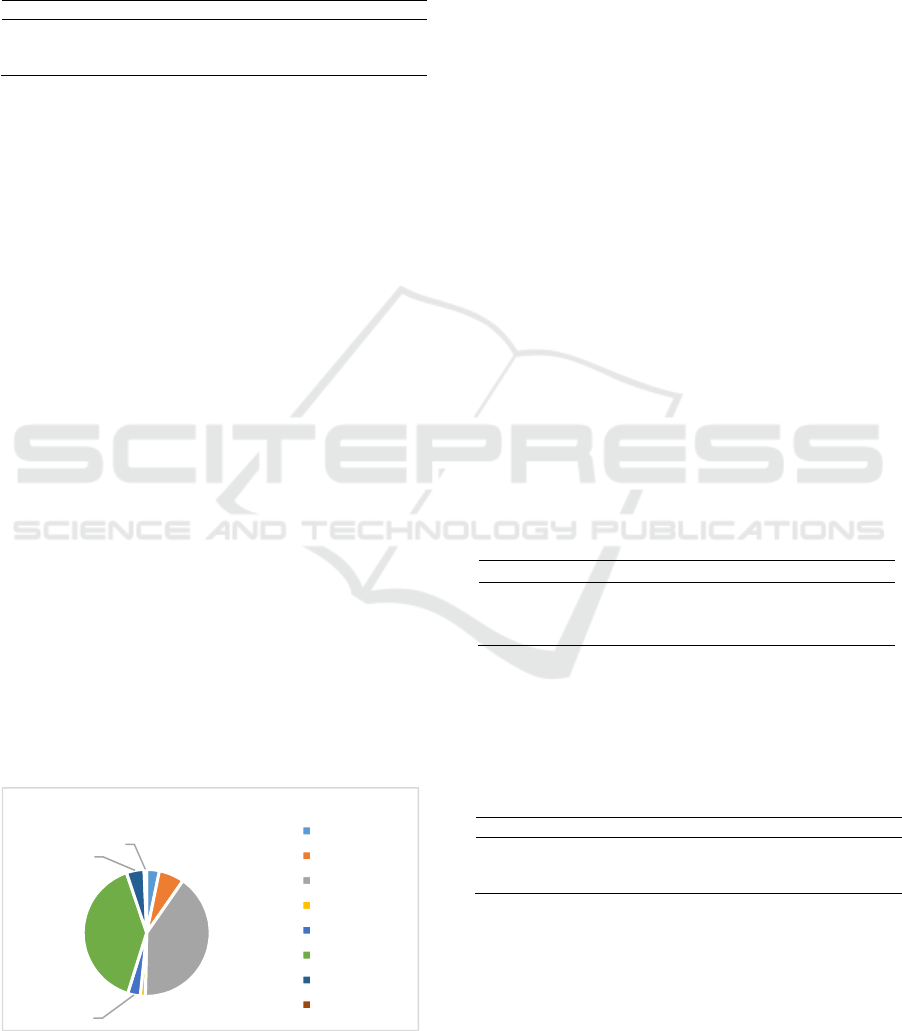

Figure 1: Waqeef based on age.

Based on the field research, it can be seen in

Figure 1 that most DT waqeef are in relatively young

age categories. That is because most of the DT

waqeef encountered during the research are mostly

santri from Daarut Tauhid Boarding School and also

students. The condition of boarding school program

in Daarut Tauhiid is primarily for children,

adolescents, and adults. From many of boarding

school programs provided in Daarut Tauhiid, there is

only one boarding school program dedicated to the

elderly namely the Pesantren Masa Keemasan.

In further analysis, the overall waqeef has stepped

on the age of adulthood which is generally at that age

the level of thinking has been in mature conditions,

ideally at that age, the respondent has been able to

digest the information and perceived about a matter

correctly and objectively.

Table 2: Waqeef based on Sex, Marital status and

Occupation.

No

Percenta

g

e

1 Sex

Man 72%

Woman 28%

2

Marital

Status

Sin

g

le 74%

Marrie

d

23%

Widow 3%

3 Occupation

Civil Servants 3%

Private employees 25%

Entrepreneu

r

7%

Student 51%

Others 14%

In table 2, can be seen that most of DT waqeef are

single, this is because most of the DT waqeef

encountered during the research are young Daarut

Tauhiid santri.

Figure 2: Waqeef based on income.

From Figure 2, can be seen that it turns out most

of the Daarut Tauhiid waqeef income is on the

smallest scale, which is between 500k up to 1,5M.

That means the scholar's ijtihad associated with this

cash waqf has been very useful for many Muslims

because pay waqf no longer can only be done by

people who have sufficient material alone. From

these conditions it can be concluded that to be a

waqeef doesn't need wait to be a rich man, this is as

Allah orders in the Holy Quran chapter Ali-Imran

verses 133-134 which reads as follows:

“And hasten to forgiveness from your Lord and a

garden as wide as the heavens and earth, prepared

for the righteous. Who spend (in the cause of Allah)

during ease and hardship ...”

4.1 Descriptive Analysis of Research

Variables

In this section, we will describe the research variables

based on respondents' answers. This research will

explain four variables which are education level (X

1

),

level of religiosity (X

2

), level of involvement of

religious organization (X

3

) and level of Islamic

economics literacy (X

4

), also perception about cash

waqf (Y). Here is an overview of each variable:

4.1.1 Overview of Perception About Cash

Waqf Variables (Y)

Table 3: Assessment category of DT waqeef perception

about cash waqf.

Range Category

X > 5115 Goo

d

3225 X 5115 Medium

X < 3225 Ba

d

12%

61%

16%

5%

4%

1%

1%

Age

12 - 18

19 - 25

26 - 32

33 - 39

40 - 46

93

30

17

9

0 20406080100

Income (IDR)

>5M 2,6 - 5M 1,6M - 2,5M 500k - 1,5 M

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

608

In table 3, the perception of cash waqf score reached

5514 points. That means the variables in the good

category. So, it can be concluded that Daarut Tauhid

waqeef's perception of cash waqf is good enough.

Next will be displayed categorization per respondent.

Table 4: DT waqeef perception per respondent.

Range Category Frequency Percentage

X > 39,7 Goo

d

112 72,2

24,3 X 39,7 Medium 40 25,8

X < 24,3 Bad 0 2

In Table 4 above it can be concluded that most

respondents have understood and perceived

positively to the money waqf. That is in accordance

with theory by Hasanah (1997) which states that the

low interest of public waqf due to their understanding

of the waqf is limited, so, the perception is not good

enough. In case of this research, as a Daarut Tauhiid

Waqeef, the respondents who joined in this study are

those who have done cash waqf, it is equal with the

perception of respondents who have the good

category. That is due to several factors, among others

due to the overall level of education of respondents

who have been high enough, the level of good

religiosity and liveliness in the involvement of the

activities of religious social organizations.

4.1.2 Overview of DT Waqeef Education

Level (X

1

)

The educational background will affect the formation

of perception or understanding of society because

educated people will have an open attitude towards

new information and view it objectively (Pareek,

1996). Education does not merely mean the transfer

knowledge process. Moreover, education makes

learners get used to thinking, behaving and acting,

according to scientific rules by the level of education

(Efrizon, 2008). Results of this field research

obtained data as in Figure 3 follows:

Figure 3: Waqeef DT education level.

From Figure 3 can be seen that overall the

respondents are dominated by middle and upper

educational level categories, and there are no

respondents with low education level. It may allow

respondents to have more open attitudes toward new

information including information about cash waqf

that is the result of contemporary scholars' ijtihad, but

also a high level of education allows one to have

better access to information than someone with a low

level of education.

4.1.3 Overview of DT Waqeef Religiosity

Level (X

2

)

Religious according to Islam can run the teachings of

religion as a whole. Allah says in Holy Quran chapter

Al-Baqarah verse 208:

Translate: O you who have believed, enter into

Islam completely (and perfectly) and do not follow

the footsteps of Satan. Indeed, he is to you a clear

enemy.

So, can be concluded that they are said to be

religious when they can carry out well what is

commanded in religion and stay away from what is

forbidden in religion. The results of field research

about the level of religiosity as follows.

Table 5: Assessment category of DT waqeef religiosity

level.

Range Category

X > 2273,3 Hi

g

h

1446,7 X 2273,3 Mediu

m

X < 1446,7 Low

Observed from religiosity level in praying

practice of DT Waqeef, overall is in the high category

range that reaches 2460 points. Next will be present

of category data for each respondent DT Waqeef.

Table 6: DT waqeef religiosity level per respondent.

Range Category Frequency Percentage

X > 14,7 High 114 73,5%

9,3 X 14,7 Medium 39 25,2%

X < 9,3 Low 2 1,3%

In Table 6 can be seen someone who has a high

level of religiosity is a person who always or at least

often carry out Allah's command include praying.

From the observation, the condition of religiosity

level of DT waqeef respondent concerning praying

practice is in the high category. And even if seen

from the data category per respondent, the high

3%

6%

41%

1%3%

40%

5%

1%

Education Level

Elementary

JHS

SHS/VHS

Diploma 2

Diploma 3

Bachelor

Master

Doctor

Determinant Analysis on Muslims Perception towards Cash Waqf - A Study on Waqeef in Pusbang Wakaf Daarut Tauhid

609

category reached 54%. It shows that the majority of

DT waqeef can be regarded as a good Muslim

because obedient in carrying out the command of

Allah regarding praying, especially in Shalat, fasting

Sunnah, paying infaq and reading the Qur'an.

4.1.4 Overview of Religious Social

Organization Involvement (X

3

)

The next variable that will affect the public

perception of cash waqf is the involvement of

religious social organizations. Understanding the

values, norms, and laws in society, whether related to

customary law or religious law, is not merely derived

from the educational level, often more is obtained

through the socialization process undertaken in the

society. (Ahmadi, 2007)

Table 7: Assessment category of DT waqeef religious

social organization involvement.

Ran

g

e Cate

g

or

y

X > 1705 Ver

y

Active

1085 X 1705 Mediu

m

X < 1085 Not Active

Based on Table 7, the level of Religious Social

Organizations involvement of respondents is in the

medium category due to the total score of the overall

variable of 1588 points. Thus, it can be concluded

that the level of DT Waqeef religious social

organizations involvement is in the category of

medium.

Table 8: DT waqeef religious social organization

involvement per respondent.

Ran

g

e Cate

g

or

y

Fre

q

uenc

y

Percenta

g

e

X > 12,5 Very Active 62 40%

7,5 X 12,5 Mediu

m

71 45,8%

X < 7,5 Not Active 22 14,2%

The social environment has many influences on

perceptions and social behavior. A good social

environment will bring a good impact on the life of a

person and vice versa so the discussion of cash waqf

as one of Islamic philanthropy instruments in this

research is closely related to the context of the

religious social environment. As in a Hadith narrated

by Abu Daud is mentioned as follows:

“Someone is according to the religion of his close

friend; then you should see who his close friend is”

In Table 8 can be seen that most of the DT waqeef

respondents were involved medium/quite actively in

the activities of religious social organizations. That

will allow respondents have more understanding

about cash waqf and potentially have good enough

perception.

4.1.5 Overview of Islamic Economic

Literacy (X

4

)

Someone who has a high literacy level in Islamic

economics, especially in the aspect of Islamic

philanthropy is very likely to have a good perception

of cash waqf.

Table 9: Assessment category of islamic economics

literacy level.

Range Categories

X > 6251,7 High

3978,3 X 6251,7 Mediu

m

X < 3978,3 Low

From field data results, the level of Islamic

economic literacy respondents is at 7133 points

which categorized high.

Table 10: Islamic economic literacy level per respondent.

Range Category Frequency Percentage

X > 40,3 High 137 88,4%

25,7 X 40,3 Medium 18 11,6%

X < 25,7 Low 0 0%

Table 10 shows that the level of literacy of

respondents’ DT waqeef is mostly in the high

category. This can be due to the DT waqf institution

has given an excellent education to its waqeef.

4.2 Model Conformity Test and CFA

Model Analysis

Table 11: Research model goodness of fit.

Recommendation Results

GFI 0,90 0.830

RMSEA 0.08 0.042

AGFI 0,90 0.800

NFI 0,90 0.750

TLI 0,90 0.900

CFI 0,90 0.910

IFI 0,90 0.910

RFI 0,90 0.730

PNFI 0,90 0.690

PGFI 0,90 0.710

Based on Table 11 can be seen that the value of

RMSEA is 0.042 0.08 indicates that the model is

fit, while based on other indicators the model is quite

fit.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

610

Table 12: CFA analysis.

Variables Sub

Variable

λ CR VE

Public

Perception

About Cash

Waqf

PW1 0.53 0.836 0.4

PW2 0.62

PW3 0.70

PW4 0.09

PW5 0.25

PW6 0.80

PW7 0.87

PW8 0.81

PW9 0.57

Education

Level

TP 0.07 0.005 0.005

Religiosity RE1 0.71 0.756 0.4

RE2 0.69

RE3 0.61

RE4 0.63

Organization

Involvement

OR1 0.77 0.818 0.6

OR2 0.83

OR3 0.72

Islamic

Economic

Literacy

LI1 0.15 0.281 0.1

LI2 0.81

LI3 0.06

LI4 0.11

LI5 0.15

LI6 0.18

LI7 -0.02

LI8 -0.02

LI9 0.17

LI10 0.24

LI11 0.16

Based on table 12 can be seen that most indicators

have a factor loading () 0.5 except indicator of

Islamic Economics Literacy, it shows that the

indicator on each variable is stated entirely valid.

Most CR values > 0.7 and one VE value of 0.5

indicate that each variable has sufficient reliability.

Also, can be seen from Chi-Squares values smaller

than Chi-Squares table (392,97), and P-value 0,05.

Table 13: Research model latent variable.

Variables Coefficient t-Values

Educational Level 0.07 0.79

Reli

g

iosit

y

0.23 1.7

Or

g

anization Involvement 0.08 0.63

Islamic Economic

Literacy

-0.14 -1.29

Table 13 illustrates latent variables that affect the

DT Waqeef public perception on cash waqf; all latent

variables are considered insignificant. That is

indicated by the value of t-Values inside the critical

limit of ± 1.96. This can be due to one of them by a

less specific research instrument, but mostly

individual variables are significant. The most

dominant factor as an indicator of the public

perception of cash waqf is Religiosity followed by

Islamic economic literacy. As found by Mokhtar

(2016) in his research that the factor of religiosity to

be the highest factor in influencing one's intention in

carrying out cash waqf which also affects the

perception.

5 CONCLUSIONS

The conclusion of this research is the social perception

which in this case waqeef in Daarut Tauhiid Waqf

categorized well, and most strongly influenced by the high

condition of religiosity and Islamic economic literacy of

respondent. These results indicate that to correct the

problem of misperception societies about cash waqf need

to be repaired through two ways, that is raising awareness

of religiosity of society or socialization and intensive

education information related to cash waqf through media

often used by society

.

REFERENCES

Ahmadi, A., 2007. Psikologi Sosial. Jakarta: PT. Rineka

Cipta.

Beik, A., 2015. Ekonomi Pembangunan Syariah. Bogor:

IPB Press.

Beik, I. S., 2013. Mengoptimalkan Wakaf Uang Bagi

Pengembangan UMKM. Jurnal Ekonomi Islam

Republika, 19 9, p. 23.

Effendi, M. I., 2007. Faktor-faktor yang Mempengaruhi

Persepsi Para Muzzaki BAZNAS Dompet Dhuafa untuk

Berderma Melalui Wakaf Tunai. Tesis, Jakarta:

Universitass Indonesia.

Efrizon, A., 2008. Faktor-Faktor yang Mempengaruhi

Pemahaman Masyarakat tentang Wakaf Uang. Tesis,

Jakarta: Universitas Indonesia (Tidak Diterbitkan).

Ekawaty, M., Muda, A. W., 2015. Wakaf Uang: Tingkat

Pemahaman Masyarakat and Faktor Penentunya

(Studi Masyarakat Muslim Kota Surabaya, Indonesia).

Mataram, Conference Comitee, p. 1311.

Hasanah, U., 1997. Peranan Wakaf dalam Mewujudkan

Kesejahteraan Sosial (Studi Kasus Pengelolaan Wakaf

di Jakarta Selatan). Disertasi, Jakarta: UIN Syarif

Hidayatullah.

Havita, G., Sayekti, K. A., Wafiroh, S. R., 2014. Model

Bank Wakaf Di Indonesia Dalam Potensinya Untuk

Mengembangkan Wakaf Uang Dan Mengatasi

Kemiskinan. Universitas Indonesia.

Medias, F., 2010. Wakaf Produktif dalam Perspektif

Ekonomi Islam. La_Riba, p. 69.

Determinant Analysis on Muslims Perception towards Cash Waqf - A Study on Waqeef in Pusbang Wakaf Daarut Tauhid

611

Mohsin, M. I. A., 2013. Financing through cash-waqf: a

revitalization to finance different needs. Emerald

Insight.

Mokhtar, M. Z., 2016. Perceptions of Universiti Sains

Malaysia Muslim Staff on Factors Influencing their

Intention to Perform Cash Waqf. Journal of Islamic

Studies and Culture, p. 101.

Nasution, M. E., Hasanah, U., 2005. Wakaf Uang Inovasi

Finansial Islam, Peluang dan Tantangan dalam

Mewujudkan Kesejahteraan Umat. Jakarta: PKTII-UI.

Pareek, U., 1996. Perilaku Organisasi. Jakarta: PT.

Pustaka Binaman Pressindo.

Stark, S., Chernyshenko, O. S., Drasgow, F., 2006.

Detecting Differential Item Functioning With

Confirmatory Factor Analysis and Item Response

Theory: Toward a Unified Strategy. Journal of Applied

Psychology, 91(6), pp. 1292-1306.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

612