The Influence of Investment Decision, Financing Decision, and

Dividend Policy on Firm Value

Study on Basic Industry and Chemical Sector Company Listed on Indonesian

Stock Exchange from Years 2006-2015

Hana Mardiyah, Umar Faruk and Leni Yuliyanti

Department of Accounting Education, Universitas Pendidikan Indonesia, Jl. Dr. Setiabudhi No. 229, Bandung, Indonesia

hanamardiyah12@gmail.com, umar_faruk53@yahoo.co.id, yuliyanti_leni@upi.edu

Keywords: Investment Decision, Financing Decision, Dividend Policy, Firm Value.

Abstract: This study aims to identify the influence of investment decision, financing decision, and dividend policy on

firm value in basic industries and chemicals company listed in the Indonesia Stock Exchange (IDX) years

2006-2015. In this study, the investment decision was measured with Price Earnings Ratio (PER), while

financing decision was measured by using Debt to Equity Ratio (DER), and dividend policy was calculated

by employing Dividend Payout Ratio (DPR), meanwhile the firm value in this present study was examined

by using Tobin’s Q ratio. Purposive sampling utilized to determine the sample of the study. Statistical analyses

used in this research were linier regression multiple with panel data. Based on regression significance test (F

test) showed that regression model can be used to take a conclusion. Whereas, T-test result showed that

investment decision has a positive influence on firm value, financing decision has a positive influence on firm

value and dividend policy has an influence on firm value with negative direction.

1 INTRODUCTION

The company’s goal in the long term is to maximize

firm value. Maximizing firm value is a very

important, because with increasing a firm value, the

prosperity of the shareholders will increase also. Firm

value is also seen to provide an overview of the actual

company condition and is often used as a tools to

influence investor’s perspectives on company

performance and company’s prospect in the future.

The ups and downs of firm value can be reflected

from changes the stock prices in capital market, the

higher stock price, the firm value will be higher too.

Firm value can be affected by financial decisions

taken by company managers, such as: investment

decision, financing decision, dividend policy. The

financial decisions are intended to increase the

prosperity of shareholders, which is shown by

increasing firm value (Husnan and Pudjiastuti, 2012).

In addition, the existence of financing decision

making by the company can provide a signal to

outsiders about company’s condition. The signal

sends information contained in each company’s

action, where such information was previously only

known by company’s management. Therefore, the

company must be wise and careful in determining

these financial decisions, because the decisions can

affect the firm value.

Basic industry and chemical sector is a sector that

has many roles in proving the country’s economy and

stimulate the productivity of society and become a

support in operational activities of other industries.

Therefore, if a firm value in basic industry and

chemical sector declines, it does not close the

likelihood that it could affect in other sectors.

This study aims to determine: (1) The influence of

investment decision on firm value. (2) The influence

of financing decision on firm value. (3) The influence

of dividend policy on firm value.

2 LITERATURE REVIEW

Harmono (2016) distinguishes financial management

functions into three forms of corporate policy, namely

(1) investment decision, (2) financing decision, (3)

dividend policy. A financial manager must be able to

optimize the three financial decisions to increase firm

value or shareholder’s wealth. Investment decision

related to allocation of funds owned by the firm into

Mardiyah, H., Faruk, U. and Yuliyanti, L.

The Influence of Investment Decision, Financing Decision, and Dividend Policy on Firm Value - Study on Basic Industry and Chemical Sector Company Listed on Indonesian Stock Exchange

from Years 2006-2015.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 809-813

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

809

investment project that will be able to provide

benefits for the firm. Investment decision is a very

important decision in an effort to increase the firm

value, because the investment decision has a big

influence on company’s development. With the right

investment decision, the firm can give a new

investment opportunities that give a profit to the firm,

so the firm can increase shareholder’s prosperity. In

addition, investment decision have a long-term

dimensions which can produce long-term

consequences as well later.

Financing decision is related to selected of the

right source of corporate funds that can provide

optimal results for the firm, whether internal funds

(equity) or external funds (debt). Use debt in

financing decision can reduce the tax costs that must

be borne by the firm (tax deductible) and can affect

the investor’s reaction. Investors will assume that the

company is able to fund all company’s activities and

able to increase shareholder wealth. But on the other

hand, excessive debt can reduce the firm value,

because the higher debt can increase a interest

expense and cause bankruptcy risk.

Dividend policy is a policy taken by the

company’s management to decide to pay a partly of a

company’s profit to the shareholders rather than hold

it as retained earnings to be re-invested to obtain

capital gains (Ambarwati, 2010). Dividends are

earnings received by investors in the short-term and

definitely accepted by investors, so dividend

payments can reduce the investor’s risk and can

attract investors to invest in the company.

Bird in the hand theory suggests that dividend

distributed by firms have a positive effect on stock

price and firm value, but on the other hand tax

preference theory suggests that investors prefer

companies to hold most of their profits because the

high dividends payout may result in greater tax

payments. Other than that, any dividend policy taken

by the company can affect the amount of company’s

retained earnings which will be used to fund

company’s investment activities. So in determining

the dividend policy, finance manager should be

consider the company’s re-investment opportunities.

The higher dividend can disrupt the firm expansion,

while the lower dividend can reduce investor interest

(Himawan and Cristiawan, 2016) therefore, dividend

policy should be considered appropriately.

3 HYPOTHESIS

H

1

: Investment decision has a positive influence on

firm value.

H

2

: Financing decision has a positive influence on

firm value.

H

3

: Dividend policy has a influence on firm value

4 METHODOLOGY

4.1 Research Variable and

Measurement

4.1.1 Dependent Variable

a. Firm Value

Firm value is the price that the prospective buyer

would pay if the company was sold (Husnan and

Pudjiastuti, 2012) firm value can be measured using

Tobin’s Q ratio. Tobin’s Q ratio is considered to

provide the best information in measuring firm value.

Because Tobin’s Q ratio has included all debt and

equity owned by the firm, so it can describe the ability

of the firm in managing all assets.

Tobin

'

sQ=

(EMV+D)

(

EBV+D

)

(1)

4.1.2 Independent Variable

a. Investment Decision

Investment decision are a matter of how financial

manager should allocate funds into a investment

project that will be profitable in the future (Sutrisno,

2012). Investment decision can be measured using

Price Earnings Ratio (PER). PER is used to measure

how investors assess a company growth prospect in

the future, and reflected in the stock price that

investors are willing to pay for each of the company’s

earnings (Sudana, 2011).

=

ℎ

ℎ

(2)

b. Financing Decision

The financing decision addresses the problem of how

much capital should be raised to fund the firm’s

operations (both existing and proposed), and what the

best mix of financing is (Pike and Neale, 2009). So

that a financial manager is required to determine the

best composition of company’s funds, namely funds

in the form of debt and equity. Financing decision are

measured using Debt to Equity Ratio (DER). Debt to

Equity Ratio shows a comparison between debt and

equity (Husnan and Pudjiastuti, 2012). The greater

DER value shown the greater amount of debt usage

in the company.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

810

=

(3)

c. Dividend Policy

Dividend policy is decision related a distribution

company profit, whether the profit will be distributed

to shareholders or will be retained as retained

earnings to finance future investment (Sartono,

2010). Dividend policy is measured using Dividend

Payout Ratio (DPR). With using Dividend Payout

Ratio can be known percentage of company earnings

are distributed as dividend and retained as retained

earnings.

=

ℎ

ℎ

(4)

4.2 Population and Sample

In this research, the data used a secondary data from

Indonesia Stock Exchange (IDX) and ICMD.

Population in this research is a company in basic

industry and chemical sector. The sample is chosen

using purposive sampling method with the following

characteristics: (1) basic industry and chemical

company listing on Indonesia Stock Exchange on

December 31, 2015, (2) published company financial

report during 2006-2015 period and present it in

Rupiah currency, (3) paid dividends at least once

during 2006-2015 period.

4.3 Analysis Technique

To know the influence of each independent variable

to dependent variable used multiple linier regression

analysis with panel data. The analysis is conducted to

determine the extent of influence given by

independent variable to dependent variable if a

number of independent variable more than one

variable. This study was conducted using panel data.

The linear regression equation in this model are:

Q = β

0

+ β

1i

t

PER + β

2i

t

DER + β

3i

t

DPR + ε

i

t

(5)

5 RESULTS

Pursuant to purposive sampling criterion, obtained

the research sample counted 25 company, but 15

company have outliers data, so amount of research

sample become ten company. After eliminating

outliers data, research data has been problems of

autocorrelation. Therefore it is necessary to heal by

using the first difference method.

Panel data model selection used by Chow Test and

Lagrange Multiplier Test. Common effect model

(pooled least square) was selected as estimation

model.

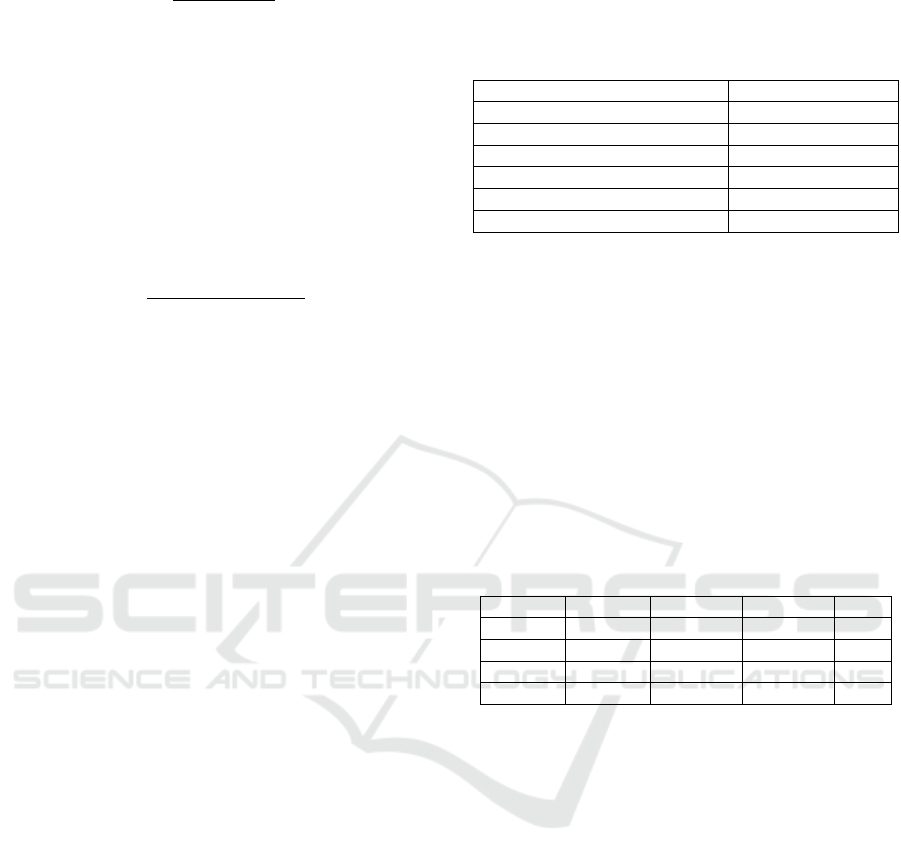

Table 1: Calculating Result of F-test.

R-square

d

0.969508

Adjusted R-square

d

0.968444

S.E. of re

g

ression 0.294972

Sum s

q

uared resi

d

7.482725

Lo

g

likelihoo

d

-15.77990

F-statistic 911.4744

Prob (F-statistic) 0.000000

Source: Output Eviews 9

Based on the result of data processing in Table 1,

it’s known that the F-statistic value is 911.4744 with

significance level 0.0000. F-table at df numerator = 3

and df denominator = 86 with α = 5% is 2.71, so F-

statistic > F-table and significance level < 0.05, it can

be concluded that means of regression, so the

equation model can used to make inferences about the

effect of investment decision, financing decision, and

dividend policy on firm value. R-squared value is

0.969508 shows that 96.95% of firm value is

influenced by independent variables in the model.

Table 2: Multiple Regression of Panel Data Analysis

Result.

Variable Coefficient Std. Erro

r

t-Statistic Prob.

C -0.031372 0.031115 -1.008260 0.3162

D

(

PER

)

0.992241 0.374248 2.651289 0.0095

D(DER) 0.371385 0.007110 52.23166 0.0000

D(DPR) -0.036038 0.008445 -4.267418 0.0001

Source: Output Eviews 9

5.1 The Influence of Investment

Decision on Firm Value

The result of regression analysis shows the value of t-

statistic of investment decision of 2.65 > t-table

1.66277 with significance level 0.0095. The value of

t-statistic > t-table, then Hypothesis 1 accepted,

investment decision has a positive influence in firm

value. Investment decision have a coefficient of

0.992241 on firm value, so if the investment decision

increases by one unit, then firm value will also

increases by 0.992241 units.

The influence of investment decision on firm

value is the result of the investment activity itself.

This is because every investment decision taken by

the company can determine company’s obtained

profit and show the optimal performance. Investment

decisions are very important, because the mistake in

investment selection can disrupt company’s

sustainability. Therefore, financial managers must

The Influence of Investment Decision, Financing Decision, and Dividend Policy on Firm Value - Study on Basic Industry and Chemical

Sector Company Listed on Indonesian Stock Exchange from Years 2006-2015

811

maintain corporate investment development to

achieve corporate objectives.

In addition, the existence of investment

expenditure by the company can provide a positive

signal (good news) for investors, that the company

has good revenue growth in the future and can

increase the shareholder’s prosperity. This makes

investors more interested and trust with company’s

prospect, so that investors more appreciate the value

of the company’s stock and firm value will be higher.

The results of this study support previous research

conducted by Mursalim et al. (2015), Efni et al.

(2012), Prapaska and Muthmainah (2012), Clementin

and Priyadi (2016), Wijaya et al. (2010), Alipudin et

al. (2014) which state that investment decision have a

positive influence on firm value.

5.2 The Influence of Financing

Decision on Firm Value

Financing decision variable has t-statistic is 52.23166

with significance level 0.0000. the t-statistic value >

t-table is 1,66277, then hypothesis 2 is accepted, so

the financing decision has a positive influence on firm

value. The financing decision has a coefficient of

0.371385, meaning that if the financing decision

increases by one unit, then firm value will increases

by 0.371385 units.

The positive influence of financing decision on

firm value is suspected by debt usage can be used as

a deduction of tax payment. In addition, high debt

usage is a positive signal for investors that the

company is able to fund all of its investment activities

and expected to improve the company’s prospects and

be able to pay its obligations to shareholders, so that

the prosperity of shareholders or firm value increases.

In trade-off theory, using debt can increase firm

value to a certain optimum point, but if the amount of

debt has exceeded the optimum point then the debt

can reduce firm value. Based on the results of this

research and trade off theory, it can be seen that

financing decision applied by the average company of

basic industry and chemical sector has not reached its

optimum point, so that financing decision on the basic

industry and chemical sector has a positive influence

on the firm value. The results of this study support

previous research by Wijaya et al. (2010), Hoque et

al. (2014), Mursalim et al. (2015), Himawan and

Cristiawan (2016), Chowdhury and Chowdhury

(2010), Efni et al. (2012) and Rehman (2016) which

states that financing decision has a positive influence

on firm value.

5.3 The Influence of Dividend Policy on

Firm Value

Dividend policy variable has t-statistic of -4.267418

with significance level 0.0001. The significance level

< α 0.05 then hypothesis 3 is accepted, so dividend

policy has an influence on firm value, but the

influence indicates a negative effect. Dividend policy

has a negative coefficient of -0.036038 it means that

if the dividend policy increases by one unit, then firm

value will decreas by 0.036038 units.

The negative influence in dividend policy variable

is assumed that the high dividend payout can cause

the less amount of retained earnings. It may cause the

company have insufficient funds experience to

funding its investment and operational activities in

the future. Increased dividends can be bad news

because it is suspected that the company has reduced

its investment plant which will subsequently affect

the investor’s perspective on firm value (Haruman,

2008). Investors assume that the greater dividends are

distributed to shareholders, the growth of investment

will be hampered and can lower firm value. In

addition, the tax preference theory states that

investors prefer if the company retained the profits,

because dividend income is taxed higher than capital

gains and the capital gain can make investors delay

the payment of taxes, because the tax of capital gains

will be collected if the shares are sold, but the tax of

dividend must be paid when the dividend is

distributed.

Dividend policy in one side may reduce investor

risk, but in other side a higher dividend policy can

reduce the amount of retained earnings. The result of

this study support previous research by Clementin

and Priyadi (2016) and Haruman (2008) which states

that the dividend policy has an influence on firm

value with a negative influence.

6 CONCLUSIONS

Based on the results in this research, it can be made

the following conclusions: (1) Investment decisions

has a positive influence on firm value. (2) Financing

decision has a positive influence on firm value. (3)

Dividend policy has an influence on firm value with

a negative direction. Further research is suggested to

examine other sectors or use different analytical

techniques and consider external factors that may

affect firm value, such as interest rates, inflation rate,

currency exchange rate, and others as an independent

variable.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

812

REFERENCES

Alipudin, A., and Hidayat, N., 2014. Investment Decision,

Financing, Dividend Policy and Price to Book Value of

Mining Companies in Indonesia Stock Exchange.

Journal of Accounting Research and Taxation JRAP.

Vol. 1. No. 1 ISSN 2339-1545, 48-59.

Ambarwati, 2010. Finance Management Continuation,

Graha Ilmu. Yogyakarta.

Chowdhury, A., Chowdhury, S. P., 2010. Impact Of Capital

Structure On Firm Value : Evidence From Bangladesh.

Business and Economic Horizon. Vol.3 Issue 3, 111-

122.

Clementin, F. S., Priyadi, M. P., 2016. Influence of

Investment Decision, Funding, Dividend Policy and

Profitability on Company Value. Journal of Accounting

Science and Research. Volume 5, No.4 ISSN: 2460-

0585, 1-16.

Efni, Y., Hadiwidjojo, D., Salim, U., Rahayu, M., 2012.

Investment Decision, Financing Decision, Dividend

Policy: The effect on Firm Value (Studies on Property

and Real Estate Sector in Indonesia Stock Exchange).

Journal of Application Manajement. Vol. 10 No. 1

ISSN 1693-5241, 128-141.

Harmono, 2016. Financial Management: Based Balanced

Scorecard Theory, Cases, and Bussiness Riset

Approach, Bumi Aksara. Jakarta.

Haruman, T., 2008. Ownership Structure, Financial

Decision and Corporate Value . Journal of Finance and

Banking. Volume 10, No. 2, ISSN 1410-8623, 150-166.

Himawan, M. R., Christiawan, Y. J., 2016. Influence of

Investment Decision, Funding Decision, and Dividend

Policy on Company Value on Manufaktur Sector in

Indonesia. Businiess Accounting Review. Vol. 4 No. 1,

193-204.

Hoque, J., Hossain, A., Hossain, K., 2014. Impact of

Capital Structure Policy on Value of The Firm - A study

On Some Selected Corporate Manufacturing Firms

Under Dhaka Stock Exchange. Ecoforum. Vol. 3, Issue

2 (5), 77-84.

Husnan, S., Pudjiastuti, E., 2012. Basic on Financial

Management, UPP STIM YKPN. Yogyakarta.

Mursalim, Hendragunawan, Nur, A. A. S., 2015. Financial

Decision, Innovation, Profitability and Company

Value: Study on Manufacturing Company Listed in

Indonesian Stock Exchange. Information Management

and Business Review. Vol. 7, No.2 ISSN 2220-3796,

72-78.

Pike, R., Neale, B. (2009). CORPORATE FINANCE AND

INVESTMENT Decisions and Strategies, Pearson

Education Limited. Harlow,

6th

edition.

Prapaska, J. R., Mutmainah, S., 2012. Analyzed the Effect

of Profitability Level, Investment Decision, Financing

Decision, and Dividend Policy on Firm Value on

Manufacturing Company in BEI Year 2009-2010.

Diponegoro Journal of Accounting. Vol. 1 No. 1, 1-12.

Rehman, O. U., 2016. Impact of Capital Structure and

Dividend Policy on Firm Value. Journal of Poverty,

Investment and Development. ISSN 2422-846X An

International Peer-review Journal Vol. 21 , 40-48.

Sartono, A., 2010. Financial Management Theory and

Application, BPFE. Yogyakarta.

Sudana, I. M., 2011. Financial Management Theory and

Practice, Erlangga. Jakarta.

Sutrisno, 2012. Financial Management Theory, Concepts

and Applications, Ekonisia. Yogyakarta.

Wijaya, L. R., Bandi, Wibawa, A., 2010. Influence of

Investment Decision, Financing Decision, and

Dividend Policy on Firm Value. National Symposium

of Accounting XIII (SNA XIII) (pp. 1-21). Purwokerto:

General Soedirman University of Purwokerto.

The Influence of Investment Decision, Financing Decision, and Dividend Policy on Firm Value - Study on Basic Industry and Chemical

Sector Company Listed on Indonesian Stock Exchange from Years 2006-2015

813