A Green Banking for Sustainable Development in Sharia Banking

Heri Setiawan

1

, Desi Erawati

1

, Akhmad Dakhoir

1

, and Luqman Luqman

2

1

Institut Agama Islam Negeri Palangka Raya, Kota Palangka Raya, Central Kalimantan, Indonesia

2

Institut Agama Islam Negeri Pontianak, Jl. Letjend. Soeprapto No. 19, West Kalimantan, Indonesia.

desi.erawati@iain-palangkaraya.ac.id

Keywords: Green Banking, Sustainable, Development, Islamic Banking.

Abstract: Green banking is a policy for protecting the environment. This study attempts to examine the implementation

of green banking in sharia banks. This research used qualitative descriptive method. The data acquired through

observation and interviews to the leader and employees of sharia banks. The results of this research showed

that sharia has applied the concept of green products, green loan, green card, and green portfolio so that the

application of green banking in sharia banking can make energy savings and others costs.

1 INTRODUCTION

Green Banking for sustainable development in the

banking world is one of the banking policies in

addressing global climate change issues. Issues of

climate change, natural disasters, and global warming

continue to be discourse and considered as a result of

the lack of public awareness of the environment. This

discourse is the concern of various circles including

economic actors that led to the discourse of Green

Banking in various countries including Indonesia.

The concept of Green Banking is a long-term

business strategy that aims to profit, but it implies the

benefits of empowerment and environmental

conservation in a sustainable manner. According to

the World Bank, Green Banking is a financial

institution that gives priority to sustainability in its

business practices (World Bank, 2010). The principle

of sustainable development ensures that development

must balance between the economy, social life, and

environmental conservation (profit, people, planet).

The agreement on Green Banking is in line with the

strategic decision of the international Climate Change

meeting in Cancun, Mexico.

Green banking has been widely implemented in

several developed and developing countries. Green

Banking is inseparable from the term green business,

according to Glen Croston, a green business is a

profitable business concept because it can provide

profits and scale economies that are very useful for

overall business continuity. In banking context,

especially green business is perceived by the

distribution of environmentally friendly credit or

known as green credit (green lending or green

banking). Green credit can be interpreted as a loan

from a financial institution to a debtor that engaged in

a business sector that has no impact on the

deterioration of environmental quality or social

condition in society (Glen Croston, 2009).

Ginovsky (2009) states that to support green

banking, bank must launch banking products that

promote sustainable practices and need to restructure

their back office operations in order to implement

environmentally friendly practices. There are two

suggested strategies for banks to follow: (1) the use

of paperless banking which results in carbon emission

reductions from internal banking operations and cost

savings, and (2) adoption of Green Street loans,

which means offering low interest rates to consumers

and businesses to use solar energy systems and

energy-saving equipment.

There are several studies that have been done

related to the application of green banking. Among

them are S.M. Mahfuzur Rahman and Suborna Barua

who conduct research on 42 banks in Bangladesh, the

result of the application showed that the concept of

green banking is not fully implemented. This research

explains that the performance of governmental bank

is much worse than the private and foreign banks

(S.M. Mahfuzur Rahman & Suborna Barua, 2016).

Rahman and Barua's research is very clear

describing the performance of banking in

Bangladesh, it just does not show how the

performance of Islamic banking there which in the

Islamic banking operations refers to the foundation of

Islamic values that sided to the environment.

82

Setiawan, H., Erawati, D., Dakhoir, A. and Luqman, L.

A Green Banking for Sustainable Development in Sharia Banking.

In Proceedings of the Annual Conference on Social Sciences and Humanities (ANCOSH 2018) - Revitalization of Local Wisdom in Global and Competitive Era, pages 82-86

ISBN: 978-989-758-343-8

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reser ved

Likewise, Neetu Sharma et al in their article

entitled "A study on customer's awareness on Green

Banking initiatives in selected public and private

sector banks with special reference" reveals that this

green banking concept policy has been applied in

India, the society also welcomed this policy. Sharma

revealed that in its findings, foreign banks are paying

more attention to the implementation of green

banking than domestic banks because the paradigm of

foreign banks is better for the sustainability of their

business (Neetu Sharma, p. 28-35).

Implementation of green banking in India is very

vigorous. It is not only on the savings of paper and

natural energy resources that are not renewable, but

banks in India also have tried to use solar energy for

ATMs. Yet, technological advancements that

encourage the implementation of green banking

should be followed by skilled human resource

resulting in a balance between the needs of green

banking concept implementation and human resource

capability, as revealed in a study conducted by Deepti

Narang (Deepti Narang, 2015).

Different studies related to green banking were

conducted by Shaumya revealed that green banking

has an effect on the performance of banks in Sri

Lanka. Quantitative research by using regression

analysis proves that the better implementation of

green banking, the better the performance of the bank.

This means that the bank is able to contribute

positively to its environment (Shaumya, 2017).

From previous research, it was suggested that the

implementation of green banking has been

implemented in several countries. Similarly,

Indonesia encouraged the implementation of this

green banking. Therefore, banks in Indonesia began

to apply this green banking concept. This study

attempts to examine how the application of green

banking in the framework of sustainable development

is based on sharia. Why sharia banks are an option?

The first, Indonesia embraced dual banking system

which means there is conventional banking that

operates in general and there is also sharia banking

that operates based on Islamic values. Both banks

have different characteristics. Secondly, Islamic

banks (Islamic banking) based on Islamic values, in

Islamic values themselves environmental issues are

getting attention. Therefore, the concept of green

banking is indirectly part of Islamic values in which

the environment is a concern. This study wanted to

see how far the application of green banking is

applied then how the impact on the sustainable

development of Islamic banks.

2 RESEARCH METHODS

This research was a field research conducted in 2017.

It used descriptive method with qualitative approach.

The process of data collection was done by

observation, in-depth interview, and documentation.

The observation conducted at PT. Bank Syariah X

Kota Palangka Raya, Central Kalimantan.

Meanwhile, the interview conducted to all subjects

related in this research that is employees of Bank

Syariah X which amounted to 24 people. The model

of analysis in this study was using Miles and

Huberman analysis.

3 RESULT AND DISCUSSION

The concept of green banking which part of the green

economy is in line with sharia economy in sustainable

development that balances economic efficiency,

equitable income, and environmental conservation.

The research looks at three green banking

implementations: implementation of service units,

operational units, and financial units.

3.1 Implementation of Green Banking

toward Service Unit

Based on the results of interviews with several

employees of PT. Bank Syariah X namely RAS and

DET, the implementation of green banking in

customer service activities in PT. Bank Syariah X is

an e-channel facility in the form of SMS banking,

mobile banking, and internet banking. Customer

transaction activity can be done anytime and

anywhere. By the existence of e-channel in PT. Bank

Syariah X, the electronic transaction activities

facilitate customers and indirectly reduce the use of

paper transactions in branch office services.

Implementation of green banking in PT. Bank

Syariah X will directly increase bank profit. The bank

profit is derived from the efficiency of paper and

energy that used such as electricity and air

conditioning (AC).

3.2 Implementation of Green Banking

toward Operational Unit

Paperless efficiency has been done in PT. Bank

Syariah X. The use of paper for bank internal

activities shall be conducted in the following manner:

A Green Banking for Sustainable Development in Sharia Banking

83

1. Use frosted paper for making memos and data for

internal purposes.

2. Use two-sided paper back and forth.

3. Use paper only for some work (paperless),

inputting customer data, online system for

verification process of financing

PT. Bank Syariah X does energy savings in the

following manner:

1. Turn off the AC in the unused room.

2. Turn off the workspace AC during break time and

pray

3. Turn off the computer when not in use.

The employee of PT. Bank Syariah X in

implementing green banking is good, although there

are still some employees who have not been

consistent. As far as it concerned, employees do paper

and energy efficiency because the embodiment of it

is one of the mission of PT. Bank Syariah X to

concern toward environmental sustainability.

3.3 Implementation of Green Banking

toward Financial Unit

In the implementation of green banking toward

financial unit, the sharia bank Syariah X provides

financing facilities to the large commercial customers

with attention to the Environmental Impact Analysis

(AMDAL). For the financing of micro small and

medium enterprises (UMKM), then PT. Bank Syariah

X has set one of its financing requirements with the

building permit (IMB). Related to this financing, PT.

Bank Syariah X shall continue to observe the

prevailing laws and regulations in Indonesia and

Bank Indonesia regulations.

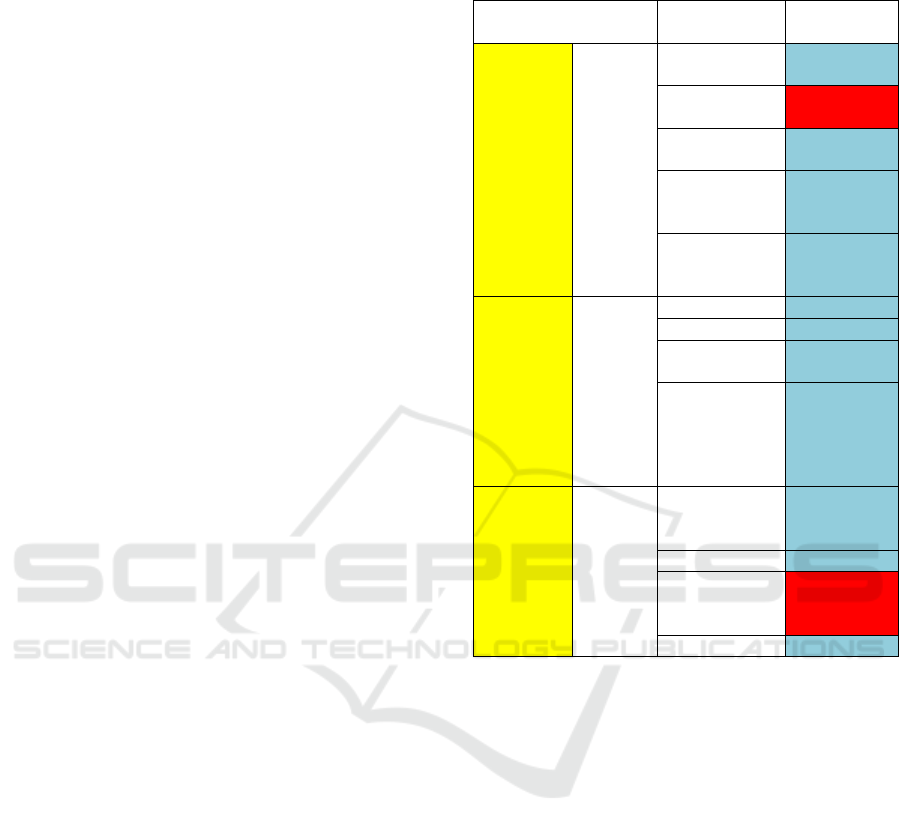

From field observation shown in table 1, the

achievement has been done at Bank Syariah X. The

achievement on product criteria has been

implemented in green banking which is green

product, green loan, green card, and green portfolio.

Talking about the criteria of corporate governance,

green employers have been employed by PT. Bank

Syariah X, but there are still some employees who

have not been consistently implementing it. Green

operational has been done through online application

system, inputting online financing process, and not

using full paper, paperless in transactions by teller

and CS, as well as green business process in

verification of providing financing facility.

Meanwhile, the criteria of environmental and

community, PT. Bank Syariah X has done energy

saving by using energy as needed. Less emission

criteria are done by reducing the use of air

conditioning (AC) in the employee's office, but not in

the banking hall.

Table 1: Achievement Criterion of Green Banking PT.

Bank Syariah X.

Criterion

Achieveme

nt

Green

Company

& Green

Banking

Corpora

te

Governa

nce

Green

employee

√

Green

Building

x

Green

Operational

√

Green

Sustainability

Performance

√

Green

Business

Process

√

Green

Banking

Product

Green Product

√

Green Loan

√

Green Credit

Card

√

Green

Portfolio

(Retail/Consu

mer/Corporate

Banking)

√

Green

Company

Environ

ment

and

Commu

nity

Corporate

Social

Responsibility

√

Less Emission

√

Use

Renewable

Energy

x

Energy Saving

√

3.4 Discussion

In line with the rapid growth of banking activities in

Indonesia, which is marked by the continuous

increase in the value of banking assets and financing

disbursed, as a result that economic activity is running

as it is. Through this economic activity, the financing

that provided by banks, it makes environmental

degradation. One of the environmental concerns that

concern the world today is the soaring CO

2

emissions.

This emission is considered as the main cause of

drastic world climate change. Up to now, national

energy supplies are still dependent on conventional

energy sources, such as petroleum, natural gas, and

coal. The dominance of these three conventional

energy sources reached more than 90 percent. Then,

in terms of consumption, more than two-thirds of the

national fuel supply (BBM) is allocated for

transportation needs. Similarly, the national industry,

which still relies on conventional energy, such as fuel

and coal. Such patterns of production, in addition to

ANCOSH 2018 - Annual Conference on Social Sciences and Humanities

84

boost economic growth, also led to an increase in CO

2

emissions.

The increasing CO

2

emission is not the only

environmental problem facing Indonesia and other

countries. Especially in Indonesia, the contribution of

pollution from other production activities is huge. For

example, the destruction of ecosystems due to

massive mining activities, the decrease of carbon

absorption due to uncontrolled deforestation, and the

decline of river and coastal quality due to disposal of

B

3

(Setyo, 2014, p. 18).

As the results in the field, Bank Syariah X is not

perfect yet, but the implementation of green banking

is good. It shows the commitment of the banking role

seeks to improve the management of the environment

in Indonesia (Djafar Al Bram, 2011).

PT. Bank Syariah X stated that banks need to be

oriented towards green banking as one of the efforts

to support environmental sustainability. This is

reinforced by interviews with one of the employees

of MSA, reduction of AC usage and paperless. The

banking business actually has no direct link with the

environment, however Bank Indonesia with various

regulations and regulations issued can encourage the

increasing role of banks in improving the quality of

environmental management (Makarim, 2004).

Although there are still many problems that must

be anticipated, the existence of green banking in

Indonesia is related to two main reasons are: First,

green banking supports sustainability development. It

is impossible if the concept of sustainable

development is not fully supported by the related

parties. Bank has a central position between the

surplus parties and those who need the funds. Thus,

banks have a 'bargaining position' and a strategic role

to educate and encourage society to participate in the

success of sustainable development. Second, green

banking has potential business. Bank is expected to

make a profit, so it should be able to anticipate the

potential of new business that will emerge. The

existence of a 'green' lifestyle will have a multiplier

effect on the growing demand for environmentally

friendly products as a potential new business (Djafar

Al Bram, 2011, p.40).

Related to the lack of green banking

implementation, this is in line with Rofikoh Rokhim’s

statement that only a small number of companies in

Indonesia that apply green business in the model, and

even it is not optimal. Likewise, it is also in line with

the results of the Asian Corporate Governance

Association (ACGA) survey (Rokhim, 2010).

4 CONCLUSIONS

This study illustrates that the implementation of green

banking in sharia banks is not only driven by the

Indonesian government policy, the application of

green banking is also in accordance with Islamic

values which become the basic philosophy and rules

of sharia banking. The impact of the implementation

of green banking is a good environment and able to

save energy and other operational costs. This is a

form of sustainable development that includes three

pillars of economic (profit), environment (planet) and

social (people).

ACKNOWLEDGEMENTS

The writer is thankful to the Postgraduate Director of

State Islamic Institute of Palangka Raya and the

advisors so that the results of this study can be

completed on time. Further thanks to PT Bank BNI

Syariah Palangka Raya, Central Kalimantan for

helping to be a research location and giving the

provided information which very useful for this

research.

REFERENCES

Djafar Al Bram. 2011. Peran Perbankan Dalam Usaha

Perbaikan Lingkungan Dengan Pendekatan Economic

Analysys of Law. Jakarta : Jurnal Law Review, Volume

XI No 2, 269.

Ginovsky, J. 2009. Green banking: Inside and out.

Community Banker, 1(1), 30-32.

Glen, C. 2009. Starting Green: From Business Plan to

Profit, Enterpreneur. Canada: Media Inc.

Kantor besar Bank X. 2011. tentang corporate

sustainability dan green banking (Notulen Diskusi).

Jakarta: Kantor besar bank Syariah X.

Makarim, N. 2004. Peran Serta Sektor dalam Pengelolaan

Lingkungan Hidup Meningkat (Siaran Pers Bersama

Bank Indonesia dan Kementerian Negara Lingkungan

Hidup). Jakarta.

Narang, Deepti, 2015. “Green Banking- A Study of Select

Banks in India”. International Journal of Management

and Commerce Innovations ISSN 2348-7585 (Online)

Vol. 3, Issue 1, pp: (5-12), Month: April 2015 -

September 2015, Available at:

www.researchpublish.com

Rahman, S M Mahfuzur & Suborna Barua. 2016. The

Design And Adoption Of Green Banking Framework

For Environment Protection: Lessons From

Bangladesh, Australian Journal of Sustainable

Business and Society, Vol. 2, No. 1, March 2016

A Green Banking for Sustainable Development in Sharia Banking

85

Rokhim, Rofikoh, 2010, “Green Busines: Stategi

Pembangunan Berkelanjutan Perusahaan. Makalah

Seminar Nasional Green Business; A Global New Deal,

A Shifting Of Economics Paradigm”. Jakarta

Setyo, B. 2014. Mengawal Green Banking Indonesia

Dalam Kerangka Pembangunan Berkelanjutan.

Jakarta: Prakarsa.

Sharma, Neetu, etc, “A study on customer’s awareness on

Green Banking initiatives in selected public and private

sector banks with special reference to Mumbai”. IOSR

Journal of Economics and Finance (IOSR-JEF) e-ISSN:

2321-5933, p-ISSN: 2321-5925 PP 28-35

www.iosrjournals.org

Shaumya, K & Anton Arulrajah, 2017. “The Impact of

Green Banking Practices on Bank’s Environmental

Performance: Evidence from Sri Lanka”. Journal of

Finance and Bank Management June 2017, Vol. 5, No.

1, pp. 77

Undang-undang. Secara teknis Bank Indonesia akan

memberikan penilaian perbankan yang ramah

lingkungan dengan lima tingkat, antara lain : tingkat

emas (tingkat tertinggi), tingkat hijau, tingkat biru,

tingkat merah, dan tingkat hitam (tingkat terendah).

Ketentuan lain yang akan ditingkatkan pada PBI ialah

persyaratan surat pernyataan pengelolaan lingkungan

bagi UMKM (Usaha Mikro, Kecil, dan Menengah)

dalam mengajukan dana pinjaman, Pub. L. No. 32

(2009).

UU no. 10 Tahun 1998. Pasal 1 ayat 13, Pub. L. No. Pasal

1 ayat 13.

ANCOSH 2018 - Annual Conference on Social Sciences and Humanities

86