The Effect of Managerial Ownership, Institutional Ownership, and

Foreign Ownership on Firm Value: An Empirical Study on

Manufacturing Companies

Prajnya Paramita Artantiwi and Hamidah

Department of Accounting, Economics and Business Faculty, Airlangga University,

Jalan Airlangga No. 4 – 6, Surabaya, Indonesia

hamidah@feb.unair.ac.id

Keywords: Managerial ownership, institutional ownership, foreign ownership, firm value

Abstract: The aim of this research is to examine the effect of managerial ownership, institutional ownership, and

foreign ownership on firm value. The study’s population were manufacturing companies listed on the

Indonesian Stock Exchange from 2013–2015. Based on purposive sampling, 315 firms constituted the

research sample. Data was analyzed by means of multiple regression analysis, with the help of SPSS 20.0.

The results of this study show that institutional ownership has no significant influence on firm value. On the

other hand, managerial ownership and foreign ownership have a significant influence on firm value.

1 INTRODUCTION

The rapid development of the business world

requires companies to continually adjust to

developments occurring in the external environment.

In running its business, every company has a vision

and a mission in order to achieve company goals

(Martono & Harjito, 2005, p. 2). The goals of a

company can be divided into three aspects: the first

is to maximize profit, the second is to increase the

wealth of the owner or the shareholders

(stockholders), and the third is to increase the value

of the company.

Corporate value can be defined as a certain

condition that has been achieved by a company as an

image of public trust to the company after going

through a process of activity for several years, which

means since company established until now.

The ownership structures examined in this research

are managerial ownership, institutional ownership,

and foreign ownership. Managerial ownership refers

to the shareholding of directors, managers,

commissioners, or any other parties involved in

corporate decision making (Jensen & Meckling,

1976).

According to Nuraina (2012), institutional

ownership refers to the stake in a company owned

by institutions such as investment companies,

insurance companies, etc. Institutional ownership

can reduce agency costs as it will result in more

optimal and improved supervision.

Several studies have been conducted in relation

to the effect of institutional ownership on corporate

value. Pakaryaningsih (2008) found a significant

influence of institutional ownership on the value of

companies listed on the Indonesian Stock Exchange

(IDX). However, a non-significant influence of

institutional ownership on corporate value was also

found. Wiranata and Nugrahanti (2013) conclude

that institutional ownership does not affect the

performance of firms; in this sense, the majority of

owners of institutions participate in corporate

control and tend to act on their own behalf, even by

sacrificing the minority ownership.

Foreign ownership refers to the percentage of

shares owned by foreign investors. Several empirical

studies conducted by Abukosim et al. (2014) found

that the presence of foreign ownership in a company

is able to increase the company’s value.

Based on this background, the present research

aims to obtain information and empirical evidence

regarding the influence of managerial, institutional,

and foreign ownership on the value of

manufacturing companies listed on the Indonesian

Stock Exchange (IDX) in the period 2013–2015.

Artantiwi, P. and Hamidah, .

The Effect of Managerial Ownership, Institutional Ownership, and Foreign Ownership on Firm Value: An Empirical Study on Manufacturing Companies.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporar y Accounting Studies in

Indonesia, pages 241-247

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

241

2 LITERATURE REVIEW

2.1 Theoretical Base

Agency theory describes the relationship that arises

because of a contract between the principal and

another party called the agent, where the principal

delegates a job to the agent. Agency theory assumes

that the principal does not have sufficient

information about the performance of the agent. In

this sense, the agent has more information than the

principal about the self-capacity, the work

environment, the company as a whole, and its future

prospects. This is what causes the information

imbalance between the principal and the agent.

Martono and Harjito (2010) argue that

“maximizing the value of the firm is called

maximizing the shareholder wealth, which also

means maximizing the price of the firm’s common

stock.”

2.2 Research Hypotheses

2.2.1 The Effect of Managerial Ownership on

Corporate Value

According to agency theory, the separation between

the ownership and management of a company can

lead to agency conflict, which is due to the

conflicting interests between the principal and the

agent, as each of them strives to increase his/her

own wealth. This difference in interests is what

triggers management to behave in a way that may

harm shareholders. As a result, supervision is

needed, which will result in agency costs for the

company.

A high level of managerial ownership will ensure

that managers actively work for the benefit of the

shareholders, themselves included, so as to increase

the value of the company and benefit the

shareholders. Research conducted by Bhabra (2007),

Chen and Steiner (1999), and Wahyudi and Pawestri

(2006) shows that managerial ownership has a

significant influence on firm value. The results of

these studies support agency cost theory, which

states that managerial ownership is an effective

mechanism for overcoming the agency problem that

impacts negatively upon company value. Applying

the theoretical base and the research results

described above, the first hypothesis can be

formulated as follows:

H1: Managerial ownership positively affects

corporate value

2.2.2 The Effect of Institutional Ownership

on Corporate Value

Agency theory suggests that institutional ownership

can act as a monitoring agent, with the role of

providing oversight of the managerial side through

supervision focusing on the proportion of ownership

of each institution in a company (Wahidahwati,

2001). Research conducted by Navissi and Naiker

(2006) and Vintila and Gherghina (2015) shows that

institutional ownership has a significant influence on

firm value. A high level of institutional ownership

will increase the institutional role in supervising the

performance of managers. In combining the

theoretical base and the research results described

above, the second hypothesis can be formulated as

follows:

H2: Institutional ownership positively affects

corporate value.

2.2.3 The Effect of Foreign Ownership on

Corporate Value

Multinational companies have the ability to increase

stock prices more than national companies. This is

because foreign ownership will result in a positive

influence on the company, such as the training

conducted by foreign companies to meet skilled

labor need and the existence of trained labor

employed in domestic companies (Fanani &

Hendrick, 2016).

Empirical research conducted by Al-Khouri et al.

(2004), Fanani and Hendrick (2016), and Wei et al.

(2005) shows that foreign ownership can increase

the value of a company, since the presence of

foreign ownership will result in a positive impact on

the company. Applying the theoretical base and the

research results described above, the third

hypothesis can be formulated as follows:

H3: Foreign ownership positively affects

corporate value.

3. RESEARCH METHODOLOGY

3.1 Research Approach

With regard to the problem under investigation, this

study utilizes an explanatory research approach,

which aims to provide an explanation of the

relationship (causality) between variables through

hypotheses testing (Sugiyono, 2012, p. 21). Based

on a quantitative approach, this research can also be

understood as confirmatory research, since it focuses

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

242

on theoretical confirmation of a particular research

object, either for explanation or prediction

(Sugiyono, 2012, p. 36).

3.2 Data Collection Procedure

The data collection procedure used in this study was

document analysis, through collecting secondary

data from the www.sahamok.com website, the

Indonesian Stock Exchange (IDX) website

(www.idx.co.id), and the www.yahoofinance.com

website during the period of 2013–2015.

3.3 Population and Sampling

A purposive sampling method was used in this

research, which is sample determination technique

with certain considerations (Sugiyono, 2012, p. 96).

4. DATA ANALYSIS AND

DISCUSSION

4.1 Description of Research Subjects and

Objects

The research subjects in this study were companies

engaged in the manufacturing sector, listed on the

Indonesian Stock Exchange (IDX), that had

published financial statements for the period 2013–

2015. Since there are many manufacturing

companies in Indonesia and they are engaged in a

homogeneous type of industry, a selection of

manufacturing companies can be expected to

provide representative results from data processing

and analysis.

The population in this study was manufacturing

companies that met the criteria specified in the

purposive sampling process. From the data of 407

manufacturing companies that had published

financial statements on the IDX in the period 2013–

2015, 315 met the criteria specified in the purposive

sampling. The research objects were all the variables

studied in this research, i.e. corporate value,

managerial ownership, institutional ownership,

foreign ownership, and company size.

4.2 Descriptive Statistic

Descriptive statistics were used to provide

information on the variables used in this study, i.e.

managerial ownership (MANOWN), institutional

ownership (INSOWN), foreign ownership

(FOROWN), corporate value, which used Tobin’s q

ratio as an assessment indicator (TOBINS), and

company size (SIZE) as the control variable in this

research.

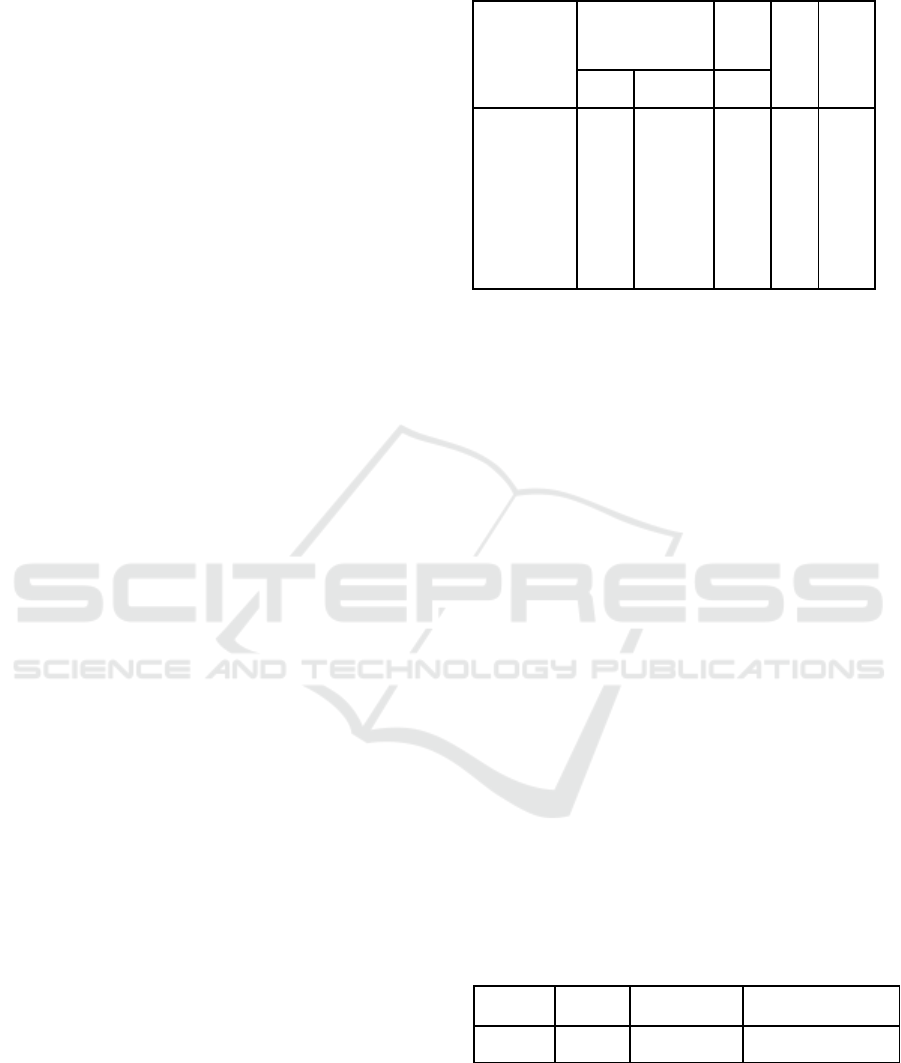

Table 1: Descriptive Statistics

N Min Max Mean SD

MANOWN 315 0.00 0.74 0.04 0.11

INSOWN 315 0.00 0.60 0.04 0.10

FOROWN 315 0.00 0.99 0.34 0.33

SIZE 315 10.66 14.39 12.30 0.69

TOBINS 315 -6.76 19.02 1.44 2.60

Valid N (listwise) 315

Valid N (listwise) 315

Source: Processed Data, 2017

Based on Table 4.1, the average managerial

ownership of all sampled companies is 0.038812,

with a standard deviation of 0.1099713. The degree

of distribution of the managerial ownership data has

a variation rate of 283.343%. This shows that the

overall managerial ownership of the sampled

companies is heterogeneous, meaning that there are

companies with relatively different percentages of

managerial ownership, but also companies that do

not have managerial ownership.

Institutional Ownership (INSOWN) has a

minimum value of 0.0000 and a maximum value of

0.5971. The average institutional ownership of all

the sampled companies is 0.042550, with a standard

deviation of 0.0997606. The degree of distribution

of the institutional ownership data has a variation

rate of 234.455%. This shows that the overall

institutional ownership of the sampled companies is

heterogeneous, meaning that the percentage of

institutional ownership of each company is relatively

diverse, in addition to there being companies with no

institutional ownership.

Foreign Ownership (FOROWN) has a minimum

value of 0.0000 for 99 manufacturing companies,

meaning that about 30% of manufacturing

companies in the period 2013–2015 had no foreign

ownership. The average foreign ownership of all the

sampled companies is 0.342058, with a standard

deviation of 0.3250774. The rate of distribution of

the foreign ownership data has a variation rate of

95.04%. This shows that the overall ownership of

the sampled companies is homogeneous, meaning

that the percentage of foreign ownership of each

The Effect of Managerial Ownership, Institutional Ownership, and Foreign Ownership on Firm Value: An Empirical Study on

Manufacturing Companies

243

company is relatively the same, although there are

also companies that do not have any foreign

ownership.

The average size of companies owned by all the

sampled companies is 12.304000, with a standard

deviation of 0.6901883. The rate of distribution of

the company size data has a variation rate of 5.61%.

This shows that company size in the overall research

is relatively uniform, where each company is of a

comparatively similar size and with the relatively

same amount of total assets.

The average corporate value for all the sampled

companies is 1.445499, with a standard deviation of

2.5499268. The level of distribution of the corporate

value data has a variation level of 176.40%. This

shows that the overall value of the companies in the

research is heterogeneous, meaning that each

company has a relatively diverse corporate value.

4.3 Model Analysis and Hypotheses

Testing

This research used multiple linear regression to test

the hypotheses. To obtain results that are free from

bias, a classical assumption test was carried out.

4.3.1 Classical Assumption Test

To ensure that the results of the hypotheses testing

were free from bias in the multiple linear regression

model, a classical assumption test was carried out.

The classical assumption test in this study used four

tests: a normality test, an autocorrelation test, a

multicollinearity test, and a heteroscedasticity test.

The classical assumption test was performed with

the help of SPSS 20.0 software.

4.3.2 Analysis of the Multiple Linear

Regression Model

Analysis of the multiple linear regression model

aimed to determine the effect of managerial

ownership (MANOWN), institutional ownership

(INSOWN), foreign ownership (FOROWN), and

firm size (SIZE) –as the control variable – on

company value, projected with Tobin’s q (TOBINS),

at manufacturing companies listed on the Indonesian

Stock Exchange during the observation period 2013-

2015 and which met the target population criteria.

The result of the multiple linear regression analysis

are presented in Table 4.2.

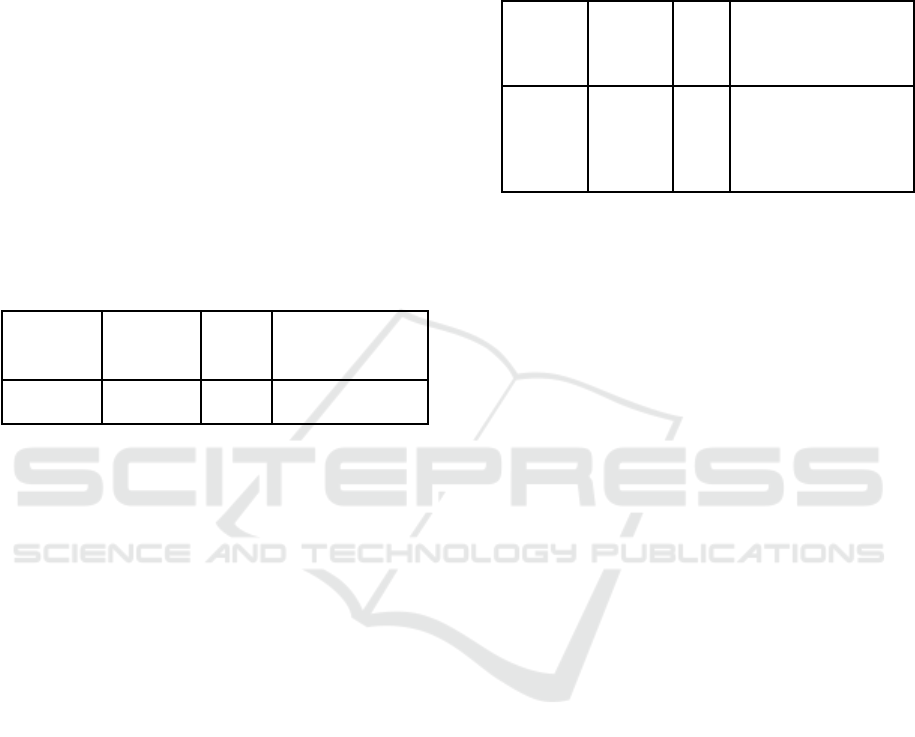

Table 2: Results of the Multiple Linear Regression Model

Model Unstandardized

Stand

t Sig.

Coefficients Coef

f

B Std. Error

Beta

(Constant) -2.1

9

0.39 -5.5

8

0.00

MANOWN 0.78 0.27 0.18 2.9

0

0.01

INSOWN 0.05 0.23 0.01 0.2

1

0.83

FOROWN 0.16 0.07 0.15 2.4

0

0.02

SIZE 0.22 0.03 0.43 7.0

3

0.00

Source: Processed Data, 2017

Based on the results in Table 4.2, the multiple

linear regression equation can be formulated as

follows:

TOBINS = -2,194 + 0,783 MANOWN + 0,049

INSOWN + 0,163 FOROWN + 0,224 SIZE + e

The regression coefficient as a positive value

indicates the occurrence of unidirectional change

between the independent variables and the

dependent variable. In this sense, a negative value

indicates the opposite relationship between the

independent variables and the dependent variable.

4.3.3 Hypotheses Testing

4.3.3.1 Coefficient Determination Test Result

A coefficient determination test was conducted to

determine the effect of all the independent variables

on the value of the company. The coefficient

determination test was measured by the Adjusted R

Square resulting from the multiple linear regression

analysis. The coefficient determination test results

are presented in Table 4.8.

Table 3: Coefficient Determination Test Results

Source: Processed Data, 2017

Based on the results in Table 4.3, the Adjusted R

Square value obtained is 0.192 (19.2%). This shows

that the independent variables used in this study can

predict the company value of manufacturing

Model

R

R Square

Adjusted R Square

1

.454

a

.206 .192

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

244

companies by 19.2%, while the remaining 80.8% is

influenced by other variables not used in this study.

4.3.4 Hypotheses Proofing

This study aims to determine the effect of

managerial ownership, institutional ownership, and

foreign ownership on corporate value. The sample

for this research was manufacturing companies

listed on the Indonesian Stock Exchange (IDX) from

2013 to 2015, which presented financial statements

and completed the required data during the study

period.

4.3.4.1 The Effect of Managerial Ownership on

Corporate Value

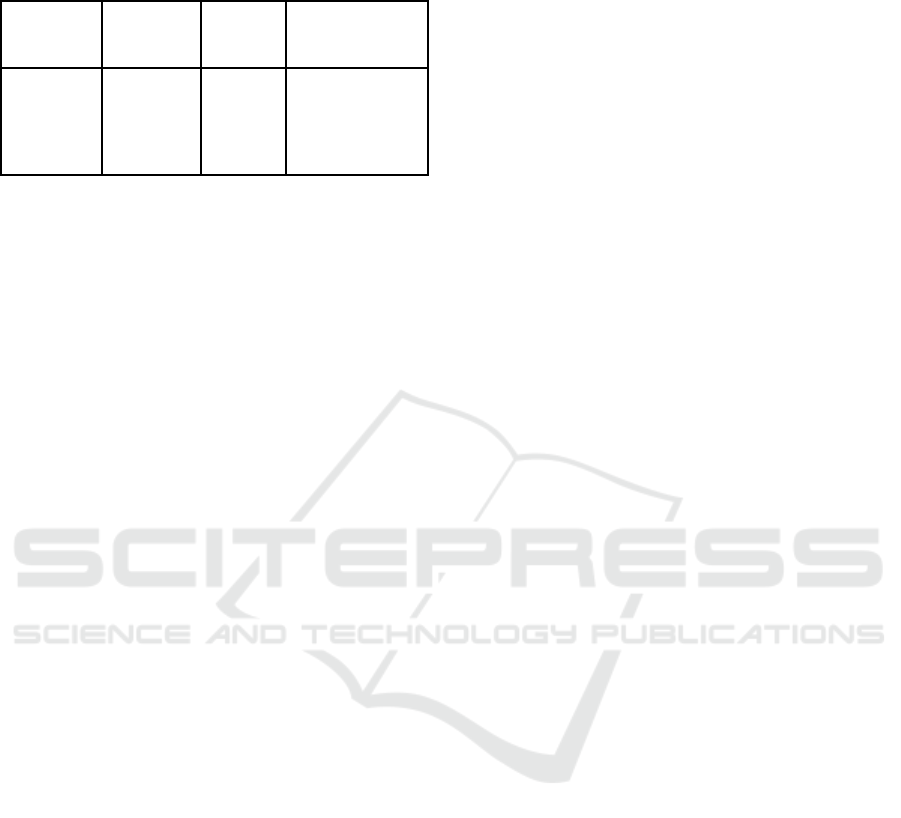

Table 4: Test Results of the Effect of Managerial

Ownership on Corporate Value

Variable

Regression

Coefficient

Sig Conclusion

MANOWN 0,783 0,004

Positive

Effect

Source: Processed Data, 2017

Based on the results of the multiple linear

regression test in Table 4.4, since the significance

level is 0.004, and therefore the significance level of

count < trust level (0.05), it can be concluded that

managerial ownership has a positive and significant

effect on firm value.

The value of the managerial regression

coefficient is 0.783, so it can be concluded that

managerial ownership can increase the value of a

company. The positive value of the regression

coefficient shows that there is a unidirectional

relationship between managerial ownership and firm

value, meaning that if managerial ownership

increases once, the value of the firm will increase by

0.783 times.

4.3.4.2 The Effect of Institutional Ownership on

Corporate Value

Table 5: Test Results of the Effect of Institutional

Ownership on Corporate Value

Source: Processed Data, 2017

Based on the results of the multiple linear

regression test in Table 4.5, since the significance

level is 0.832, and therefore the significance level of

count > trust level (0.05), it can be concluded that

institutional ownership has a positive but non-

significant effect on corporate value.

Since the value of the institutional ownership

regression coefficient is 0.049, it can be concluded

that institutional ownership can increase the value of

the company. The positive value of the regression

coefficient indicates that there is a unidirectional

relationship between institutional ownership and

corporate value, meaning that when institutional

ownership increases once, the value of the firm will

increase by 0.049 times. According to the level of

significance and the regression coefficient with

regard to the effect of institutional ownership on

company value, institutional ownership has no effect

on firm value. In this sense, H2 (institutional

ownership affects company value) is rejected.

4.3.4.3

The Effect of Foreign Ownership on

Corporate Value

The influence of foreign ownership on company

value in this research was analyzed by using the t

test produced in the multiple linear regression

model. The result of the multiple linear regression

analysis regarding the effect of foreign ownership on

company value is presented in Table 4.6.

Variable

Regressio

n

coefficient

Sig

Conclusion

INSOWN

0,049 0,832

Insignificant positive

effect

The Effect of Managerial Ownership, Institutional Ownership, and Foreign Ownership on Firm Value: An Empirical Study on

Manufacturing Companies

245

Table 6: Test Results for the Effect of Foreign Ownership

on Corporate Value

Source: Processed Data, 2017

According to the results of the multiple linear

regression test in Table 4.6, since the significance

level is 0.017, and therefore the significance level of

count < trust level (0.05), it can be concluded that

foreign ownership has a positive and significant

effect on company value.

The value of the foreign ownership regression

coefficient is 0.163, meaning that foreign ownership

can increase the value of a company. The positive

value of the regression coefficient shows a

unidirectional relationship between foreign

ownership and company value, so if foreign

ownership increases once, then the value of the firm

will increase by 0.163 times. Based on the level of

the significance and regression coefficient relating to

the effect of foreign ownership on company value,

foreign ownership has a positive and significant

effect on the value of the company. Therefore, H3

(foreign ownership has a positive effect on company

value) is accepted.

5. CONCLUSIONS AND

SUGGESTIONS

5.1 Conclusions

Based on the results of the research analysis, the

following can be concluded:

1. Managerial ownership positively affects

company value. The results show that the

greater the ownership of managers in a

company, the less likely the managers are to

perform actions that can harm the company.

2. Institutional ownership does not have a positive

effect on corporate value. The results show that

institutional ownership can reduce

opportunistic behavior by managers through

active supervision. Active supervision will

become passive as the amount of institutional

ownership in the firm increases due to the

possibility of compromise between institutional

shareholders and managers acting for their own

interests regardless of other shareholders.

3. Foreign ownership positively affects the value

of the company. The greater the foreign

ownership, the greater rights that shareholders

have in decision making, thus indirectly

providing monitoring on managerial

performance, which will affect the value of the

company.

5.2 Suggestions

Based on the research results, the author suggests

that future research examines other industrial

sectors, such as the financial industry sector, which

have different characteristics from the

manufacturing industry.

For investors, the results can be used to consider

possible future investments. In this sense,

investments or stock purchases are preferable in

companies with foreign ownership and managerial

ownership because the presence of foreign and

managerial ownership will have a positive impact on

the company’s operational performance, which will

increase the value of the company and therefore the

welfare of the shareholders.

For the company, the results can be used to

overcome any agency problems that occur within the

company, and thus reduce the information gap

between shareholders and managers so as to improve

the performance of the company and increase

corporate value.

REFERENCES

Abukosim, et al. 2014. Ownership Structure and Firm

Value: Empirical Study on Indonesia Manufacturing

Listed Companies. Journal of Arts, Science, &

Commerce, 5.

Al-Khouri, R., et al. 2004. Foreign ownership and firm

valuation: an empirical investigation. Finance India,

18(2), 779.

Bhabra, G. S. 2007. Insider ownership and firm value in

New Zealand. Journal of Multinational Financial

Management, 17(2), 142-154.

Chen, C. R., and Steiner, T. L. 1999. Managerial

ownership and agency conflicts: A nonlinear

simultaneous equation analysis of managerial

ownership, risk taking, debt policy, and dividend

policy. Financial Review, 34(1), 119-136.

Fanani, Z., and Hendrick, Y. 2016. Struktur Kepemilikan

dan Nilai Perusahaan. Iqtishadia, 9.

Variable

Regression

coefficient

Sig

Conclusion

FOROWN

0,163 0,017

Significant positive

effect

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

246

Jensen, M. C., and Meckling, W. H. 1976. Theory of the

firm: Managerial behavior, agency costs and

ownership structure. Journal of financial economics,

3(4), 305-360.

Navissi, F., and Naiker, V. 2006. Institutional ownership

and corporate value. Managerial Finance, 32(3), 247-

256.

Pakaryaningsih, Elok. 2008. Peranan Kepemilikan

Institusional Terhadap Nilai Perusahaan Dalam

Tinjauan Hubungan Non-Linear Kasus Perusahaan

yang Terdaftar di Bursa Efek Indonesia. Jurnal

Manajemen dan Bisnis, 12(2), 128-137.

Scott, William R. 2003. Financial Accounting Theory.

New Jersey: Prentice Hall Inc

Sugiyono. 2012. Metode Penelitian Kuantitatif Kualitatif

dan R&D. Bandung: Alfabeta.

Vintila, G., dan Gherghina, S. C. 2015. Does Ownership

Structure Influence Firm Value? An Empirical

Research towards the Bucharest Stock Exchange

Listed Companies. International Journal of Economics

and Financial Issues, 5(2).

Wahyudi, U., dan Pawestri, H. P. 2006.

Healy, P. M., & Palepu, K. G., 2001. Information

asymmetry, corporate disclosure, and the capital

markets: A review of the empirical disclosure

literature. Journal of Accounting and Economics,

31(1–3), 405-440.

Hope, O-K., 2003. Disclosure practices, enforcement of

accounting standards, and analysts forecasts accuracy:

an international study. Journal of Accounting Research

41(2):235-272.

Houqe, M. N., van Zijl, T., Dunstan, K., & Karim, A. K.

M. W., 2012. The Effect of IFRS Adoption and

Investor Protection on Earnings Quality around the

World. The International Journal of Accounting, 47(3),

333-355.

Jeanjean, T., & Stolowy, H., 2008. Do accounting

standards matter? An exploratory analysis of earnings

management before and after IFRS adoption. J.

Account. Public Policy, vol. 27, pp. 480–494.

Jensen, M. C., & Meckling, W. H., 1976. Theory of the

Firm: Managerial Behavior, Agency Cost, and

Ownership Structure. Journal of Financial Economics,

3 (4), 305-360.

Leuz, C., Nanda, D., & Wysocki, P. D., 2003. Earnings

management and investor protection: an international

comparison. Journal of Financial Economics, 69, 505-

527.

Rahmaningtyas, F., & Farahmita, A., 2015. Pengaruh

Perlindungan Investor terhadap Hubungan antara

Adopsi IFRS dan Tingkat Manajemen Laba di

Beberapa Negara Asia. Simposium Nasional Akuntansi

18.

Scott, W. R., 2012. Financial Accounting Theory. Sixth

Edition. USA: Prentice Hall.

Sugiyono. 2012. Metode Penelitian Kuantitatif Kualitatif

dan R&D. Bandung: Alfabeta.

Vintila, G., dan Gherghina, S. C. 2015. Does Ownership

Structure Influence Firm Value? An Empirical

Research towards the Bucharest Stock Exchange

Listed Companies. International Journal of Economics

and Financial Issues, 5(2).

Wahyudi, U., dan Pawestri, H. P. 2006. Implikasi struktur

kepemilikan terhadap nilai perusahaan: dengan

keputusan keuangan sebagai variabel intervening.

Simposium Nasional Akuntansi, 9, 1-25.

Wei, Z., et al. 2005. Ownership Structure and Firm Value

in China's Privatized Firms: 1991-2001. Journal of

financial and quantitative analysis, 40(1), 87-108

Wiranata, Y. A., dan Nugrahanti, Y. W. 2013. Pengaruh

struktur kepemilikan terhadap profitabilitas perusahaan

manufaktur di Indonesia. Jurnal Akuntansi dan

Keuangan, 15(1), 15-26.

The Effect of Managerial Ownership, Institutional Ownership, and Foreign Ownership on Firm Value: An Empirical Study on

Manufacturing Companies

247