Risk Profile And Corporate Governance On Company Performance

In The Banking Industry

Adistyana Damaranti, Iman Harymawan, and Mohammad Nasih

Department of Accounting, Faculty of Economics and Business, Universitas Airlangga, Surabaya, Indonesia

adistyanadamaranti@gmail.com, harymawan.iman@feb.unair.ac.id

Keywords: Capital, Corporate Governance, Earnings, Loan to Deposit Ratio, Non-Performing Loan, Return On Assets,

Risk Profile.

Abstract: The purpose of this research is to identify and analyze the connection between the risk profile and

performance of public banks on the Indonesian Stock Exchange for the years 2012–2015. This research uses

a quantitative method and a purposive sampling technique with a sample population of 128. The results

show that Non-Performing Loan and Loan to Deposit Ratio have a significant and negative effect on Return

on Assets, while Net Open Position has no significant effect on Return on Assets. The conclusion that taken

from this research is that the performance of a bank is dependent on how the bank manages its performing

loans and its liquidity.

1 INTRODUCTION

The banking sector has become an intermediary

institution that plays an important role in the

financial system of society. Bank health is an

important aspect that must be understood. To keep

the banks in a good health, supervision is undertaken

by the Financial Services Authority (OJK), which

requires banks to conduct self-assessment on their

own health levels and take effective remedial

measures.

Basically, the banking policy issued and

implemented by the Financial Services Authority

aims to create and maintain the health of banks,

either individually or consolidated. The health or

financial and non-financial conditions of a bank are

in the interests of all relevant stakeholders, owners,

managers, bank users, and governments.

Along with the banking needs in terms of facing

global challenges, Bank Indonesia has made

improvements to its method of appraising bank

health. Bank Indonesia considers that the previous

method of appraisal, CAMELS (Capital, Assets

Quality, Management, Earning, Liquidity, and

Sensitivity Market), was less able to assess bank

health, so it changed the bank health rating method

to RGEC (Risk Profile, Good Corporate

Governance, Earnings, and Capital), either

individually or consolidated, as of January 2012,

with the issuance of Bank Indonesia Regulation

No.13 / 1 / PBI / 2011 (Setyaningsih & Herawati,

2013). The difference between RGEC and CAMELS

lies in the assessment of risk profile and good

corporate governance. Risk profile assessment is a

new appraisal relating to the level of bank

soundness, while corporate governance, which used

to be part of management’s assessment of the

CAMELS method, is now a standalone component

of the RGEC assessment (Dincer, H., Gencer, G.,

Orhan, N., & Sahinbas, K, 2011; Hardikasari, E.,

Hardikasari, E., & Pamudji, S, 2011).

RGEC is associated with a health rating

assessment that focuses on risk assessment. In the

risk profile, there are eight aspects of risk that are of

concern in the assessment of the bank’s RGEC

method of health risk: credit risk, market risk,

liquidity risk, operational risk, legal risk, strategic

risk, compliance risk, and reputation risk

(Permatasari & Nuswantara, 2012).

The first part of this paper will examine the

effect between risk profile, represented by Non-

Performing Loan (NPL), Net Open Position (NOP),

and Loan to Deposit Ratio (LDR), and Return on

Assets, representing the Earnings Appraisal Factor.

As we know, risk profile is one of the four factors

for appraising bank health.

The second part of this paper will examine Good

Corporate Governance, represented by components

of the board of commissioners, audit quality, and the

composition of independent commissioners, with

316

Damaranti, A., Harymawan, I. and Nasih, M.

Risk Profile And Corporate Governance On Company Performance In The Banking Industry.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 316-322

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Return on Assets representing the Earnings

Appraisal Factor. Additionally, Good Corporate

Governance is one of the four factors for appraising

bank health.

2 HYPOTHESIS DEVELOPMENT

Credit risk arises from the failure of the debtor

and/or other parties to fulfil obligations to the bank.

Credit risk is generally found in all banking

activities, the performance of which depends on the

performance of the counterparty, the issuer, or the

borrower. In managing bank credit risk in Indonesia,

Bank Indonesia issued Regulation No.13 / 1 / PBI /

2011, which required banks in Indonesia to conduct

bank rating assessments using the RGEC method.

The RGEC method includes the rating of bank

health by assessing bank credit risk. According to

the RGEC method, the effect of credit risk can be

measured by the Non-Performing Loan (NPL) ratio,

which measures the ability of the company in

managing non-performing loans that are

substandard, doubtful, or loss-making (Eng, 2013).

Based on Bank Indonesia Regulation No.13 / 1 / PBI

/ 2011, banks have provisions that the NPL should

be less than 5%. The lower the NPL ratio in the

bank, the better the bank will be in managing the

non-performing loans, and the better the bank rating

in the risk profile factor. In some previous studies, a

small credit risk brings good bank performance

(Sabir Muhammad, Ali Muhammad, Habbe Hamid,

2012; Eng, 2013). Based on the description above,

the first hypothesis for this research is as follows:

H1: Non-Performing Loan negatively affects

Return on Assets.

Market Risk arises in the balance sheet position

and administrative accounts, including derivative

transactions, due to changes in market conditions,

and the risk of change of option price. According to

Bank Indonesia Regulation No.13 / 1 / PBI / 2011,

market risk includes foreign exchange risk arising

from foreign exchange transactions. Net Open

Position (NOP) is one of the instruments set by Bank

Indonesia in assessing foreign exchange risk to be

covered by bank capital. The purpose of the NOP

ratio measurement is for bank security from forex

risk (hedging risk), mitigation of bank/customer

support speculation, managing the bank’s forex

assets (maintaining balance of sources and use of

funds), as a tool for Bank Indonesia to monitor bank

health and to manage the stability of the rupiah. The

lower the NOP ratio of the bank the better, since the

foreign exchange risk is lower so the foreign

exchange risk can be covered by bank capital. In

some previous studies, a small market risk resulted

in good bank performance. Based on the description

above, the second hypothesis for this research is as

follows:

H2: Net Open Position positively affects Return

on Assets.

Liquidity risk is assessed on a bank’s ability to

settle its short-term liabilities. According to Bank

Indonesia Regulation No.13 / 1 / PBI / 2011, in the

assessment of bank soundness by the RGEC method,

liquidity risk can be measured by the Loan to

Deposit Ratio (LDR) ratio, which measures the

bank’s ability to repay the withdrawal, which the

depositors do by relying on credit as liquidity. Banks

with good LDR quality have a small risk, are able to

pay their short-term liabilities, or are able to manage

their liquidity. The lower the LDR ratio, the better

the bank’s liquidity risk; a lower liquidity risk

reflects the bank’s ability to manage its liquidity

well. In previous studies, a small liquidity risk

results in good bank performance (Sabir

Muhammad, Ali Muhammad, Habbe Hamid, 2012).

Based on the description above, the third hypothesis

for this research is as follows:

H3: Loan to Deposit Ratio negatively affects

Return on Assets.

Corporate governance can be described as a set

of relationships between the board of

commissioners, directors, shareholders, and other

stakeholders of a company. This relationship

establishes a system that regulates and controls the

company concerned. Corporate governance can also

be assessed by the RGEC method implemented by

Bank Indonesia Regulation No.13 / 1 / PBI / 2011.

The board of directors is responsible for the

operation of the company in accordance with the

intent and purpose of the company. Bank Indonesia

requires each bank to have at least three directors.

The composition of the board of directors in

accordance with the standards of the Bank Indonesia

Regulation will affect the rating of a bank. In Dedu

& Chitan’s (2013) study, the composition of the

board of directors that meets the standards will have

an effect on the performance of the bank. Based on

the description above, the fourth hypothesis for this

research is as follows:

H4: The size of the Board of Directors has a

positive effect on Return on Assets.

Audit quality is a form of good corporate

governance. In accordance with Bank Indonesia

Regulation No.13 / 1 / PBI / 2011, corporate

governance is assessed by the RGEC method. Audit

quality reflects good corporate financial reporting,

Risk Profile And Corporate Governance On Company Performance In The Banking Industry

317

with good audit quality expected to increase trust

among users such as investors, creditors, or

customers. The audit quality in this study is reflected

by auditors of the Big Four public accounting firms

and the non-Big four public accounting firms, as the

auditor’s influence in generating audit quality is

measured by how many public accounting firms

conduct an audit of a bank that has gone public. In

some previous studies, the quality of a good audit

will affect the performance of the company (Sari,

2010). Based on the above description, the fifth

hypothesis for this study is as follows:

H5: Audit quality positively affects Return on

Assets.

An independent board of commissioners is

responsible for and authorized to oversee

management action, and it advises management if it

is deemed necessary. Independent commissioners

may not have financial, management, share

ownership, and/or family relationships with other

members of the board of commissioners, directors,

and/or other controlling shareholders or relationships

that may affect their ability to act independently.

According to Bank Indonesia Regulation No.13 / 1 /

PBI / 2011, the composition of the board of

commissioners shall consist of independent

commissioners and commissioners, with a minimum

composition of 50% of the total members of the

board of commissioners required to be independent

commissioners. In Noverio & Dewayanto’s (2011)

study, the control of independent commissioners

influenced the bank’s performance. Based on the

description above, the sixth hypothesis for this

research is as follows:

H6: Percentage of the Indepndent Board of

Commissioners have a positive effect on Return

on Assets.

3 DATA

3.1 Samples

The population in this research is banking

companies that have gone public on the Indonesian

Stock Exchange (BEI) during the period 2012–2015.

Sampling in this research was carried out by a

purposive sampling method, with the aim of

obtaining a representative sample with four criteria:

[1] banks that have gone public and are listed on the

Indonesian Stock Exchange; [2] banks that have

published financial statements regularly during the

period 2012-2015; [3] banking companies whose

shares are actively traded on the Indonesian Stock

Exchange for the four periods of the research; [4]

banking companies that were not in the process of

delisting during the period of observation.

Based on the list of samples above, the

researchers used a sample of 32 commercial banks.

The list of 32 bank samples was observed for four

periods (2012 to 2015). Consequently, there was 128

sets of data.

3.2 Variables

This study uses risk profile and corporate

governance as independent variables and bank

performance as measured by Return on Assets

(ROA) as a dependent variable. Risk profile is

defined as credit risk, market risk, and liquidity risk,

in accordance with a quantitative measurement of

risk profile regulated in Bank Indonesia Regulation

Number 13/1 / PBI / 2011. Corporate governance is

defined as the composition of the board of directors,

the quality of the audit, and the components of the

board of commissioners. The following is an outline

of the six independent variables in this study:

1. Credit risk is the risk of failure of the debtor in

fulfilling the bank’s liabilities (Sabir

Muhammad, Ali Muhammad, Habbe Hamid,

2012; Eng, 2013), measured by the Non-

Performing Loan (NPL) ratio.

2. Market risk is the risk that occurs due to foreign

exchange transactions, which can be measured

using the Net Open Position (NOP) ratio.

3. Liquidity risk is the risk of possible loss due to

the inability of the bank to meet the obligations

due. Liquidity risk can be measured using the

Loan to Deposit (LDR) ratio.

4. Board size (BOARDSIZE) is the total number of

board directors and commissioners. In this study,

the Board of Commissioners is one of the

measurement variables of corporate governance.

5. Audit quality is used to detect and report material

errors in financial statements. The quality of

audit in this study is measured by the company

using the services of Big Four public

accountancy firms or non-Big four public

accountancy firms (Sari, 2010). In this study, the

quality of audit is measured by how many public

accounting firms audit the listed banks in the

period 2012-2015. We define Big Four auditors

if they are in the top four in term of number of

clients in banking industry within the sample

period. Audit Quality (AQ) is the second

measurement variables of corporate governance

in this research.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

318

6. The third governance variable is percentage of

independent commissionaire (INDCOM).

INDCOM is the total number of independent

commissioners scaled by total number of board

commissioners. Independent commissioners in

the company have duties and responsibilities

related to quality control information contained

in the financial statements (Utama & Musa,

2011).

The control variables used in this study are the

ratio of Capital Adequacy Ratio (CAR) and firm

size. CAR is one of the ratios used in the health

rating assessment based on Bank Indonesia

Regulation Number 13/1 / PBI / 2011 in the RGEC

method of Capital Bank assessment, while firm size

is measured by net total assets log (Astutik &

Djazuli, 2014).

4 Empirical Analysis

4.1 An Overview of Subject and Object

Research

The research subjects used are banking companies

listed on the Indonesian Stock Exchange during the

period 2012–2015, i.e. banking companies that meet

the predetermined criteria of sampling. Banking is

part of the financial sector of the Indonesian Stock

Exchange. Since the issuance of Bank Indonesia

Regulation No.13 / 1 / PBI / 2011, bank health is

expected to have a more representative assessment

method. If the bank has a good bank health rating,

then it will have a good performance (Leventis, S.,

Dimitropoulos, P. E., & Anandarajan, A, 2012).

Bank performance can be measured by using

earnings in the rating of the bank soundness RGEC

method. In this study, the authors use the variable

Return on Assets in measuring the earnings of a

bank. Good or bad performance of the bank will

affect the users of financial statements. A good bank

soundness should have a good overall level of the

four existing assessments, namely Risk Profile,

Good Corporate Governance, Earnings, and Capital.

The object of this research is the effect of risk

profile and corporate governance on the

performance of banks that go public in BEI, as

regulated in Bank Indonesia Regulation No.13 / 1 /

PBI / 2011, based on the RGEC method (Risk

Profile, Good Corporate Governance, Earnings,

Capital). In this study, the authors measure the risk

profile with the variables Non-Performing Loan,

Loan to Deposit Ratio, and Net Open Position.

Corporate governance is measured by the

composition of the board of directors, the quality of

the audit, and the components of the board of

commissioners. The author uses company size and

Capital Adequacy Ratio as control variables.

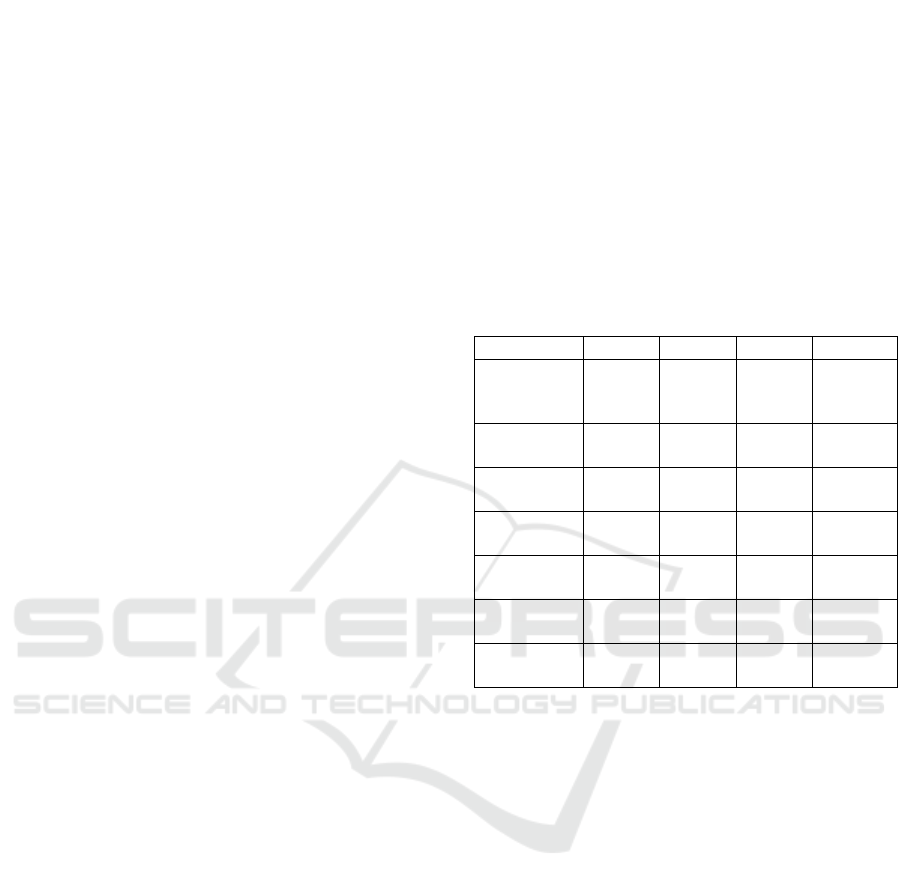

As presented in Table 1, Return on Assets

(ROA) of the sample companies obtained an average

of 1.773. This means that the average sample

company is able to get a net profit of 1.773% of the

total assets owned by the company in one period.

The median for ROA is 1.71, with the median

indicating a mean value. The maximum value of

6.41 means that the highest ROA from a sample

company is 6.41% of total assets owned by the

company in one period, while the minimum value of

ROA is 5.37% of total assets.

Table 1: Descriptive Statistics

Variable Mean Median Min Max

ROA 1.773 1.71 -5.37 6.41

NPL 2.451 2.11 0.21 9.95

NOP 1.669 1.115 -10.72 9.61

LDR 82.89 82.24 0 112.54

BOARDSIZE 7.085 6 3 11

AQ 0.765 1 0 1

INDCOM 0.578 0.571 0.461 0.733

CAR 16.95 16.5 10.05 26.56

SIZE 17.57 17.403 15.063 20.593

The Non-Performing Loan sample obtained an

average of 2.451. This reflects the risk of failure of

the debtor in fulfilling the bank’s obligation of

2.451%. The median for Non-Performing Loans is

2.11, where the median indicates a median value.

The maximum value of 12.28 means that the highest

Non-Performing Loan of the sample company can

reach 9.95, while the minimum value of Non-

Performing Loan is 0.21.

With respect to Net Open Position, the sample

companies obtained an average of 1.669. This

reflects the risks arising from foreign exchange

transactions of 1.669%. The median for Net Open

Position is 1.115, where the median indicates a mean

value. The maximum value of 9.61 means that the

highest Net Open Position of the sample company

can reach 9.61, while the minimum Net Open

Position value is -10.72.

Loan Deposits to Ratio of the sample company

obtained an average of 82.89. This reflects the risks

arising from foreign exchange transactions of

82.89%. The median for Loan Deposits to Ratio is

82.24, where the median indicates a median value. A

maximum value of 112.54 means that the Loan

Deposits to the highest Ratio of the companies

Risk Profile And Corporate Governance On Company Performance In The Banking Industry

319

sampled can reach 112.54, while the minimum value

of Loan Deposits to Ratio is 0.

Based on the results of the data processing in

Table 4.2, the components of the board of

commissioners of the sample companies obtained an

average of 7.085. This reflects the components of

the board of commissioners of bank companies

reaching 7.085%. The median for the board

component is 6, where the median represents the

mean value. The maximum value of 3 means that the

highest audit quality of the sample company can

reach 3, while the minimum value of the

commissioner’s component is 12.

The audit quality of the sample companies

obtained an average of 0.765. This reflects the audit

quality of bank companies reaching 0.765%. The

median for the composition of the board of

commissioners is 1, where the median denotes the

middle value. A maximum value of 11 means that

the highest audit quality of the sample company can

reach 11, while the minimum value of audit quality

is 3.

The board of directors, defined as IC2 in the

table, is calculated by the total composition of the

board of directors coupled with the number of

components of the board of commissioners divided

by the total of both. The total IC2 of the sample

firms obtained an average of 0.578. This reflects IC2

reaching 0.578%. The median for the composition of

the board of directors is 0.571, where the median

indicates a mean value. The maximum value of

0.733 means that the highest IC2 of the companies

sampled can reach 0.733, while the minimum value

of IC2 is 0.461.

The Capital Adequacy Ratio of the sample

companies obtained an average of 16.95. This

reflects CAR reaching 16.95%. The median for the

composition of the board of commissioners is 16.5,

where the median denotes the middle value. The

maximum value of 26.56 means that the Capital

Adequacy Ratio of the sample company can reach

26.56%.

With respect to size, the sampled companies

obtained an average of 17.57. This reflects the

company’s size reaching 17.57%. The median for

the composition of the board of commissioners is

17.403, where the median denotes the median value.

The maximum value of 20,593 means that the

highest company size of the sampled companies is

20,593, while the minimum value of 15,063 firm

size is 15,063.

4.2 Model Analysis and Evidence of

Hypotheses

This study used multiple linear regression analysis

techniques to test the hypotheses that were built. A

multiple linear regression test using software

STATA version 14 was used to examine the

relationship between the variables. The independent

variables are reflected by three variables, namely

proxy risk profile to Non-Performing Loan, Loan to

Deposit Ratio, and Net Open Position.

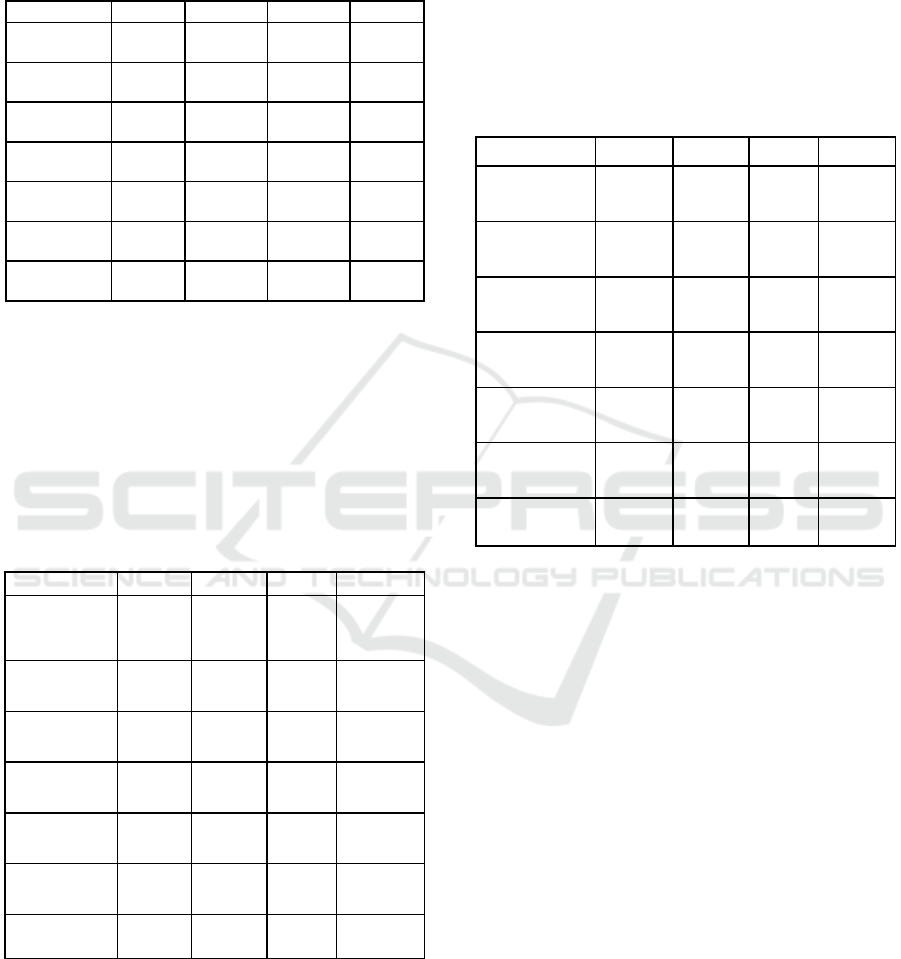

Table 2: Results of regression of risk profile on

performance

Variables [1] [2] [3] [4]

NPL -

0.266

***

(

-3.65

)

-

0.267***

(

-3.76

)

NOP -0.098

*

(

-1.77

)

-0.100*

(

-1.94

)

LDR -0.017

*

(-1.92)

-0.020**

(-2.44)

CAR 0.103

**

(2.53)

0.123

***

(2.92)

0.112

***

(2.65)

0.092**

(2.30)

SIZE 0.330

*

(

1.87

)

0.277

(

1.52

)

0.273

(

1.50

)

0.367**

(

2.14

)

CONSTANT -5.703

*

(

-1.93

)

-6.371

**

(

-2.08

)

-4.131

(

-1.26

)

-3.140

(

-1.02

)

R-squared

No obs

0.389

128

0.339

128

0.342

128

0.432

128

Corporate governance is proxies by the size of

board commissionaire, the audit quality, and

percentage of independent commissionaire. The

dependent variable used by the author is the

measurement of company performance (ROA). For

control variables, the author used the Capital

Adequacy Ratio (CAR) and company size.

Regression analysis was used to determine the

direction of the relationship between independent

variables and the dependent variable, whether each

independent variable is positive or negative, and to

predict the value of the dependent variable if the

value of the dependent variable increases or

decreases.

Based on Table 2 model 1, the regression of the

NPL variable has a negative and significant

association to ROA (t-value -3.65). In model 2, we

find that NOP has a negative and significant

association to ROA, with significance equal to 10%

(t-value -1.77). In model 3, the LDR variable has a

negative and significant association to ROA, with a

significance level of 10% (tvalue -1.92). These

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

320

results are remain significant when we run in model

4.

Table 3: Results of regression of corporate governance on

performance

Variables [1] [2] [3] [4]

BOARDSIZE 0.270**

(2.26)

0.155

(1.35)

AQ

0.020

(0.06)

-0.169

(-0.51)

INDCOM

-2.083

(-0.76)

-2.643

(-1.03)

CAR 0.103**

(2.53)

0.123***

(2.92)

0.112***

(2.65)

0.092**

(2.30)

SIZE 0.330*

(1.87)

0.277

(1.52)

0.273

(1.50)

0.367**

(2.14)

CONSTANT -5.703*

(-1.93)

-6.371**

(-2.08)

-4.131

(-1.26)

-3.140

(-1.02)

R-squared

No obs.

0.389

128

0.339

128

0.342

128

0.432

128

Table 3 presents the results of regression of

corporate governance variables on performance. In

model 1, the coefficient of COMSIZE has apositive

and significant associations to performance (t-value

2.26). In models 2 and 3, we find no significant

associations between AQ and INDCOM to

performance.

Table 4: Results of robust regression of risk profile on

performance

Variables [1] [2] [3] [4]

NPL -

0.266

**

(

-2.00

)

-

0.267***

(

-2.69

)

NOP -0.098

(-1.25)

-0.100*

(-1.70)

LDR -0.017

*

(-1.89)

-0.020

(-1.64)

CAR 0.103

**

(2.51)

0.123

***

(2.74)

0.112

**

(2.36)

0.092**

(2.17)

SIZE 0.330

*

(1.76)

0.277

(1.51)

0.273

(1.41)

0.367*

(1.97)

CONSTANT -5.703

*

(-1.67)

-6.371

*

(-1.75)

-4.131

(-1.02)

-3.140

(-0.79)

R-squared

No obs

0.389

128

0.339

128

0.342

128

0.432

128

Table 4 presents results of robust regression of

risk profiles on performance. Consistent with OLS

regression results, we find that NPL, NOP, and LDR

are negatively correlated to performance. However,

the result for NOP is insignificant.

Table 5 shows the results of robust regression of

corporate governance variables on bank

performance. The findings confirm the OLS

regression results that BOARDSIZE is positive and

significantly associated to ROA. With regards to

audit quality and percentage of independent

commissionaire, we find no significant association

to bank performance.

Table 5: Robust regression result of corporate governance

on performance

Variables [1] [2] [3] [4]

BOARDSIZE 0.270

*

(1.95)

0.155

(1.14)

AQ 0.020

(0.05)

-0.169

(0.41)

INDCOM -2.083

(-0.71)

-2.643

(-0.87)

CAR 0.103

**

(2.51)

0.123

***

(2.74)

0.112

**

(2.36)

0.092**

(2.17)

SIZE 0.330

*

(1.76)

0.277

(1.51)

0.273

(1.41)

0.367*

(1.97)

CONSTANT -5.703

*

(-1.67)

-6.371

*

(-1.75)

-4.131

(-1.02)

-3.140

(-0.79)

R-squared

No obs

0.389

128

0.339

128

0.342

128

0.432

128

In model 4, regression of the KDK variable has a

positive influence, with significance to ROA equal

to 10% (t count: 1.95). This model has a positive

control variable, i.e. CAR, with a significance level

of 5% (t arithmetic: 2.51) and SIZE with a

significance level of 10% (t count: 1.76). In models

5 and 6, the regressions of the KA and IC2 variables

have no effect on ROA. In model 7, the NPL has a

negative effect, with a strong significance to ROA of

1% (t count: -2.69), the NOP has a significant

negative effect on the ROA of 10% (-1.70), and

LDR, KDK, KA, IC2 have a significant influence on

ROA.

5 CONCLUSION

This study aimed to determine the effect of the

independent variables Non-Performing Loan, Net

Open Position, and Loan to Deposit Ratio on Return

on Assets in banking companies in Indonesia listed

on the Indonesian Stock Exchange during 2012-

2015. The variables used in this study were Non-

Risk Profile And Corporate Governance On Company Performance In The Banking Industry

321

Performing Loans, Net Open Position, and Loan to

Deposit Ratio, Board of Directors composition,

Board of Commissioner components, Audit Quality,

Size, Capital Adequacy Ratio, and Return on Assets.

Based on the analysis of the research results, the

following conclusions can be drawn:

a. Regression test results show that risk profile

variables measured using Non-Performing Loan

and Loan to Deposit Ratio have a significant and

negative effect on Return on Assets. This means

that, when the values of the Non-Performing

Loan and Loan to Deposit ratios of the company

increase, the Return on Assets will decrease, and

vice versa; if the Non-Performing Loan and Loan

to Deposit ratios are down, then Return on

Assets will experience an increase; however, the

Net Open Position has no effect on Return on

Assets, meaning that when the value of the Net

Open Position of a company experiences an

increase, then Return on Assets has no effect.

b. The result of the regression test shows that

corporate governance variables measured using

Components of Board of Commissioners have a

significant and positive effect on Return on

Assets, while Audit Quality and Board of

Directors Composition have a non-significant

positive effect on Return on Assets.

REFERENCES

Astutik, P., & Djazuli, A. 2014. Influence of Bank Health

Level according to Risk Based Bank Rating on

Financial Performance (Study on Sharia Bank in

Indonesia). Jurnal Ilmiah Mahasiswa FEB, 3(1).

Central Bank of Indonesia. Central Bank of Indonesia

Regulation No. 13/ 1/ PBI/ 2011 about Assessment of

Commercial Bank Rating.

Dedu, V., & Chitan, G. 2013. The influence of internal

corporate governance on bank performance-an

empirical analysis for Romania. Procedia-Social and

Behavioral Sciences, 99, 1114-1123.

Dincer, H., Gencer, G., Orhan, N., & Sahinbas, K. 2011. A

performance evaluation of the Turkish banking sector

after the global crisis via CAMELS ratios. Procedia-

Social and Behavioral Sciences, 24, 1530-1545.

Eng, T. S. 2013. Effect of NIM, BOPO, LDR, NPL and

CAR against ROA of International and National Bank

Go Public period 2007-2011. Jurnal Dinamika

Manajemen, 1(3).

Hardikasari, E., Hardikasari, E., & Pamudji, S. 2011. The

Influence of Corporate Governance Implementation

on Financial Performance in Banking Industry listed

in Indonesia Stock Exchange (BEI) year 2006-2008.

Universitas Diponegoro.

Leventis, S., Dimitropoulos, P. E., & Anandarajan, A.

2012. Signalling by banks using loan loss provisions:

the case of the European Union. Journal of Economic

Studies, 39(5), 604-618.

Noverio, R., & Dewayanto, T. 2011. Analysis of the

Auditor’s Quality Impact, Liquidity, Profitability and

Solvency on Going Concern Audit Opinion on

Manufacturing Companies listed on Indonesia Stock

Exchange. Universitas Diponegoro.

Permatasari, I., & Nuswantara, D. A. (2012). Information

Content Analysis on New Regulation of Commercial

Banks’ Health: A Study on Indonesian Case. Paper

presented at the International Conference on

Management (online), (www.internationalconference.

com.my, accessed on 20 Mei 2013).

Sabir Muhammad, Ali Muhammad, Habbe Hamid. 2012.

Analysis on the Influence of Bank Health Ratio on

Financial Performance of Sharia Bank and

Conventional Bank in Indonesia. Jurnal IISn Vol. 1

no.1.

Sari, I. 2010. The Influence of Good Corporate

Governance Mechanism on National Banking

Performance (Study on Banking Companies listed in

Indonesia Stock Exchange period 2006-2008).

Universitas Diponegoro.

Setyaningsih, N. R., & Herawati, T. 2013. Influence of

Bank Health Level on Profit Change (Study on Sharia

Bank in Indonesia year 2010-2012). Jurnal Ilmiah

Mahasiswa FEB, 2(2).

Utama, C. A., & Musa, H. 2011. The Causality between

Corporate Governance Practice and Bank

Performance: Empirical Evidence from Indonesia.

Gadjah Mada International Journal of Business,

13(3).

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

322