Effect of Financing of Revenue Sharing on Return on Assets of Sharia

Commercial Banks in Indonesia

Faris Kurnia Hakim, Mauizhotul Hasanah, and Sri Herianingrum

Department of Islamic Economics, Postgraduate School, Universitas Airlangga, Surabaya ,indonesia

Keywords: Financing of Revenue Sharing Principle, Mudharabah, Musyarakah, Return On Asset

Abstract: This study is conducted to determine the effect of revenue sharing principle by using mudharabah and

musyarakah contracts simultaneously and partially to Return on Asset of Sharia Commercial Bank in

Indonesia. The design of research is quantitative. The object of research is 13 Sharia Commercial Banks in

Indonesia which has done starting from January 2016 to March 2018. Analytical techniques used are

multiple linear regression or Ordinary Least Squares (OLS). The results show that the financing of revenue

sharing principle by using mudharabah and musyarakah contracts simultaneously has no significant effect

on Return On Assets of Sharia Commercial Bank in Indonesia. Mudharabah financing is partially no

significant effect on Return On Asset of Sharia Commercial Bank in Indonesia. Musyarakah financing is

partially no significant effect on Return On Assets of Sharia Commercial Banks in Indonesia.

1 INTRODUCTION

Islamic banks in Indonesia consist of Sharia

Commercial Bank and Sharia Business Unit. The

channeling of funds in the Shariah Commercial

Bank is directly shown in the productive sector and

is included in income-generating assets (productive

assets). Productive assets can be financing the

principle of revenue sharing, namely: financing

mudaraba and musharaka. According to

Muhammad (2005: 272-279), mudharabah and

musyarakah financing affect the financial

performance of Sharia Commercial Bank which is

displayed in the ratio of the bank that is ROA.

The purpose objective is determined by the

government, namely to increase productive

financing in order to create economic growth and

people's welfare. In practice, consumer financing is

often channeled by Islamic Commercial Banks in

Indonesia. Consumer financing products that are

often channeled are referred to as consumer banking

segment financing.

Mudharabah and musyarakah financing in

several Sharia Commercial Banks have increased

annually from 2016 to 2018. The increase is also

shown in Return On Assets of Sharia Commercial

Banks in 2016-2018. However, financing by not

using financing the principle of revenue sharing

(murabaha) in Syariah Commercial Bank still

dominates the financing. This research was

conducted to find out whether ROA Bank Syariah in

Indonesia is significantly influenced by mudharabah

and musyarakah financing, either simultaneously or

partially.

This study raises the productive financing

channeled by Islamic Commercial Banks in

Indonesia which should be a motor of financing to

drive economic growth and equitable welfare of the

people but in reality, the motor financing is

consumptive financing that uses murabahah

financing contracts.

Sudana (2009: 26) explains that ROA

demonstrates the company's ability to use all of its

assets to generate profits. This ratio is important for

management to evaluate the effectiveness and

efficiency of enterprise management in the use of all

corporate assets

Arifin (2003: 63) explains that net profit rate

(profit) obtained by sharia bank is influenced by

several factors, including income and expenditure.

Assets that generate income is the financing of

profit-sharing principles by using mudaraba and

musharaka contracts

According to Muhammad (2005: 272-279), when

the income of sharia commercial banks derived from

the financing of the principle of profit sharing

increases and the cost incurred by the financing has

176

Kurnia Hakim, F., Hasanah, M. and Herianingrum, S.

Effect of Financing of Revenue Sharing on Return on Assets of Sharia Commercial Banks in Indonesia.

DOI: 10.5220/0007539701760180

In Proceedings of the 2nd International Conference Postgraduate School (ICPS 2018), pages 176-180

ISBN: 978-989-758-348-3

Copyright

c

2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

decreased or fixed, the ROA of sharia banks is

increasing. Then, if the income of sharia banks is

derived from the financing of the profit-sharing

principle decreases and the costs incurred by the

financing of the profit-sharing principle are

increased or improved, the ROA of sharia general

banks will decrease. From the above explanation, it

can be said that financing the principle of profit

sharing affects the ROA (Return On Asset) sharia

commercial banks.

According to Fredrick (2016) that musharaka,

ijara, and murabaha have a positive influence on

ROA with the value of regression as a whole

significant effect as seen from the ratio F for the

regression is 21.796 with p-value 0.0028. So when

musyarakah financing increased then it will improve

the performance of Islamic banks as well, it is the

Islamic banks in Indonesia to further increase the

financing of musharaka in order to maximize the

return of assets of sharia banks.

According Jaurino and Renny (2017), from the

results of research that mudharabah financing has a

positive and significant influence on bank

profitability. But musyarakah financing has no effect

on bank profitability. This is shown by the value of

t-statistics where when t the statistics> 1.96.

Nur Gilang (2013) states that simultaneously

FDR, NPF, ROA, CAR and the rate of profit sharing

affect the mudharabah financing. Partially, the FDR

variable has a negative effect on mudharabah

financing. NPF variables have no effect on

mudharabah financing. Whereas for the ROA, CAR,

and profit sharing variables have a positive effect on

mudharabah financing.

Ismed, Yenny, and Fauzan (2016) state that

mudharabah has a significant effect on ROA, while

murabahah and musyarakah have no significant

effect on ROA. Simultaneously the three

independent variables have a positive effect on

ROA.

Based on this we have proposed the following

hypothesis:

H

0a

: Mudharabah and musyarakah financing

simultaneously have no significant effect

on Return On Asset of Sharia

Commercial Bank in Indonesia

H

1a

: Mudharabah and musyarakah financing

simultaneously have a significant effect

on Return On Asset of Sharia

Commercial Bank in Indonesia

H

0b

: Mudharabah financing and partial

musyarakah financing has no significant

effect on Return On Asset of Sharia

Commercial Bank in Indonesia

H-

1b

: Mudharabah and musyarakah financing

are partially significant effect on Return

On Asset of Sharia Commercial Bank in

Indonesia

2 RESEARCH METHODOLOGY

The data in this study use secondary data, in form of

time series data covering the period from January

2016 to March 2018. Data on Return On Asset,

mudharabah, and musyarakah variables are obtained

from statistical data of sharia banking in the Otoritas

Jasa Keuangan (https: //www.ojk .go.id). This

research uses quantitative approach, using linear

regression method or OLS (Ordinary Least Squares)

using EViews 9.0. The object of research is sharia

commercial bank in Indonesia, in total of 13 sharia

commercial banks

3 RESULT AND DISCUSSION

3.1 Multiple Linear Analysis

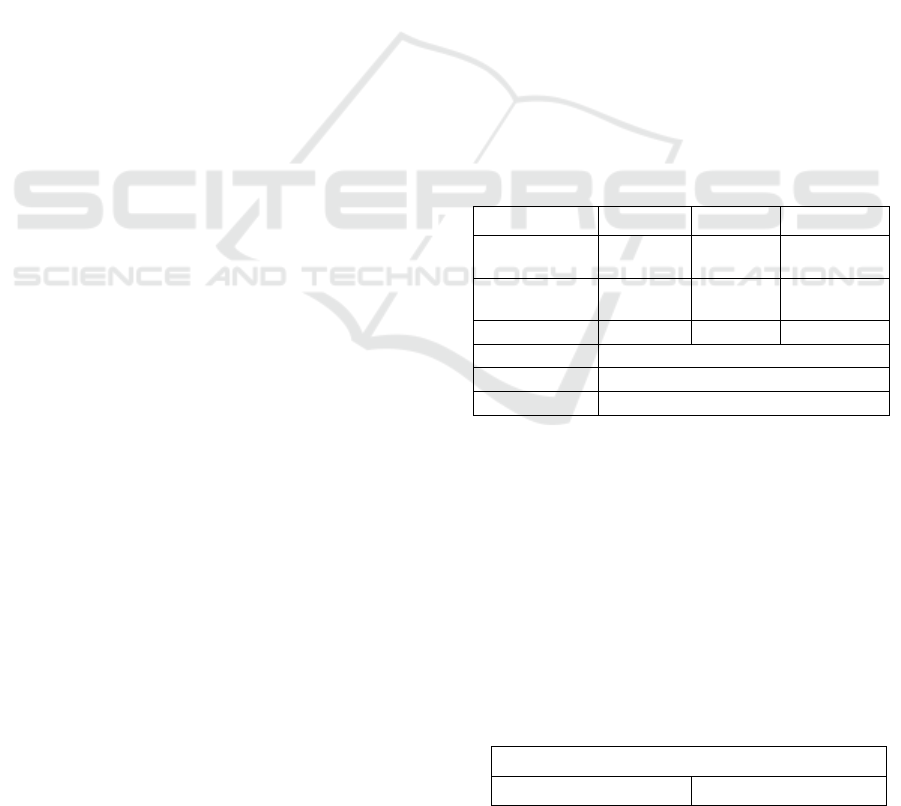

Table 1: Multiple Linear test results.

Variable

Koefisien

t-stat

Probability

X1

(Mudharabah)

-

74.71111

-

1.121444

0.2732

X2

(Musyarakah

11.49847

0.874610

0.3905

C

1931.887

1.046370

0.3058

R-Squared

0.057743

F-Stat

0.735380

Probablitas

0.489815

Source: processed data

Based on table 1., The coefficient of

determination (R-Squared) is 0.057743. The value of

R-Squared is not good because it is smaller than 1.

This means 5.77 percent ROA variable can be

explained by mudharabah and musyarakah

financing, while the remaining 94.23 percent is

explained by other variables which have not been

examined.

3.2 Normality test

Table 2: Jarque-Berra (JB) Test.

Jarque-Bera Test:

Jarque-Bera

2.041445

Effect of Financing of Revenue Sharing on Return on Assets of Sharia Commercial Banks in Indonesia

177

Possibility

0.360334

Source: processed data

JB Test probability value is 0.360334. The value

is greater than α = 0.05. That means that the normal

distributed error term in the multiple linear

regression model.

3.3 Autocorrelation Test

Table 3: Breusch-Godfrey Serial Correlation LM Test.

Breusch-Godfrey Serial Correlation LM Test:

F-Statistic

4.698613

Prob.F (2,13)

0.0200

Obs*R-

Squared

8.081131

Prob.Chi-Square (2)

0.0176

Source: processed data

Based on the test result, the probability value of Obs

* R-squared is 0.0176. The value is smaller than α =

0.05. That means there is autocorrelation in the

multiple linear regression model. It also means that

there is a correlation between members of a series of

observations sorted by time or space.

3.4 Heteroscedasticity Test

Table 4: Uji Heteroskidastisitas.

Heteroscedasticity Test : White

F-Statistik

1.030863

Prob. F (3,15)

0.3720

Obs *R-

Squared

2.135952

Prob. Chi-Square

(3)

0.3437

Source: processed data

Based on the test results, probability value Obs * R-

Square is 0.3437. This is a value greater than α =

0.05. This means that there is no heteroscedasticity

in the multiple linear regression model. It is also

significant that a linear regression model has a

constant residual variance.

3.5 Multicolinearity Test

Table 5. Correlation Matrix.

Mudharabah

Musyarakah

ROA

Mudharabah

1.000000

0.403178

-

0.1664

66

Musyarakah

0.403178

1.000000

0.0914

73

ROA

-0.166466

0.091473

1.0000

00

Source: processed data

Based on the results of multicolinearity test through

the correlation matrix, the relationship between

independent variables between mudharabah

financing and musyarakah financing is not

experiencing multicolinearity because the value of

the matrix of mudharabah financing correlation with

musyarakah financing was less than 0.8.

According to Arifieanto (2012: 52), little

multicollinearity does not change the properties of

OLS parameters as Best Linear Unbiased Estimator

(BLUE). The parameters obtained are still valid to

reflect the condition of the population. This means

that when no multicollinearity means the parameter

used is valid.

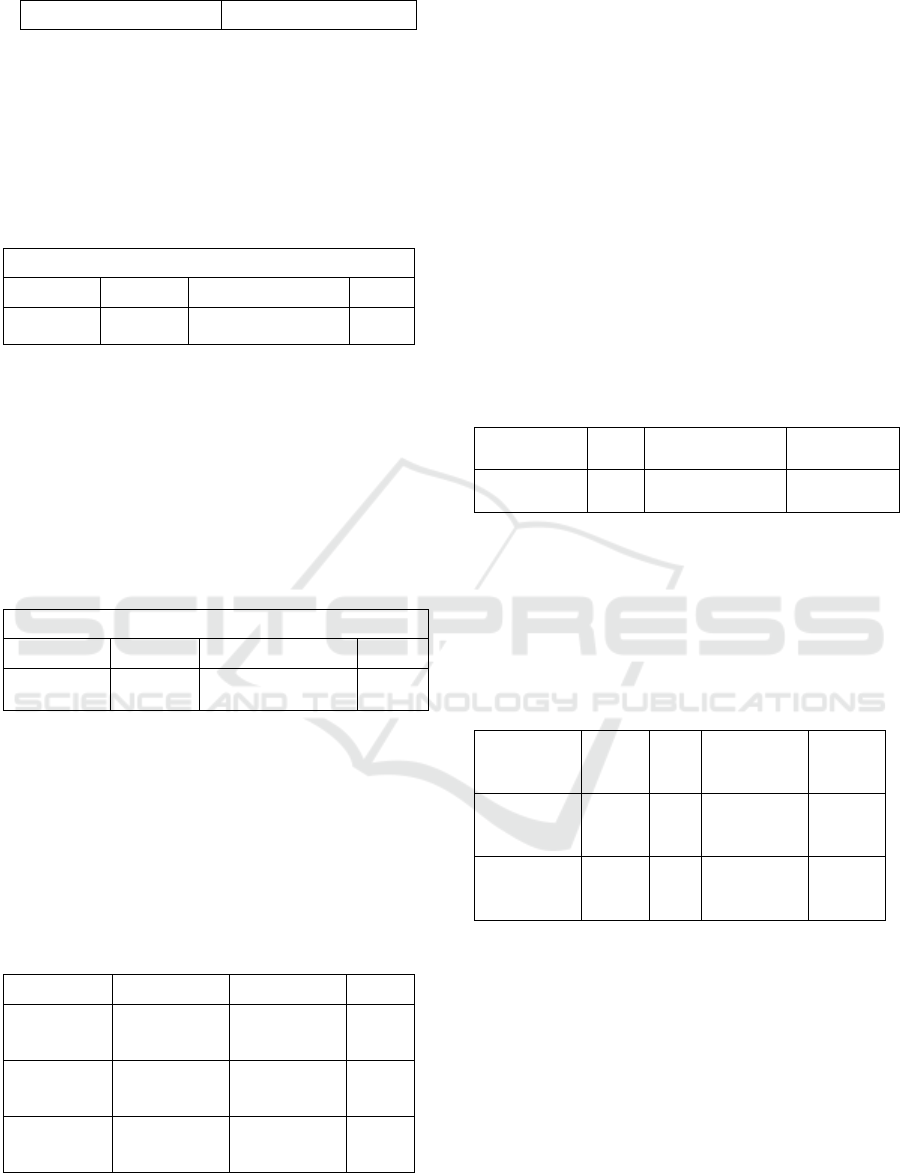

3.6 SimultanTest (F-Test)

Table 6. Simultant Test (F-Test).

Probability

Value

Hypothesis

verification

Conclusion

0.489815

0,05

0.489815 > 0,05

H0a

accepted

Source: processed data

Based on the test, mudharabah financing and

musyarakah financing simultaneously have no

significant effect on ROA of sharia bank in

Indonesia.

3.7 Partial Test (t-test)

Table 7. Partial Test (t-test).

Variable

P-

Value

Hypothesis

Conclu

sion

Mudharaba

h

0.273

2

0,0

5

0.2732>0,0

5

H0b

accepte

d

Musyaraka

h

0.390

5

0,0

5

0.3905>0,0

5

H0b

accepte

d

Source: processed data

Based on the test, partial mudharabah financing has

no significant effect on ROA of sharia bank in

Indonesia. Musyarakah financing partially has no

significant effect on ROA of sharia bank in

Indonesia. The results of this study are reinforced by

the results of research conducted by Jurino and

Renny (2017) which states that the results of his

research shows that musyarakah financing does not

affect the profitability of banks. Hendrawati (2017)

stated based on the analysis test and partial

discussion there is a significant positive effect of

profit sharing for profitability, there is a significant

ICPS 2018 - 2nd International Conference Postgraduate School

178

positive effect of sales & purchases of financing,

there is a significant positive influence of financial

ratios on savings to profitability there is a negative

effect on financing a significant non-performing

profitability at PT Bank Muamalat Indonesia Tbk,

and simultaneously significant differences to the

financing of profit sharing, financing of sales &

purchases, financing to deposit ratio and non-

performing financing of profitability at PT Bank

Muamalat Indonesia Tbk .

The model equations that have met the

assumptions of normality and classical assumptions

are:

ROA = 1931.887 + -74.71111 ln X1 + 11.49847

ln X2 (3.)

Based on the above formula there is a value of

1931.887. This means that ROA variables increase

1931, 887 units when there is no channeling of funds

in the form of mudharabah financing and

musyarakah financing.

The coefficient of mudharabah financing

regression is -74.71111. The coefficient is negative

meaning mudharabah financing has a negative

effect on the ROA of sharia banks in Indonesia.

Mudharabah financing changes are not in line

with ROA. If the mudharabah financing variables

increase by 100 percent, the ROA variable will

decrease by 7471, 111 percent with the assumption

that the other variable is constant.

The coefficient of musharaka financing

regression is 11.49847. The coefficient is positive

value means musyarakah financing has a positive

effect on the ROA of sharia banks in Indonesia. This

is reinforced by the research of Fredrick Ogilo

(2016) which concludes from his research that

musharaka, ijarah, and murabaha have a positive

effect on ROA, with the regression value as a whole

has a significant effect seen from the ratio F for the

regression is 21.796 with p-value 0.0028. So when

musyarakah financing increased then it will improve

the performance of Islamic banks as well. It is the

Islamic banks in Indonesia to further increase the

financing of musharaka in order to maximize the

return of assets of sharia banks.

Musharaka financing changes in the direction of

ROA. If musyarakah financing variables increase by

100 percent, the ROA variable will increase by

1149, 847 percent with the assumption that the other

variable is constant. Mudharabah and musyarakah

financing are productive financing channeled by

Islamic Commercial Banks in Indonesia, which can

be a driving force for economic growth and equal

distribution of people's welfare but in reality the

motor financing is the consumptive financing in the

form of murabahah.

Productive and consumptive financing can create

a balance between the real sector and the monetary

sector, now that can be a motor of financing is

consumptive financing that uses murabahah

contracts by Sharia Commercial Banks in Indonesia

because the disbursement of murabahah financing is

easier than the mudharabah and musyarakah

financing, generated by less murabahah financing

and in a fairly fast period of time, and in a short time

also can create a large profit for Islamic Commercial

Banks in Indonesia. Therefore, the results are in line

with the existing reality that mudharabah and

musyarakah financing does not have a positive

effect on ROA because currently people tend to

prefer murabahah financing.

4 CONCLUSIONS AND

RECOMMENDATIONS

Based on the analysis and discussion that has been

described, the conclusion is (1) Mudharabah

financing and Musyarakah financing simultaneously

have no significant effect on ROA of sharia bank in

Indonesia. (2) Mudharabah financing partially has

no significant effect on ROA of sharia bank in

Indonesia. Musyarakah financing partially has no

significant effect on ROA of sharia bank in

Indonesia.

Based on the results of the analysis and

discussion that has been described, there are

suggestions for Islamic banking and subsequent

researchers namely, (1) Islamic banking should

increase mudharabah financing and musyarakah

financing because each channeling of the funds

affect the productive sector and the current position

of the amount of mudharabah financing and the

amount of musyarakah financing is not in large

amount so it does not have a significant positive

effect on ROA of sharia bank in Indonesia. (2)

Murabahah financing is still a motorcycle financing

channeled by sharia banks in Indonesia. Syariah

banking continues to channel murabahah financing

in large numbers along with a focus on consumer

financing that leads to the productive sector.

Shariah banking is recommended to increase

mudharabah financing and musyarakah financing

because each channeling of the fund affects the

productive sector and the current position of

mudharabah financing and musyarakah financing is

not in large amount so it does not significantly affect

Effect of Financing of Revenue Sharing on Return on Assets of Sharia Commercial Banks in Indonesia

179

the ROA of sharia banks in Indonesia. In the future,

further research can be done by adding time series

data and independent variables that may affect ROA.

REFERENCES

Abusharbeh, Mohammaed T. (2016) Analysis the Effect of

Islamic Banks Performance on Depositor’s Fund:

Evidence from Indonesia. International Journal of

Economics and Finance.

Ajija, Shochrul R dkk. 2011. Cara Cerdas Menguasai

EViews. Jakarta: Salemba Empat.

Ansori, Muslich & Sri Iswati. 2009. Metodologi Penelitian

Kuantitatif. Surabaya: Universitas Airlangga tekan.

Arifin Zainul. 2003. Dasar-Dasar Manajemen Bank

Syariah. Jakarta: AlvaBet.

Giannini, Nur Gilang. 2013. Faktor yang Mempengaruhi

Pembiayaan Mudharabah pada Bank Umum Syariah

di Indonesia. Accounting Analysis Journal.

Hendrawati, 2017. Effect of Profit Sharing Financing,

Sale& Purchase Financing, Financing to Deposit

Ratio and Non Performing Financing to Profitability

(Case Study at PT Bank Muamalat Indonesia TBK).

International Journal of Applied Business and

Economic Research

Jaurino. Wulandari, Renny. 2017. The Effect of

Mudharabah and Musyarakah on The Profitability of

Islamic Banks. Parahyangan Internasional Thrid

Accounting and Business Conference 2017.

Statistik Perbankan Syariah Otoritas Jasa Keuangan.

Lind, Douglas A dkk. 2009. Teknik-teknik Statistika dalam

Bisnis dan Ekonomi Menggunakan Kelompok Data

Global. Jakarta: Salemba Empat.

Medyawati, Henny. Yunanto, Muhamad. 2018. The Effect

of FDR, BOPO, and Profit Sharing on The

Profitability of Islamic Banks in Indonesia.

International Journal of Economics, Commerce and

Management.

Muhammad Rifqi. 2008. Akuntansi Keuangan Syariah.

Yogyakarta: P3EI tekan.

Muhammad. 2005. Manajemen Bank Syariah.

Yogyakarta: UPP AMP YKPN.

Muhammad. 2005. Manajemen Dana Bank Syariah.

Yogyakarta: Ekonisia.

Muhammad. 2005. Manajemen Pembiayaan Bank

Syariah. Yogyakarta: UPP AMP YKPN.

Ogilo, Fredrick. 2016. Effects of Financial Instruments on

Performance of Islamic Banks in Kenya. The

International Journal Of Business & Management

Rivai, Veitzhal dkk. 2012. perbankan Syariah &

Keuangan. Yogyakarta: BPFE.

Nazaruddin Abdul. 2010. Sukuk: Memahami & Membedah

atas Obligasi pada Perbankan Syariah. Yogyakarta:

Ar-Ruzz Media.

Wijaya, Ismed. Iirawan, Yenny. Ramadhan Fauzan. 2016.

Analisis Pengaruh Pendapatan Murabahah,

Mudharabah, dan Musyarakah Terhadap Return on

Asset PT Bank Syariah Mandiri. Jurnal Ekonomi dan

Bisnis. Volume 16 No 1. ISSN 1693-8852

ICPS 2018 - 2nd International Conference Postgraduate School

180