The Influence of Subjective Norms, Taxation Knowledge, and

Perception of The Financial Condition of The Personal Taxpayer on

Personal Taxpayer Compliance in KPP Pratama Mulyorejo Surabaya

Heru Tjaraka,

and Dwi Nurwicaksono

Department of Accounting, Faculty of Economics and Businessy, Universitas Airlangga, Surabaya, Indonesia

heru_tjaraka@yahoo.co.id

Keywords: Financial Condition, Subjective Norms, Taxpayer Compliance, Taxation Knowledge.

Abstract: This research aims to determine what factors affect taxpayers’ compliance in fulfilling their tax obligations.

The three factors studied are subjective norms, taxation knowledge, and perception of the personal

taxpayer’s financial condition in KPP Pratama Mulyorejo Surabaya. The hypothesis testing in this study

uses multiple linear regression analysis. Its results show that all the independent variables have a significant

effect on the dependent variable. The conclusion from this study is that subjective norms, taxation

knowledge, and perception of the individual taxpayer’s financial condition affects the level of taxpayers’

obedience in fulfilling their tax obligations in KPP Pratama Surabaya Mulyorejo.

1 INTRODUCTION

The taxation system in Indonesia is a self-

assessment system. The implementation of a self-

assessment system can run effectively and

efficiently if the taxpayer compliance level is

properly formed. However, in practice, the level of

taxpayer compliance regarding fulfilling their tax

obligations is low and this can be seen from a tax

revenue that is not yet at its optimum. To be able to

achieve the target tax revenue, then it needs to

improve taxpayer compliance.

There are several ways to understand

taxpayer compliance behavior, one of which is by

using the theory of planned behavior (TPB).

According to Ajzen (1991), the TPB is used because

it can measure specifically taxpayer compliance

behavior. In addition, according to Bobek and

Hatfield (2003), their research explained that

taxpayer compliance is strongly influenced by

several variables. Some of these variables are

subjective norms, knowledge of taxation, and the

financial condition of the taxpayers themselves.

Tax is one of the biggest income contributors

for the country. Tax Office Primary (KPP) is the

main gateway for taxpayers to perform their tax

obligation and conducts counseling, services, and

supervision of taxpayer income tax, value added tax,

sales tax on luxury goods, and other indirect taxes.

According to data collected through the KPP

Mulyorejo, state revenues in the tax sector in the last

three years experienced a drastic change, in which

the net tax revenue was unable to meet the budgeted

tax revenue. This is because the amount of realized

tax returns was still far from the number of effective

taxpayers, which indicates the compliance ratio of

taxpayers is not yet at its maximum.

This study aims to identify the factors that

affect the level of taxpayer compliance in order to

optimize the state revenue in the taxation sector.

2 LITERATURE REVIEW

2.1 Effect of Subjective Norms on

Taxpayer Compliance

According to Ajzen (1991), subjective norms are the

perception of social influences on forming certain

behaviors.

In the research by Bobek and Hatfield (2003), it

is found that subjective norms affect taxpayer

compliance behavior and one indicator is the

influence of family members, friends, and company

leaders. Hanno and Violette (1996) also use family

230

Tjaraka, H. and Nurwicaksono, D.

The Influence of Subjective Norms, Taxation Knowledge, and Perception of The Financial Condition of The Personal Taxpayer on Personal Taxpayer Compliance in KPP Pratama Mulyorejo

Surabaya.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 230-234

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

indicators in their research. From this description,

the proposed hypothesis is:

H1: Subjective norms affect the compliance of

taxpayers in KPP Surabaya Mulyorejo.

2.2 Effect of Taxation Knowledge on

Taxpayer Compliance

Knowledge of taxation is one of the factors that

shapes perceptions about compliance behavior. In

his research, Prasetyo (2006) revealed that the lack

of information about the taxation system and related

regulations means small business owners in the

Jogjakarta area do not understand the obligation of

taxation.

According to Hardiningsih and Yulianawati

(2011), knowledge about taxation is a process of

changing attitudes and taxpayer behavior through

teaching and training. Therefore, it is necessary for

each taxpayer to understand the tax system because

the more taxpayers understand about tax, the more

taxpayers will understand the sanctions that are

applied when neglecting their tax obligations. From

the description above, the proposed hypothesis is:

H2: Taxation knowledge affects the compliance

of taxpayers in KPP Surabaya Mulyorejo.

2.3 Effect of Perceptions About Financial

Conditions on Taxpayer

Compliance

The financial condition is the taxpayers’ financial

ability that is measured according to their

profitability. Profitability is one of the factors that

influence taxpayer compliance behavior because

profitability affects taxpayers reporting their tax

(Slemrod, 1989).

According to Bradley (1994), taxpayers who

have a high level of profitability tend to report taxes

honestly while taxpayers who have low levels of

profitability will tend to make irregularities by

reporting taxes that do not fulfill the actual

conditions. From the description above, the

proposed hypothesis is:

H3: Perceptions about the taxpayer’s financial

condition affects taxpayer compliance in KPP

Pratama Surabaya Mulyorejo.

3 RESEARCH METHODOLOGY

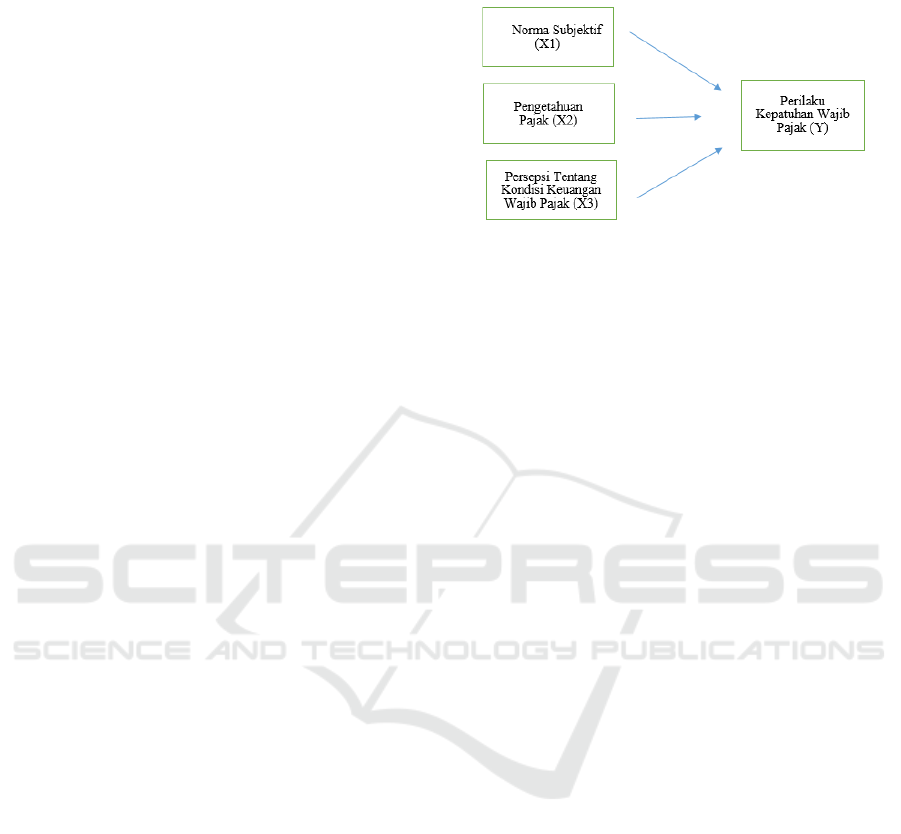

3.1 Conceptual Framework

Based on the background of this problem, the

supporting theories, and the proposed hypotheses,

the conceptual framework used in this study is as

follows:

Figure 1: Conceptual Framework

3.2 Operational Definition and Variable

Measurement

3.2.1 Taxpayer Compliance Variable (Y)

The taxpayer compliance variable is a dependent

variable in which taxpayer compliance can be

measured by using several indicators. According to

Mustikasari (2007), taxpayer compliance can be

measured by looking at several factors, namely:

1. The accuracy of taxpayers in submitting a tax

return (SPT).

2. The accuracy of taxpayers in paying or depositing

taxes.

3. The accuracy of the taxpayer in reporting their tax

return in accordance with the conditions of the

taxpayer.

3.2.2 Subjective Norms Variable (X1)

The subjective norm variable is one of the

independent variables in this research. The

subjective norm is a social factor derived from the

perceived social pressure to encourage an action or

behavior.

Subjective norms can be assessed from several

indicators such as:

1. The biological family encourages compliance.

2. The non-birth family encourages compliance.

3. Close friends of taxpayers are pushing for

compliance.

4. The other party taxpayer encourages compliance.

3.3.3 Taxation Knowledge Variable (X2)

An understanding of the rules and obligations of

each taxpayer greatly affects the compliance of each

taxpayer. According to Hardiningsih and

Yulianawati (2011), the way to assess the taxpayer’s

The Influence of Subjective Norms, Taxation Knowledge, and Perception of The Financial Condition of The Personal Taxpayer on Personal

Taxpayer Compliance in KPP Pratama Mulyorejo Surabaya

231

knowledge about taxation can be seen from several

indicators, namely:

1. How much tax information taxpayers know.

2. An understanding of applicable tax laws.

3. The understanding of taxation programs issued by

the Directorate General of Taxes.

3.3.4 Perception About Financial Condition

of the Taxpayer Variable (X3)

The perception of the financial condition of

taxpayers is a variable that greatly affects the

compliance behavior of taxpayers. The financial

condition is the financial ability of taxpayers that is

measured from the taxpayer’s level of profitability.

Profitability is one of the factors that influence the

taxpayers’ intention to comply with the applicable

tax laws. According to Mustikasari (2007), there are

several indicators used to measure the financial

condition of taxpayers:

1. Conditions of cash flow last year.

2. The amount of profit before tax last year.

3. The number of total assets owned by the taxpayer.

3.3.5 Research Model

The variables in this study are measured using an

interval scale and a Likert scale is used to assess the

variables using positive and negative statements.

To test the hypothesis proposed in this study, a

multiple linear regression equation is used:

Y = α + b1X1 + b2X2 + b3X3 + e

(1)

Information:

Y = Taxpayer compliance

α = Constants

X1 = Subjective norm

X2 = Taxation knowledge

X3 = Perception of Taxpayer’s Financial Condition

b1,2,3 = Regression coefficient

3.3.6 Data

The data used in this study comes from interviews

with informants and questionnaires distributed to

respondents residing in Surabaya Tax Office.

The sampling technique involves a non-

probability method with a random sampling of at

least 100 respondents of effective taxpayers in KPP

Pratama Surabaya Mulyorejo.

4 RESULT AND DISCUSSION

4.1 Results

Table 4.1: Multiple Linear Regression Analysis Results

Based on table 4.1, the multiple linear regression

equation is as follows:

Y = 8,035 + 0,480 X1 + 0,573 X2 + 0,282 X3 + e

The result of the hypothesis test shows a constant

value of α equal to 8.035. This value is positive,

which means if the independent variable, namely the

subjective norm, taxation knowledge, or perception

of financial condition has a value of 0 or constant,

hence tax compliance is 8.035, which means the tax

compliance rate will equal 8.035 if other variables

are 0.

The result of the hypothesis test shows the

value of b1 is 0.480, a significant positive value. The

value indicates if there is an increase in the

subjective norm variable (X1) and if the taxation

knowledge variable (X2) and perception of financial

condition variable (X3) are considered constant, then

there will be an increase in tax compliance (Y) to

0.480. Such results indicate that the subjective norm

affects taxpayer compliance in KPP Pratama

Surabaya Mulyorejo.

The result of the hypothesis test shows the

value of b2 is equal to 0.573, or a positive

compliance value. This value indicates if there is an

increase in the taxation knowledge variable (X2) and

if the subjective norm variable (X1) and perception

of financial condition (X3) are considered constant,

then there will be an increase in tax compliance (Y)

equal to 0.573. This result shows that the financial

condition affects taxpayer compliance in KPP

Pratama Surabaya Mulyorejo.

The results of the hypothesis test show that

the value of b3 is equal to 0.282, a positive

coefficient value. This value shows that if there is an

increase in the perception of the financial condition

variable (X3) and if the subjective norms variable

(X1) and taxation knowledge variable (X2) are

considered constant, there will be an increase in tax

compliance by 0.282.

Model

Unstand.

Coef.

Stand.

Coef.

T.

Sig.

Col sta.

B

Stat.

Error.

Beta

Tol.

VIF

(Const)

8.035

3.372

2.38

.019

NTOTAL

.480

.165

.290

2.90

.005

.581

1.72

PTOTAL

.573

.162

.362

3.53

.001

.552

1.81

PKTOTAL

.282

.102

.218

2.76

.007

.934

1.07

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

232

For the value of e (error) shown in the

hypothesis test, the results obtained a value of 3.305.

This value will be compared with the standard

deviation of tax compliance variables (Y). If the

value of e is smaller than the standard deviation of

the tax compliance variable, then the regression

model is good. The standard deviation value of the

tax compliance variable obtained a value of 4.362,

so the regression model used is good because the

standard deviation value of the tax compliance

variable is greater than the value e.

4.2 Discussion

The first hypothesis stated that subjective norms

affect taxpayer compliance in KPP Pratama

Surabaya Mulyorejois and is accepted. This is

proven by the results of the linear regression test that

shows a significant value on the partial test of 0.005

with a positive coefficient direction. According to

Ajzen (1991), the subjective norm is the individual’s

perception of social influences in shaping certain

behaviors. Subjective norms are also a function of

perceived individual expectations where one or more

people around them agree to a particular behavior

and motivate the individual to obey them. Subjective

norms are formed from normative beliefs and

motivations from the influence of the referent group.

Therefore, each individual can be affected or not

affected by another, this depends on the personalities

involved and the will of others. The results of this

study are in accordance with research conducted by

McGraw and Scholz (1991) who state that taxpayer

compliance has an important influence on predicting

the behavior of each taxpayer.

The second hypothesis states that taxation

knowledge affects the compliance of individual

taxpayers in KPP Pratama Surabaya Mulyorejo; this

is accepted. This is seen by the results of the linear

regression test that shows a significant value in the

partial test of 0.001 with a positive coefficient

direction. An understanding of the regulations and

obligations of each taxpayer affects the compliance

of each taxpayer. Taxpayers who do not know or

understand the tax laws tend to become disobedient

taxpayers so that they need an understanding of the

tax regulations. According to Ajzen (1991) the fully

functional in individuals is to process available

information like behavioral traits such as social

attitudes, knowledge, and personality traits. It plays

an important role in predicting and explaining

human behavior. The results of this study are in

accordance with research conducted by Hardiningsih

and Yulianawati (2011), which states that

knowledge about taxation is a process of changing

attitudes and taxpayer behavior through teaching and

training.

The third hypothesis states that the perception

of the financial condition affects the compliance of

individual taxpayers in KPP Pratama Surabaya

Mulyorejois; this is accepted. This is proven by the

results of the linear regression test that shows a

significant value on the partial test of 0.007 with a

positive coefficient direction. The financial

condition is the financial ability of taxpayers that is

measured from their profitability. Profitability is one

of the factors that influence the taxpayers’ intention

to comply with the applicable tax laws. According to

Ajzen (1991), performance is the most influential

factor, at least for some non-motivational degree

such as the availability of the necessary

opportunities and resources (e.g. time, money, skills,

and cooperation of others). Collectively, these

factors represent people who actually have control

over their behavior. The results of this study are in

accordance with research conducted by Bradley

(1994). Taxpayers who have a high level of

profitability tend to report their taxes honestly and

vice versa.

Simultaneously, the independent variables,

namely the subjective norms, taxation knowledge,

and perceptions of financial condition, have a

significant positive effect on the tax compliance

variable. This is because these three independent

variables interact and become determinants of each

individuals’ behavior. The subjective norm is shaped

by the expectations of others and the motivation to

act. Lack of knowledge about taxes means every

individual can be easily influenced by information

from outside. The financial condition of each

individual who has a low level of profitability will

also affect the level of taxpayer compliance.

5 Conclusions

Based on the analysis, the following conclusions are

drawn:

1. Subjective norms have a positive and significant

effect on taxpayer compliance in KPP Pratama

Surabaya Mulyorejo. This shows that taxpayer

compliance has an important influence on

predicting the behavior of each taxpayer.

2. Tax knowledge has a positive and significant

effect on taxpayer compliance in KPP Pratama

Surabaya Mulyorejo. This shows that knowledge

about taxation is a process of changing attitudes

The Influence of Subjective Norms, Taxation Knowledge, and Perception of The Financial Condition of The Personal Taxpayer on Personal

Taxpayer Compliance in KPP Pratama Mulyorejo Surabaya

233

and behavior of taxpayers through teaching and

training.

3. Perception of the financial condition of the

individual taxpayer has a positive and significant

effect on taxpayer compliance in KPP Pratama

Surabaya Mulyorejo. This proves that taxpayers

who have a high level of profitability tend to

report their taxes honestly and vice versa.

4. Subjective norms, tax knowledge, and perception

of the financial condition of individual taxpayers

all have a positive and significant effect on

taxpayer compliance in KPP Pratama Surabaya

Mulyorejo.

REFERENCES

Ajzen, I. (1991). The theory of planned behavior.

Organizational behavior and human decision

processes, 50(2), 179-211

Bobek, D. D., & Hatfield, R. C. (2003). An investigation

of the theory of planned behavior and the role of moral

obligation in tax compliance. Behavioral Research in

Accounting, 15(1), 13-38.

Bradley, C. F. (1994). An empirical investigation of

factors affecting corporate tax compliance behavior.

Hardiningsih, P., &Yulianawati, N. (2011). Faktor-faktor

yang mempengaruhikemauanmembayarpajak.

DinamikaKeuangandanPerbankan, 3(2).

McGraw, K. M., &Scholz, J. T. (1991). Appeals to civic

virtue versus attention to self-interest: Effects on tax

compliance. Law and Society Review, 471-498.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

234