Analysis of the Effect of Regional Financial Performance on Regional

Economic Growth in Indonesia Year 2012-2016

Mieke Nadia Rossa, Sulistyo Sulistyo and Eris Dianawati

Program Studi Akuntansi, Universitas Kanjuruhan Malang, Malang, Indonesia

miekenadia@gmail.com

Keywords: Financial Performance, Independence Ratio, Dependency Ratio, Effectiveness Ratio, Regional Economic

Growth.

Abstract: Economic growth of a region can be seen from the financial capacity of the region in financing its own

activities, the better the financial capacity of the region will further encourage regional economic growth.

The purpose of this study is to test and obtain empirical evidence of the influence of financial performance

on economic growth in cities and districts in East Java Region and to know how the difference between

economic growth and financial performance between the city and district of East Java Region 2012-2016.

The sample in this research are 6 districts, and 3 cities located in east java area with research object that is

financial performance in the form of independence ratio, dependency ratio, effectiveness ratio, and

economic growth. Determination of the sample is done by using purposive sampling method and the method

used in this research is done by multiple linear regression analysis and T-test. Based on the results of this

study, financial performance in the form of independence ratio and effectiveness ratio showed a significant

positive impact on economic growth, while the dependency ratio has no significant effect on economic

growth. Further economic growth between city and district has significant difference, financial performance

in the form of independence and dependency ratios have significant differences between city and district,

while the financial performance of the ratio of effectiveness has no significant difference between the city

and district in East Java Region in 2012- 2016.

1 INTRODUCTION

Economic growth of a region can be seen from the

financial capacity of the region in financing its own

activities, the better the financial capacity of the

region will further encourage regional economic

growth. Local financial capacity can be assessed or

measured by local financial performance (Ardi,

2008; Aristovnik, 2012; Bose et al., 2007).

East Java has 38 Cities and Districts, and is the

province that has the most districts and cities in

Indonesia. However the number of districts and

cities does not guarantee that economic growth in

the province has not decreased (Arsa and Setiawina,

2015; Wuku, 2015). Lately, the percentage of

economic growth in East Java has been fluctuated.

Here is the data of East Java economic growth last 5

years starting from 2012-2016.

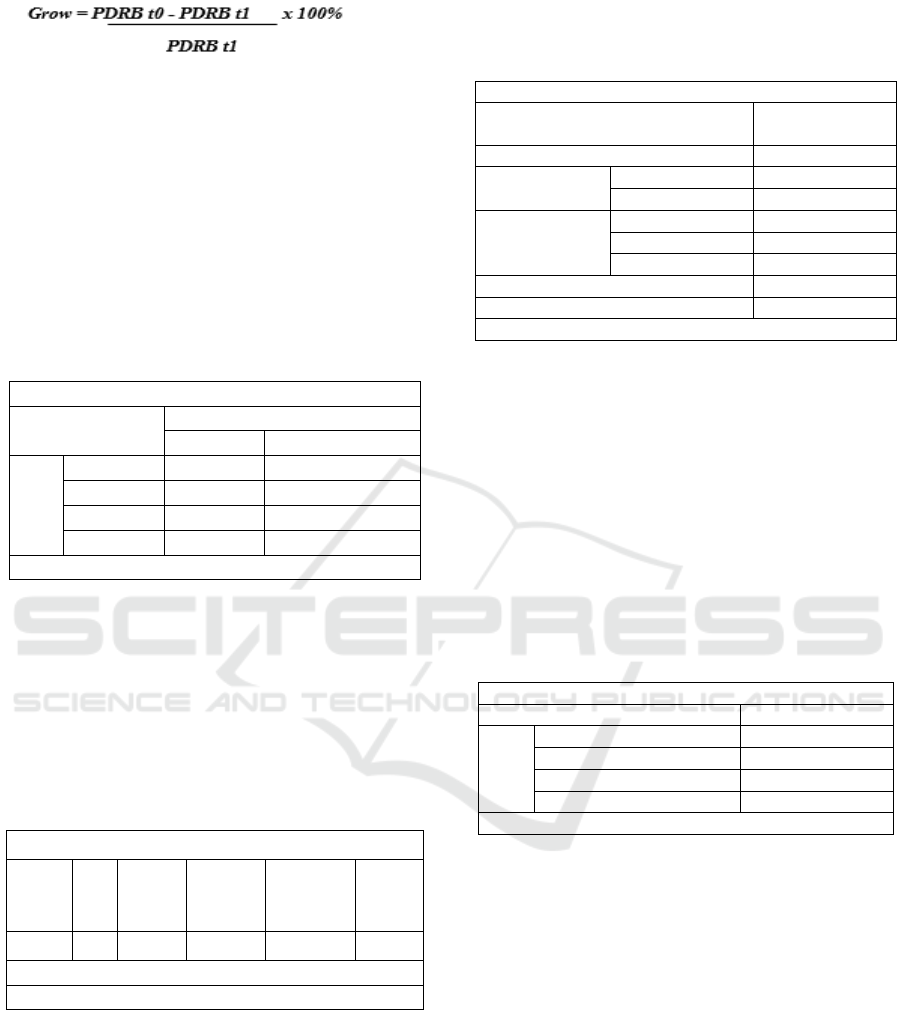

Table 1: East Java Economic Growth Period 2012-2016

(BPS, 2013).

Economic Growth of East Java period 2012-2016

in Billion Rupiah

Year PDRB

AHDK

Economic Growth

2012 1124464.64 6.64%

2013 1192789.8 6.08%

2014 1262684.5 5.86%

2015 1331394.99 5.44%

2016 1405236.11 5.55%

From the table 1 shows that the percentage of

economic growth in East Java in 2013 has decreased

until 2015, and in 2016 the percentage of economic

growth increased although not significant. The

phenomenon of economic growth instability in East

Java along with the declining quality of financial

performance in Cities and Districts located in the

province of East Java.

Financial performance in East Java province still

needs to be improved. Based on the report of the

376

Rossa, M., Sulistyo, S. and Dianawati, E.

Analysis of the Effect of Regional Financial Performance on Regional Economic Growth in Indonesia Year 2012-2016.

In Proceedings of the Annual Conference on Social Sciences and Humanities (ANCOSH 2018) - Revitalization of Local Wisdom in Global and Competitive Era, pages 376-381

ISBN: 978-989-758-343-8

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

audit result of the 2016 regional government's

finance by BPK Jatim, there are still many cities and

districts in eastern Java whose financial performance

has decreased and cannot be said good and needs to

be improved again, such as Madiun, Tulungagung,

Probolinggo, Sampang, Sumenep, Nganjuk district,

and others because they get the WDP predicate (fair

with exceptions) (BPKP, 2012). This is in line with

the economic growth of East Java which recently

also experienced instability.

Based on the phenomenon that occurred in East

Java Province above and previous research is diverse

then researchers want or are interested in doing a

study on "Analysis of the Effect of Financial

Performance on Regional Economic Growth in

Regency and City Region East Java Period 2012 -

2016"

The formulation of problem in this research are:

(1) How is the effect of financial performance to

economic growth in East Java (2) How is the effect

of financial performance in the form of

independence ratio to economic growth in East Java

(3) How is the effect of financial performance in the

form of dependency ratio to economic growth in

East Java (4) How is the influence of financial

performance in the form of ratio of effectiveness to

economic growth in East Java (5) How is the

difference of economic growth between city and

district in east java (6) How is the difference of

financial performance between city and regency in

East Java.

The purpose of this study is to determine: (1) the

effect of financial performance on economic growth

in East Java and how much influence. (2) the effect

of financial performance in the form of

independence ratio to economic growth in East Java

and how big the effect is. (3) the influence of

financial performance in the form of dependency

ratio to economic growth in East Java and how big

the effect is. (4) the effect of financial performance

in the form of ratio of effectiveness to economic

growth in East Java and how big the effect is. (5) the

difference of economic growth in city and district in

East Java. (6) the difference of financial

performance between city and district in East Java.

Based on the theory and the results of previous

research, it can be formulated hypothesis as follows:

H1: Financial performance simultaneously

affects regional economic growth;

H2: Ratio of regional autonomy positively

affects regional economic growth;

H3: Regional financial dependency ratio

negatively affects regional economic growth;

H4: PAD Effectiveness Ratio positively

affects regional economic growth.

2 METHOD

This study used secondary data sources with data

collection techniques documentation that is data

collection techniques in the form of local financial

statements of 2013-2016 obtained from the website

BPKAD city districts respectively

www.bpkad.go.id. While the report of economic

growth district city area East Java can be seen at

www.bps.jatim.go.id.

The samples used are 9 districts / cities, 6 of

them are districts and 3 cities. The sample is chosen

based on sampling criteria with probability sampling

method with purposive sampling technique from the

population of 38 districts / cities, so the data are

examined for five periods for about 45 data.

This study used multiple linear regression

analysis to determine the effect of financial

performance in the form of independence ratio,

dependency, and effectiveness on regional economic

growth. Meanwhile, to know the difference of

economic growth and financial performance

between city and district, technique of T-test

analysis with Mann-Whitney and Kruskall-Wallis

type were used. Operational definitions of variables

used are variable (X) of financial performance

consisting of several ratios:

2.1 Ratio of Regional Financial

Independence (X1)

(1)

2.2 Regional Financial Dependency

Ratio (X2)

(2)

2.3 Ratio of Local Original Income

Effectiveness (X3)

(3)

Variable (Y) regional economic growth can be

calculated by the formula:

Analysis of the Effect of Regional Financial Performance on Regional Economic Growth in Indonesia Year 2012-2016

377

(4)

3 RESULTS AND DISCUSSION

3.1 Classic Assumption Test

This test was conducted in several analyzes namely

normality test, multicollinierity test,

heteroscedasticity test, and autocorrelation test.

3.2 Multicollinearity Test

Table 2: Multicollinearity Test Results.

Coefficients

a

Model

Collinearity Statistics

Tolerance VIF

1 (Constant)

X1 .975 1.025

X2 .973 1.028

X3 .996 1.004

a. Dependent Variable: Y

Source: SPSS 22 output (researchers processed data, 2018).

The multicollinearity test shows that all variables

have VIF values less than 10, hence it shows that no

relationship between independent variables in the

regression model used or research data does not

contain symptoms of multicollinearity.

3.3 Autocorrelation Test

Table 3: Autocorrelation Test Results.

Model Summary

b

Model R

R

Square

Adjusted

R Square

Std. Error

of the

Estimate

Durbin-

Watson

1

.730

a

.532 .498 .01962 1.950

a. Predictors: (Constant), X3, X1, X2

b. Dependent Variable: Y

Source: SPSS 22 output (researchers processed data, 2018).

The autocorrelation test showed from all three

regressions that the Durbin-Watson value lies

between 1.55 and 2.46. That is, in the regression

model used there is no correlation between the tester

errors of t period (current) with errors of period t-1

(previous).

3.4 Normality Test

Table 4: Normality Test Results.

One-Sam

p

le Kolmo

g

orov-Smirnov Test

Unstandardized

Residual

N 45

Normal

Parameters

a,b

Mean .0000000

Std. Deviation .01894052

Most Extreme

Differences

Absolute .082

Positive .082

Negative -.073

Test Statistic .082

As

y

m

p

. Si

g

.

(

2-tailed

)

.200

c,d

a. Test distribution is Normal.

Source: SPSS 22 output (researchers processed data, 2018).

The normality test of all three regressions shows

that the Asymp.Sig value is greater than 0.05. That

is, in the regression used, the confounding or

residual variable has a normal distribution.

3.5 Heteroscedasticity Test

Heteroscedasticity test with Glejser approach shows

that each independent variable has a significance

value greater than 0.05, meaning that the regression

model used does not occur heteroscedasticity.

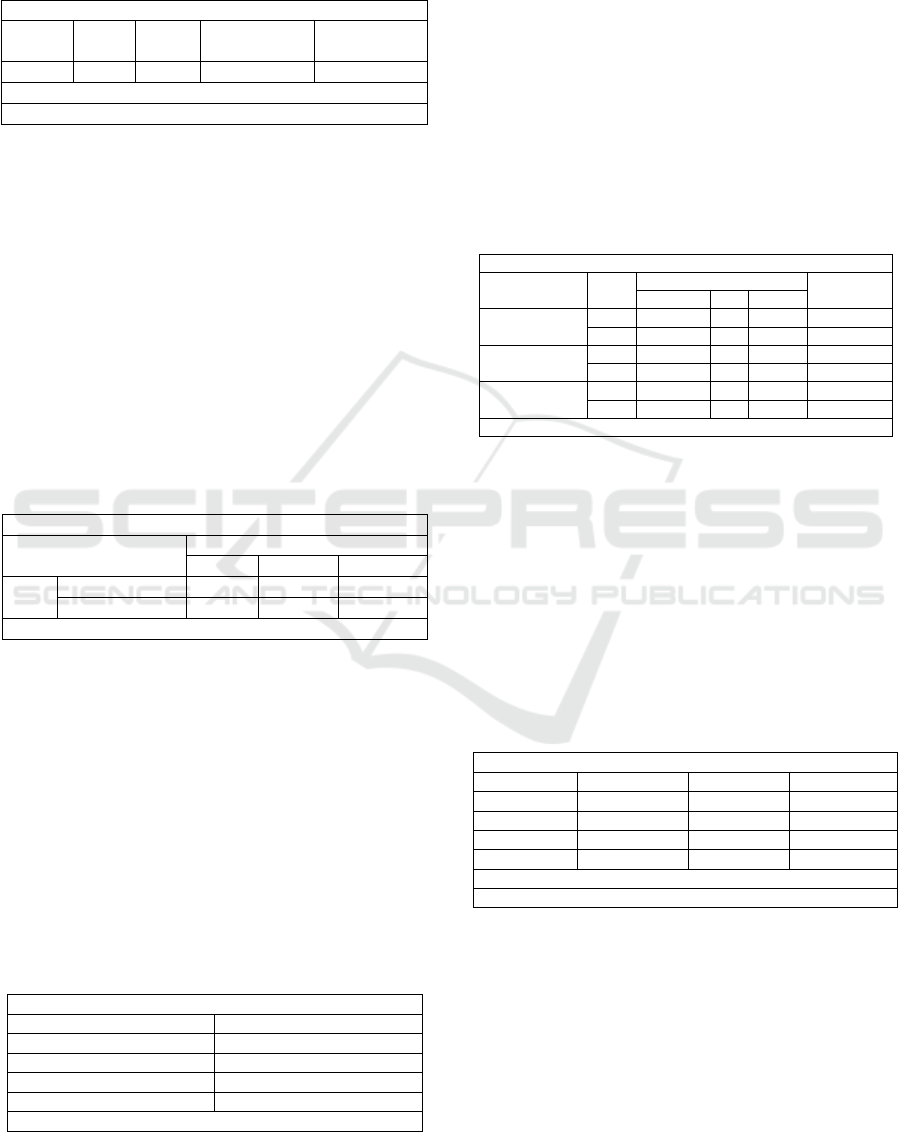

Table 5: Heteroscedasticity Test Results.

Coefficients

Model Si

g

.

1

(

Constant

)

.000

X1 .362

X2 .508

X3 .064

a. Dependent Variable: RES_2

Source: SPSS 22 output (researchers processed data, 2018).

Based on the results of Glejser test above each

variable has a sig value greater than 0.05, then in

this study did not occur heteroscedasticity.

3.6 Regression Analysis

Regression analysis used in this study is multiple

linear regression, this analysis is used to obtain a

comprehensive picture of the influence of

independent variables to the dependent variable.

Here are the results of multiple regression analysis.

ANCOSH 2018 - Annual Conference on Social Sciences and Humanities

378

Table 6: Results of Multiple Linear Regression Analysis.

Coefficients

a

Model

Unstandardized

Coefficients

Standardized

Coefficients t Sig.

B Std. Error Beta

1 (Constant)

.166 .020 8.462 .000

X1

.024 .008 .317 2.927 .006

X2

-.018 .010 -.202 -1.865 .069

X3

.111 .019 .612 5.716 .000

a. Dependent Variable: Y

Source: SPSS 22 output (researchers processed data, 2018).

Y= 0,166+0,024X

1

-0,018X

2

+0,111X

3

+e (5)

Constant value of 0.166 means that if other

variables are constant, then economic growth

will increase by 0.166%;

The value of regression coefficient of

Independence Ratio (X1) is positive of 0,024

means that the Ratio of Independence

increases by 1% assuming other variables are

constant, then economic growth will increase

by 0,024%;

The value of regression coefficient of

Financial Dependency Ratio (X2) is negative

of -0.018 has meaning if the Financial

Dependency Ratio increased by 1% assuming

other variables are constant, the regional

economic growth will decrease by 0.018%;

The value of regression coefficient of PAD

Effectiveness Ratio (X3) is positive of 0.111

has meaning if PAD Effectiveness Ratio

increased by 1% with assumption other

variables are constant, hence economic growth

area will increase about 0,111%.

3.7 F Test (simultaneous)

Table 7: Result of simultaneous significance.

ANOVA

a

Model

Sum of

Squares df

Mean

Square F Sig.

1 Regressio

n

.018 3 .006

15.55

6

.000

b

Residual .016 41 .000

Total .034 44

a. Dependent Variable: Y

b. Predictors: (Constant), X3, X1, X2

Source: SPSS 22 output (researchers processed data, 2018).

The results of the simultaneous significance test

show that the significance f is smaller than the

significiance level, which is 0,000 <0.05 or alpha

5%. This means that simultaneously variable

independence ratio (X1), financial dependency ratio

(X2), and PAD Effectiveness ratio (X3) have

significant effect on regional economic growth.

Then Ha.1 is accepted (supported by data).

3.8 T Test (partial)

3.8.1 H

2

: The Effect of Financial

Performance in the form of Ratio of

Independence on Economic Growth

The significance value of t test on the independence

ratio variable (X1) that is equal to 0.006 is smaller

than alpha 0.05 (5%). This means that the variable

(X1) or independence ratio has a significant effect

on regional economic growth. Beta for X1 = 0.317

indicates the level of sensitivity of the regional

independence ratio on regional economic growth,

where the effect is positive (in line). Then Ha.2 is

accepted (supported by data).

3.8.2 H

3

: The Effect of Financial

Performance in the Form of Ratio of

Dependency on Economic Growth

The significance value of t test on dependency ratio

variable (X2) is 0,069 smaller than alpha 0,05 (5%).

This means that the variable (X2) or partial

dependency ratio has no significant effect on

regional economic growth. Beta for X2 = -0.202,

indicating the degree of sensitivity of regional

dependency ratio to regional economic growth,

where the influence is negative (counterclockwise).

Hence Ha.3 states that the ratio of financial

dependence negatively influenced is rejected (not

supported by data).

3.8.3 H

4

: The Influence of Financial

Performance as a Ratio of

Effectiveness on Economic Growth

The significance value of t test on the effectiveness

ratio variable (X3) is 0.000 greater than alpha 0.05

(5%). This means that the variable (X3) or partial

effectiveness ratio significantly affects regional

economic growth. Beta for X3 = 0.612 indicates the

level of sensitivity ratio of regional effectiveness to

regional economic growth, where the influence is

positive (in line). Hence, Ha.4 states that the

effectiveness ratio is positively accepted (supported

by data).

Analysis of the Effect of Regional Financial Performance on Regional Economic Growth in Indonesia Year 2012-2016

379

3.9 Determination Coefficient Test

(adjusted R

2

)

Table 8: Coefficient Determination Test Results.

Model Summary

b

Model R R Square

Adjusted R

Square

Std. Error of the

Estimate

1 .730

a

.532 .498 .01962

a. Predictors: (Constant), X3, X1, X2

b. Dependent Variable: Y

Source: SPSS 22 output (researchers processed data, 2018).

The result of determination coefficient test shows

that the value of Adjusted R2 is 0,498 or 49,8%. In

this case can be interpreted that ability of

independent variable that is independence ratio,

dependency ratio, and effectiveness ratio, explaining

regional economic growth value equal to 49,8%, and

the rest equal to 50,2% explained by variable which

is not examined in this research.

3.10 T Tests of Economic Growth

Between City And District

3.10.1 Normality Test

Table 9: Normality Test.

Tests of Normality

GROUP

Shapiro-Wilk

Statistic df Sig.

PDRB 1 .569 30 .000

2 .871 15 .035

a. Lilliefors Significance Correction

Source: SPSS 22 output (researchers processed data, 2018).

Note: Group 1 = District, Group 2 = City.

Based on normality test results note that

significant value can be seen in the sig column. That

is in the districts of 0.000 and the city of 0.000 and

both are smaller than <0.05. That means that data

between cities and districts is not normally

distributed. Thus the parametric test cannot be done,

because the data is not normally distributed and in

this study using non-parametric test with Mann-

Whitney test.

3.10.2 Mann-Whiteney Test

Table 10: Mann-Whitney Test.

Test Statistics

a

Economy Growth

Mann-Whitney U 147.000

Wilcoxon W 612.000

Z -1.878

Asymp. Sig. (2-tailed) .046

a. Grouping Variable: KELOMPOK

Source: SPSS 22 output (researchers processed data, 2018).

Based on the result of Mann-Whitney statistic

output, Asymp. value Sig. (2-tailed) of 0.046, and

smaller than the probability value of 0.05. Then the

decision that can be taken is that if the value of

significance or sig. (2-tailed) is less than <0.05 then

there is a difference. So it can be concluded that

economic growth between city and district is

different.

3.11 T Test of Financial Performance

between City and Regency

3.11.1 Normality Test

Table 11: Normality Test with Shapiro-Wilk.

Test of Normally

Group Shapiro-Wil

k

Explanation

Statistic df Sig.

Independence 1 0.886 30 0.004 abnormal

2 0.783 15 0.002 abnormal

Dependency 1 0.75 30 0 abnormal

2 0.873 15 0.37 abnormal

Effectiveness 1 0.783 30 0 abnormal

2 0.926 15 0.241 normal

a. Liliefors Significance Correction

Source: SPSS 22 output (researchers processed data, 2018).

Based on the normality test the three variables do

not have normal data, while the effectiveness ratio

data on the city has a significant value of 0.241

which means greater than 0.05, the effectiveness

ratio data on the city is normally distributed. Even so

data between city and district cannot be tested by

parametric method because one of the data is not

normally distributed.

3.11.2 Kruskall Waliss Test

Table 12: Result of Kruskal Waliss Test

Test Statistics

a,b

Independence Dependency Effectiveness

Chi-Square 26.301 4.388 1.568

df 1 1 1

Asymp. Sig. 0.000 0.036 0.211

Explanation Differen

t

Differen

t

No Differen

t

a. Kruskal Wallis Test

b

. Grouping Variable: Group

Source: SPSS 22 output (researchers processed data, 2018).

Based on the output results, it can be seen that

the ratio of independence in district and city has

significant difference. The dependency ratio on the

city and district has significant difference. While the

ratio of effectiveness in city and district is almost

equal or does not have a significant difference.

ANCOSH 2018 - Annual Conference on Social Sciences and Humanities

380

4 CONCLUSION

Based on the results of this study, financial

performance in the form of independence ratio and

effectiveness ratio showed a significant positive

impact on economic growth, while the dependency

ratio has no significant effect on economic growth.

Further economic growth between city and district

has significant difference, financial performance in

the form of independence and dependency ratios

have significant differences between city and

district, while the financial performance of the ratio

of effectiveness has no significant difference

between the city and district in East Java Region in

2012- 2016.

REFERENCES

Ardi, H., 2008. Analisis kinerja keuangan terhadap

pertumbuhan ekonomi, pengangguran dan

kemiskinan, Universitas Trunojoyo.

Aristovnik, A., 2012. Fiscal decentralization in Eastern

Europe: a twenty-year perspective, MPRA Paper No.

39316, University of Ljubljana, Faculty of

Administration, Slovenia.

Arsa, I. K., Setiawina, N. D., 2015. Pengaruh Kinerja

Keuangan Pada Alokasi Belanja Modal dan

Pertumbuhan Ekonomi Pemerintah Kabupaten/Kota

Se- Provinsi Bali Tahun 2006 s.d. 2013. Jurnal

Buletin Studi Ekonomi. Vol. 20.

Bose, N., Haque, M. E., Osborn, D. R., 2007. Public

expenditure and economic growth: a disaggregated

analysis for developing countries.” The Manchester

School, 75(5), 533-556.

BPKP, 2012. Petunjuk Penyusunan Kompilasi Laporan

Keuangan dan Analisis Kinerja Keuangan Pemerintah

Daerah (Revisi).

BPS. 2013. Laju Pertumbuhan Ekonomi PDRB ADHK

2000

Wuku, A., 2015. Analisis Pengaruh Kinerja Keuangan

Terhadap Pertumbuhan Ekonomi Dan Dampaknya

Terhadap Pengangguran Dan Kemiskinan (Studi Pada

Kabupaten Dan Kota Di Pulau Jawa Periode 2007-

2011). Jurnal EBBANK. Vol. 6, No. 1, Halaman: 1 –

18.

Analysis of the Effect of Regional Financial Performance on Regional Economic Growth in Indonesia Year 2012-2016

381