The Impact of Proprietary Costs, Agency Costs, and Financing

Incentives on Segment Profit Growth Variations

Iswajuni,Yadi Arudistara

1

Faculty of Economics and Business, Universitas Airlangga, Surabaya, Indonesia

yuyun_iswahyuni@yahoo.com

Keywords: Agency Costs, Differences in Earning Growth Segment, Financing Incentives, Proprietary Costs.

Abstract: This study aims to determine the effects of proprietary costs, agency costs, and financing incentives on the

differences in segment earnings growth in state-owned enterprises listed on the Indonesia Stock Exchange for

the period 2009–2015. The data sources consisted of financial statements, annual reports, and sustainability

reports. The study used a quantitative research method. Data were analyzed using multiple regression analysis.

The research shows that the three variables of proprietary costs, agency costs, and financing incentives show

a significant effect on segment profit growth variations.

1 INTRODUCTION

The globalization era has brought about changes to

the world’s economy. The disappearance of inter-

state boundaries and the introduction of free trade

agreements have opened up business opportunities

for the improvement of countries’ economies. The

disappearance of boundaries for the inter-state

economy has provided companies with the

opportunity to attract external parties, especially

investors. One important element in attracting

investors is accurate information about a company,

especially regarding its performance, predictions for

future cash flow and earnings, and risks that may

occur in the future, one of which can be obtained from

the company's financial statements (Muhammad &

Siregar, 2012). This is because financial statement

users want transparency of information to be provided

by companies in order to assess their future prospects

and risks.

One important indication of information for

investors is segment reporting, alongside income and

cash flow statements (Brown, 1997). The reported

company segment must exceed at least 10% of the

total revenue of all segments or otherwise meet the

requirement, the segment may be loaded, with

management's consideration that the information is

useful to external parties (Bestari & Siregar, 2012).

Segment information helps external users to analyze

better the performance of each segment within a

company. The decision to disclose segment

information by increasing or limiting it is under the

control of the manager. Factors that may affect the

quality of the disclosures from these segments will be

analyzed in this study.

Segment reporting consists of information

between segments that results in profitability. The

operating segment is one of the segments reported by

a company; this segment has a large number of

products, services, and areas of market operations that

provide information on growth trends, diversity of

operating areas, etc. (Dermawan et al., 2016).

Reporting on this segment will increase transparency

and provide more reliable information for the users of

financial statements to make decisions. This is

because the users of financial statements need not

only the overall financial statements but also more

detailed information on the reports from different

business segments of the company.

Managers consider whether the information can

lead to competitors changing their strategies, or even

attract the attention of major business competitors.

Such factors may reduce information on variations in

profitability between segments (Blanco et al., 2015).

This research aims to understand the factors that

affect the variations in segment profit growth, which

consist of proprietary costs, agency costs, and

financing incentives as independent variables. The

study was conducted in the period 2009–2015, taking

into account the effects of the application of

regulations related to the operating segment in

Indonesia, specifically PSAK No. 5 (revised 2009), to

assess companies’ disclosure of information relating

224

Iswajuni, . and Arudistara, Y.

The Impact of Proprietary Costs, Agency Costs, and Financing Incentives on Segment Profit Growth Variations.

In Proceedings of the Journal of Contemporar y Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 224-229

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

to variations in profit growth over that year. PSAK 5

(revised 2009) came into effect in 2011 and adopted

the regulations of IFRS 8, which are related to

segment reporting. This PSAK supersedes the old

regulation of PSAK 5 (revised 2000). Disclosure of

segments based on regulation provides more

informative for financial statement users who need to

make investment decisions. However, the decision to

provide information on variations in profit growth

between segments does not necessarily depend on the

implementation of PSAK 5 (revised 2009). The

existence of standards disclosure for the regulation of

these segments is expected to improve the quality of

a firm’s segment information.

2 LITERATURE REVIEW

2.1 Proprietary Costs

According to a previous study (Wang et al., 2011),

proprietary costs associated with the variation in

profit growth between segments have had a

significant affect. In relation to proprietary costs,

which correlate with the level of business

competition, a company will tend to hide information

on the variation in profit growth between segments so

that this cannot be used by competitors, thus leading

to losses for the company. The following hypothesis

is formulated for this study:

H1: Proprietary costs have a significant effect on the

variation in profit growth between segments.

2.2 Agency Costs

The same study (Wang et al., 2011) mentions that

there is a significant relationship between agency

costs and variation in profit growth between

segments. Managers will always prioritize their own

interests to achieve a good performance assessment

by shareholders. Managers will cover the varied

segment of the segment's poor profit growth. In

relation to the high costs associated with the agent,

the manager will attempt to manipulate the profit

growth between segments in order to produce

information on the variation in the form of inaccurate

earnings growth. In this study, the second hypothesis

is formulated as follows:

H2: Agency costs significantly influence the variation

in profit growth between segments.

2.3 Financing Incentives

In the previous study (Wang et al., 2011), financing

incentives as associated with profit growth between

segments is reported to indicate a positive

relationship. This is because companies that have a

high dependence on external financing will attempt to

reveal a good variation in profit growth between

segments to eliminate information asymmetry with

creditors. In this study, the third hypothesis is

formulated as follows:

H3: Financing incentives have a significant influence

on the variation in profit growth between segments.

3 RESEARCH METHODOLOGY

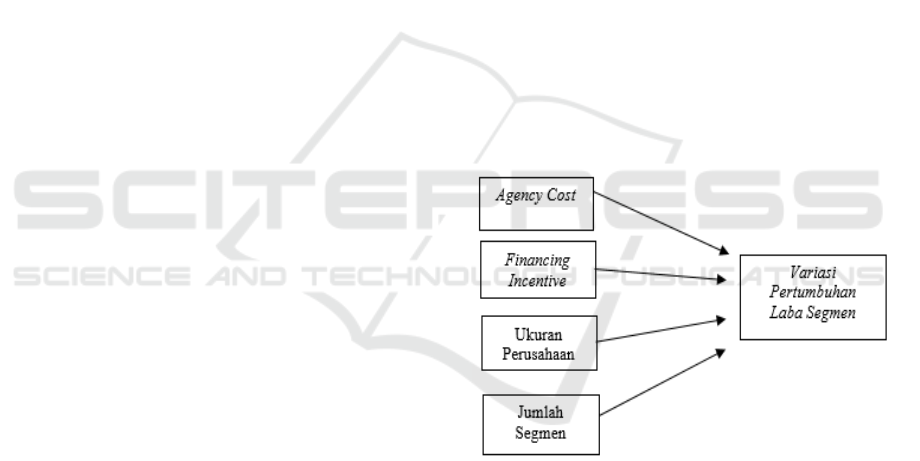

3.1 Conceptual Framework

Based on the background, problem statement, and

development of the hypotheses, the variables can be

formulated through a conceptual framework, as

shown in Figure 3.1.

Figure 1: Conceptual Framework

3.2 Operational Definition and Variable

Measurement

3.2.1Variation in Segment Profit Growth

Variation in segment profit growth is an operating

profit alteration, taken from the current operating

profit minus the previous year's operating profit,

scaled by the previous year's operating profit (Wang

et al., 2011). The growth of a company's segment

profit is a reflection of its performance.

The Impact of Proprietary Costs, Agency Costs, and Financing Incentives on Segment Profit Growth Variations

225

Description :

LO : operating profit, current year

: operating profit, previous year

3.2.2 Proprietary Costs

Proprietary costs consist of competitive disadvantage

costs and political costs. The cost of competitive

disadvantage is the cost that causes the company's

competitiveness to weaken as a result of the

disclosure of information through the published

financial statements utilized by business competitors.

Political costs are the costs incurred by the emergence

of new regulations from the government due to the

disclosure of information in the financial statements

(Murdoko Sudarmadji & Sularto, 2007).

The chosen method for this study is the

Herfindahl index.

Description :

: quadratic of sales value

: quadratic of total sales of firm

3.2.3 Agency Costs

The agency costs consist of monitoring costs,

bonding costs, and residual loss. Monitoring costs are

the costs borne by the shareholders in supervising and

controlling agent behavior. Bonding costs are the

costs borne by the manager in order to comply with

the mechanism in order to provide assurance of

serving the interests of shareholders. Residual loss is

a sacrifice that decreases shareholder wealth as a

result of agency problems (Destriana, 2011). The

measurement method used for agency costs is free

cash flow, which by searching operating net cash flow

is then less by cash dividend and capital expenditure,

then scaled with the company's total assets (Wang et

al., 2011).

Description :

ONCF : operating net cash flow

CD : cash dividend

CE : capital expenditure

TA : total asset

3.2.4 Financing Incentives

Financing incentives are the bonus obtained from

external financing as the company's efforts reveal

variations in profit growth between segments as a

benchmark of company performance. The calculation

of financing incentives uses a measurement of

external financing calculated using the sum of

external equity financing and debt financing divided

by the total assets.

Description :

EEF : external equity financing

DF : debt financing

TA : total asset

3.3 Research Model

This study used a quantitative research method, with

four independent variables as variable X

(independent variables) and variable Y (dependent

variable). The independent variables consist of

proprietary costs, agency costs, and financing

incentives. The dependent variable is the variation of

profit growth between segments.

To test the proposed hypotheses, this study used a

multiple linear regression equation, as follows:

Y= + β1 PC+β2 AC+ β3 FI+e

Y = variation in profit growth between

segments

= constant

β1 – β4 = coefficient regression

PC = proprietary costs

AC = agency costs

FI = financing incentive

e = error

3.4 Data

The study used secondary quantitative data

obtained from the Indonesia Stock Exchange, and

partly from www.idx.com, consisting of the annual

reports and financial reports of companies in the

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

226

category of state-owned enterprises for the period

2009–2015.

The data collection procedure for this research

used the purposive sampling technique. The total

number of samples obtained for this research was

105. Here is a list of State-Owned Enterprises

(BUMN) included in the sample of 105 for the period

2009–2015.

4 RESULTS AND DISCUSSION

4.1 Results

In this study, multiple linear regression analysis was

conducted to determine the effect of the independent

variables, consisting of proprietary costs (HHI),

agency costs (FCF), and financing incentives, on the

dependent variable of earnings growth (EGRWAR),

with control variables in the form of company size

(LNAT) and number of segments (NSEG) for the

period 2009–2015. The results of the multiple linear

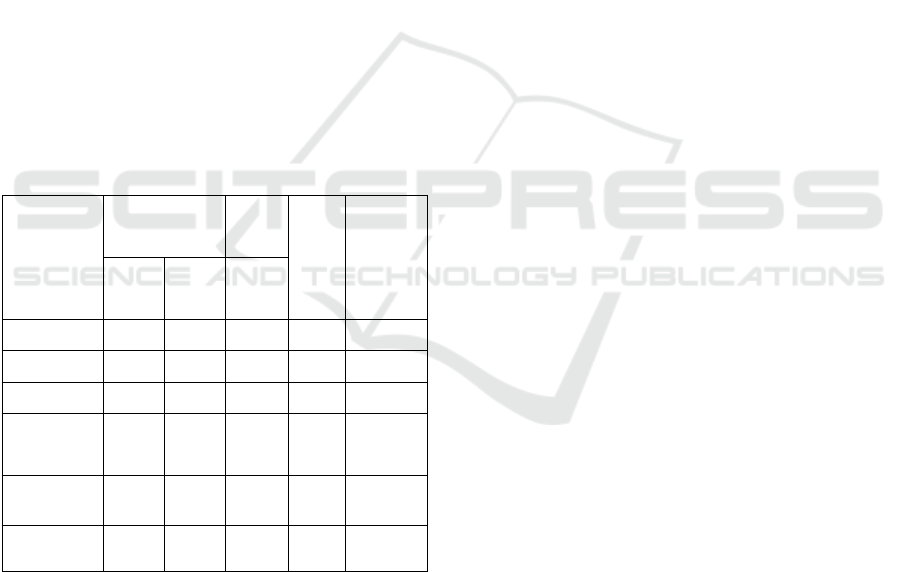

regression are presented in Table 1.

Table 1: Regression Result

Notes:

* = significant at the rate of 1% (0.01)

** = significant at the rate of 5% (0.05)

*** = significant at the rate of 10% (0.10)

Based on Table 3.1, the results obtained from the

multiple linear regression are as follows:

Y= 1.830 + 0.428 HHI +0.97 FCF + 0.020 FI –

0.085 LNAT + 0.107 NSEG + e

The results of the hypothesis test show that the

value of constant α is equal to 1.830. This is a positive

value, which means that the independent variables of

proprietary costs, agency costs, and financing

incentives affect the large variation in segment profit

growth.

The results of the hypothesis test show that the

regression value of proprietary costs is 0.482. This

value indicates that, if the variable of proprietary

costs increases by one unit, this will increase the

variation in segment profit growth.

The results of the hypothesis test show that the

regression value of agency costs is 0.987. This value

indicates that, if the variable of agency costs increases

by one unit, this will increase the variation in segment

profit growth.

The results of the hypothesis test show that the

regression value of financing incentives is 0.020. This

value indicates that, if the variable of financing

incentives increases by one unit, this will increase the

variation in segment profit growth.

The regression coefficient value of the firm

size hypothesis test shows a value of -0.085. This

value indicates that a decrease of one unit in the

control variable of firm size will increase the

variation in segment profit growth.

The regression coefficient value of the number

of segments shows a value of 0.107. This value

indicates that an increase of one unit in the control

variable of the number of segments will increase the

variation in segment profit growth

4.2 Discussion

The first hypothesis, which states that proprietary

costs affect the variation in segment profit growth, is

accepted. The results of this study indicate that

proprietary costs have a significant positive effect on

the variation in profit growth between segments, as

evidenced by the Herfindahl index. This shows that

the environment and level of business competition in

BUMN companies does not affect the decision of

managers to provide information on profit growth

between segments. This is because BUMN

companies are not only profit-seeking but also

providers of public goods and services, as well as

drivers of the national economy. BUMN companies

also control the oligopoly market structure. An

oligopoly is a market that offers one type of product

that is controlled by several companies. BUMN

companies also have diversified products in their

segment of operations and are not dependent on only

one product. This condition results in the relatively

Model

Unstandardized

Coeffficient

Stand.

Coef.

T

Sig.

B

Stat.

Error.

Beta

(Const.)

1.830

1.339

1.367

0.175

HHI

0.482

0.286

0.220

1.681

0.096***

FCF

0.987

0.481

0.215

2.055

0.043**

Financing_

Ins

0.020

0.006

0.333

3.149

0.002*

LNAT

-

0.085

0.045

-

0.204

-

1.867

0.065***

NSEG

0.107

0.060

0.235

1.779

0.079***

The Impact of Proprietary Costs, Agency Costs, and Financing Incentives on Segment Profit Growth Variations

227

low proprietary costs, resulting in high variation in

the growth of information. In contrast to companies

that concentrate on only one type of product, making

high proprietary cost so that the company will limit

the information of variation of segment profit. The

reason for this is that, for companies that rely on one

type of product, the level of business competition is

particularly influential for their continuity.

The second hypothesis, which states that

agency costs affect the variation in segment profit

growth, is accepted. The results of this study indicate

that agency costs have a significant positive effect on

the variation in profit growth between segments.

Agency costs calculated using free cash flow show

significant results. This shows that the motive of

agency costs can describe the motives of managers in

providing information on the variation in profit

growth between segments. This condition can occur

because managers in BUMN companies are directly

responsible to the government as a shareholder, and

such companies have a management and supervision

system based on the principles of good corporate

governance. The position of shareholders in BUMN

companies has also been represented by the

management of the company with the existence of the

cost agency that has been issued and the dominant

poetic content so that the policy manager can be

controlled easily according to the requirements of the

shareholders (government).

The third hypothesis, which states that financing

incentives affect the variation in segment profit

growth, is accepted. The results of this study indicate

that financing incentives have a significant positive

effect on the variation in profit growth between

segments. This is because BUMN companies in

Indonesia receive more capital from outside, such as

funding the majority of the government so that when

external capital financing increases, so too does

information on profit growth between segments. The

information is the responsibility of BUMN

companies to the government, and also acts as an

appraisal of the companies’ performance to secure

government funding. The results of this study are

similar to the research by Wang et al. (2011), which

also indicates that financing incentives have a

significant positive effect on the variation in profit

growth between segments.

Simultaneously, the independent variables of

proprietary costs, agency costs, and financing

incentives have a significant positive effect on the tax

compliance variable. This is because these three

independent variables interact and become

determinants of managers’ decisions to provide

information on the variation in segment profit growth.

5 CONCLUSIONS

Based on the analysis that has been carried out, the

following conclusions can be drawn:

1. Proprietary cost proxies in the Herfindahl index

have a significant positive effect on the variation in

profit growth between segments.

2. Agency cost proxies by free cash flow also show a

significant positive effect on the variation in profit

growth between segments.

3. Financing incentives proxies based on external

financing show a significant positive effect on the

variation in profit growth between segments.

REFERENCES

AUP. (2009). Pedoman Penulisan Pembimbingan dan

Ujian Skripsi. Surabaya: AUP Universitas Airlangga.

Bestari, M., & Siregar, S. V. (2012). DETERMINAN

MOTIF PENGUNGKAPAN VARIASI

PERTUMBUHAN LABA ANTAR SEGMEN

PERUSAHAAN MANUFAKTUR YANG

TERDAFTAR DI INDONESIA. Universitas

Indonesia. Blanco, B., Lara, G., Juan, M., &Tribo, J.

A. (2015). Segment disclosure and cost of capital.

Journal of Business Finance & Accounting, 42(3-4),

367-411.

Blanco, B., Lara, J. M. G., & Tribó, J. (2014). The relation

between segment disclosure and earnings quality.

Journal of Accounting and Public Policy, 33(5), 449-

469.

Brown, P. (1997). Financial data and decision making by

sell-side analysts. The Journal of Financial Statement

Analysis, 2(3), 43-48.

Chen, P., & Zhang, G. (2001). Heterogeneous Investment

Opportunities and the Value Relevance of Segment

Accounting Data. Paper presented at the 2001 Summer

Symposium at Hong Kong University of Science and

Technology, Hong Kong.

Destriana, N. (2011). Masalah dan Biaya Keagenan.

Media Bisnis, 3(1), 8-16.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the

firm: Managerial behavior, agency costs and

ownership structure. Journal of financial economics,

3(4), 305-360.

Lewellen, K. (2006). Financing decisions when managers

are risk averse. Journal of Financial Economics,

82(3), 551-589.

Muhammad, F., & Siregar, S. V. (2012). ANALISIS

TINGKAT PENGUNGKAPAN SEGMEN:

FAKTOR-FAKTOR.

Sembiring, E. R. (2005). Karakteristik Perusahaan dan

Pengungkapan Tanggung Jawab Sosial pada

Perusahaan yang Tercatat di Bursa Efek Jakarta.

Simposium Nasional Akuntansi, 7, 15-16.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

228

Soetedjo, S. (2009). Pembahasan Pokok-pokok Pikiran

Teori Akuntansi Vernon Kam: Surabaya: Airlangga

University Press.

Wang, Q., Ettredge, M., Huang, Y., & Sun, L. (2011).

Strategic revelation of differences in segment earnings

growth. Journal of Accounting and Public Policy,

30(4), 383-392.

The Impact of Proprietary Costs, Agency Costs, and Financing Incentives on Segment Profit Growth Variations

229