A Comparative Analysis of Current Cryptocurrencies

Lara Mauri

1

, Stelvio Cimato

1

and Ernesto Damiani

2

1

Computer Science Department, Università degli Studi di Milano, via Bramante 65, Crema (CR) – 26013, Italy

2

EBTIC Laboratory, Khalifa University, Abu Dhabi Campus, PO Box 127788, Abu Dhabi, U.A.E.

Keywords: Cryptographic Protocol, Blockchain, Bitcoin, Ethereum, Ripple.

Abstract: Blockchain technology is having a deep impact on the financial and technical sectors providing a mechanism

for the creation of decentralized currencies and a number of applications in different fields. At the core of the

technology there is a consensus protocol enabling the maintenance of a distributed ledger. In general current

systems are complex schemes that implement a combination of cryptographic algorithm, distributed

techniques, and incentive driven behaviour. In this paper we focus on three of the most diffused platforms,

i.e. Bitcoin, Ripple, and Ethereum, and provide a comparative analysis of their most important features such

as the architecture, the scripting language, the economic and security properties.

1 INTRODUCTION

Digital currencies such as Bitcoin (Nakamoto, 2008)

have pioneered a new approach to tracking financial

transactions. Bitcoin’s breakthrough was to combine

existing techniques (distributed ledgers, public-key

encryption, consensus protocols, Merkle tree

hashing) in an innovative way. The underlying

blockchain architecture is essentially a type of

distributed ledger, i.e. a digital record of ownership

maintained on a distributed network of computers.

The identical copies of the digital ledger (a

continuously growing list of transaction records) are

shared among the network participants and updated

automatically every time a new transaction occurs.

Since additions to the ledger are decided on a

consensus basis by multiple entities, once a

transaction is entered in the blockchain, the record is

immutable and therefore provides an auditable

history of events that cannot be modified. In addition,

blockchain is censorship resistant, which means that

no actor can prevent a legitimate transaction from

being added to the ledger; the integrity of the ledger

is maintained by reaching a consensus about its state.

Ledgers are the basic consensus technology of

transaction at the heart of all modern business models.

The traditional approach to certify the correctness of

transactions requires complete reliance upon a single

centralized authority with formal responsibility over

the system. On the contrary, the blockchain

architecture acts as an alternative value transfer

system that breaks the paradigm of centralized

consensus by using a ledger replicated among

different nodes in a peer-to-peer network. Such

decentralized scheme represents a completely new

means of forming consensus reliably across time.

Moreover, unlike highly centralised systems in which

there is a single point of failure, the blockchain design

does not need to rely on a trusted third party thus

eliminating the risks that come with data being held

centrally. Indeed, the system is designed so that it is

maintained collaboratively by the decentralised

network of nodes that can initiate direct transactions

of data.

Distributed ledgers are highly efficient because

authorized ledger changes are immediately reflected

in all copies of the record. Also, changes by

participants without the necessary permission to

modify the blockchain are rejected, so corrupting the

ledger is extremely difficult. Although distributed

ledger technology (DLT) was created to allow a

global network to securely transact and exchange

value without the need for a third-party organization

in the middle, firms and other institutions are now

actively exploring the practical applications for

blockchain technology beyond the financial world

(Swan, 2015), particularly in the areas of health,

science, government, culture and art. Thanks to their

immutable nature and processing capability, these

digital technologies can be applied to a wide range of

industries and services and thus facilitate the grow of

a sharing economy.

Contribution In this paper, we study the broad field

of DLT. We provide a comparative analysis across

Mauri, L., Cimato, S. and Damiani, E.

A Comparative Analysis of Current Cryptocurrencies .

DOI: 10.5220/0006648801270138

In Proceedings of the 4th International Conference on Information Systems Security and Privacy (ICISSP 2018), pages 127-138

ISBN: 978-989-758-282-0

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

127

the most widely diffused platforms, and specifically,

we scrutinize the design of Bitcoin, Ethereum and

Ripple, with the intent of pointing out the differences

in strategies adopted by them. We devote particular

attention to implementing choices, functionalities and

related concepts. More in details: in Section 2 we

consider the alternatives in types of membership

allowed by the models, along with other components.

Then, in Section 3 we stress the role of blockchain in

the actualization of a structural change in the

economy. Section 4 analyzes the consensus models

used by the different protocols. Section 5 describes

the scripting features, followed by an inspection of

some peculiarities of the platforms in Section 6. A

discussion on some security aspects is presented in

Section 7 while we draw some final conclusions in

Section 8.

2 BLOCKCHAIN BASED

SYSTEMS

The Bitcoin cryptographic currency first popularized

the concept of blockchain. Up until Bitcoin and its

distributed globally-shared ledger was invented,

digital assets were entirely managed by centralized

authorities keeping track of all transactions (BitFury

Group, 2016). In blockchain-based architectures, the

lack of a central entity who exercises concurrency

control over the system has shifted this responsibility

to a whole network providing a new way of mitigating

the risks associated with traditional systems.

Since the emergence of Bitcoin protocol, various

distributed consensus models have been proposed

with novel means of establishing consensus between

parties and divergent areas of focus.

Ethereum is one of the most prominent second-

generation blockchain technology, whose intent is to

create a new model for building decentralized

applications (Buterin, 2014a). The protocol is based

on a combination of virtual machines and stack-based

architecture, featuring a Turing-complete scripting

language, which opens the doors to a hypothetically

unlimited range of applications.

Even though the term “blockchain technology” is

often treated as a synonym for DLT, blockchain

represents one specific type of distributed ledger in

which blocks of transactional data are linked to one

another with data integrity maintained by

cryptography. Consensus ledgers are one of the other

possible structures that can be used to implement

DLT arrangements and Ripple (Schwartz et al, 2014),

in particular, is a type of consensus-oriented

distributed database which targets financial use cases.

This system is not a blockchain technology, since

transactions are not added in the form of blocks that

are hash chained to each other. However, similarly to

the block-oriented consensus models, the Ripple

network updates the ledger through a consensus

process between nodes.

2.1 Models and Structural Features

The decentralized paradigm, on which the blockchain

technology is based, transfers authority and trust to a

network open to all and enables its nodes to transact

with varying degrees of control of the ledger. As the

technology matured, development efforts by financial

institutions have made it possible to adapt this

paradigm to existing contexts in which data is not

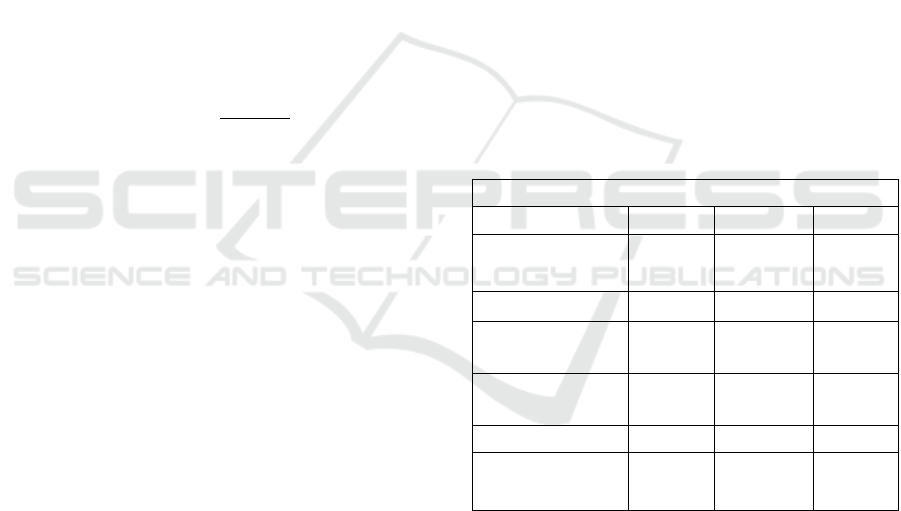

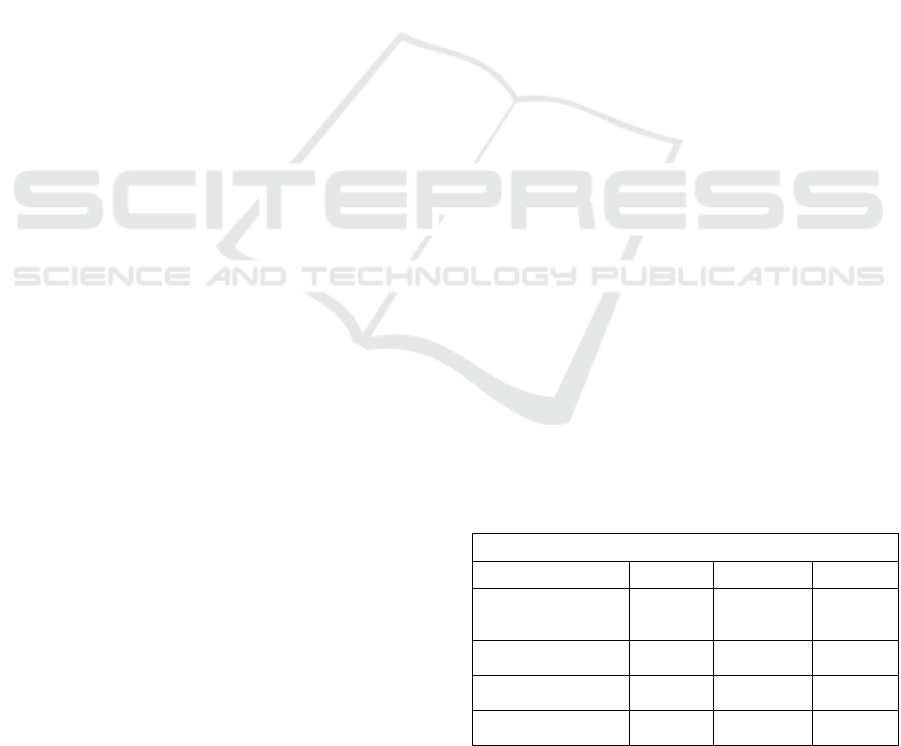

completely transparent. Table 1 outlines the types of

membership governing each model, as well as

information related to transaction processing and data

structure used to efficiently verify the integrity of all

the transactions.

Table 1: Compared analysis of the architecture for the three

platforms. Symbols: ‘✓’ means that the protocol has the

feature and ‘’ that it has not.

Blockchain-based systems

Bitcoin

Ethereum

Ripple

Permissioned (1) /

Permissionless (2)

(2)

(2)

(1)

Public / Private

Public

Public

Public

Trade history

recorded

✓

✓

✓

Data structure

Merkle

tree

Patricia

tree

Merkle

tree

Notion of account

✓

✓

Multiple senders

and receivers

✓

✓

Depending on whether or not the network nodes are

required to authenticate themselves to participate in

the voting process, two main categories of blockchain

are distinguished: permissionless blockchain and

permissioned blockchain. The former is a distributed

consensus ledger in which no authorization is

required to perform transaction processing. There are

no restrictions on identities of nodes which act as

verifiers and thus anybody can join the network to

become a participant in the consensus process as well

as create blocks of transactions. Bitcoin and

Ethereum are open-ended systems and consequently,

any node can take part in the consensus process to

ICISSP 2018 - 4th International Conference on Information Systems Security and Privacy

128

advance the blockchain. Ripple takes a different

direction and relies on a permissioned setup. Here

only entities belonging to a predefined list of subjects

with known identities can become a verifier in the

system. Indeed, Ripple requires each node to define a

Unique Node List (UNL), which is a set of trusted

authorities. During the process execution, validating

servers vote on the validity of all transactions

received, and each of them consult its list of chosen

validators in order to reach consensus. Since

validators are preselected by an authority, all the

participants in the protocol are known and trusted,

meaning that they are also accountable according to

laws. Permissioned blockchains are based on trust

models and therefore, they better comply with

existing regulations, where only trusted members are

allowed to participate in the consensus; this

configuration maintains compatibility with the

traditional finance setting, but at the cost of reduced

censorship-resistance. Transaction processing is

performed in a more controlled setting, which

operates in an inherently biased way. This exposes the

system to dishonest behaviours by users who might

be involved in fraudulent activities.

Instead, permissionless systems minimize human

factor by replacing it with rigorous approaches, which

are enforced automatically, thereby eliminating trust

involved in interaction between parties and associated

vulnerabilities.

According to (BitFury Group and Garzik, 2015),

there is a second categorization of blockchain types

that is based on the access to the ledger data itself:

public blockchain and private blockchain. In public

blockchains, including Bitcoin and Ethereum, all

records are publicly transparent. Everyone can

participate in the process for determining the next

block to be inserted into the chain as well as read

transactions. This type of blockchain is considered

fully decentralized. At the other end of the spectrum,

private blockchains rely on the model of user rights,

where the possibility to read or modify the blockchain

data is restricted to entities within an organisation.

Since write permissions are kept centralized to one

organization, this configuration could be defined as a

traditional centralized network. However, there are

nuances to the private model concept depending on

the underlying degree of control. For example, since

Ripple is built with a public-based architecture, it is

technically a public system. Nevertheless, it can be

understood as an intermediate model between the

public and the private one because of its closed and

monitored nature. Regardless of the type of allowed

membership, one of the main benefits offered by

distributed ledger technologies is that any asset

referenced in a transaction is traceable through the

blockchain up until its creation. Bitcoin and other

systems which extend on its innovations keep an

updated record of all the transactions that ever

occurred in the history of the network. Ethereum also

has the property that every block contains a copy of

both the transaction list and the current state of its

network. To be more precise, the state is not directly

stored in each block; every block header contains

only the state root, i.e. the root hash of an evolved

Merkle tree, called Patricia tree, that stores the entire

state of the system. These trees record key/value

bindings, where the keys are addresses and the values

consist of account declarations, and boost efficiency

by introducing some modifications to the data

structure (Ethereum Wiki (b)). In addition to the state

root, every block header in Ethereum contains two

other roots related to transactions and receipts

respectively. The property such that each block can

use the root hash of the Patricia tree to refer to the

entire tree is particularly useful when the difference

of state between two blocks is fairly small because

unchanged data of the tree can be simply referenced

without the need to store them twice.

As previously mentioned, Patricia trees are

specialized kind of Merkle trees. The original

application of Merkle proofs introduced in Bitcoin

provides a very efficient process to verify whether a

transaction is part of a block (Antonopoulos, 2014).

Each header block includes the Merkle root, which is

the hash of all the hashes of all the transactions in the

block. The efficiency of Merkle trees is leveraged by

the simplified payment verification (SPV), which

allows light clients to verify that a transaction has

been accepted by the network by downloading just

the chain of block headers, instead of downloading

the entire blockchain. However, since SPV nodes do

not have all transactions and do not download full

blocks, they can prove that a particular transaction is

included in a block, but cannot prove anything about

the current state (Buterin, 2015).

Multi-level data structures represent also an

important scalability feature of the Ripple protocol.

The Ripple ledger chain is similar to the blockchain

architecture. Every ledger is meant as a notional

structure that consists of a previous ledger, a

transaction tree (containing the transactions that have

taken place since the previous ledger) and a state tree

(showing all the account balances, settings, etc.)

(Ripple Labs). So, in contrast to blockchain, each

Ripple ledger contains only the transactions that

created the current ledger from the previous one,

rather than the entire transaction history. This means

that the ledger chain stores all transactions, so it is

A Comparative Analysis of Current Cryptocurrencies

129

possible to rebuild the trade history and confirm the

results of a specific transaction, but the information

that a node needs to store to serve in a fully functional

way is reduced to just the last ledger state.

Ripple users are equipped with a pair of

signing/verification keys to securely send

transactions. Any proposed change to the shared

global ledger, i.e. every transaction, is signed with the

private key of the wallet owner and the corresponding

public key is included in the transaction. The ECDSA

algorithm is the basis for its public key cryptography

and Ripple uses the same elliptic curve specifications

as in Bitcoin except for a different leading byte in the

address format. Unlike Bitcoin and Ethereum, the

current Ripple system only supports transactions

involving a single sender and a single receiver.

Recently, Moreno-Sanchez et al (Moreno-Sanchez et

al, 2017) proposed a protocol called PathJoin,

providing an innovative combination of the

functionality of Ripple protocol and a distributed

threshold signature scheme that overcomes this

limitation and performs atomic transactions.

Instead of explicitly have user identification, the

Bitcoin system uses public key security in which

bitcoins are linked to public keys through unspent

transaction outputs (UTXOs). The UTXO model

requires that each transaction input has a referral to

the output of a previous transaction and the concept

of user balance is a derived construct created by the

cumulative amount of unspent bitcoins associated

with the corresponding public key of the user.

So, the Bitcoin format of transaction implies that the

concepts of accounts and balances are essentially

defined as states of ownership. This peculiarity

cannot be found in the Ethereum ecosystem, in which,

on the contrary, there is a built-in notion of higher-

level concepts such as accounts. In particular,

Ethereum manages two types of accounts: externally

owned accounts (EOAs) and contract accounts.

The externally owned account defines the basic form

of account, which is controlled by a private key and

akin to the abstract concept of Bitcoin accounts.

EOAs have no code and are directly controlled by real

human beings; therefore, the simple ownership of the

private key associated with an EOA gives the ability

to send ether (Ethereum’s intrinsic currency) and

messages from it.

In contrast, contract accounts, on the other hand, are

controlled entirely by code and their code is executed

whenever they receive instructions in the form of a

transaction from an EOA

.

3 ECONOMICS

Unlike traditional payment systems, which typically

involve the transfer of funds denominated in a

sovereign currency, Bitcoin has its own unit of

account called bitcoin. In essence, blockchain-based

assets could be classified as bearer assets, i.e. the

ownership of an asset amounts to nothing more than

the knowledge of the corresponding private key.

Bitcoins are native tokens with no reference to any

underlying commodity and for this reason they have

no intrinsic value (Murphy et al, 2015); they have no

physical form and their supply is not determined by a

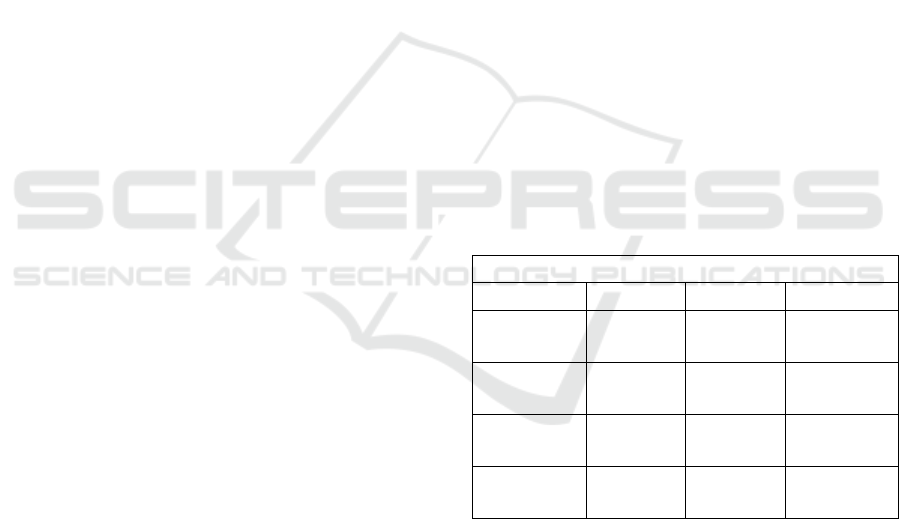

central bank. As shown in Table 2, currently, about

17 million BTC are in circulation (CoinMarketCap).

However, the Bitcoin monetary policy is based on

artificial scarcity, i.e. bitcoins are created in such a

way that their numbers are inherently scarce. As it

stands now, the total value of Bitcoin currency units

in circulation represents 79% of the total coins that

will be produced. Indeed, the supply of bitcoins is

programmed to grow at a steady rate and the total

amount of BTC that can be created is capped at 21

million, which is predicted to be reached in

approximately 2140.

Table 2: Compared analysis of the economic features for

the three platforms. Symbols: ‘✓’ means that the protocol

has the feature and ‘’ that it has not.

Economics

Bitcoin

Ethereum

Ripple

Native

currency

BTC

ETH

XRP

Circulating

supply

16,684,58

7 BTC

95,779,68

1 ETH

38,622,892,

459 XRP

Maximum

supply

21 million

BTC

100 billion

XRP

Deflationary

nature

✓

✓

The finite monetary base is a clear indication of the

fact that the currency has an inherent tendency to be

deflationary. Since in Ripple the number of XRP

(Ripple’s native currency) starts off at an all-time

maximum of 100 billion, its ecosystem has the same

deflationary behaviour. However, while the Bitcoin

network creates new bitcoins through the mining

process and the number of BTC in circulation

increases more and more slowly as time passes (until

eventually stabilizing at the permanent amount of 21

million), Ripple has no fair mechanism for coin

introduction into the network. As a result, XRP is

ICISSP 2018 - 4th International Conference on Information Systems Security and Privacy

130

designed to be a scarce asset and its supply decreases

each time a transaction fee is paid; to date, there are

about 39 billion XRP in existence available to the

public (CoinMarketCap). Another important

component of the Ripple network to consider is the

fact that it natively supports cross-currency payments,

thereby allowing parties to transact in the currency

they desire. Therefore, it does not only promise to

facilitate the exchange between currencies within its

network, but also aims to be integrated with existing

financial infrastructures, becoming a bridge between

traditional banking and emerging electronic payment

mechanisms (Rosner and Kang, 2016; Swanson,

2015).

Currently there are many industry leaders evaluating

blockchain technology and almost every major

financial market institution in the world is doing DLT

research. Banks and financial market leaders are

adopting blockchain solutions dramatically faster

than initially expected. Two market study reports

from the IBM Institute for Business Value (Bear et

al., 2016a, 2016b) found that in 2017, 14% of finan-

cial markets institutions and 15% of banks expect to

have blockchains in production and at commercial

scale. According to the studies, more than 70% of

these early adopters are prioritizing blockchain

efforts in order to change the role of hierarchies and

trust. By replacing top-down control with distributed

consensus, blockchains are seen as a means to create

new business models and access new markets.

Ethereum (the second platform for market

capitalization, after Bitcoin) represents one of the

most exciting ongoing developments in the

blockchain scenario (Davidson et al, 2016). Ether

(Ethereum’s value token), is meant as a system

resource needed to execute smart contracts, i.e. the

mechanism carrying out the direct exchange of values

between untrusted parties. Unlike the other two

protocols, Ethereum has infinite monetary base,

meaning there is no hard limit for this particular coin;

the issuance of ether occurs at a constant annual linear

rate via the mining process, but the rate of growth of

the supply is not constant. The amount of ether

available at the present time and circulating in the

market is roughly 96 million (CoinMarketCap).

4 CONSENSUS MECHANISMS

Blockchain technology enables entities to transact

directly even though they do not trust each other,

without the need to send proposed transactions to a

centralized third-party acting as a trusted

intermediary. In contrast to traditional centralized

systems, participants collectively maintain the

common shared ledger in a decentralized fashion

allowing a faster reconciliation between transacting

parties. Each node keeps an individual copy of the

blockchain, whose state is updated as newly-mined

blocks are added. However, nodes may have

completely inconsistent view of data recorded on the

blockchain due to the divergent order in which

transactions are listed in the replicas. Therefore,

participants need to coordinate among each other in

order to determine the legitimate ledger and guarantee

the consistency of the system across all nodes.

Achieving consensus in a distributed setting is not a

trivial task due to the strong dynamism of the system

and the numerous actors involved. In addition, the

network has to be able to operate properly even in the

presence of malicious nodes that can cause Byzantine

faults. These failures were first identified and

described by (Lamport et al., 1982) as the Byzantine

General’s Problem. The original problem description

characterizes the case of a group of generals, each

commanding a portion of an army, trying to formulate

a common plan of action for attacking the surrounded

enemy city. Generals communicate only through

messengers to reach a mutual agreement. However,

some generals might be traitors and hence have the

potential motivation to lie and distort messages (such

an adversarial environment is comparable to the

situation of a distributed system).

From a general perspective, one of Bitcoin’s main

contribution is a solution to this problem by means of

a consensus mechanism that safeguards the stability

of the network. The consensus method enforces a

temporal and unambiguous ordering of transactions

in the system, thereby ensuring a unique authoritative

view of the world state. Proof-of-Work (PoW) is the

mechanism introduced by Bitcoin to reach a

consensus on the distributed shared state. In essence,

the algorithm requires each node to show that it has

performed some amount of work in order for a set of

new transactions (block) to be accepted by the

network members. The PoW consists in the search for

a specific hash digest that is less than a certain

difficulty level fixed by the system. The idea behind

proof-of-work is simple and involves repeatedly

hashing the header of the newly formed block, which

the participant is wishing to publish, together with a

nonce until a solution with desirable properties

emerges; practically, the goal is to find a hash starting

with a certain number of zero-bits. Since the next

block always includes the PoW hash of the last mined

block, the structure resulting from the consensus

process is a hash chain which grows incrementally

(hence the name of blockchain).

A Comparative Analysis of Current Cryptocurrencies

131

Bitcoin’s PoW scheme laid the theoretical foundation

for modern consensus models and new ones are still

emerging providing innovative functions and

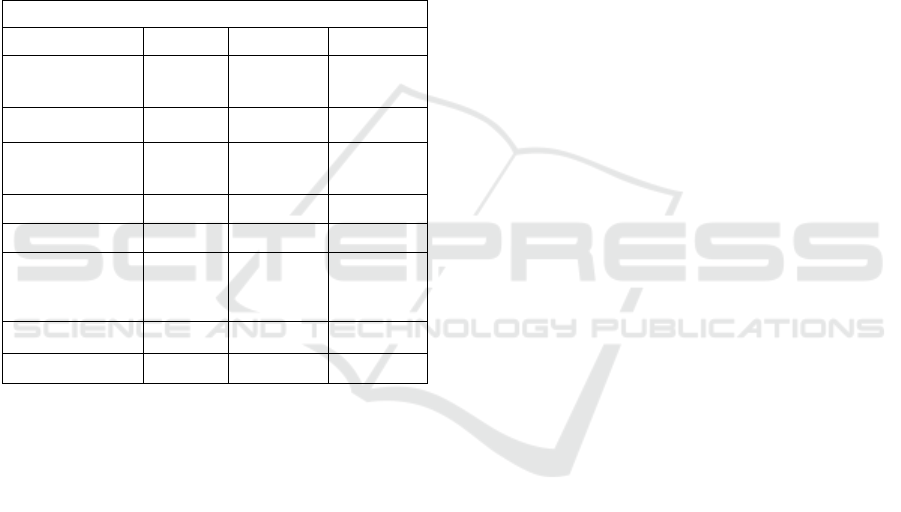

properties (Cachin and Vukolić, 2017). As Table 3

outlines, Ethereum currently proposes Ethash as its

specific proof-of-work algorithm (Ethereum Wiki

(a)). It requires to randomly create a dataset

(initialized by the current blockchain length), which

forms a DAG (directed acyclic graph) and then

attempt to solve a specific constraint on it. Each

Ethereum client has to generate the DAG, which is

regenerated every epoch, i.e. every 30000 blocks.

Table 3: Compared analysis of the consensus models for the

three platforms. Symbols: ‘✓’ means that the protocol has

the feature and ‘’ that it has not.

Consensus mechanisms

Bitcoin

Ethereum

Ripple

Verification

method

PoW

PoW

(Ethash)

Consensus

Involved nodes

All

All

Validators

Hash algorithm

SHA-

256

Keccak-

256

SHA-

512Half

Bock time

10 min

~14 sec

5-10 sec

Transaction rate

Low

Low

High

Probabilistic

transaction

finality

✓

✓

Mining reward

✓

✓

Transaction fee

✓

✓

✓

Although the proof used in Ethereum is similar to

Bitcoin PoW protocol, the point in Ethash is that it

uses a different cryptographic primitive for its

hashing function, called Keccak-256 (a variant of the

FIPS 202 based standard (SHA-3) (FIPS 202, 2015),

instead of relying on the double SHA-256 hash

algorithm.

Proof-of-work represents the technique commonly

used for achieving fault tolerance in a distributed

system. However, there are models that use a

different approach to demonstrate consistency of

transactions. Among them, Ripple is a current

application of Byzantine agreement which opted for

a voting scheme in order to advance the state of the

shared ledger. It implements a round-based process

called consensus, whose objective is to make it

possible for all the nodes to agree on which

transactions to include in the last closure of the

ledger. A crucial aspect of this protocol is the fact that

only a group of nodes can participate in advancing the

ledger, thus acting as validating servers, and the

system is based on trust relationships, since each

server only considers the proposals from the nodes in

its UNL. In an iterative process, validators vote on the

validity of transactions received and the ledger is

finalized when a super-majority of 80% of votes from

servers in the UNL is reached. After a consensus

round completes, validating servers calculate a new

version of the ledger and transmit their results to the

network. In particular, they publish a signed hash of

the ledger, called validation, whose purpose is to

ensure that all participants derive the same ledger.

The hash function used in Ripple is known as SHA-

512Half. It provides a hash value that is calculated by

applying SHA-512 to some contents; then the result

is truncated to the first 256 bytes. Since in Ripple

there is no process of solving the proof-of-work

cryptographic puzzle, consensus is fast and ledgers

are validated in seconds. As a new ledger is closed

approximately every 5 seconds, Ripple takes on

average from 5 to 10 seconds to confirm a transaction.

This is significantly different from Bitcoin block

time. Indeed, a new block is generated roughly every

10 minutes. The Ethereum network, by comparison,

produces a block every 14 seconds on average.

One of the important factors that requires close

attention when evaluating a blockchain platform is

perhaps the transaction finality (Buterin, 2016). This

criterion indicates whether a transaction included in

the blockchain is truly finalized, i.e. there is no way

to revert that operation. Typically, decentralized

systems provide this property probabilistically.

Because blocks are calculated in a distributed setting,

two independent nodes can discover a new block and

broadcast it almost simultaneously. This leads to the

creation of a temporary fork, an occurrence that can

be exploited by a malicious node to intentionally

cause a reorganization in the ordering of transactions.

Even though Bitcoin solves this problem by requiring

that users accept the longest branch (i.e. the branch

involving the highest amount of computational effort)

as the true one, in practice, there is no system that

offers truly complete finality. However, a user can

consider a transaction practically final by means of

the number of confirmations, which represent the

blocks depth. In the specific case of Bitcoin,

transactions are confirmed after the generation of six

consecutive blocks and hence, a payment is

confirmed after one hour on average. As a result, in

systems operating in the same way as Bitcoin,

transaction finality is a probabilistic concept that is

heavily dependent on the waiting time required by a

transaction before being considered as confirmed and

then final. Both Bitcoin and Ethereum are incapable

of dealing with high transaction rates because of such

ICISSP 2018 - 4th International Conference on Information Systems Security and Privacy

132

a slow transaction confirmation mechanism. Ripple,

conversely, is a model designed for high performance

and immediate transaction finality, since once a

transaction is included in the last validated ledger, it

is confirmed fast and cannot be reversed.

An important function in maintaining the

immutability of the blockchain system is that of

incentives. As it is known, DLT works through means

of game theory, since the consensus process requires

co-operation between actors with unaligned interests.

The game-theoretic approach plays a critical role in

achieving a balanced strategy to maintain a unified

version of the global ledger. As such, PoW-based

systems cannot function without economic rewards

for nodes participating in the creation of new blocks

(BitFury Group, 2015). Bitcoin incorporates

incentive mechanisms, which come in the form of

mining rewards and transaction fees. The first node

that successfully solves the PoW and gets to add its

block to the blockchain can collect the block reward.

Currently, it amounts to 12.5 bitcoins. This issuance

is determined algorithmically: the reward halves

every 210,000 blocks (roughly every four years). The

next halving is expected to occur in June 2020

(Bitcoin Clock). Ethereum introduced a similar

wealth distribution mechanism by which the

successful PoW miner receives a static block reward

of 5 ETH. The beneficiary also receives the gas

expended by executing the transactions in the block,

where gas is the fundamental network cost unit at the

base of each transaction. Moreover, there is an extra

reward equal to 7/8 of the static block reward for

including uncles (i.e. stales blocks), with a maximum

of two uncles allowed per block. The approach

adopted by Ripple differs completely from the models

just described as it does not provide a direct monetary

reward for nodes support. The reason behind such

lack of an incentive mechanism lies in the fact that the

XRP were premined and the protocol does not have a

mining process.

On the other hand, the second Bitcoin revenue stream

is represented by the voluntary transactions fees

associated with a block. If the value of a transaction

input exceeds the value of the output, the net

difference in value may be claimed as a transaction

fee, which serves as an incentive to make sure that a

particular transaction will get included into the next

block. Also in Ethereum’s environment, the variable

fee is a way to prioritize some transactions over

others. Fees in Ethereum are denominated in gas,

which represents the amount of ether that covers the

cost of executing a transaction. So every transaction

must contain, alongside its other data, two further gas

related fields: a gasprice value and a startprice value.

The latter defines the maximum amount of gas that

the transaction sender is willing to pay. Ether is used

to purchase gas, which is bought prior to the

execution of a transaction at a certain price. At the end

of the transaction, if not all the gas is consumed,

unused gas is refunded in ether to the sender’s

account; thus, ether is converted freely to and from

gas as required. Instead, if the gas runs out while the

transaction is being executed, this is treated as an

exception: the state is completely reverted, but the

ether used to purchase the gas is not refunded.

In Ripple each transaction submitted to the network

requires a transaction fee specified in XRP. This cost

is designed to increase based upon the transaction

load (currently, the minimum transaction cost is

0.00001 XRP). The novelty associated with this kind

of fee is the fact that, unlike the other two protocols,

there are no beneficiaries and therefore, it is not paid

to any party. Once a transaction is included in a

validated ledger, the exact amount of XRP specified

by the fee parameter is irrevocably destroyed.

Consequently, this approach creates a sort of artificial

scarcity that makes XRP more valuable and drives a

tendency toward the concentration of wealth.

5 SCRIPTING

The Bitcoin UTXO model characterizes how

transactions move value from transaction inputs to

transaction outputs. Since bitcoins are thought of as

unspent outputs associated to a public key, transfers

occur in a chain of transactions consuming and

creating UTXO. Each input of a transaction refers to

a given previous output, which is defined by a script.

So transaction validation is achieved through the

execution of a scripting language, whose goal is to

ascertain under which condition is it possible for a

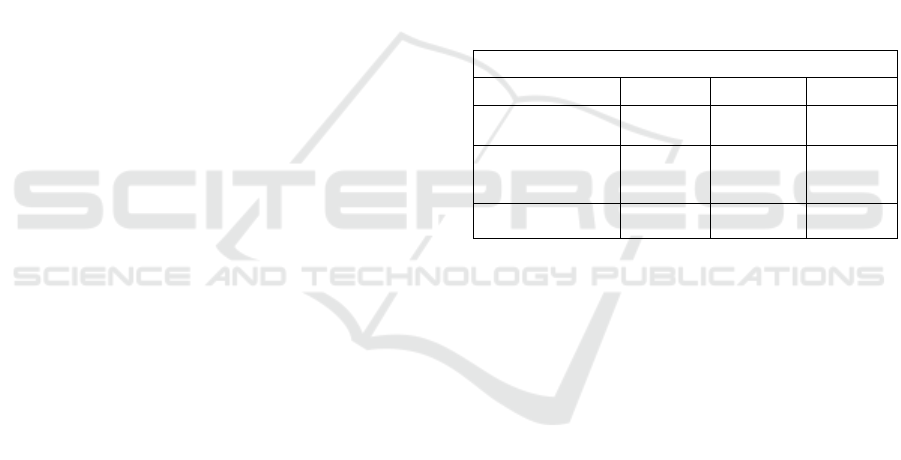

user to spend the outputs (Table 4).

Table 4: Compared analysis of the scripting features for the

three platforms. Symbols: ‘✓’ means that the protocol has

the feature and ‘’ that it has not.

Scripting

Bitcoin

Ethereum

Ripple

Built-in script

language

✓

✓

Smart contract

implementation

✓

✓

Turing-completeness

✓

A Comparative Analysis of Current Cryptocurrencies

133

Specifically, Bitcoin has a locking script which

specifies the spending conditions and an unlocking

script which satisfies such requirement and allows the

output to be spent (Bonneau et al., 2015).

However, the scripting functionalities of the

underlying technology behind Bitcoin can be used for

application domains that go beyond currency. For

example, the expressiveness of the blockchain

technology can be used to implement what is known

as smart contract, a concept introduced by Nick

Szabo in 1997 (Szabo, 1997). Smart contracts

represent a technical advancement to the practice of

law, which formalize the contractual obligations into

programming code and verify them in a self-

executing way, eliminating ambiguity problems of

natural languages. Since contracting parties can

structure their relationships without involving a

trusted third party, the decentralized scheme of math-

based currency systems like Bitcoin, Ethereum and

Ripple makes distributed ledger networks suitable for

smart contracts. In 2014, Ripple released the first

prototype for Codius, a platform that uses the concept

of smart oracles (Schwartz and Thomas, 2014) to

implement smart contracts. However, the

development of the project was discontinued nearly a

year later (Thomas, 2015). Instead, Ethereum is

specifically designed as a multipurpose platform,

featuring smart contract functionality. One of the key

points of this system is that the protocol implements

a completely programmable blockchain enabling the

execution of an unlimited variety of user-

customizable smart contracts. Because of its

resilience to tampering, these computer programs can

be leveraged to automatically conduct transactions or

perform specific actions on the Ethereum blockchain.

The three protocols differ markedly in terms of

scripting: Ethereum’s programming language has a

Turing-complete nature, Bitcoin has several

limitations, including non-Turing-completeness, and

Ripple does not even have a scripting language. The

Bitcoin network has purposefully omitted Turing-

completeness, meaning that the scripts do not support

all computation (e.g. iterative loops). This restriction

has the function to avoid undesired behaviours related

to a problem in computer science known as the

halting problem, according to which there is no

possible mathematical way to determine whether a

computer program will halt or continue to run forever.

Despite the fact that Bitcoin’s scripting is realized by

a simple stack-based language supporting basic

operations, the protocol implements a weak version

of smart contracts. Thanks to an unlimited ability to

implement rich logic, Ethereum takes the scripting

features of Bitcoin blockchain to the next level. The

protocol is designed to execute code of arbitrary

algorithmic complexity, created for any purpose users

deem necessary, where the only limit is given by the

imagination of its developer and associated resources.

User-defined operations need to be interpreted and

this task is handled by the Ethereum Virtual Machine,

which constitutes the key part of the execution model

(Wood, 2014).

6 PLATFORMS PECULIARITIES

As Table 5 illustrates, the platforms have some

differences in the technical features and peculiarities

that derive from the different types of consensus

mechanism they adopt.

Table 5: Compared analysis of the platforms peculiarities.

Symbols: ‘✓’ means that the protocol has the feature and

‘’ that it has not.

Platforms peculiarities

Bitcoin

Ethereum

Ripple

Determinism

✓

✓

✓

Energy

consumption

Wasteful

Wasteful

Efficient

ASIC resistance

✓

✓

At the core, DLT creates opportunities of leveraging

consensus-oriented models for transaction validation

within the context of a distributed ecosystem. A

consensus mechanism is the way in which the nodes

agree on the value of a proposed change that then

updates the shared ledger, and can be described as the

set of rules and procedures that ensures consistency

and authenticity. Following this idea, the logic for

distributed ledger transaction processing must

be deterministic because each participant in the

consensus process has to be able to find the same

result when verifying a transaction. Otherwise, each

node would produce different outputs causing

consensus failure.

Ripple makes extensive use of the concept of

determinism, especially when servers communicate

with each other to agree upon the finality of the state

after processing the transactions as a unit. Indeed,

since all nodes must publish precisely the same

ledger, it is imperative that they converge on the same

transaction set. If there are multiple conflicting

transactions in the same round, participants can sort

and execute them in a deterministic way following

pre-defined rules.

ICISSP 2018 - 4th International Conference on Information Systems Security and Privacy

134

Bitcoin requires nodes to solve a cryptographic

puzzle, which is computationally hard by design, in

order to add a new block to the blockchain. The PoW-

based consensus forces participants to expend

computational resources toward the purpose of

ensuring the safety of the network. Since this effort

has a measurable cost associated to it, Bitcoin relies

on incentive mechanisms to induce nodes to solve the

proof-of-work. Therefore, the PoW concept as used

in Bitcoin comes along with a few drawbacks.

First of all, due to the need for enormous amounts of

computational resources, the protocol consumes a lot

of electricity, and hence it is wasteful in terms of

energy expenditure (O’Dwyer and Malone, 2014).

Secondly, since mining profitability depends on

factors such as hash rate and cost of electricity, the

competitive nature of the process has led miners to

develop more powerful and cost-efficient customized

hardware. As a result, the mining ecosystem has come

to be dominated by ASICs. These are a kind of

integrated circuit specifically built for a certain

purpose (in Bitcoin’s case the task consists in

computing uniquely the SHA-256 hash function),

whose power is to achieve massive gains through

parallelization. With the introduction of ASIC

implementations, the probability of being the first to

successfully find a valid nonce has become very low

for a regular user. Consequently, in order to increase

their chance of winning the mining competition,

participants rely on mining pools, which are groups

of miners that contribute to perform the block

validation jointly; in case of win they split the mining

reward according the contributed processing power.

Today, the majority of bitcoin mining is done in data

centers, by large powerful companies that take

control of the mining power. The emergence of

mining pools, therefore, has caused a departure from

the original Bitcoin idea of decentralization

(Nakamoto, 2008).

By using Ethash, Ethereum combats mining

centralization (a problem that does not affect Ripple

ecosystem, since it does not require mining to achieve

consensus). Its mining algorithm is meant to be

ASIC-resistant, meaning that ASICs are no more

efficient than general-purpose computers at mining.

Ethash is designed to be memory hardness, a property

where the time to compute a valid PoW derives from

the amount of memory required to hold data. The

function takes a very large amount of memory and

this reduces the power of specialized hardware

solutions, thereby encouraging individuals to use

their GPUs and allowing a tangible decentralized

mining process. However, the consensus process is

based on the proof that a particular amount of

computation has been expended in finding a value

less than a pre-defined target threshold and hence,

also Ethereum wastes a lot of energy. Conversely,

Ripple is more environment-friendly thanks to the

absence of mining. Indeed, the energy cost of its

consensus process only derives from the processing

power needed to update the ledger and verify the

transactions.

In light of the energy expenditure, one of the

proposed improvements to the current design of

Ethereum involves the update of the PoW scheme

(Buterin, 2014b). The idea is to move to Proof-of-

Stake (PoS), i.e. an approach in which the probability

to create a block is proportional to a user’s ownership

of cryptocurrency in the blockchain system. The

algorithm is designed to overcome the downsides of

Bitcoin-like PoW mining process by requiring all

nodes to compete with their node fraction of stake. So

it is based on the distribution of digital currency

within the system rather than computational

resources. The proposal for this new scheme, known

as Casper, is still in testing, but a rough

implementation guide has recently been released

(Ethereum Research).

7 SECURITY ASPECTS

By design, once a transaction is added to the

blockchain and confirmed, it can never be reversed.

The existence of multiple shared copies of the same

ledger makes these systems inherently harder to

attack than centralized solutions. However, even

though data integrity is one of the key point of

blockchains, distributed ledgers are not invulnerable

to cyber-attack because legitimate changes to the

global record can be made in principle by anyone.

Table 6: Compared analysis of the security aspects for the

three platforms. Symbols: ‘✓’ means that the protocol is

resistant in principle to the attack and ‘’ that it is not.

Security

Bitcoin

Ethereum

Ripple

Double-spending

attack

✓

✓

✓

Sybil attack

✓

✓

✓

51% attack

✓

DoS attack

✓

✓

✓

The double-spending problem refers to a failure case

of digital cash schemes where two separate

transactions sent into the network spend the same

A Comparative Analysis of Current Cryptocurrencies

135

digital currency (a double spend is hence a deliberate

fork). Bitcoin solves this problem by chronologically

ordering blocks of transactions into an ongoing chain

of proof-of-work that is visible to all users. Therefore,

by implementing a confirmation mechanism and

imposing the rule that bitcoins can be spent only from

UTXO, Bitcoin naturally defends against it.

Similarly, Ethereum uses its PoW-based algorithm to

prevent the risk that a user could concurrently spend

the same unit of currency in several transactions.

However, the previously mentioned Bitcoin’s SPV

method, is not always effective in resisting double-

spending attacks. In (Karame et al, 2012), authors

investigate the problem and demonstrate that these

attacks can be performed in spite of the measures

recommended by Bitcoin developers.

Ripple offers an alternative solution to the double-

spending problem through its consensus process. It is

resistant to the attack because transactions are

considered validated only when an overwhelming

majority of validators sign validations for the same

ledger. Since the process requires agreeing on an

order for the transactions, if two transactions are a

double spend, the attack is solved simply by agreeing

on which of the two transactions comes first (the other

is considered invalid, and hence not applied).

As shown in Table 6, all three platforms are immune

to Sybil attacks (Douceur, 2002). Reputation-based

systems are susceptible to this type of attack, in which

a malicious agent assumes multiple pseudonymous

identities with the goal to gain a disproportionately

large influence. By acquiring control over a

substantial fraction of the system, the adversary is

able to manipulate the voting outcomes.

Bitcoin and Ethereum prevent this attack by means of

PoW. The ability of block generation is proportional

to the computing power, and not to the number of

counterfeit identities (Tschorsch and Scheuermann,

2015). Therefore, the capability of the attacker is

determined by the number of blocks it can produce.

The way in which Ripple avoids Sybil attacks is based

on a strategy that is conceptually opposed to the

approach adopted by Bitcoin, because Ripple does

not work in an open environment where anyone can

participate in the consensus process. Indeed, given

that it implements a permissioned system, a Sybil-

resistant strategy is superfluous. Instead of evaluating

proposals from all validators in the network, a

validating server needs to query only its UNL. The

sole fact that consensus is reached by means of trusted

relationships guarantees Sybil resistance.

In the current landscape, blockchain design is

inherently vulnerable to a 51% attack (Swan, 2015).

Blockchain paradigms rely on the assumption that the

majority of nodes act honestly, but in principle it

would be possible for a single malevolent node or

organization to amass a large amount of

computational power and disrupt the stability of the

process. In particular, if an attacker controls >50% of

the mining power, he can create an independent

branch maintaining a fork. Thus if this attack is

successful, a malicious actor can manipulate the

ledger to his advantage and double spend his own

currency, thereby rewriting blockchain history.

Empirical evidence shows that this attack is infeasible

for any single user, as it would require enormous

computational power to recompute all proofs for all

the previous blocks in the chain. However, although

Bitcoin itself is purely decentralized, the declining

incentive to mine leads to centralization of the mining

function. (Beikverdi and Song, 2015) argue that this

trend toward centralization increases the risk of a

51% attack. Another research (Eyal and Sirer, 2014)

proves that the selfish attack (i.e. a method by which

a coordinated group of nodes increase their returns by

not publishing a valid solution to the rest of the

network), facilitates the grow in size of the colluding

group because honest miners strategically decide to

join the selfish miners.

Ethereum shares the same weaknesses as Bitcoin

about the 51% attack, but its ASIC-resistant design

makes the protocol more resistant to the attack.

Ripple, as it is known, does not rely on distributed

computational power to protect the integrity of the

network. It replaces the vote per computing power of

the miners notion of PoW based consensus

mechanisms with the vote per validator (Karame and

Androulaki, 2016). The underlying assumption is that

the majority of Ripple nodes will not collude to

manipulate the voting result. Actually, if 80% of

validating servers collude, it is possible to confirm a

fraudulent transaction. Thereby, the Ripple

equivalent of Bitcoin’s 51% attack is when a group

gets control over a sufficient number of validators to

cause consensus fail. As participants specifically

select their own validating servers, the probability of

success of the attack is very low. However, in the

event that the majority of validators become

malicious, they can rewrite the entire system

transaction history (Armknecht et al., 2015).

Finally, since distributed ledger technologies are

based around a public ledger of information

maintained by a network of computers around the

world, adversaries could broadcast large amounts of

transaction spam in an attempt to disrupt the normal

operation of the network. The most visible

consequence of such attack is the creation of excess

load on the network, which causes difficulties in

ICISSP 2018 - 4th International Conference on Information Systems Security and Privacy

136

processing legitimate transactions. To mitigate

denial-of-service (DoS) attacks, Ripple enforces a

transaction fee. Moreover, unlike other architectures,

Ripple requires each account to have a small reserve

of XRP for the creation of ledger entries in order to

protect the network from abusive creation of ledger

spam. The current minimum amount needed to fund

a new address is 20 XRP. This creates a strong

disincentive against ledger spamming because any

attacks aimed at wasting network bandwidth become

very expensive for malicious agents.

A denial-of-service attack on Ethereum blockchain

would imply that a malicious actor utilizes the

network resources improperly in an attempt to

interfere with the miners’ ability to quickly settle

legitimate transactions. Due to the Turing-complete

nature of the contracts, Ethereum is inherently

vulnerable to DoS attacks, as an attacker could

perform a successful attack by sending transactions

that loop forever. However, it protects the network

against DoS attacks through the use of gas. Gas limits

the number of computational step a transaction

execution is allowed to take, and hence ensures that

there can be no infinite loop. Similarly, Bitcoin has

some DoS prevention built-in. Theoretically, it is

immune to hostile infinite loops because its scripting

language is non-Turing-complete. Actually, Bitcoin

is vulnerable to DoS attacks (Vasek et al, 2014).

8 CONCLUSIONS

In this paper, we presented a survey specifically

targeting the distinguishing features of three of the

most diffused platforms, i.e. Bitcoin, Ethereum and

Ripple. The compared analysis of these systems

focused on their common points, as well as

differences in how they maintain the integrity of data

recorded on the shared ledger, by grouping them into

six main categories. The work includes an accurate

description of the different consensus and incentive

mechanisms adopted by the platforms for securing the

network. Also we examined the scripting features,

security aspects and impact on the economy, as well

as related concepts.

Whereas blockchain is still in its emergent and

immature technological phase, the increasing interest

on it is showing the importance and awareness of

distributed ledgers as one of the most promising

technology that will have a pervasive impact on the

future of many sectors of our socio-economic

systems. Indeed, the emergence of the blockchain

technology could give rise to the next generation

beyond the internet, potentially leading to the creation

of new types of economies. Blockchain’s ability to

catalyse transparency is based on the way it leverages

a global peer-to-peer network to guarantee integrity

of value exchanged between parties without the need

for central authorities. Therefore, by providing a way

of recording transactions securely, distributed ledger

technology offers the opportunity to reimage how the

financial system can work. However, it should not be

understood only as a disruptive technology, but also

as a foundational technology that offers the

possibility to create new foundations for the social

infrastructure (Iansiti and Lakhani, 2017).

REFERENCES

Antonopoulos, A. M. 2014. Mastering Bitcoin: Unlocking

Digital Crypto-Currencies. O'Reilly Media,

Sebastopol.

Armknecht, F., Karame, G. O., Mandal, A., Youssef, F. and

Zenner, E. 2015. Ripple: Overview and Outlook. In:

Proceedings of International Conference on Trust &

Trustworthy Computing, 9229:163–180.

Bear, K., Drury, N., Korsten, P., Pureswaran, V., Wallis, J.

and Wagle, L. 2016a. Blockchain rewires financial

markets: Trailblazers take the lead. Executive Report -

IBM Institute for Business Value, [online] Available:

https://www-01.ibm.com/common/ssi/cgi-bin/ssialias?

htmlfid=GBP03469USEN&

Bear, K., Drury, N., Korsten, P., Pureswaran, V., Wallis, J.

and Wagle, L. 2016b. Leading the pack in blockchain

banking: Trailblazers set the pace. Executive Report -

IBM Institute for Business Value, [online] Available:

https://www-01.ibm.com/common/ssi/cgi-

bin/ssialias?htmlfid=GBP03467USEN.

Beikverdi, A. and Song, JS. 2015. Trend of centralization

in Bitcoin’s distributed network. In: Software

Engineering, Artificial Intelligence, Networking and

Parallel/Distributed Computing (SNPD), 2015 16th

IEEE/ACIS International Conference on, pp. 1–6.

Bitcoin Clock, [online] Available: http://bitcoinclock.com/

BitFury Group 2016. Digital Assets on Public Blockchains.

White Paper, [online] Available: http://www.the-block

chain.com/docs/bitfury-digital_assets_on_public_bloc

kchains.pdf.

BitFury Group 2015. Incentive Mechanisms for Securing

the Bitcoin Blockchain. White Paper, [online]

Available: http://bitfury.com/content/5-white-papers-

research/bitfury-incentive_mechanisms_for_securing_

the_bitcoin_blockchain-1.pdf.

BitFury Group and Garzik, J. 2015. Public versus Private

Blockchains - Part 1: Permissioned Blockchains. White

Paper, [online] Available: http://bitfury.com/content/5-

white-papers-research/public-vs-private-pt1-1.pdf.

Bonneau, J., Miller, A., Clark, J., Narayanan, A., Kroll, J.

A. and Felten, E. W. 2015. SoK: Research Perspectives

and Challenges for Bitcoin and Cryptocurrencies. In:

A Comparative Analysis of Current Cryptocurrencies

137

Proceedings of the 36th IEEE Symposium on Security

and Privacy (SP’15), pp. 104–121.

Buterin, V. 2014a. A Next-Generation Smart Contract and

Decentralized Application Platform. White Paper,

[online] Available: https://github.com/ethereum/wiki/

wiki/White-Paper.

Buterin, V. 2014b. On Stake, [online] Available:

https://blog.ethereum.org/2014/07/05/stake/

Buterin, V. 2015. Merkling in Ethereum, [online]

Available: https://blog.ethereum.org/2015/11/15/merkl

ing-in-ethereum/

Buterin, V. 2016. On Settlement Finality, [online]

Available: https://blog.ethereum.org/2016/05/09/on-

settlement-finality/

Cachin C. and Vukolić, M. 2017. Blockchain Consensus

Protocols in the Wild. Technical Report

arXiv:1707.01873, IBM Research – Zurich, [online]

Available: https://arxiv.org/abs/1707.01873.

CoinMarketCap, Cryptocurrency Market Capitalizations,

[online] Available: https://coinmarketcap.com/

Davidson, S., De Filippi, P. and Potts, J. 2016. Economics

of Blockchain, [online] Available: http://dx.doi.org/

10.2139/ssrn.2744751.

Douceur, J. R. 2002. The Sybil Attack. In: Proceedings of

the 1

st

International Workshop on Peer-to-Peer Systems

(IPTPS ’02).

Ethereum Wiki (a), Ethash, [online] Available:

https://github.com/ethereum/wiki/wiki/Ethash.

Ethereum Wiki (b), Patricia Tree, [online] Available:

https://github.com/ethereum/wiki/wiki/Patricia-Tree.

Ethereum Research, Casper Version 1 Implementation

Guide, [online] Available: https://github.com/

ethereum/research/wiki/Casper-Version-1-

Implementation-Guide.

Eyal I. and Sirer, E. G. 2014. Majority Is Not Enough:

Bitcoin Mining Is Vulnerable. In: Financial

Cryptography and Data Security, 8437:436–454.

FIPS 202, 2015. SHA-3 Standard: Permutation-Based

Hash and Extendable-Output Functions, [online]

Available: http://nvlpubs.nist.gov/nistpubs/FIPS/NIST.

FIPS.202.pdf.

Iansiti M. and Lakhani, K. R. 2017. ‘The Truth about

Blockchain’, Harvard Business Review 95(1):118–127.

Karame G. O. and Androulaki, E. 2016. Bitcoin and

Blockchain Security. Artech House, Norwood.

Karame, G. O., Androulaki, E. and Capkun, S. 2012.

Double-spending fast payments in Bitcoin. In:

Proceedings of the 2012 ACM Conference on Computer

and Communication Security, pp. 906–917.

Lamport, L., Shostak, R. E. and Pease, M. 1982. The

Byzantine Generals Problem. ACM Transactions on

Programming Languages and Systems (TOPLAS),

4(3):382–401.

Moreno-Sanchez, P., Ruffing, T. and Kate, A. 2017.

PathShuffle: Mixing Credit Paths for Anonymous

Transactions in Ripple. In: Proceedings on Privacy

Enhancing Technologies, 2017(3):107–126.

Murphy, E. V., Murphy, M. M. and Seitzinger, M. V. 2015.

Bitcoin: Questions, Answers, and Analysis of Legal

Issues, Congressional Research Service, [online]

Available: https://fas.org/sgp/crs/misc/R43339.pdf.

Nakamoto, S. 2008. Bitcoin: A peer-to-peer electronic cash

system, [online] Available: https://bitcoin.org/bitcoin.

pdf.

O’Dwyer, K. J. and Malone, D. 2014. Bitcoin mining and

its energy footprint. In: 25th IET Irish Signals and

Systems Conference and China-Ireland International

Conference on Information and Communications

Technologies (ISSC 2014/CIICT 2014), pp. 280–285.

Ripple Labs, The Ledger, [online] Available:

https://ripple.com/build/ledger-format/#tree-format.

Rosner, M. T. and Kang, A. 2016. ‘Understanding and

Regulating Twenty-First Century Payment Systems:

The Ripple Case Study’, Michigan Law Review. 114(4):

649–681.

Schwartz E. and Thomas S. 2014. Smart Oracles: A Simple,

Powerful Approach to Smart Contracts, [online]

Available: https://github.com/codius/codius/wiki/Smar

t-Oracles:-A-Simple,-Powerful-Approach-to-Smart-

Contracts.

Schwartz, D., Youngs, N. and Britto, A. 2014. The Ripple

Protocol Consensus Algorithm. White Paper, [online]

Available: https://ripple.com/files/ripple_consensus_w

hitepaper.pdf.

Swan, M. 2015. Blockchain: Blueprint for a New Economy.

O’Reilly Media, Sebastopol.

Swanson, T. 2015. Consensus-as-a-service: a brief report

on the emergence of permissioned, distributed ledger

systems, [online] Available: http://www.ofnumbers.

com/wp-content/uploads/2015/04/Permissioned-distrib

uted-ledgers.pdf.

Szabo, N. 1997. ‘Formalizing and securing relationships on

public networks’, First Monday 2(9).

Thomas, S. 2015. Codius - One Year Later, [online]

Available: https://codius.org/blog/codius-one-year-

later/

Tschorsch, F. and Scheuermann, B. 2015. Bitcoin and

beyond: A technical survey on decentralized digital

currencies. IACR Cryptology ePrint Archive 2015:464.

Vasek, M., Thornton, M. and Moore, T. 2014. Empirical

analysis of denial-of-service attacks in the bitcoin

ecosystem. In: Financial Cryptography and Data

Security, 8438:57–71.

Wood, G. 2014. Ethereum: A secure decentralised

generalised transaction ledger. Yellow Paper, [online]

Available: http://gavwood.com/paper.pdf.

ICISSP 2018 - 4th International Conference on Information Systems Security and Privacy

138