The Potential Development of Trade on Services by Micro Small

Medium Enterprises in ASEAN

Koesrianti

1

and Tri Andjarwati

2

1

Department of International Law, Faculty of Law - Universitas Airlangga, Jalan Dharmawangsa Dalam Selatan,

Surabaya, Indonesia

2

Faculty of Economic – Universitas 17 Agustus 1945, Jalan Semolowaru 45, Surabaya, Indonesia

Keywords: MSMEs, AEC, Trade Services, Global ASEAN

Abstract: Micro, Small and Medium Enterprises (MSMEs) in ASEAN are the backbone of ASEAN economic

development regarding to their share of total establishment and absorb employment. The majority type of

business of MSMEs in ASEAN, however, is mainly trade of goods. The establishment of the AEC in 2015

will attract investment from foreign countries that provide MSMEs in the region with good prospects

including trade on services. MSMEs however have not explored yet the chances offered by free flow of

services that expected to bring enormous benefits to MSMEs in ASEAN. The increasing trade on services in

this economic globalized digital era, may be construed as economically sound that tends to have efficient

allocation of MSMEs resources as economic actors in the AEC scheme. This paper discusses the

opportunity of MSMEs in trade on services provided by the AEC economic integration and liberalization

through global value chains that would have been achieved by Global ASEAN. It explores trade on services

in particular its’ potential in ASEAN single market and production base. It also discusses the Priority

Integration Sectors (PIS) of ASEAN as only five service sectors have been agreed in PIS. This became

challenge and opportunities for MSMEs in the region.

1 INTRODUCTION

Services currently represent more than two thirds of

World Gross Domestic Product (GDP). It covered

73 per cent in high-income countries against 54 per

cent and 47 per cent respectively in middle-and low-

income countries. Merchandise accounts for the

majority of world trade (approximately 61 per cent),

while services (approximately 20 per cent) are

playing an increasingly important role in world

trade. (Lester, Mercurio, and Davies, 2012).

Since 1995 ASEAN has put some interests on

trade in services and it has been one of the

increasingly important component of not only the

economic development of ASEAN Member States

(AMS), but also of equally important component of

ASEAN economic policy as well. Unlike trade in

goods, trade in services has been evolved and

became the focus of national economic policies of

AMS throughout the years and among ASEAN has

made an effort to improve the competitiveness and

attractiveness of the ASEAN region for the services

sector. There are seven sectors that covered by

ASEAN Framework Agreement on Services

(AFAS) include construction, financial services,

businesses services, air transport, tourism, maritime

transport, and telecommunication.

1.1 Trade in Services: Opportunity and

Challenges of ASEAN’ MSMEs

The establishment of the ASEAN Economic

Community in 2015 should constitute as a turning

point for MSMEs in ASEAN. One of the AEC

pillars is single market and production base. It aims

not only to have economic integration for intra-trade

in ASEAN but also integration into the global

market. This brings both challenges and

opportunities for all of AMS.

MSMEs are the backbone of ASEAN Economies

because their widespread presence in non-urban and

poorer sub-regions as accounted of 96 per cent of

existence (SAP SMED 2010-2015, SAP SMED

2016-2025, SME Policy Index 2014). In addition,

MSMEs in ASEAN also contribute to greater

economic growth and social development (30%-

53% of GDP of AMS).

708

Koesrianti, K. and Andjarwati, T.

The Potential Development of Trade on Services by Micro Small Medium Enterprises in ASEAN.

DOI: 10.5220/0007550107080711

In Proceedings of the 2nd International Conference Postgraduate School (ICPS 2018), pages 708-711

ISBN: 978-989-758-348-3

Copyright

c

2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

ASEAN MSMEs have opportunities of the AEC

as tightness of domestic market is overcome, AMS

agreed to set a lower tariffs and access to MSMEs’

incentives, economies of scale, trade with perishable

goods enabled, the improvement of access to sea-

ports (to inter-national markets) that has attracted for

foreign investments, such as Multi-National

Corporations into the region (Southiseng and

Bartels, 2016).

2 General Agreement on Trade in

Services (GATS) under WTO

Trade in services can comprise of the following:

business services, communication services,

construction and related engineering services,

distribution services, educational services,

environmental services, financial services, health-

related and social services, tourism and travel-

2.1 Trade in Services in ASEAN

AFAS has provided the official platform for ASEAN

to undertake its effort to improve the openness and

competitiveness of services sectors in ASEAN and was

designed to integrate ASEAN trade in services with

aims as the following (ASEAN Secretariat,

2014):

1.

Enhance cooperation in services amongst AMS

in order to improve the efficiency and

competitiveness, diversify production capacity,

and supply and distribution of services of their

service suppliers within and outside ASEAN;

2.

Eliminate substantially restrictions to trade in

services amongst AMS;

3.

Liberalize trade in services by expanding the

depth and scope of liberalization beyond those

undertaken by AMS under the GATS with the

aim to realizing a free trade area in services.

related services, recreational, cultural and sporting

services, transport services, and other services not

include elsewhere. (Lisa Eifert, 2016).

The meaning of the term service is defined in Art

I.3(b) GATS as follows: service’ includes any

service in any sector except services supplied in the

exercise of governmental authority (Mitsuo

Matsushita, Thomas J. Schoenbaum & Petros C.

Mavroidis, 2006) International trade in services is

defines by the four Modes of Supply of the General

Agreement on Trade in Services (GATS). Mode 1 is

cross border trade which is defined as delivery of

service from the territory of one country into the

territory of other country. Mode 2 is consumption

abroad, means, it covers supply of a service of one

country to the service consumer of any other country

or in other words consumer travels to producer and

vice versa. Mode 3 is commercial presence (foreign

investment) which covers services provided by a

service supplier of one country in the territory of any

other country in long-term. Mode 4 is presence of

natural persons which covers services provided by a

service supplier of one country through the presence

of natural persons in the territory of any other

country in temporary movement of natural persons,

means, service supplies across border to provide

services to a consumer. To sum up, whereas mode 1

and 2 service supplier not present within the territory

of the Member, mode 3 and 4 service supplier

present within the territory of the Member.

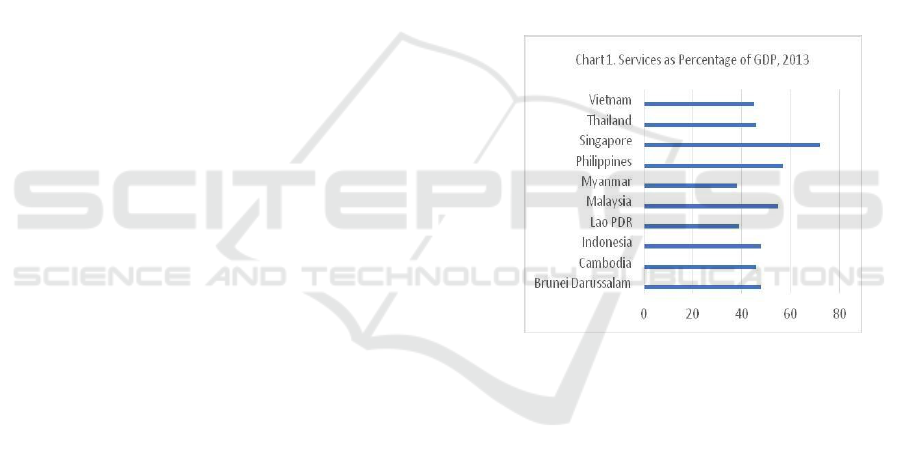

Trade in services has been continuously

significant component of Gross Domestic Product

(GDP) in AMS. As shown by Chart 1, as of 2013, an

average AMS had generated about 45% to 55% of

its GDP from services sectors, as compared to the

agriculture and industrial sectors.

Source: Source: ASEANstats, 2015

Figure 1: Chart Service as Percentage of GDP 2013.

As shown by Chart 1, as of 2013, an average

AMS had generated about 45% to 55% of its GDP

from services sectors, as compared to the

agriculture and industrial sectors. For example,

Myanmar, the lowest economy of AMS has

generated 38% of its output from the services

sector, while Singapore as the highest among AMS

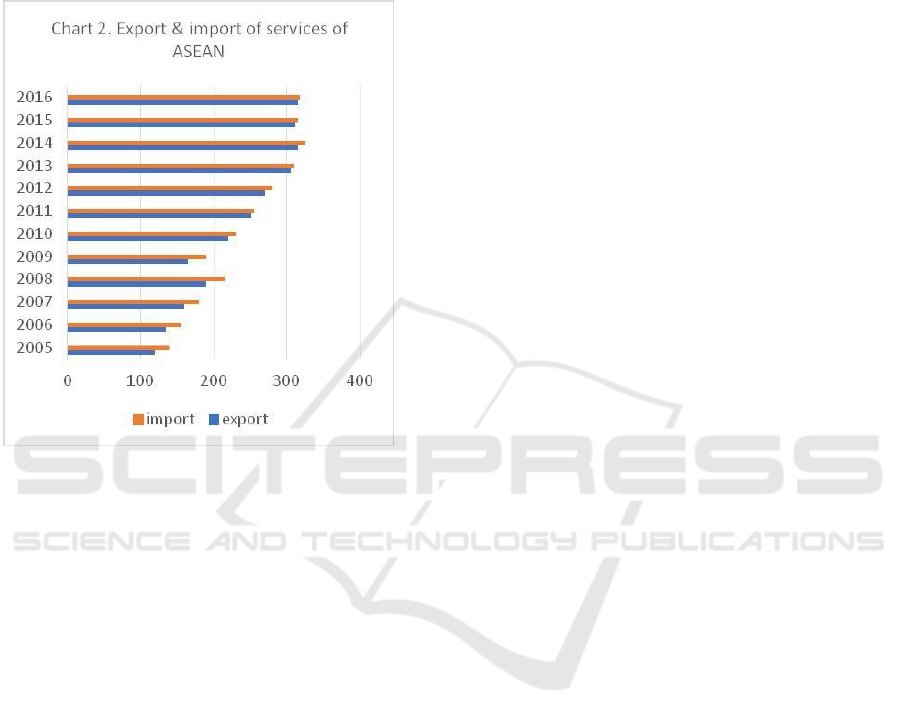

has generated 72%. The growth of export of

services seems to follow the growth of import

closely with almost equal proportions in any given

year (see Chart 2).

The AEC Blueprint 2025 para.5 stated that in

the next decade ASEAN will also provide a new

emphasis on the development and promotion of

MSMEs in its economic integration efforts.

ASEAN’s export of services consists of several

sectors as the following:(ASEAN Secretariat,

The Potential Development of Trade on Services by Micro Small Medium Enterprises in ASEAN

709

2015): Maintenance and repair; Transport; Travel;

Construction; Insurance and pension services;

Financial services; Intellectual property charges;

Telecommunications and ICT; Other business

services; Personal, cultural and recreational;

Government goods and services.

Source: ASEAN Services Report, 2017

Figure 2: Chart Export&Import of Service of ASEAN

2.2 ASEAN Free Trade Agreements

with ASEAN Dialogue Partners

It is interesting to note the statement that ‘[I]t is

often stated that there are two main reasons

advanced for why countries trade with each other.

The first is economics and the second is peace and

security.’ In this globalization era, it is undeniably

that every country in the world does trade with other

countries, trade in goods as well as trade in services

based on two main reasons advanced namely

economics and peace and security. In fact, no nation

has experienced sustained economic growth by

closing itself from international trade and

investment.

ASEAN has established agreement on trade in

services (TIS Agreement) with its’ dialogue

partners, which include: the Agreement on Trade in

Services of the Framework Agreement on

Comprehensive Economic Co-operation between

ASEAN and the People’s Republic of China (TIS

Agreement). It was signed by ASEAN Economic

Ministers and Minister of Commerce of China on 17

January 2007 in Cebu, the Philippines, the

Agreement on Trade in Services under the

Framework Agreement on

Comprehensive

Economic

Cooperation among the Governments of the Member

Countries of ASEAN and the Republic of Korea on

21 November 2007 in Singapore, the Agreement

Establishing the ASEAN – Australia – New Zealand

Free Trade Area which signed on 27 February 2009

in Cha-am, Thailand and the Agreement on Trade in

Services under the Framework Agreement on

Comprehensive

Economic Cooperation

between ASEAN and the Republic of India was

signed on 13 November 2014 in Nay Pyi Taw,

Myanmar.

3 ASEAN MSMEs and global value

chains

3.1 MSMEs ASEAN: Strength and

weaknesses

The MSMEs in ASEAN are small firms with less

training, and depend more to external recruitment

for raising competence and concern with financing,

regulatory burdens as they poorly equipped to deal

with the problem arising from regulations because

limited access of information on regulation on

product export, compliance procedure associated

with R&D and new technology.

To enable the MSMEs ASEAN be competitive,

ASEAN policy makers and the national government

of ASEAN Member States have to create policy

support in order to level playing field for SMEs as

mentioned by Yuri Sato as the inclusive pathway

(Yuri Sato, 2013).

3.2 Global Value Chains (GVC)

Free flow of services is an essential element in

building the AEC, as envisaged to be realized in

year 2020 by the ASEAN Heads of

States/Governments through the Declaration of Bali

Concord II. In the 11

th

ASEAN Summit, all AMS

agreed to accelerated the liberalization of trade in

services by 2015, means, ASEAN re-affirms its’

seriousness to further integrate its services sector

and deepen its economic integration process. The

AEC Blueprint aims to transform ASEAN into

single market and production base, a highly

competitive economic region, a region of equitable

economic development, and a region fully integrated

into the global economy.

The development of MSME ASEAN can be

pushed by public-private partnership (PPP)

mechanism. The AEC Blueprint 2025 stated that

PPP mechanism is an important tool for decision

ICPS 2018 - 2nd International Conference Postgraduate School

710

makers to strengthen economic and social

development through the harnessing of private

sector expertise, sharing of risks, and provision of

additional sources of funding and enhance

participation in Global Value Chains (GVC) in order

to achieve a highly integrated and cohesive economy

Compare to large enterprises, MSMEs ASEAN

have problem of financing since financial institution

reluctance to give financial support. Beyond 2015,

however, ASEAN MSMEs will form a major part of

regional and global supply chains. In this context,

MSMEs are important vehicle for AMS economic

empowerment with some constructive supports from

ASEAN policy makers, AMS governments and

guided cooperation based on PPP combine with

innovative strategy into action on R&D, innovative

products and training, hiring skilled employee.

4 CONCLUSIONS

Accounting for more than 96 per cent of enterprises

in ASEAN region, MSMEs are a significant engine

of economic growth in the region that all

stakeholders must seek all constructive efforts in

sustaining MSMEs remain competitive.

Trade in services will be another challenge for

ASEAN policy makers and AMS with all of the

economic and non-economic barriers in regional

sphere as well as proper implementation at national

level of every AMS. It is a significant economic

sector that can be cultivated in the AEC competitive

era.

Government of AMS through economic

integration of AEC can collaborate in giving strong

support to MSME ASEAN by providing programs

and economic policies concerning international

market expansion, integration into global supply

chains and finding new customers, exhibit regulatory

simplification, standardization and

mutual

recognition in the regional economic collaboration.

REFERENCES

ASEAN Secretariat, 2015, ASEAN Integration in

Services, ASEAN Secretariat, Jakarta.

Eifert, Lisa, 2016, Trade in Services in the ASEAN

Economic Community (AEC), GIZ Training

Course: “Challenges and Opportunities the

ASEAN Economic Community 2025”, Bangkok,

9-11 March 2016

Lester, Simon, Mercurio, Bryan, and Davies, Arwel,

2012, World Trade Law: Text, Materials and

Commentary, Second Ed, Hart Publishing:

Oxford and Portland, Oregon

Matsushita, Mitsuo, Schoenbaum, Thomas J. &

Mavroidis, Petros C., 2006, The World Trade

Organization: Law, Practice, and Policy, the

Oxford International Law Library, Oxford

University Press,

SAP SMED 2010-2015, SAP SMED 2016-2025,

SME Policy Index 2014

Sato, Yuri, the Development of Small and Medium

Enterprises in the ASEAN Economies,

http://www.jcie.org/japan/j/pdf/pub/publst/1451/

9_s ato.pdf

Southiseng, Nittana and Bartels, Karl, 2016, The

ASEAN Economic Community and SMEs: More

Risks than Potentials? Training Course on

Challenges and Opportunities of the ASEAN

Economic Community 2025, 10-11 March 2016,

Bangkok, Thailand.

The Potential Development of Trade on Services by Micro Small Medium Enterprises in ASEAN

711