Mood and Investment Decision-Making: An Experimental Study

Ardianto

Department of Accounting, Faculty of Economics and Business, Universitas Airlangga,

Jalan Airlangga No. 4 – 6, Surabaya, Indonesia

ardianto@feb.unair.ac.id

Keywords: Decision-Making, Experimental, Investment, Mood.

Abstract: Investment decision-making involves strategic decisions that have a long-term impact and that can affect a

significant amount of funds. Investment decision-making also involves risk. The aim of this experimental

study is to determine whether the moods of prospective investors have an effect on their decision making.

Using final-semester students who have taken the financial statement analysis course as the subjects, this

study determines whether any changes in decisions occur in conjunction with the transformation of the

subject’s mood. Several previous studies have studied the influence of financial report framing on

investment decisions. In contrast to previous research, however, this study pays more attention to the

subjects who make the decisions. The results of this study show that, in a business situation with the same

prospects, an investor with a positive mood will have the desire to make larger investments, compared to an

investor who is in a negative mood. In this way, it can be proven that mood is related to investment

decisions. This study also shows that gender (masculine vs. feminine) does not have a moderating effect on

the relationship between mood and investment decision.

1 INTRODUCTION

Investment decision-making is very risky and

requires a lot of funds. Accuracy in investment

decision-making has a long-term impact and

involves considerable value for money. Some of the

major cases where investment decisions have failed

have proved the magnitude of the impact on the

company. In contrast to previous research, this study

focuses more on the effect that the conditions the

subject (or decision maker) experiences can affect

the decisions they make. There have been various

investigations into the level of courage a decision

maker has. Some test the influence had by

differences in financial report framing on the results

of investment decisions (Powell and Ansic, 1997;

Sandeep et al., 2012). Unlike previous research,

however, this study examines how the conditions

experienced by the subject (the decision maker) can

affect the decision he or she makes.

This study only considers whether a happy mood

may have an impact by causing greater optimism,

which further affects the determination of higher

investment rates. However, this study’s aim is to

prove whether a feeling of optimism when making

decisions can be caused by an antecedent that has

created a happy mood. Regardless of the accuracy of

the decisions, this research has proved that a happy

atmosphere can affect the magnitude of investment

decisions; this proof could inspire further research to

prove the effect of mood on accuracy in decision

making.

There are other studies that have also proved that

happiness is a requirement for people to work hard

and thereby become successful. Happiness can bring

an optimistic feeling, release stress, achieve a goal

more aggressively and face a situation more calmly.

Conditions of happiness can be a driving force that

will cause someone to work harder in order to

achieve success.

The empirical evidence suggests that this is not

the case, however. Indeed, a number of researchers

and thinkers have argued that the ability to be happy

and contented with life is a central criterion for the

ability to adapt and for positive mental health

(Diener, 1984; Jahoda, 1958; Taylor and Brown,

1988).

The experimental designs used in this study, in

addition to showing the main effect of causal

relationships between happiness and the value of

investment decisions, can also simultaneously see

Ardianto, .

Mood and Investment Decision-Making: An Experimental Study.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 189-193

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

189

the effect of gender on the link between the variable

happiness and the value of the investments.

2 LITERATURE REVIEW

2.1 Happiness

Psychology literature contains no universal

definition of happiness. Happiness is a subjective

condition felt by someone who is experiencing

satisfaction with life, contentment and wellbeing

(Ryan and Deci, 2001). According to Kahneman

(1999), in order to know whether someone is happy

or not, they should be cognitively evaluated. This

means that, in order to determine whether someone

is in a happy condition or not, this needs to be self-

determined by the subject.

2.2 Optimism

Various research in the literature states that

happiness fosters optimism. Circular conditions can

occur where, in the end, optimism will also result in

success and will ultimately return and impact on

levels of happiness.

Optimism or positive thinking is the key to

success and happiness. Research has also shown that

positive thinking can reduce the pressure of

increasing emotional wellbeing and cardiovascular

health (Wellner and Adox, 2000).

Optimism is how someone reacts to social failure

in their life (Myers, 2008). A stressful situation

experienced by an individual can result in a loss of

willingness to make an effort. The existence of

optimism can change the negative feeling in order to

achieve maximum results. According to McGinnis

(1995) people who are optimistic have 12 defining

characteristics, as follows:

1. Optimistic people are rarely surprised by

difficulty.

2. Optimistic people look to problem-solve.

3. Optimists feel confident that they have control

over their futures.

4. Optimistic people give regular updates.

5. Optimistic people put a stop to their negative

thoughts.

6. Optimism increases the power of appreciation.

7. Optimists use their imagination to train for

success.

8. Optimists are always happy, even when they do

not feel happy.

9. Optimists feel confident that they have an almost

unlimited ability to extend themselves.

10. Optimists foster lots of love in their lives.

11. Optimists like to exchange good news.

12. Optimists accept what cannot be changed.

Optimistic individuals will tend to be confident

about their decisions and in their abilities. Chang

(2002) defines optimism as an individual

expectation of good things. In other words, optimists

are individuals who expect good events to happen in

their future lives.

Scheier and Carver (2002) state that optimism is

the dispositional tendency of individuals to have

positive expectations overall, even though they may

face misfortune or difficulties in life.

Optimism is an attitude of always having good

expectations of everything and the tendency to

expect a pleasant outcome. In other words, optimism

is a way of thinking or a paradigm of positive

thinking (Carver and Scheier, 1993).

Scheier and Carter also state that an optimist is a

person who has good expectations of their future

lives. Their futures include positive goals and

expectations that cover all aspects of life (as cited in

Snyder, 2002).

2.3 Gender

Gender is theoretically different from biological sex

in how it distinguishes between men and women. In

this study, gender measurement is conducted using a

traditional concept. This concept measures gender

on a continuum, going from “very masculine” up to

“very feminine.”

Gender concepts have evolved. The gender

dimension now not only splits issues into a

masculine vs. feminine dichotomy; rather, each

continuum can also be separated into stages between

“very masculine” and “not very masculine”.

However, there are no degrees to feminine

measurement at all, until “very feminine”.

Considering the simplicity and focus of this

research (in that it only considers aspects of

behavioral research in accounting) it uses a

traditional measurement of gender. This only

considers the traits of masculine versus feminine

behavior, comparing “very masculine” conditions to

those that are “very feminine”.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

190

3 RESEARCH METHODOLOGY

This study used an two-by-two between-subjects

experimental design, using the final-year students as

research subjects. Student subjects were used

because this study measures variables that have

transferable properties. Students and investors will

actually behave similarly when they receive equal

treatment. This condition means that the students, as

subjects, can stand in for investors. Additionally, the

experience factor is controlled during this research.

The focus of the observations in this study is the

feeling of happiness itself. Thus, the study tests

happiness’s influence on the amount of investments

made by the subject. In order to create two groups to

act as a treatment group and control group, the 24

subjects were randomly separated by filling out the

questionnaires, answering items that asked them

about their moods.

The establishment of groups of subjects who had

happy and unhappy moods was achieved through

these questionnaires. The questionnaire contained a

choice of statements to be filled by the selected

subjects according to their mood. Option 1 means

the respondents are happy, while option 2 means that

they are unhappy. Subsequently, subjects who

identified as being happy were asked to enter a

particular room (Room A), while those subjects who

identified as being unhappy were asked to enter

another room (Room B). Subject groups in both

rooms were then assigned the same investment

decision-making task, with the same data. The only

difference was in the subjects’ moods.

3.1 Variable Measurement

3.1.1 Mood

Mood is measured by identifying the psychological

nature of the subject (i.e., whether they are happy or

unhappy. By enabling self-assessment through the

use of a single-item scale (the question: "Are you

generally happy right now?") the subject’s answer

can be measured on a scale of 0 to 10.

According to Kahneman (1999) in order to

ascertain whether someone is happy or not a

cognitive evaluation is necessary. In other words, if

we wish to determine whether a person is in a happy

condition or not, their answer needs to be self-

determined. The validity of using this single-scale

measurement has been studied by Abdel (2006),

who states that: “[a] single item [scale] had a good

convergent validity because it was highly and

positively correlated with optimism, hope, self

esteem, positive effect, extraversion, and self ratings

of both physical and mental health. Single scale is

reliable, valid, and viable in community surveys as

well as in cross-cultural comparison.”

3.1.2 Gender

In this study, gender measurement uses a traditional

concept that measures gender on a very masculine

continuum, going up to “very feminine”. Using the

question instrument that identifies characteristics

from “very masculine” to “very feminine”, subjects

will be identified according to their gender status.

Gender measurements in this study still use

the gender role identity. This concept refers to the

comparison of characteristics according to gender-

related social norms and gender-related

characteristics. This concept was originally

developed by Kagan (1964).

3.1.3 Investment Decisions

The investment decisions were measured using a

question instrument that consisted of several

investment decisions ranging from Rp. 1 Billion to

Rp. 10 Billion, thus indicating the boldness of the

investment made by the subject.

4 RESULTS

4.1 Descriptive Statistics

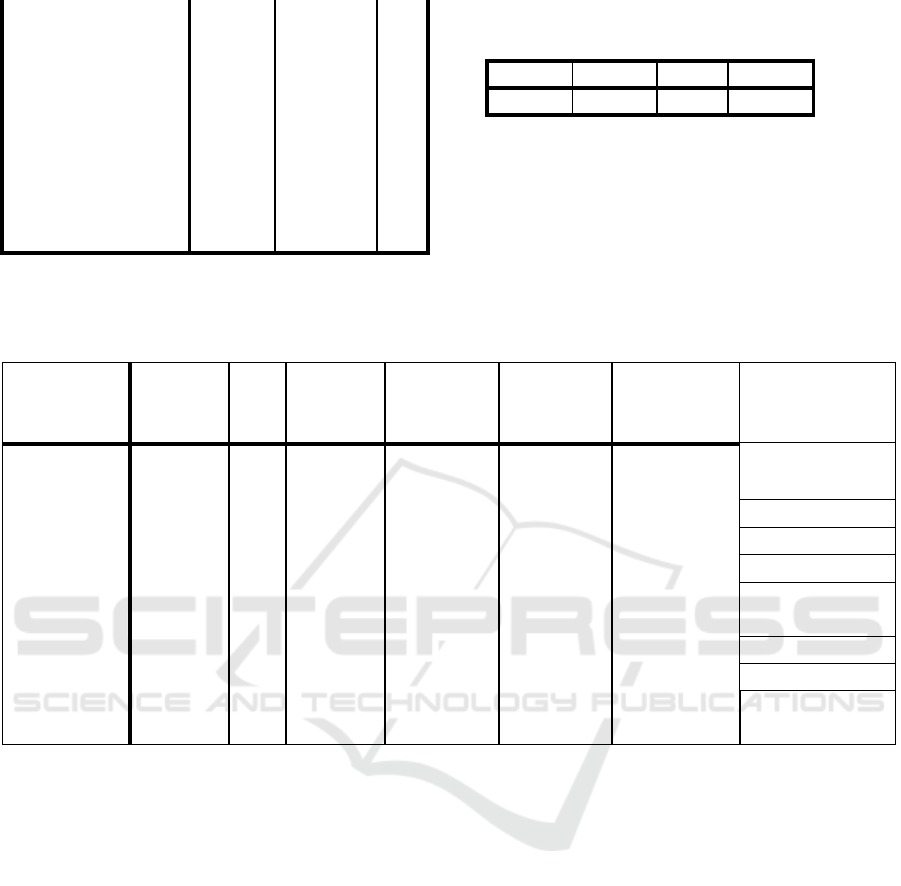

Table 1: Descriptive Statistics

Mood

Gender

Mean

Std.

Deviation

N

Happy

2.20

7.0000

.

1

2.40

9.0000

.

1

2.60

8.0000

.

1

3.00

8.6667

2.30940

3

3.20

9.5000

.70711

2

3.60

7.0000

1.41421

2

3.80

10.0000

.00000

2

Total

8.5833

1.56428

12

Unhappy

2.40

5.0000

.

1

2.80

8.0000

.

1

Mood and Investment Decision-Making: An Experimental Study

191

3.00

5.0000

2.82843

2

3.20

5.0000

.

1

3.40

1.0000

.

1

3.60

4.0000

2.64575

3

3.80

7.0000

.

1

4.20

6.0000

1.41421

2

Total

5.0000

2.29624

12

Table 2: Levene’s Test

F

df1

df2

Sig.

3.382

14

9

.036

Levene’s test addresses the null

hypothesis that the error variance of

the dependent variable is equal across

groups.

a. Design: Intercept + Kelompok +

Gender + Kelompok * Gender

Table 3: Examination of the Subject Effect

Dependent Variable: Investment

Source

Type III

Sum of

Squares

df

Mean

Square

F

Sig.

Partial Eta

Squared

Noncent.

Parameter

Corrected

Model

124.792

a

14

8.914

2.158

.124

.771

30.219

Intercept

825.756

1

825.756

199.959

.000

.957

199.959

Mood

49.504

1

49.504

11.988

.007

.571

11.988

Gender

47.068

9

5.230

1.266

.365

.559

11.398

Mood *

Gender

1.284

4

.321

.078

.987

.033

.311

Error

37.167

9

4.130

Total

1269.000

24

Corrected

Total

161.958

23

a. R Squared = .771 (Adjusted R-squared = .414)

b. Computed using alpha = .05

By using an error rate of 5%, Table 3 shows a

significant difference in the level of significance,

with a 0.007 increase on the investment value score

given by the group of happy subjects, compared to

that given by the group of unhappy subjects. This

means that mood differences affect the value of the

investment made by the subject.

However, gender differences (masculine vs.

feminine) do not affect the strength of the

relationship between mood and the value of the

investment made by the subject.

5 CONCLUSIONS

The results show that happy subjects tend to make

higher-value investment decisions than subjects who

are in unhappy moods. From these results, it can be

concluded that mood affects the size of the

investment made by the individual.

The implications of this study provide an insight

into the concept that investment decisions are

influenced by a person's emotional changes. This

indicates the importance of an investor’s mental

state when making an investment decision. Although

this study does not look at the end result of the

investment, the influence of an individual’s mental

state on their decision making has been proven in

this study.

Interaction effect testing shows there is no

moderate effect of gender on the strength of the

relationship between mood and the value of the

investment made. Thus, it can be concluded that

gender characteristics do not affect the strength of

the relationship that exists between mood and the

value of the investment made by the subject.

Subjects that show feminine and masculine gender

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

192

characteristics still experience a significant influence

that is not different in strength.

REFERENCES

Abdel, Khalek A.M., 2006. Measuring Happiness

with A Si ngle Item Scale. Social Behavior and

Personality.

Chang, E. C. (2002). Cultural influences on

optimism and pessimism: Differences in Western

and Eastern construals of the self. In E. C. Chang

(Ed.), Optimism and pessimism: Implications for

theory, research, and practice (pp. 257−280).

Washington, DC: American Psychological

Association.

Diener, E., 1984. Subjective well-being.

Psychological Bulletin, 95, 542-575.

Hasnain, N., Wazid, S.W., Hasan, Z., 2014.

Optimism, Hope, and Happiness as Correlates of

Psychological Well Being among Young Adult

Assamese Males and Females. IOSR Journal Of

Humanities And Social Science Vol 19 PP 44-

51.

Jahoda, M., 1958. Current concepts of positive

mental health. New York: Basic Books.

Kahneman, D., Diener, E., Schwarz, N., 1999. Well

Being: The Foundation of Hedonic Psychology.

New York: russel Sagr Found.

Mishra, S., Gregson, M., Lalumiere M.L., 2012.

Framming effect and Risk Sensitive Decision

Making. British Journal of Psychology.

Ryan, R.M., Deci, E.L., 2001. On Happiness and

Human Potentials: A Review of Research on

Hedonic and Eudaimonic Well Being.

Annu.Rev.Psychol. 2001.52:141

Scheier, M. F., Carver, C. S., and Bridges, M. W.

(2001). Optimism, pessimism, and psychological

well-being. In E. C. Chang (Ed.), Optimism and

pessimism: Implications for theory, research, and

practice (pp. 189−216). Washington, DC:

American Psychological Association.

Taylor, S. E., Brown, J. D., 1988. Illusion and well-

being: A social psychological perspective on

mental health. Psychological Bulletin, 103, 193-

210.

Mood and Investment Decision-Making: An Experimental Study

193