Cost-Risk Optimization Applied in the Context of Regulation

Ibtissem Chouba

1,2

and Jean-Sébastien Sottet

2

1

Université de Lorraine, France

2

LIST, 5 avenue des Hauts Fourneaux, L- Luxembourg, Luxembourg

Keywords: Regulation, Optimization, Mixed Integer Linear Program.

Abstract: Most engineering, maintenance and operating decisions involve some aspect of Cost/risk trade-off. In this

context we will talk about the cost- risk optimization applied to information systems in the context of

application of regulations. In this paper, a conceptual model of risk based regulation, based on the existing

business and risk architecture models will be presented. Then, a conceptual cost-risk model associated with

the implementation of risk mitigating controls will be adopted and integrated into the optimization

approach. Following this cost model, a mixed-integer linear program will be described. The bi-objective

optimization of the risk-cost will then be solved with IBM ILOG CPLEX optimizer to define an optimized

solution. The result of the calculation of the optimization will serve as a help to the decision-making of the

company.

1 INTRODUCTION

Regulation has multiple objectives (stability of the

system, access to the market, consumer protection),

and is complemented by legal obligations (European

regulations and directives) and recommendations of

good practices (industrial and international

standards). However, responding to regulation is

increasingly burdensome for companies, both in

terms of financial cost, but also complexity. This

cost, in terms of infrastructure, personnel, etc. can be

weighed against the level of risk of non-compliance.

Risk-based regulation consists in expressing the

regulation in terms of risks to be mitigated. The

identification of risks (and related threats) as well as

the tolerance level is defined by the authorities (i.e.,

the regulators). One constraint is that such risk-

based regulation should be made at the overall

enterprise level, thus based on enterprise models

(Lankhorst, Marc M., 2004).

In this context, we rely on a model-driven

approach (Barbero, M., et al., 2008; Salay, R., et al.,

2009) which relates together multiple models of

different nature (enterprise models, risks and threats

models, etc.). We then combine, through

transformations, this multi-model approach with

optimization. As a result, we focus on the cost-risk

optimization that the company faces when imposing

a new regulation, modifying an existing regulation.

We design an optimization approach that will help

enterprises’ decision makers to select the appropriate

costs regarding risk tolerance and enterprise

investment capabilities. The example used in this

article is based on Information Technologies

Security (ITS) risks.

This paper is organized as follow: first we

introduce the related work on cost-risk optimization.

In Section 3 we introduce our model-based approach

used for risk management including enterprise

assets, and the threat setting. Section 4 shows our

conceptual contribution for cost-risk modelling.

Section 5 proposes our technical solutions and

practical modelling of the risk-based optimization

problem. Section 6 depicts a comparison between

the technical solutions implemented. We finally

conclude this article in Section 7.

2 RELATED WORK

Optimization is a large field with a lot of domain

application. We here focus on a bi-criteria

optimisation: risk-cost. One of the peculiarities

of our work is to propose a holistic and local view

on the enterprise assets (supported by enterprise

model) to help decision maker Risk-cost

optimization is proposed in different domains, with

different approaches (Rocchetta, R., et al., 2015;

536

Chouba, I. and Sottet, J-S.

Cost-Risk Optimization Applied in the Context of Regulation.

DOI: 10.5220/0006659105360543

In Proceedings of the 6th International Conference on Model-Driven Engineering and Software Development (MODELSWARD 2018), pages 536-543

ISBN: 978-989-758-283-7

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Goettelmann, E., et al., 2013; Poolsappasit, N., et al.,

2012).

In (Rocchetta, R., et al., 2015), and in the system

engineering field, the authors discuss the problem of

cost-risk optimization in the context of risk

assessment of distributed energy systems consider-

ing extreme weather conditions. In this context, a

framework for probabilistic risk assessment and a

framework for cost-risk optimization using the

evolutionary algorithm NSGAII (Deb, K., et al.,

2002) were developed.

In the field of industry, many mathematical and

heuristic models have been developed with the aim

of optimizing the supply chain using the Just In

Time (JIT) approach but without taking into

consideration the potential risks that may occur

during its implementation and cause significant

disruption to all members of the supply chain.

In (El Dabee, F., et al., 2014), the genetic algorithm

is developed to find the optimal solution of the

mathematical model proposed in (Medical

laboratories AT, 2012), thus reducing the cost-risk

of the final product in the JIT production system.

In (Goettelmann, E., et al., 2013) it is to optimize

the quality of service (and its cost) to the security

risk, helping to choose the right cloud service

broker. They used a heuristic approach, based on the

Tabu-search algorithm (Glover, F., 1997). Here the

approach includes a pre-partitioning of the data.

In (Poolsappasit, N., et al., 2012), inspired by

"attack-tree" (Dewri, R., 2007), the authors propose

a version based on Bayesian networks to model the

probabilities of risk (these are used to reduce

optimizing the risk-cost in a system whose resources

are limited). Probabilities come from different

sources. In addition, they propose the use of a

genetic algorithm in order to propose different

solutions for mono optimizations (e.g., reduce only

the cost) and multi-objectives.

In (Špačková, O., and Straub, D., 2015), the cost-

benefit analysis method was studied in the

framework of cost-risk optimization under budgetary

constraints. This study has been developed within

the framework of natural hazard management, but it

can be applied to various risk management domains.

This method was used to identify risk mitigation

strategies by ensuring equivalence between control

costs and the reduced value of risks.

In the MDE community a very few work

addressed the combination of metamodels and

optimization. For instance, in (Dougherty, B., et al.,

2012), they use optimisation cloud computing

consumption and resources using model-driven

configurations – including constraints – and relying

on a constraint solver. Early works, focusing on

code generation addressed optimization of the

generated code but not use optimization and models

in a decision process.

3 MULTI-MODELS:

ENTERPRISE RISK BASED

REGULATION

Risk assessment is one of the mandatory tasks a

service provider (i.e., a regulated enterprise) has to

do in order to show its compliance with given

regulations. The regulation institutes are responsible

of the stability are to assess the compliance reports

of the enterprises. Regulation institutes are asking

regulated enterprises to establish of a homogeneous

risk assessment following regulation rules.

Then, as the risk assessment covers all the

enterprise assets that are of different nature: people,

IT infrastructure, products, services, data, etc. We

use Enterprise Architecture Model (Lankhorst, Marc

M., 2004; M. Op’t Land, et al., 2008) (EAM) for

modelling the enterprise assets. EAM provides the

necessary abstraction to avoid setting too much

modelling element whilst keeping the essence of

enterprise business, technical assets and processes.

In addition, risk assessment is provided by different

information source concerning threats (e.g., threat

database, standard threats in a given domain,

vulnerability, etc.), controls (i.e, threat mitigation),

actual incidents, etc. The regulation institutes are

also dealing with models and they need an holistic

view on the level of compliance aggregating and

consequently comparing the models coming from

the regulated enterprise”.

In this context, we need to support the various

models used in enterprise risk-assessment and relate

them together (e.g., vulnerability represents a

relation between a threat an EAM element).

Technically, we based our approach on a model

environment we developed (Sottet, J. S. and Biri, N.

(2016). This modelling environment allows for more

flexibility when dealing with uncertainty in

modelling notably when linking modelling elements.

3.1 Enterprise Architecture Model

EAM (Lankhorst, Marc M., 2004; M. Op’t Land, et

al., 2008) have been developed to support

enterprises governance tasks. They help mastering

the complexity of organisation, changes in

organisations, facing crisis, etc. They are used in

Cost-Risk Optimization Applied in the Context of Regulation

537

many situations (A. Anaby-Tavor, 2010): internal

communication, strategy and vision development,

enterprise transformation, knowledge management,

costing, etc.

We use Archimate, the open-group standard to

build an EAM. This model is then imported into our

environment to be used as a base reference model

for the risk assessment.

3.2 Reference Models for Risk

Assessments

Risk assessment incorporates risk analysis and risk

management, i.e., it combines systematic processes

for risk identification and determination of their

consequences, and how to deal with these risks.

We build a relation between EAM assets and risk

assets in order to propose a reference view on

enterprise risk assessment: we map threats and

vulnerabilities that impact enterprise assets.

As a first step, a reference EAM is established by

regulation body and depicts the typical elements

(processes, data, document, personnel, etc.) that an

enterprise in a given sector could conform to.

The map between reference architecture and

threats could also be given by regulation bodies.

They identify which assets is influence by which

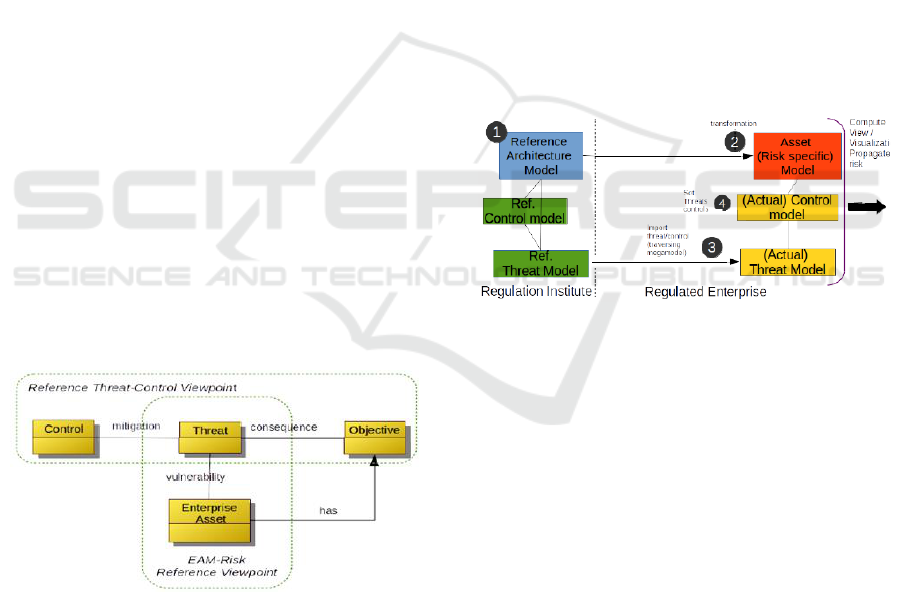

threat. Figure 1 shows our conceptual view of

reference enterprise risk assessment elements. We

have put in addition the objectives impacted by the

threat (i.e., threat consequences) as well as the

control that mitigate the threats. The level of

acceptability of a threat regarding an asset is also

given by regulation institute.

Figure 1: Conceptual metamodel for Risk Assessment.

3.3 Risk Assessment Process

The risk assessment process is mainly a model-based

activity: injecting models from different sources in

our modelling environment. As a result, the

reference architecture model is provided from the

Archi environment. A specific injector has been

developed for translating Archi models in XMI in

our environment that eludes all unnecessary

elements for establishing a reference model. The

controls and threats models come from different

source (threats are defined by some standard body or

provided by recurring incident bases). In this first

experiment we imported controls and threat from

existing tool e.g., (Nicolas Mayer and Jocelyn

Aubert, 2014).

We have defined our own process for enterprise

risk assessment. First the reference models (threats,

controls and architecture) are given by the regulation

institute. It stipulates the organisation of risk

assessment that a regulated enterprise has to

perform. In a second type, the enterprise can

personalize the reference model (provide more

detailed information).

The main difference regarding traditional

approach (Dubois, É., et al., 2010) is that risk

assessment is done by providing control on actual

threats that impact assets. The relation between

threats and enterprise assets is to be given (i.e., we

know that a potential intrusion could affect all

enterprise’s application servers visible on internet).

Figure 2: Risk assessment process.

4 CONCEPTUAL COST-RISK

MODEL

In order to maintain organization’s standard of

excellence, it requires solutions to continuously

manage operations while striking the right balance

between cost optimization, and risk control. For that

reason we define the following cost-risk model.

This conceptual cost-risk model was established

with the purpose to apply an optimization approach

that represents the risk assessment step (step 4 in

Figure 2). This step is about setting the controls to

mitigate risks.

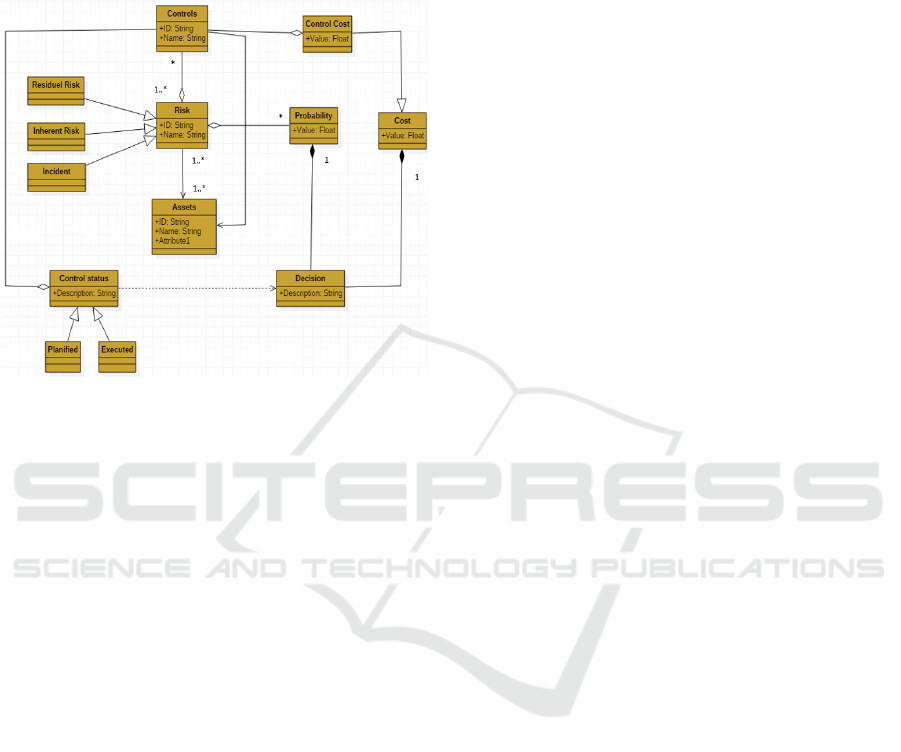

In Figure 3, we propose a more detailed

metamodel of risk assessment for the risk-cost

optimization purpose. Compared with the conceptual

metamodel of risk assessment in figure 1, the

concept of Risk cost, Decision, Maximum cost,

residual risk, inherent risk, assets have been added.

MODELSWARD 2018 - 6th International Conference on Model-Driven Engineering and Software Development

538

Our Cost-Risk metamodel offers objects

composed of risk scenarios by asset or group of

assets. This modelling facilitates the management of

the most common risks and allows gaining in

objectivity as well as in efficiency.

Figure 3: Cost-risk metamodel.

In this conceptual cost-risk model, the inherent

risk and the residual risk must be taken into account.

The inherent risk is measured by assuming that there

is no control or mitigation strategy in place. The

residual risk reflects the level of risk following the

application of controls and the mitigation of the

inherent risks.

Each asset is to be associated with a risk. And

depending on the referential, each risk per asset is

scored, and a total is computed that represents the

global risk of each type of asset. The score of each

risk represent the probability that the risk occur.

Control implemented on assets as a mitigation

effect the risk and thus reduces its probability to

impact the asset. For that, each control has a reduced

value of risk. The risks are mitigated by one or

multiple security controls. In order to mitigate risk,

the total cost of controls to be applied, which is

constrained by a maximal available budget, is

balanced against the acceptable level of the residual

risk (Maximum risk) for each asset.

To summarize, all the components of this

conceptual cost-risk model aim to identify the risk

mitigation strategies that lead to an optimal trade-off

between the costs of the mitigation measures and the

achieved risk reduction. This metamodel will be

(partially) used to structure the information to be

passed from initial reference EAM and risk model to

the optimization algorithm.

5 OPTIMIZATION APPROACH

As the number of threats and vulnerabilities

continues to grow, a strategy of mitigating all risk

equally becomes unsustainable especially when the

problem to be solved is complex. First because the

risks themselves are not independent (one risk may

cause others), and the setting up of controls can

itself create new risks. Second, because we must

take into consideration the problem of minimizing

the cost of controls. However, system administrators

are often faced with a more challenging problem

since they have to work within a fixed budget that

may be less than the minimum cost of controls. The

problem is how to select a subset of controls

measures so as to be within the budget and yet

minimize the residual risk of the system. In this

section, we develop an optimisation approach with a

Mixed Integer Linear Program (MILP) to solve this

problem by formulating a mathematical model

derived from the cost–risk model presented

previously and then we solve it with Cplex optimizer

(ILOG, I., 2012). Cplex is a linear programing

solving environment. It is notably based on variant

of the Simplex algorithm (Dantzig, G., et al., 1955).

Mathematical Model: Bi-objectives

Here we present the formulated mathematical model

used to detail made decisions at the tactical level

concerning risk based regulation. This model will

decide about the needed mitigation controls that

allow to reduce the current risk value to an

acceptable level for each asset, and by respecting the

budget for risk reduction measures that is limited.

In this section we will define our problem

parameters as following:

Definition of Indices:

A: Set of assets a A

N: Set of Mitigation Controls i N

M: Set of Risk j M

Optimization Data Description:

: The cost of control i to correct the risk j that

impact the asset a

: The probability that a risk j impact the asset a

: The percentage reduction of risk j by the

control i

Cost max : The maximal available budget Cost

max to correct the risk j that impact the asset a

Cost-Risk Optimization Applied in the Context of Regulation

539

Risk max : The maximum acceptable risk value for

each asset a

Optimization Constraints Definition

The sum of the costs (Σ C

aji

) of the mitigation

Controls i to be applied to correct each risk j must be

less than the maximum budget allocated for each

risk impacting the asset a.

a

A, j M, i N

(1)

The residual risk should respect the maximum

acceptable risk value for each asset a

(2)

The value of risk, control cost and the percentage

reduction of risk j by the control i should be greater

than zero.

, , (3)

Decision Variables

= 1 If the control i mitigates the risk j that

impact the asset a.

0 Else

Objective Function

The objective is twofold: minimize ∑ Caji the cost

of mitigation controls i of the risks j that impact the

asset a and minimize the residual risk value of each

risk j .

Minimise

a A , j M, i N

Minimise

M, N

Subject to

a A, j M, i N

, ,

6 EXPERIMENTATION AND

EVALUATION

In this section we will illustrate on a case study the

approach presented above. This case-study is about

regulation of risk in a national health-care system.

We present the problem of the cost-risk optimization

of risk assessment and its mathematical formulation.

This optimization approach is included in a broader

process involving the several (meta)models

presented before

The objective is to study the balance between

security risk and cost, and to determine what checks

to apply to minimize the value of these two criteria.

A resolution of the linear program and an analysis of

these results will be evaluated in order to find the

optimal solution.

Note that, as our approach could be generalized

to type of controls and other kind of threats. Beyond,

the present case we can also imagine applied it to

any metamodel against the optimization problem.

6.1 Regulation Overview

We here focus on the biomedical analysis laboratory

part of the medical domain. We have established an

EAM with the participation of key representative

partners and with the help of standards (Medical

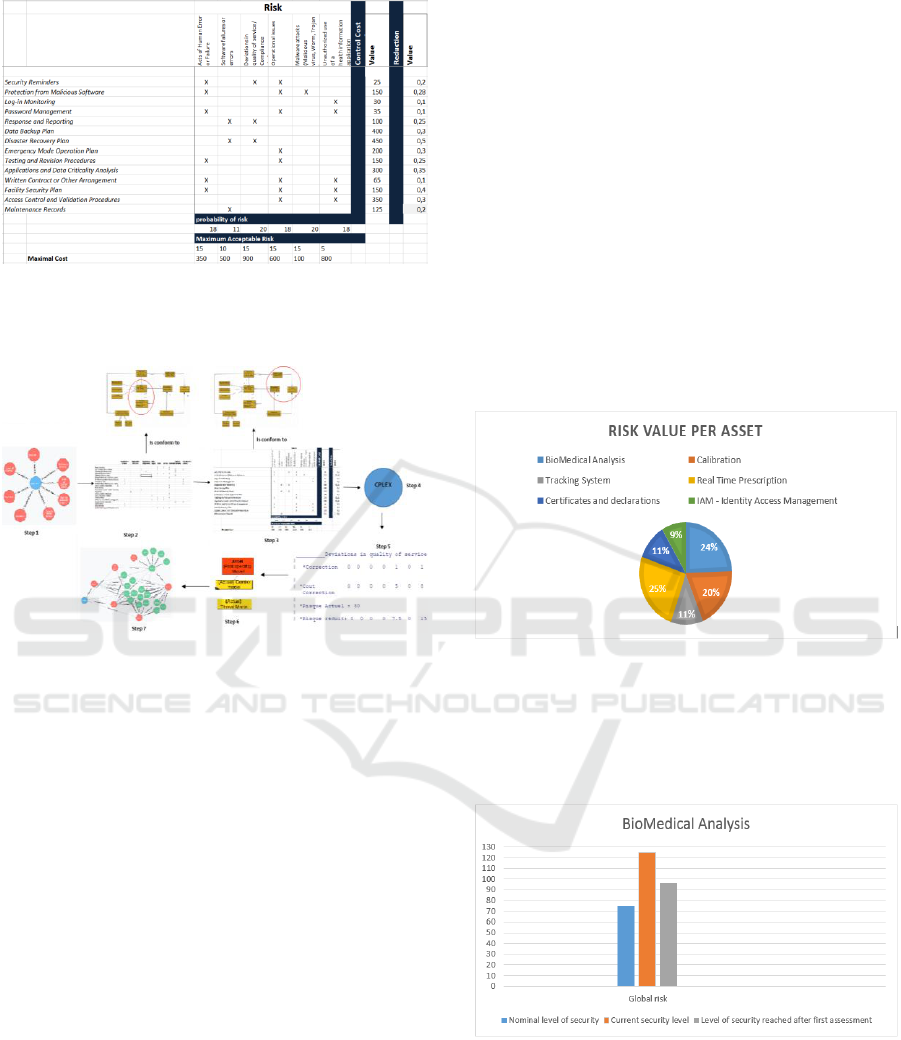

laboratories AT, 2012). The figure 4 summarizes a

part of the result of this preliminary work.

We consider a set of 6 assets, in which optimal

risk mitigation strategies are identified. The identify-

cation of possible strategies and the assessment of the

risks and costs associated with these strategies are

shown in figure 5. The utilized input data are

hypothetical, but they are based on real case studies

and they thus reflect an achievable ratio between risk

reduction and costs. For all strategies, the net present

value of risk and cost are evaluated. These values are

presented in figure 5. We aim to select the best

strategies that minimize the sum of the net present

value of residual risk and costs for each asset.

The Figure 4 and Figure 5 show respectively the

relation between Threats and EAM and Control and

Threat.

Figure 4: Spreadsheet for setting the mappings between

EA metamodel and Risk.

MODELSWARD 2018 - 6th International Conference on Model-Driven Engineering and Software Development

540

Figure 5: Spreadsheet for mappings control on risks.

6.2 Risk Optimization Process

Figure 6: Overall process and involved models.

The first step is the risk optimization process

consists in establishing a graph model that identifies

the relation between each asset and the different

risks. The relation consists in describing which

assets a risk potentially impacts. This model is

conforms to Archimate metamodel (Lankhorst, Marc

M., 2004) to which we added the concept of risk. In

the second step, this model is transformed to a

model (a table considered as a data model for

CPLEX) which represents the mappings between the

assets and risks. Also, another data model is

established in step 3 to represent the risk

mitigations/controls, control cost, the probability

that a risk impact an asset, and the reduction value of

each control. These values are in this paper manually

entered by experts but we can automatize some of

those from other data sources (e.g., incident data

feed). This two models represented in step 2 and 3

are conform to the metamodel described in figure 3.

After that, in step 4, the problematic of cost-risk

optimization is described in a mixed integer linear

program (described in Section 5) which will be

resolved with the IBM ILOG CPLEX optimizer

(step5). CPLEX displays the best controls to be

applied that allow us to minimize both control costs

and the residual risk value. This result can be

transformed to a graph model that represents the

associations amongst risks, assets and the optimum

controls (step7).

6.3 Results

The results of the optimization approach for

each asset are summarized in following figures.

It shows for each asset the total residual risk

.

Figure 7 shows the percentage of risks for each

asset. We note that the asset ''Real Time Prescription''

is the most risky as well as ''Biomedical Analysis'',

while ''Identity Access Management'' is the least risky

with 9% of total risk.

Figure 7: Risk per Asset.

The following figures describe the residual risk

after risk mitigation. Here, we explain only the

‘BioMedical Analysis’ result but the same analysis

applies for the rest.

Figure 8: Total residual risk for BioMedical Analysis.

The figure 8 shows a bar chart where the vertical

axis of the ordinates bears the risk values.

It has 3 bars that describe three levels of risk:

The first stick 'blue' describes the nominal security

level (very good). The second stick 'orange'

describes the value or safety of current risk (before

implementation of controls). The third stick 'grey'

Cost-Risk Optimization Applied in the Context of Regulation

541

describes the level of security achieved after the

implementation of controls (the residual risk).

It is noted that after the first controls, the overall

level of risk exceeds the nominal risk level.

Figure 9: Interpretation risk by risk of Biomedical

Analysis.

In the figure 9, we see the risk-by-risk result. It

appears that certain risks can be dealt with correctly

This increase in the overall level of risk comes

from ‘Social Engineering attacks’ risk which still

exceeds its maximum level for this asset. Moreover,

it only decreased by 5%. Whilst the ‘Acts of Human

Error or failure’ risk even exceeds its maximum

value, it is at a more or less acceptable level.

‘Operational issues’ risk is mitigated. It is decreased

to an acceptable level.

6.4 Decision Making

There is no optimal solution to achieve the overall

level of safety. This result just managed to improve

the risk treatment but not to the degree imposed by

the risk constraints.

In view of the financial constraints imposed, one

can not in any case arrive at the nominal risk, so

either the decision maker accepts the risk as it is. It

is necessary to alert the Risk Manager about budget

constraints and help him to handle the not managed

risks.

7 CONCLUSION

In this article we presented a model-driven approach

for enterprise-risk management. It is coupled with

optimization approach developed through a mixed

integer linear program and solved with the optimizer

CPLEX. It aims to resolve the problem of selection

of optimal risk mitigations controls: it finds the

optimal controls that allow minimizing at the same

time the residual risk and the cost of controls. It was

shown that sometimes the assets cannot be

optimized as a whole. We can just manage to

improve the risk treatment but not to the degree

imposed by the risk constraints and this is due to the

financial constraints imposed.

We also show how this optimization phase could

be integrated in a more global model-driven

approach, all along a given process.

Our future work is to take into account the risk

propagation in the graph model obtained at the end

of the process and eventually combine it with the

optimization process. In that case, a different

optimization algorithm, beyond CPLEX, should be

implemented. Finally we aim at being more generic

against the optimization process and the given

metamodels. We aim at providing a facility to

describe the elements to optimize on a given

metamodel, coupling model-driven approach and

optimization.

REFERENCES

Rocchetta, R., Li, Y. F., & Zio, E. (2015). Risk assessment

and risk-cost optimization of distributed power genera-

tion systems considering extreme weather conditions.

Reliability Engineering & System Safety, 136, 47-61.

Goettelmann, E., Fdhila, W., & Godart, C. (2013).

Partitioning and cloud deployment of composite web

services under security constraints. In Cloud

Engineering (IC2E), 2013 IEEE International

Conference on (pp. 193-200). IEEE.

Glover, F. (1997). Tabu search and adaptive memory

programming—advances, applications and challenges.

In Interfaces in computer science and operations

research (pp. 1-75). Springer US.

Goettelmann, E., Dahman, K., Gâteau, B., & Godart, C.

(2014, June). A formal broker framework for secure

and cost-effective business process deployment on

multiple clouds. In Forum at the Conference on

Advanced Information Systems Engineering (CAiSE)

(pp. 3-19). Springer International Publishing.

Poolsappasit, N., Dewri, R., & Ray, I. (2012). Dynamic

security risk management using bayesian attack

graphs. IEEE Transactions on Dependable and Secure

Computing, 9(1), 61-74.

Xiao, F., & McCalley, J. D. (2007). Risk-based security

and economy tradeoff analysis for real-time operation.

IEEE Transactions on Power Systems, 22(4), 2287-

2288.

Dewri, R., Poolsappasit, N., Ray, I., & Whitley, D. (2007,

October). Optimal security hardening using multi-

objective optimization on attack tree models of

networks. In Proceedings of the 14th ACM conference

on Computer and communications security (pp. 204-

213). ACM.

Rodrigues da Silva, Model-driven engineering: A survey

MODELSWARD 2018 - 6th International Conference on Model-Driven Engineering and Software Development

542

supported by the unified conceptual model Alberto.

2015 The Author. Published by Elsevier Ltd.

E. Goettelmann, K. Dahman, B. Gateau, E. Dubois,and C.

Godart. A security risk assessment model for business

process deployment in the cloud. In Services

Computing (SCC), 2014 IEEE International

Conference on, pages 307{314. IEEE, 2014.

Lankhorst, Marc M. "Enterprise architecture modelling—

the issue of integration." Advanced Engineering

Informatics 18, no. 4 (2004): 205-216.

M. Op’t Land, H. A. Proper, M. Waage, J. Cloo, and C.

Steghuis. Enterprise Architecture – Creating Value by

Informed Governance. Enterprise Engineering Series.

Springer, 2008.

A. Anaby-Tavor, D. Amid, A. Fisher, A. Bercovici, H.

Ossher, M. Callery, M. Desmond, S. Krasikov, and I.

Simmonds. Insights into Enterprise Conceptual

Modeling. Data Knowl. Eng., 69(12):1302–1318,

2010. URL: http://dx.doi.org/10.1016/j.datak.2010.

10.003.

El Dabee, F., Marian, R., & Amer, Y. (2014). A

simultaneous cost-risk reduction optimisation in JIT

systems using genetic algorithms. IEEE conf. In

Control System, Computing and Engineering

(ICCSCE).

Špačková, O., & Straub, D. (2015). Cost‐Benefit Analysis

for Optimization of Risk Protection Under Budget

Constraints. Risk Analysis, 35(5), 941-959.

Medical laboratories AT requirements for quality and

competence ISO 15189, 2012.

Nicolas Mayer and Jocelyn Aubert. (2014). Sector-

Specific Tool for Information Security Risk

Management in the Context of Telecommunications

Regulatio. In Proceedings of the 7th International

Conference on Security of Information and Networks

(SIN '14). ACM, New York, NY, USA, pages 85,

4 pages.

Dubois, É., Heymans, P., Mayer, N., & Matulevičius, R.

(2010). A systematic approach to define the domain of

information system security risk management. In

Intentional Perspectives on Information Systems

Engineering (pp. 289-306).

Barbero, M., Jouault, F., & Bézivin, J. (2008, March).

Model driven management of complex systems:

Implementing the macroscope's vision. In Engineering

of Computer Based Systems, 2008. ECBS 2008. 15th

Annual IEEE International Conference and Workshop

on the (pp. 277-286). IEEE.

Salay, R., Mylopoulos, J., & Easterbrook, S. (2009). Using

macromodels to manage collections of related models.

In Advanced Information Systems Engineering (pp.

141-155). Springer Berlin/Heidelberg.

Dougherty, B., White, J., & Schmidt, D. C. (2012).

Model-driven auto-scaling of green cloud computing

infrastructure. Future Generation Computer Systems,

28(2), 371-378.

Deb, K., Pratap, A., Agarwal, S., & Meyarivan, T. A. M.

T. (2002). A fast and elitist multiobjective genetic

algorithm: NSGA-II. IEEE transactions on

evolutionary computation, 6(2), 182-197.

Sottet, J. S., & Biri, N. (2016). JSMF: a Javascript

Flexible Modelling Framework. FlexMDE@

MoDELS, 2016, 42-51.

ILOG, I. (2012). CPLEX optimizer. Online. Available:

http://www01.ibm.com/software/commerce/optimizati

on/cplex-optimizer.

Dantzig, G., Orden, A., & Wolfe, P. (1955). The

generalized simplex method for minimizing a linear

form under linear inequality restraints. Pacific Journal

of Mathematics, 5(2), 183-195.

Cost-Risk Optimization Applied in the Context of Regulation

543