Analysis on Intelligent Manufacturing Transaction Cost in

Manufactuing Industry

Yiye Zhang

College of Management and Economics, Tianjin University, No. 92 Weijin Road, Tianjin, P.R. China

Keywords: Intelligent Manufacturing; Transaction Cost; Game Analysis.

Abstract: As Germany's Industry 4.0 program quickly swept the world, China also actively embraced the arrival of the

new era. The State Council of China officially announced "Made in China 2025" as a Chinese version of

Industry 4.0. This essay is based on the theory of transaction costs of new institutional economics. Through

further clarifying the connotation of intelligent manufacturing in manufacturing industry, and using

transaction cost theory to analyze the relationship between intelligent manufacturing and transaction costs,

and finally proposing suggestions to accelerate intelligent manufacturing in manufacturing industry.

1 CONNOTATION AND

INFLUENCING FACTORS OF

INTELLIGENT

MANUFACTURING

TRANSACTION COST IN

MANUFACTING INDUSTRY

Intelligent manufacturing refers to the establishment

of intelligent production in order to meet the

individual customization of the consumers, and get

rid of the labor-intensive production methods of

high-energy consumption, low efficiency, and less

innovation of traditional enterprises (Saridis, 1997).

It also improves company's modernization and

intelligent manufacturing process. The construction

of intelligent manufacturing in manufacturing

industry should include the following key elements:

strengthening quality technology research and

fostering independent brands, improving innovation

capability, realizing innovation to improve the

development of the national manufacturing industry,

upgrading the green manufacturing industry and

ecological civilization, optimizing the industrial

layout and promoting the coordination development

of enterprises in different scales (Miao, 2015).

The main factors affecting the manufacturing

intelligent transaction cost in manufacturing industry

consist of powerful big data collection and

processing technology, fast mobile payment

methods, and powerful industry association

supervision methods. These three factors play a

decisive role in reducing transaction costs and

improving transaction efficiency. Meanwhile, they

also affect the cost of obtaining information

exchange between the transaction objects, the

indirect costs from signing to completing the

contract, and monitoring cost whether the

transaction object trades follows the content of the

contract (Dahlman, 1979).

2. ANALYSIS OF INTELLIGENT

MANUFACTURING AND

TRANSACTION COST IN

MANUFACTURING INDUSTRY

2.1 Analysis of the Relationship between

Intelligent Manufacturing and

Transaction Costs in Manufacturing

Industry

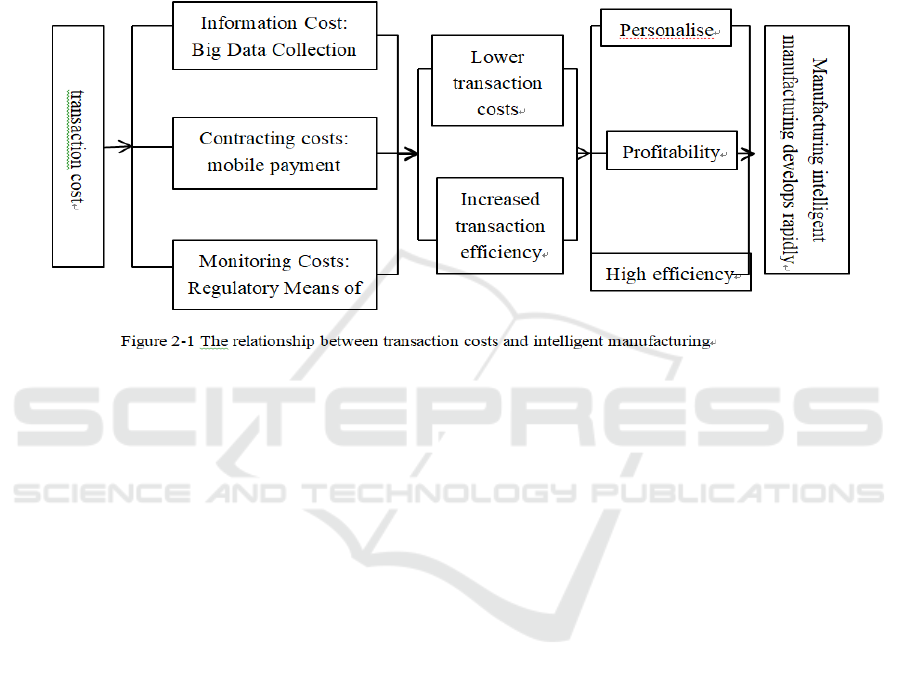

The integration of manufacturing industry and

modern information technologies such as big data

collection and processing and mobile payment

technologies has formed a brand-new intelligent

manufacturing model, which has resulted in lower

transaction costs and higher transaction efficiency.

Therefore, manufacturing industry has facilitated a

rapid development due to a series of methods and

technologies. First, big data collection and

processing technology effectively and accurately

position the sales market of manufacturing industry.

Second, online payment methods of mobile device

terminals build a convenient platform for the

transaction. Third, industry associations have strong

supervision for the enterprises to ensure the safety

and security of trading. The effective operation of

these three entities is an important embodiment of

transaction efficiency, which reduces information

costs, contracting costs, and supervision costs, and

promotes the individuality, efficiency, and

profitability of manufacturing production(Figure 2-

1).

2.1.1 The Relationship Between Transaction

Costs and Personalization

The relationship between transaction cost and

personalization is mainly determined by the

collection and processing results of big data. It can

be considered that the big data collection and

processing technology is positively related to

transaction efficiency and the level of

personalization, and negatively related to transaction

costs. In specific, efficient big data collection and

processing technology can promote locating market

requirements accurately, personalising product, and

reducing transaction costs.

2.1.2 The Relationship Between Transaction

Costs and Profitability

The relationship between transaction cost and

profitability is mainly determined by the use of

mobile payment methods. It can be considered that

the application of mobile payment methods is

positively related to transaction efficiency and

profitability, and negatively related to transaction

costs (Yang, 2014). In specific, the rational use of

mobile payment methods can reduce transaction

costs, increase transaction efficiency, increase the

profitability of enterprises, and promote the rapid

development of the manufacturing industry.

2.1.3 The Relationship Between Transaction

Costs and Efficiency

The relationship between transaction costs and

efficiency is mainly determined by the strong

supervision of industry associations, which

positively related to transaction efficiency and high

efficiency, and negatively related to transaction

costs. In specific, powerful supervisory measures

can reduce transaction costs, improve transaction

efficiency, and promote efficient operation of

enterprises.

2.2 Analysis of the Influencing Factors

for the Transaction Cost in

Manufacturing Industry

The determinants of transaction costs include the

"contractor" factors, consisting of bounded

rationality and opportunism, and trading factors,

such as asset specificity, uncertainty, and transaction

frequency.

2.2.1 “Contractor” Factors

When the limited rationality and opportunistic

behavior of the “contractor” is researched, it can also

be analyzed from the perspective of the game theory,

in specific, to analyze the emergence of price wars

among enterprises and the emergence of free riders

and opportunism(Williamson, 1981).

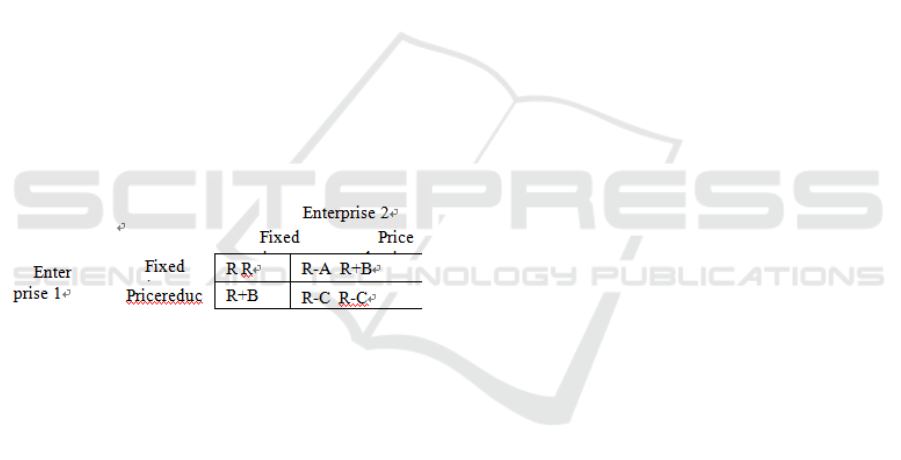

(1) Price Game

In manufacturing industry, since the competition

among enterprises is fierce, price wars are being

fought with each other, which disrupts the normal

market order and damaging the interests of

enterprises. This problem can be analyzed from the

perspective of game theory. In the price war of an

enterprise, it is assumed that each enterprise is

rational, and there exist a typical non-cooperative

game relationship between the enterprises. In the

course of the game, there are two main price

strategies for companies to choose from, i.e., price

reduction and fixed price. When only two companies

participate in the game and meet certain

assumptions, the following game payment matrix is

available (Table 2-1).

Table 2-1 Price game payment matrix.

Among them:

R means the equal returns obtained beforethe export

price reduction of the export products;

B represents the additional net income gained by the

enterprise who reduce the price;

A denotes the loss of price stability under the

condition of B;

C indicates the loss caused by both parties' price

reductions.

The best strategy for this prisoner's dilemma

model is (price reduction, price reduction).

Specifically, the "price wars" of enterprises not only

damage their own interests, but also harm the

interests of other companies, and the results will

surely cause harm for both sides. The above

payment matrix just describes a game process, but in

actual economic life, the enterprises will paticipate

multiple games.

Together with a finite number of repeated games,

according to backward induction, each game player

will adopt the same strategy (price reduction, price

reduction) for each game. With consideration of an

infinite number of repeated games, it is necessary to

introduce the benefit of the latter stage into discount

factor

)1/(1:

γ

δ

δ

+=

, where

γ

is the market

interest rate with one period as deadline.

When the discount coefficient δ is relatively

large, for the manufacturers, the future interests are

considered more important relate to the current

interests. They will not cause their long-term

interests to be damaged for the sake of the current

interests. However, assumed that more companies

participate in the game, the greater the ratio of net

income to loss of future profits in each company's

one-off opportunistic uncooperative behavior, the

greater the incentive for opportunistic behaviour

(Jiang, 2014). This situation is consistent with the

observation of social reality in China. If the

company's product price strategy is carried out in an

infinite number of repeated games, and in the case of

a large number of companies in a market, it happens

that a price drop, which will surely put the company

into a vicious cycle of great harm.

(2) The Game between Enterprises under

Intelligent Manufacturing

From previous analysis, the manufacturing

industry is gradually taking the path of intelligent

manufacturing. At present, the majority of

enterprises that are capable of intelligent

manufacturing are large-scale enterprises with

financial advantage. However, there still exist

numbers of companies that are not capable of

intelligent manufacturing. This will lead to the

problem that whether small businesses want to

establish intelligent manufacturing. From the

perspective of the game, it can be explained by using

Smart Pig Game Model.

It is assumed that there are two companies

involved in the game, and the players are rational.

One of them has a certain scale (enterprise A),

which can carry out intelligent manufacturing. The

other is smaller (enterprise B), and it cannot perform

R&D for intelligent manufacturing. Meanwhile,

assume intelligent manufacturing will increase the

revenue of the market by 10 units, and the cost of

intelligent manufacturing will be 2 units. If two

enterprises develop intelligent manufacturing

together, A can get 7 units of revenue, while B can

get 3 units. If cost of intelligent manufacturing is

removed, A gets 5 units, and B gets 1 unit. If A

develops intelligent manufacturing, A gets 6 units,

and net gains are 4 units, while B gets 4 units. If B

develops intelligent manufacturing, A gets 9 units, B

gets 1 unit, but after removing costs, A loses 1 unit.

If neither develops intelligent manufacturing, they

cannot gain profit. It is summarized as the following

game payment matrix (Table 2-2).

Table 2-2 Wise Pig Game Payout Matrix.

Enterprise B

deve

l

Not

dl

Enter

prise A

develop

5 1 4 4

Not

dl

9 -1 0 0

After analysis, the small-scale enterprise

(Enterprise B) will certainly choose not to develop,

so that the large-scale enterprise (Enterprise A) will

choose to develop intelligent manufacturing.

However, if we do not take the cost in account, we

found that the large-scale enterprise and small-scale

enterprise will share the revenue equally at last, and

there will exist free riders.

The above analysis just describes a game

process. In the real market, there will usually be

repeated games. Thus, from the long term

perspective, it is helpful for small-scale enterprises

to establish brands through independent R&D or to

learn from large-scale companies under certain

levels of supervision. Therefore, it can be found that

the limited rationality and opportunistic behavior of

“the contractor” will disrupt the competitive market

among enterprises and increase transaction costs.

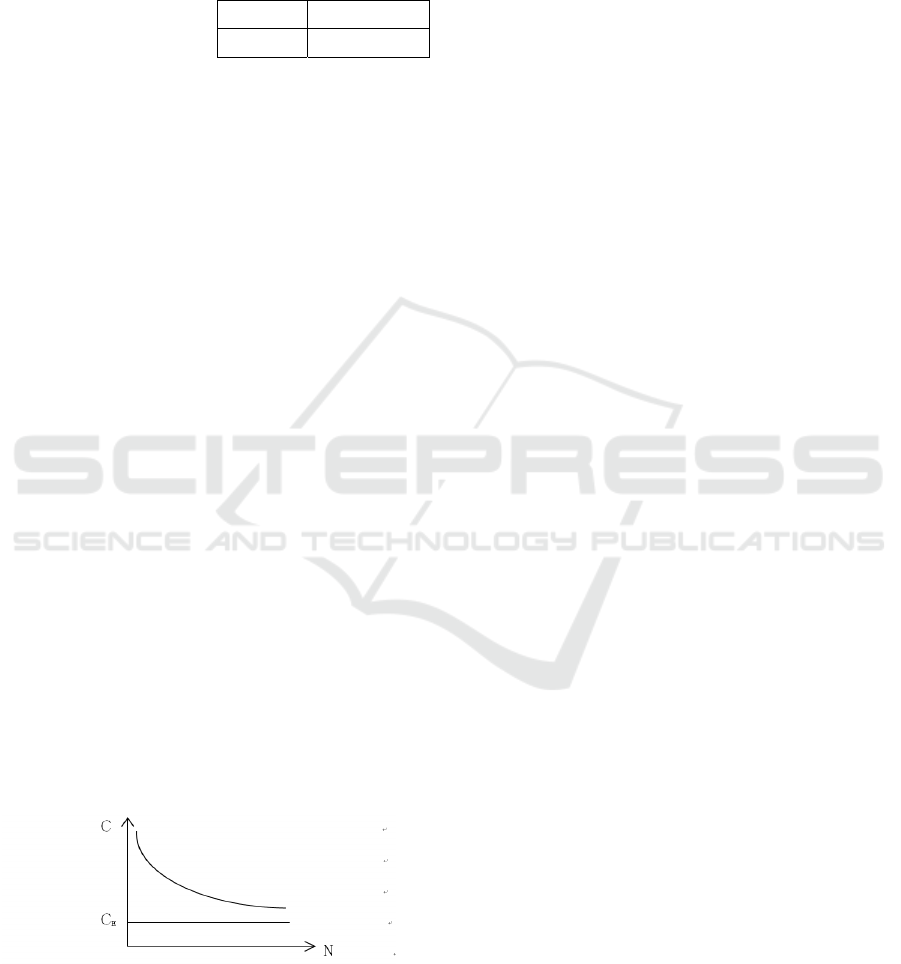

2.2.2 Trading Factors

Trading factors mainly include asset specificity, and

transaction frequency. On the one hand, when the

existing old manufacturing equipment is eliminated

or improved in developing intelligent

manufacturing, it will lose all or part of the input

assets and increase transaction costs. On the other

hand, in the course of repetitive transactions,

transaction costs will decrease as the frequency of

transactions increases. However, transaction costs

will not be reduced indefinitely as the frequency of

transactions will increase(Williamson, 1979).

(Figure 2-2).

Figure 2-2 Relationship between transaction frequency

and transaction cost

3 SUGGESTIONS

According to the current situation of intelligent

manufacturing in manufacturing industry in China, it

can be proposed that in order to improve intelligent

manufacturing in manufacturing industry can be

conducted from three perspectives.

3.1 Formulating Production Capacity

and Eliminating Backward

Production Capacity Based on

Market Demand

At present, some enterprises in manufacturing

industry are still in a state of overcapacity and

backward production capacity. In order to deal with

the problem and improve enterprise’s performance,

on the one hand, large enterprises should reduce the

production of high-volume, low-quality products.

Moreover, customizing production capacity

according to market demand, increasing the

introduction of advanced production equipment and

technologies, and gradually optimizing product

quality is also necessary for large-scale enterprises

to achieve the reform. On the other hand, small

enterprises should not only reduce the production of

low-tech products, but also transform the

development target to technology research and

development. Therefore, the unique brand will be

built.

3.2 Strengthen Innovation to Increase

Intelligent Manufacturing

Development

Innovation is the driving force for companies to

move toward intelligent production. Enterprises

should accelerate the pace of innovation with the

support from government and higher education

institutions. Moreover, they can also increase the

introduction of technological talents, the use of

intelligent technologies, and the connection and

cooperation with other enterprises. Therefore, the

core competitiveness of the enterprises, and constant

upgrading and optimization of industrial structure

can finally be achieved.

3.3 Promoting Clean and Environmental

Friendly Production to Upgrade

Product

Environmental protection is an issue that cannot be

ignored in the development of any industry. The

state’s requirements for cleaner production, energy

conservation, and emission reductions are

increasing. Enterprises should strictly control the

disposal and discharge of pollutants, increase

investment in wastewater and tail gas treatment, and

gradually realize intelligent upgrading of their

products.

4 CONCLUSIONS

This essay clarifies the connotation and influencing

factors of intelligent manufacturing and transaction

costs in manufacturing industry. After analysing the

relationship between intelligent manufacturing and

transaction costs, we proposed suggestions to

accelerate intelligent manufacturing in

manufacturing industry, consisting of formulating

production capacity, strengthening innovation, and

promoting clean and environmental friendly

production.

ACKNOWLEDGEMENTS

This research was financially supported by the

National Social Science Foundation of China

(16BGL138 ).

REFERENCES

1. Dahlman, C. J., 1979. The Problem of

Externality. Journal of Law and Economics, 22 (1),

pp.141–162.

2. Jiang, W. H., 2014. Seeing the world with game

thinking. Zhejiang University Press. Zhejiang.

3. Miao, W., 2015. Made in China 2025, on the road to

achieve manufacturing power. Auto Time, 11, pp.8-

10.

4. Saridis, G. N., 1997. Intelligent Manufacturing.

Advanced Manufacturing, 69(5), pp.100-119.

5. Williamson, O. E., 1979. Transaction Cost

Economics: The Governance of Contractual Relation

s. Journal of Law and Economics, 22(2), pp.233-

261.

6. Williamson, O. E., 1981. The Economics of

Organization: The Transaction Cost Approach.

American Journal of Sociology, 87(3), pp.548-577.

7. Yang, Y., 2014. The Research of Development of

Internet of Finance based on transaction cost theory.

Unpublished theses (MEc), Hunan Normal

University.